95e89f9a8a25f746f2cc6e1c9e11cec5.ppt

- Количество слайдов: 28

THE ECONOMIC VALUE OF A PORT CITY Presentation to Maritime Summit Durban 26 October 2011 Trevor Jones University of Kwa. Zulu-Natal

THE ECONOMIC VALUE OF A PORT CITY Presentation to Maritime Summit Durban 26 October 2011 Trevor Jones University of Kwa. Zulu-Natal

Outline & way forward • Context of the discussion – The “economic value” of a port – The Port of Durban in a regional context • The Port of Durban and the Ethekweni economy – Employment impacts – Expenditure impacts • Port users and the trading community – Port costs and productivity/competitiveness – Port capacity and congestion • The future size & shape of the Port of Durban – Capacity expansion & the DIA “dig out” option – Who will pay and how much? – Who will manage/operate and how well?

Outline & way forward • Context of the discussion – The “economic value” of a port – The Port of Durban in a regional context • The Port of Durban and the Ethekweni economy – Employment impacts – Expenditure impacts • Port users and the trading community – Port costs and productivity/competitiveness – Port capacity and congestion • The future size & shape of the Port of Durban – Capacity expansion & the DIA “dig out” option – Who will pay and how much? – Who will manage/operate and how well?

The economic value of a port Value to whom? • Value to the host city/region (e. Thekweni), in terms of jobs, investment opportunities, spending etc • Value to the community of port users, in terms of user costs, time etc. . “The economic function of a port is to lower the generalised cost of through transport” (Goss)

The economic value of a port Value to whom? • Value to the host city/region (e. Thekweni), in terms of jobs, investment opportunities, spending etc • Value to the community of port users, in terms of user costs, time etc. . “The economic function of a port is to lower the generalised cost of through transport” (Goss)

Durban as a regional port • Colossal by African standards (i. t. o infrastructure and traffic base) • Very large by Indian Ocean Rim standards • Very large by southern hemisphere standard • Modest by global standards

Durban as a regional port • Colossal by African standards (i. t. o infrastructure and traffic base) • Very large by Indian Ocean Rim standards • Very large by southern hemisphere standard • Modest by global standards

Durban as the leading southern hemisphere port? • No, i. t. o. aggregate cargo volumes • Not quite, i. t. o. container volumes (teus): #3 behind Jakarta and Santos • Very likely, yes i. t. o. depth & diversity its related port community (cluster) • Emphatically no, i. t. o. productivity & competitive cost to port users

Durban as the leading southern hemisphere port? • No, i. t. o. aggregate cargo volumes • Not quite, i. t. o. container volumes (teus): #3 behind Jakarta and Santos • Very likely, yes i. t. o. depth & diversity its related port community (cluster) • Emphatically no, i. t. o. productivity & competitive cost to port users

Value of Durban port to Ethekwini? • What does handling 70+ million tons of cargo annually do economically for the metropole? • …or handling 2. 6 million teus annually? … not a simple relationship, because. . 1 ton crude oil 1 ton anthracite 1 ton fruit in pallets 1 ton containerised computer components 1 ton bagged rice

Value of Durban port to Ethekwini? • What does handling 70+ million tons of cargo annually do economically for the metropole? • …or handling 2. 6 million teus annually? … not a simple relationship, because. . 1 ton crude oil 1 ton anthracite 1 ton fruit in pallets 1 ton containerised computer components 1 ton bagged rice

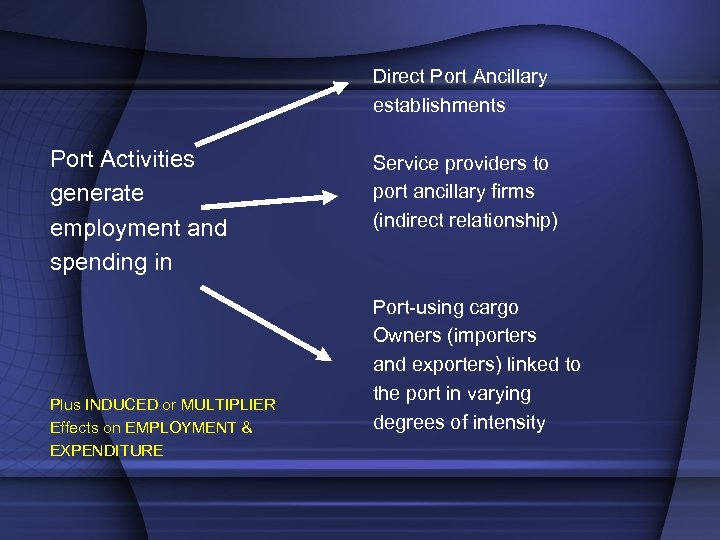

Direct Port Ancillary establishments Port Activities generate employment and spending in Plus INDUCED or MULTIPLIER Effects on EMPLOYMENT & EXPENDITURE Service providers to port ancillary firms (indirect relationship) Port-using cargo Owners (importers and exporters) linked to the port in varying degrees of intensity

Direct Port Ancillary establishments Port Activities generate employment and spending in Plus INDUCED or MULTIPLIER Effects on EMPLOYMENT & EXPENDITURE Service providers to port ancillary firms (indirect relationship) Port-using cargo Owners (importers and exporters) linked to the port in varying degrees of intensity

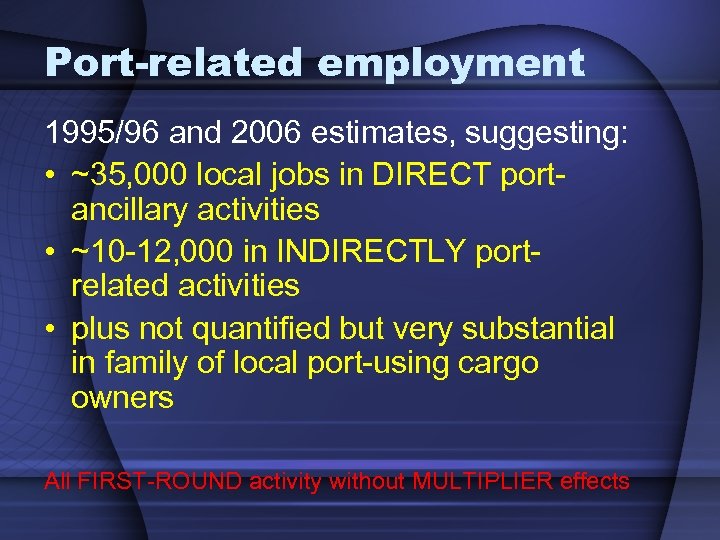

Port-related employment 1995/96 and 2006 estimates, suggesting: • ~35, 000 local jobs in DIRECT portancillary activities • ~10 -12, 000 in INDIRECTLY portrelated activities • plus not quantified but very substantial in family of local port-using cargo owners All FIRST-ROUND activity without MULTIPLIER effects

Port-related employment 1995/96 and 2006 estimates, suggesting: • ~35, 000 local jobs in DIRECT portancillary activities • ~10 -12, 000 in INDIRECTLY portrelated activities • plus not quantified but very substantial in family of local port-using cargo owners All FIRST-ROUND activity without MULTIPLIER effects

Main “suspects” would include: • • • Transnet (TNPA, TPT & TFR) Private Terminal operators Clearing & Forwarding Warehousing, depots, logistics (key area – Durban as a distribution “platform”) Road haulage Ships Agency Stevedores (shrinking) Ship repair (& shipbuilding? ) Security (growing) Ship chandlers, suppliers Bunker industry

Main “suspects” would include: • • • Transnet (TNPA, TPT & TFR) Private Terminal operators Clearing & Forwarding Warehousing, depots, logistics (key area – Durban as a distribution “platform”) Road haulage Ships Agency Stevedores (shrinking) Ship repair (& shipbuilding? ) Security (growing) Ship chandlers, suppliers Bunker industry

Port-related expenditure Main estimated first-round elements are: • ~R 2. 2 billion wages & salaries in portancillary cluster (2010 prices) • ~R 1. 4 billion in local non-wage spending (indirectly port-related), or ~R 3. 6 billion in aggregate first-round portrelated spending in the local economy

Port-related expenditure Main estimated first-round elements are: • ~R 2. 2 billion wages & salaries in portancillary cluster (2010 prices) • ~R 1. 4 billion in local non-wage spending (indirectly port-related), or ~R 3. 6 billion in aggregate first-round portrelated spending in the local economy

INDUCED spending? • Local economy multiplier values of 1. 7 to 1. 9 plausible (Brisbane, Oakland, Durban, etc. . ) • Aggregate annual port-related local expenditure of ~ R 6. 0 to R 6. 9 billion All on a NARROW view of the port without considering cargo owners

INDUCED spending? • Local economy multiplier values of 1. 7 to 1. 9 plausible (Brisbane, Oakland, Durban, etc. . ) • Aggregate annual port-related local expenditure of ~ R 6. 0 to R 6. 9 billion All on a NARROW view of the port without considering cargo owners

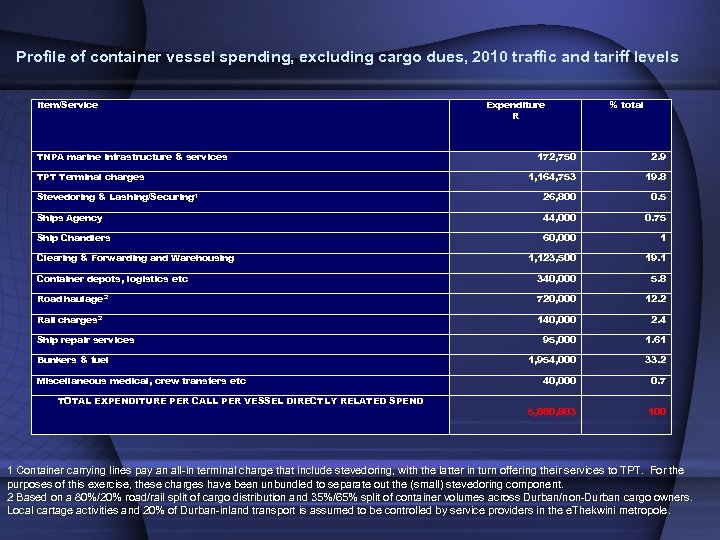

Expenditure impact of gains or losses in port traffic? • • • Consider the spending per call of: 32, 000 grt container vessel Working 1550 boxes* at the DCT, Port time 2 days 500 tons bunker fuel purchased 2010/11 harbour tariffs * 650 full imported boxes, 400 full exports, 250 empties, 250 transhipped

Expenditure impact of gains or losses in port traffic? • • • Consider the spending per call of: 32, 000 grt container vessel Working 1550 boxes* at the DCT, Port time 2 days 500 tons bunker fuel purchased 2010/11 harbour tariffs * 650 full imported boxes, 400 full exports, 250 empties, 250 transhipped

Profile of container vessel spending, excluding cargo dues, 2010 traffic and tariff levels Item/Service TNPA marine infrastructure & services Expenditure R % total 172, 750 2. 9 1, 164, 753 19. 8 Stevedoring & Lashing/Securing 1 26, 800 0. 5 Ships Agency 44, 000 0. 75 Ship Chandlers 60, 000 1 1, 123, 500 19. 1 Container depots, logistics etc 340, 000 5. 8 Road haulage 2 720, 000 12. 2 Rail charges 2 140, 000 2. 4 95, 000 1. 61 1, 954, 000 33. 2 40, 000 0. 7 5, 880, 803 100 TPT Terminal charges Clearing & Forwarding and Warehousing Ship repair services Bunkers & fuel Miscellaneous medical, crew transfers etc TOTAL EXPENDITURE PER CALL PER VESSEL DIRECTLY RELATED SPEND 1 Container carrying lines pay an all-in terminal charge that include stevedoring, with the latter in turn offering their services to TPT. For the purposes of this exercise, these charges have been unbundled to separate out the (small) stevedoring component. 2 Based on a 80%/20% road/rail split of cargo distribution and 35%/65% split of container volumes across Durban/non-Durban cargo owners. Local cartage activities and 20% of Durban-inland transport is assumed to be controlled by service providers in the e. Thekwini metropole.

Profile of container vessel spending, excluding cargo dues, 2010 traffic and tariff levels Item/Service TNPA marine infrastructure & services Expenditure R % total 172, 750 2. 9 1, 164, 753 19. 8 Stevedoring & Lashing/Securing 1 26, 800 0. 5 Ships Agency 44, 000 0. 75 Ship Chandlers 60, 000 1 1, 123, 500 19. 1 Container depots, logistics etc 340, 000 5. 8 Road haulage 2 720, 000 12. 2 Rail charges 2 140, 000 2. 4 95, 000 1. 61 1, 954, 000 33. 2 40, 000 0. 7 5, 880, 803 100 TPT Terminal charges Clearing & Forwarding and Warehousing Ship repair services Bunkers & fuel Miscellaneous medical, crew transfers etc TOTAL EXPENDITURE PER CALL PER VESSEL DIRECTLY RELATED SPEND 1 Container carrying lines pay an all-in terminal charge that include stevedoring, with the latter in turn offering their services to TPT. For the purposes of this exercise, these charges have been unbundled to separate out the (small) stevedoring component. 2 Based on a 80%/20% road/rail split of cargo distribution and 35%/65% split of container volumes across Durban/non-Durban cargo owners. Local cartage activities and 20% of Durban-inland transport is assumed to be controlled by service providers in the e. Thekwini metropole.

Profile of Container Vessel Spending, 2010 Traffic & Tariff levels Miscellaneous medical, crew infrastructure TNPA marine transfers etc, 40, 000 & services, 172, 750 Bunkers & fuel, 1, 954, 000 TNPA cargo dues, 1, 534, 500 TPT Terminal charges, 1, 164, 753 Ship repair services, 95, 000 Rail charges 3, 140, 000 Road haulage 3, 720, 000 Clearing & Forwarding and Warehousing, 1, 123, 500 Stevedoring & Ships Agency, 44, 000 Ship Chandlers, 60, 00026, 800 Lashing/Securing 1, Container depots, logistics etc, 340, 000

Profile of Container Vessel Spending, 2010 Traffic & Tariff levels Miscellaneous medical, crew infrastructure TNPA marine transfers etc, 40, 000 & services, 172, 750 Bunkers & fuel, 1, 954, 000 TNPA cargo dues, 1, 534, 500 TPT Terminal charges, 1, 164, 753 Ship repair services, 95, 000 Rail charges 3, 140, 000 Road haulage 3, 720, 000 Clearing & Forwarding and Warehousing, 1, 123, 500 Stevedoring & Ships Agency, 44, 000 Ship Chandlers, 60, 00026, 800 Lashing/Securing 1, Container depots, logistics etc, 340, 000

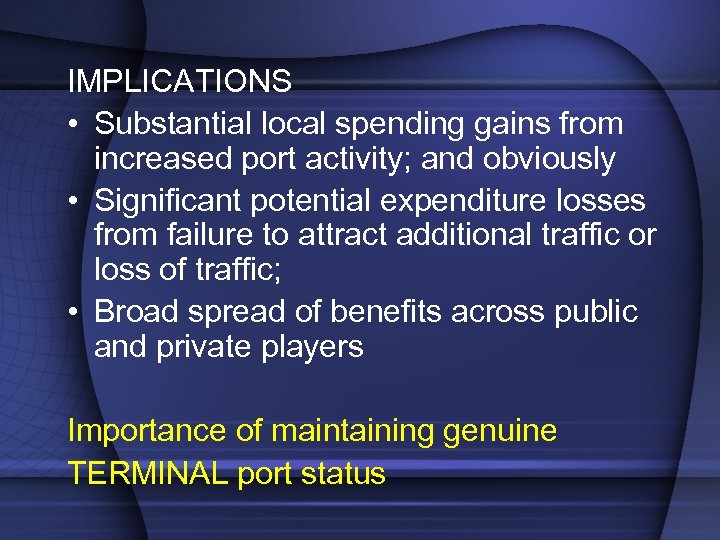

IMPLICATIONS • Substantial local spending gains from increased port activity; and obviously • Significant potential expenditure losses from failure to attract additional traffic or loss of traffic; • Broad spread of benefits across public and private players Importance of maintaining genuine TERMINAL port status

IMPLICATIONS • Substantial local spending gains from increased port activity; and obviously • Significant potential expenditure losses from failure to attract additional traffic or loss of traffic; • Broad spread of benefits across public and private players Importance of maintaining genuine TERMINAL port status

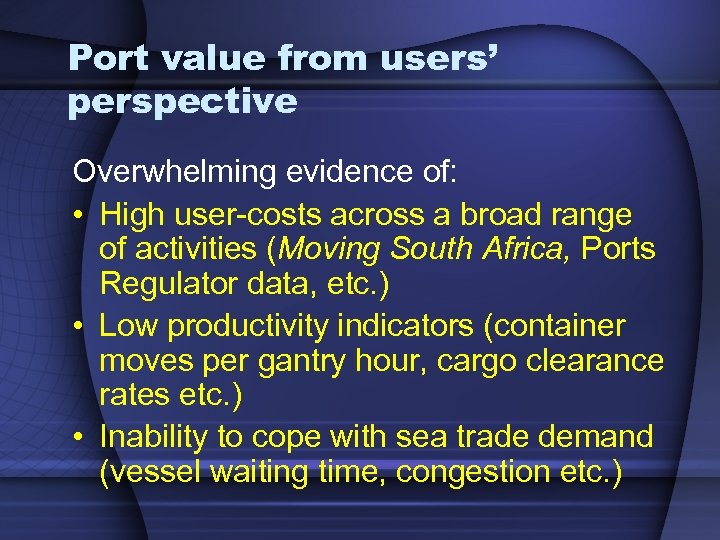

Port value from users’ perspective Overwhelming evidence of: • High user-costs across a broad range of activities (Moving South Africa, Ports Regulator data, etc. ) • Low productivity indicators (container moves per gantry hour, cargo clearance rates etc. ) • Inability to cope with sea trade demand (vessel waiting time, congestion etc. )

Port value from users’ perspective Overwhelming evidence of: • High user-costs across a broad range of activities (Moving South Africa, Ports Regulator data, etc. ) • Low productivity indicators (container moves per gantry hour, cargo clearance rates etc. ) • Inability to cope with sea trade demand (vessel waiting time, congestion etc. )

Comparative port authority costs – Durban, Rotterdam, Sydney, Melbourne Vessel: Type: Tonnage: Draught: Time in port: Cargo activity: MSC Charleston Cellular container vessel (gearless) 89, 954 gross registered tons (GT) 12 metres on arrival and departure 96 hours (4 days) 2, 000 teus discharged (imported cargo) 1, 600 teus loaded (exported cargo) 400 empties loaded

Comparative port authority costs – Durban, Rotterdam, Sydney, Melbourne Vessel: Type: Tonnage: Draught: Time in port: Cargo activity: MSC Charleston Cellular container vessel (gearless) 89, 954 gross registered tons (GT) 12 metres on arrival and departure 96 hours (4 days) 2, 000 teus discharged (imported cargo) 1, 600 teus loaded (exported cargo) 400 empties loaded

In terms of PORT AUTHORITY charges, Durban a massively high cost port, but not in all respects… • Charges for MARINE INFRASTRUCTURE (Port dues) and MARINE SERVICES not the main problem – Port dues generally below those of competitor ports in EU, Oz – Pilotage costs modest by international standards – Some good things happening in terms of marine services delivery, but…. • Charges for CARGO-HANDLING INFRASTRUCTURE outrageously high – Cargo dues still the real tariff bugbear – Still price/costs distortions (Ad Valorem Wharfage ghosts not laid) – A disastrous situation in terms of attracting additional, marginal cargoes – Militates against attainment of strategic “hub” port status

In terms of PORT AUTHORITY charges, Durban a massively high cost port, but not in all respects… • Charges for MARINE INFRASTRUCTURE (Port dues) and MARINE SERVICES not the main problem – Port dues generally below those of competitor ports in EU, Oz – Pilotage costs modest by international standards – Some good things happening in terms of marine services delivery, but…. • Charges for CARGO-HANDLING INFRASTRUCTURE outrageously high – Cargo dues still the real tariff bugbear – Still price/costs distortions (Ad Valorem Wharfage ghosts not laid) – A disastrous situation in terms of attracting additional, marginal cargoes – Militates against attainment of strategic “hub” port status

Costs worsened by chronic congestion, vessel queuing Small exercise • 115 container vessels • 43 days (daily Sapref reports) • August-September 2011 • Daily timecharter rates imputed Average delay of 3. 28 days Time cost of ~R 40 million (~R 1 million/day)

Costs worsened by chronic congestion, vessel queuing Small exercise • 115 container vessels • 43 days (daily Sapref reports) • August-September 2011 • Daily timecharter rates imputed Average delay of 3. 28 days Time cost of ~R 40 million (~R 1 million/day)

Whither Durban port? DIA “dig-out” port site the front runner • Right choice • Less saturated immediate port area • Good intermodal links (rail focus to inland clearing house – Cato Ridge? ) • Real capacity enhancement and “hub” port basis

Whither Durban port? DIA “dig-out” port site the front runner • Right choice • Less saturated immediate port area • Good intermodal links (rail focus to inland clearing house – Cato Ridge? ) • Real capacity enhancement and “hub” port basis

Future challenges: who will pay for new capacity and how much and who will manage and how effectively? • A pairing of a municipal and a national port site? (fanciful) • A more powerful partnership with private investors? MUCH STRONGER TRANSNET/CITY/ PORT USERS RELATIONSHIPS THE WAY TO UNLOCK PORT VALUE

Future challenges: who will pay for new capacity and how much and who will manage and how effectively? • A pairing of a municipal and a national port site? (fanciful) • A more powerful partnership with private investors? MUCH STRONGER TRANSNET/CITY/ PORT USERS RELATIONSHIPS THE WAY TO UNLOCK PORT VALUE