6d70ae2dddcc49696386be2002c337d4.ppt

- Количество слайдов: 43

The Economics of Information MB MC

MB MC Introduction n The invisible hand theory assumes that buyers are fully informed. l n People who don’t know what they are buying. Given that consumers are not fully informed, they must employ strategies for gathering information. Consumer report l Amazon. com review l Talk to family and friends l Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 2

MB MC n Example l n How the Middleman Adds Value How should a consumer decide which pair of skis to buy? u Skis R Us has a. . . . Øknowledgeable sales staff Øand a large inventory u They Recommend Salomon X-Scream 9 skis for $600 u The skis can be purchased on the Internet for $400 Question facing the buyer l Is spending $600 on the right skis better than $400 on the wrong ones? Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 3

MB MC n How the Middleman Adds Value How does better information affect economic surplus? l l l Ellis wants to sell a Babe Ruth baseball card. His reservation price is $300. An ad in the local newspaper cost $5. The maximum price in the local market is $400. e. Bay cost is 5% of the Internet auction price. The maximum prices in the e. Bay market is $900 and $800. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 4

MB MC n How the Middleman Adds Value Example l How does better information affect economic surplus? u Notice that winning bidder pay the second price on e. Bay. u Economic surplus: = Price paid - transaction costs - reservation price ØLocal market = $400 - $5 - $300 = $95 Øe. Bay = $800 - $40 - $300 = $460 + $100 = $560 Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 5

MB MC n How the Middleman Adds Value How does better information affect economic surplus? l Economic surplus is increased when a product goes to the person who values it the most. l Sales agents and other middlemen help add economic value. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 6

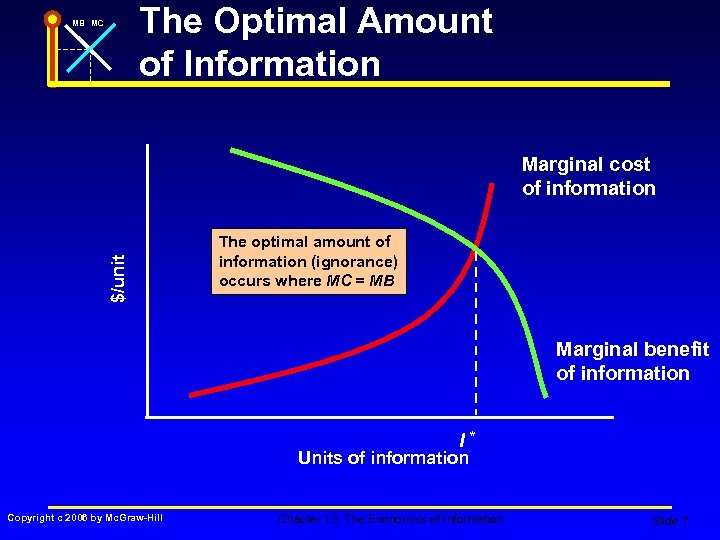

The Optimal Amount of Information MB MC $/unit Marginal cost of information The optimal amount of information (ignorance) occurs where MC = MB Marginal benefit of information I* Units of information Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 7

MB MC n The Free Rider Problem l n The Optimal Amount of Information An incentive problem in which too little of a good or service is produced because nonpayers cannot be excluded from using it Economic Naturalist l l Why is finding a knowledgeable salesclerk often difficult? Why did Rivergate Books, the last bookstore in Lambertville, NJ, recently go out of business? Get advice/preview from salesclerk/bookstore Buy the stuff on line for a cheaper price. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 8

MB MC n The Optimal Amount of Information Two Guidelines for Rational Search Additional search time is more likely to be worthwhile for expensive items than cheap ones l Prices paid may be higher when the cost of a search is higher l n When to search Expensive items l Lower cost in searching l Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 9

MB MC n Example l n The Optimal Amount of Information Should a person living in Paris, TX, spend more or less time searching for an apartment than someone living in Paris, France? Example l Tom and Tim are shopping for a used upright piano. l Tom has a car & Tim does not. l Which one should expect to examine fewer pianos before making a purchase? Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 10

MB MC n The Optimal Amount of Information The Gamble Inherent in Search l When engaging in further search there additional costs and uncertain benefits and, therefore, there is a degree of risk or gamble from the search. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 11

MB MC n The Optimal Amount of Information Determining whether or not to take the gamble: l Compute the expected value of the gamble u The sum of the possible outcomes multiplied by their respective probabilities l Fair Gamble u Coin flip: Heads win $1, Tails lose $1 u Probabilities: 50% for head and 50% for tail. u Expected value = (. 5)($1) + (. 5)(-$1) = 0 Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 12

MB MC n The Optimal Amount of Information Determining whether or not to take the gamble: Better-than-fair-gamble u. Coin flip: Heads win $2, Tails lose $1 u. Expected value = (. 5)($2) + (. 5)(-$1) =. 5 l Risk-neutral person u. Will accept any gamble that is fair or better l Risk-averse person u. Will refuse any fair gamble l Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 13

MB MC n The Optimal Amount of Information Example l Should you search further for an apartment? u. Searching for an apartment in a neighborhood where identical apartments rent fo $400 & $360 u. Of the vacant apartments, 80% rent for $400 and 20% rent for $360 u. You must visit the apartment to get to rental rate u. You are risk neutral. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 14

MB MC n The Optimal Amount of Information Example l Should you search further for an apartment? u The first visit is a $400 apartment. u The opportunity cost of an additional visit is $6. l The expected value of another visit: u Find one $360 apartment: save $40 and pay $6 u Find another $400 apartment: pay $6 u (. 2)($34) + (. 80)(-$6) = $2 u What is your decision given that you are risk neutral? What if you are risk averse? Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 15

MB MC n The Optimal Amount of Information The Commitment Problems When Search is Costly Since searching is costly, you may just take whatever is available for good. But… l What happens when, by chance, a more attractive option comes along after the search has ceased? l When information is costly and the search must be limited, a relationship may stay for a while then may dissolve. l Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 16

MB MC n The Optimal Amount of Information The Commitment Problems When Search is Costly l Commitment agreements u Lease agreements Øbinding the landlords/tenants for a specified period u Employment contracts ØHonor obligations under normal situations u Marriage contracts ØPenalizes whose who abandon their spouses, big wedding etc. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 17

MB MC n The Optimal Amount of Information Marriage contract and Prenup l Searching for a perfect match is costly l In an imperfect match, one side may have disadvantage when the match breaks up. l To induce the disadvantaged party to enter the marriage contract, a break up cost upon the party with advantage is imposed. l If the imposed break up cost is too high for the advantaged party, a prenup is used to lower that cost to induce the advantaged party enter into marriage. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 18

MB MC Asymmetric Information n Asymmetric Information l Situations in which buyers and sellers are not equally well informed about the characteristics of goods and services for sale in the marketplace. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 19

MB MC Asymmetric Information n Example l n Will Jane sell her car to Tom? Assume l Jane wants to sell a 2000 Miata u 70, 000 highway miles u. Complete maintenance u. Excellent condition u. Average price is $8, 000 u. Jane’s reservation price is $10, 000 Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 20

MB MC Asymmetric Information n Tom l Reservation price u$13, 000 if in excellent condition u$9, 000 if not in excellent condition l Will not pay $10, 000 because he cannot tell if Jane’s car is an excellent buy ucannot tell the quality of the car even by a mechanic, so treat Jane’s as average. u. Tom buys an average car at $8, 000 Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 21

MB MC Asymmetric Information n Example l There is a loss in economic surplus u. Assuming Tom had paid Jane $11, 000 l Tom u. Pays $8, 000 and has a gain of $1, 000 ($9, 000 - $8, 000) if he buys the average car Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 22

MB MC Asymmetric Information Tom’s Gain if he buys at $11, 000 u$13, 000 - $11, 000 = $2, 000 (bought from Jane) u Tom’s Loss=$2, 000 - $1, 000 = $1, 000 (compared to paying $8, 000) l Jane’s loss is $1, 000 (=11, 000 -10, 000) l Total loss is $2, 000 ($1, 000 for Jane & $1, 000 for Tom) l n Asymmetric information costs economic surplus Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 23

MB MC Asymmetric Information n The Lemons Model l Asymmetric information tends to reduce the average quality of goods offered for sale. l People who have below average (lemons) cars, are more likely to want to sell them. l Buyers know that below average cars are likely to be on the market and lower their reservation prices. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 24

MB MC Asymmetric Information n The Lemons Model l Because used car prices are low, people with good cars keep them longer. l The average quality of used cars falls even further. l As the average quality of used cars falls, buyers’ reservation price will fall as well. l And so on and so forth. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 25

MB MC Asymmetric Information n Example l Should you buy your aunt’s car? u 4 -year old Accord u. The asking price of $10, 000 is the blue book value. u. You believe the car is in good condition. u. It is a good deal because the blue book value is the equilibrium price for below average cars. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 26

MB MC Asymmetric Information n Example l How much will a naïve buyer pay for a used car? Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 27

MB MC Asymmetric Information n Assume l There are only good cars and lemons. l 10% of all new cars are lemons. l Good used cars are worth $10, 000 and lemons are worth $6, 000. l The used car market is 90% good cars and 10% lemons. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 28

MB MC Asymmetric Information n Example l Calculating the expected value: u(. 90)($10, 000) + (. 10)($6, 000) = $9, 600 u. Reservation price for a risk-neutral buyer l A naïve buyer will pay $9, 600 for a used car. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 29

MB MC Asymmetric Information n Example l Who will sell a used car for what the naïve buyer is willing to pay? u. Would not sell a good car that is worth $10, 000 u. Would sell a lemon that is worth $6, 000 u. Only lemons will be on the market u. Price will fall to $6, 000 Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 30

MB MC Asymmetric Information n If you have a good used car for sale, how can you get a higher price? Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 31

MB MC Asymmetric Information n The Credibility Problem In Trading l People tend to interpret ambiguous information in ways that promote their own interests. l Sellers: overstate the quality of their products for higher price. l Buyers: understate the amount they’re willing to pay to bargain a low price. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 32

MB MC Asymmetric Information n The Costly-to-Fake Principle l To communicate information credibly, a signal must be costly or difficult to fake. l Called “signaling” in game theory l Who wants to fake? l Who can signal? Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 33

MB MC Asymmetric Information n Economic Naturalist: common signals Firms insert the phrase “As advertised on TV” when they advertise their products in magazines and newspapers for million dollars TV ads. u. Signal the ability to earn money back from the profit on the product. l Many companies care a lot about elite educational credentials. u. High grade: signal for high capability l Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 34

MB MC Asymmetric Information n Economic Naturalist l Many clients seem to prefer lawyers who wear expensive suits. Expensive personal items signal the ability to earn money from winning cases. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 35

MB MC Asymmetric Information n Statistical Discrimination l The practice of making judgments about the quality of people, goods, or services based on the characteristics of the groups to which they belong. l Use information on groups (statistics) instead of on individual customer to make pricing decisions. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 36

MB MC Asymmetric Information n Economic Naturalist l Why do males under 25 years of age pay more than other drivers for auto insurance? l The group of males under 25 years old tends to have more accidents than other group. l If you belong to that group, you pay higher premium. l High grades/expensive suits signals which group an individual belongs to. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 37

MB MC Asymmetric Information n Adverse Selection l The pattern in which insurance tends to be purchased disproportionately by those who are most costly for companies to insure l Raises premiums l Reduces the number of low-risk policy holders l Increases Copyright c 2006 by Mc. Graw-Hill the risk level of the insured Chapter 13: The Economics of Information Slide 38

MB MC Asymmetric Information n Adverse Selection l Happens when the insurance contract is sold/signed. l High risk individuals would like to pay higher prices. l Same price looks more attractive to high risk individuals than people with average/low risk l Government enforced insurance policy may lower the premium in the market. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 39

MB MC Asymmetric Information n Moral Hazard l The tendency of people to expend less effort protecting those goods that are insured against theft or damage n Happens after the insurance contract is signed. n Because of insurance, people tend to choose riskier behavior for lower potential loss. Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 40

MB MC Asymmetric Information n Moral Hazard l Deductibles are used to reduce moral hazard and adverse selection. l Benefits from deductibles in the insurance policy u. Lower rates u. Increase the incentive to drive safely u. Reduce the number of claims, which lowers cost and premiums Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 41

MB MC Disappearing Political Discourse n Economic Naturalist l Why do opponents of the death penalty often remain silent? (bad signal) l Why do proponents of legalized drugs remain silent? (bad signal) l Why did it take Richard Nixon – a diehard anti-communist – to reestablish normal diplomatic relations to China – a communist country at then? (no bad signal) Copyright c 2006 by Mc. Graw-Hill Chapter 13: The Economics of Information Slide 42

End of Chapter MB MC

6d70ae2dddcc49696386be2002c337d4.ppt