Presentation-risk management FINAL.pptx

- Количество слайдов: 50

The European Sovereign Debt Crisis Master of Science in Banking and Finance – LSF February 2014 Feliks Khamaev Philip Hoffmann Laura Paladino Risk Management Yosr Bahloul Professor Lehnert Elona Malaj

Flow of Presentation I. History II. Three phases in relation between euro and the european sovereign debt - reforms and regulation III. Role of international institutions IV. Forecasts of analytics vs our vision

History

History With the Maastricht Treaty 11 Countries of the European Union decided to enter in an economic and monetary union which implies they create a common market with a common currency. • 1 January 1999, the became legal transaction currency • 1 January 2002, the euro became the official currency of 11 countries.

History Foundings States of the Euro-zone 1999 Italy, 2001 2007 2008 2009 2011 2014 Belgium, Germany, Finland, France, Ireland, Luxembourg, Netherlands, Austria, Portugal and Spain Greece Slovenia Malta and Cyprus Slovakia Estonia Latvia

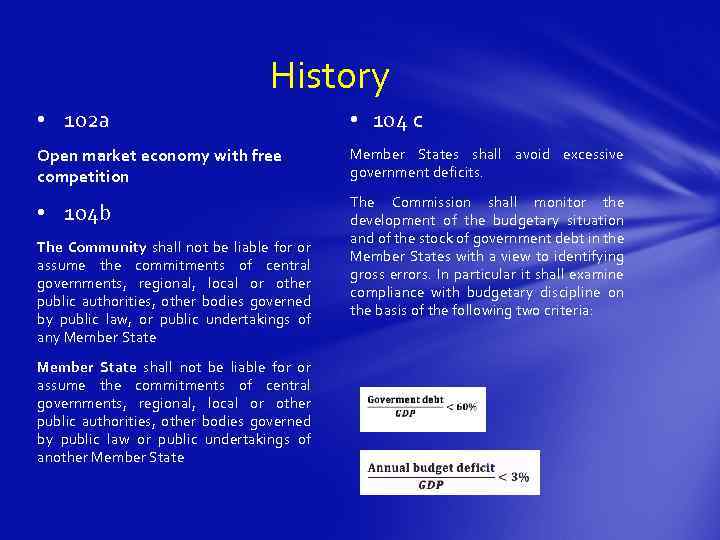

History Maastricht Treaty • 07. 02. 1992 signed • 01. 1993 came into force • Important points for the economic and monetary union are in articel 102 a – 109 m

History • 102 a • 104 c Open market economy with free competition Member States shall avoid excessive government deficits. • 104 b The Commission shall monitor the development of the budgetary situation and of the stock of government debt in the Member States with a view to identifying gross errors. In particular it shall examine compliance with budgetary discipline on the basis of the following two criteria: The Community shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of any Member State shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law or public undertakings of another Member State

History Potential Benefits Potential costs o No more exchange rate between participating members o If you are not an optimal currency area, joining a monetary union can lead to the following: • Greater transparency • Smaller transactions costs in doing business across borders • Larger economic fluctuations • Budget deficits No exchange rate uncertainty • Monetary policy • o Moral hazard o Monetary policy conducted by ECB more credible than the one conducted by own CB o Greater economic unification • Increased global status • Greater political integration o Costs that are not necessarily economic include

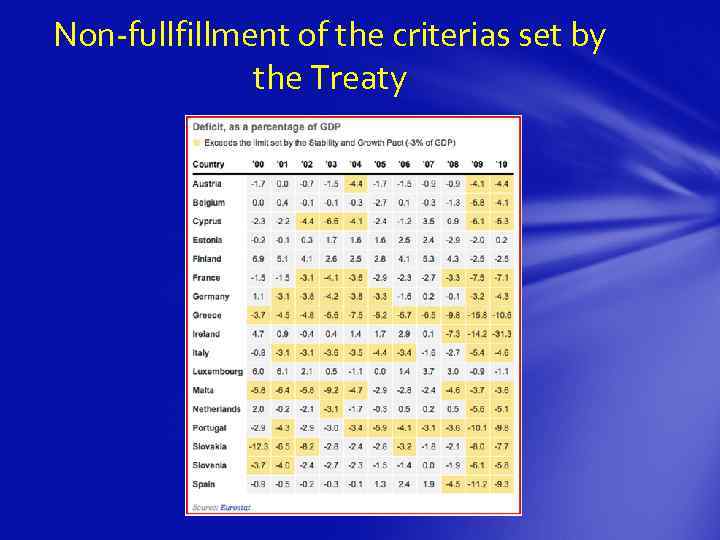

Non-fullfillment of the criterias set by the Treaty

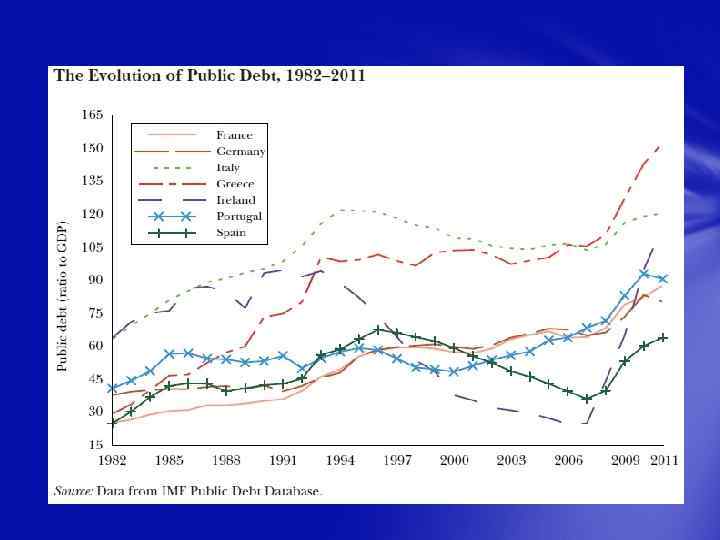

Pre-Crisis Period The aggregate European data mask considerable variation at the individual country level Moreover, low spread on sovereign debt also indicated that markets did not expect substantial default risk and certainly not a fiscal crisis of the scale that could engulf the euro system as a whole.

Pre-Crisis Period In fact, with the benefit of hindsight, 1999 -2007 looks like a period of good growth performance. In the same period, a benign financial environment masked the accumulation of an array of macroeconomic, financial and fiscal vulnerabilities (Wyplosz 2006; Caruan and Avdijev 2012).

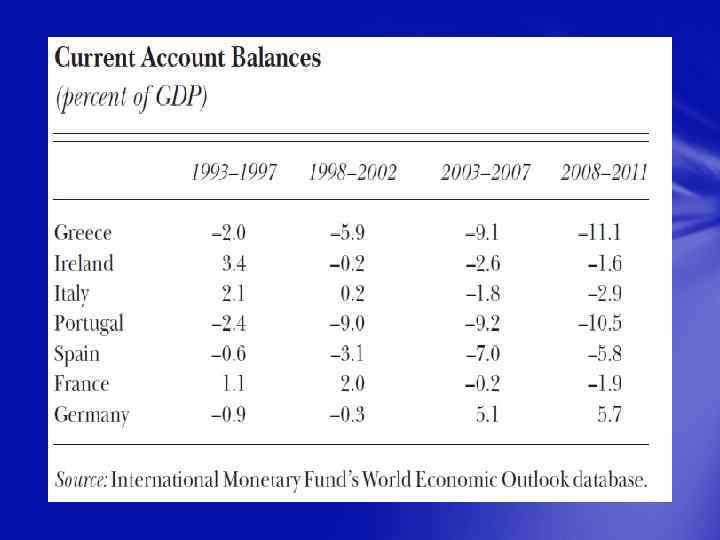

Financial imbalances and external imbalances: i) A key predictor of a banking crisis is the scale of the preceding domestic credit boom which lead to a banking crisis lower interest rates annd easier availability of credit stimulated consumption-related and property-related borrowing (Fagan&C. 2007) ii) Increase in the dispersion and persistence of current imbalances across the euro area to the extent that current account imbalances accelerated income convergence by reallocating resources from capital-abundant highincome countries to capital-scarce low-income countries, this would be a positive gain from monetary union (Blanchard and Giavazzi 2002) !!! However, under certain conditions, the accumulation of external imbalances posed significant macroeconomic risks

Pre-Crisis Period Countries running large and sustained external deficits undergo several risk factors A current account deficit can be harmful for the medium-term performance if increased expenditure on nontradables squeezes the tradables sector by bidding up wages and drawing resources away from industries with higher scope for productivity growth. q A large current account deficit poses short-term risks, if there is a sudden stop in funding markets such that the deficit must be narrowed quickly. q

Pre-Crisis Period The 2003 -2007 Boom The most intense phase of the dispersion in credit growth and current account occured during 2003 -2007 simultaneously with the securitization boom and the U. S. subprime episode. Why? The answer can be found in the underlying dynamics of the global financial system and the unusually low long-term interest rates. Who is to blame? The credit boom was not primarily due to government borrowing. Rather, households were the primary borrowers in some countries (Ireland), corporations in other countries (Spain) and both the government and corporations in other ones (Portugal, Greece).

Pre-Crisis Period Failure to Tighten Fiscal Policy National governments failed to tighten fiscal policy during 2003 -2007 In light of: • In some countries, the credit and housing booms directly generated extra tax revenues. . • Faster –growing euro member countries had inflation rates above the euro average, which also boosted tax revenues through the non-indexation of many tax categories. . • Low interest rate meant that debt servicing costs were below historical averages. . As a result, fiscal policy became less countercyclical after the creation of the Euro, undoing an improvement in cyclical performance that had been evident in the 1990 s (Benetrix and Lane 2012)

Pre-Crisis Period What had to be done? A more prudential and forward-looking approach to risk management would be more aggressive actions to accumulate buffers that might help if or when the boom ended in a sudden and disruptive fashion…

Pre-Crisis Risk Factors Lesson learned out of it ü For the euro periphery, the 2008 global financial crisis triggered a major reassessment among investors of the sustainability of rapid credit growth and large external deficits. ü The combined impact of domestic recessions, banking sector distress and the decline in risk appetite among international investors would fuel the conditions for a sovereign debt crisis.

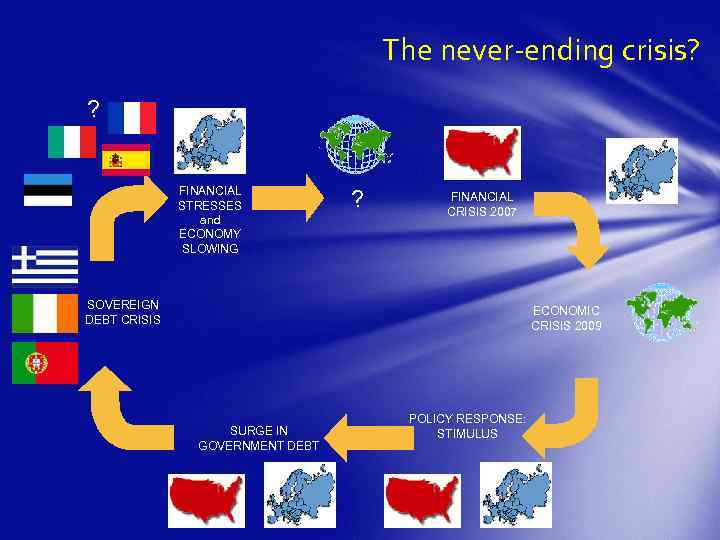

The never-ending crisis? ? FINANCIAL STRESSES and ECONOMY SLOWING ? FINANCIAL CRISIS 2007 SOVEREIGN DEBT CRISIS ECONOMIC CRISIS 2009 SURGE IN GOVERNMENT DEBT POLICY RESPONSE: STIMULUS

During the Crisis Period Global Financial Crisis Chronology: • August 2007 marked the first phase of the global financial crisis, with initiation of liquidity operations by the ECB; • Global crisis entered a more acute phase in September 2008 with the collapse of Lehman Brohers; • Global financial shock had asymmetric effects across the euro area. Cross-border financial flows dried up in late 2008 with investors repatriating funds to home markets and reassessing their international exposure levels.

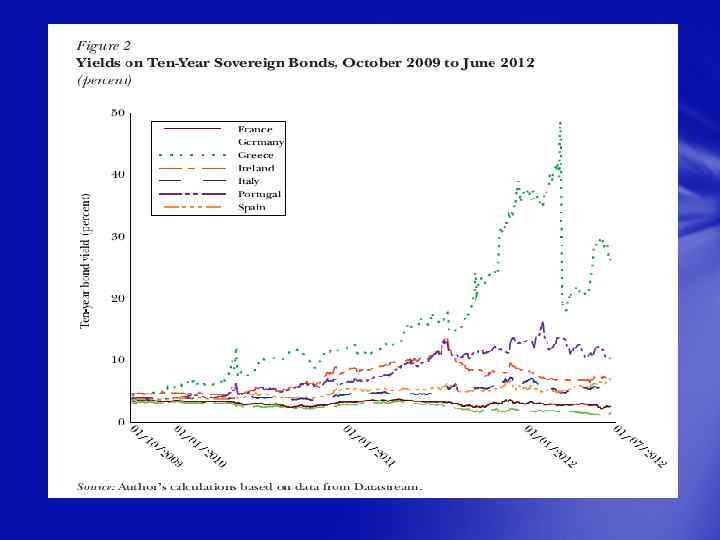

During the Crisis Period From Financial Shock to Sovereign Debt Crisis Through 2008 and 2009, there was relatively little concern about European Sovereign Debt. During this period, the main focus was on stability of the area-wide banking system, with country-specific fiscal risks remaining in the background. In late 2009, the European Sovereign Debt entered a new phase many countries report larger-than-expected increases in deficit/GDP ratios. Consequently: rising spreads on sovereign bonds

Common Response to the Sovereign Debt Crisis 3 countries were shut of the bond market during 2010 -11. In each of the three bailouts, the joint EU/IMF programs foresees three-year funding provided under condition of implementing fiscal austerity packages and structural reforms to boost growth and recapitalize/deleverage overextended banking systems. Decision to set up a temporary European Financial Stability Facility to issue bond on the basis of guarantees from the member states for providing official funding in any future crisis.

Potential problems faced by funding plans • Given the scale of macroeconomic, financial, and fiscal imbalances, the plausible time scale for macroeconomic adjustment was longer than the standard three-year term of such deals • Excessively rapid fiscal consolidation can exacerbate weaknesses in the banking system • The fiscal targets were not conditional on the state of the wider European economy. As growth projections for the wider European economy declined throughout 2011, the country-specific targets looked unobtainable for external reason • The original bailouts included a sizable penalty premium of 300 basis points built into the interest rate, which is standard IMF practice • The bailout funds have been used to recapitalize banking systems, in addition to covering the “regular” fiscal deficits • IMF principle that funding is only provided if the sovereign debt level is considered to be sustainable

Risks of multiple equilibria § Significant factor during the crisis has been the increased volatitlity in euro sovereign debt markets. § One option to encourage the good equilibrium is to create a firewall through the availability of an official safety net. § The European Central Banks program to purchase sovereign bonds can be viewed as a way to reduce the risk of the bad equilibrium. § There have also been calls for the European Central Bank to take further steps to stabilize the sovereign debt market. § It could increase the firepower of the European Stability Mechanism by allowing it to borrow from the ECB.

PROSPECTUS FOR POST-CRISIS REDUCTION IN SOVEREIGN DEBT. . even if the current austerity programs are sufficient to stabilize debt ratios there remains the post-crisis adjustment challenge of gradually reducing government debt to safer levels. . Four reasons why the underlying fundamentals for reducing the debt/GDP ratio are not promising : 1) Growth in nominal GDP is likely to be low 2) The political economy environment is likely to be challenging 3) The possibility for financing at least some of the sovereign debt through «financial repression» are limited 4) Risk premia will likely remain nontrivial for most indebted member states.

Reforms to address sovereign Debt Concerns What kind of reforms? in the first instance, the reforms of fiscal character(? ) Fiscal governance reforms are based on two principles: a) high public debt levels pose a threat to fiscal stability; b) the fiscal balance should be close to zero “over the cycle” Fiscal Compact Treaty (since 2013) requires the new fiscal principles be embedded in each country’s national legislation New system focuses on the structural budget balance Under the new system, there is a specified time frame for reducing public debt below the ceiling of 60% of GDP

Implementation problems of the new approach In contrast to the original Stability and Growth Pact, the primary source of fiscal discipline is intended to be national. The Fiscal Compact requires that the fiscal rules are written into domestic legislation and that national independent fiscal councils be created to monitor the compliance with the specified fiscal rules

More extensive reforms under discussion 1) Creation of a banking union the diabolic loop between national banking systems and national sovereigns was central to the fiscal crisis. Ingredients of banking union include: Europea-level regulatory responsibility, deposit insurance, bank resolution policies and a joint fiscal backstop 2) Introduction of common areawide «Eurobonds» with the goal of avoiding the disruptive impact of destabilizing speculative attacks on national sovereign debt markets inside the euro area. Fiscally stronger member states might support eurobonds if it is cheaper than alternatives for reducing default risk, for ex. , with bigger bailout funds. 3) Europe might seek a deeper level of fiscal union, agreeing to share certain tax streams or spending programs in a way that would be delinked from fluctuations in national-level output. In related fashion, enhanced coordination of national fiscal policies enabling the collective fiscal position of the euro area.

Rapid erosion of confidence in sovereigns First financial crisis 2007 highlighted the fragilities of the private financial institutions These problems interacted with weak public finances Market questioning the risk free status of the debt issued by governments worldwide Far reaching implications->creates adverse feedback effects on financial institutions and in particular magnifies counterparty credit risk and creates significant funding challenges for banking system.

Restoration of confidence in sovereign debt - a vital step Bolster capital of banks and repair their balance sheets is good but not enough Corrective action on the fiscal side Structural reforms Credible finance backstops during the adjustment phase Time is critical if contagioun is to be contained

Eurobonds as a solution? Eurobonds ØEconomic analysts, senior European Union officials, members of the European Parliament and financial market participants believe such a step could help resolve the region's debt crisis ØGermany adamantly opposed-> As the euro zone's most powerful economy, Germany enjoys the lowest sovereign borrowing costs and would stand to lose most if such bonds, were introduced as it would effectively end up having to underwrite weaker, more risky member states

Proposals Hans-Joachim Dubel (Berlin)-creating European sovereign bonds -- dubbed 'purple' bonds -- that are: Ø Part-insured by the EU's rescue fund, the European Financial Stability Facility (EFSF). ØEach bond would be split into senior and junior tranches, with the senior section, around 60 percent of the total, insured by the EFSF and its successor, the European Stability Mechanism

Proposals Bruegel (Brussels)-separate 'red' and 'blue' bonds. ØEuro zone bonds -- blue bonds -- would be issued jointly and collectively up to the value of 60 percent of each euro zone member state's GDP. ØBorrowing beyond that level would require an individual state to issue red bonds without the collective guarantee of the euro zone, with the market likely to charge a higher yield to reflect the additional risk.

Proposals Inspired by EFSF some economists propose creating a central European debt agency that would issue bonds on behalf of any member country that needed financing. Unlike the EFSF, which is only designed to help rescue euro zone members that are in trouble, the debt agency would regularly issue bonds for individual countries. Strong guarantees -- for as much as 300 percent of the value of the borrowed amount -- would help ensure the bonds were highly rated.

Implications and potential risks of this proposals Bundesbank ->a common euro bond initiative creates a "freerider" situation where bigger economies are saddled with the liabilities of weaker members and face higher borrowing costs Germany->The idea cannot even be entertained until there is much tighter fiscal coordination and a more level tax field across the euro zone. Worries->a euro zone bond, with its lower interest rate, would be another invitation for southern Europe to splurge on debt. That could be mitigated in part by charging higher rates for bonds issued by countries with higher debts and deficits.

Implications and potential risks of this proposals Loss of sovereignty- the toughest issue is the that national parliaments would confront if euro bonds were introduced. ØGermany ->almost certainly insist on creating a central authority responsible for reviewing national budgets and financing needs, with the right to a veto. ØIt would effectively mean the setting up of a pan-euro zone finance ministry or fiscal authority, undermining one of the most fundamental sovereign powers of a state -- taxation.

Arguments against eurobonds MORAL HAZARD: is introduced by joint issuance of debt through eurobonds. By agreeing to eurobonds, the EU would be rewarding bad behaviour and giving irresponsible governments access to even more cheap credit. NO POLITICAL BACKING: a properly functioning fiscal union would need more than just eurobonds. It equally needs fiscal transfers from surplus countries to poorer countries; a single treasury to coordinate joint fiscal policy; harmonised taxation etc Thus, Eurobonds on their own are not a panacea. There is no political appetite on the part of electorates for the kind of radical federalism that would be required. ILLEGAL: Eurobonds are illegal – both according to the EU treaties and according to national law. Implementing them without treaty change would expose the EU to serious legal challenges. TREATY CHANGE will be required to make it legal. This will require years of lengthy negotiation, including ratification by national parliaments and possibly referenda in some countries. The current crisis required a solution now, not several years down the road.

Arguments for eurobonds COMPLETING MONETARY UNION : The architects of the euro created a monetary union without the necessary fiscal side to support it. Now, the flaw has been exposed and either the eurozone will collapse, which is catastrophic for Euro-economies, or members will need to consolidate a full fiscal union. TOUGH RULES: There is no moral hazard associated with eurobonds, because they would only be introduced after the fiscal compact is in place. The compact institutes much tougher rules for member-states, including constitutionally defined debt-ceilings. This helps to avoid a repeat of current situation, because governments would find it harder to abuse cheap credit. ONE MORE STEP: Eurobonds should not be seen as the completing part of the puzzle, but rather as one more important step towards the goal of deeper European integration. DIFFERENT BOND TYPES: True, some of the proposals for eurobonds might require treaty change, but the Commission argues (PDF) that certain types of eurobond can be introduced without the need to re-open the treaties.

Role of Institutions of the European Union The European Parlament The Court of Auditors The European Council The Council of European Union The European Central Bank The European Commission The European Court of Justice

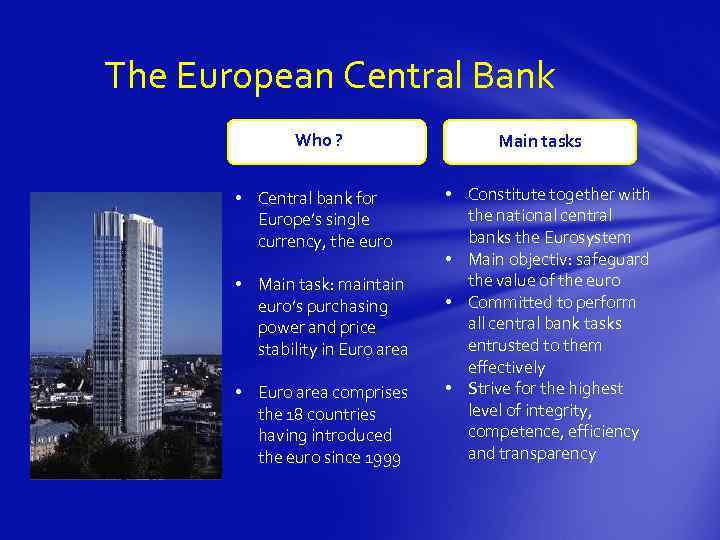

The European Central Bank Who ? • Central bank for Europe’s single currency, the euro • Main task: maintain euro’s purchasing power and price stability in Euro area • Euro area comprises the 18 countries having introduced the euro since 1999 Main tasks • Constitute together with the national central banks the Eurosystem • Main objectiv: safeguard the value of the euro • Committed to perform all central bank tasks entrusted to them effectively • Strive for the highest level of integrity, competence, efficiency and transparency

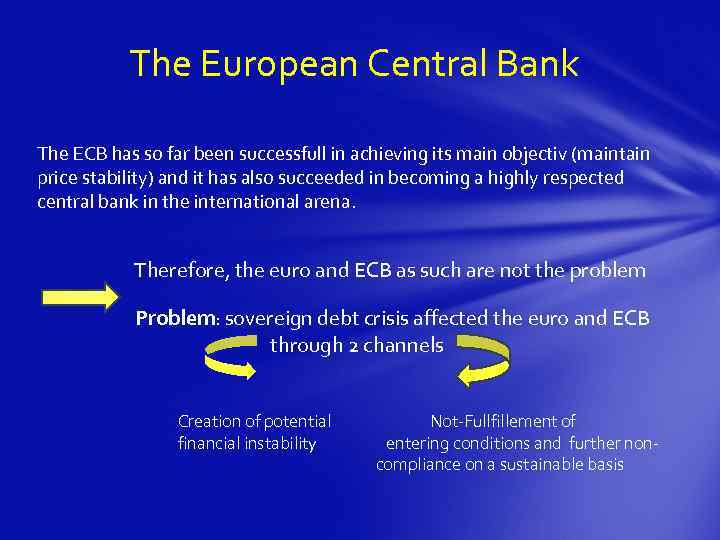

The European Central Bank The ECB has so far been successfull in achieving its main objectiv (maintain price stability) and it has also succeeded in becoming a highly respected central bank in the international arena. Therefore, the euro and ECB as such are not the problem Problem: sovereign debt crisis affected the euro and ECB through 2 channels Creation of potential financial instability Not-Fullfillement of entering conditions and further noncompliance on a sustainable basis

The European Central Bank How the ECB responded to the sovereign debt crisis ? 3 Crisis Management! aspects Only analysis &views, responsabilitiy in the hand of politicans Future prevention Crisis resolution • First time ECB Council had to take a decision on whether and how to intervene in government debt markets through monetary policy Securities Market Programme (SMP)

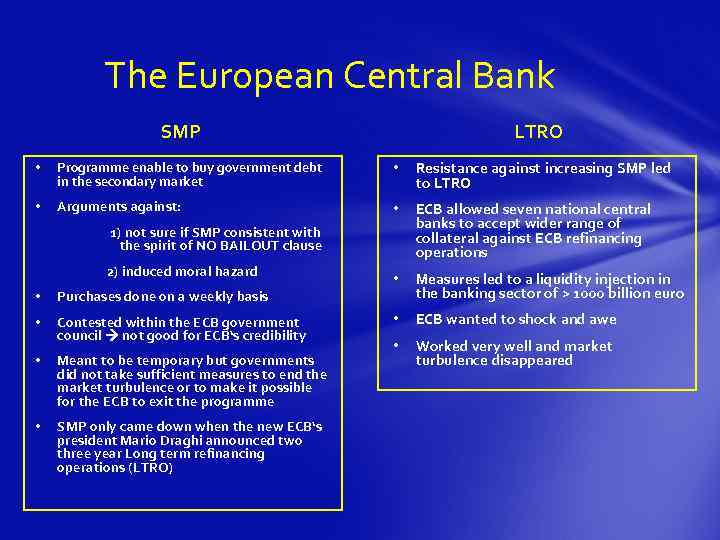

The European Central Bank SMP LTRO • Programme enable to buy government debt in the secondary market • Resistance against increasing SMP led to LTRO • Arguments against: • ECB allowed seven national central banks to accept wider range of collateral against ECB refinancing operations • Measures led to a liquidity injection in the banking sector of > 1000 billion euro • ECB wanted to shock and awe • Worked very well and market turbulence disappeared 1) not sure if SMP consistent with the spirit of NO BAILOUT clause 2) induced moral hazard • Purchases done on a weekly basis • Contested within the ECB government council not good for ECB‘s credibility • Meant to be temporary but governments did not take sufficient measures to end the market turbulence or to make it possible for the ECB to exit the programme • SMP only came down when the new ECB‘s president Mario Draghi announced two three year Long term refinancing operations (LTRO)

The European Central Bank Challenges ahead and conclusions As a response to the crisis, ECB introduced full allotment of its refinancing operations at the end of 2008 Negative side effects • Crisis caused strains within the Governing Council • Step towards renationalisation of monetary policy • Zombie banks Conclusions • Measures were successful in calming down markets but they cannot solve the crisis.

• Called „euro bailout fund“ or „emergency parachute“ • Established in Luxembourg • Most important tool against the european sovereign debt crisis • A Fund which give loans to countries and Banks with liquidity problems • The ESM can buy government bonds on the primary market and on the secondary market. • Successor of the ESFS • Alternative to Eurobonds

Forecasts of Analytics vs our vision http: //www. youtube. com/watch? v=RAQ 4 Lycbu 2 A

Conclusion The most benign perspective on the European sovereign debt crisis is that it provides an opportunity to implement reforms that are necessary for a stable monetary union but that would not have been politically feasible in its absence. A more modest hope is that the unfolding reform process will deliver a monetary union that can survive, even if it remains vulnerable to recurring crises.

Presentation-risk management FINAL.pptx