c10a9183418eb836b76b19ccb222de1e.ppt

- Количество слайдов: 17

THE EMPLOYED INDIVIDUALS WITH DISABILITIES (EID) PROGRAM n Medical Assistance for Workers with Disabilities Michael Dalto, Work Incentives Project Director Maryland Department of Disabilities 1

Employed Individuals with Disabilities (EID) Also known as the Medicaid Buy-In, EID is a work incentive that provides Medicaid, for a limited premium, to people who: n n n Meet Social Security’s disability criteria after reaching age 18 Are U. S. citizens or qualified aliens aged 18 – 64 Are working for pay Meet income limits Meet resource limits 2

Employed Individuals with Disabilities (EID) Disability n You may be eligible for EID if you: n n n Currently receive SSDI Formerly received SSDI or SSI as an adult and lost the benefit for reasons other than medical improvement (i. e. , earnings, other income or resources) Meet Social Security’s medical disability standard, but are not eligible for SSDI or SSI due to non-disability criteria. 3

Employed Individuals with Disabilities (EID) Countable Income n “Countable” income must be below 300% of federal poverty level (FPL) n n $32, 670/yr. ($2, 722/mo. ) for an individual (in 2011) $44, 130/yr. ($3, 677/mo. ) for a married couple (in 2011) 4

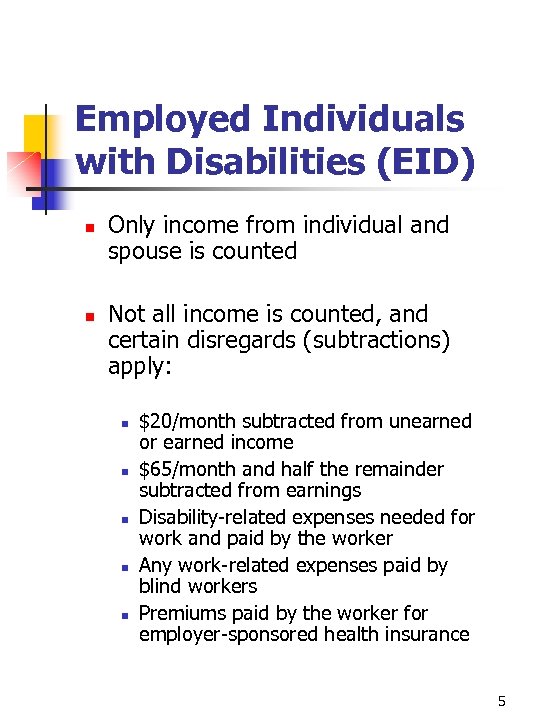

Employed Individuals with Disabilities (EID) n n Only income from individual and spouse is counted Not all income is counted, and certain disregards (subtractions) apply: n n n $20/month subtracted from unearned or earned income $65/month and half the remainder subtracted from earnings Disability-related expenses needed for work and paid by the worker Any work-related expenses paid by blind workers Premiums paid by the worker for employer-sponsored health insurance 5

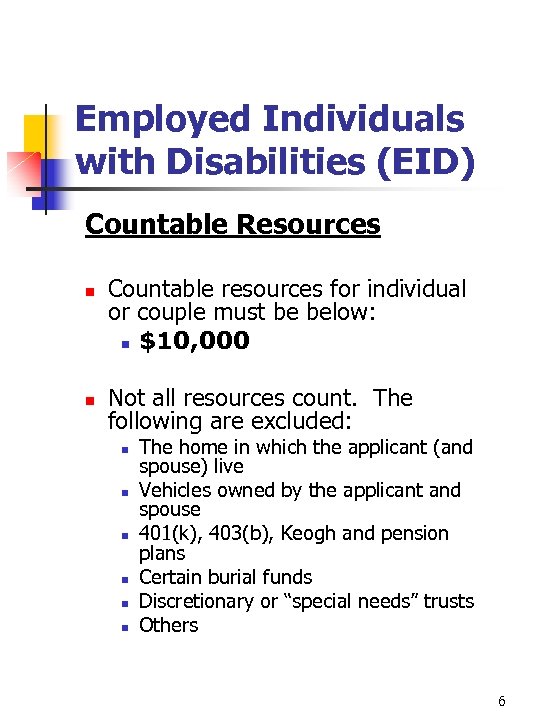

Employed Individuals with Disabilities (EID) Countable Resources n n Countable resources for individual or couple must be below: n $10, 000 Not all resources count. The following are excluded: n n n The home in which the applicant (and spouse) live Vehicles owned by the applicant and spouse 401(k), 403(b), Keogh and pension plans Certain burial funds Discretionary or “special needs” trusts Others 6

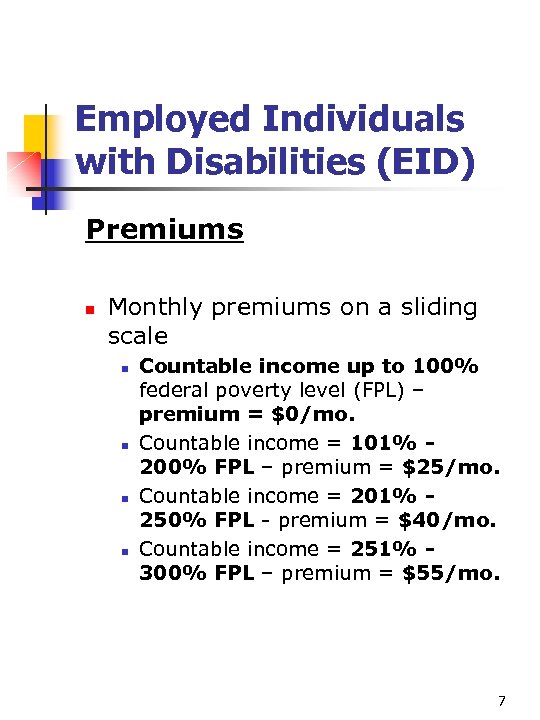

Employed Individuals with Disabilities (EID) Premiums n Monthly premiums on a sliding scale n n Countable income up to 100% federal poverty level (FPL) – premium = $0/mo. Countable income = 101% 200% FPL – premium = $25/mo. Countable income = 201% 250% FPL - premium = $40/mo. Countable income = 251% 300% FPL – premium = $55/mo. 7

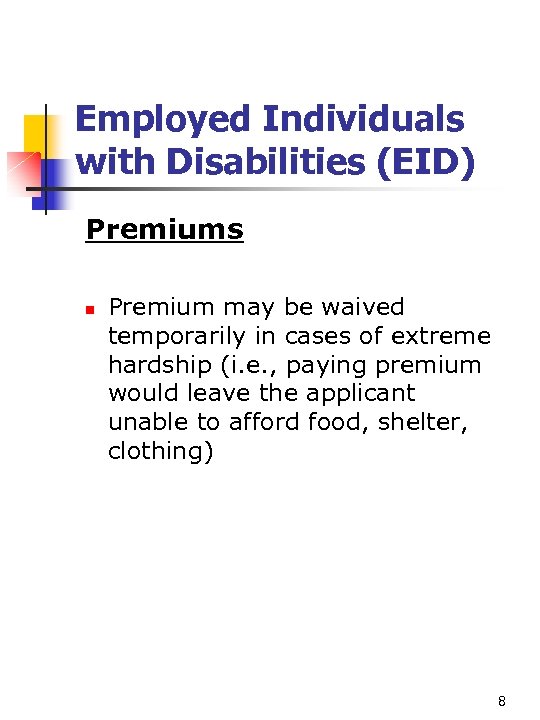

Employed Individuals with Disabilities (EID) Premiums n Premium may be waived temporarily in cases of extreme hardship (i. e. , paying premium would leave the applicant unable to afford food, shelter, clothing) 8

Employed Individuals with Disabilities (EID) Once You’re Enrolled n n If found eligible, Medicaid is retroactive to the 1 st day of the month the application is received EID provides “fee for service” Medicaid – don’t join a managed care organization 9

Employed Individuals with Disabilities (EID) n n Provides full coverage for people with no other insurance; “wrap-around” (supplemental) coverage for those with private insurance or Medicare If private insurance denies a service, Medical Assistance may cover it 10

Employed Individuals with Disabilities (EID) n n Medical Assistance covers premiums, deductibles and coinsurance for Medicare. May save individual up to thousands of dollars per year. EID Medical Assistance a good alternative for people enrolled in Qualified Medicare Beneficiary (QMB) or Specified Low Income Medicare Beneficiary (SLMB). EID has higher income and resource limits and covers some items Medicare, QMB and SLMB don’t. 11

Employed Individuals with Disabilities (EID) HOW TO APPLY n n Contact the EID Outreach Program at: n 443 -514 -5034 n 1 -800 -637 -4113 n eid@mdod. state. md. us A staff member will contact you to list the EID eligibility criteria, answer questions, take your application, and tell you which documents you need to include with your application. 12

Employed Individuals with Disabilities (EID) ELIGIBILITY QUESTIONS n Contact the Division of Eligibility and Waiver Services (DEWS) at 410 -767 -7090. 13

Success Stories Vicki Received Qualified Medicare Beneficiary (QMB), had to limit wages to $60/month n Switched to EID – began to earn $900/month n 14

Success Stories Edward Was “spending down” to get Medical Assistance, which cost him $8, 000 every six months. n Quickly found a job and enrolled in EID. n Saved almost $16, 000 per year. n 15

Success Stories Edward Was “spending down” to get Medical Assistance, which cost him $8, 000 every six months. n Quickly found a job and enrolled in EID. n Saved almost $16, 000 per year. n 16

Success Stories Kim Enrolled in EID and saved over $1, 000 a month on Medicare premiums, deductibles and coinsurance. n With savings, he and his wife were able to buy a house. n 17

c10a9183418eb836b76b19ccb222de1e.ppt