417d5210625d7a5630744b30675e70e6.ppt

- Количество слайдов: 23

The Federal Reserve System I. Origins of the FRS II. Its Functions & Structure ECO 473 – Money & Banking – Dr. D. Foster

The Federal Reserve System I. Origins of the FRS II. Its Functions & Structure ECO 473 – Money & Banking – Dr. D. Foster

The Federal Reserve System I. Origins of the FRS ECO 473 – Money & Banking – Dr. D. Foster

The Federal Reserve System I. Origins of the FRS ECO 473 – Money & Banking – Dr. D. Foster

Central Banking – The Bank of England • Created in 1694 – – – – – Bought gov’t bonds and issued notes. Held all government debt. Notes were not “legal tender, ” but widely accepted. Insolvent in 2 years. Parliament allowed them to suspend specie payment. Brief competition (Nat’l Land Bank; South Seas) 1708: monopoly on bank notes & short term loans. Late 1700 s, massive suspension lasted 24 years. 1833: notes made legal tender. • Peel Act – limit fractional reserve notes – Failed to recognize deposits as money.

Central Banking – The Bank of England • Created in 1694 – – – – – Bought gov’t bonds and issued notes. Held all government debt. Notes were not “legal tender, ” but widely accepted. Insolvent in 2 years. Parliament allowed them to suspend specie payment. Brief competition (Nat’l Land Bank; South Seas) 1708: monopoly on bank notes & short term loans. Late 1700 s, massive suspension lasted 24 years. 1833: notes made legal tender. • Peel Act – limit fractional reserve notes – Failed to recognize deposits as money.

Central Banking - The 1 st and 2 nd BUS • Mercantilist movement behind banks. • Fed owns 20%, deposits funds here. • Banks buy government debt; issue notes. • 1791 -1796 wholesale prices up 72%. • Periodic specie suspension and bank panics. • BUS will hold bank notes. • 2 nd BUS inflates, then deflates in 1819. • “The bank was saved, but the people ruined. ” • Jackson kills the 2 nd BUS.

Central Banking - The 1 st and 2 nd BUS • Mercantilist movement behind banks. • Fed owns 20%, deposits funds here. • Banks buy government debt; issue notes. • 1791 -1796 wholesale prices up 72%. • Periodic specie suspension and bank panics. • BUS will hold bank notes. • 2 nd BUS inflates, then deflates in 1819. • “The bank was saved, but the people ruined. ” • Jackson kills the 2 nd BUS.

The “Free Banking” Era: 1836 -1863 • Van Buren sets up Independent Treasury System – Came and went and lasted only until Civil War. – Fed’l government held only specie, not paper. • Decentralized banking 1836 -1862 – Still heavily regulated. – State banks required to hold state gov’t. debt to back their note/dd issue. – Notes accepted for taxes. – Restricted branching making redemption harder. • Private note clearing – Suffolk System – Held specie reserve of members. – Different bank notes accepted. – Insulated banks from panics.

The “Free Banking” Era: 1836 -1863 • Van Buren sets up Independent Treasury System – Came and went and lasted only until Civil War. – Fed’l government held only specie, not paper. • Decentralized banking 1836 -1862 – Still heavily regulated. – State banks required to hold state gov’t. debt to back their note/dd issue. – Notes accepted for taxes. – Restricted branching making redemption harder. • Private note clearing – Suffolk System – Held specie reserve of members. – Different bank notes accepted. – Insulated banks from panics.

The National Banking System • Specie suspension & greenbacks 12/1861. • 1861 to 1863, MS doubled. – Wholesale prices up 22% per year during war. • The National Banking Act of 1863 – Created national currency. – Taxed non-national bank notes. – Bought gov’t debt & issued notes. – The rise & fall of Jay Cooke. – State banks benefit by holding reserves in nat’l notes. – Didn’t stop periodic panics.

The National Banking System • Specie suspension & greenbacks 12/1861. • 1861 to 1863, MS doubled. – Wholesale prices up 22% per year during war. • The National Banking Act of 1863 – Created national currency. – Taxed non-national bank notes. – Bought gov’t debt & issued notes. – The rise & fall of Jay Cooke. – State banks benefit by holding reserves in nat’l notes. – Didn’t stop periodic panics.

![The Federal Reserve System • “An engine of inflation. ” [See Appendix] • An The Federal Reserve System • “An engine of inflation. ” [See Appendix] • An](https://present5.com/presentation/417d5210625d7a5630744b30675e70e6/image-7.jpg) The Federal Reserve System • “An engine of inflation. ” [See Appendix] • An addition layer means more money creation. • 1914 to 1920, MS doubles – member banks DD 250%. – non-member banks DD 33%. • Reserve deposits on savings falls. – Shift from DD to TD. – Generally accepted that savings are “payable upon demand. ” • Ben Strong & the Morgans.

The Federal Reserve System • “An engine of inflation. ” [See Appendix] • An addition layer means more money creation. • 1914 to 1920, MS doubles – member banks DD 250%. – non-member banks DD 33%. • Reserve deposits on savings falls. – Shift from DD to TD. – Generally accepted that savings are “payable upon demand. ” • Ben Strong & the Morgans.

The Federal Reserve Banking System v Purpose: Purpose 1. Develop, supervise & control the nation’s money. 2. Serve as a national check-clearing system. 3. Serve as depository for federal gov’t. funds. v Board of Governors of the FRS ü 7 members, equal standing. . . but, includes ü Secretary of the Treasury and ü Comptroller of the Currency. v Problems: Problems ü Only using discount window, ü Each District Bank sets its own policy.

The Federal Reserve Banking System v Purpose: Purpose 1. Develop, supervise & control the nation’s money. 2. Serve as a national check-clearing system. 3. Serve as depository for federal gov’t. funds. v Board of Governors of the FRS ü 7 members, equal standing. . . but, includes ü Secretary of the Treasury and ü Comptroller of the Currency. v Problems: Problems ü Only using discount window, ü Each District Bank sets its own policy.

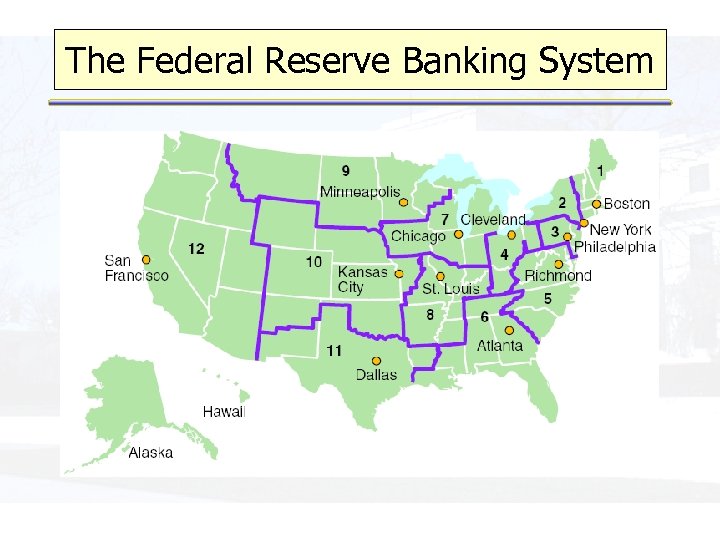

The Federal Reserve Banking System

The Federal Reserve Banking System

The Early Fed, 1913– 1935 v Accommodates the Treasury Dept. during WWI. ü Buys Treasury bonds to finance G spending (aka “monetizing the debt”). ü From 1916 to 1918, this increases MS by 70%. ü Huge risk of inflation. v The Great Depression - Failure of the Fed ü Initially increased liquidity, but pulled back. ü By 1933, 33% of banks fail, MS fallen 33%.

The Early Fed, 1913– 1935 v Accommodates the Treasury Dept. during WWI. ü Buys Treasury bonds to finance G spending (aka “monetizing the debt”). ü From 1916 to 1918, this increases MS by 70%. ü Huge risk of inflation. v The Great Depression - Failure of the Fed ü Initially increased liquidity, but pulled back. ü By 1933, 33% of banks fail, MS fallen 33%.

The Federal Reserve System II. Its Functions & Structure ECO 473 – Money & Banking – Dr. D. Foster

The Federal Reserve System II. Its Functions & Structure ECO 473 – Money & Banking – Dr. D. Foster

The Fed - version 2. 0, 1935 v Serves as a “lender of last resort. ” v Board of Governors reconstituted: ü All 7 member selected by President/Senate confirms. üCan’t include Treasury Sec. nor Comptroller of Currency. ü Members serve 14 yr. terms on staggered basis. ü Geographic diversity. ü Office of Chairman and Vice Chairman created. ü Has authority over district banks. v Federal Open Market Committee (FOMC) ü 12 members; primary policy-making body.

The Fed - version 2. 0, 1935 v Serves as a “lender of last resort. ” v Board of Governors reconstituted: ü All 7 member selected by President/Senate confirms. üCan’t include Treasury Sec. nor Comptroller of Currency. ü Members serve 14 yr. terms on staggered basis. ü Geographic diversity. ü Office of Chairman and Vice Chairman created. ü Has authority over district banks. v Federal Open Market Committee (FOMC) ü 12 members; primary policy-making body.

The Evolution of the Modern Fed v WWII - working “for” the U. S. Treasury v Federal Reserve–Treasury Accord (1951) v “Leaning Against The Wind” – Martin (1953 -1970) v The technocratic Fed – Burns (1970 -1978). . . the “political business cycle” v Coping with inflation – Volcker (1979 -1987) v Keeping the economy stable? – Greenspan (1987 -2006) v Coping with recession – Bernanke (2006 -2014) – Yellen (2014 -? )

The Evolution of the Modern Fed v WWII - working “for” the U. S. Treasury v Federal Reserve–Treasury Accord (1951) v “Leaning Against The Wind” – Martin (1953 -1970) v The technocratic Fed – Burns (1970 -1978). . . the “political business cycle” v Coping with inflation – Volcker (1979 -1987) v Keeping the economy stable? – Greenspan (1987 -2006) v Coping with recession – Bernanke (2006 -2014) – Yellen (2014 -? )

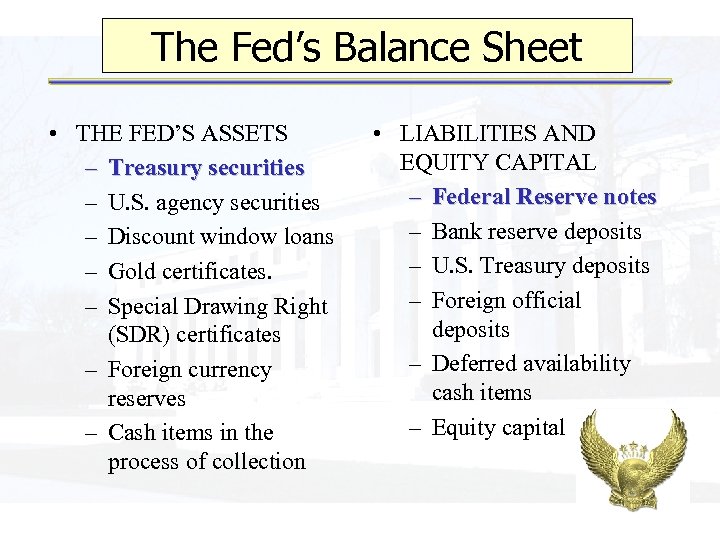

The Fed’s Balance Sheet • THE FED’S ASSETS – Treasury securities – U. S. agency securities – Discount window loans – Gold certificates. – Special Drawing Right (SDR) certificates – Foreign currency reserves – Cash items in the process of collection • LIABILITIES AND EQUITY CAPITAL – Federal Reserve notes – Bank reserve deposits – U. S. Treasury deposits – Foreign official deposits – Deferred availability cash items – Equity capital

The Fed’s Balance Sheet • THE FED’S ASSETS – Treasury securities – U. S. agency securities – Discount window loans – Gold certificates. – Special Drawing Right (SDR) certificates – Foreign currency reserves – Cash items in the process of collection • LIABILITIES AND EQUITY CAPITAL – Federal Reserve notes – Bank reserve deposits – U. S. Treasury deposits – Foreign official deposits – Deferred availability cash items – Equity capital

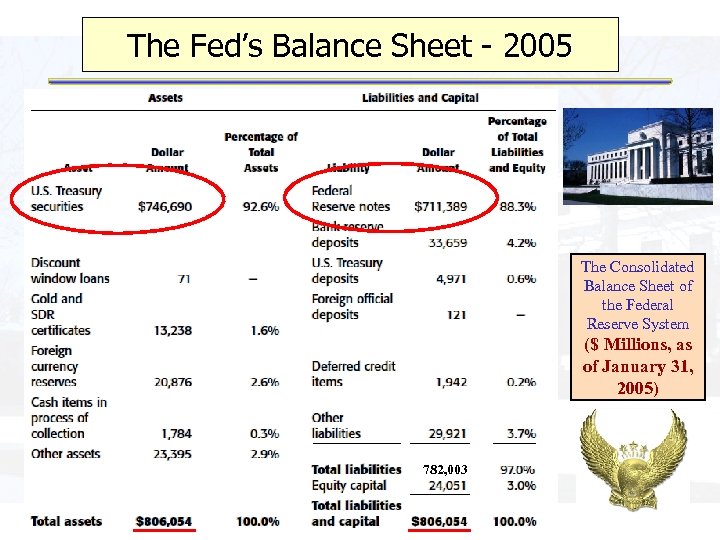

The Fed’s Balance Sheet - 2005 The Consolidated Balance Sheet of the Federal Reserve System ($ Millions, as of January 31, 2005) 782, 003

The Fed’s Balance Sheet - 2005 The Consolidated Balance Sheet of the Federal Reserve System ($ Millions, as of January 31, 2005) 782, 003

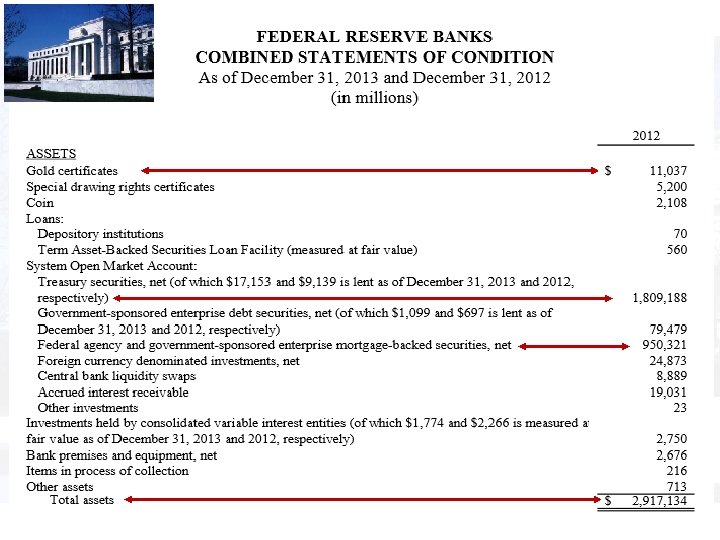

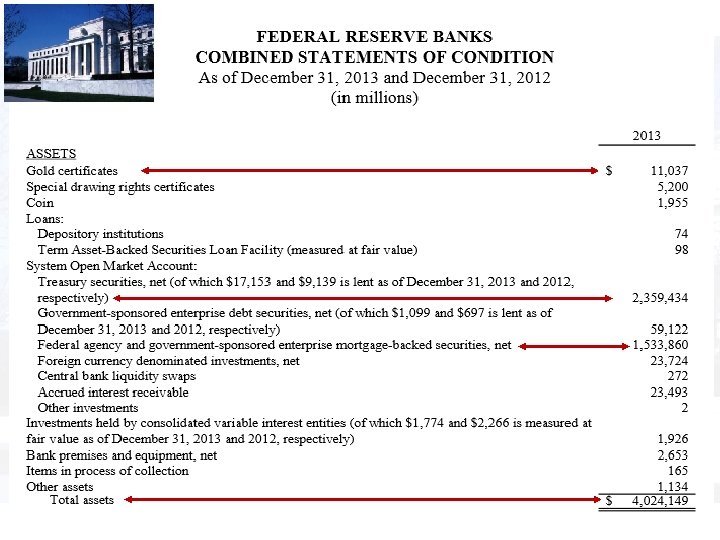

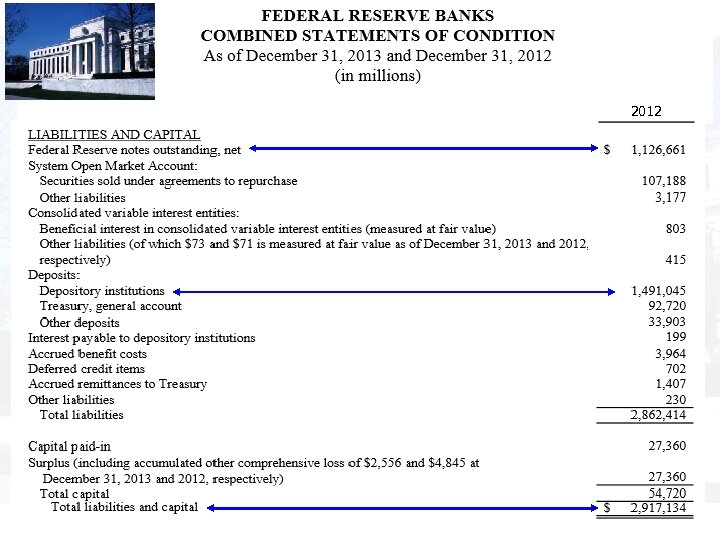

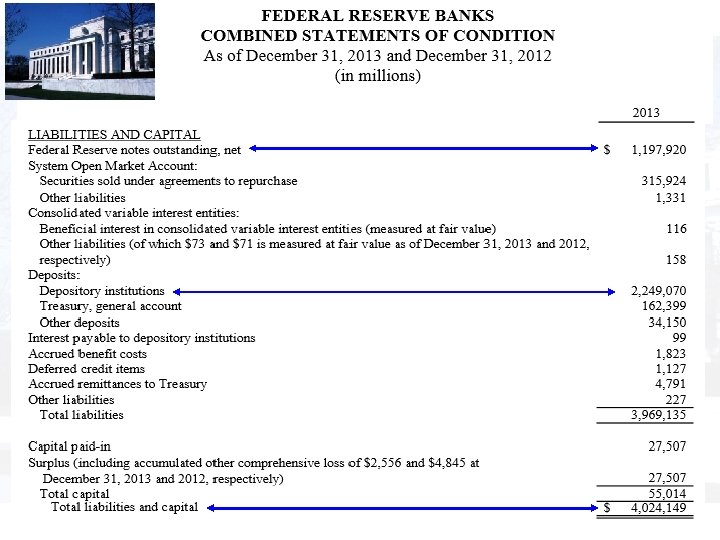

2012

2012

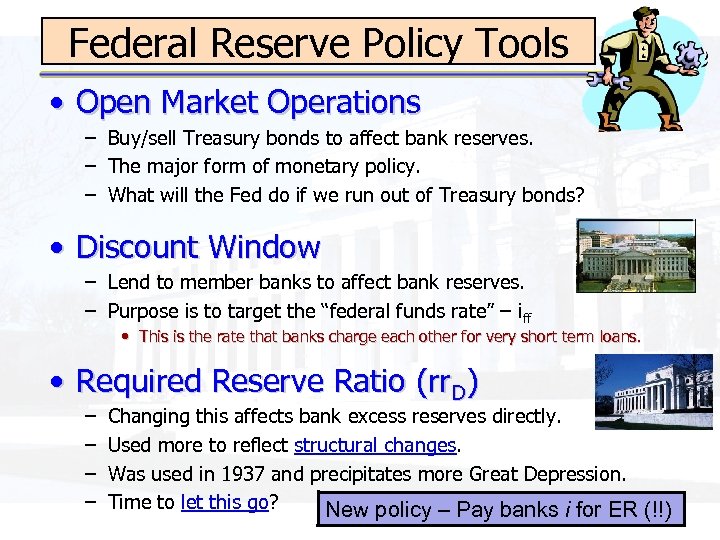

Federal Reserve Policy Tools • Open Market Operations – Buy/sell Treasury bonds to affect bank reserves. – The major form of monetary policy. – What will the Fed do if we run out of Treasury bonds? • Discount Window – Lend to member banks to affect bank reserves. – Purpose is to target the “federal funds rate” – iff • This is the rate that banks charge each other for very short term loans. • Required Reserve Ratio (rr. D) – – Changing this affects bank excess reserves directly. Used more to reflect structural changes. Was used in 1937 and precipitates more Great Depression. Time to let this go? New policy – Pay banks i for ER (!!)

Federal Reserve Policy Tools • Open Market Operations – Buy/sell Treasury bonds to affect bank reserves. – The major form of monetary policy. – What will the Fed do if we run out of Treasury bonds? • Discount Window – Lend to member banks to affect bank reserves. – Purpose is to target the “federal funds rate” – iff • This is the rate that banks charge each other for very short term loans. • Required Reserve Ratio (rr. D) – – Changing this affects bank excess reserves directly. Used more to reflect structural changes. Was used in 1937 and precipitates more Great Depression. Time to let this go? New policy – Pay banks i for ER (!!)

Goals of Monetary Policy • Inflation goals: – Low/no inflation with limited year-to-year variability. • Output goals: – High and stable economic (GDP) growth. • Employment goals: – Stable employment growth with low unemployment.

Goals of Monetary Policy • Inflation goals: – Low/no inflation with limited year-to-year variability. • Output goals: – High and stable economic (GDP) growth. • Employment goals: – Stable employment growth with low unemployment.

The Federal Reserve System I. Origins of the FRS II. Its Functions & Structure ECO 473 – Money & Banking – Dr. D. Foster

The Federal Reserve System I. Origins of the FRS II. Its Functions & Structure ECO 473 – Money & Banking – Dr. D. Foster

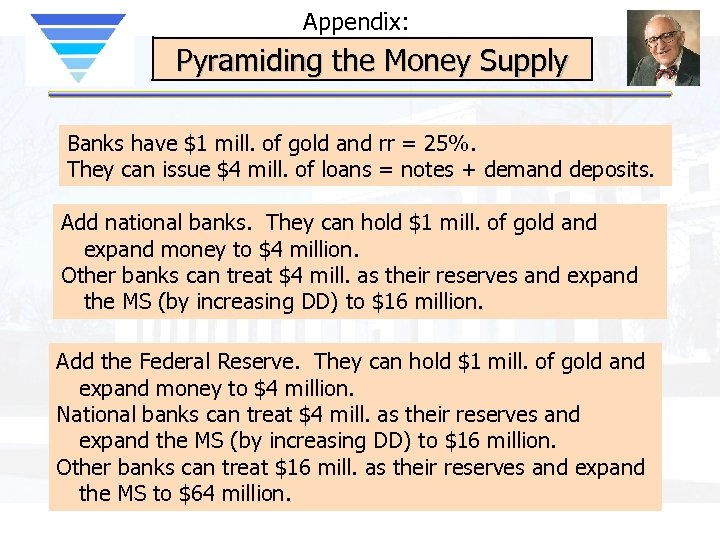

Appendix: Pyramiding the Money Supply Banks have $1 mill. of gold and rr = 25%. They can issue $4 mill. of loans = notes + demand deposits. Add national banks. They can hold $1 mill. of gold and expand money to $4 million. Other banks can treat $4 mill. as their reserves and expand the MS (by increasing DD) to $16 million. Add the Federal Reserve. They can hold $1 mill. of gold and expand money to $4 million. National banks can treat $4 mill. as their reserves and expand the MS (by increasing DD) to $16 million. Other banks can treat $16 mill. as their reserves and expand the MS to $64 million.

Appendix: Pyramiding the Money Supply Banks have $1 mill. of gold and rr = 25%. They can issue $4 mill. of loans = notes + demand deposits. Add national banks. They can hold $1 mill. of gold and expand money to $4 million. Other banks can treat $4 mill. as their reserves and expand the MS (by increasing DD) to $16 million. Add the Federal Reserve. They can hold $1 mill. of gold and expand money to $4 million. National banks can treat $4 mill. as their reserves and expand the MS (by increasing DD) to $16 million. Other banks can treat $16 mill. as their reserves and expand the MS to $64 million.