69b293f50f0deb8ab1072241aab2ebaf.ppt

- Количество слайдов: 88

The Financial Reporting Workshop Comfy Hotel, Eldoret November 10, 2014 The application of IFRS: IFRS basic principles ICPAK

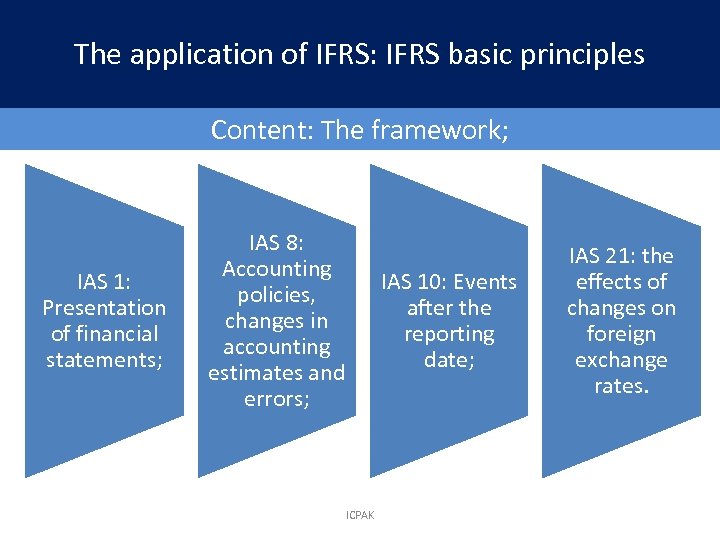

The application of IFRS: IFRS basic principles Content: The framework; IAS 1: Presentation of financial statements; IAS 8: Accounting policies, changes in accounting estimates and errors; IAS 10: Events after the reporting date; ICPAK IAS 21: the effects of changes on foreign exchange rates.

The IASB’s Conceptual Framework 3 • Framework sets out agreed concepts that underlie IFRS financial reporting – the objective of general purpose financial reporting – qualitative characteristics – elements of financial statements – recognition – measurement – presentation and disclosure Other concepts all flow from the objective ICPAK

Framework-based understanding 4 • Relates IFRS requirements to the concepts in the Conceptual Framework • Reasons why some IFRS requirements do not maximize those concepts (e. g. application of the cost constraint or inherited requirements) Concepts Principles ICPAK Rules

5 Framework-based understanding provides… • a cohesive understanding of IFRSs – Framework facilitates consistent and logical formulation of IFRSs • a basis for judgement in applying IFRSs – Framework established the concepts that underlie the estimates, judgements and models on which IFRS financial statements are based • a basis for continuously updating IFRS knowledge and IFRS competencies ICPAK

Framework’s role in applying IFRSs 6 Does the Framework help me apply IFRSs? • Yes, Framework is in IAS 8 hierarchy – Preparers use the Framework to make the judgements that are necessary to apply IFRSs – Auditors and regulators assess those judgements – Investors, lenders and others consider those judgements when using IFRS financial information to inform their decisions ICPAK

If no specific IFRS requirement 7 • Use judgement to – develop a policy that results in relevant information that faithfully represents (ie complete, neutral and error free) – Hierarchy: 1 st IFRS dealing with similar and related issue 2 nd Framework definitions, recognition crit. Etc. Can also in parallel refer to GAAPs with similar Framework ICPAK

In other words, if no IFRS requirement… 8 Framework-based approach would ask: • What is the economics of the phenomenon (e. g. transaction or event)? • What relevant information using the accrual basis of accounting faithfully present that economic phenomenon to inform decisions of investors and lenders (potential and existing)? • Is there anything in IFRSs that prevents me from providing that information? ICPAK

The application of IFRS: IFRS basic principles Content: The framework; IAS 1: Presentation of financial statements; ICPAK

Objective and Scope Objective To prescribe the basis for presentation of general purpose financial statements to ensure comparability both with the entity's financial statements of previous periods and with the financial statements of other entities. Scope Applies to all general purpose financial statements prepared and presented in accordance with IFRS. However, the scope of the standard Excludes the presentation of ‘interim financial statements’ which is Covered by IAS 34 – Interim Financial Reporting ICPAK

Purpose of Financial Statements To provide information about: • Financial position • Financial performance • Cash flows • Management’s stewardship of resources entrusted to them To meet these objectives financial statements provide information about an entity's assets, liabilities, equity, income & expenses, including gains & losses, other changes in equity & cash flows. The above assists users in predicting the entity's future ICPAK cash flows (timing & certainty).

Components of financial statements A complete set of financial statements comprises: • a statement of financial position as at the end of the financial year i. e. a balance sheet • a statement of comprehensive income for the period i. e. an income statement • a statement of changes in equity showing either • all changes in equity or • changes in equity other than those arising from with equity holders acting in their capacity as equity holders; • a cash flow statement; and • notes, comprising a summary of significant accounting policies and other explanatory notes. Note: Reports and statements presented outside FS are outside the scope of IFRSs eg ICPAK financial review by management, environmental reports.

Overall Considerations The overall considerations of IAS 1 can be categorized into: • • Fair presentation and compliance with IFRSs Going Concern Accrual basis of accounting Materiality and aggregation Offsetting Frequency of reporting Comparative information Consistency of presentation ICPAK

Structure and Content The following are covered under the structure and content of financial statements: 1. Identification 2. Statement of financial position (balance sheet) 3. Statement of comprehensive income (income statement) 4. Statement of changes in equity 5. Statement of cash flows 6. Notes ICPAK

Structure and Content 1. Identification The financial statements need to be clearly identified and distinguished from other information in the same document. • Name of the reporting entity • Whether the financial statements are of an individual entity or group • Period covered by the financial statements • Date at the end of the reporting period • Presentation currency • Level of rounding used ICPAK

Structure and Content 2. Statement of financial position – balance sheet As a minimum, the following must be disclosed: • • • • • Property, plant and equipment Investment property Intangible assets Financial assets Investments accounted for using the equity method of accounting Biological assets Inventories Trade and other receivables Cash and cash equivalents Total assets held for sale Trade and other payables Provisions Financial liabilities Current tax Deferred tax Non-controlling interests, presented within equity ICPAK Issued capital and reserves attributable to owners of the parent

Structure and Content 2. Statement of financial position – balance sheet (continued) Additional line items and headings can be presented. The balance sheet can be presented in two formats: • current/non-current • assets/liabilities The assets/liabilities format can only be used if this format provides information that is reliable and more relevant. However, all assets and liabilities must be presented in order of liquidity. ICPAK

Structure and Content 2. Statement of financial position – balance sheet (continued) Current liabilities: An entity shall classify a liability as current when: • It expects to settle the liability in its normal operating cycle • It holds the liability primarily for the purpose of trading • The liability is due to be settled within 12 months after the reporting date • The entity does not have an unconditional right to defer settlement of the liability for at least 12 months after the reporting period All other liabilities are classified as non-current. ICPAK

Structure and Content 2. Statement of financial position – balance sheet cont. . Information that can be presented either on the balance sheet or in the notes: • Property, plant and equipment disaggregated into classes in accordance with IAS 16 • Receivables disaggregated into amounts receivable from trade customers, related parties, prepayments and other amounts • Inventories are disaggregated into classes in accordance with IAS 2 • Provisions disaggregated into provisions for employee benefits and other items • Equity capital and reserves disaggregated into various classes, such as paid-up capital, share premium and reserves ICPAK

Structure and Content 2. Statement of financial position – balance sheet cont… Information that can be presented either on the balance sheet, statement of changes in equity or in the notes: • • For each class of share capital • Number of shares authorised • Number of shares issued and fully paid, and issued but not fully paid • Par value of shares, or that the shares have no par value • A reconciliation of the number of shares outstanding at the beginning and end of the period • Rights, restrictions and preferences attaching to each class • Shares in the entity held by the entity, by its subsidiaries and associates • Shares reserved for issue under options and contracts Nature and purpose of each reserve within equity ICPAK

Structure and Content 3. Statement of comprehensive income – income statement As a minimum, the following must be disclosed: • Revenue • Finance costs • Share of profit/loss of associates and joint ventures accounted for using the equity method • Tax expense • A single amount comprising: • The post tax profit/loss of discontinued operations • The post tax gain/loss on the measurement to fair value less costs to sell or on the disposal of assets consisting of discontinued operations • Profit or loss ICPAK

Structure and Content 3. Statement of comprehensive income – income statement Information to be presented in the income statement or notes: • Material items need to be disclosed separately • Impairment provisions • Restructuring costs • Disposals of property, plant and equipment • Disposals of investments • Discontinued operations • Litigation settlements • Reversals of provisions Expenses need to be presented using either of the following classifications: • • By nature i. e purchases, depreciation, employment costs By function i. e distribution costs, cost of sales, administrative costs ICPAK

Structure and Content 4. Statement of changes in equity As a minimum, the following must be disclosed: • • Total comprehensive income showing separately amounts attributable to the owners and to non-controlling interests (minority) For each component of equity, the effects of retrospective adjustments For each component of equity, a reconciliation between the carrying amount at the beginning and end of the period, separately disclosing changes from: • Profit or loss • Each item of comprehensive income • Transactions with owners in their capacity as owners Dividends recognised as distributions to owners 5. Statement of cash flows Dealt with by IAS 7 on Cash Flow Statements. ICPAK

Structure and Content 6. Notes The notes have to: • Present information about the basis of preparation and specific accounting policies • Disclose the information required by IFRSs that is not presented elsewhere in the financial statements • Provide information that is not presented elsewhere in the financial statements, but is relevant to understanding them. IAS 1 requires the notes to be presented in a systematical manner with cross references to the income statement, balance sheet, statement of changes in equity and cash flow statement. ICPAK

Structure and Content 6. Notes Disclosure of accounting policies: Significant accounting estimates, assumptions and judgements have to be disclosed. Estimates and assumptions: Biological assets: In arriving at the fair valuation of biological assets, the management estimate the success rate of planting at 78%. Based on the managements past experience the success rate should not fall below 75%. Should the success rate fall by 5% from the estimate assumed by the management, the fair valuation of biological assets would decrease by Shs. XX. Judgements: Revenue recognition: The company enters into contracts for most of its sales made. As stipulated in the contracts, the buyer has the right to return the goods, within 100 days from the date of delivery, in the event of dissatisfaction with regards to the quality, provided that such a complaint is justified. In such an event, the company shall replace the spoilt plants to the ratio of one to one (1: 1). Based on the company management's past experience when undertaking similar contracts, the dissatisfaction rate cannot be established due to factors beyond their control. Accordingly, the revenue on the said transactions has been recognised. ICPAK

Capital Disclosures For financial periods beginning on or after 1 January 2007, entities need to disclose information to enable users to evaluate the entity’s objectives, policies and processes for managing capital. • Qualitative information about its objectives, policies and processes for managing capital, including: • A description of what it manages as capital • Externally imposed capital requirements: nature of these requirements and how these are incorporated into the management of capital • How the entity is meeting its objectives for managing capital • Summary quantitative data about what it manages as capital e. g. ratio’s • Any changes in the above from the previous period • Whether the entity complied with the externally imposed capital requirements and the consequences of non-compliance, if any ICPAK

Other Disclosures Notes: • amounts of dividends proposed or declared before the financial statements were authorised for issue but not recognised as a distribution and the related amount per share • any amounts of cumulative preference dividends not recognised Anywhere: • Domicile and legal form • Country of incorporation • Address of its registered office • Address of its principal place of business (if different from above) • Description of the nature of the entity’s operations and its principal activities • The name of the parent and ultimate parent of the group. ICPAK

The application of IFRS: IFRS basic principles Content: The framework; IAS 8: Accounting policies, changes in accounting estimates and errors; ICPAK

Objective and scope of IAS 8 • Selecting and applying accounting policies • Accounting for changes in: – Accounting policies – Accounting estimates • Corrections of prior period errors ICPAK

Accounting policies • Accounting policies – Specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements ICPAK

Selection and application of accounting policies • Accounting policy determined by – Applying a specific IFRS – Considering any relevant implementation guidance • In absence of a specific IFRS – Use judgement to develop an accounting policy that results in relevant and reliable information • First, refer to IFRSs dealing with similar and related issues and second, to framework • Consider pronouncement of other setters or industry practices if consistent ICPAK above with

Consistency of accounting policies • Select and apply accounting policy consistently for similar transactions, other events and conditions – Example: equity method for all jointly controlled entities • May adopt different policies – When an IFRS requires or permits categorisation of items for which different policies may be appropriate – But accounting policy selected and applied should be consistent to each ICPAK category

Disclosure – Judgment and estimation • Disclose the judgements made by management – that have the most significant effect • Disclose information about key assumptions – concerning the future, and other key sources of estimation uncertainty – disclose for those assets and liabilities • their nature; and • their carrying amount at the end of the reporting period ICPAK

Changes in accounting policies • Consistency is important • Change an accounting policy only if the change: – is required by an IFRS; or – results in the financial statements providing reliable and more relevant information ICPAK

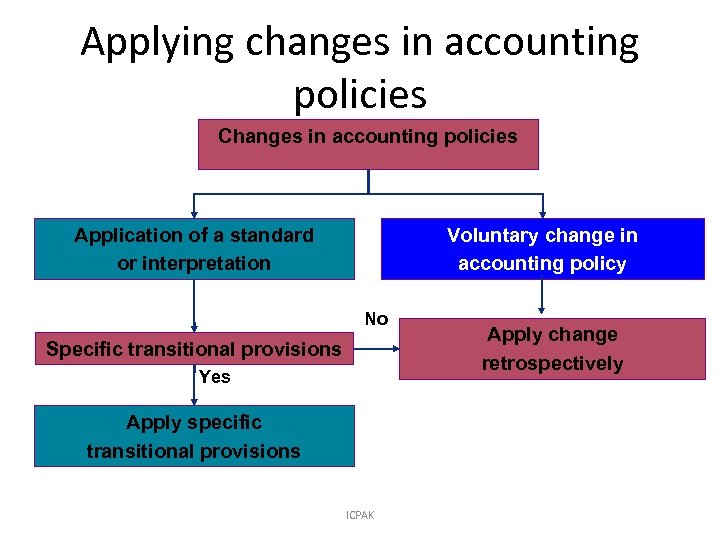

Applying changes in accounting policies Changes in accounting policies Application of a standard or interpretation Voluntary change in accounting policy No Specific transitional provisions Yes Apply specific transitional provisions ICPAK Apply change retrospectively

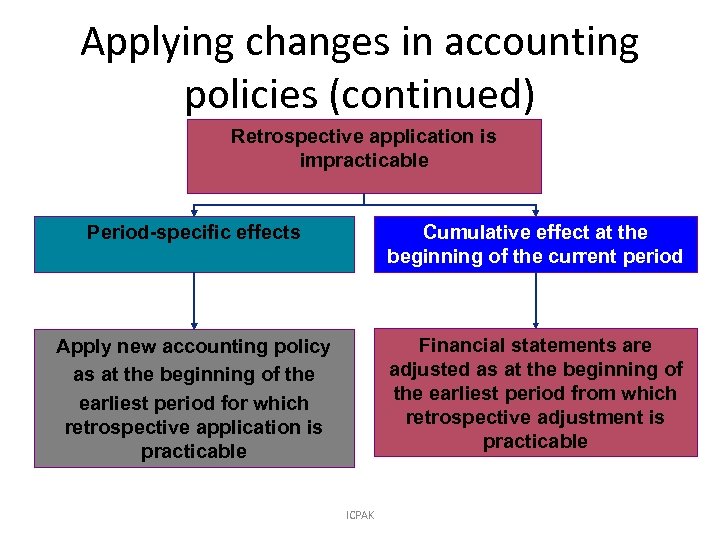

Applying changes in accounting policies (continued) Retrospective application is impracticable Period-specific effects Cumulative effect at the beginning of the current period Apply new accounting policy as at the beginning of the earliest period for which retrospective application is practicable Financial statements are adjusted as at the beginning of the earliest period from which retrospective adjustment is practicable ICPAK

Retrospective application Impracticability • Use only information that – Provides evidence of circumstances at the time; and – Would have been available when the financial statements of that period were authorised for issue • If a significant estimate requires the use of information that does not meet these criteria then – Retrospective application is impracticable ICPAK

Changes in accounting policies – Disclosure • When an entity restates, IAS 1 requires an entity to prepare an additional statement of financial position as at the beginning of the comparative period • When initial application of a standard or an interpretation has an effect, disclose – Change in accordance with transitional provisions – For current period and each prior period presented the amount of the adjustment for each financial line item affected and for basic and diluted earnings per share, if IAS 33 applies – The amount of the adjustment relating to periods before those presented, to the extent practicable – If retrospective application is required but impracticable, the circumstances and a description • Need not repeat these disclosures in subsequent periods ICPAK

Changes in accounting policies – Disclosure (continued) • When a voluntary change: – Has an effect on the current period or any prior period – Would have such an effect except that it is impracticable to determine the amount of the adjustment; or – Might have an effect on future periods • Then we are required to disclose: – Why the change provides reliable and more relevant information – For current period and each prior period presented the amount of the adjustment for each line item affected – The amount of the adjustment relating to periods before those presented – If retrospective application is impracticable, the circumstances and a description • Need not repeat these disclosures in subsequent periods ICPAK

Changes in accounting policies Disclosure (continued) • When not applying a new IFRS that has been issued but is not yet effective, disclose – This fact – Known or reasonably estimable information relevant to assessing the possible impact that application of the new IFRS will have on the financial statements in the period of initial application ICPAK

Changes in accounting estimates • Include the effect of a change in an accounting estimate in net profit or loss in – The period of the change, if the change affects the period only, or – The period of the change and future periods, if the change affects both • If difficult to distinguish between change in accounting estimate and in accounting policy – Treat the change as a change in accounting estimate ICPAK

Changes in accounting estimates (continued) • Disclose the nature and amount of a change in an estimate: – That has an effect in the current period, or – Is expected to have an effect in the future periods • If impracticable to quantify the amount, disclose that fact ICPAK

Prior period errors • Errors in respect of recognition, measurement, presentation or disclosure • Prior period errors – Omission and misstatements for one or more prior periods arising from a failure to use, or misuse of, reliable information • Such errors include – The effects of mathematical mistakes in applying accounting policies – Oversights or misinterpretations of facts ICPAK – Fraud

Correction of material prior period errors • Correct material prior period errors retrospectively in the first set of financial statements authorised for issue after discovery by: – Restating the comparative amounts for the prior period presented in which the error occurred; or – If the error occurred before the earliest prior period presented, restating the opening balances for the earliest prior period presented ICPAK

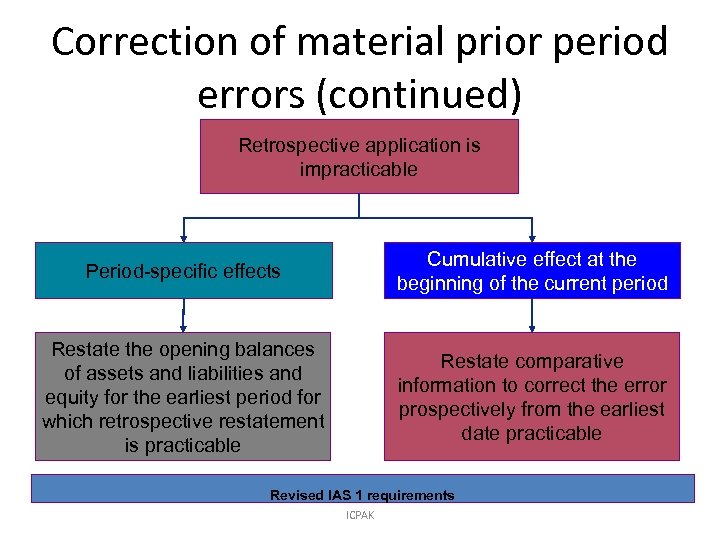

Correction of material prior period errors (continued) Retrospective application is impracticable Period-specific effects Cumulative effect at the beginning of the current period Restate the opening balances of assets and liabilities and equity for the earliest period for which retrospective restatement is practicable Restate comparative information to correct the error prospectively from the earliest date practicable Revised IAS 1 requirements ICPAK

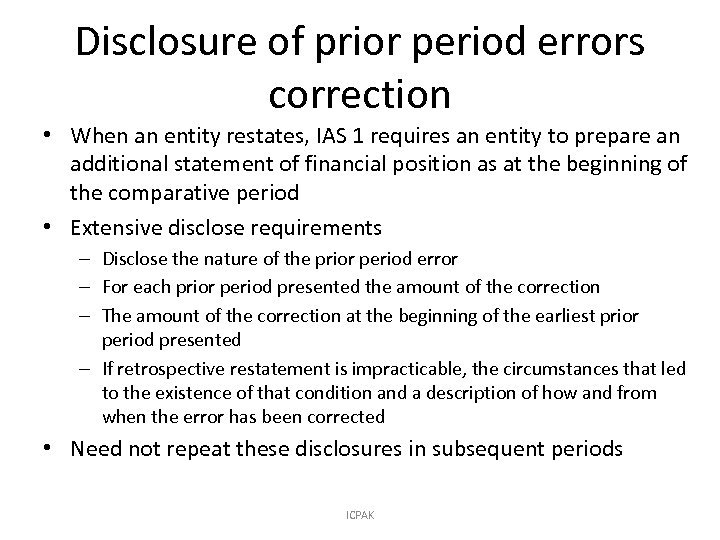

Disclosure of prior period errors correction • When an entity restates, IAS 1 requires an entity to prepare an additional statement of financial position as at the beginning of the comparative period • Extensive disclose requirements – Disclose the nature of the prior period error – For each prior period presented the amount of the correction – The amount of the correction at the beginning of the earliest prior period presented – If retrospective restatement is impracticable, the circumstances that led to the existence of that condition and a description of how and from when the error has been corrected • Need not repeat these disclosures in subsequent periods ICPAK

The application of IFRS: IFRS basic principles Content: The framework; IAS 10: Events after the reporting date; ICPAK

Objective and scope • The objective of the Standard is to prescribe: – When an entity should adjusts its financial statements for events after the balance sheet date. – The disclosures that an entity should give about the date when the financial statements were authorized for issue and about events after the balance sheet date. • Scope – This standard shall be applied in the accounting for, and disclosure of, events after the balance sheet date. ICPAK

Definitions • Events after the balance sheet date are those events, favorable and unfavorable, that occur between the balance sheet date and the date when the financial statements are authorized for issue. Two types of events can be identified: • Those that provide evidence of conditions that existed at the balance sheet date (adjusting events after the balance sheet date); and • Those that are indicative of conditions that arose after the balance sheet date (non-adjusting events after the balance sheet date). ICPAK

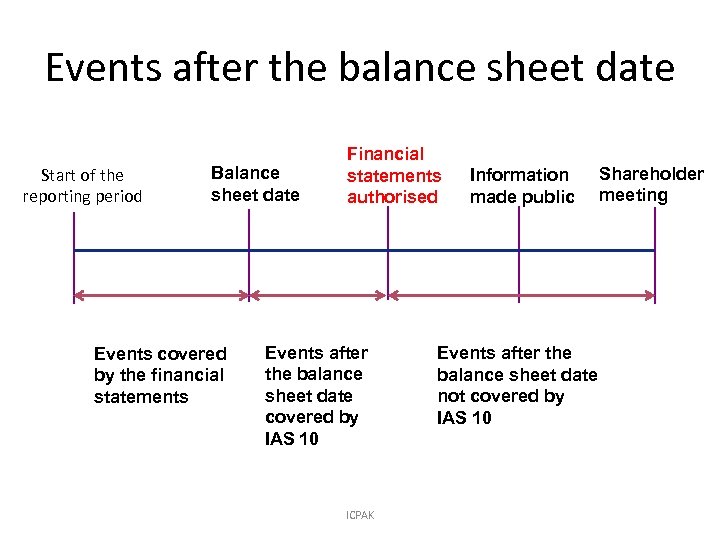

Events after the balance sheet date Start of the reporting period Balance sheet date Events covered by the financial statements Financial statements authorised Events after the balance sheet date covered by IAS 10 ICPAK Information made public Events after the balance sheet date not covered by IAS 10 Shareholder meeting

Example The management of an enterprise completes draft financial statements for the year to 31 December 2013 on 28 February 2014. On 18 March 2014, the board of directors reviews the financial statements and authorizes them for issue. The enterprise announces its profit and selected other financial information on 19 March 2014. The financial statements are made available to shareholders and others on 1 April 2014. The annual meeting of shareholders approves the financial statements on 15 May 2014 and the approved financial statements are then filed with a regulatory body on 17 May 2014. The financial statements are authorized for issue on 18 March 2014 (date of Board authorization for issue). ICPAK

Adjusting and non-adjusting events • Adjusting events: – Provide evidence of conditions that existed at the balance sheet date – Should adjust amounts recognised in the financial statements • Non-adjusting events: – Indicate conditions that arose after the balance sheet date – Should not adjust amounts recognised in the financial statements ICPAK • disclosure requirements for material non-adjusting events

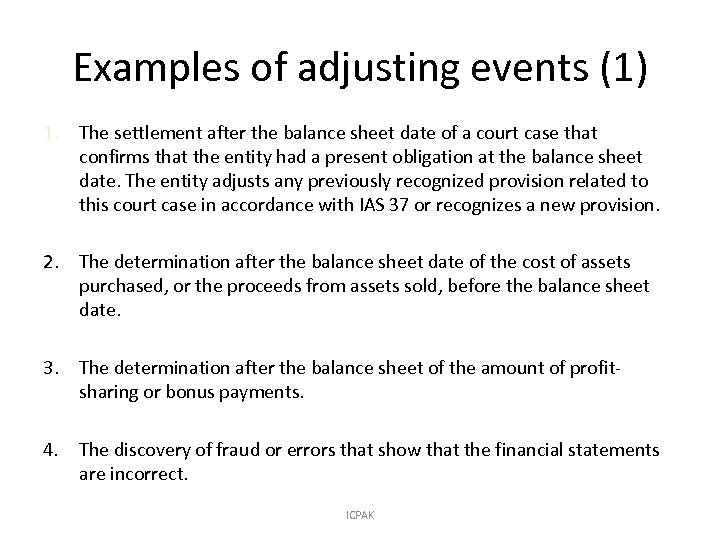

Examples of adjusting events (1) 1. The settlement after the balance sheet date of a court case that confirms that the entity had a present obligation at the balance sheet date. The entity adjusts any previously recognized provision related to this court case in accordance with IAS 37 or recognizes a new provision. 2. The determination after the balance sheet date of the cost of assets purchased, or the proceeds from assets sold, before the balance sheet date. 3. The determination after the balance sheet of the amount of profitsharing or bonus payments. 4. The discovery of fraud or errors that show that the financial statements are incorrect. ICPAK

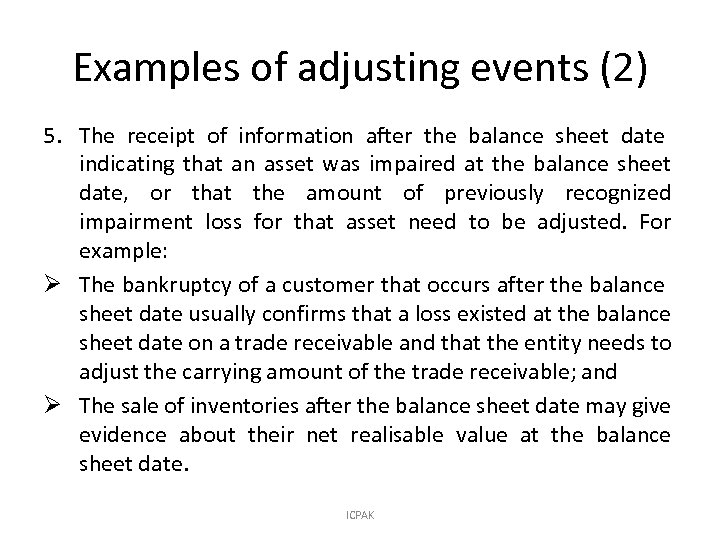

Examples of adjusting events (2) 5. The receipt of information after the balance sheet date indicating that an asset was impaired at the balance sheet date, or that the amount of previously recognized impairment loss for that asset need to be adjusted. For example: Ø The bankruptcy of a customer that occurs after the balance sheet date usually confirms that a loss existed at the balance sheet date on a trade receivable and that the entity needs to adjust the carrying amount of the trade receivable; and Ø The sale of inventories after the balance sheet date may give evidence about their net realisable value at the balance sheet date. ICPAK

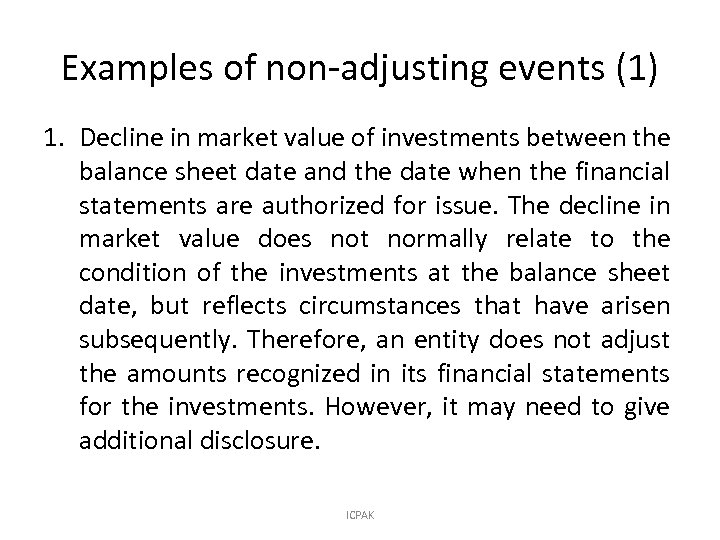

Examples of non-adjusting events (1) 1. Decline in market value of investments between the balance sheet date and the date when the financial statements are authorized for issue. The decline in market value does not normally relate to the condition of the investments at the balance sheet date, but reflects circumstances that have arisen subsequently. Therefore, an entity does not adjust the amounts recognized in its financial statements for the investments. However, it may need to give additional disclosure. ICPAK

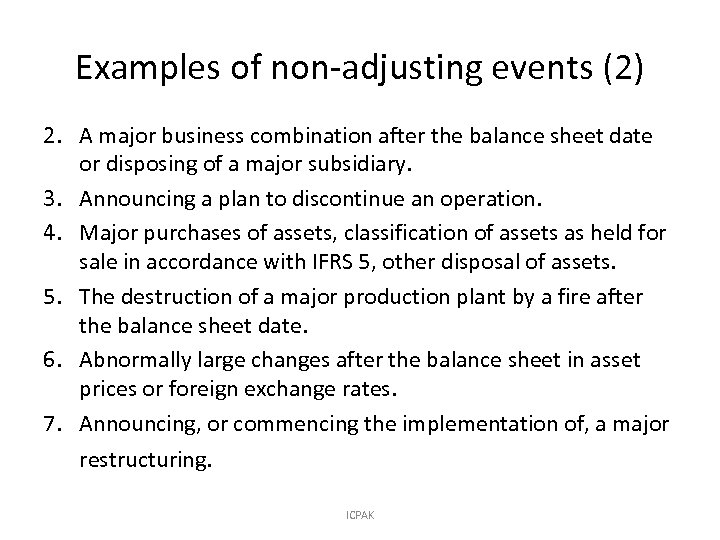

Examples of non-adjusting events (2) 2. A major business combination after the balance sheet date or disposing of a major subsidiary. 3. Announcing a plan to discontinue an operation. 4. Major purchases of assets, classification of assets as held for sale in accordance with IFRS 5, other disposal of assets. 5. The destruction of a major production plant by a fire after the balance sheet date. 6. Abnormally large changes after the balance sheet in asset prices or foreign exchange rates. 7. Announcing, or commencing the implementation of, a major restructuring. ICPAK

Examples of non-adjusting events (3) 8. Changes in tax rates or tax laws announced after the balance sheet date that have significant effect on current and deferred tax assets and liabilities. 9. Commencing major litigation arising solely out of events that occurred after the balance sheet date. ICPAK

Dividends and going concern • Dividends – Dividends declared after the balance sheet date should not be recognised as a liability at the balance sheet date but should be disclosed in notes – If dividends are declared (ie the dividends are appropriately authorized and no longer at the discretion of the entity) after the balance sheet date but before the financial statements are authorized for issue, the dividends are not recognized as a liability at the balance sheet date because they do not meet the criteria of present obligation in IAS 37. Such dividends are disclosed in the notes (IAS 1). ICPAK

Going concern • If the going concern assumption becomes inappropriate after the balance sheet date, the financial statements should not be prepared on a going concern basis for example: • Deterioration in operating results and financial position after the balance sheet date may indicate a need to consider whether the going concern assumption is still appropriate. ICPAK

Disclosure • Date of authorisation for issue of financial statements (FS) • Who gave authorisation • Eventual power of someone to amend the FS after issuance • Updating of disclosures about conditions existing at the balance sheet date • Material non-adjusting events: – nature of the event – an estimate of its financial effect, or that such an ICPAK estimate cannot be made

The application of IFRS: IFRS basic principles Content: The framework; IAS 21: the effects of changes on foreign exchange rates. ICPAK

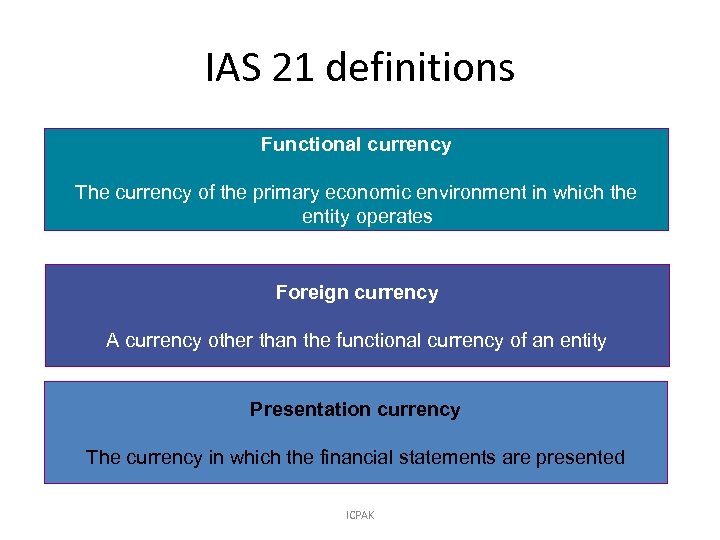

IAS 21 definitions Functional currency The currency of the primary economic environment in which the entity operates Foreign currency A currency other than the functional currency of an entity Presentation currency The currency in which the financial statements are presented ICPAK

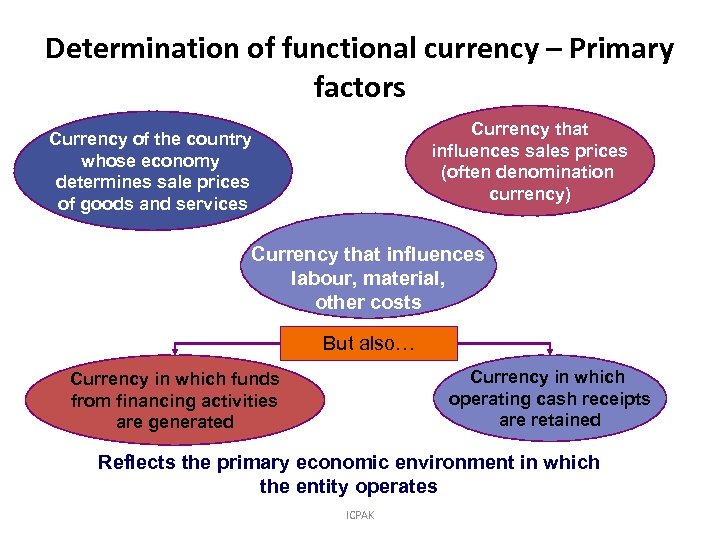

Determination of functional currency – Primary factors Currency that influences sales prices (often denomination currency) Currency of the country whose economy determines sale prices of goods and services Currency that influences labour, material, other costs But also… Currency in which operating cash receipts are retained Currency in which funds from financing activities are generated Reflects the primary economic environment in which the entity operates ICPAK

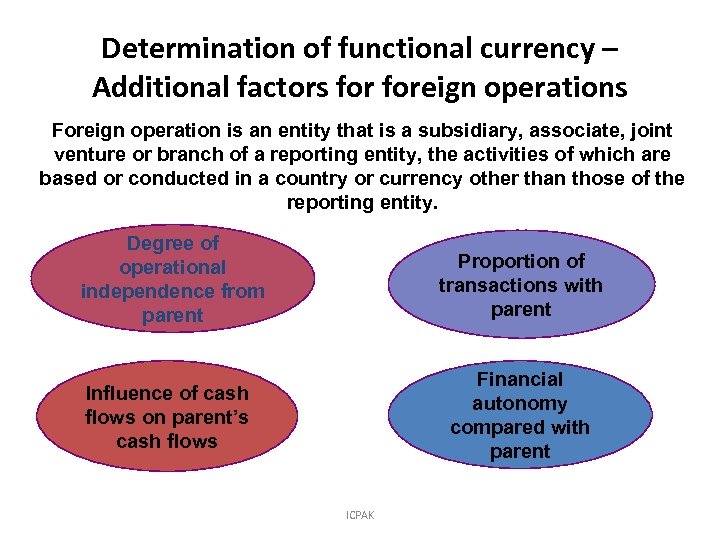

Determination of functional currency – Additional factors foreign operations Foreign operation is an entity that is a subsidiary, associate, joint venture or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity. Degree of operational independence from parent Proportion of transactions with parent Influence of cash flows on parent’s cash flows Financial autonomy compared with parent ICPAK

Choice of functional currency? • An entity does not have a free choice of functional currency • An entity cannot change functional currency unless facts and circumstances relevant to its determination change • Change should be applied prospectively ICPAK

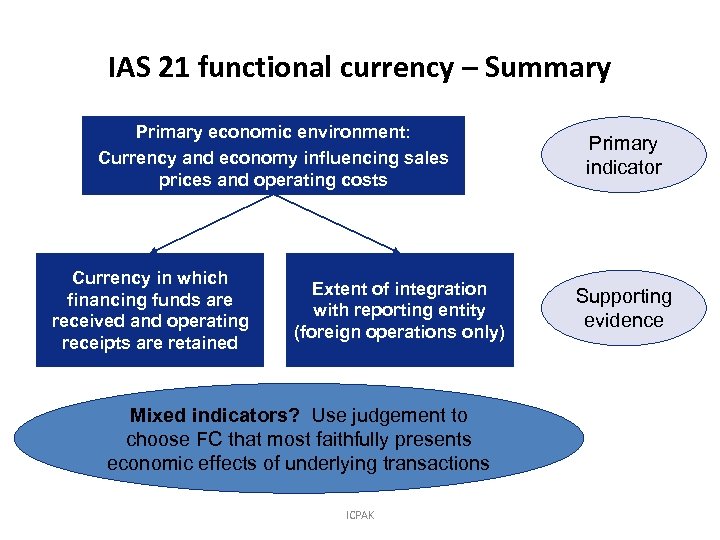

IAS 21 functional currency – Summary Primary economic environment: Currency and economy influencing sales prices and operating costs Currency in which financing funds are received and operating receipts are retained Extent of integration with reporting entity (foreign operations only) Mixed indicators? Use judgement to choose FC that most faithfully presents economic effects of underlying transactions ICPAK Primary indicator Supporting evidence

Example • Company A is a manufacturer of steel products. The majority of products are sold into the local market using the international price for steel, quoted in U. S. dollars. Competitive forces in the country also influence the local sales price. • The majority of raw material purchases are from local suppliers, denominated in local currency, based on the price of steel, quoted in U. S. dollars, on the London Metal Exchange. • These sales and raw material purchases are invoiced and settled in local currency. Most other expenses are in local currency as well. • A significant amount of financing is in U. S. dollars to match the currency in which the sales are priced, while cash reserves are held in local currency. • What is the functional currency of the company? ICPAK

Reporting foreign currency transactions in the functional currency – Initial recognition • Recognise transaction at the rate at the transaction date • May use e. g. average rate for week or month as a practical approximation – Average rates not reliable if currency fluctuates significantly ICPAK

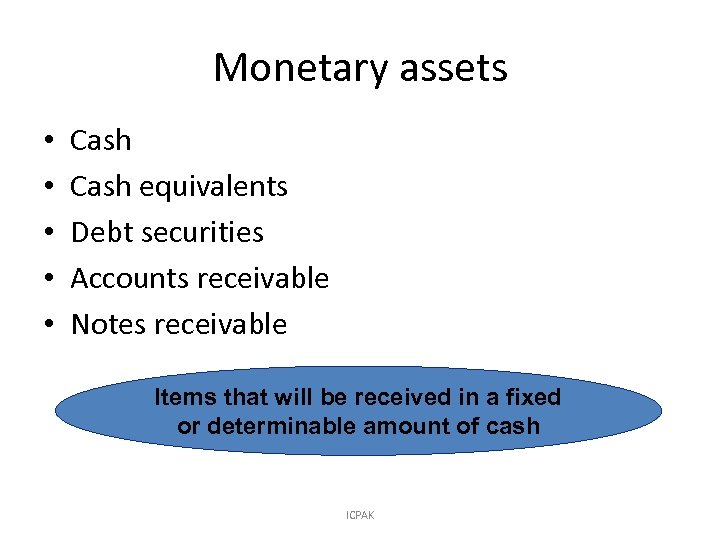

Monetary assets • • • Cash equivalents Debt securities Accounts receivable Notes receivable Items that will be received in a fixed or determinable amount of cash ICPAK

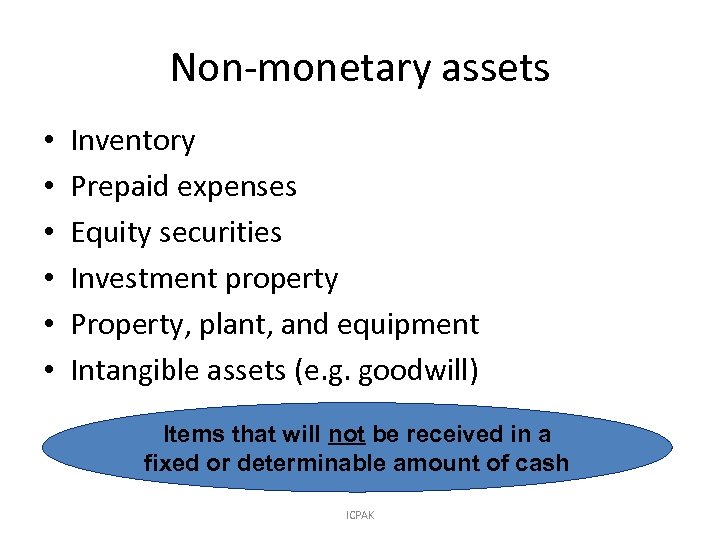

Non-monetary assets • • • Inventory Prepaid expenses Equity securities Investment property Property, plant, and equipment Intangible assets (e. g. goodwill) Items that will not be received in a fixed or determinable amount of cash ICPAK

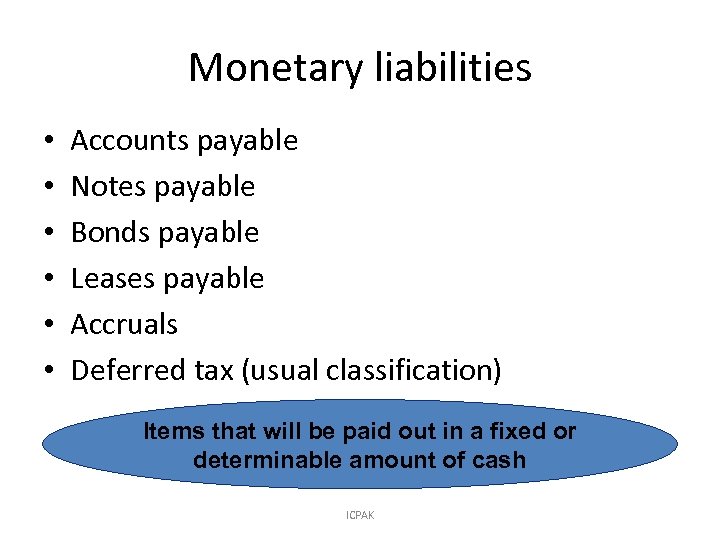

Monetary liabilities • • • Accounts payable Notes payable Bonds payable Leases payable Accruals Deferred tax (usual classification) Items that will be paid out in a fixed or determinable amount of cash ICPAK

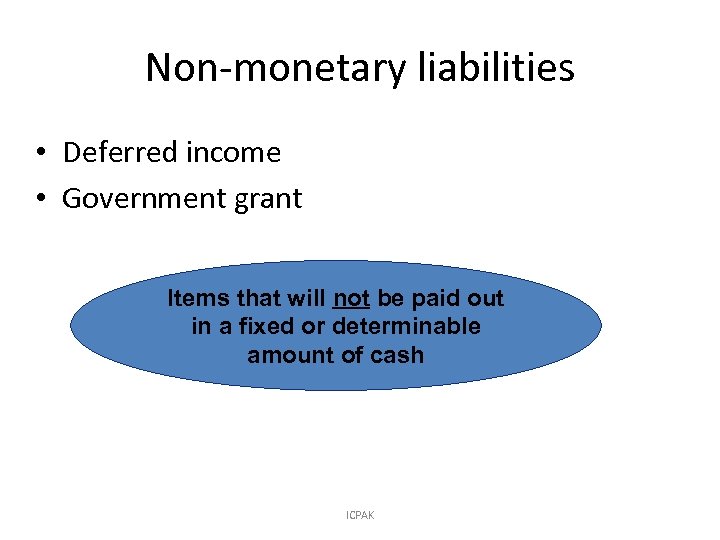

Non-monetary liabilities • Deferred income • Government grant Items that will not be paid out in a fixed or determinable amount of cash ICPAK

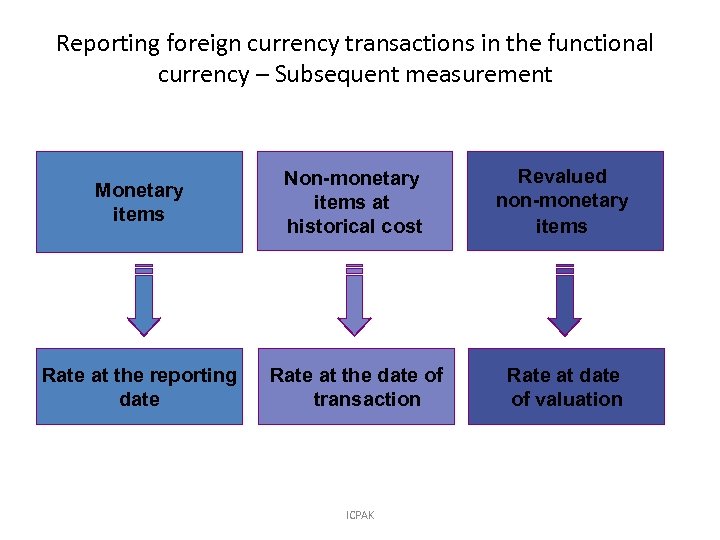

Reporting foreign currency transactions in the functional currency – Subsequent measurement Monetary items Non-monetary items at historical cost Revalued non-monetary items Rate at the reporting date Rate at the date of transaction Rate at date of valuation ICPAK

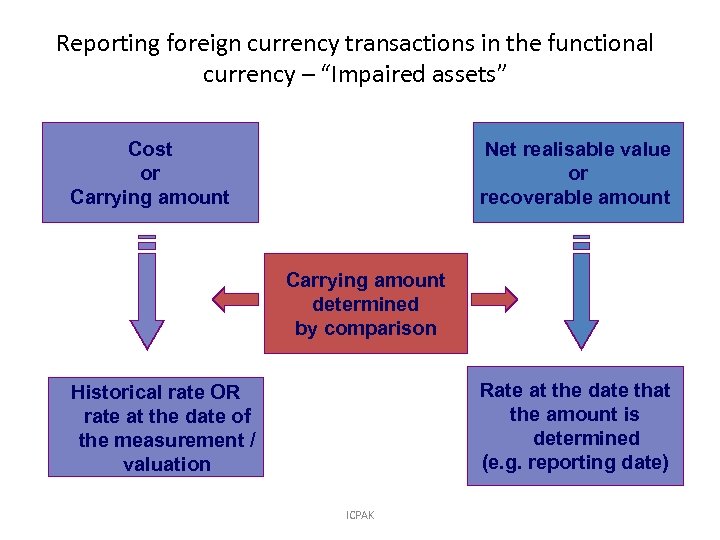

Reporting foreign currency transactions in the functional currency – “Impaired assets” Cost or Carrying amount Net realisable value or recoverable amount Carrying amount determined by comparison Rate at the date that the amount is determined (e. g. reporting date) Historical rate OR rate at the date of the measurement / valuation ICPAK

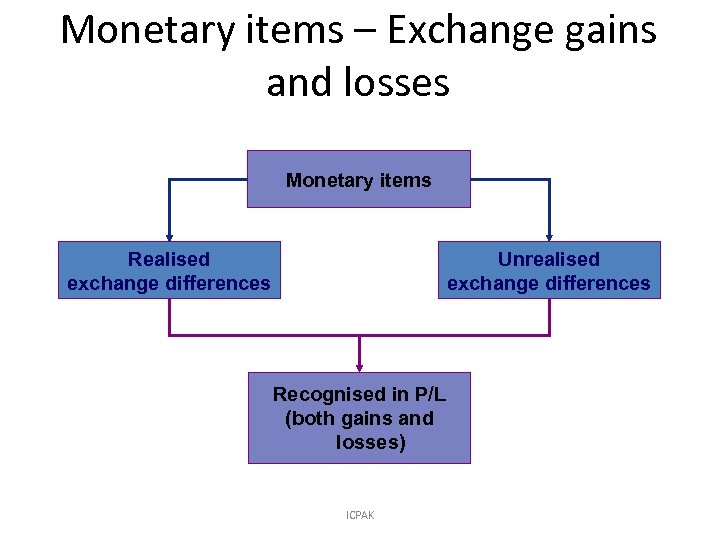

Monetary items – Exchange gains and losses Monetary items Realised exchange differences Unrealised exchange differences Recognised in P/L (both gains and losses) ICPAK

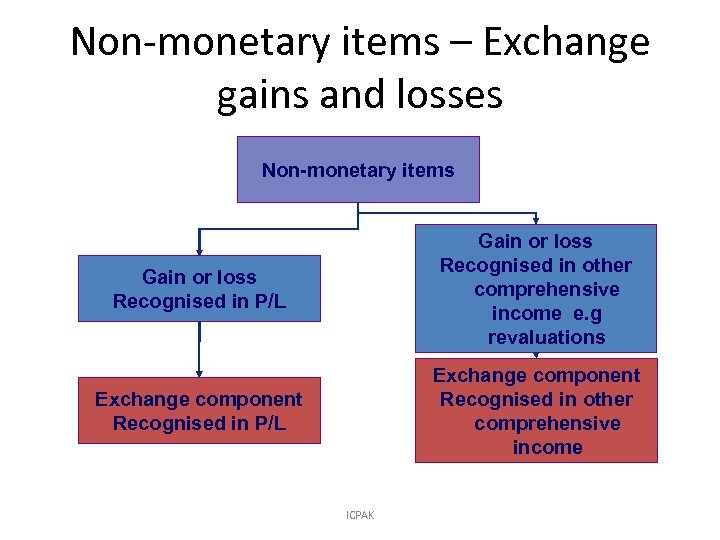

Non-monetary items – Exchange gains and losses Non-monetary items Gain or loss Recognised in P/L Gain or loss Recognised in other comprehensive income e. g revaluations Exchange component Recognised in P/L Exchange component Recognised in other comprehensive income ICPAK

Change in functional currency • Only if there is a change to the underlying transactions, events and conditions • Translation procedures should be applied to the new functional currency prospectively from the date of the change ICPAK

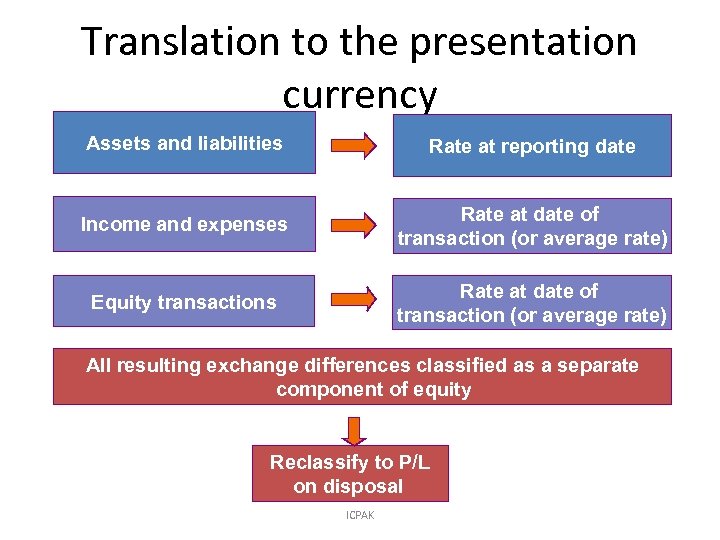

Translation to the presentation currency Assets and liabilities Rate at reporting date Income and expenses Rate at date of transaction (or average rate) Equity transactions Rate at date of transaction (or average rate) All resulting exchange differences classified as a separate component of equity Reclassify to P/L on disposal ICPAK

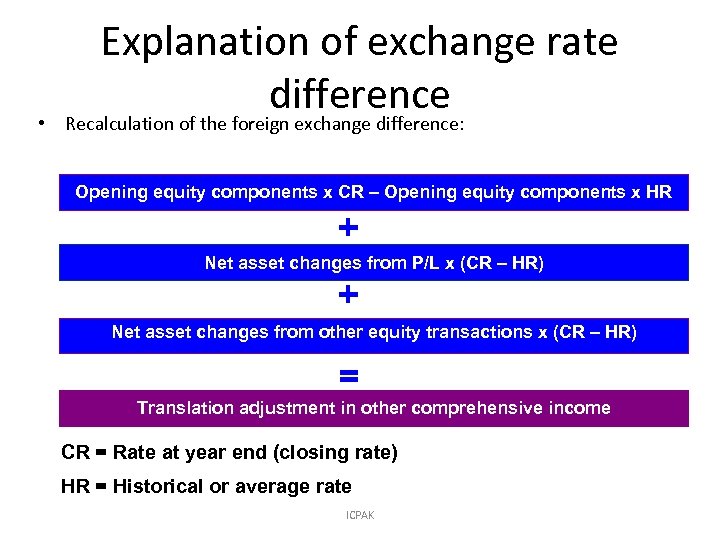

Explanation of exchange rate difference • Recalculation of the foreign exchange difference: Opening equity components x CR – Opening equity components x HR + Net asset changes from P/L x (CR – HR) + Net asset changes from other equity transactions x (CR – HR) = Translation adjustment in other comprehensive income CR = Rate at year end (closing rate) HR = Historical or average rate ICPAK

Translation of a foreign operation • Non-controlling interest allocated share of accumulated exchange difference • Goodwill and fair value adjustments arising from a business combination are treated as assets/liabilities of the foreign operation translated at the reporting date • Exchange gains and losses on intra-group items are taken to P/L • Different year-ends – 3 month lag permitted – Adjust for significant changes in exchange rates between different year-ends ICPAK

Exchange differences – Net investment in a foreign operation • Net investment in a foreign operation – the amount of the entity’s interest in the net assets of that foreign operation • If the settlement of monetary item receivable from or payable to a foreign operation is neither planned nor likely to occur in the foreseeable future, exchange differences on such item are recognised: – In profit or loss by both the reporting entity and the foreign operation in their individual financial statements – In other comprehensive income and accumulated in a separate component of equity in the consolidated financial statements • Accumulated exchange differences are reclassified from equity to profit or loss on disposal of the foreign ICPAK operation

What is a hyperinflationary economy? • No absolute rate at which hyperinflation is deemed to arise. Indicators: – Population keeps its wealth in a stable currency or in nonmonetary assets – Population regards monetary amounts not in local currency but in terms of a stable currency e. g. , prices quoted in a stable foreign currency – Credit terms compensate for the expected loss of purchasing power during the credit period – Interest rates, wages and prices are linked to a price index – The cumulative inflation rate over three years is approaching or exceeds 100% ICPAK

A matter of judgement! • IAS 29 does not give a definition of hyperinflation • Becoming or ceasing to be hyperinflationary is a trend, not a discrete event • Quantitative factors are not decisive in their own right, but need to be evaluated in the light of the economic circumstance and trends • Judgement used in coordination with the local profession and local accounting standard setter, so that all companies in a country apply (or cease to apply) IAS 29 at the same time ICPAK

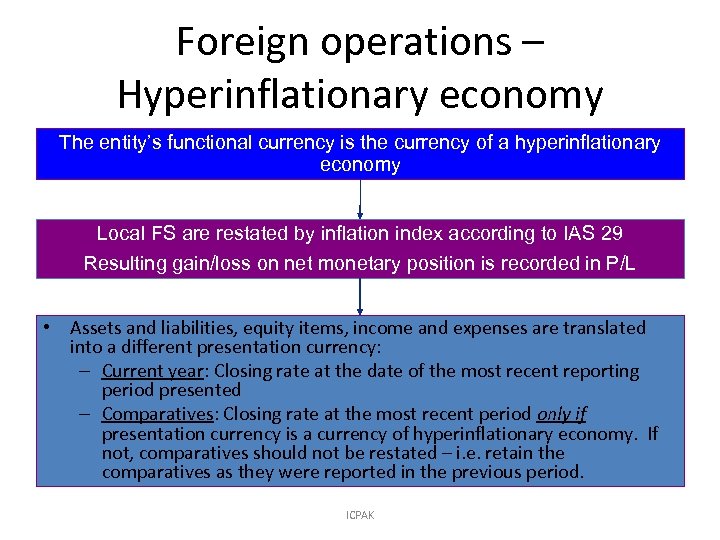

Foreign operations – Hyperinflationary economy The entity’s functional currency is the currency of a hyperinflationary economy Local FS are restated by inflation index according to IAS 29 Resulting gain/loss on net monetary position is recorded in P/L • Assets and liabilities, equity items, income and expenses are translated into a different presentation currency: – Current year: Closing rate at the date of the most recent reporting period presented – Comparatives: Closing rate at the most recent period only if presentation currency is a currency of hyperinflationary economy. If not, comparatives should not be restated – i. e. retain the comparatives as they were reported in the previous period. ICPAK

Key disclosures • Exchange rate differences included in: – P/L (except for financial instruments measured at FV through P/L) – Other comprehensive income • Reminders – Refer to functional currency and presentation currency – In accounting policy note disclose that P/L items are translated at rate at transaction dates ICPAK

Additional disclosures • Reasons (if applicable): – Why there has been a change in the functional currency – Why the presentation and functional currency are different • If entity’s presentation currency is different from its functional currency, its financial statements should be described as compliant with IFRSs only if all the requirements of IAS 21 are applied ICPAK

Additional disclosures (continued) • If entity’s additional financial information is displayed in a currency different from either its functional or its presentation currency and all the requirements of IAS 21 have not been met: – Clearly identify such information as supplementary – Disclose the currency of the supplementary information – Disclose the entity’s functional currency and the method of translation used as a basis for presenting the supplementary information ICPAK

Thank you ICPAK 88

69b293f50f0deb8ab1072241aab2ebaf.ppt