33074aca72bcb80b03b78ab018e371d2.ppt

- Количество слайдов: 16

The excessive imbalances procedure (EIP) Declan COSTELLO European Commission Directorate General for Economic and Financial Affairs DNB and IMF workshop on «Preventing macroeconomic imbalances in the euro area » Amsterdam, 13 -14 October European Commission

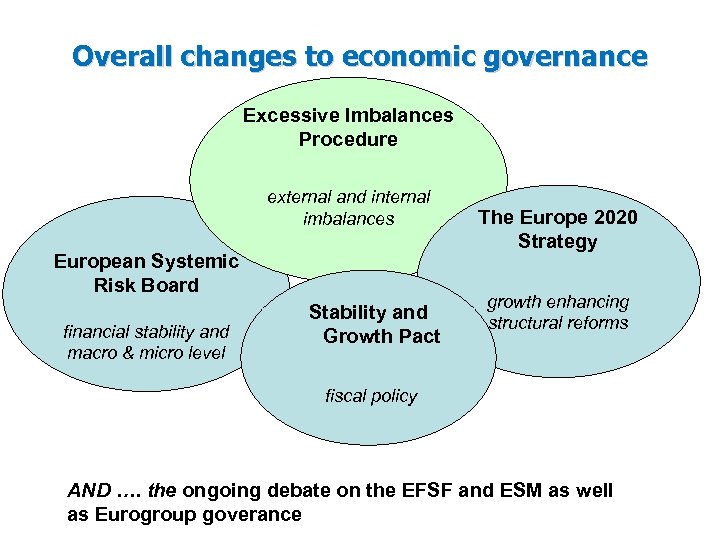

Overall changes to economic governance Excessive Imbalances Procedure external and internal imbalances European Systemic Risk Board financial stability and macro & micro level Stability and Growth Pact The Europe 2020 Strategy growth enhancing structural reforms fiscal policy AND …. the ongoing debate on the EFSF and ESM as well as Eurogroup goverance

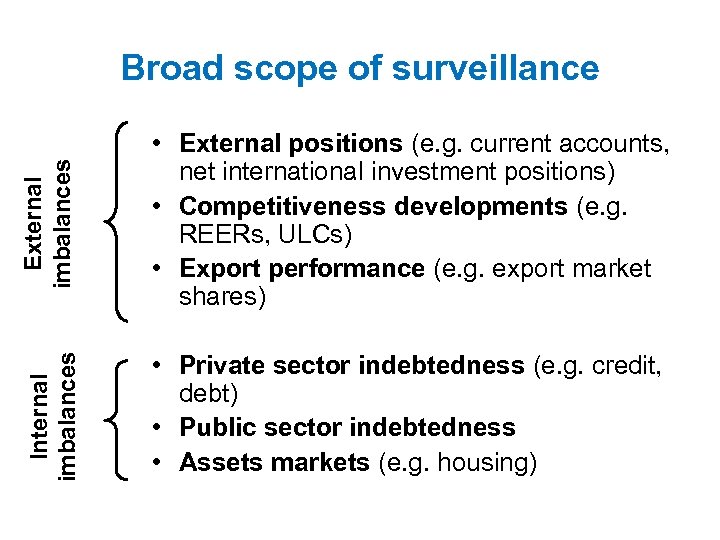

External imbalances • External positions (e. g. current accounts, net international investment positions) • Competitiveness developments (e. g. REERs, ULCs) • Export performance (e. g. export market shares) Internal imbalances Broad scope of surveillance • Private sector indebtedness (e. g. credit, debt) • Public sector indebtedness • Assets markets (e. g. housing)

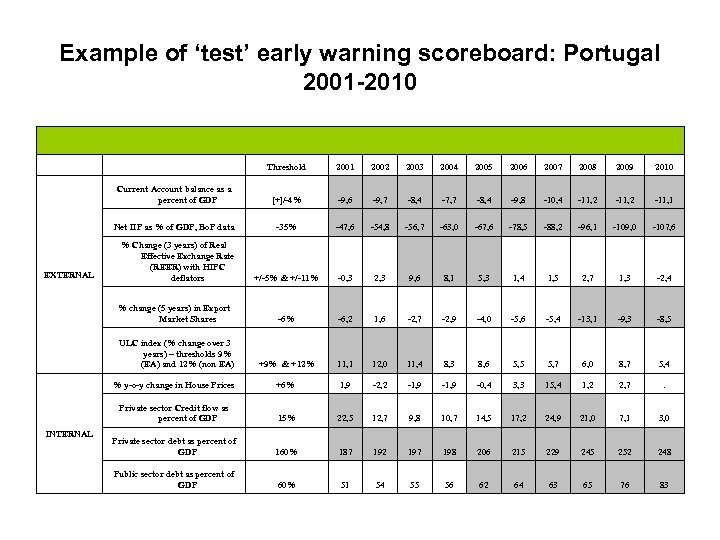

Example of ‘test’ early warning scoreboard: Portugal 2001 -2010 2002 2003 2004 2005 2006 2007 2008 2009 2010 [+]/-4% -9, 6 -9, 7 -8, 4 -7, 7 -8, 4 -9, 8 -10, 4 -11, 2 -11, 1 Net IIP as % of GDP, Bo. P data -35% -47, 6 -54, 8 -56, 7 -63, 0 -67, 6 -78, 5 -88, 2 -96, 1 -109, 0 -107, 6 +/-5% & +/-11% -0, 3 2, 3 9, 6 8, 1 5, 3 1, 4 1, 5 2, 7 1, 3 -2, 4 % change (5 years) in Export Market Shares -6% -6, 2 1, 6 -2, 7 -2, 9 -4, 0 -5, 6 -5, 4 -13, 1 -9, 3 -8, 5 ULC index (% change over 3 years) – thresholds 9% (EA) and 12% (non EA) +9% & +12% 11, 1 12, 0 11, 4 8, 3 8, 6 5, 5 5, 7 6, 0 8, 7 5, 4 % y-o-y change in House Prices +6% 1, 9 -2, 2 -1, 9 -0, 4 3, 3 15, 4 1, 2 2, 7 . Private sector Credit flow as percent of GDP INTERNAL 2001 Current Account balance as a percent of GDP EXTERNAL Threshold 15% 22, 5 12, 7 9, 8 10, 7 14, 5 17, 2 24, 9 21, 0 7, 1 3, 0 Private sector debt as percent of GDP 160% 187 192 197 198 206 215 229 245 252 248 Public sector debt as percent of GDP 60% 51 54 55 56 62 64 63 65 76 83 % Change (3 years) of Real Effective Exchange Rate (REER) with HIPC deflators

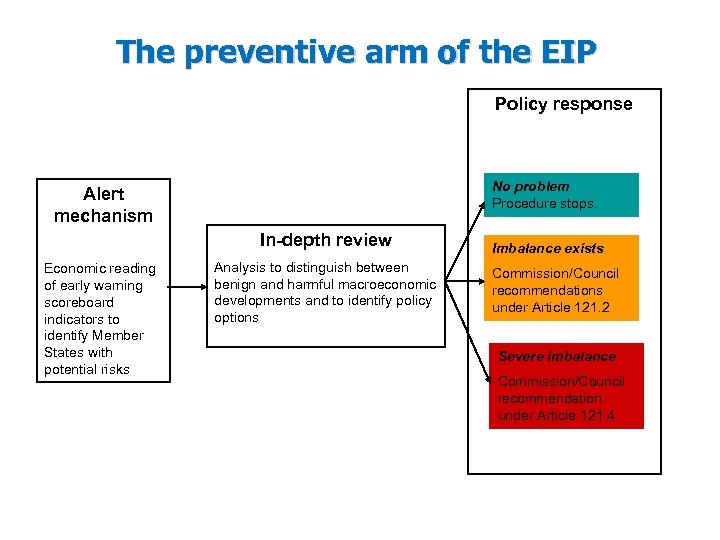

The preventive arm of the EIP Policy response No problem Procedure stops. Alert mechanism In-depth review Economic reading of early warning scoreboard indicators to identify Member States with potential risks Analysis to distinguish between benign and harmful macroeconomic developments and to identify policy options Imbalance exists Commission/Council recommendations under Article 121. 2 Severe imbalance Commission/Council recommendation under Article 121. 4

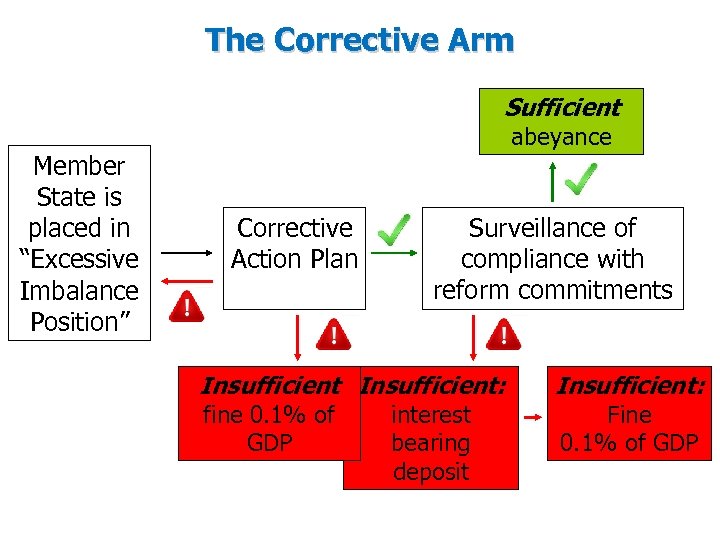

The Corrective Arm Sufficient Member State is placed in “Excessive Imbalance Position” abeyance Corrective Action Plan Surveillance of compliance with reform commitments Insufficient: fine 0. 1% of GDP interest bearing deposit Insufficient: Fine 0. 1% of GDP

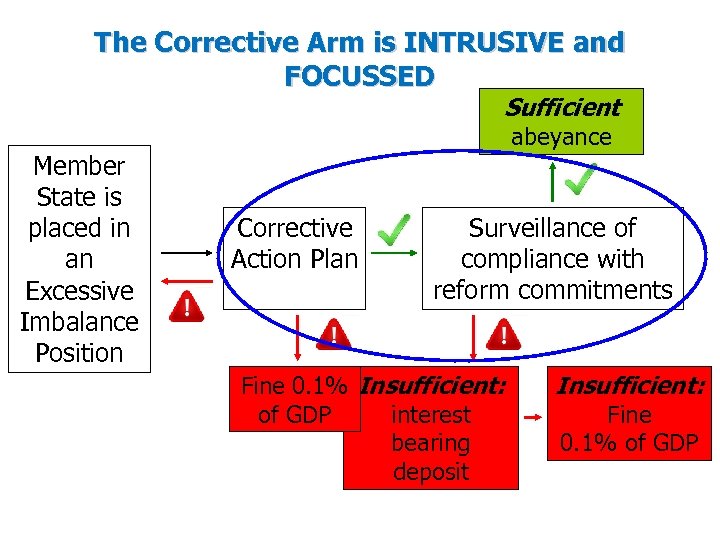

The Corrective Arm is INTRUSIVE and FOCUSSED Sufficient Member State is placed in an Excessive Imbalance Position abeyance Corrective Action Plan Surveillance of compliance with reform commitments Fine 0. 1% Insufficient: of GDP interest bearing deposit Insufficient: Fine 0. 1% of GDP

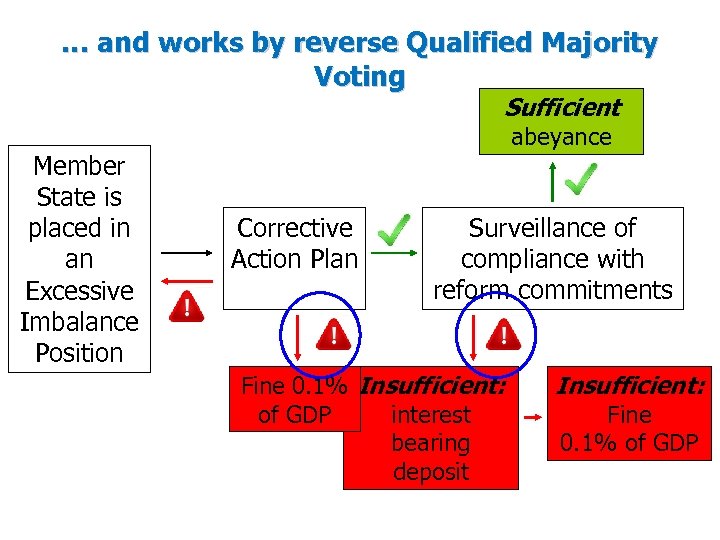

… and works by reverse Qualified Majority Voting Sufficient Member State is placed in an Excessive Imbalance Position abeyance Corrective Action Plan Surveillance of compliance with reform commitments Fine 0. 1% Insufficient: of GDP interest bearing deposit Insufficient: Fine 0. 1% of GDP

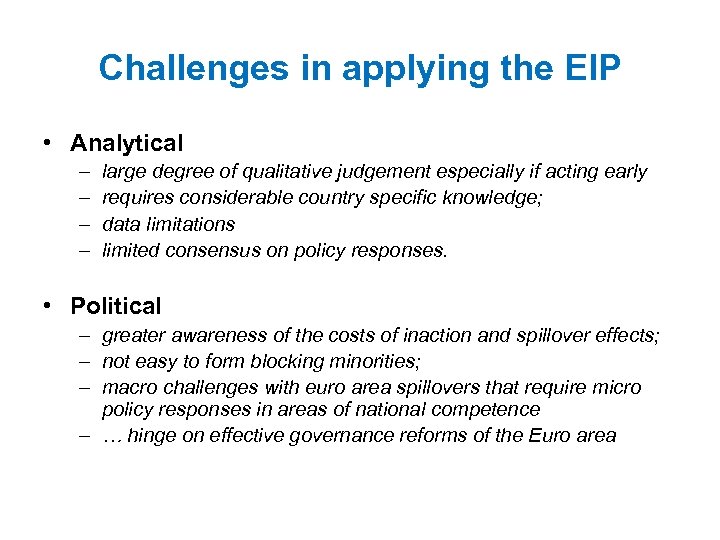

Challenges in applying the EIP • Analytical – – large degree of qualitative judgement especially if acting early requires considerable country specific knowledge; data limitations limited consensus on policy responses. • Political – greater awareness of the costs of inaction and spillover effects; – not easy to form blocking minorities; – macro challenges with euro area spillovers that require micro policy responses in areas of national competence – … hinge on effective governance reforms of the Euro area

Additional slides

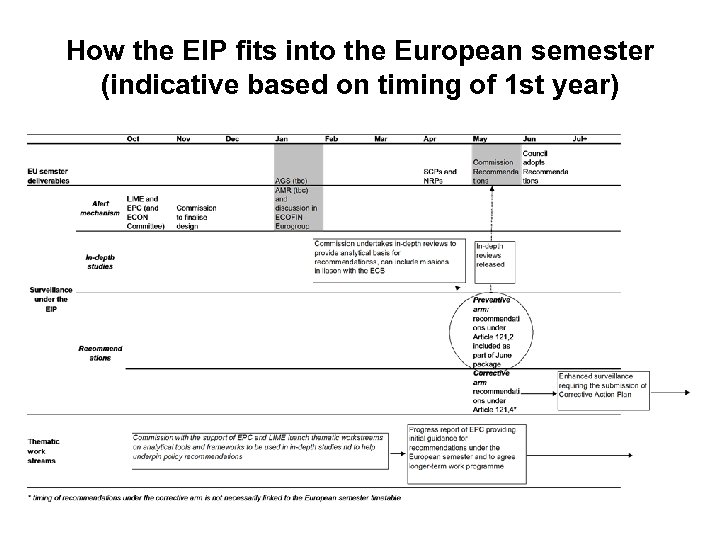

How the EIP fits into the European semester (indicative based on timing of 1 st year)

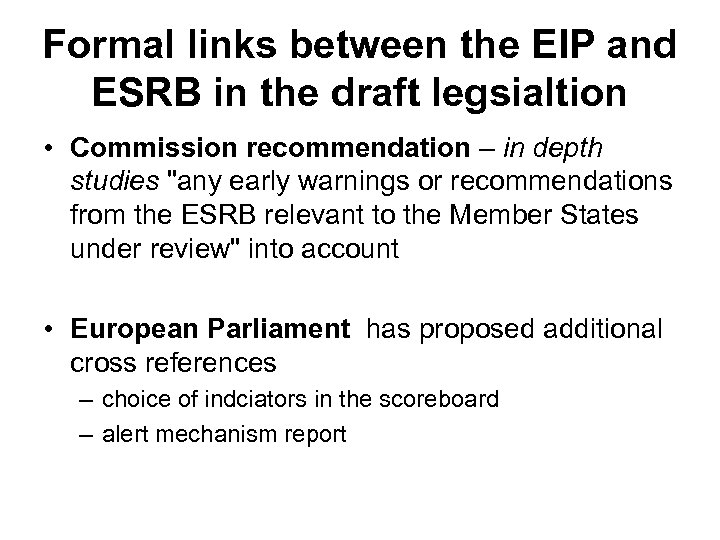

Formal links between the EIP and ESRB in the draft legsialtion • Commission recommendation – in depth studies "any early warnings or recommendations from the ESRB relevant to the Member States under review" into account • European Parliament has proposed additional cross references – choice of indciators in the scoreboard – alert mechanism report

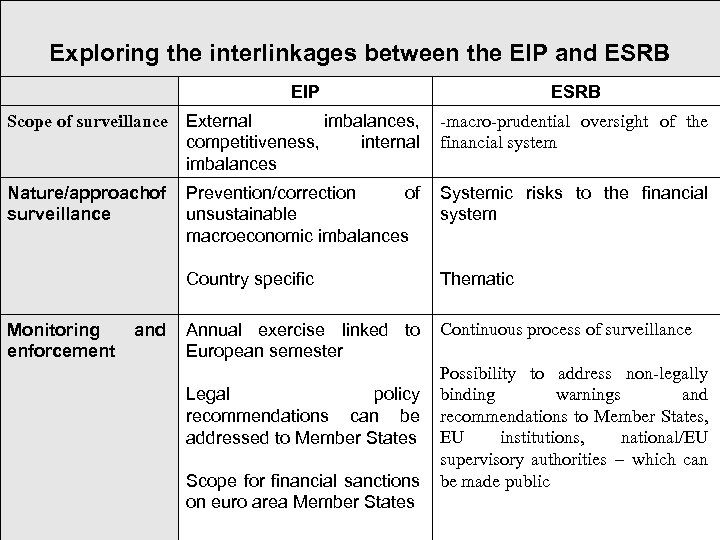

Exploring the interlinkages between the EIP and ESRB EIP ESRB Scope of surveillance External imbalances, competitiveness, internal imbalances -macro-prudential oversight of the financial system Nature/approachof surveillance Prevention/correction of unsustainable macroeconomic imbalances Systemic risks to the financial system Country specific Thematic Annual exercise linked to European semester Continuous process of surveillance Monitoring enforcement and Legal policy recommendations can be addressed to Member States Scope for financial sanctions on euro area Member States Possibility to address non-legally binding warnings and recommendations to Member States, EU institutions, national/EU supervisory authorities – which can be made public

Ensuring synergies • Commission-ESRB: ECFIN Commissioner is permanent member with voting rights on ESRB Steering Board and provides inputs • ECOFIN-EFC-ESRB: Council can be a recipient of ESRB recommendations or warnings and EFC President is a non-voting member of ESRB • EIP-ESRB-Parliament: ESRB required to present annual report to Parliament and there will be regular meetings with ECON Committee. Parliament is co-legislator for EIP and will be involved at various steps of the procedure – Cooperation at technical level between Commission, ESRB and ECB

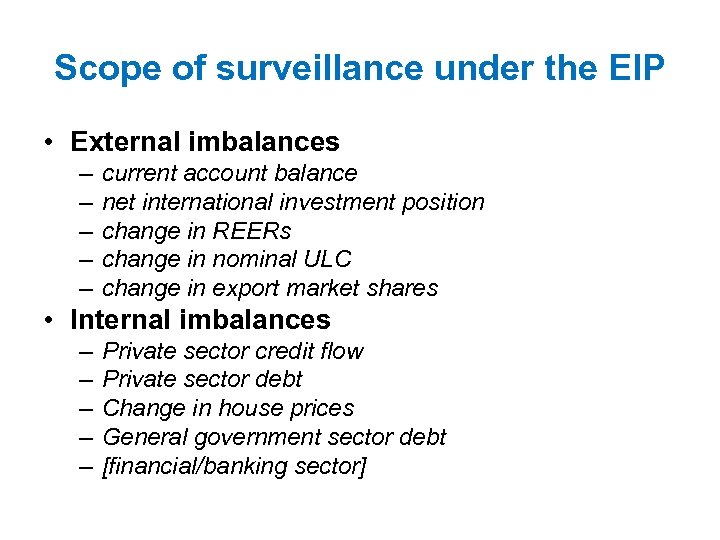

Scope of surveillance under the EIP • External imbalances – – – current account balance net international investment position change in REERs change in nominal ULC change in export market shares • Internal imbalances – – – Private sector credit flow Private sector debt Change in house prices General government sector debt [financial/banking sector]

33074aca72bcb80b03b78ab018e371d2.ppt