35931a5e9458fa237dd80d9fe659f0fa.ppt

- Количество слайдов: 34

The exchange rate system in Hong Kong Linked exchange rate system

The exchange rate system in Hong Kong Linked exchange rate system

Hong Kong is a…… Trading Centre International Financial & Monetary Centre What is the reason make Hong Kong so Successful? The Linked exchange rate system

Hong Kong is a…… Trading Centre International Financial & Monetary Centre What is the reason make Hong Kong so Successful? The Linked exchange rate system

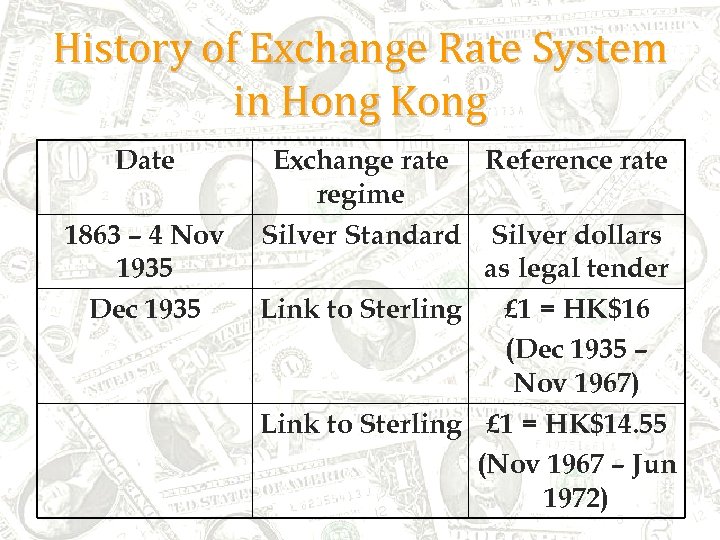

History of Exchange Rate System in Hong Kong Date 1863 – 4 Nov 1935 Dec 1935 Exchange rate Reference rate regime Silver Standard Silver dollars as legal tender Link to Sterling £ 1 = HK$16 (Dec 1935 – Nov 1967) Link to Sterling £ 1 = HK$14. 55 (Nov 1967 – Jun 1972)

History of Exchange Rate System in Hong Kong Date 1863 – 4 Nov 1935 Dec 1935 Exchange rate Reference rate regime Silver Standard Silver dollars as legal tender Link to Sterling £ 1 = HK$16 (Dec 1935 – Nov 1967) Link to Sterling £ 1 = HK$14. 55 (Nov 1967 – Jun 1972)

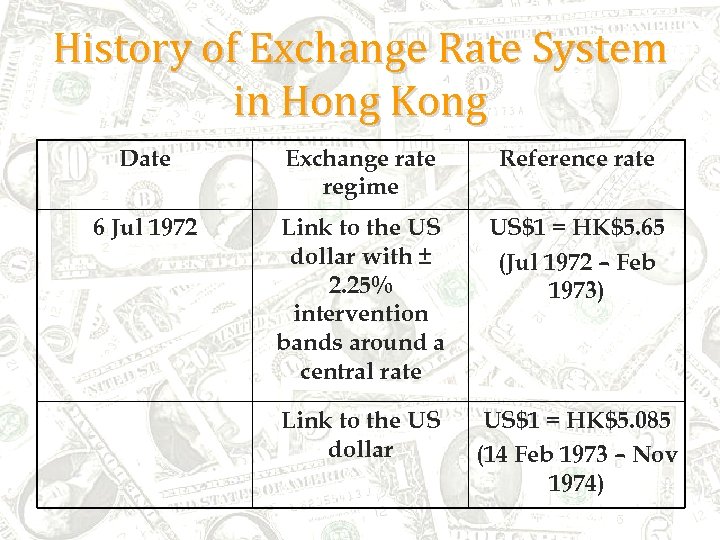

History of Exchange Rate System in Hong Kong Date Exchange rate regime Reference rate 6 Jul 1972 Link to the US dollar with ± 2. 25% intervention bands around a central rate US$1 = HK$5. 65 (Jul 1972 – Feb 1973) Link to the US dollar US$1 = HK$5. 085 (14 Feb 1973 – Nov 1974)

History of Exchange Rate System in Hong Kong Date Exchange rate regime Reference rate 6 Jul 1972 Link to the US dollar with ± 2. 25% intervention bands around a central rate US$1 = HK$5. 65 (Jul 1972 – Feb 1973) Link to the US dollar US$1 = HK$5. 085 (14 Feb 1973 – Nov 1974)

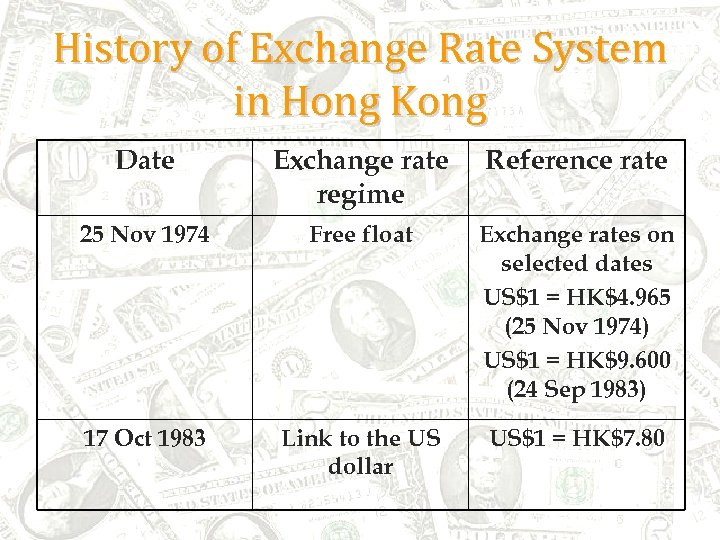

History of Exchange Rate System in Hong Kong Date Exchange rate regime Reference rate 25 Nov 1974 Free float Exchange rates on selected dates US$1 = HK$4. 965 (25 Nov 1974) US$1 = HK$9. 600 (24 Sep 1983) 17 Oct 1983 Link to the US dollar US$1 = HK$7. 80

History of Exchange Rate System in Hong Kong Date Exchange rate regime Reference rate 25 Nov 1974 Free float Exchange rates on selected dates US$1 = HK$4. 965 (25 Nov 1974) US$1 = HK$9. 600 (24 Sep 1983) 17 Oct 1983 Link to the US dollar US$1 = HK$7. 80

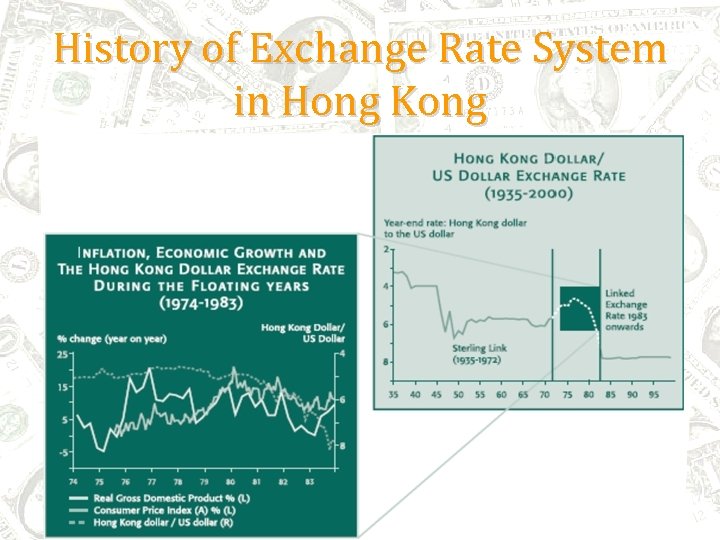

History of Exchange Rate System in Hong Kong

History of Exchange Rate System in Hong Kong

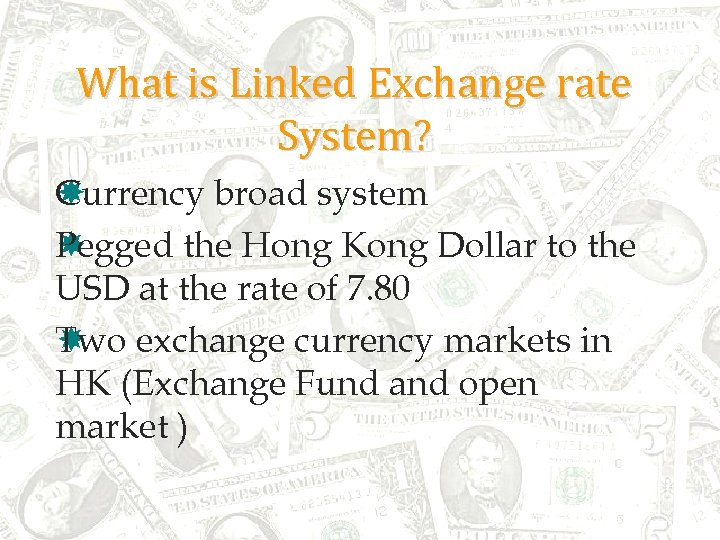

What is Linked Exchange rate System? C urrency broad system Pegged the Hong Kong Dollar to the USD at the rate of 7. 80 Two exchange currency markets in HK (Exchange Fund and open market )

What is Linked Exchange rate System? C urrency broad system Pegged the Hong Kong Dollar to the USD at the rate of 7. 80 Two exchange currency markets in HK (Exchange Fund and open market )

Ways to fixed the exchange rate at HK$7. 8 = US$1 Arbitrage activities • Different in the price of a good in different market • Buy the product at the lower price market • Sell it at the higher price market Two kinds of arbitrage activities in exchange rate system a) Interest rate arbitrage b) Currency arbitrage

Ways to fixed the exchange rate at HK$7. 8 = US$1 Arbitrage activities • Different in the price of a good in different market • Buy the product at the lower price market • Sell it at the higher price market Two kinds of arbitrage activities in exchange rate system a) Interest rate arbitrage b) Currency arbitrage

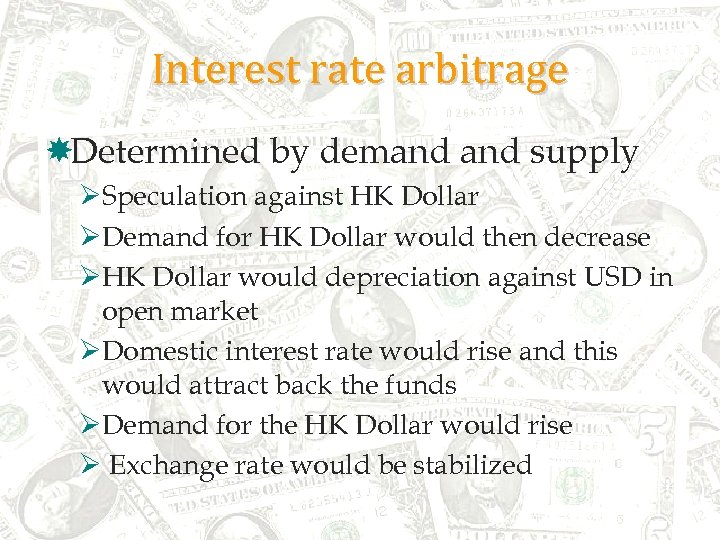

Interest rate arbitrage Determined by demand supply ØSpeculation against HK Dollar ØDemand for HK Dollar would then decrease ØHK Dollar would depreciation against USD in open market ØDomestic interest rate would rise and this would attract back the funds ØDemand for the HK Dollar would rise Ø Exchange rate would be stabilized

Interest rate arbitrage Determined by demand supply ØSpeculation against HK Dollar ØDemand for HK Dollar would then decrease ØHK Dollar would depreciation against USD in open market ØDomestic interest rate would rise and this would attract back the funds ØDemand for the HK Dollar would rise Ø Exchange rate would be stabilized

Interest rate arbitrage Ø Speculation for HK dollar Ø Demand for HK dollar would rise Ø Exchange rate of HK dollar to US dollar would increase in open market Ø Domestic interest rate would then fall Ø Demand for HK dollar would fall Ø Exchange rate of HK dollar would be stabilized

Interest rate arbitrage Ø Speculation for HK dollar Ø Demand for HK dollar would rise Ø Exchange rate of HK dollar to US dollar would increase in open market Ø Domestic interest rate would then fall Ø Demand for HK dollar would fall Ø Exchange rate of HK dollar would be stabilized

Currency arbitrage Exchange rate of HKD fall in open market Exchange rate fixed in the close market Different of HKD to USD in open market

Currency arbitrage Exchange rate of HKD fall in open market Exchange rate fixed in the close market Different of HKD to USD in open market

How does bankers gain profit? Sell USD for HK Dollar in open market Sell HK Dollar for USD in Exchange Fund Exchange rate of HK Dollar for USD would be stabilized

How does bankers gain profit? Sell USD for HK Dollar in open market Sell HK Dollar for USD in Exchange Fund Exchange rate of HK Dollar for USD would be stabilized

Why the linked exchange rate system important to HK ? 1. Suits the needs of a highly open economy such as Hong Kong’s 2. Enables Hong Kong to adjust to shocks without the damage and volatility of a sudden currency collapse

Why the linked exchange rate system important to HK ? 1. Suits the needs of a highly open economy such as Hong Kong’s 2. Enables Hong Kong to adjust to shocks without the damage and volatility of a sudden currency collapse

Why the linked exchange rate system important to HK ? 3. Provides Hong Kong with a firm monetary 4. Reduces the foreign exchange risk faced by importers, exporters and international investors

Why the linked exchange rate system important to HK ? 3. Provides Hong Kong with a firm monetary 4. Reduces the foreign exchange risk faced by importers, exporters and international investors

The effectiveness of the Linked is helped by a number of economic attributes enjoyed by Hong Kong: 1. The structure of Hong Kong economy is flexible and responsive 2. Hong Kong’s banking system is strong and solvent, and well able to deal with the fluctuations in interest rates

The effectiveness of the Linked is helped by a number of economic attributes enjoyed by Hong Kong: 1. The structure of Hong Kong economy is flexible and responsive 2. Hong Kong’s banking system is strong and solvent, and well able to deal with the fluctuations in interest rates

The effectiveness of the Linked is helped by a number of economic attributes enjoyed by Hong Kong: 3. The Hong Kong Government pursues a prudent fiscal policy 4. Hong Kong possesses ample foreign currency reserves for supporting the Linked Exchange Rate System

The effectiveness of the Linked is helped by a number of economic attributes enjoyed by Hong Kong: 3. The Hong Kong Government pursues a prudent fiscal policy 4. Hong Kong possesses ample foreign currency reserves for supporting the Linked Exchange Rate System

Advantages of the Linked Exchange Rate System Provides a stable, predictable and well understood monetary system Suited to Hong Kong’s highly external and flexible economy To its position as an international financial centre

Advantages of the Linked Exchange Rate System Provides a stable, predictable and well understood monetary system Suited to Hong Kong’s highly external and flexible economy To its position as an international financial centre

Advantages of the Linked Exchange Rate System Enables Hong Kong’s economy to adjust to external shocks without the damage Volatility of a sudden currency collapse Provides Hong Kong with a firm monetary anchor Reduces the foreign exchange risk

Advantages of the Linked Exchange Rate System Enables Hong Kong’s economy to adjust to external shocks without the damage Volatility of a sudden currency collapse Provides Hong Kong with a firm monetary anchor Reduces the foreign exchange risk

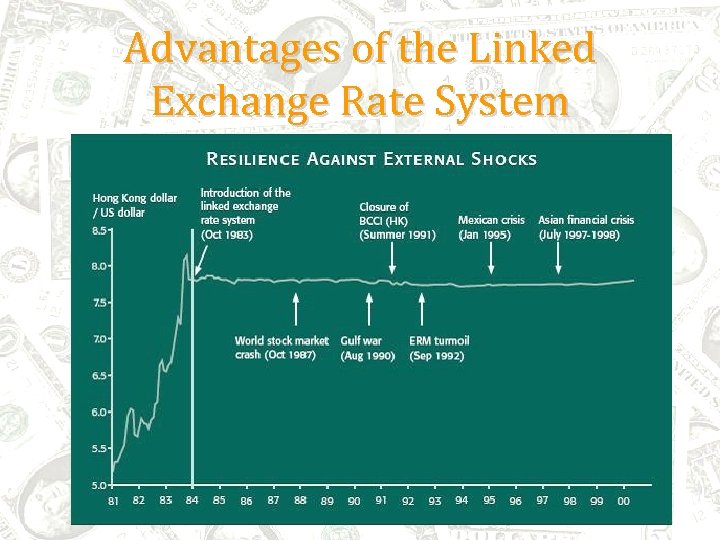

Advantages of the Linked Exchange Rate System The Hong Kong dollar exchange rate has remained stable in the face of various shocks Unaffected by the 1987 stock market crash

Advantages of the Linked Exchange Rate System The Hong Kong dollar exchange rate has remained stable in the face of various shocks Unaffected by the 1987 stock market crash

Advantages of the Linked Exchange Rate System Stable Hong Kong’s economy in the face of external shocks without the damage and volatility of a sudden currency collapse

Advantages of the Linked Exchange Rate System Stable Hong Kong’s economy in the face of external shocks without the damage and volatility of a sudden currency collapse

Advantages of the Linked Exchange Rate System

Advantages of the Linked Exchange Rate System

Advantages of the Linked Exchange Rate System the price level of Hong Kong has been exceptionally stable: There had been an increase more than 10% in price level five times (1973, 1974, 1979, 1980 and 1981) a year within the twenty years

Advantages of the Linked Exchange Rate System the price level of Hong Kong has been exceptionally stable: There had been an increase more than 10% in price level five times (1973, 1974, 1979, 1980 and 1981) a year within the twenty years

Disadvantages of the Linked Exchange Rate System Ties Hong Kong to US monetary policy The economy of Hong Kong is directly affected by the monetary policy of US and US Dollar The business cycle of Hong Kong and US might not be indifferent

Disadvantages of the Linked Exchange Rate System Ties Hong Kong to US monetary policy The economy of Hong Kong is directly affected by the monetary policy of US and US Dollar The business cycle of Hong Kong and US might not be indifferent

Disadvantages of the Linked Exchange Rate System In 1998, Hong Kong was facing a depression and a high unemployment rate Hong Kong Government might increase the money supply of Hong Kong Dollar Reduce the price of goods in Hong Kong

Disadvantages of the Linked Exchange Rate System In 1998, Hong Kong was facing a depression and a high unemployment rate Hong Kong Government might increase the money supply of Hong Kong Dollar Reduce the price of goods in Hong Kong

Disadvantages of the Linked Exchange Rate System To increase the export and decrease imports Theoretically, flexible exchange rate system should be used

Disadvantages of the Linked Exchange Rate System To increase the export and decrease imports Theoretically, flexible exchange rate system should be used

Disadvantages of the Linked Exchange Rate System But, US Dollar was appreciating Restricted Hong Kong government to change the money supply Obstructed the speed of recovering in Hong Kong A great matter when Hong Kong and US are in alien business cycles

Disadvantages of the Linked Exchange Rate System But, US Dollar was appreciating Restricted Hong Kong government to change the money supply Obstructed the speed of recovering in Hong Kong A great matter when Hong Kong and US are in alien business cycles

Disadvantages of the Linked Exchange Rate System Reduces Hong Kong's ability to deal with external shocks • HKMA surrenders its power to adjust the territory's monetary policy to the U. S. Federal Reserve • The currency crisis in Southeast Asia in 1998, could lead to excessive financial market volatility whenever there are speculative attacks on the Hong Kong dollar

Disadvantages of the Linked Exchange Rate System Reduces Hong Kong's ability to deal with external shocks • HKMA surrenders its power to adjust the territory's monetary policy to the U. S. Federal Reserve • The currency crisis in Southeast Asia in 1998, could lead to excessive financial market volatility whenever there are speculative attacks on the Hong Kong dollar

Should the exchange rate system be changed to float? For: • The HKMA can get back the independence of monetary policy ― HKMA can use suitable policy to stabilize the Hong Kong economy ― The Hong Kong monetary policy has to follow that of US under the linked ― Use the same monetary policy may cause serious problems

Should the exchange rate system be changed to float? For: • The HKMA can get back the independence of monetary policy ― HKMA can use suitable policy to stabilize the Hong Kong economy ― The Hong Kong monetary policy has to follow that of US under the linked ― Use the same monetary policy may cause serious problems

Should the exchange rate system be changed to float? Against: • The economy in Hong Kong may greatly fluctuate • Price level fluctuated greatly in 1970 s – 80 s • Lots of money flows in Hong Kong everyday

Should the exchange rate system be changed to float? Against: • The economy in Hong Kong may greatly fluctuate • Price level fluctuated greatly in 1970 s – 80 s • Lots of money flows in Hong Kong everyday

Should the exchange rate system be changed to float? HKMA does not have necessary monetary instruments • The policy of controlling money supply

Should the exchange rate system be changed to float? HKMA does not have necessary monetary instruments • The policy of controlling money supply

Should the exchange rate system be changed to float? The necessary conditions of changing the system • HKMA has the full necessary monetary policy • Do not let the market entirely freely operate • Notice the change suddenly

Should the exchange rate system be changed to float? The necessary conditions of changing the system • HKMA has the full necessary monetary policy • Do not let the market entirely freely operate • Notice the change suddenly

Conclusion The exchange rate system of Hong Kong has been improving Stabilize the Hong Kong economy Brings a basis of being an international financial centre There will not be a change in the system in the following few years

Conclusion The exchange rate system of Hong Kong has been improving Stabilize the Hong Kong economy Brings a basis of being an international financial centre There will not be a change in the system in the following few years

The End

The End