221f5c261bfc820cf2941f7ad4d54333.ppt

- Количество слайдов: 37

The effects of changes in Foreign Currency Exchange rates IAS 21 Presented by: CPA Peter Njuguna +254 722 608 618

The effects of changes in Foreign Currency Exchange rates IAS 21 Presented by: CPA Peter Njuguna +254 722 608 618

Scope n n Accounting for transaction and balances in foreign currencies Translating results and financial position of foreign operations (subsidiary, associate or joint venture under equity method) Translating entity’s results and financial position into presentation currency Excludes derivatives accounted for under IFRSs 9 (IAS 39)

Scope n n Accounting for transaction and balances in foreign currencies Translating results and financial position of foreign operations (subsidiary, associate or joint venture under equity method) Translating entity’s results and financial position into presentation currency Excludes derivatives accounted for under IFRSs 9 (IAS 39)

Objective n n Entity financial statements are sensitive to changes in foreign exchange rates Three factors, which stem from the entity’s underlying business model and business environment 1. Foreign transactions (e. g. , buying or selling in other countries) 2. Foreign operations (e. g. , operating a business in other countries) 3. Presentation currency (e. g. , presenting financial statements in another currency) 3

Objective n n Entity financial statements are sensitive to changes in foreign exchange rates Three factors, which stem from the entity’s underlying business model and business environment 1. Foreign transactions (e. g. , buying or selling in other countries) 2. Foreign operations (e. g. , operating a business in other countries) 3. Presentation currency (e. g. , presenting financial statements in another currency) 3

Transactions and balances n n n Many entities enter into transactions denominated in other currencies as part of their normal day-to-day business activities Any contract that is entered into, which is denominated in another currency and/or requires settlement in another currency, will be affected by changes in exchange rates Examples include foreign purchases and borrowing/lending in another currency

Transactions and balances n n n Many entities enter into transactions denominated in other currencies as part of their normal day-to-day business activities Any contract that is entered into, which is denominated in another currency and/or requires settlement in another currency, will be affected by changes in exchange rates Examples include foreign purchases and borrowing/lending in another currency

Foreign operations n n n Entities may also own businesses that are located in different countries Advantages may include tax incentives, access to raw materials, etc. Foreign operation n An entity that is a subsidiary, associate, joint venture, or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity 5

Foreign operations n n n Entities may also own businesses that are located in different countries Advantages may include tax incentives, access to raw materials, etc. Foreign operation n An entity that is a subsidiary, associate, joint venture, or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity 5

Presentation of financial statements n n An entity may choose to present its financial statements in a foreign currency An entity may do this because it accesses capital markets in another country (multlisted) n need to make the statements more comparable and understandable to local users

Presentation of financial statements n n An entity may choose to present its financial statements in a foreign currency An entity may do this because it accesses capital markets in another country (multlisted) n need to make the statements more comparable and understandable to local users

Recognition of exchange differences n n Any gains/losses produced on translation are recognized in profit or loss in the period they arise Three exceptions • Hedges • Non-monetary items, where IFRSs require all related gains/losses to be recorded, for instance, to OCI n Related foreign exchange gains/losses should also be recorded to OCI • Monetary item which is treated as part of the investment in the foreign operation, is recorded to OCI n Such as a long-term receivable from a foreign operation 7

Recognition of exchange differences n n Any gains/losses produced on translation are recognized in profit or loss in the period they arise Three exceptions • Hedges • Non-monetary items, where IFRSs require all related gains/losses to be recorded, for instance, to OCI n Related foreign exchange gains/losses should also be recorded to OCI • Monetary item which is treated as part of the investment in the foreign operation, is recorded to OCI n Such as a long-term receivable from a foreign operation 7

Foreign Exchange rates n Foreign currencies are traded n “Over-the-counter” (OTC) n Made up of commercial, investment banks and currency bureaus n Exchange rate is the price of one currency against another in the money market

Foreign Exchange rates n Foreign currencies are traded n “Over-the-counter” (OTC) n Made up of commercial, investment banks and currency bureaus n Exchange rate is the price of one currency against another in the money market

Functional and reporting currency n n n Functional currency – currency of the primary economic environment in which the company operates Presentational currency – currency in which the parent company prepares its financial statements Foreign currency – any currency other than the functional currency of the company Local currency – currency of a particular country being referred to Exchange difference – difference resulting from translating a given number of units of one currency into another currency at different exchange rates Functional currency must be established in all cases n Functional currency can only change if operating criteria used in its selection have changed

Functional and reporting currency n n n Functional currency – currency of the primary economic environment in which the company operates Presentational currency – currency in which the parent company prepares its financial statements Foreign currency – any currency other than the functional currency of the company Local currency – currency of a particular country being referred to Exchange difference – difference resulting from translating a given number of units of one currency into another currency at different exchange rates Functional currency must be established in all cases n Functional currency can only change if operating criteria used in its selection have changed

Basics in Foreign Exchange n Foreign exchange deals include n n n Spot transaction – exchange takes place within 2 days of a trade agreement; uses the spot rate Outright forwards – exchange takes place 3 or more days after the date of a trade agreement; uses forward rate FX swap – one currency is exchanged for another on one date and then swapped back at a future date Future – standard agreement to trade currency at a specific price on a specific date Option – the right, but not the obligation, to trade foreign currency in the future

Basics in Foreign Exchange n Foreign exchange deals include n n n Spot transaction – exchange takes place within 2 days of a trade agreement; uses the spot rate Outright forwards – exchange takes place 3 or more days after the date of a trade agreement; uses forward rate FX swap – one currency is exchanged for another on one date and then swapped back at a future date Future – standard agreement to trade currency at a specific price on a specific date Option – the right, but not the obligation, to trade foreign currency in the future

Foreign Currency Transactions n n n Denominated in currency other than the reporting currency of the firm No problems if transactions are denominated in the firm’s domestic currency If transaction is settled immediately, the transaction is recorded at the spot rate

Foreign Currency Transactions n n n Denominated in currency other than the reporting currency of the firm No problems if transactions are denominated in the firm’s domestic currency If transaction is settled immediately, the transaction is recorded at the spot rate

Foreign Currency Transactions n If a transaction is denominated in a foreign currency and settled at a subsequent reporting date, four problems arise involving n Initial recording of the transaction n Recording of foreign currency balances at subsequent reporting dates n Treatment of any foreign exchange gains and losses n Recording of the settlement of foreign currency receivables and payables when they come due

Foreign Currency Transactions n If a transaction is denominated in a foreign currency and settled at a subsequent reporting date, four problems arise involving n Initial recording of the transaction n Recording of foreign currency balances at subsequent reporting dates n Treatment of any foreign exchange gains and losses n Recording of the settlement of foreign currency receivables and payables when they come due

Foreign Currency Transactions n The transaction may have two components n Monetary component – cash received/paid or accounts receivable/payable n Nonmonetary component – equipment or inventory purchased or sold

Foreign Currency Transactions n The transaction may have two components n Monetary component – cash received/paid or accounts receivable/payable n Nonmonetary component – equipment or inventory purchased or sold

Foreign Currency Transactions Example Kenya Roads Ltd purchase a caterpillar on credit from German at a cost of € 123 000. The Functional currency of Kenya Roads is Ksh. n n Equipment and A/P are recorded at the spot rate on the transaction date – Why? Transaction is divided into 2 parts – purchase of equipment and decision to finance through A/P At reporting date, equipment remains at historical cost, A/P changes to reflect new spot rate Any difference between the spot rates is a gain or loss, reflected in the period in which the rate changed

Foreign Currency Transactions Example Kenya Roads Ltd purchase a caterpillar on credit from German at a cost of € 123 000. The Functional currency of Kenya Roads is Ksh. n n Equipment and A/P are recorded at the spot rate on the transaction date – Why? Transaction is divided into 2 parts – purchase of equipment and decision to finance through A/P At reporting date, equipment remains at historical cost, A/P changes to reflect new spot rate Any difference between the spot rates is a gain or loss, reflected in the period in which the rate changed

Basic requirement for transaction and balances n Requirements n Monetary items are recorded at the closing rate n Nonmonetary items should recorded at the historical exchange rate n Nonmonetary items carried at fair value should be recorded at the rate in effect when the fair values were determined

Basic requirement for transaction and balances n Requirements n Monetary items are recorded at the closing rate n Nonmonetary items should recorded at the historical exchange rate n Nonmonetary items carried at fair value should be recorded at the rate in effect when the fair values were determined

Procedure The process 1: Determine functional currency for the reporting entity (this will be used for measurement) 2: Translate items into the functional currency 3: Identify and translate items into the presentation currency (in necessary) 16

Procedure The process 1: Determine functional currency for the reporting entity (this will be used for measurement) 2: Translate items into the functional currency 3: Identify and translate items into the presentation currency (in necessary) 16

Determining functional currency Functional currency is the currency in which cash is generated or expended Factors to consider in making the decision are: • • • Sales Labour and raw materials Financing currency Operating currency Regulatory and competitive environment Additional factors foreign subsidiaries • • Independence Relative volume/size of transactions with parent Cash management Self-sufficiency 17

Determining functional currency Functional currency is the currency in which cash is generated or expended Factors to consider in making the decision are: • • • Sales Labour and raw materials Financing currency Operating currency Regulatory and competitive environment Additional factors foreign subsidiaries • • Independence Relative volume/size of transactions with parent Cash management Self-sufficiency 17

Accounting requirements Initial recognition n Foreign currency transactions are initially recognized in the functional currency Current exchange rate (known as the spot rate) is used in translating the foreign currency amount Average weekly or monthly rate can be used n must be numerous transactions and the exchange rate does not fluctuate significantly Reporting at the ends of subsequent reporting periods n n In many cases, transactions result in balances that remain at the financial statement date Balances are divided into two categories: n monetary n non-monetary 18

Accounting requirements Initial recognition n Foreign currency transactions are initially recognized in the functional currency Current exchange rate (known as the spot rate) is used in translating the foreign currency amount Average weekly or monthly rate can be used n must be numerous transactions and the exchange rate does not fluctuate significantly Reporting at the ends of subsequent reporting periods n n In many cases, transactions result in balances that remain at the financial statement date Balances are divided into two categories: n monetary n non-monetary 18

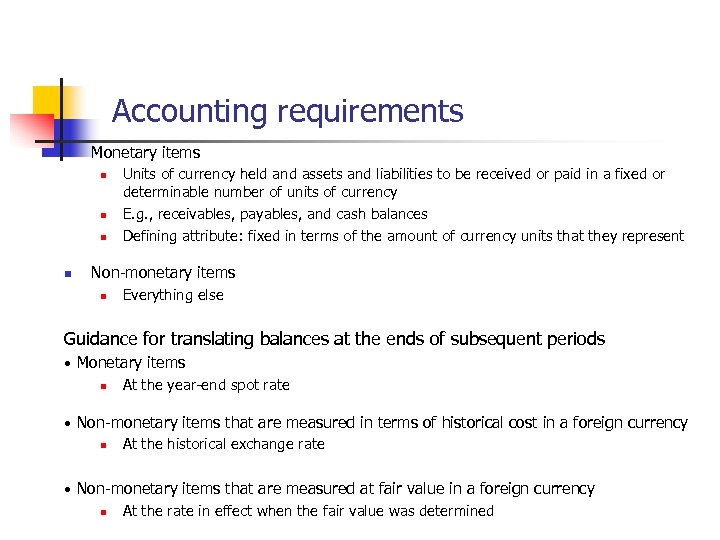

Accounting requirements n Monetary items n n Units of currency held and assets and liabilities to be received or paid in a fixed or determinable number of units of currency E. g. , receivables, payables, and cash balances Defining attribute: fixed in terms of the amount of currency units that they represent Non-monetary items n Everything else Guidance for translating balances at the ends of subsequent periods • Monetary items n At the year-end spot rate • Non-monetary items that are measured in terms of historical cost in a foreign currency n At the historical exchange rate • Non-monetary items that are measured at fair value in a foreign currency n At the rate in effect when the fair value was determined 19

Accounting requirements n Monetary items n n Units of currency held and assets and liabilities to be received or paid in a fixed or determinable number of units of currency E. g. , receivables, payables, and cash balances Defining attribute: fixed in terms of the amount of currency units that they represent Non-monetary items n Everything else Guidance for translating balances at the ends of subsequent periods • Monetary items n At the year-end spot rate • Non-monetary items that are measured in terms of historical cost in a foreign currency n At the historical exchange rate • Non-monetary items that are measured at fair value in a foreign currency n At the rate in effect when the fair value was determined 19

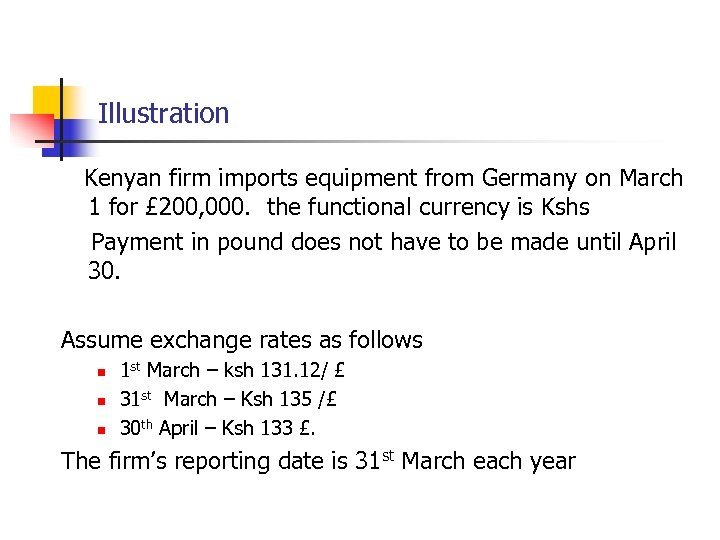

Illustration Kenyan firm imports equipment from Germany on March 1 for £ 200, 000. the functional currency is Kshs Payment in pound does not have to be made until April 30. Assume exchange rates as follows n n n 1 st March – ksh 131. 12/ £ 31 st March – Ksh 135 /£ 30 th April – Ksh 133 £. The firm’s reporting date is 31 st March each year

Illustration Kenyan firm imports equipment from Germany on March 1 for £ 200, 000. the functional currency is Kshs Payment in pound does not have to be made until April 30. Assume exchange rates as follows n n n 1 st March – ksh 131. 12/ £ 31 st March – Ksh 135 /£ 30 th April – Ksh 133 £. The firm’s reporting date is 31 st March each year

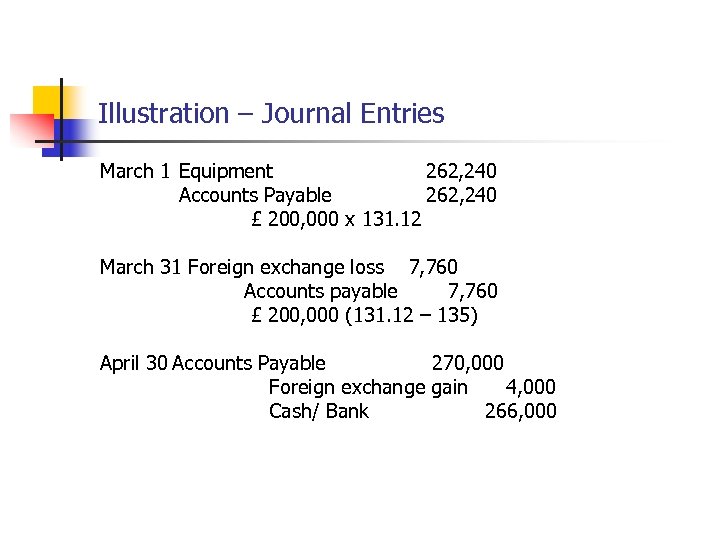

Illustration – Journal Entries March 1 Equipment 262, 240 Accounts Payable 262, 240 £ 200, 000 x 131. 12 March 31 Foreign exchange loss 7, 760 Accounts payable 7, 760 £ 200, 000 (131. 12 – 135) April 30 Accounts Payable 270, 000 Foreign exchange gain 4, 000 Cash/ Bank 266, 000

Illustration – Journal Entries March 1 Equipment 262, 240 Accounts Payable 262, 240 £ 200, 000 x 131. 12 March 31 Foreign exchange loss 7, 760 Accounts payable 7, 760 £ 200, 000 (131. 12 – 135) April 30 Accounts Payable 270, 000 Foreign exchange gain 4, 000 Cash/ Bank 266, 000

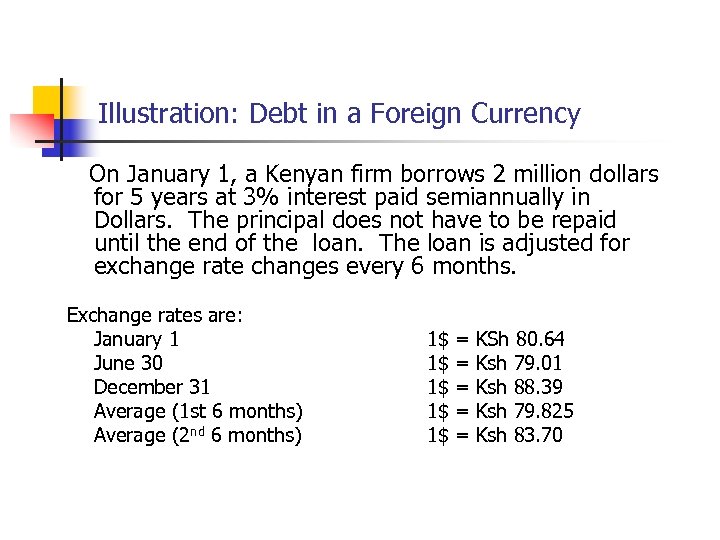

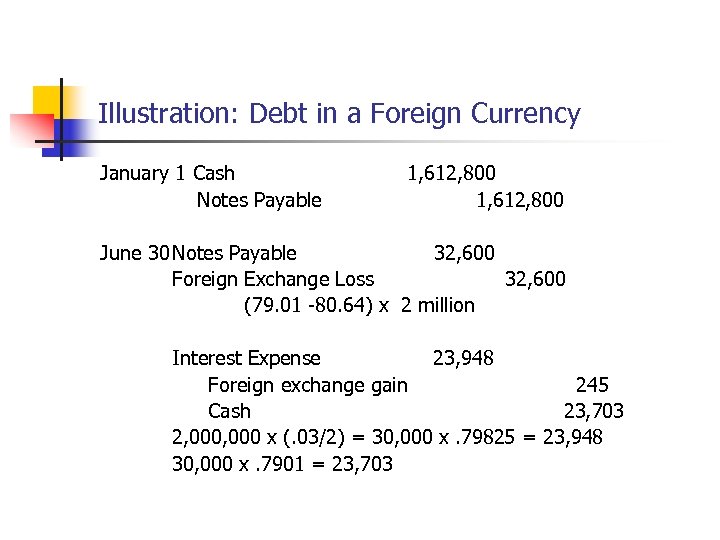

Illustration: Debt in a Foreign Currency On January 1, a Kenyan firm borrows 2 million dollars for 5 years at 3% interest paid semiannually in Dollars. The principal does not have to be repaid until the end of the loan. The loan is adjusted for exchange rate changes every 6 months. Exchange rates are: January 1 June 30 December 31 Average (1 st 6 months) Average (2 nd 6 months) 1$ 1$ 1$ = = = KSh 80. 64 Ksh 79. 01 Ksh 88. 39 Ksh 79. 825 Ksh 83. 70

Illustration: Debt in a Foreign Currency On January 1, a Kenyan firm borrows 2 million dollars for 5 years at 3% interest paid semiannually in Dollars. The principal does not have to be repaid until the end of the loan. The loan is adjusted for exchange rate changes every 6 months. Exchange rates are: January 1 June 30 December 31 Average (1 st 6 months) Average (2 nd 6 months) 1$ 1$ 1$ = = = KSh 80. 64 Ksh 79. 01 Ksh 88. 39 Ksh 79. 825 Ksh 83. 70

Illustration: Debt in a Foreign Currency January 1 Cash Notes Payable 1, 612, 800 June 30 Notes Payable 32, 600 Foreign Exchange Loss 32, 600 (79. 01 -80. 64) x 2 million Interest Expense 23, 948 Foreign exchange gain 245 Cash 23, 703 2, 000 x (. 03/2) = 30, 000 x. 79825 = 23, 948 30, 000 x. 7901 = 23, 703

Illustration: Debt in a Foreign Currency January 1 Cash Notes Payable 1, 612, 800 June 30 Notes Payable 32, 600 Foreign Exchange Loss 32, 600 (79. 01 -80. 64) x 2 million Interest Expense 23, 948 Foreign exchange gain 245 Cash 23, 703 2, 000 x (. 03/2) = 30, 000 x. 79825 = 23, 948 30, 000 x. 7901 = 23, 703

Illustration: Debt in a Foreign Currency Dec. 31 Foreign exchange loss 187, 600 Notes Payable 187, 600 (79. 01 - 88. 39) x 2 million Interest Expense 25, 110 Foreign exchange loss 1, 407 Cash 26, 517 30, 000 x 83. 70 = 25, 110 30, 000 x 88. 39 = 26, 517

Illustration: Debt in a Foreign Currency Dec. 31 Foreign exchange loss 187, 600 Notes Payable 187, 600 (79. 01 - 88. 39) x 2 million Interest Expense 25, 110 Foreign exchange loss 1, 407 Cash 26, 517 30, 000 x 83. 70 = 25, 110 30, 000 x 88. 39 = 26, 517

Translating to Presentation Currency n n Entity chooses to present its statements in a currency other than the functional currency Create the need for additional translation from functional currency to the presentation currency 25

Translating to Presentation Currency n n Entity chooses to present its statements in a currency other than the functional currency Create the need for additional translation from functional currency to the presentation currency 25

Translating to Presentation Currency n n Guidance • Assets and liabilities are recorded at the closing exchange rate • Income and expenses are recorded at the rate in effect when the transactions occurred • Resulting translations gains/losses are recorded through OCI Translation gains and losses n Not recognized in profit or loss because they have little or no effect on present or future cash flows from operations

Translating to Presentation Currency n n Guidance • Assets and liabilities are recorded at the closing exchange rate • Income and expenses are recorded at the rate in effect when the transactions occurred • Resulting translations gains/losses are recorded through OCI Translation gains and losses n Not recognized in profit or loss because they have little or no effect on present or future cash flows from operations

Net investment in foreign operation n Key issues includes Exchange rates at which various accounts are translated from one currency into another Subsequent treatment of gains and losses

Net investment in foreign operation n Key issues includes Exchange rates at which various accounts are translated from one currency into another Subsequent treatment of gains and losses

Foreign operation n n Foreign operation – a subsidiary, associate, joint venture, or branch whose activities are based in a country other than that of the reporting enterprise Different functional currency Cash generated and expended in a foreign currency Does not expose the parent entity to immediate effect of fluctuation in exchange rate. Impact of cash flow significant only in the group context or if the net investment in foreign operations is to be realised

Foreign operation n n Foreign operation – a subsidiary, associate, joint venture, or branch whose activities are based in a country other than that of the reporting enterprise Different functional currency Cash generated and expended in a foreign currency Does not expose the parent entity to immediate effect of fluctuation in exchange rate. Impact of cash flow significant only in the group context or if the net investment in foreign operations is to be realised

Translation of foreign operations n n n All assets and liabilities are translated at the closing exchange rate This include goodwill on consolidation which is expressed in the functional currency of the foreign operation. Income and expenses and other comprehensive income are translated at exchange rates at the date of the transaction Exchange difference recognized to other comprehensive income Net worth is translated at the historical rate

Translation of foreign operations n n n All assets and liabilities are translated at the closing exchange rate This include goodwill on consolidation which is expressed in the functional currency of the foreign operation. Income and expenses and other comprehensive income are translated at exchange rates at the date of the transaction Exchange difference recognized to other comprehensive income Net worth is translated at the historical rate

How Re-measurement Works n n n Overall direction Make all the adjustment to comply with IFRS in the functional currency Example inventory Lower-of-cost or market values of inventory should be calculated first Investment property fair value should be incorporated Revaluation of PPE should be effected

How Re-measurement Works n n n Overall direction Make all the adjustment to comply with IFRS in the functional currency Example inventory Lower-of-cost or market values of inventory should be calculated first Investment property fair value should be incorporated Revaluation of PPE should be effected

Closing rate n n Used when the functional currency is defined as the foreign currency Steps in the current rate method n n n Total assets and liabilities are translated at the current exchange rate Stockholders’ equity accounts are translated at the appropriate historical rate for the period All revenue and expense items are translated at the average exchange rate for the period (rate prevailing when the transaction occurred) Dividends are translated at the exchange rate in effect when they were issued Translation gains and losses are taken through other comprehensive income

Closing rate n n Used when the functional currency is defined as the foreign currency Steps in the current rate method n n n Total assets and liabilities are translated at the current exchange rate Stockholders’ equity accounts are translated at the appropriate historical rate for the period All revenue and expense items are translated at the average exchange rate for the period (rate prevailing when the transaction occurred) Dividends are translated at the exchange rate in effect when they were issued Translation gains and losses are taken through other comprehensive income

n n n Hyperinflationary economy exists All amounts are translated at the closing rates except for comparatives, which shall remain at the prior year’s translation rates When the entity’s functional currency is that of a hyperinflationary economy as per IAS 29

n n n Hyperinflationary economy exists All amounts are translated at the closing rates except for comparatives, which shall remain at the prior year’s translation rates When the entity’s functional currency is that of a hyperinflationary economy as per IAS 29

Disposal or partial disposal of a foreign operation n Upon disposal of the foreign operation n Disposals include n n Any foreign exchange gains/losses previously recorded through OCI will be recorded through profit or loss Portion of exchange gains/losses attributable to the non-controlling interest is derecognized but not through profit or loss Loss of control Loss of significant influence Loss of joint control Partial disposals n Include payment of dividends when the dividend payment is itself a return of investment or includes a return of investment 33

Disposal or partial disposal of a foreign operation n Upon disposal of the foreign operation n Disposals include n n Any foreign exchange gains/losses previously recorded through OCI will be recorded through profit or loss Portion of exchange gains/losses attributable to the non-controlling interest is derecognized but not through profit or loss Loss of control Loss of significant influence Loss of joint control Partial disposals n Include payment of dividends when the dividend payment is itself a return of investment or includes a return of investment 33

Overall consideration n n Acceptable to have a different year end than the reporting entity Year end must be within three months Any significant changes or transactions in the intervening period are adjusted for Goodwill and fair value increments arising from business combinations are treated as assets of the foreign operation

Overall consideration n n Acceptable to have a different year end than the reporting entity Year end must be within three months Any significant changes or transactions in the intervening period are adjusted for Goodwill and fair value increments arising from business combinations are treated as assets of the foreign operation

Elimination of Intercompany Profits n n n Profits must be eliminated upon consolidation, combination, or the equity method Profits are based on the exchange rates at the dates of the sales or transfers Intercompany payables/ receivables n Expose either the parent or foreign operation to an exchange risk n Related gains/losses are recorded through profit or loss n If they are part of the net investment, they are recorded to OCI

Elimination of Intercompany Profits n n n Profits must be eliminated upon consolidation, combination, or the equity method Profits are based on the exchange rates at the dates of the sales or transfers Intercompany payables/ receivables n Expose either the parent or foreign operation to an exchange risk n Related gains/losses are recorded through profit or loss n If they are part of the net investment, they are recorded to OCI

Disclosure n The following should be disclosed • Exchange gains and losses recorded through profit and loss and comprehensive income • Fact that the presentation currency is different from the functional currency, if this is the case • Where there has been a change in functional currency n Additional disclosures are required in certain situations 36

Disclosure n The following should be disclosed • Exchange gains and losses recorded through profit and loss and comprehensive income • Fact that the presentation currency is different from the functional currency, if this is the case • Where there has been a change in functional currency n Additional disclosures are required in certain situations 36

Thank you Interactive session

Thank you Interactive session