Financial intermediaries.pptx

- Количество слайдов: 13

The financial environment: Financial intermediaries (deposit institutions, insurance companies, pension funds, financial brokers). Europe and Ukraine practice. Catherine Zbuker September, 2012

The financial environment: Financial intermediaries (deposit institutions, insurance companies, pension funds, financial brokers). Europe and Ukraine practice. Catherine Zbuker September, 2012

What is Financial intermediation? - channeling funds between surplus and deficit agents. A financial intermediary is a financial institution that connects surplus and deficit agents. The classic example of a financial intermediary – bank. Certain assets or liabilities different assets or liabilities.

What is Financial intermediation? - channeling funds between surplus and deficit agents. A financial intermediary is a financial institution that connects surplus and deficit agents. The classic example of a financial intermediary – bank. Certain assets or liabilities different assets or liabilities.

Functions performed by financial intermediaries Maturity transformation. Converting short-term liabilities to long term assets. Risk transformation. Converting risky investments into relatively risk-free ones. Convenience denomination. Matching small deposits with large loans and large deposits with small loans.

Functions performed by financial intermediaries Maturity transformation. Converting short-term liabilities to long term assets. Risk transformation. Converting risky investments into relatively risk-free ones. Convenience denomination. Matching small deposits with large loans and large deposits with small loans.

Advantages of financial intermediaries 1. Cost advantage over direct lending/borrowing. 2. Market failure protection the conflicting needs of lenders and borrowers are reconciled, preventing market failure.

Advantages of financial intermediaries 1. Cost advantage over direct lending/borrowing. 2. Market failure protection the conflicting needs of lenders and borrowers are reconciled, preventing market failure.

Types of financial intermediaries Depository institution is a financial institution that is legally allowed to accept monetary deposits from consumers. UKRAINE: PJSC “NATIONAL DEPOSITORY OF UKRAINE” (NDU) Europe: Promontory Financial Group

Types of financial intermediaries Depository institution is a financial institution that is legally allowed to accept monetary deposits from consumers. UKRAINE: PJSC “NATIONAL DEPOSITORY OF UKRAINE” (NDU) Europe: Promontory Financial Group

Insurance companies Life insurance companies, which sell life insurance, annuities and pensions products. Non-life, general, or property/casualty insurance companies, which sell other types of insurance.

Insurance companies Life insurance companies, which sell life insurance, annuities and pensions products. Non-life, general, or property/casualty insurance companies, which sell other types of insurance.

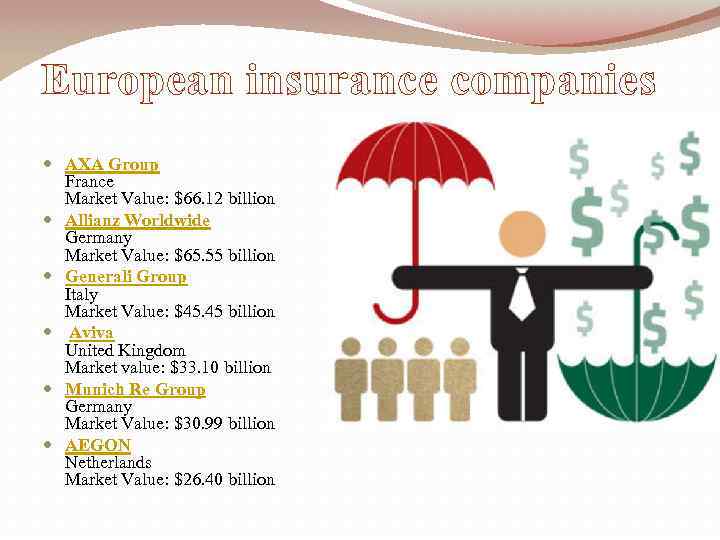

European insurance companies AXA Group France Market Value: $66. 12 billion Allianz Worldwide Germany Market Value: $65. 55 billion Generali Group Italy Market Value: $45. 45 billion Aviva United Kingdom Market value: $33. 10 billion Munich Re Group Germany Market Value: $30. 99 billion AEGON Netherlands Market Value: $26. 40 billion

European insurance companies AXA Group France Market Value: $66. 12 billion Allianz Worldwide Germany Market Value: $65. 55 billion Generali Group Italy Market Value: $45. 45 billion Aviva United Kingdom Market value: $33. 10 billion Munich Re Group Germany Market Value: $30. 99 billion AEGON Netherlands Market Value: $26. 40 billion

Ukrainian Insurance Companies Grawe Ukraina Insurance Alico AIG Life Insurance TAS Insurance Ekko Insurance Company Nadiya Insurance Garant Life Insurance Universalnaya Insurance Lemma Insurance Avantyeh Insurance Aura Insurance Etalon Insurance AKU Garant Insurance Oranta Insurance Aska Insurance Garant-Avto Insurance

Ukrainian Insurance Companies Grawe Ukraina Insurance Alico AIG Life Insurance TAS Insurance Ekko Insurance Company Nadiya Insurance Garant Life Insurance Universalnaya Insurance Lemma Insurance Avantyeh Insurance Aura Insurance Etalon Insurance AKU Garant Insurance Oranta Insurance Aska Insurance Garant-Avto Insurance

PENSION FUND Pension fund is any plan, fund, or scheme which provides retirement income. Public vs. private pension funds A public pension - is regulated under public sector law. A private pension fund is regulated under private sector law.

PENSION FUND Pension fund is any plan, fund, or scheme which provides retirement income. Public vs. private pension funds A public pension - is regulated under public sector law. A private pension fund is regulated under private sector law.

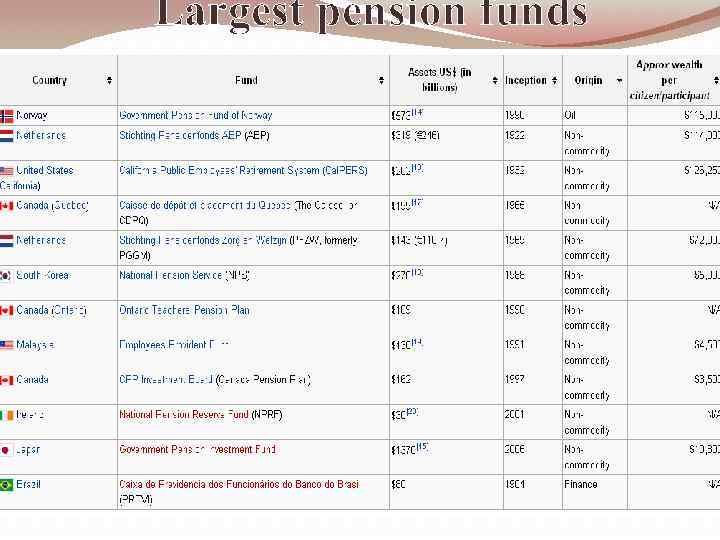

Largest pension funds

Largest pension funds

Pension fund of Ukraine The sources of forming the assets of Pension Fund are: insurance contributions; funds of State budget and state special-purpose funds that are remitted to the Fund in cases envisaged by legislation; charitable contributions of legal entities and natural persons; voluntary contributions for obligatory state pension insurance; other earnings according to legislation.

Pension fund of Ukraine The sources of forming the assets of Pension Fund are: insurance contributions; funds of State budget and state special-purpose funds that are remitted to the Fund in cases envisaged by legislation; charitable contributions of legal entities and natural persons; voluntary contributions for obligatory state pension insurance; other earnings according to legislation.

Financial brokers - acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. Tasks of financial broker: - Retail Banking, dealing directly with individuals and small businesses; - Business banking, providing services to mid-market business; - Corporate banking, directed at large business entities; - Land mortgage banking, it specializes in originating and/or serving land mortgage loans; - Private banking, providing wealth management services to High Net Worth Individuals and families; - Investment banking, relating to activities on the financial markets.

Financial brokers - acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. Tasks of financial broker: - Retail Banking, dealing directly with individuals and small businesses; - Business banking, providing services to mid-market business; - Corporate banking, directed at large business entities; - Land mortgage banking, it specializes in originating and/or serving land mortgage loans; - Private banking, providing wealth management services to High Net Worth Individuals and families; - Investment banking, relating to activities on the financial markets.