321a34b491fa7e7fdde5783b81486a3e.ppt

- Количество слайдов: 27

The Federal Reserve System: Purposes and Functions Kristin A. Van Gaasbeck California State University, Sacramento ECON 135: Money & Banking

The Federal Reserve System: Purposes and Functions Kristin A. Van Gaasbeck California State University, Sacramento ECON 135: Money & Banking

Central Bank Goals n Goals q q q n Different central banks may emphasize some of these goals more than others. q n Price stability (low inflation) High and stable real economic growth (high employment) Stable financial markets Stable interest rates Stable exchange rates Conducting the nation’s monetary policy. Inflation targeting, fixed exchange rates Some of these goals may require contrary policies.

Central Bank Goals n Goals q q q n Different central banks may emphasize some of these goals more than others. q n Price stability (low inflation) High and stable real economic growth (high employment) Stable financial markets Stable interest rates Stable exchange rates Conducting the nation’s monetary policy. Inflation targeting, fixed exchange rates Some of these goals may require contrary policies.

Central Bank Independence n The need for an independent central bank is linked to its goals – especially the goal of price stability. q Central banks that are less independent generally have higher inflation rates. Why? n n n Political pressure to increase the money supply (generate short-run growth and sacrifice long-run inflation). Central bankers may be expected to finance government budget deficits (fiscal policy). Independence is linked to: q q q Decision by committee Accountability Transparency

Central Bank Independence n The need for an independent central bank is linked to its goals – especially the goal of price stability. q Central banks that are less independent generally have higher inflation rates. Why? n n n Political pressure to increase the money supply (generate short-run growth and sacrifice long-run inflation). Central bankers may be expected to finance government budget deficits (fiscal policy). Independence is linked to: q q q Decision by committee Accountability Transparency

Background n The Federal Reserve System (“the Fed”) is the central bank of the United States. q n Founded by Congress in 1913 to provide the nation with a safer, more flexible and more stable monetary and financial system. Congress designed the structure of the Fed to give it a broad perspective on the economy.

Background n The Federal Reserve System (“the Fed”) is the central bank of the United States. q n Founded by Congress in 1913 to provide the nation with a safer, more flexible and more stable monetary and financial system. Congress designed the structure of the Fed to give it a broad perspective on the economy.

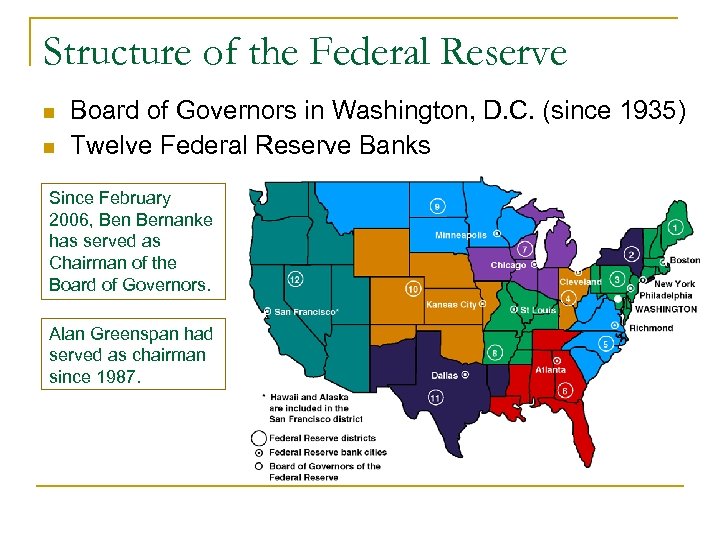

Structure of the Federal Reserve n n Board of Governors in Washington, D. C. (since 1935) Twelve Federal Reserve Banks Since February 2006, Ben Bernanke has served as Chairman of the Board of Governors. Alan Greenspan had served as chairman since 1987.

Structure of the Federal Reserve n n Board of Governors in Washington, D. C. (since 1935) Twelve Federal Reserve Banks Since February 2006, Ben Bernanke has served as Chairman of the Board of Governors. Alan Greenspan had served as chairman since 1987.

Structure of the Federal Reserve System n There are three key components of the Federal Reserve System: q q q The Federal Open Market Committee – conduct of monetary policy The Board of Governors – administrative head of the Federal Reserve System The Federal Reserve District Banks – banking functions for the System

Structure of the Federal Reserve System n There are three key components of the Federal Reserve System: q q q The Federal Open Market Committee – conduct of monetary policy The Board of Governors – administrative head of the Federal Reserve System The Federal Reserve District Banks – banking functions for the System

Federal Open Market Committee n Federal Open Market Committee (FOMC) is the policy-making group within the Federal Reserve System. q Membership includes 12 voting members: n n q Board of Governors (seven members) President of the Federal Reserve Bank of New York Four other Reserve Bank presidents (rotating, one-year terms) President Yellen is a voting member of the FOMC. Committee meets eight times each year. Last meeting? Next meeting?

Federal Open Market Committee n Federal Open Market Committee (FOMC) is the policy-making group within the Federal Reserve System. q Membership includes 12 voting members: n n q Board of Governors (seven members) President of the Federal Reserve Bank of New York Four other Reserve Bank presidents (rotating, one-year terms) President Yellen is a voting member of the FOMC. Committee meets eight times each year. Last meeting? Next meeting?

Board of Governors n Administrative head of the Federal Reserve System q q n Seven members appointed by the U. S. President, subject to Senate confirmation q n Created in the 1930 s as a general move toward a more centralized system. Responsible for regulatory changes and enforcement, collecting and analyzing data, economics research, and approves bank mergers. Chairperson is selected by the President for a four-year term. Term: 14 -year terms q Maximum of one full term, but governors may serve part of an incomplete term and be reappointed to a full term thereafter.

Board of Governors n Administrative head of the Federal Reserve System q q n Seven members appointed by the U. S. President, subject to Senate confirmation q n Created in the 1930 s as a general move toward a more centralized system. Responsible for regulatory changes and enforcement, collecting and analyzing data, economics research, and approves bank mergers. Chairperson is selected by the President for a four-year term. Term: 14 -year terms q Maximum of one full term, but governors may serve part of an incomplete term and be reappointed to a full term thereafter.

Federal Reserve Bank of San Francisco n The 12 th District is the largest Federal Reserve district in terms of geographic area and population. q q q 1. 3 million square miles, or 36% of the nation’s area. 60. 3 million people accounted for 20% of the U. S. population in 2005. 25. 6 million workers in 2005 n n q n 19% of the nation’s total nonfarm employment 21% of the nation’s total personal income. 22% of the nation's exports of manufactured goods in 2005. Janet Yellen is the President of the 12 th district Reserve Bank.

Federal Reserve Bank of San Francisco n The 12 th District is the largest Federal Reserve district in terms of geographic area and population. q q q 1. 3 million square miles, or 36% of the nation’s area. 60. 3 million people accounted for 20% of the U. S. population in 2005. 25. 6 million workers in 2005 n n q n 19% of the nation’s total nonfarm employment 21% of the nation’s total personal income. 22% of the nation's exports of manufactured goods in 2005. Janet Yellen is the President of the 12 th district Reserve Bank.

Purposes and Functions n Over time, the Federal Reserve’s role in banking and policy has expanded. n The Federal Reserve’s duties fall into four general areas: q q Conducting the nation’s monetary policy. Supervising and regulating banking institutions. Providing financial services to depository institutions and the federal government. Maintaining stability of the financial system.

Purposes and Functions n Over time, the Federal Reserve’s role in banking and policy has expanded. n The Federal Reserve’s duties fall into four general areas: q q Conducting the nation’s monetary policy. Supervising and regulating banking institutions. Providing financial services to depository institutions and the federal government. Maintaining stability of the financial system.

Conduct of Monetary Policy n The “textbook” monetary policy tools are: q Open Market Operations n n q Primary Credit (Discount Loans) n n q Federal Reserve Bank of New York buys/sells U. S. Treasury securities with securities dealers (“primary dealers”) The proceeds from these transactions are deposited into, or withdrawn from, the banking system Private banks may borrow from Reserve Banks at an interest rate set by the Board of Governors (primary credit rate) Allows the Federal Reserve to act as a lender of last resort Reserve requirement n n The fraction of deposits banks may not lend out. These must be held in reserves (vault cash or with the Fed)

Conduct of Monetary Policy n The “textbook” monetary policy tools are: q Open Market Operations n n q Primary Credit (Discount Loans) n n q Federal Reserve Bank of New York buys/sells U. S. Treasury securities with securities dealers (“primary dealers”) The proceeds from these transactions are deposited into, or withdrawn from, the banking system Private banks may borrow from Reserve Banks at an interest rate set by the Board of Governors (primary credit rate) Allows the Federal Reserve to act as a lender of last resort Reserve requirement n n The fraction of deposits banks may not lend out. These must be held in reserves (vault cash or with the Fed)

Conduct of Monetary Policy n In addition, the Federal Reserve uses q Contractual Clearing Balances n n n Bank deposits with the Federal Reserve held beyond required reserve balances. Banks maintain these balances for liquidity purposes (to clear checks/electronic payments). In practice, the Fed relies on open market operations to implement monetary policy.

Conduct of Monetary Policy n In addition, the Federal Reserve uses q Contractual Clearing Balances n n n Bank deposits with the Federal Reserve held beyond required reserve balances. Banks maintain these balances for liquidity purposes (to clear checks/electronic payments). In practice, the Fed relies on open market operations to implement monetary policy.

Conduct of Monetary Policy n FOMC communicates to the public through interest rates q Federal funds rate target n n n q Interbank lending rate Market-determined rate manipulated through open market operations. Current target is 5. 25% (last changed on June 29, 2006, up from 5%) Primary credit rate (“Discount rate”) n n Interest rate on Federal Reserve loans to banks. Loans are approved and issued by Federal Reserve Banks. (“Discount window”) Primary credit rate by the Board of Governors, but historically only changes when FOMC changes the federal funds rate target. Currently, the Board of Governors simply sets the primary credit rate as 100 basis points above the FOMC federal funds rate target.

Conduct of Monetary Policy n FOMC communicates to the public through interest rates q Federal funds rate target n n n q Interbank lending rate Market-determined rate manipulated through open market operations. Current target is 5. 25% (last changed on June 29, 2006, up from 5%) Primary credit rate (“Discount rate”) n n Interest rate on Federal Reserve loans to banks. Loans are approved and issued by Federal Reserve Banks. (“Discount window”) Primary credit rate by the Board of Governors, but historically only changes when FOMC changes the federal funds rate target. Currently, the Board of Governors simply sets the primary credit rate as 100 basis points above the FOMC federal funds rate target.

Supervision and Regulation of Banks n The Federal Reserve is responsible for the following sectors in the banking industry: q q Bank holding companies – own one or more banks State-chartered banks that are members of the Federal Reserve System (state member banks) n n n Membership in the Federal Reserve System means the bank owns equity shares in the Federal Reserve Bank in its district. All banks with a federal charter are members of the system State banks have the option to be members. q Foreign branches of member banks q Edge and agreement corporations n q q U. S. banks may conduct international banking activities through these U. S. state-licensed branches of foreign banks Nonbanking activities of foreign banks

Supervision and Regulation of Banks n The Federal Reserve is responsible for the following sectors in the banking industry: q q Bank holding companies – own one or more banks State-chartered banks that are members of the Federal Reserve System (state member banks) n n n Membership in the Federal Reserve System means the bank owns equity shares in the Federal Reserve Bank in its district. All banks with a federal charter are members of the system State banks have the option to be members. q Foreign branches of member banks q Edge and agreement corporations n q q U. S. banks may conduct international banking activities through these U. S. state-licensed branches of foreign banks Nonbanking activities of foreign banks

Supervision and Regulation of Banks n As of March 31, 2006, in the 12 th District, there were: q q 47 state member banks 116 national banks 461 state-chartered non-member banks 77 U. S. branches, agencies, and representative offices of foreign banks and eight Edge Act agreement corporations.

Supervision and Regulation of Banks n As of March 31, 2006, in the 12 th District, there were: q q 47 state member banks 116 national banks 461 state-chartered non-member banks 77 U. S. branches, agencies, and representative offices of foreign banks and eight Edge Act agreement corporations.

Supervision and Regulation of Banks n Other regulators of the banking industry include q q q n Office of the Comptroller of the Currency (OCC) – national banks Federal Deposit Insurance Corporation (FDIC) – nonmember state banks, mutual savings banks Office of Thrift Supervision (OTS) – thrifts, savings & loans, and mutual savings banks Regulators use the CAMELS rating system: q q q C – capital adequacy A – asset quality M – management and administration E – earnings L – liquidity S – sensitivity to market risk

Supervision and Regulation of Banks n Other regulators of the banking industry include q q q n Office of the Comptroller of the Currency (OCC) – national banks Federal Deposit Insurance Corporation (FDIC) – nonmember state banks, mutual savings banks Office of Thrift Supervision (OTS) – thrifts, savings & loans, and mutual savings banks Regulators use the CAMELS rating system: q q q C – capital adequacy A – asset quality M – management and administration E – earnings L – liquidity S – sensitivity to market risk

Supervision and Regulation of Banks n Why does a bank’s CAMELS rating matter? q n Poor ratings indicates banks are taking on excessive risk, threatening the stability of the banking system. Why do banks need to be regulated? q Asymmetric information problems: n n n With deposit insurance, depositors have no incentive to provide oversight for banks’ activities. Bank managers have different incentives than their shareholders Bank managers know that regulators have an incentive to keep larger banks afloat to avoid paying out deposit insurance claims (“Too Big to Fail”)

Supervision and Regulation of Banks n Why does a bank’s CAMELS rating matter? q n Poor ratings indicates banks are taking on excessive risk, threatening the stability of the banking system. Why do banks need to be regulated? q Asymmetric information problems: n n n With deposit insurance, depositors have no incentive to provide oversight for banks’ activities. Bank managers have different incentives than their shareholders Bank managers know that regulators have an incentive to keep larger banks afloat to avoid paying out deposit insurance claims (“Too Big to Fail”)

Supervision and Regulation of Banks n What do the banks care about CAMELS? q q q n Qualification for primary, secondary credit loans Deposit insurance premiums based on CAMELS Poor ratings lead to increased monitoring and examinations by regulators. This attracts unwanted attention to the bank, potentially reducing share prices. Reserve Requirement q Board of Governors sets the reserve requirement. n n n A percentage of deposits that must be held in reserves. Since 1990 s, a percentage of transactions deposits Banks verify this requirement when reporting balance sheet information to the Federal Reserve Banks (every two weeks).

Supervision and Regulation of Banks n What do the banks care about CAMELS? q q q n Qualification for primary, secondary credit loans Deposit insurance premiums based on CAMELS Poor ratings lead to increased monitoring and examinations by regulators. This attracts unwanted attention to the bank, potentially reducing share prices. Reserve Requirement q Board of Governors sets the reserve requirement. n n n A percentage of deposits that must be held in reserves. Since 1990 s, a percentage of transactions deposits Banks verify this requirement when reporting balance sheet information to the Federal Reserve Banks (every two weeks).

Supervision and Regulation of Banks n Banks satisfy the reserve requirement through: q q Vault cash (currency in its vault) Balances held at a Federal Reserve Bank n Banks use their balances with Reserve Banks to satisfy the reserve requirement and to clear financial transactions. q q n Given the volume and unpredictability of transactions that clear throughout the day, banks seek to hold an end-of-day balance to protect against unexpected debits that would leave their accounts overdrawn (and subject to charge). These positive balances, held above the reserve requirement are known as contractual clearing balances. Beginning in 2016, the Fed will pay interest on bank balances held at Reserve Banks.

Supervision and Regulation of Banks n Banks satisfy the reserve requirement through: q q Vault cash (currency in its vault) Balances held at a Federal Reserve Bank n Banks use their balances with Reserve Banks to satisfy the reserve requirement and to clear financial transactions. q q n Given the volume and unpredictability of transactions that clear throughout the day, banks seek to hold an end-of-day balance to protect against unexpected debits that would leave their accounts overdrawn (and subject to charge). These positive balances, held above the reserve requirement are known as contractual clearing balances. Beginning in 2016, the Fed will pay interest on bank balances held at Reserve Banks.

Financial Services: Government n Federal Reserve Banks provide banking services to several groups. q Federal Reserve Banks act as fiscal agents for the federal government. n n n q Pay Treasury checks Process electronic payments Issue, transfer, and redeem U. S. Treasury securities Reserve Banks provide services to other central banks and international agencies, including maintaining: n non-interest-bearing accounts (in U. S. dollars) securities safekeeping accounts for safekeeping gold

Financial Services: Government n Federal Reserve Banks provide banking services to several groups. q Federal Reserve Banks act as fiscal agents for the federal government. n n n q Pay Treasury checks Process electronic payments Issue, transfer, and redeem U. S. Treasury securities Reserve Banks provide services to other central banks and international agencies, including maintaining: n non-interest-bearing accounts (in U. S. dollars) securities safekeeping accounts for safekeeping gold

Financial Services: Depository Institutions n Distribute and receive currency and coin q q q When Congress established the Federal Reserve System, it recognized that the public’s demand for currency is variable. Each of the 12 Reserve Banks is authorized to issue paper currency (the U. S. Treasury issues coin). About 45% of all paper currency printed is $1 bills. Of the total U. S. currency in worldwide circulation, up to two-thirds is held outside of the country. The Federal Reserve Bank of San Francisco is the home of the American Currency Exhibit.

Financial Services: Depository Institutions n Distribute and receive currency and coin q q q When Congress established the Federal Reserve System, it recognized that the public’s demand for currency is variable. Each of the 12 Reserve Banks is authorized to issue paper currency (the U. S. Treasury issues coin). About 45% of all paper currency printed is $1 bills. Of the total U. S. currency in worldwide circulation, up to two-thirds is held outside of the country. The Federal Reserve Bank of San Francisco is the home of the American Currency Exhibit.

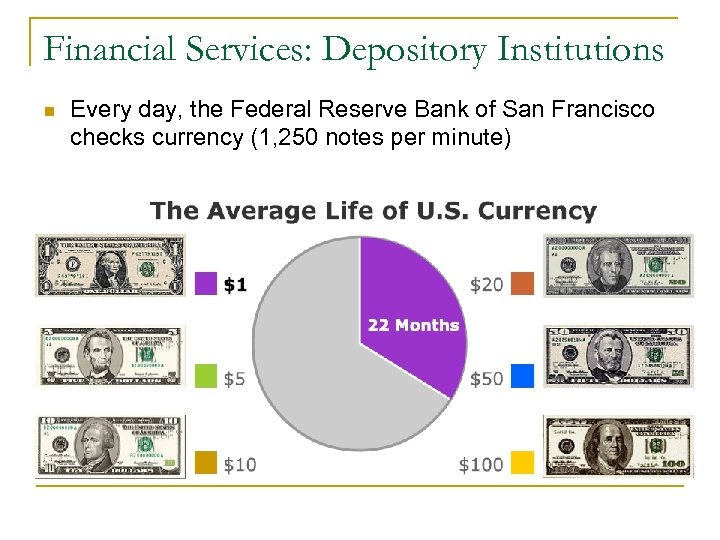

Financial Services: Depository Institutions q When currency is worn or damaged, the Reserve Bank destroys it and replaces it with new paper currency. n n n q q The Fed’s Cash Services department processes currency high speed computer controlled machines that each verify currency at a rate of approximately 1, 250 notes per minute. The average life span of bills is as follows: $1 (22 months), $20 (25 months), $100 (60 months) In 2005, the Fed spent $479 million to destroy damaged currency and to print and transport new currency. Suspected counterfeit currency is removed from circulation and reported to the U. S. Secret Service. In 2005, the 12 th district processed 19. 1 billion currency notes, or about 76 million pieces a day.

Financial Services: Depository Institutions q When currency is worn or damaged, the Reserve Bank destroys it and replaces it with new paper currency. n n n q q The Fed’s Cash Services department processes currency high speed computer controlled machines that each verify currency at a rate of approximately 1, 250 notes per minute. The average life span of bills is as follows: $1 (22 months), $20 (25 months), $100 (60 months) In 2005, the Fed spent $479 million to destroy damaged currency and to print and transport new currency. Suspected counterfeit currency is removed from circulation and reported to the U. S. Secret Service. In 2005, the 12 th district processed 19. 1 billion currency notes, or about 76 million pieces a day.

Financial Services: Depository Institutions n Every day, the Federal Reserve Bank of San Francisco checks currency (1, 250 notes per minute)

Financial Services: Depository Institutions n Every day, the Federal Reserve Bank of San Francisco checks currency (1, 250 notes per minute)

Financial Services: Depository Institutions n Check processing q The Federal Reserve Banks clear checks for the banking system. n n n q In 2003, Reserve Banks cleared 58% of interbank checks Depository institutions cleared the remainder through private arrangements among themselves. In 2003, the Reserve Banks collected 16, 271 million checks worth $15. 8 trillion. They also paid $267 million in Treasury checks and $198 million in postal money orders. In 2005, the San Francisco Federal Reserve Bank processed 1. 3 billion commercial checks.

Financial Services: Depository Institutions n Check processing q The Federal Reserve Banks clear checks for the banking system. n n n q In 2003, Reserve Banks cleared 58% of interbank checks Depository institutions cleared the remainder through private arrangements among themselves. In 2003, the Reserve Banks collected 16, 271 million checks worth $15. 8 trillion. They also paid $267 million in Treasury checks and $198 million in postal money orders. In 2005, the San Francisco Federal Reserve Bank processed 1. 3 billion commercial checks.

Financial Services: Depository Institutions n Electronic payments q Automated Clearinghouse (ACH) n Developed jointly by the Fed and the private sector in the 1970 s as a more efficient alternative to checks. n Currently, a nationwide mechanism for processing credit and debit transfers electronically. q n Payments are sent by banks and processed by the Reserve Banks in batches. There is a private-sector competitor (Electronic Payments Network). Dramatic increase in these payments: q q 1975: 6 million transactions worth $92. 9 billion. 2003: 6. 5 billion transactions worth $16. 8 trillion

Financial Services: Depository Institutions n Electronic payments q Automated Clearinghouse (ACH) n Developed jointly by the Fed and the private sector in the 1970 s as a more efficient alternative to checks. n Currently, a nationwide mechanism for processing credit and debit transfers electronically. q n Payments are sent by banks and processed by the Reserve Banks in batches. There is a private-sector competitor (Electronic Payments Network). Dramatic increase in these payments: q q 1975: 6 million transactions worth $92. 9 billion. 2003: 6. 5 billion transactions worth $16. 8 trillion

Financial Services: Depository Institutions n Electronic payments q Fedwire Funds Service n n Provides real-time gross settlement system in which more than 9, 500 participants (banks) are able to initiate immediate electronic funds transfers. All banks are maintain an account with a Federal Reserve Bank are eligible to participate. q n q Participants use Fedwire to handle large-value, time-critical payments, such as payments to settle interbank purchases, trades of financial securities, or to disburse or repay large loans. Reserve Banks secure transfer of funds once received. National Settlements Service n Automated mechanism for submitting settlement information to the Reserve Banks.

Financial Services: Depository Institutions n Electronic payments q Fedwire Funds Service n n Provides real-time gross settlement system in which more than 9, 500 participants (banks) are able to initiate immediate electronic funds transfers. All banks are maintain an account with a Federal Reserve Bank are eligible to participate. q n q Participants use Fedwire to handle large-value, time-critical payments, such as payments to settle interbank purchases, trades of financial securities, or to disburse or repay large loans. Reserve Banks secure transfer of funds once received. National Settlements Service n Automated mechanism for submitting settlement information to the Reserve Banks.

Stability of the Financial System n The Federal Reserve maintains financial system stability through the aforementioned broad duties. q q q Conduct of monetary policy designed to promote economic stability (e. g. , low inflation, stable output growth, and low unemployment). Regulation and supervision of banking system critical for stability and long-run economic growth. Financial services promote financial system efficiency.

Stability of the Financial System n The Federal Reserve maintains financial system stability through the aforementioned broad duties. q q q Conduct of monetary policy designed to promote economic stability (e. g. , low inflation, stable output growth, and low unemployment). Regulation and supervision of banking system critical for stability and long-run economic growth. Financial services promote financial system efficiency.