61b97c4175228e6765f8ea7097019fea.ppt

- Количество слайдов: 33

The financial crisis and its consequences for the real economy IBFP- 27. 11. 2009 Henri Bogaert Federal Planning Bureau Economic analyses and forecasts

The financial crisis and its consequences for the real economy IBFP- 27. 11. 2009 Henri Bogaert Federal Planning Bureau Economic analyses and forecasts

Outline • Origins of the crisis • Where do we stand now? • The near future Federal Planning Bureau Economic analyses and forecasts

Outline • Origins of the crisis • Where do we stand now? • The near future Federal Planning Bureau Economic analyses and forecasts

Origins of the crisis Federal Planning Bureau Economic analyses and forecasts

Origins of the crisis Federal Planning Bureau Economic analyses and forecasts

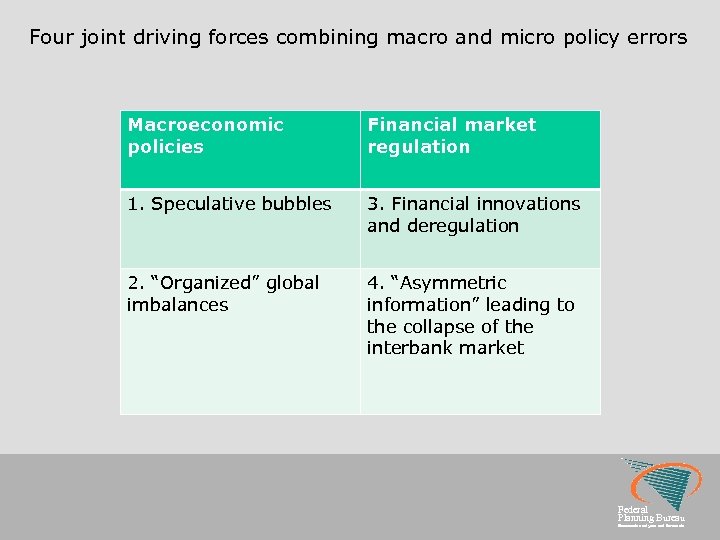

Four joint driving forces combining macro and micro policy errors Macroeconomic policies Financial market regulation 1. Speculative bubbles 3. Financial innovations and deregulation 2. “Organized” global imbalances 4. “Asymmetric information” leading to the collapse of the interbank market Federal Planning Bureau Economic analyses and forecasts

Four joint driving forces combining macro and micro policy errors Macroeconomic policies Financial market regulation 1. Speculative bubbles 3. Financial innovations and deregulation 2. “Organized” global imbalances 4. “Asymmetric information” leading to the collapse of the interbank market Federal Planning Bureau Economic analyses and forecasts

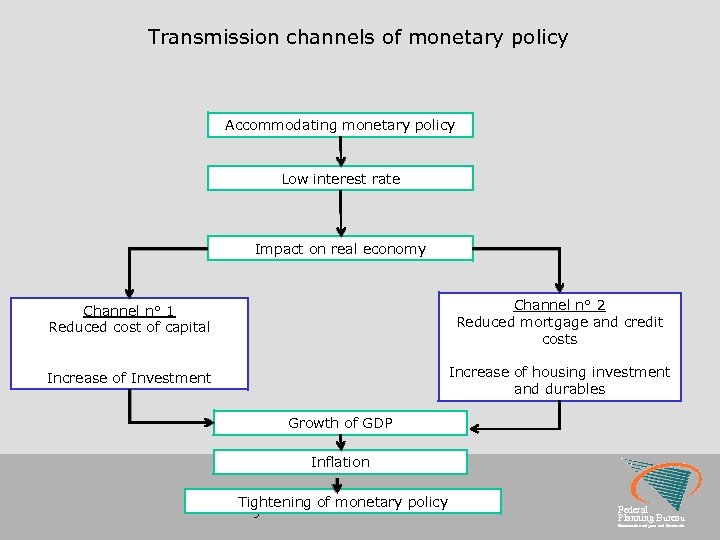

Transmission channels of monetary policy Accommodating monetary policy Low interest rate Impact on real economy Channel n° 1 Reduced cost of capital Channel n° 2 Reduced mortgage and credit costs Increase of Investment Increase of housing investment and durables Growth of GDP Inflation Tightening of monetary policy 5 Federal Planning Bureau Economic analyses and forecasts

Transmission channels of monetary policy Accommodating monetary policy Low interest rate Impact on real economy Channel n° 1 Reduced cost of capital Channel n° 2 Reduced mortgage and credit costs Increase of Investment Increase of housing investment and durables Growth of GDP Inflation Tightening of monetary policy 5 Federal Planning Bureau Economic analyses and forecasts

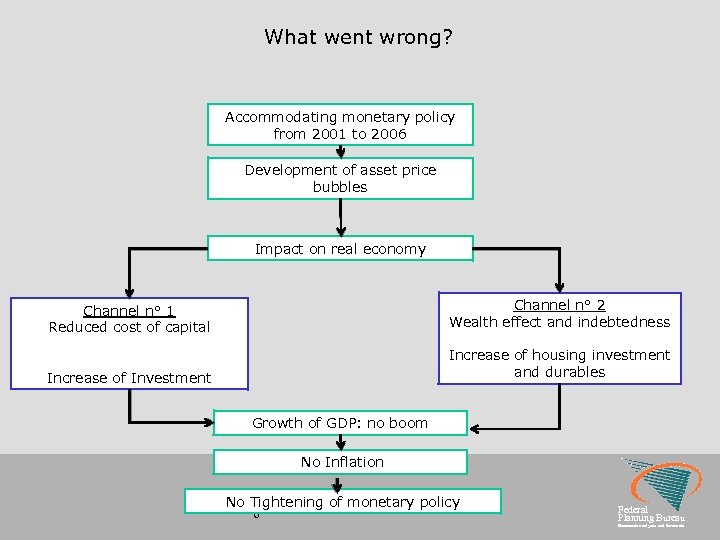

What went wrong? Accommodating monetary policy from 2001 to 2006 Development of asset price bubbles Impact on real economy Channel n° 1 Reduced cost of capital Channel n° 2 Wealth effect and indebtedness Increase of Investment Increase of housing investment and durables Growth of GDP: no boom No Inflation No Tightening of monetary policy 6 Federal Planning Bureau Economic analyses and forecasts

What went wrong? Accommodating monetary policy from 2001 to 2006 Development of asset price bubbles Impact on real economy Channel n° 1 Reduced cost of capital Channel n° 2 Wealth effect and indebtedness Increase of Investment Increase of housing investment and durables Growth of GDP: no boom No Inflation No Tightening of monetary policy 6 Federal Planning Bureau Economic analyses and forecasts

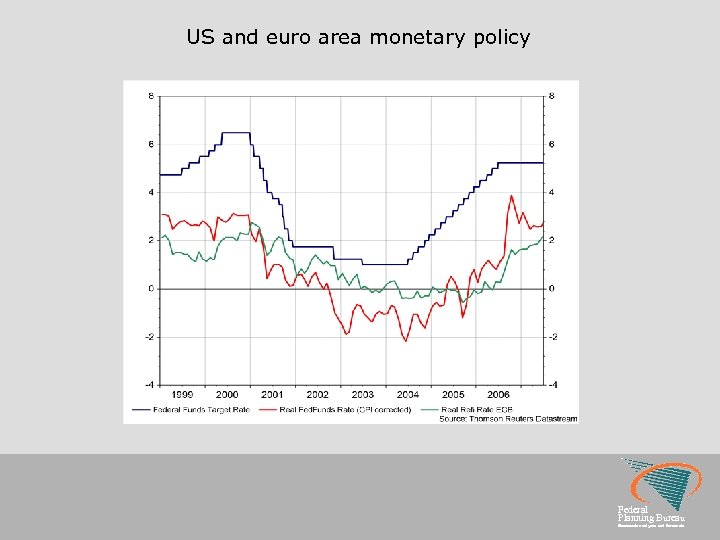

US monetary policy • • • Following the bursting of the technology bubble, rates were slashed to fight deflation Real fedfundsrate close to 0% or even negative for 5 years Making credit very cheap Increased risk taking, resulting in historically low risk spreads Pushing up asset prices (financial & houses) Federal Planning Bureau Economic analyses and forecasts

US monetary policy • • • Following the bursting of the technology bubble, rates were slashed to fight deflation Real fedfundsrate close to 0% or even negative for 5 years Making credit very cheap Increased risk taking, resulting in historically low risk spreads Pushing up asset prices (financial & houses) Federal Planning Bureau Economic analyses and forecasts

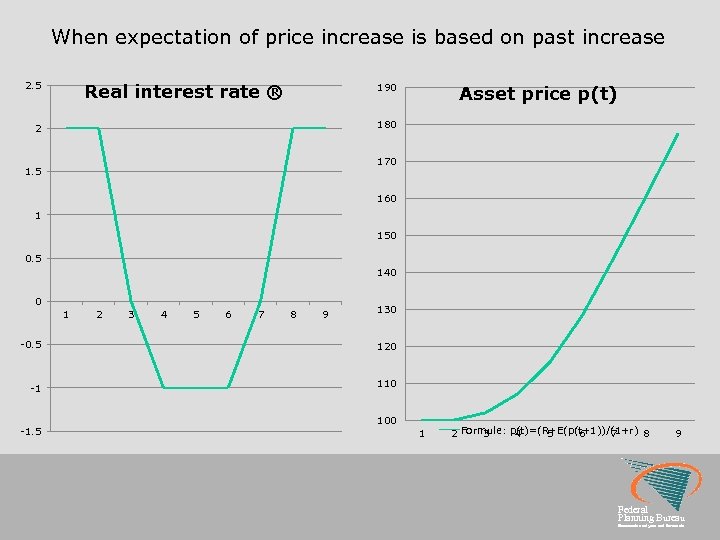

When expectation of price increase is based on past increase 2. 5 Real interest rate ® 190 Asset price p(t) 180 2 170 1. 5 160 1 150 0. 5 140 0 1 2 3 4 5 6 7 8 9 130 -0. 5 120 -1 110 -1. 5 100 1 2 Formule: p(t)=(R+E(p(t+1))/(1+r) 8 3 4 5 6 7 9 Federal Planning Bureau Economic analyses and forecasts

When expectation of price increase is based on past increase 2. 5 Real interest rate ® 190 Asset price p(t) 180 2 170 1. 5 160 1 150 0. 5 140 0 1 2 3 4 5 6 7 8 9 130 -0. 5 120 -1 110 -1. 5 100 1 2 Formule: p(t)=(R+E(p(t+1))/(1+r) 8 3 4 5 6 7 9 Federal Planning Bureau Economic analyses and forecasts

US and euro area monetary policy Federal Planning Bureau Economic analyses and forecasts

US and euro area monetary policy Federal Planning Bureau Economic analyses and forecasts

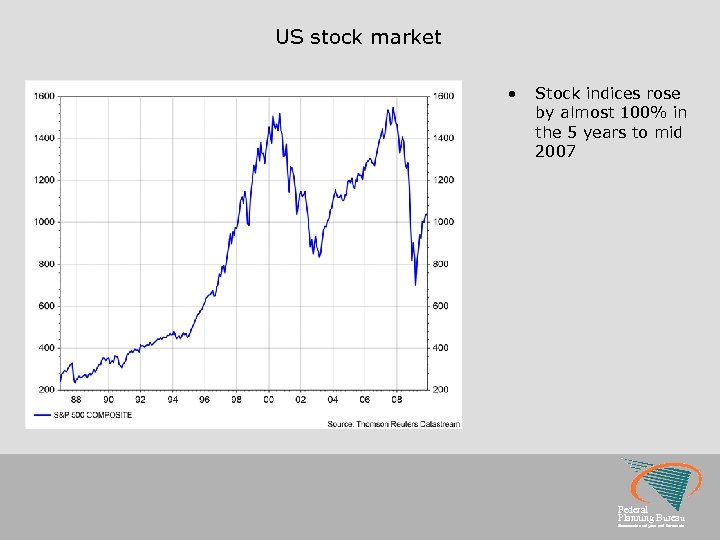

US stock market • Stock indices rose by almost 100% in the 5 years to mid 2007 Federal Planning Bureau Economic analyses and forecasts

US stock market • Stock indices rose by almost 100% in the 5 years to mid 2007 Federal Planning Bureau Economic analyses and forecasts

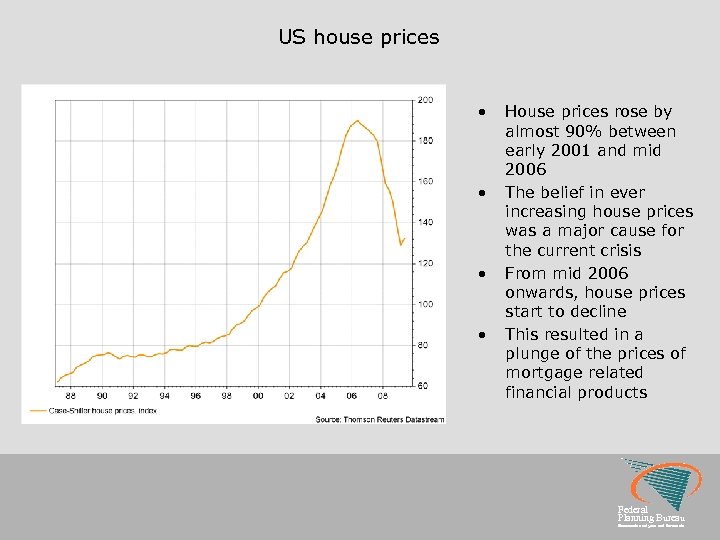

US house prices • • House prices rose by almost 90% between early 2001 and mid 2006 The belief in ever increasing house prices was a major cause for the current crisis From mid 2006 onwards, house prices start to decline This resulted in a plunge of the prices of mortgage related financial products Federal Planning Bureau Economic analyses and forecasts

US house prices • • House prices rose by almost 90% between early 2001 and mid 2006 The belief in ever increasing house prices was a major cause for the current crisis From mid 2006 onwards, house prices start to decline This resulted in a plunge of the prices of mortgage related financial products Federal Planning Bureau Economic analyses and forecasts

US household indebtness (debt-to-income ratio) Federal Planning Bureau Economic analyses and forecasts

US household indebtness (debt-to-income ratio) Federal Planning Bureau Economic analyses and forecasts

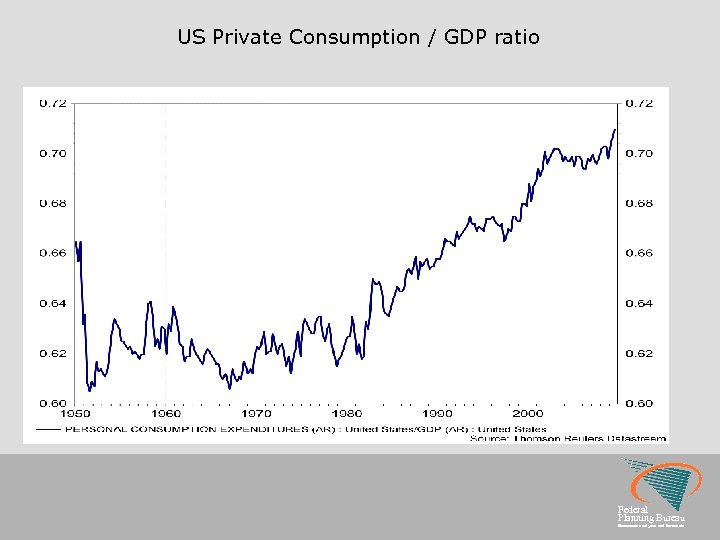

US Private Consumption / GDP ratio Federal Planning Bureau Economic analyses and forecasts

US Private Consumption / GDP ratio Federal Planning Bureau Economic analyses and forecasts

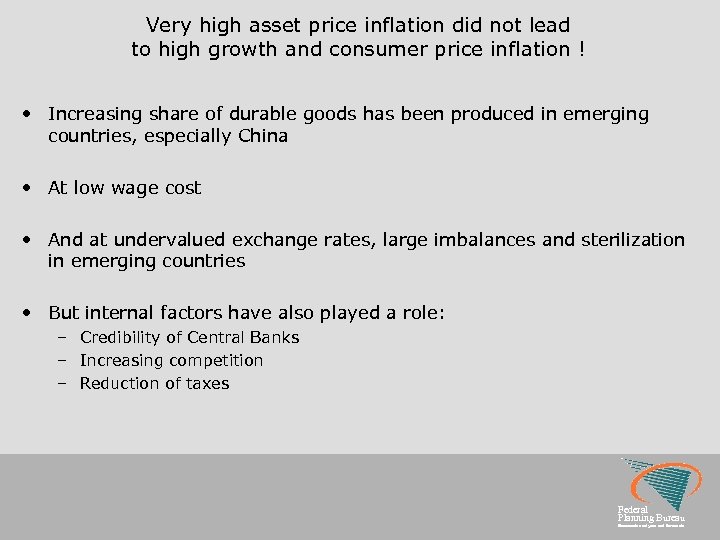

Very high asset price inflation did not lead to high growth and consumer price inflation ! • Increasing share of durable goods has been produced in emerging countries, especially China • At low wage cost • And at undervalued exchange rates, large imbalances and sterilization in emerging countries • But internal factors have also played a role: – Credibility of Central Banks – Increasing competition – Reduction of taxes Federal Planning Bureau Economic analyses and forecasts

Very high asset price inflation did not lead to high growth and consumer price inflation ! • Increasing share of durable goods has been produced in emerging countries, especially China • At low wage cost • And at undervalued exchange rates, large imbalances and sterilization in emerging countries • But internal factors have also played a role: – Credibility of Central Banks – Increasing competition – Reduction of taxes Federal Planning Bureau Economic analyses and forecasts

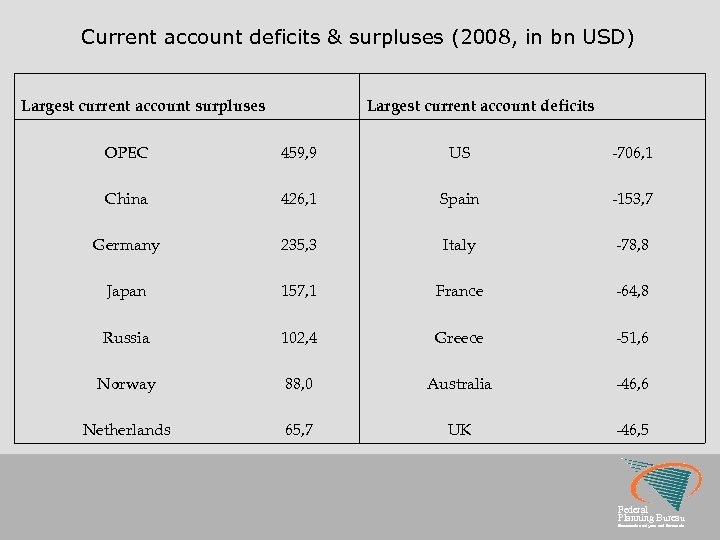

Current account deficits & surpluses (2008, in bn USD) Largest current account surpluses Largest current account deficits OPEC 459, 9 US -706, 1 China 426, 1 Spain -153, 7 Germany 235, 3 Italy -78, 8 Japan 157, 1 France -64, 8 Russia 102, 4 Greece -51, 6 Norway 88, 0 Australia -46, 6 Netherlands 65, 7 UK -46, 5 Federal Planning Bureau Economic analyses and forecasts

Current account deficits & surpluses (2008, in bn USD) Largest current account surpluses Largest current account deficits OPEC 459, 9 US -706, 1 China 426, 1 Spain -153, 7 Germany 235, 3 Italy -78, 8 Japan 157, 1 France -64, 8 Russia 102, 4 Greece -51, 6 Norway 88, 0 Australia -46, 6 Netherlands 65, 7 UK -46, 5 Federal Planning Bureau Economic analyses and forecasts

Consequences of the crisis for the real economy and where do we stand now? Federal Planning Bureau Economic analyses and forecasts

Consequences of the crisis for the real economy and where do we stand now? Federal Planning Bureau Economic analyses and forecasts

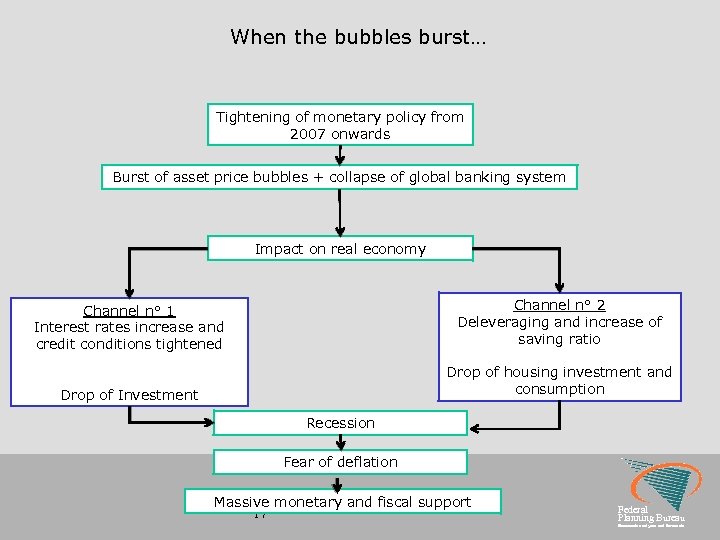

When the bubbles burst… Tightening of monetary policy from 2007 onwards Burst of asset price bubbles + collapse of global banking system Impact on real economy Channel n° 1 Interest rates increase and credit conditions tightened Channel n° 2 Deleveraging and increase of saving ratio Drop of Investment Drop of housing investment and consumption Recession Fear of deflation Massive monetary and fiscal support 17 Federal Planning Bureau Economic analyses and forecasts

When the bubbles burst… Tightening of monetary policy from 2007 onwards Burst of asset price bubbles + collapse of global banking system Impact on real economy Channel n° 1 Interest rates increase and credit conditions tightened Channel n° 2 Deleveraging and increase of saving ratio Drop of Investment Drop of housing investment and consumption Recession Fear of deflation Massive monetary and fiscal support 17 Federal Planning Bureau Economic analyses and forecasts

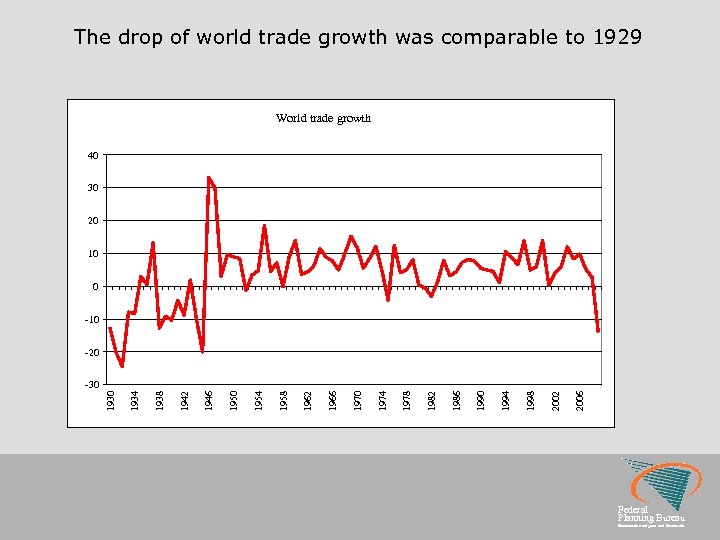

The drop of world trade growth was comparable to 1929 World trade growth 40 30 20 10 0 -10 -20 2006 2002 1998 1994 1990 1986 1982 1978 1974 1970 1966 1962 1958 1954 1950 1946 1942 1938 1934 1930 -30 Federal Planning Bureau Economic analyses and forecasts

The drop of world trade growth was comparable to 1929 World trade growth 40 30 20 10 0 -10 -20 2006 2002 1998 1994 1990 1986 1982 1978 1974 1970 1966 1962 1958 1954 1950 1946 1942 1938 1934 1930 -30 Federal Planning Bureau Economic analyses and forecasts

World GDP growth since 1930 Federal Planning Bureau Economic analyses and forecasts

World GDP growth since 1930 Federal Planning Bureau Economic analyses and forecasts

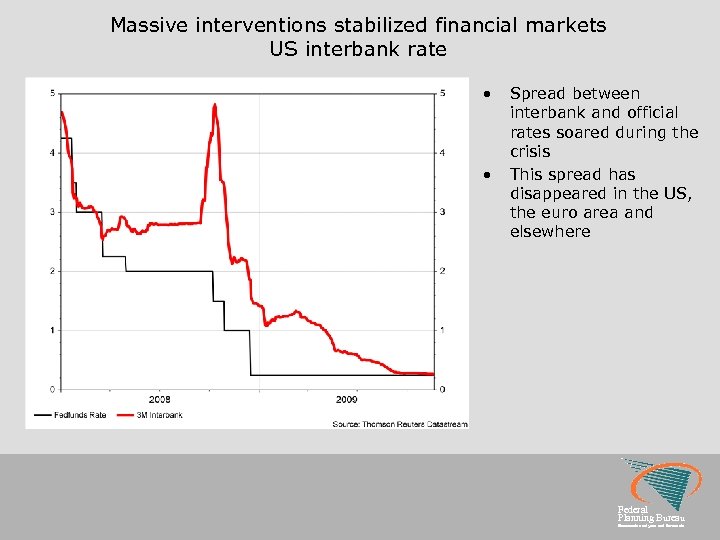

Massive interventions stabilized financial markets US interbank rate • • Spread between interbank and official rates soared during the crisis This spread has disappeared in the US, the euro area and elsewhere Federal Planning Bureau Economic analyses and forecasts

Massive interventions stabilized financial markets US interbank rate • • Spread between interbank and official rates soared during the crisis This spread has disappeared in the US, the euro area and elsewhere Federal Planning Bureau Economic analyses and forecasts

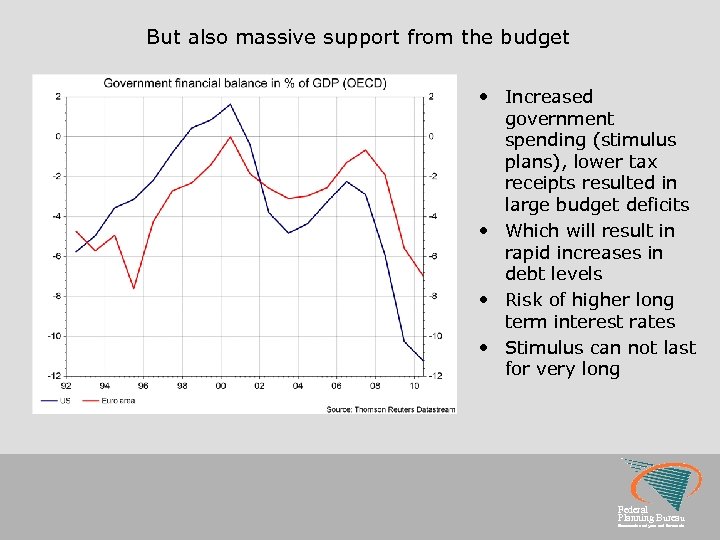

But also massive support from the budget • Increased government spending (stimulus plans), lower tax receipts resulted in large budget deficits • Which will result in rapid increases in debt levels • Risk of higher long term interest rates • Stimulus can not last for very long Federal Planning Bureau Economic analyses and forecasts

But also massive support from the budget • Increased government spending (stimulus plans), lower tax receipts resulted in large budget deficits • Which will result in rapid increases in debt levels • Risk of higher long term interest rates • Stimulus can not last for very long Federal Planning Bureau Economic analyses and forecasts

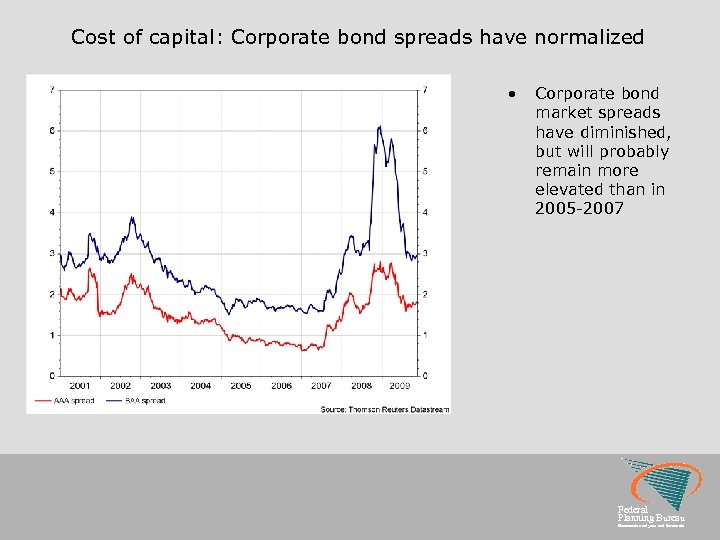

Cost of capital: Corporate bond spreads have normalized • Corporate bond market spreads have diminished, but will probably remain more elevated than in 2005 -2007 Federal Planning Bureau Economic analyses and forecasts

Cost of capital: Corporate bond spreads have normalized • Corporate bond market spreads have diminished, but will probably remain more elevated than in 2005 -2007 Federal Planning Bureau Economic analyses and forecasts

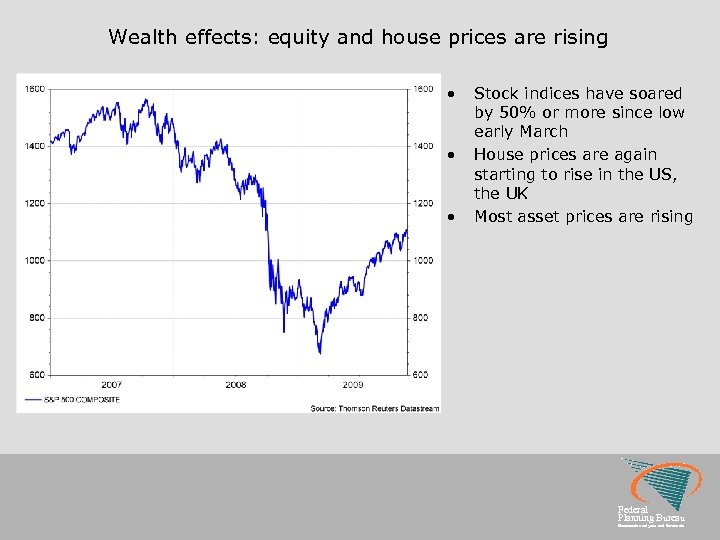

Wealth effects: equity and house prices are rising • • • Stock indices have soared by 50% or more since low early March House prices are again starting to rise in the US, the UK Most asset prices are rising Federal Planning Bureau Economic analyses and forecasts

Wealth effects: equity and house prices are rising • • • Stock indices have soared by 50% or more since low early March House prices are again starting to rise in the US, the UK Most asset prices are rising Federal Planning Bureau Economic analyses and forecasts

The global recession has ended Near term optimism caused by a combination of temporary factors : - fiscal stimulus - inventory rebuilding rather than by solid private consumption and investment growth Federal Planning Bureau Economic analyses and forecasts

The global recession has ended Near term optimism caused by a combination of temporary factors : - fiscal stimulus - inventory rebuilding rather than by solid private consumption and investment growth Federal Planning Bureau Economic analyses and forecasts

The near future Federal Planning Bureau Economic analyses and forecasts

The near future Federal Planning Bureau Economic analyses and forecasts

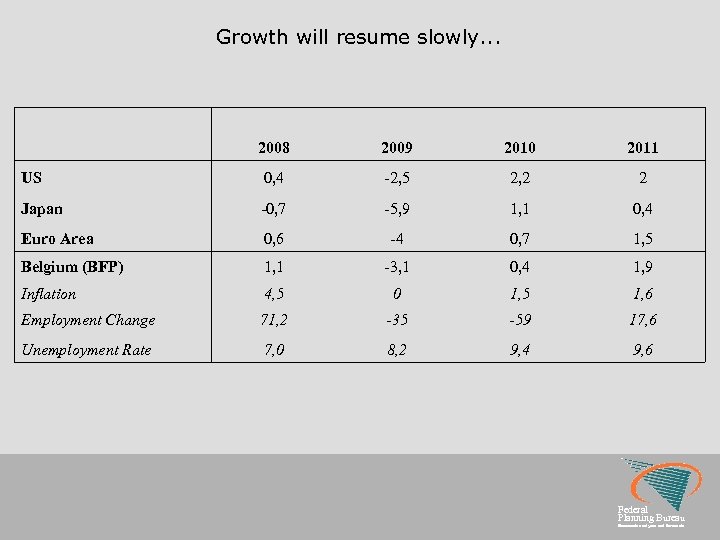

Growth will resume slowly. . . 2008 2009 2010 2011 US 0, 4 -2, 5 2, 2 2 Japan -0, 7 -5, 9 1, 1 0, 4 Euro Area 0, 6 -4 0, 7 1, 5 Belgium (BFP) 1, 1 -3, 1 0, 4 1, 9 Inflation 4, 5 0 1, 5 1, 6 Employment Change 71, 2 -35 -59 17, 6 Unemployment Rate 7, 0 8, 2 9, 4 9, 6 Federal Planning Bureau Economic analyses and forecasts

Growth will resume slowly. . . 2008 2009 2010 2011 US 0, 4 -2, 5 2, 2 2 Japan -0, 7 -5, 9 1, 1 0, 4 Euro Area 0, 6 -4 0, 7 1, 5 Belgium (BFP) 1, 1 -3, 1 0, 4 1, 9 Inflation 4, 5 0 1, 5 1, 6 Employment Change 71, 2 -35 -59 17, 6 Unemployment Rate 7, 0 8, 2 9, 4 9, 6 Federal Planning Bureau Economic analyses and forecasts

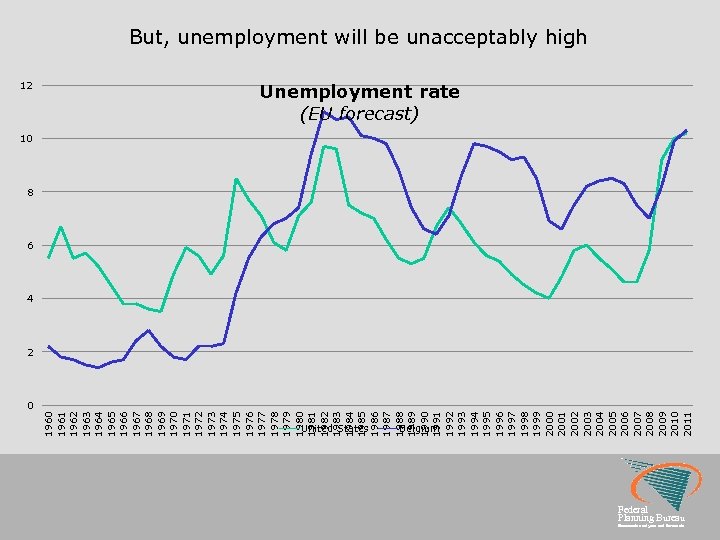

12 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 But, unemployment will be unacceptably high Unemployment rate (EU forecast) 10 8 6 4 2 0 United States Belgium Federal Planning Bureau Economic analyses and forecasts

12 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 But, unemployment will be unacceptably high Unemployment rate (EU forecast) 10 8 6 4 2 0 United States Belgium Federal Planning Bureau Economic analyses and forecasts

Danger of early exit, exhibit 1: Greece A B C D Bank assets (in bn €) ECB funding (in bn €) B/A Debt/GDP in 2010 GR 481 38 7, 9 111, 8 IR 1650 98 5, 9 80, 3 BE 1163 40 3, 4 106, 4 GE 7519 221 2, 9 84, 1 ES 3427 84 2, 5 68, 2 NL 2208 40 1, 8 76, 6 LX 1150 19 1, 7 n/a FR 7707 101 1, 3 94, 2 IT 3730 30 0, 8 127, 3 Source: FT, Barclays, OECD Federal Planning Bureau Economic analyses and forecasts

Danger of early exit, exhibit 1: Greece A B C D Bank assets (in bn €) ECB funding (in bn €) B/A Debt/GDP in 2010 GR 481 38 7, 9 111, 8 IR 1650 98 5, 9 80, 3 BE 1163 40 3, 4 106, 4 GE 7519 221 2, 9 84, 1 ES 3427 84 2, 5 68, 2 NL 2208 40 1, 8 76, 6 LX 1150 19 1, 7 n/a FR 7707 101 1, 3 94, 2 IT 3730 30 0, 8 127, 3 Source: FT, Barclays, OECD Federal Planning Bureau Economic analyses and forecasts

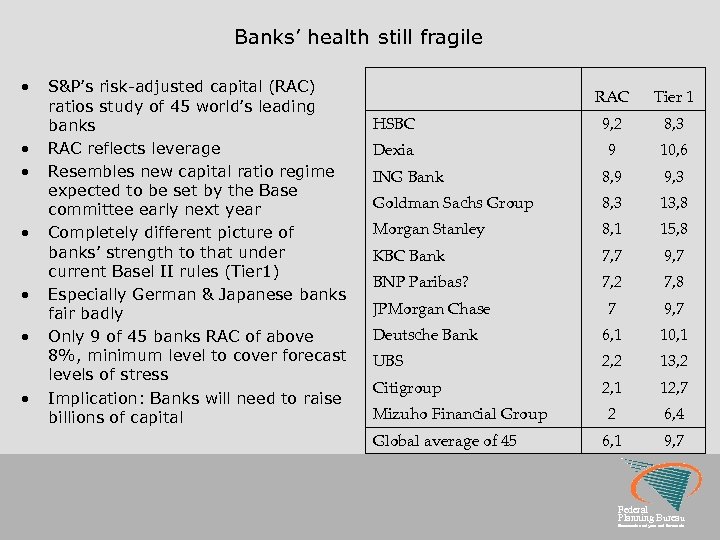

Banks’ health still fragile • • S&P’s risk-adjusted capital (RAC) ratios study of 45 world’s leading banks RAC reflects leverage Resembles new capital ratio regime expected to be set by the Base committee early next year Completely different picture of banks’ strength to that under current Basel II rules (Tier 1) Especially German & Japanese banks fair badly Only 9 of 45 banks RAC of above 8%, minimum level to cover forecast levels of stress Implication: Banks will need to raise billions of capital RAC Tier 1 HSBC 9, 2 8, 3 Dexia 9 10, 6 ING Bank 8, 9 9, 3 Goldman Sachs Group 8, 3 13, 8 Morgan Stanley 8, 1 15, 8 KBC Bank 7, 7 9, 7 BNP Paribas? 7, 2 7, 8 7 9, 7 Deutsche Bank 6, 1 10, 1 UBS 2, 2 13, 2 Citigroup 2, 1 12, 7 2 6, 4 6, 1 9, 7 JPMorgan Chase Mizuho Financial Group Global average of 45 Federal Planning Bureau Economic analyses and forecasts

Banks’ health still fragile • • S&P’s risk-adjusted capital (RAC) ratios study of 45 world’s leading banks RAC reflects leverage Resembles new capital ratio regime expected to be set by the Base committee early next year Completely different picture of banks’ strength to that under current Basel II rules (Tier 1) Especially German & Japanese banks fair badly Only 9 of 45 banks RAC of above 8%, minimum level to cover forecast levels of stress Implication: Banks will need to raise billions of capital RAC Tier 1 HSBC 9, 2 8, 3 Dexia 9 10, 6 ING Bank 8, 9 9, 3 Goldman Sachs Group 8, 3 13, 8 Morgan Stanley 8, 1 15, 8 KBC Bank 7, 7 9, 7 BNP Paribas? 7, 2 7, 8 7 9, 7 Deutsche Bank 6, 1 10, 1 UBS 2, 2 13, 2 Citigroup 2, 1 12, 7 2 6, 4 6, 1 9, 7 JPMorgan Chase Mizuho Financial Group Global average of 45 Federal Planning Bureau Economic analyses and forecasts

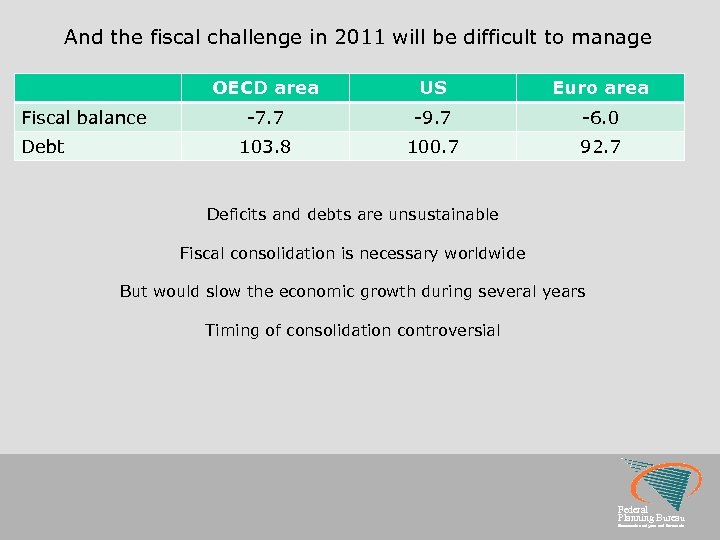

And the fiscal challenge in 2011 will be difficult to manage OECD area Debt Euro area -7. 7 -9. 7 -6. 0 103. 8 Fiscal balance US 100. 7 92. 7 Deficits and debts are unsustainable Fiscal consolidation is necessary worldwide But would slow the economic growth during several years Timing of consolidation controversial Federal Planning Bureau Economic analyses and forecasts

And the fiscal challenge in 2011 will be difficult to manage OECD area Debt Euro area -7. 7 -9. 7 -6. 0 103. 8 Fiscal balance US 100. 7 92. 7 Deficits and debts are unsustainable Fiscal consolidation is necessary worldwide But would slow the economic growth during several years Timing of consolidation controversial Federal Planning Bureau Economic analyses and forecasts

Two rebalancing acts needed • That would lead to a sustainable recovery : – From public to private spending: otherwise debts would continue to rise and risk pushing interest rates higher – Shift from domestic to foreign demand in the US & shift from foreign to domestic demand in Germany, China and the rest of Asia Will take time Federal Planning Bureau Economic analyses and forecasts

Two rebalancing acts needed • That would lead to a sustainable recovery : – From public to private spending: otherwise debts would continue to rise and risk pushing interest rates higher – Shift from domestic to foreign demand in the US & shift from foreign to domestic demand in Germany, China and the rest of Asia Will take time Federal Planning Bureau Economic analyses and forecasts

Outcome? Three scenarios • Pessimistic: – Fiscal and monetary exit strategy happens too soon – Private demand does not take over role of government spending, while banks tighten credit standards & prices – Economic activity nosedives – New problems surface in the financial sector • Towards the next bubble: – – Monetary and fiscal too loose for too long Asset prices are boosted by the lenghty surge in liquidity Governments, central banks allow more inflation to erode debt Bubble collapses bringing us back to the situation of late 2008, but starting with much higher debt rates • Global rebalancing: – Timing of monetary and fiscal exit is just ‘right’ – Chinese domestic demand become drivers of world economy (Germany? ) – US households repair balance sheet (deleveraging, saving more), US growth more driven by external sector Federal Planning Bureau Economic analyses and forecasts

Outcome? Three scenarios • Pessimistic: – Fiscal and monetary exit strategy happens too soon – Private demand does not take over role of government spending, while banks tighten credit standards & prices – Economic activity nosedives – New problems surface in the financial sector • Towards the next bubble: – – Monetary and fiscal too loose for too long Asset prices are boosted by the lenghty surge in liquidity Governments, central banks allow more inflation to erode debt Bubble collapses bringing us back to the situation of late 2008, but starting with much higher debt rates • Global rebalancing: – Timing of monetary and fiscal exit is just ‘right’ – Chinese domestic demand become drivers of world economy (Germany? ) – US households repair balance sheet (deleveraging, saving more), US growth more driven by external sector Federal Planning Bureau Economic analyses and forecasts

Federal Planning Bureau Economic analyses and forecasts

Federal Planning Bureau Economic analyses and forecasts