8ec0fcade5bb7b8facc9f51085b4e97c.ppt

- Количество слайдов: 27

The emerging carbon market an introduction Presentation to the PCF/WBI Training Integrating Carbon Finance in Bank’s Work November 19, 2001 Franck Lecocq – DECRG / PCFplus Research

Early carbon market 1996 -2001 2

Greenhouse gases emission reductions an unusual commodity Emission Reductions = Hypothetical baseline emissions - Effective emissions • Different “qualities” of ERs depending on the credibility of the baseline scenario • Players are interested in different “brands” depending on their objectives 3

Carbon prices in past transactions 4

Sellers • Key motivations: – Gain additional revenue – Strategic positioning to take advantage of future demand for ERs (e. g. Costa-Rica) • However, at prices much below $3/t. CO 2 e, carbon finance has too small an impact on projects’ IRRs (except maybe for some forestry activities). 5

Motivations of buyers Governments Firms (large utilities, energy cies, etc. ) Individuals • Regulations in place • Expect regulations on GHG emissions in the future – Hedge against future costs – Influence future regulation – Learning – Strategic positioning • “Green” factor – Hedge against risk of appearing bad – Differentiating products 6

Quantities in past transactions • Partial information available. • Within OECD and EITs: 40 -60 Mt. CO 2 e have been transacted. • In developing countries: Less activity but growing. Mostly government funded, but private activity growing. • General trend towards sophistication: buyers clubs (PCF), traders, financial derivatives (options), integrated marketplaces, etc. 7

How may the market look like in coming years? 8

Emerging market drivers 1. Regulations constraining GHG emissions are being developed: – National policies (e. g. UK, The Netherlands) – Subnational regulations (e. g. some US States) – Regional initiatives (EU-wide trading) 2. Firms are increasingly taking action, in particular voluntary emission commitments 3. Parallel markets are emerging: e. g. carbon neutral certification. 9

Current or projected national policies Trading? EU UK France Norway Germany Denmark Sweden Netherlands Finland Ireland Australia USA Canada Japan New Zealand Russia Yes No Yes Ongoing work Yes Yes Ongoing work Yes No Start-up 2005 2001 2003? 2005 or earlier 2001 2005 or later US dependent ? US dependent Not decided Project-based mechanism? At least from 2008 Yes Yes Later Yes Yes Ongoing work Yes Yes Yes 10

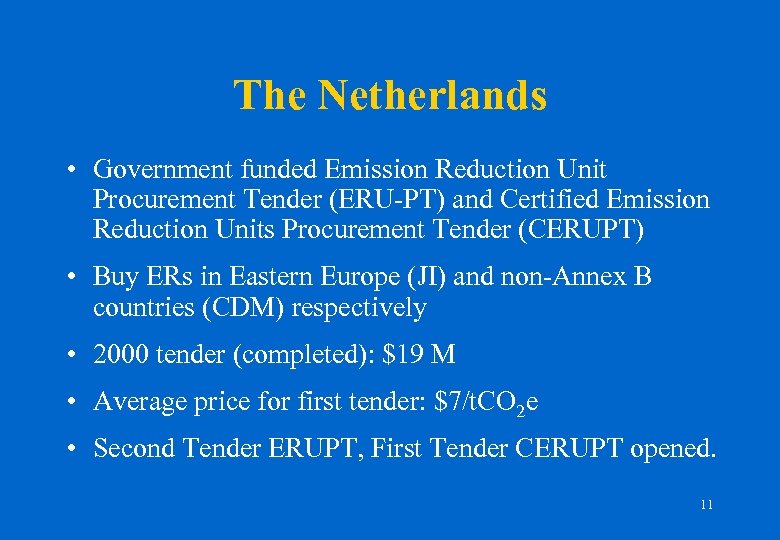

The Netherlands • Government funded Emission Reduction Unit Procurement Tender (ERU-PT) and Certified Emission Reduction Units Procurement Tender (CERUPT) • Buy ERs in Eastern Europe (JI) and non-Annex B countries (CDM) respectively • 2000 tender (completed): $19 M • Average price for first tender: $7/t. CO 2 e • Second Tender ERUPT, First Tender CERUPT opened. 11

United Kingdom • Climate Change Levy (April 2001) – Tax on energy use – Rebates in exchange for voluntary commitments – Benefits recycled in other corporate tax rebates • Emission Trading (end of 2001) – On a voluntary basis for a limited range of companies – Projects outside UK are considered for 2002. 12

Regional regulations US/Canada • Oregon: CO 2 emissions standard for new energy utilities. Price cap: $0. 57/t. Co 2. Utilities can offset emissions using project based mechanisms. • Washington: New plants must demonstrate the use of best available techniques for CO 2 emissions control. • Massachusetts: CO 2 emissions cap for energy utilities effective in 2005. Utilities can offset excess emissions using project-based mechanisms. • New-England + Eastern Canadian Provinces: -20% in 2020 compared to 1990. 13

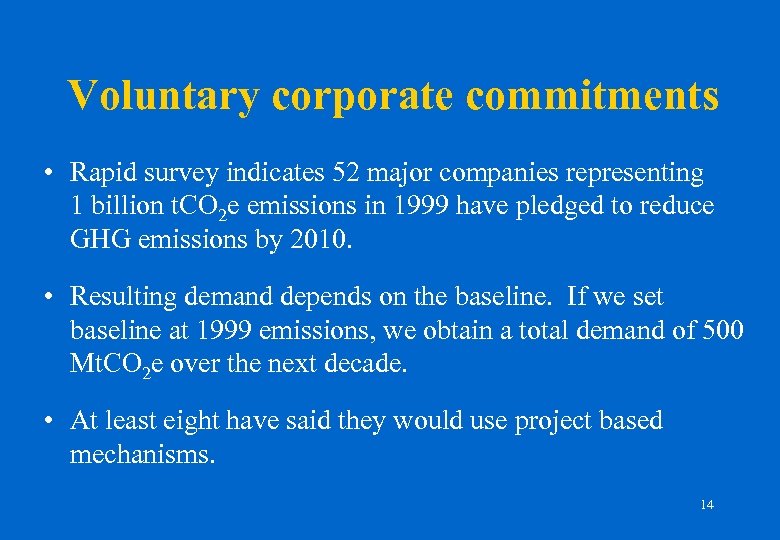

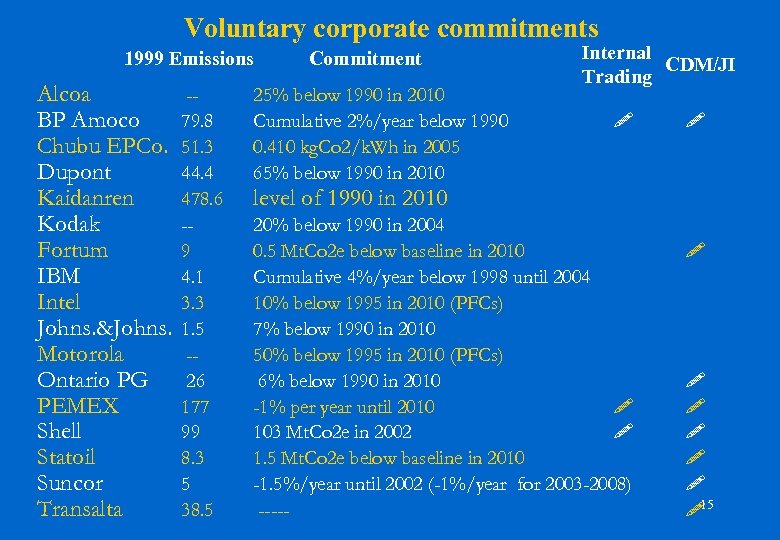

Voluntary corporate commitments • Rapid survey indicates 52 major companies representing 1 billion t. CO 2 e emissions in 1999 have pledged to reduce GHG emissions by 2010. • Resulting demand depends on the baseline. If we set baseline at 1999 emissions, we obtain a total demand of 500 Mt. CO 2 e over the next decade. • At least eight have said they would use project based mechanisms. 14

Voluntary corporate commitments 1999 Emissions Alcoa BP Amoco Chubu EPCo. Dupont Kaidanren Kodak Fortum IBM Intel Johns. &Johns. Motorola Ontario PG PEMEX Shell Statoil Suncor Transalta -79. 8 51. 3 44. 4 478. 6 -9 4. 1 3. 3 1. 5 -26 177 99 8. 3 5 38. 5 Commitment 25% below 1990 in 2010 Cumulative 2%/year below 1990 0. 410 kg. Co 2/k. Wh in 2005 65% below 1990 in 2010 Internal CDM/JI Trading level of 1990 in 2010 20% below 1990 in 2004 0. 5 Mt. Co 2 e below baseline in 2010 Cumulative 4%/year below 1998 until 2004 10% below 1995 in 2010 (PFCs) 7% below 1990 in 2010 50% below 1995 in 2010 (PFCs) 6% below 1990 in 2010 -1% per year until 2010 103 Mt. Co 2 e in 2002 1. 5 Mt. Co 2 e below baseline in 2010 -1. 5%/year until 2002 (-1%/year for 2003 -2008) ----- 15

In addition, Canada and Australia have voluntary ER programs with very good coverage of key emitting sectors. 16

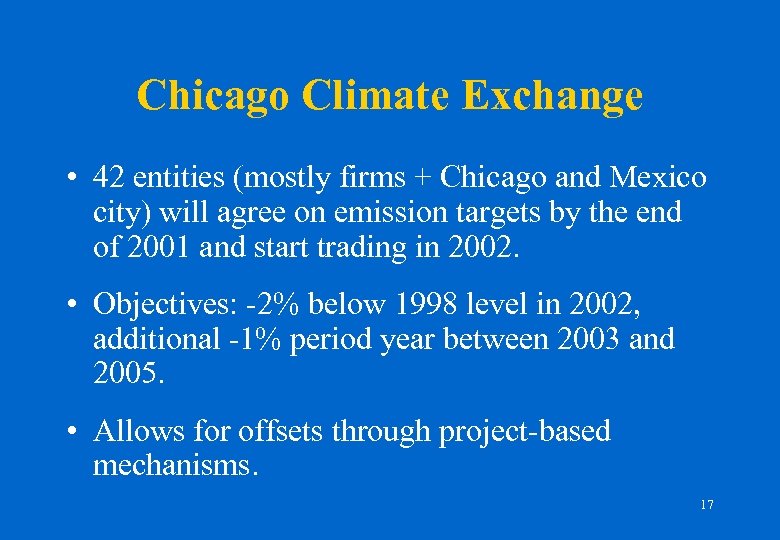

Chicago Climate Exchange • 42 entities (mostly firms + Chicago and Mexico city) will agree on emission targets by the end of 2001 and start trading in 2002. • Objectives: -2% below 1998 level in 2002, additional -1% period year between 2003 and 2005. • Allows for offsets through project-based mechanisms. 17

Emerging carbon funds Prototype Carbon Fund +… • About 5 private sector funds to capture JI/CDM Carbon credits in all investments. • Handful of private equity funds also seeking carbon credit investors to raise IRR in deals. • Major forestry funds thinking about C credits. • New energy private equity and mutual funds might seek C credit deals if demand rises. • Social funds use C as screening indicator. 18

Market for “carbon neutral” products and services • Increasingly, individuals and private or public organizations are looking for credible ways to offset the emissions their activities cause. • Some firms provide this service – Future Forests, 550 ppm or Klima – and buy ERs. • Typically market for third-party verified ERs (but not necessarily Kyoto compatible) 19

Conclusion • The carbon market already exists, and is growing rapidly. • With success in Bonn/Marrakesh, market for Kyoto compatible ERs (CDM, JI) and Emission Quotas (Trading) now likely to grow. • However, demand for non-Kyoto ERs likely to remain strong because of US-based demand, climate neutral business activity and “green” motivation. 20

For more information State and Trends of the Carbon Market – Natsource Summary available at www. prototypecarbonfund. org (PCFplus Research section). Full report available to Bank Staff on demand to PCF. Carbon Market Intelligence Report – Eco. Securities Two reports available at www. prototypecarbonfund. org (PCFplus Research section). Third report expected Febr. 2002. National Strategic Studies Explore ER supply opportunities for some of the Bank’s client countries. Available at http: //www-esd. worldbank. org/cc/. 21

Annex: some insights on future prices and quantities 22

Demand supply with Kyoto Hot Air financial flow to Russia and EE Total Annex B demand for ERs Domestic Carbon Sinks Mitigation within Annex B (domestic or via trading or JI) CDM Market 23

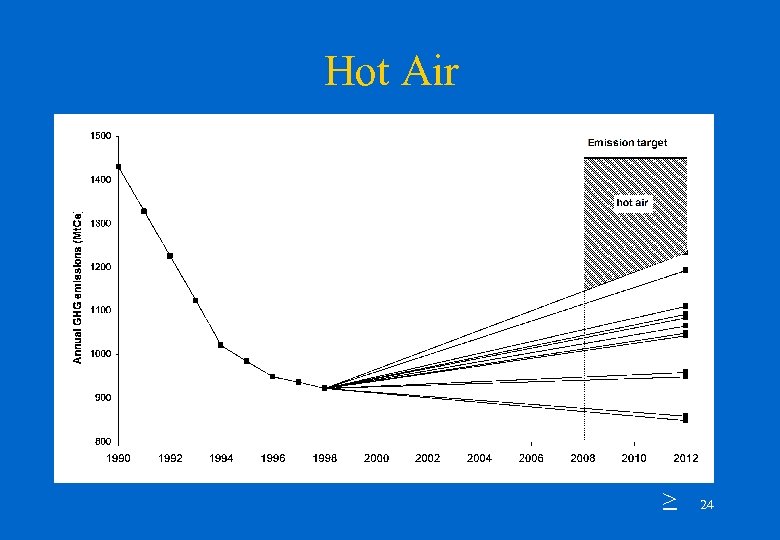

Hot Air > 24

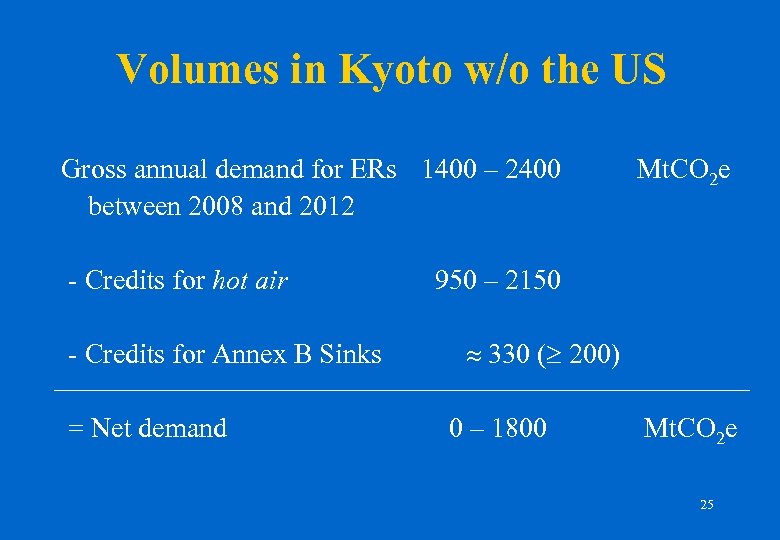

Volumes in Kyoto w/o the US Gross annual demand for ERs 1400 – 2400 between 2008 and 2012 - Credits for hot air - Credits for Annex B Sinks = Net demand Mt. CO 2 e 950 – 2150 » 330 ( 200) 0 – 1800 Mt. CO 2 e 25

Carbon Market Impact • Hot-air and new Annex I sinks allowances depress CDM/JI market – W/o US, up to 100% of OECD needs may be met by hot air + sinks. • Both CDM/JI “project-based” and “hot –air” (emissions trading) markets will be “policy-driven” – Hot air may be cheap but politically unpalatable – CDM/JI project-based more expensive and difficult but high quality and politically acceptable 26

Prices in Post Co. P 6 World • With full competition, our market analysis suggests: – CDM trades from near zero up to $8/t. CO 2 e – Range of $1. 50 -4/t. CO 2 e more likely in our view – PCF currently pays $3 -4/t. CO 2 e • Non-KP Market drivers are significant: OECD domestic regimes and Corporate Voluntary market 27

8ec0fcade5bb7b8facc9f51085b4e97c.ppt