9d67b8ce58d3e1d5319be1e3f678da4e.ppt

- Количество слайдов: 39

The Finance Lobby and the European Union

The Lobby Groups

The Finance Lobby in the EU • 700 lobbyists in Bruxelles • Most lobbying via associations • Commands huge sums of money • Deemed to be ‘experts’ by the Commission

Legislative process in five stages 1. The big plans (strategy) 2. Proposals are made 3. Politicial decision process (Council and Parliament) 4. Precisioning and transposure 5. Enforcement

How the EU designed the rules that flunked

The crisis • Big banks had made huge risky investments • Credit rating agencies had deemed them right all along • Accountancy standards/rules had made it next to impossible for the authorities to see through them • Hedge funds were one type of vehicle that enables banks to hide bad investments

The financial sector and the crisis Four examples: 1. (Self) regulation of banks 2. Credit rating agencies 3. Accountancy standards 4. Hedge funds

Why the expert groups matter • They provide lobbyists with a chance to influence new legislation before it’s released by the Commission • They’re an important part of the surface of contact between the lobbyists and the civil servants.

Expert group on banking • • • Mr Javier Arias Banco Bilbao Vizcaya Mr Michel Van Lierde Lease. Europe/Euro-Finas Dr Lothar Blatt- von Raczeck Deutscher Sparkassen- und Giroverband Mr Rainer W. Boden Deutsche Bank AG Mr Steve Johnson European Banking Federation Mr Bill Eldridge Barclays Bank PLC Mr Mick Mc. Ateer Which? (UK Consumer Association) Mr Gérard Gardella Société Générale Mr Alain Gourio BNPPARIBAS Mr Volker Heegemann EACB Ms Judith Hardt European Mortgage Federation Mr Riccardo Iozzo San Paolo IMI Bank • • • Ms Michaela Koller ESBG - European Saving Banks Association Mr Wim Mijs ABN AMRO Mr Joan Rosas Xicota La Caixa Ms Katharine Seal LIBA Ms Emmanuelle Sebton ISDA Prof. Blanche Sousi Université Lyon 3, Chaire Jean Monnet Mr Tomasz J. Stachurski ING Poland Mr Freddy Van Den Spiegel Fortis Bank Mr Miles Webber Merrill Lynch Mr Pehr Wissén Svenska Handelsbanken Mr Andreas Zehnder European Federation of Building Societies

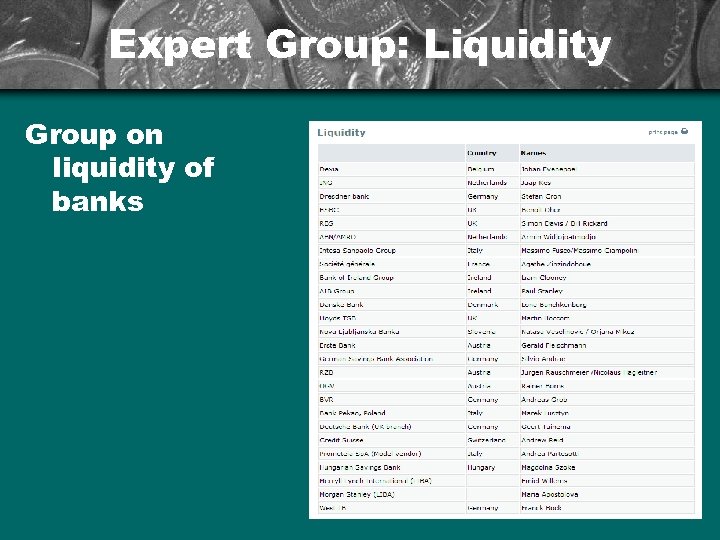

Expert Group: Liquidity Group on liquidity of banks

Credit rating agencies • • • Pr Luis Miguel Beleza, Banco Comercial Português; Dott Salvatore Bragantini, Centrobanca S. p. A. ; Dr Rolf E Breuer, Deutsche Bank AG; Mr Donald Brydon, AXA Investment Managers; Mr Ignace Combes, Euroclear Bank; Mr P. P. F. de Vries, Euroshareholders; Mr Lars-Erik Forsgardh, Swedish Shareholders Association; Mr Dominique Hoenn, Euronext; Ms Sonja Lohse, Nordea AB; • • Mr Theodoros Philippou, The Institute of Certified Public Accounts of Cyprus, Mr Mariano Rabadan, (INVERCO); Mr Wieslaw Rozlucki, Warsaw Stock Exchange; Pr Rüdiger von Rosen, Deutsches Aktieninstitut; Pr Dr Emmanuel D. Xanthakis, Marfin Bank Mr Zoltan Zpeder, OTP Bank RT

Investment Funds • • • • Mr Segun Aganga UK Goldman Sachs Mr Antonio Ary dos Santos Freire P Santander Ms Odette Cesari FR Axa-IM Mr Neil Donnelly IRL Pioneer Mr Alain Dubois FR Lyxor Mr Horst Eich DE Allianz Mr Paul Feeney UK Gartmore Mr Holger Hartenfels DE Deutsche Bank Ms Gay Huey Evans US Citigroup-Tribeca Mr Alain Reinhold FR ADI Mr Rupert Rossander CH MAN Mr Lindsay Tomlinson UK BGI Mr Jack Tracy UK Morgan Stanley Mr Luc de Vet LUX Citco Mr Neil Warrender UK RAB Capital Mr Damian Neylin IRL Pricewaterhouse. Coopers

Expert group on investments

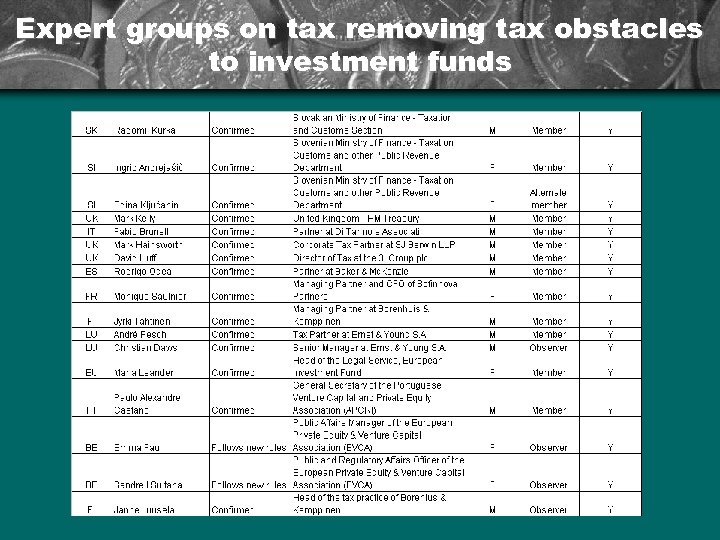

Expert groups on tax removing tax obstacles to investment funds

Accountancy standards • • • Johan van Helleman, KPMG Yves Bernheim, Mazars & Guerard Andreas Bezold, IAS 39 Implementation Guidance Committee Allan Cook, UK Accounting Standards Board Stig Enevoldsen, Deloitte & Touche Begoña Giner, Professor in Accounting and Finance, Valencia. Hans Leeuwerik, Shell International Freddy Méan, Petro. Fina, ERT (European Round Table) Eberhard Scheffler, German standard setter GASB Friedrich Spandl, Bank für Arbeit und Wirtschaft AG (BAWAG) Giuseppe Verna, Italian Accounting Standards Setting Body

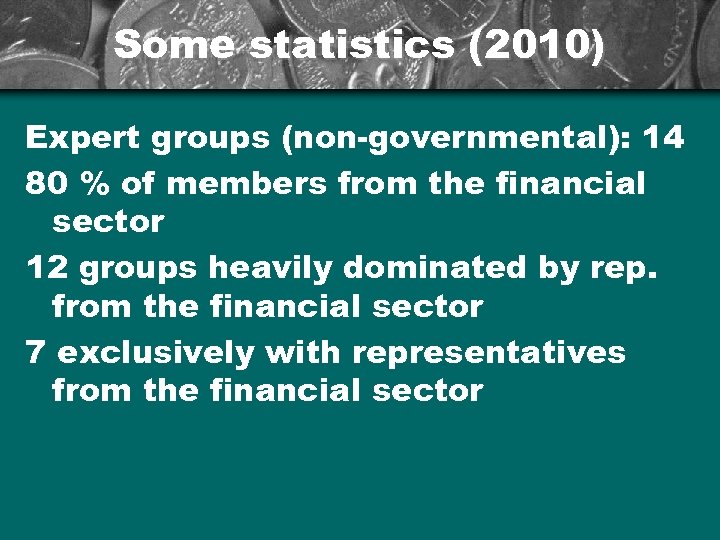

Some statistics (2010) Expert groups (non-governmental): 14 80 % of members from the financial sector 12 groups heavily dominated by rep. from the financial sector 7 exclusively with representatives from the financial sector

The crisis and the big promise

The crisis and the promise “I think the current crisis has shown that we need a comprehensive rethinking of our regulatory and supervision rules for financial markets” José Manuel Barroso, October 2008

A protagonist Charlie Mc. Creevy Single Market Commissioner (2004 -2009) Former Irish minister of finance

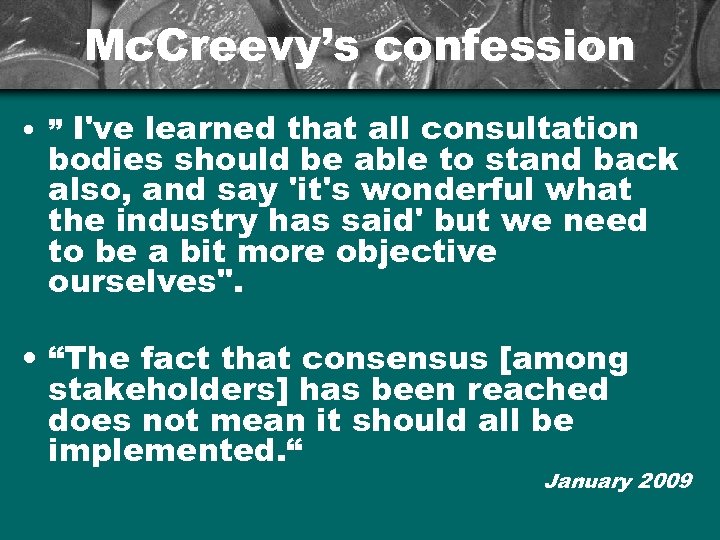

Mc. Creevy’s confession • ” I've learned that all consultation bodies should be able to stand back also, and say 'it's wonderful what the industry has said' but we need to be a bit more objective ourselves". • “The fact that consensus [among stakeholders] has been reached does not mean it should all be implemented. “ January 2009

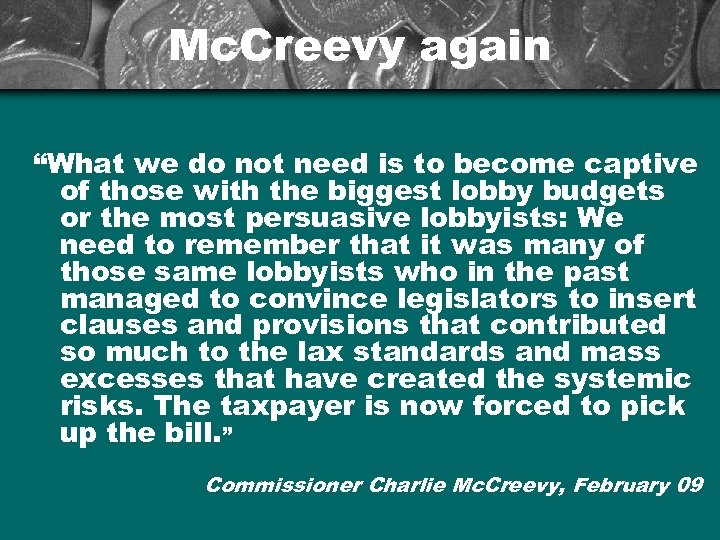

Mc. Creevy again “What we do not need is to become captive of those with the biggest lobby budgets or the most persuasive lobbyists: We need to remember that it was many of those same lobbyists who in the past managed to convince legislators to insert clauses and provisions that contributed so much to the lax standards and mass excesses that have created the systemic risks. The taxpayer is now forced to pick up the bill. ” Commissioner Charlie Mc. Creevy, February 09

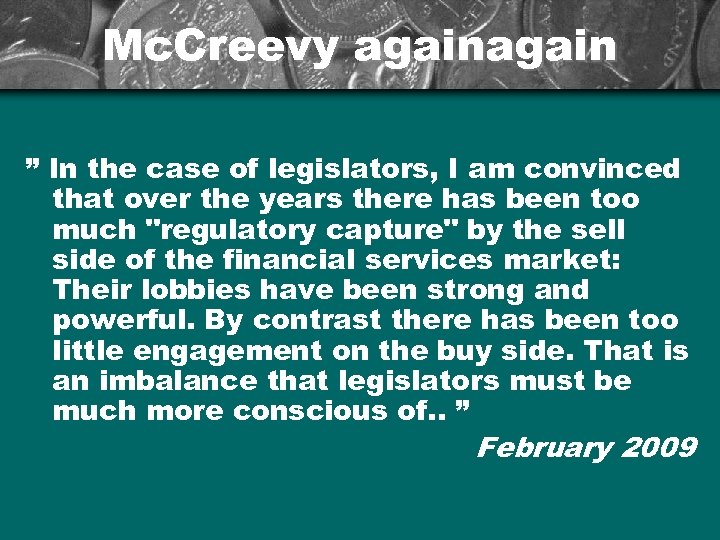

Mc. Creevy again ” In the case of legislators, I am convinced that over the years there has been too much "regulatory capture" by the sell side of the financial services market: Their lobbies have been strong and powerful. By contrast there has been too little engagement on the buy side. That is an imbalance that legislators must be much more conscious of. . ” February 2009

How the financial lobby won the post-crisis battle

The first step: the de Larosière group Jacques de Larosière (BNP Paribas) Otmar Issing (Goldman Sachs) Onno Ruding (Citicorp) Rainer Masera (Lehman Brothers) José Pérez Fernandez (ex-BBVA) Leszek Balcerowicz Lars Nyberg

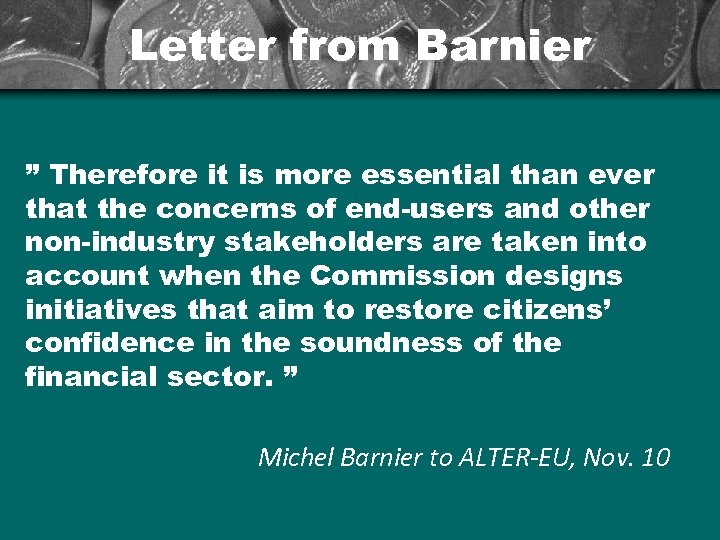

Letter from Barnier ”I am aware that the financial and economic crisis has significantly shaken the confidence of consumers, retail investors and SMEs in the regulation that are meant to protect them from failings in the financial system. ” Michel Barnier to ALTER-EU, Nov. 10

Letter from Barnier ” Therefore it is more essential than ever that the concerns of end-users and other non-industry stakeholders are taken into account when the Commission designs initiatives that aim to restore citizens’ confidence in the soundness of the financial sector. ” Michel Barnier to ALTER-EU, Nov. 10

Banking regulation “. . a very real risk” that “regulatory reforms come into force that could undermine global recovery and job creation” Institute of Internationale Finance, Summer 2010

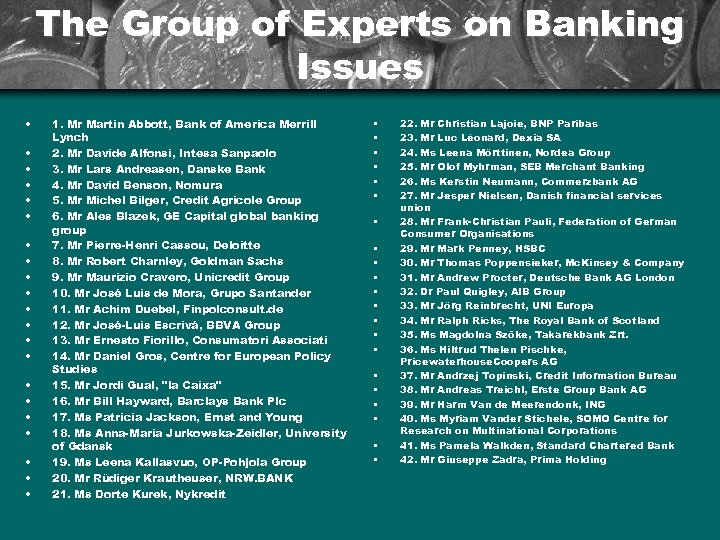

The Group of Experts on Banking Issues • • • • • • 1. Mr Martin Abbott, Bank of America Merrill Lynch 2. Mr Davide Alfonsi, Intesa Sanpaolo 3. Mr Lars Andreasen, Danske Bank 4. Mr David Benson, Nomura 5. Mr Michel Bilger, Credit Agricole Group 6. Mr Ales Blazek, GE Capital global banking group 7. Mr Pierre-Henri Cassou, Deloitte 8. Mr Robert Charnley, Goldman Sachs 9. Mr Maurizio Cravero, Unicredit Group 10. Mr José Luis de Mora, Grupo Santander 11. Mr Achim Duebel, Finpolconsult. de 12. Mr José-Luis Escrivá, BBVA Group 13. Mr Ernesto Fiorillo, Consumatori Associati 14. Mr Daniel Gros, Centre for European Policy Studies 15. Mr Jordi Gual, "la Caixa" 16. Mr Bill Hayward, Barclays Bank Plc 17. Ms Patricia Jackson, Ernst and Young 18. Ms Anna-Maria Jurkowska-Zeidler, University of Gdansk 19. Ms Leena Kallasvuo, OP-Pohjola Group 20. Mr Rüdiger Krautheuser, NRW. BANK 21. Ms Dorte Kurek, Nykredit • • • • • • 22. Mr Christian Lajoie, BNP Paribas 23. Mr Luc Léonard, Dexia SA 24. Ms Leena Mörttinen, Nordea Group 25. Mr Olof Myhrman, SEB Merchant Banking 26. Ms Kerstin Neumann, Commerzbank AG 27. Mr Jesper Nielsen, Danish financial services union 28. Mr Frank-Christian Pauli, Federation of German Consumer Organisations 29. Mr Mark Penney, HSBC 30. Mr Thomas Poppensieker, Mc. Kinsey & Company 31. Mr Andrew Procter, Deutsche Bank AG London 32. Dr Paul Quigley, AIB Group 33. Mr Jörg Reinbrecht, UNI Europa 34. Mr Ralph Ricks, The Royal Bank of Scotland 35. Ms Magdolna Szőke, Takarékbank Zrt. 36. Ms Hiltrud Thelen Pischke, Pricewaterhouse. Coopers AG 37. Mr Andrzej Topinski, Credit Information Bureau 38. Mr Andreas Treichl, Erste Group Bank AG 39. Mr Harm Van de Meerendonk, ING 40. Ms Myriam Vander Stichele, SOMO Centre for Research on Multinational Corporations 41. Ms Pamela Walkden, Standard Chartered Bank 42. Mr Giuseppe Zadra, Prima Holding

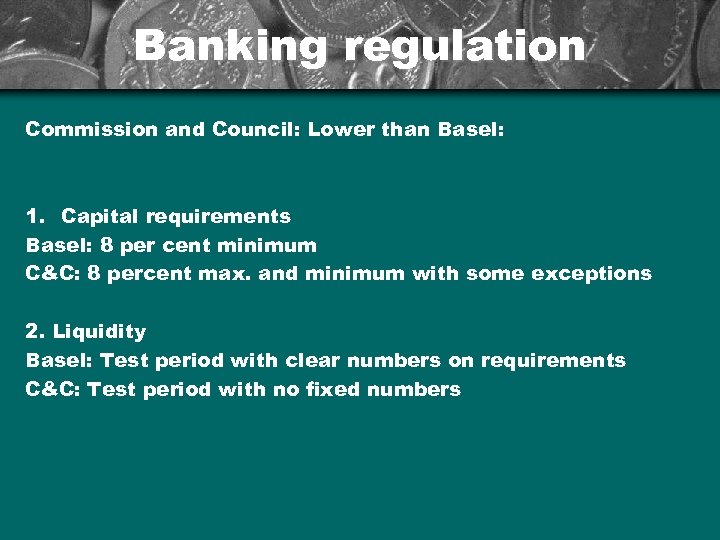

Banking regulation Commission and Council: Lower than Basel: 1. Capital requirements Basel: 8 per cent minimum C&C: 8 percent max. and minimum with some exceptions 2. Liquidity Basel: Test period with clear numbers on requirements C&C: Test period with no fixed numbers

Banking regulation New rule on leverage: Max. ratio: 33 times the banks’ assets 31

Corporate capture Accounting standards Derivatives Investment and investor regulation (Mi. FID)

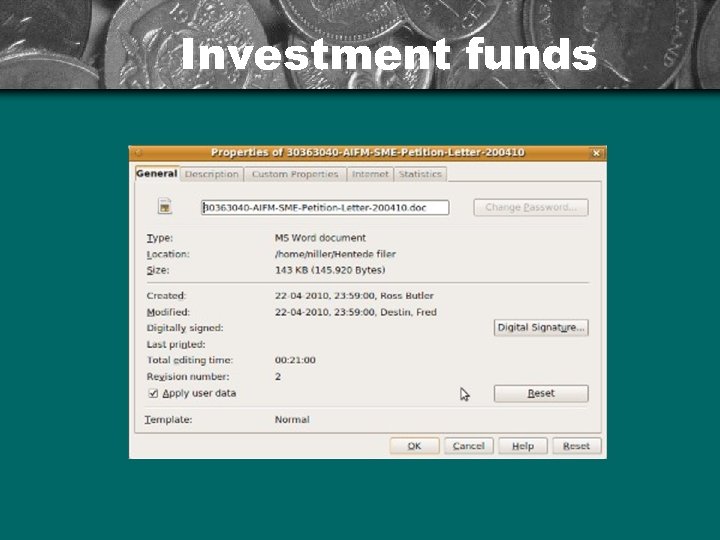

Investment funds • Scaremongering • Lobbying at national level (UK not least) • Contacts to the US government • Massive lobbying in the European Parliament • Astroturfing

Investment funds ” Nearly 700 companies signed a letter to MEPs warning of the dangers of the directive. . ” The Independent, May 2010 The Directive…”would distort the market, harm finance for innovation and company growth and ultimately inhibit Europe’s economic recovery. ” Letter signed by 700 ‘SMEs’

Investment funds

Part of a conclusion • Overhaul of expert groups • A mandatory register for lobbyists (incl. financial transparency) • Development of an ‘arms length principle’ • Improvement of rules on access-todocuments

www. corporateeurope. org

9d67b8ce58d3e1d5319be1e3f678da4e.ppt