79c7de838c29028e70caedaaee366f65.ppt

- Количество слайдов: 17

The energy crisis: the impact on employment Dr. Miriam Altman Executive Director Centre for Poverty, Employment and Growth Human Sciences Research Council maltman@hsrc. ac. za or altmanm@mweb. co. za

The energy crisis: the impact on employment Dr. Miriam Altman Executive Director Centre for Poverty, Employment and Growth Human Sciences Research Council maltman@hsrc. ac. za or altmanm@mweb. co. za

What is the energy crisis? • Why is this a crisis? What are the causes? • In essence: – Eskom is monopoly, governed by a regulator (Nersa), and overseen by two departments – its shareholder (DPE) and its policy dept (Do. E) – To cover current and future electricity consumption, it should have already invested in new capacity some years ago – Initially, govt intended to draw in private investors, but then did not. Neither was Eskom allowed to move ahead with major investments – Price has not been increased to cover operational costs and depreciation – Major investments now required, but with no retained earnings available nor a large shareholder equity injection – Oversight of operations weak – lack competition and information. • This led to slow action on coal shortage which led to first crisis • Underinvestment causes Eskom to work past sustainable capacity

What is the energy crisis? • Why is this a crisis? What are the causes? • In essence: – Eskom is monopoly, governed by a regulator (Nersa), and overseen by two departments – its shareholder (DPE) and its policy dept (Do. E) – To cover current and future electricity consumption, it should have already invested in new capacity some years ago – Initially, govt intended to draw in private investors, but then did not. Neither was Eskom allowed to move ahead with major investments – Price has not been increased to cover operational costs and depreciation – Major investments now required, but with no retained earnings available nor a large shareholder equity injection – Oversight of operations weak – lack competition and information. • This led to slow action on coal shortage which led to first crisis • Underinvestment causes Eskom to work past sustainable capacity

Critical considerations • Reducing the energy/electricity/coal intensity of the economy – Reasons: • Reduce carbon emissions • Reduce pressure to invest in electricity • Reduce macro-economic impact – funds diverted to electricity investments • Raise employment intensity – Policies: • Encourage alternative energy sources • Encourage adoption of physical and process technologies that support energy efficiency • Raise the electricity price, so that firms and consumers buy less, and hopefully adapt. • Improve the efficiency of operation and of investment – Policies: • Governance, information and oversight • Competition in parts of the value chain

Critical considerations • Reducing the energy/electricity/coal intensity of the economy – Reasons: • Reduce carbon emissions • Reduce pressure to invest in electricity • Reduce macro-economic impact – funds diverted to electricity investments • Raise employment intensity – Policies: • Encourage alternative energy sources • Encourage adoption of physical and process technologies that support energy efficiency • Raise the electricity price, so that firms and consumers buy less, and hopefully adapt. • Improve the efficiency of operation and of investment – Policies: • Governance, information and oversight • Competition in parts of the value chain

Why is the price being raised? • Cost recovery of operations – price has not increased to cover operations, nor depreciation • Primary energy costs • Cost of investment - in context of lack of retained earnings • Maintain credit worthiness so that credit rating does not slip while it is on a capital raising drive • Promote energy efficiency, although this is not stated goal – Immediately critical to enable Eskom to achieve ‘reserve margin’ and improve reliability • Approach: – Price is being raised over extended period so that firms can adjust. However, communication has become clearer so that they know what to adjust to.

Why is the price being raised? • Cost recovery of operations – price has not increased to cover operations, nor depreciation • Primary energy costs • Cost of investment - in context of lack of retained earnings • Maintain credit worthiness so that credit rating does not slip while it is on a capital raising drive • Promote energy efficiency, although this is not stated goal – Immediately critical to enable Eskom to achieve ‘reserve margin’ and improve reliability • Approach: – Price is being raised over extended period so that firms can adjust. However, communication has become clearer so that they know what to adjust to.

2008 Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 2007 Rank 1 3 2 7 4 6 5 12 10 8 9 11 13 14 Country Italy Germany Austria United Kingdom Netherlands Spain Belgium Sweden Finland France United States Australia Canada South Africa Cost (US¢)/k. Wh One Year Percentage Change 19. 61 17. 95 16. 91 15. 39 15. 29 13. 56 13. 40 10. 73 10. 63 10. 11 9. 44 8. 52 7. 04 3. 41 Five Year Percentage Change +6. 6% +16. 7% +6. 9% +37. 4% +3. 7% +12. 1% +0. 4% +40. 0% +31. 0% +1. 4% +4. 0% +6. 8% -0. 4% +4. 8% The survey is based on prices as of April 1, 2008 for the supply of 1, 000 k. W for an organization with a monthly usage of 450, 000 k. Wh. All prices are in US cents per kilowatt hour and exclude VAT. Where there is more than a single supplier, an unweighted average of available prices was used. Where available in each country and widely used by the consuming public, deregulated or liberalized contract pricing was used in this survey. The percentage change is calculated using the local currency in order to eliminate currency movement distortion. 2007 -2008 NUS Consulting Group International Electricity Survey & Cost Comparison April 2008 © +35. 4% +67. 7% +45. 3% +135. 9% +63. 1% +36. 5% +30. 8% +75. 5% +45. 7% +27. 5% +22. 6% +34. 2% +14. 6% +22. 8%

2008 Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 2007 Rank 1 3 2 7 4 6 5 12 10 8 9 11 13 14 Country Italy Germany Austria United Kingdom Netherlands Spain Belgium Sweden Finland France United States Australia Canada South Africa Cost (US¢)/k. Wh One Year Percentage Change 19. 61 17. 95 16. 91 15. 39 15. 29 13. 56 13. 40 10. 73 10. 63 10. 11 9. 44 8. 52 7. 04 3. 41 Five Year Percentage Change +6. 6% +16. 7% +6. 9% +37. 4% +3. 7% +12. 1% +0. 4% +40. 0% +31. 0% +1. 4% +4. 0% +6. 8% -0. 4% +4. 8% The survey is based on prices as of April 1, 2008 for the supply of 1, 000 k. W for an organization with a monthly usage of 450, 000 k. Wh. All prices are in US cents per kilowatt hour and exclude VAT. Where there is more than a single supplier, an unweighted average of available prices was used. Where available in each country and widely used by the consuming public, deregulated or liberalized contract pricing was used in this survey. The percentage change is calculated using the local currency in order to eliminate currency movement distortion. 2007 -2008 NUS Consulting Group International Electricity Survey & Cost Comparison April 2008 © +35. 4% +67. 7% +45. 3% +135. 9% +63. 1% +36. 5% +30. 8% +75. 5% +45. 7% +27. 5% +22. 6% +34. 2% +14. 6% +22. 8%

Price increases • To achieve minimum financial ratios, we estimated that Eskom would have needed a minimum average nominal price increase of about 31% per annum over the Multi. Year Price Determination (MYPD 2) period (2010/11 to 2012/13). • However, Nersa awarded 24. 8%, 25. 8% and 25. 9% in 2010/11, 2011/12 and 2012/13. • All things being equal, we believe that this will push Eskom into net losses, and a dangerous zone in its cash flow.

Price increases • To achieve minimum financial ratios, we estimated that Eskom would have needed a minimum average nominal price increase of about 31% per annum over the Multi. Year Price Determination (MYPD 2) period (2010/11 to 2012/13). • However, Nersa awarded 24. 8%, 25. 8% and 25. 9% in 2010/11, 2011/12 and 2012/13. • All things being equal, we believe that this will push Eskom into net losses, and a dangerous zone in its cash flow.

What will consumers pay? • • • The smelters have separate agreements that are not regulated, and so they are not affected by the Nersa decision. Some industries are supplied directly by Eskom, and they will pay the full increase. Other industries are supplied by municipalities. Nersa ruled that municipalities are allowed to increase their electricity prices by only about 15% to 16% each year. While industries supplied directly by Eskom face a higher increase, they will be paying about half the price of municipality-supplied businesses – an average of about 42 c per kilowatt hour versus about 91 c to 96 c per kilowatt hour. For most industries, this should not have a major impact on costs, although it will hopefully spur energy saving behaviour. However, the energy intensive industries will be hard hit and will require adjustment support.

What will consumers pay? • • • The smelters have separate agreements that are not regulated, and so they are not affected by the Nersa decision. Some industries are supplied directly by Eskom, and they will pay the full increase. Other industries are supplied by municipalities. Nersa ruled that municipalities are allowed to increase their electricity prices by only about 15% to 16% each year. While industries supplied directly by Eskom face a higher increase, they will be paying about half the price of municipality-supplied businesses – an average of about 42 c per kilowatt hour versus about 91 c to 96 c per kilowatt hour. For most industries, this should not have a major impact on costs, although it will hopefully spur energy saving behaviour. However, the energy intensive industries will be hard hit and will require adjustment support.

The impact on employment will depend on: – The extent of energy cuts ultimately required; – The relative pattern of initial sector impacts; – Linkages between firms and sectors, which will determine knock-on effects; – Mitigating strategies and the responses to them; – Coping strategies of firms and sectors; – Macroeconomic impacts, on exchange and interest rates, investment plans, etc.

The impact on employment will depend on: – The extent of energy cuts ultimately required; – The relative pattern of initial sector impacts; – Linkages between firms and sectors, which will determine knock-on effects; – Mitigating strategies and the responses to them; – Coping strategies of firms and sectors; – Macroeconomic impacts, on exchange and interest rates, investment plans, etc.

Economic impact • The potential economic impact of a once-off price rise of 35% could include: – CPI rises by 1. 2% more than it would otherwise. Half the inflationary impact stems from the direct impact on electricity costs for consumers, and half from the indirect knock-on effects on the cost of other goods in the CPI. – The PPI would rise by 1. 3 % more than it would otherwise, and this would raise the cost of a representative basket of SA exports by 0. 9%. – The impact on GDP would be very small, approximately -0. 1%.

Economic impact • The potential economic impact of a once-off price rise of 35% could include: – CPI rises by 1. 2% more than it would otherwise. Half the inflationary impact stems from the direct impact on electricity costs for consumers, and half from the indirect knock-on effects on the cost of other goods in the CPI. – The PPI would rise by 1. 3 % more than it would otherwise, and this would raise the cost of a representative basket of SA exports by 0. 9%. – The impact on GDP would be very small, approximately -0. 1%.

Impact on employment and the poor – 3 main impacts to consider: • the direct cost to poor households • the passing on of higher prices by firms for goods that poor households buy • the impact on employment – Low income households are disproportionately affected. The CPI for poor households rises by 1. 6%, as opposed to 1. 1% for rich households. – Even if poor households received free electricity, their costs would rise by 0. 7% as a result of the indirect effects of the 35% electricity price increase. – The impact on employment depends on how companies respond. We estimate that total employment might fall by between 0. 24% and 0. 60%. This amounts to about 25, 000 to 50, 000 jobs, mostly expected to be lost by lower skill workers.

Impact on employment and the poor – 3 main impacts to consider: • the direct cost to poor households • the passing on of higher prices by firms for goods that poor households buy • the impact on employment – Low income households are disproportionately affected. The CPI for poor households rises by 1. 6%, as opposed to 1. 1% for rich households. – Even if poor households received free electricity, their costs would rise by 0. 7% as a result of the indirect effects of the 35% electricity price increase. – The impact on employment depends on how companies respond. We estimate that total employment might fall by between 0. 24% and 0. 60%. This amounts to about 25, 000 to 50, 000 jobs, mostly expected to be lost by lower skill workers.

The pace of price adjustment matters • a 27% price increase could cause electricity consumption to fall by 5% • …. . whereas the 72% price increase would be required to reduce consumption by 10%. • This assumes that price is the only consideration, and that there are no incentives. • This shows how difficult it can be to rapidly reduce consumption past the first phase of ‘low hanging fruit’.

The pace of price adjustment matters • a 27% price increase could cause electricity consumption to fall by 5% • …. . whereas the 72% price increase would be required to reduce consumption by 10%. • This assumes that price is the only consideration, and that there are no incentives. • This shows how difficult it can be to rapidly reduce consumption past the first phase of ‘low hanging fruit’.

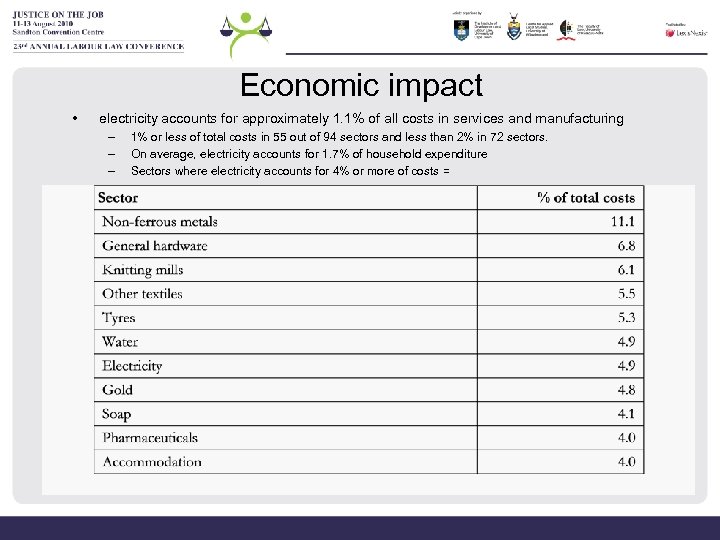

Economic impact • electricity accounts for approximately 1. 1% of all costs in services and manufacturing – – – 1% or less of total costs in 55 out of 94 sectors and less than 2% in 72 sectors. On average, electricity accounts for 1. 7% of household expenditure Sectors where electricity accounts for 4% or more of costs =

Economic impact • electricity accounts for approximately 1. 1% of all costs in services and manufacturing – – – 1% or less of total costs in 55 out of 94 sectors and less than 2% in 72 sectors. On average, electricity accounts for 1. 7% of household expenditure Sectors where electricity accounts for 4% or more of costs =

Security of supply • For employment, it seems that the biggest impacts are contained if: • Price increases are not so large that firms are truly unable to adjust – otherwise they are forced to cut back on operations, and potentially new investment. As long as the increases are within a range, the impacts are relatively small • A small number of (albeit important) industries are disproportionately affected and need support – such mining or accommodation. • The power is reliable. • Power is “off” or “on”. When it is off, operations shut down. Unreliability, like rolling blackouts, are extremely pernicious. • Some predict that ‘load shedding’ will continue to 2013, with about 40 to 50 days lost per year (vs about 55 in 2008) – depends largely on ability to implement energy efficiency programmes. Investec estimates load shedding could cut 0. 5% off GDP growth annually

Security of supply • For employment, it seems that the biggest impacts are contained if: • Price increases are not so large that firms are truly unable to adjust – otherwise they are forced to cut back on operations, and potentially new investment. As long as the increases are within a range, the impacts are relatively small • A small number of (albeit important) industries are disproportionately affected and need support – such mining or accommodation. • The power is reliable. • Power is “off” or “on”. When it is off, operations shut down. Unreliability, like rolling blackouts, are extremely pernicious. • Some predict that ‘load shedding’ will continue to 2013, with about 40 to 50 days lost per year (vs about 55 in 2008) – depends largely on ability to implement energy efficiency programmes. Investec estimates load shedding could cut 0. 5% off GDP growth annually

Support for adjustment is urgent • ‘demand side management’ incentives should be aligned to existing industrial cash and tax incentives available to firms and consumers for physical and process innovations. – The dti has introduced the Developmental Electricity Pricing Programme (DEPP) to attract new investments that would benefit from a discounted electricity price. – There are existing programmes that could be altered slightly to have an important impact on the energy efficiency. Examples of these programmes include: • the accelerated depreciation allowances on manufacturing equipment, mining, bio-waste and small-medium enterprises. • the dti’s Small, Medium Enterprise Development Programme (SMEDP) subsidises the capital investment of new and expanding firms in a range of sectors. • The dti’s Critical Infrastructure Programme (CIP) is a non-refundable, cash grant that is available to the approved beneficiary upon the completion of an infrastructure project that can be shown to underpin a group of further investments in a location. – New programmes would be needed for services such as accommodation, property and retail • Such adjustments could potentially halve the economic impact, and also put SA on a lower energy usage path

Support for adjustment is urgent • ‘demand side management’ incentives should be aligned to existing industrial cash and tax incentives available to firms and consumers for physical and process innovations. – The dti has introduced the Developmental Electricity Pricing Programme (DEPP) to attract new investments that would benefit from a discounted electricity price. – There are existing programmes that could be altered slightly to have an important impact on the energy efficiency. Examples of these programmes include: • the accelerated depreciation allowances on manufacturing equipment, mining, bio-waste and small-medium enterprises. • the dti’s Small, Medium Enterprise Development Programme (SMEDP) subsidises the capital investment of new and expanding firms in a range of sectors. • The dti’s Critical Infrastructure Programme (CIP) is a non-refundable, cash grant that is available to the approved beneficiary upon the completion of an infrastructure project that can be shown to underpin a group of further investments in a location. – New programmes would be needed for services such as accommodation, property and retail • Such adjustments could potentially halve the economic impact, and also put SA on a lower energy usage path

Other impacts on poor households municipal finances • Nersa ruled that municipalities should only increase their prices by about 15% pa. The aim was to contain overcharging by municipalities, since only a portion of their delivery costs are generated by the Eskom price, and the other portion by transmission, maintenance and other services whose costs are not rising as quickly. • Municipalities could submit motivation for exception where they could show that they had not passed on the full electricity price increase in previous years. • Some municipalities have complained that the 15% ruling will require them to cross-subsidise electricity provision, and they will have to pull resources out of other delivery areas. • However, there is also another related concern, in that many municipalities have severe cash flow challenges, where consumers pay late or not at all. It is possible that some municipalities raise the price higher than what it costs to provide electricity to cover this cash flow challenge.

Other impacts on poor households municipal finances • Nersa ruled that municipalities should only increase their prices by about 15% pa. The aim was to contain overcharging by municipalities, since only a portion of their delivery costs are generated by the Eskom price, and the other portion by transmission, maintenance and other services whose costs are not rising as quickly. • Municipalities could submit motivation for exception where they could show that they had not passed on the full electricity price increase in previous years. • Some municipalities have complained that the 15% ruling will require them to cross-subsidise electricity provision, and they will have to pull resources out of other delivery areas. • However, there is also another related concern, in that many municipalities have severe cash flow challenges, where consumers pay late or not at all. It is possible that some municipalities raise the price higher than what it costs to provide electricity to cover this cash flow challenge.

Concluding points…. • There has been considerable focus of discussion on electricity prices, partly due to annual public hearings and price rulings by the regulator • The main concern viz electricity’s impact on employment and poverty include: – The price should increase in a manner that is realistic in respect of the pace of adjustment – Regularity of supply is the most important issue. • The price should be kept so low that Eskom is forced to compromise electricity supply • The price should be high enough that consumers cut back • Government needs to more urgently support rapid adjustment of firms especially, and also households • New investment is urgent, and the cost of that investment should be kept low – Poor households are affected by the price they pay for electricity, but also they pay higher prices as firms pass on electricity price increases. The poor are disproportionately affected by consumer goods inflation. – Municipalities should not rely on electricity tariffs for cross-subsidy to other expenditure

Concluding points…. • There has been considerable focus of discussion on electricity prices, partly due to annual public hearings and price rulings by the regulator • The main concern viz electricity’s impact on employment and poverty include: – The price should increase in a manner that is realistic in respect of the pace of adjustment – Regularity of supply is the most important issue. • The price should be kept so low that Eskom is forced to compromise electricity supply • The price should be high enough that consumers cut back • Government needs to more urgently support rapid adjustment of firms especially, and also households • New investment is urgent, and the cost of that investment should be kept low – Poor households are affected by the price they pay for electricity, but also they pay higher prices as firms pass on electricity price increases. The poor are disproportionately affected by consumer goods inflation. – Municipalities should not rely on electricity tariffs for cross-subsidy to other expenditure