a264cbf8f665985f22f62c5ea8a27c13.ppt

- Количество слайдов: 16

The English Dual Registration System: Security over Patents and the Pathway to Reform Dr Janice Denoncourt Academic Forum of INSOL EUROPE Conference 2017 Warsaw 4 -5 October 2017 ©J Denoncourt 2017

The English Dual Registration System: Security over Patents and the Pathway to Reform Dr Janice Denoncourt Academic Forum of INSOL EUROPE Conference 2017 Warsaw 4 -5 October 2017 ©J Denoncourt 2017

About me…Janice Denoncourt Senior Lecturer in Law 1988 BA, Mc. Gill University 1996 Australian Barrister & Solicitor 1998 In-house Counsel Australian plc 2001 Senior Associate Minter Ellison, Western Australia 2003 British Council Chevening Scholar 2004 Legal Affairs Manager, private UK company 2006 Solicitor England & Wales 2008 Law Academic / Researcher 2015 Ph. D University of Nottingham 2017 Senior Fellow HEA Chair, Organising Committee EIPTN

About me…Janice Denoncourt Senior Lecturer in Law 1988 BA, Mc. Gill University 1996 Australian Barrister & Solicitor 1998 In-house Counsel Australian plc 2001 Senior Associate Minter Ellison, Western Australia 2003 British Council Chevening Scholar 2004 Legal Affairs Manager, private UK company 2006 Solicitor England & Wales 2008 Law Academic / Researcher 2015 Ph. D University of Nottingham 2017 Senior Fellow HEA Chair, Organising Committee EIPTN

Men of Progress (19 American inventors) Christian Schussele (1824 -1879) American National Portrait Gallery Illustrates the rewards of commercialization were more accessible to aspiring inventor-capitalists.

Men of Progress (19 American inventors) Christian Schussele (1824 -1879) American National Portrait Gallery Illustrates the rewards of commercialization were more accessible to aspiring inventor-capitalists.

£ 133 billion ©J Denoncourt 2017

£ 133 billion ©J Denoncourt 2017

Investment in intangibles overtakes tangibles ©J Denoncourt 2017

Investment in intangibles overtakes tangibles ©J Denoncourt 2017

Corporate value of intangible assets Intangible assets are now estimated to represent 70 -80% of the value of UK companies Source: Goodridge, P. , Haskell, J. and Wallis, G. UK Intangible Investment and Growth: New measures of UK investment in knowledge assets and intellectual property rights (September 2016) Independent Report commissioned by the UK Intellectual Property Office ISBN: 978 -1 -910790 -25 -0 ©J Denoncourt 2017

Corporate value of intangible assets Intangible assets are now estimated to represent 70 -80% of the value of UK companies Source: Goodridge, P. , Haskell, J. and Wallis, G. UK Intangible Investment and Growth: New measures of UK investment in knowledge assets and intellectual property rights (September 2016) Independent Report commissioned by the UK Intellectual Property Office ISBN: 978 -1 -910790 -25 -0 ©J Denoncourt 2017

Investment in intangibles overtakes tangibles • Inventions, brands, content, code, data, knowhow and confidential information. • 9% higher than traditional “tangible” investment e. g. real estate, machinery and IT hardware. • 53% of intangible investments are protected by IP rights. • Most economically important IP rights are patents, copyright and trade marks. • Economic inversion from tangible to intangible assets underlines why patent applications, granted patents, patent licences and mixed patent portfolios are increasingly used to secure credit and need to be enforced in the event of borrower insolvency. ©J Denoncourt 2017

Investment in intangibles overtakes tangibles • Inventions, brands, content, code, data, knowhow and confidential information. • 9% higher than traditional “tangible” investment e. g. real estate, machinery and IT hardware. • 53% of intangible investments are protected by IP rights. • Most economically important IP rights are patents, copyright and trade marks. • Economic inversion from tangible to intangible assets underlines why patent applications, granted patents, patent licences and mixed patent portfolios are increasingly used to secure credit and need to be enforced in the event of borrower insolvency. ©J Denoncourt 2017

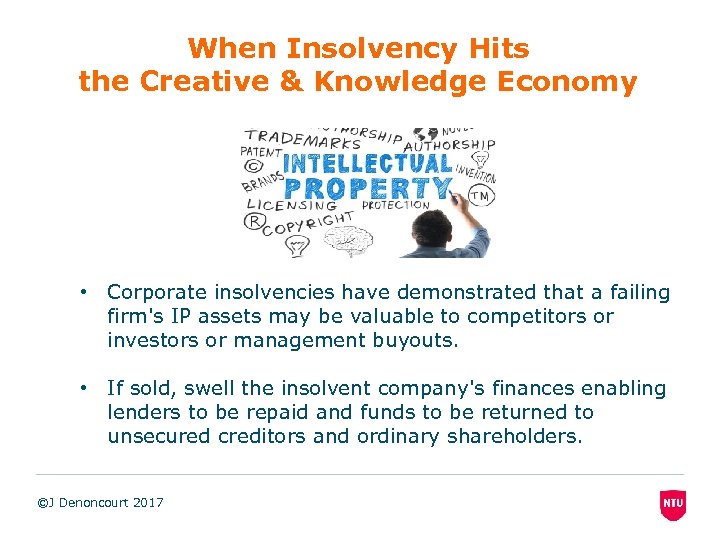

When Insolvency Hits the Creative & Knowledge Economy • Corporate insolvencies have demonstrated that a failing firm's IP assets may be valuable to competitors or investors or management buyouts. • If sold, swell the insolvent company's finances enabling lenders to be repaid and funds to be returned to unsecured creditors and ordinary shareholders. ©J Denoncourt 2017

When Insolvency Hits the Creative & Knowledge Economy • Corporate insolvencies have demonstrated that a failing firm's IP assets may be valuable to competitors or investors or management buyouts. • If sold, swell the insolvent company's finances enabling lenders to be repaid and funds to be returned to unsecured creditors and ordinary shareholders. ©J Denoncourt 2017

Asset Partitioning & IP assets • Asset partitioning = a strategy in preparing for insolvency e. g. acquiring IP assets cheaply out of the insolvent estate, either through an asset sale, i. e. pre-pack, or through a formal reorganisation. • SHs can take steps to depress the value of the enterprise by removing key assets, notably IP rights. Without IP rights, the going concern value is significantly reduced. • In the case of reorganisation, the method of valuation adopted is key. If the SHs can offer a reorganisation plan under which the creditors receive the liquidation value with a bonus of say 25%, the money offered could be considered too low if the IP rights have been taken out. ©J Denoncourt 2017

Asset Partitioning & IP assets • Asset partitioning = a strategy in preparing for insolvency e. g. acquiring IP assets cheaply out of the insolvent estate, either through an asset sale, i. e. pre-pack, or through a formal reorganisation. • SHs can take steps to depress the value of the enterprise by removing key assets, notably IP rights. Without IP rights, the going concern value is significantly reduced. • In the case of reorganisation, the method of valuation adopted is key. If the SHs can offer a reorganisation plan under which the creditors receive the liquidation value with a bonus of say 25%, the money offered could be considered too low if the IP rights have been taken out. ©J Denoncourt 2017

Taking Security over Patents: The English Dual Registration System

Taking Security over Patents: The English Dual Registration System

Taking Security over Patents: The English Dual Registration System • Both patent-specific provisions and general principles concerning personal property comprise the English legal framework. • Analysis of the fundamentals of the procedure for perfecting patent assets for security interest purposes. • The challenges posed by the inefficient dual security registration system in England Wales • The pathway to reform and the potential for a personal property security register to include IP assets as in the UK and Australia and many other nations.

Taking Security over Patents: The English Dual Registration System • Both patent-specific provisions and general principles concerning personal property comprise the English legal framework. • Analysis of the fundamentals of the procedure for perfecting patent assets for security interest purposes. • The challenges posed by the inefficient dual security registration system in England Wales • The pathway to reform and the potential for a personal property security register to include IP assets as in the UK and Australia and many other nations.

The Pathway to Reform The Secured Transactions Reform Project https: //securedtransactionslawreformproject. org/ I take the view that our laws relating to such transactions are in need of reform, by being brought up to date, simplified and made easier to understand operate. In recent years other common law countries have introduced welcome and successful reforms and I believe that we should follow their lead. - Lord Saville

The Pathway to Reform The Secured Transactions Reform Project https: //securedtransactionslawreformproject. org/ I take the view that our laws relating to such transactions are in need of reform, by being brought up to date, simplified and made easier to understand operate. In recent years other common law countries have introduced welcome and successful reforms and I believe that we should follow their lead. - Lord Saville

The Pathway to Reform Chan, ‘Secured Transactions Law Reform: The Long and Winding Road’ (2017) 4 JIBFL 215 Insolvency The STR Project is considering is the abolition of the distinction between a fixed and floating charge, given the uncertainties relating to the distinction which exist in practice. A number of consequences currently flow from the distinction in insolvency. This group is considering the alternative ways in which these issues could be addressed in insolvency if the distinction were to be removed in order to inform the wider work of the project. As part of this work, this group has prepared a response to the UK Insolvency Service’s consultation entitled ‘A Review of the Corporate Insolvency Framework: A Consultation on Options for Reform. ’

The Pathway to Reform Chan, ‘Secured Transactions Law Reform: The Long and Winding Road’ (2017) 4 JIBFL 215 Insolvency The STR Project is considering is the abolition of the distinction between a fixed and floating charge, given the uncertainties relating to the distinction which exist in practice. A number of consequences currently flow from the distinction in insolvency. This group is considering the alternative ways in which these issues could be addressed in insolvency if the distinction were to be removed in order to inform the wider work of the project. As part of this work, this group has prepared a response to the UK Insolvency Service’s consultation entitled ‘A Review of the Corporate Insolvency Framework: A Consultation on Options for Reform. ’

UK Reform: a single PPS registration system? Reform in other jurisdictions? The Personal Property Securities Act 2009 (Cth), in force in 2012, established a national PPS register and a new regime for creation, legal effect and enforcement of security interests in personal property in Australia. It introduced a single, national set of rules in a federal state. While unique in some areas, it is broadly based on principles developed and implemented in the US, Canada and NZ. The system was reviewed in a final report on 18 th March 2015 which included 394 recommendations for improvements to the Act and the PPS register See http: //www. ppsr. gov. au/Pages/ppsr. aspx

UK Reform: a single PPS registration system? Reform in other jurisdictions? The Personal Property Securities Act 2009 (Cth), in force in 2012, established a national PPS register and a new regime for creation, legal effect and enforcement of security interests in personal property in Australia. It introduced a single, national set of rules in a federal state. While unique in some areas, it is broadly based on principles developed and implemented in the US, Canada and NZ. The system was reviewed in a final report on 18 th March 2015 which included 394 recommendations for improvements to the Act and the PPS register See http: //www. ppsr. gov. au/Pages/ppsr. aspx

Bibliography Denoncourt, J. Patent-backed Debt Finance: Should Company Law Take the Lead to Provide a ‘True and Fair’ View of SME Patent Assets? (2015) See Chapter 3, available at: http: //eprints. nottingham. ac. uk/30743/ Denoncourt, J. Chapter 1 ‘IP Debt Finance and SMEs: Trends and Initiatives from Around the World’ in Toshiyuki Kono (Ed. ) Security Interests in Intellectual Property in a Global Context (2017) Springer Verlang Denoncourt, J. Intellectual Property, Finance and Corporate Governance (2017) Routledge Research in IP Monograph Series (forthcoming in December) Chan, ‘Secured Transactions Law Reform: The Long and Winding Road’ (2017) 4 Butterworths Journal of International Banking and Financial Law 215 Brown, D. ‘Personal Property Securities Act in Australia: an early stocktake’ (2014) Butterworths Journal of International Banking and Financial Law 274 Thomas, S. ‘Security interests in intellectual property: proposals for reform’ (June 2017) Volume 37, Issue 2 Legal Studies pp 214– 247

Bibliography Denoncourt, J. Patent-backed Debt Finance: Should Company Law Take the Lead to Provide a ‘True and Fair’ View of SME Patent Assets? (2015) See Chapter 3, available at: http: //eprints. nottingham. ac. uk/30743/ Denoncourt, J. Chapter 1 ‘IP Debt Finance and SMEs: Trends and Initiatives from Around the World’ in Toshiyuki Kono (Ed. ) Security Interests in Intellectual Property in a Global Context (2017) Springer Verlang Denoncourt, J. Intellectual Property, Finance and Corporate Governance (2017) Routledge Research in IP Monograph Series (forthcoming in December) Chan, ‘Secured Transactions Law Reform: The Long and Winding Road’ (2017) 4 Butterworths Journal of International Banking and Financial Law 215 Brown, D. ‘Personal Property Securities Act in Australia: an early stocktake’ (2014) Butterworths Journal of International Banking and Financial Law 274 Thomas, S. ‘Security interests in intellectual property: proposals for reform’ (June 2017) Volume 37, Issue 2 Legal Studies pp 214– 247

THANK YOU

THANK YOU