a07ae45093a3d22eaf507650ba7788ca.ppt

- Количество слайдов: 36

The Economic Slump: What it Means for P/C Insurers An Update & Outlook for the US Property/Casualty Insurance Industry for 2001 and Beyond June 2001 Robert P. Hartwig, Ph. D. Vice President & Chief Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: (212) 346 -5520 Fax: (212) 732 -1916 bobh@iii. org www. iii. org

The Economic Slump: What it Means for P/C Insurers An Update & Outlook for the US Property/Casualty Insurance Industry for 2001 and Beyond June 2001 Robert P. Hartwig, Ph. D. Vice President & Chief Economist Insurance Information Institute 110 William Street New York, NY 10038 Tel: (212) 346 -5520 Fax: (212) 732 -1916 bobh@iii. org www. iii. org

Presentation Outline • Financial highlights and 2001 forecasts; • Wall Street Review • Scope of the economic slowdown • P/C industry performance during recessions • Threats to specific lines • Other “Big Money” Issues

Presentation Outline • Financial highlights and 2001 forecasts; • Wall Street Review • Scope of the economic slowdown • P/C industry performance during recessions • Threats to specific lines • Other “Big Money” Issues

INDUSTRY HIGHLIGHTS & FORECASTS

INDUSTRY HIGHLIGHTS & FORECASTS

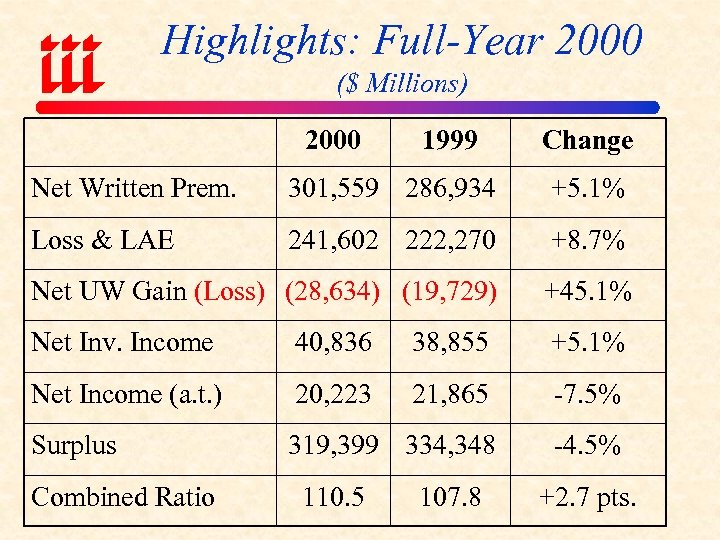

Highlights: Full-Year 2000 ($ Millions) 2000 1999 Change Net Written Prem. 301, 559 286, 934 +5. 1% Loss & LAE 241, 602 222, 270 +8. 7% Net UW Gain (Loss) (28, 634) (19, 729) +45. 1% Net Inv. Income 40, 836 38, 855 +5. 1% Net Income (a. t. ) 20, 223 21, 865 -7. 5% Surplus 319, 399 334, 348 -4. 5% Combined Ratio 110. 5 107. 8 +2. 7 pts.

Highlights: Full-Year 2000 ($ Millions) 2000 1999 Change Net Written Prem. 301, 559 286, 934 +5. 1% Loss & LAE 241, 602 222, 270 +8. 7% Net UW Gain (Loss) (28, 634) (19, 729) +45. 1% Net Inv. Income 40, 836 38, 855 +5. 1% Net Income (a. t. ) 20, 223 21, 865 -7. 5% Surplus 319, 399 334, 348 -4. 5% Combined Ratio 110. 5 107. 8 +2. 7 pts.

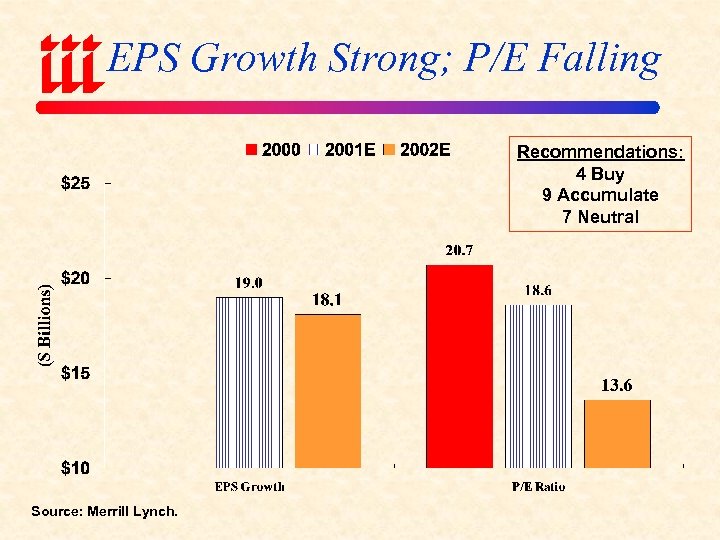

EPS Growth Strong; P/E Falling Recommendations: 4 Buy 9 Accumulate 7 Neutral Source: Merrill Lynch.

EPS Growth Strong; P/E Falling Recommendations: 4 Buy 9 Accumulate 7 Neutral Source: Merrill Lynch.

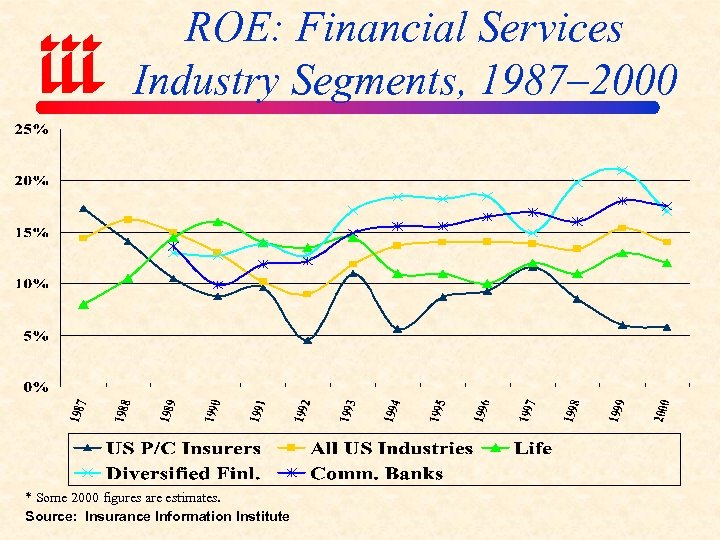

ROE: Financial Services Industry Segments, 1987– 2000 * Some 2000 figures are estimates. Source: Insurance Information Institute

ROE: Financial Services Industry Segments, 1987– 2000 * Some 2000 figures are estimates. Source: Insurance Information Institute

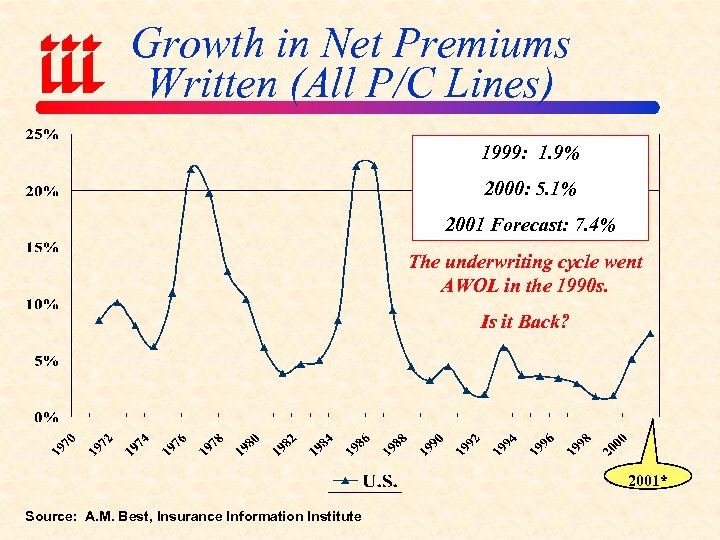

Growth in Net Premiums Written (All P/C Lines) 1999: 1. 9% 2000: 5. 1% 2001 Forecast: 7. 4% The underwriting cycle went AWOL in the 1990 s. Is it Back? 2001* Source: A. M. Best, Insurance Information Institute

Growth in Net Premiums Written (All P/C Lines) 1999: 1. 9% 2000: 5. 1% 2001 Forecast: 7. 4% The underwriting cycle went AWOL in the 1990 s. Is it Back? 2001* Source: A. M. Best, Insurance Information Institute

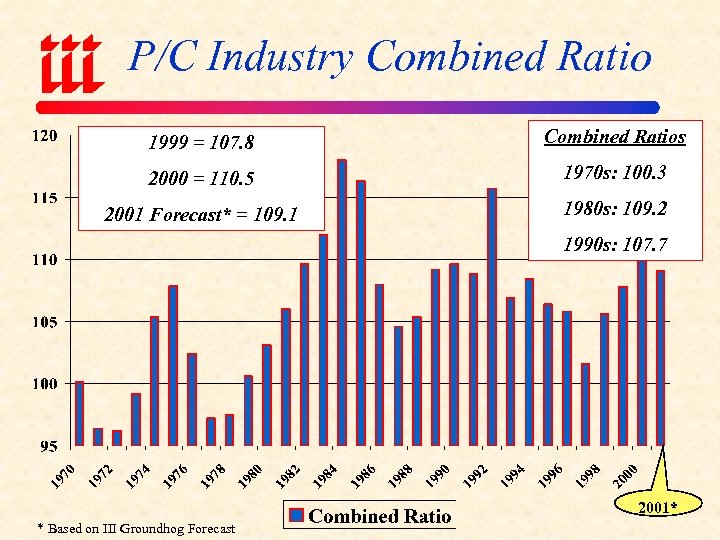

P/C Industry Combined Ratio 1999 = 107. 8 Combined Ratios 2000 = 110. 5 1970 s: 100. 3 2001 Forecast* = 109. 1 1980 s: 109. 2 1990 s: 107. 7 2001* * Based on III Groundhog Forecast

P/C Industry Combined Ratio 1999 = 107. 8 Combined Ratios 2000 = 110. 5 1970 s: 100. 3 2001 Forecast* = 109. 1 1980 s: 109. 2 1990 s: 107. 7 2001* * Based on III Groundhog Forecast

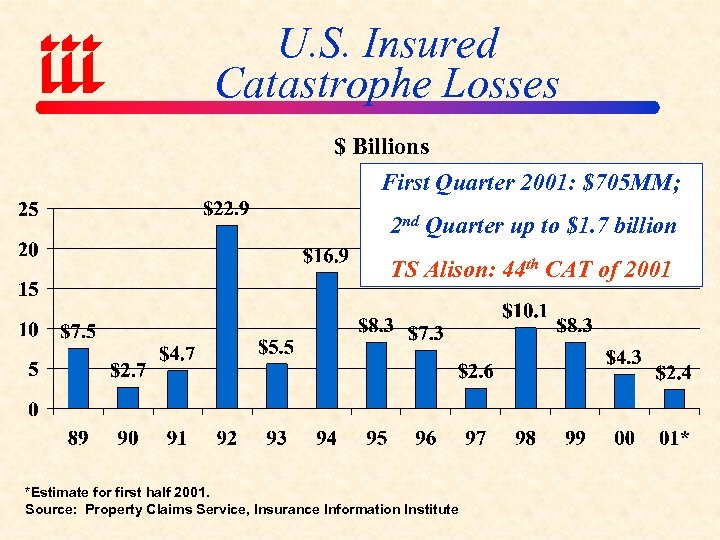

U. S. Insured Catastrophe Losses $ Billions First Quarter 2001: $705 MM; 2 nd Quarter up to $1. 7 billion TS Alison: 44 th CAT of 2001 *Estimate for first half 2001. Source: Property Claims Service, Insurance Information Institute

U. S. Insured Catastrophe Losses $ Billions First Quarter 2001: $705 MM; 2 nd Quarter up to $1. 7 billion TS Alison: 44 th CAT of 2001 *Estimate for first half 2001. Source: Property Claims Service, Insurance Information Institute

WALL STREET PERSPECTIVE

WALL STREET PERSPECTIVE

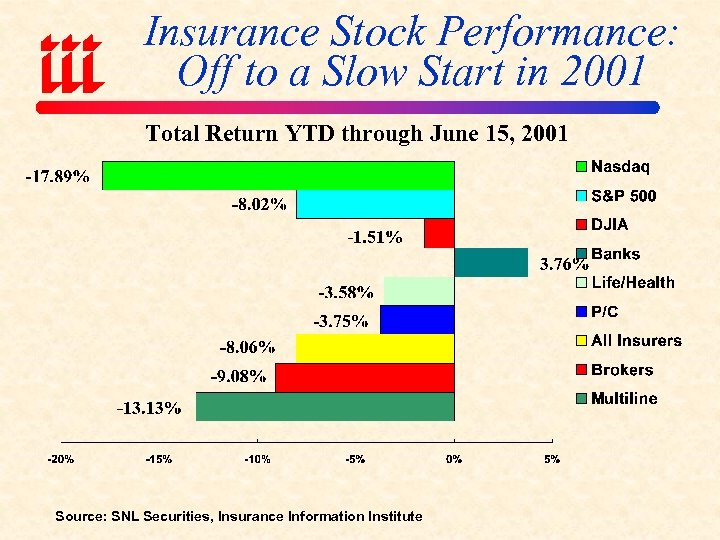

Insurance Stock Performance: Off to a Slow Start in 2001 Total Return YTD through June 15, 2001 Source: SNL Securities, Insurance Information Institute

Insurance Stock Performance: Off to a Slow Start in 2001 Total Return YTD through June 15, 2001 Source: SNL Securities, Insurance Information Institute

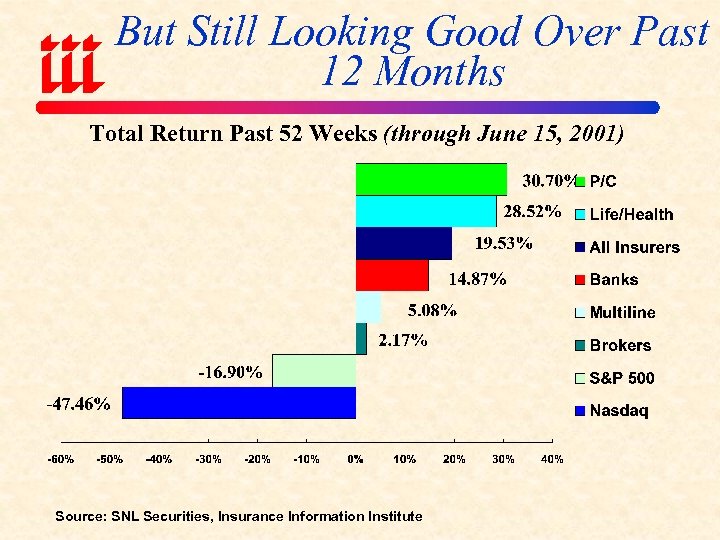

But Still Looking Good Over Past 12 Months Total Return Past 52 Weeks (through June 15, 2001) Source: SNL Securities, Insurance Information Institute

But Still Looking Good Over Past 12 Months Total Return Past 52 Weeks (through June 15, 2001) Source: SNL Securities, Insurance Information Institute

Insurance IPO Boomlet • 3 Insurance IPOs scheduled for June could raise as much as $1. 44 billion (there were only 3 insurance IPOs in all of 2000) Ø Odyssey Re: Expected to raise $274. 3 - $325. 7 MM Ø Willis Group: Expected to raise as much as $276 MM Ø The Phoenix Cos. : Expected to raise as much as $836. 2 MM • Why Insurance? Why Now? Ø Sector outperforming S&P, NASDAQ (Tech) Ø Good counter-cyclical play; Hancock/MET success Ø Overall market more hospitable to IPOs

Insurance IPO Boomlet • 3 Insurance IPOs scheduled for June could raise as much as $1. 44 billion (there were only 3 insurance IPOs in all of 2000) Ø Odyssey Re: Expected to raise $274. 3 - $325. 7 MM Ø Willis Group: Expected to raise as much as $276 MM Ø The Phoenix Cos. : Expected to raise as much as $836. 2 MM • Why Insurance? Why Now? Ø Sector outperforming S&P, NASDAQ (Tech) Ø Good counter-cyclical play; Hancock/MET success Ø Overall market more hospitable to IPOs

THE ECONOMIC SLOWDOWN SCOPE OF THE PROBLEM

THE ECONOMIC SLOWDOWN SCOPE OF THE PROBLEM

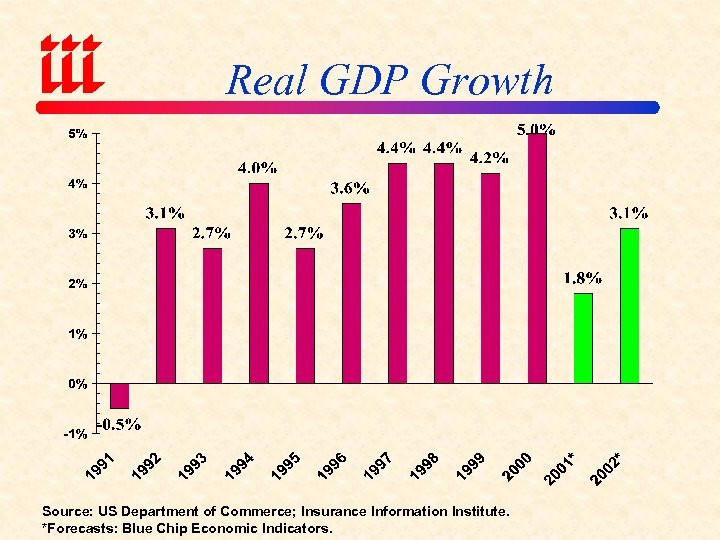

Real GDP Growth Source: US Department of Commerce; Insurance Information Institute. *Forecasts: Blue Chip Economic Indicators.

Real GDP Growth Source: US Department of Commerce; Insurance Information Institute. *Forecasts: Blue Chip Economic Indicators.

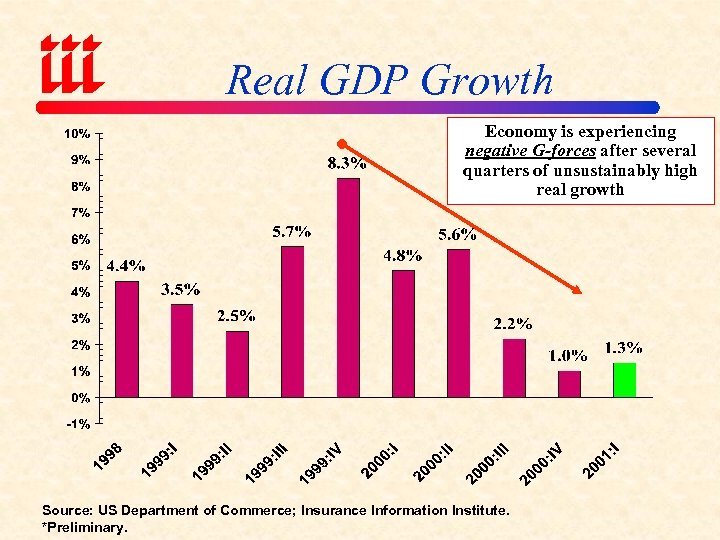

Real GDP Growth Economy is experiencing negative G-forces after several quarters of unsustainably high real growth Source: US Department of Commerce; Insurance Information Institute. *Preliminary.

Real GDP Growth Economy is experiencing negative G-forces after several quarters of unsustainably high real growth Source: US Department of Commerce; Insurance Information Institute. *Preliminary.

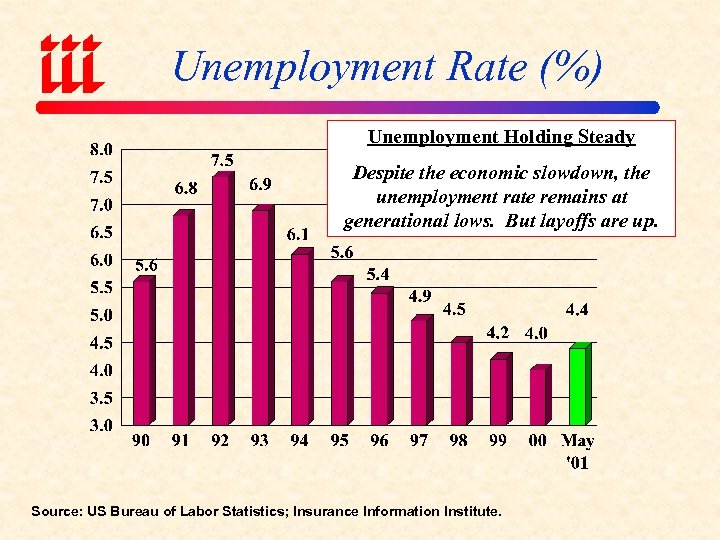

Unemployment Rate (%) Unemployment Holding Steady Despite the economic slowdown, the unemployment rate remains at generational lows. But layoffs are up. Source: US Bureau of Labor Statistics; Insurance Information Institute.

Unemployment Rate (%) Unemployment Holding Steady Despite the economic slowdown, the unemployment rate remains at generational lows. But layoffs are up. Source: US Bureau of Labor Statistics; Insurance Information Institute.

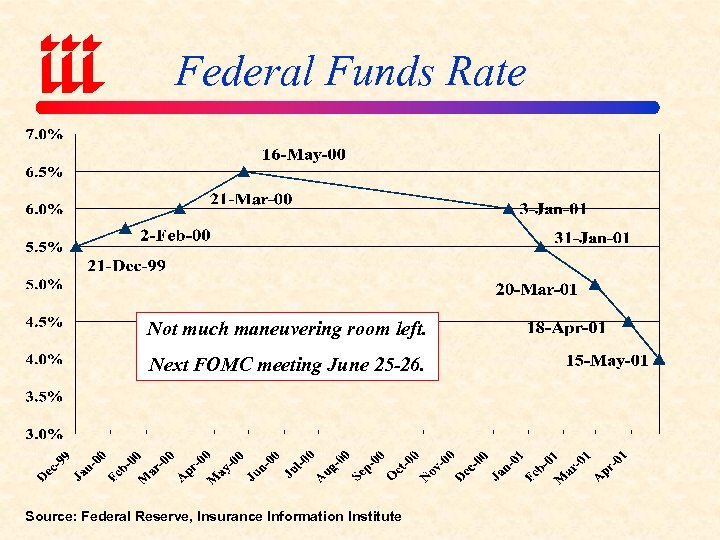

Federal Funds Rate Not much maneuvering room left. Next FOMC meeting June 25 -26. Source: Federal Reserve, Insurance Information Institute

Federal Funds Rate Not much maneuvering room left. Next FOMC meeting June 25 -26. Source: Federal Reserve, Insurance Information Institute

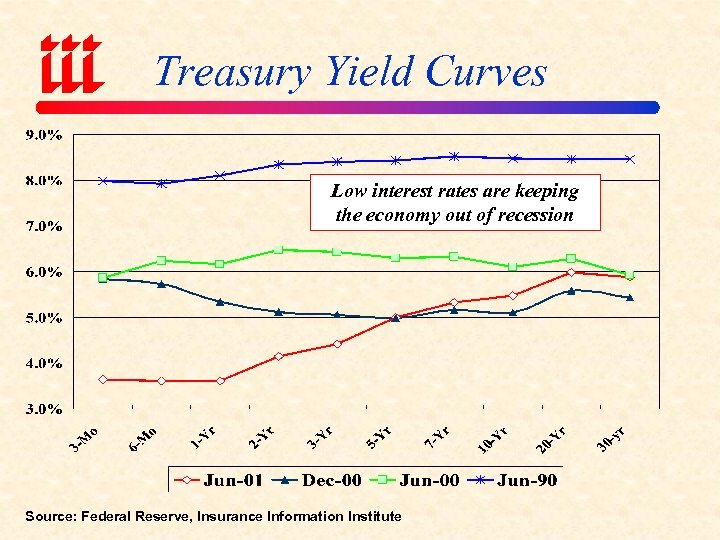

Treasury Yield Curves Low interest rates are keeping the economy out of recession Source: Federal Reserve, Insurance Information Institute

Treasury Yield Curves Low interest rates are keeping the economy out of recession Source: Federal Reserve, Insurance Information Institute

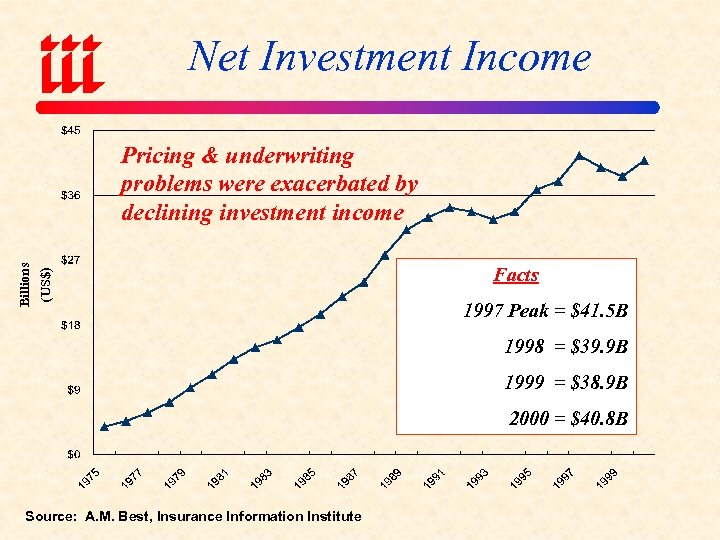

Net Investment Income (US$) Billions Pricing & underwriting problems were exacerbated by declining investment income Facts 1997 Peak = $41. 5 B 1998 = $39. 9 B 1999 = $38. 9 B 2000 = $40. 8 B Source: A. M. Best, Insurance Information Institute

Net Investment Income (US$) Billions Pricing & underwriting problems were exacerbated by declining investment income Facts 1997 Peak = $41. 5 B 1998 = $39. 9 B 1999 = $38. 9 B 2000 = $40. 8 B Source: A. M. Best, Insurance Information Institute

THE ECONOMIC SLOWDOWN HISTORICAL IMPACTS ON PROFITABILITY

THE ECONOMIC SLOWDOWN HISTORICAL IMPACTS ON PROFITABILITY

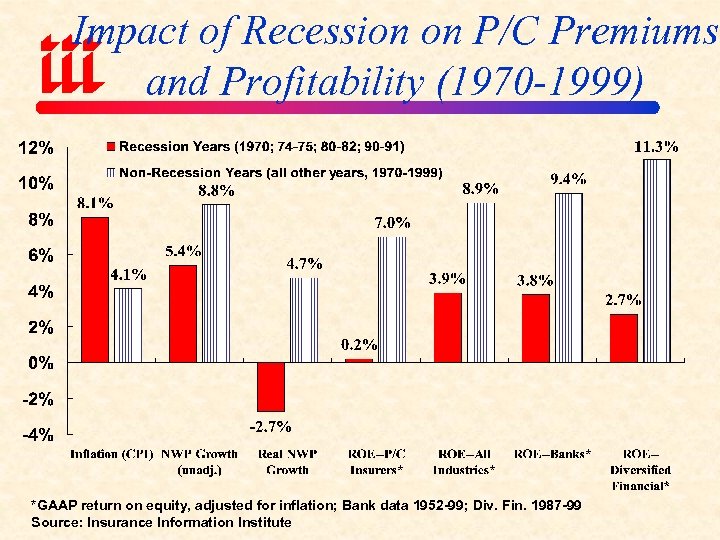

Impact of Recession on P/C Premiums and Profitability (1970 -1999) *GAAP return on equity, adjusted for inflation; Bank data 1952 -99; Div. Fin. 1987 -99 Source: Insurance Information Institute

Impact of Recession on P/C Premiums and Profitability (1970 -1999) *GAAP return on equity, adjusted for inflation; Bank data 1952 -99; Div. Fin. 1987 -99 Source: Insurance Information Institute

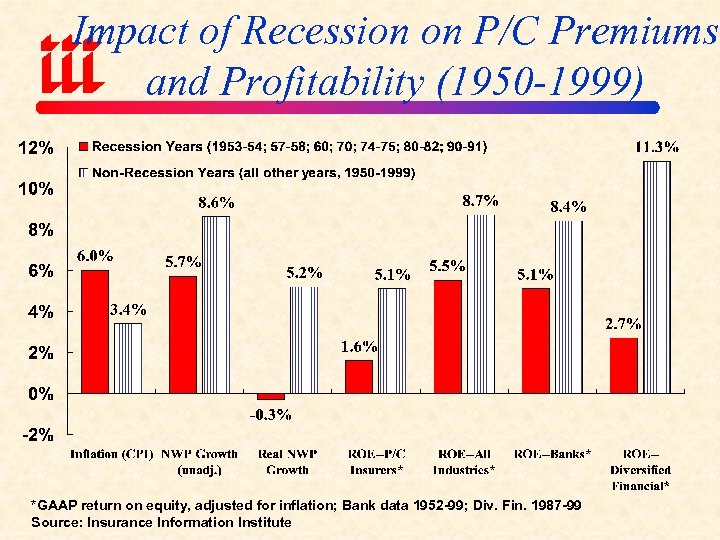

Impact of Recession on P/C Premiums and Profitability (1950 -1999) *GAAP return on equity, adjusted for inflation; Bank data 1952 -99; Div. Fin. 1987 -99 Source: Insurance Information Institute

Impact of Recession on P/C Premiums and Profitability (1950 -1999) *GAAP return on equity, adjusted for inflation; Bank data 1952 -99; Div. Fin. 1987 -99 Source: Insurance Information Institute

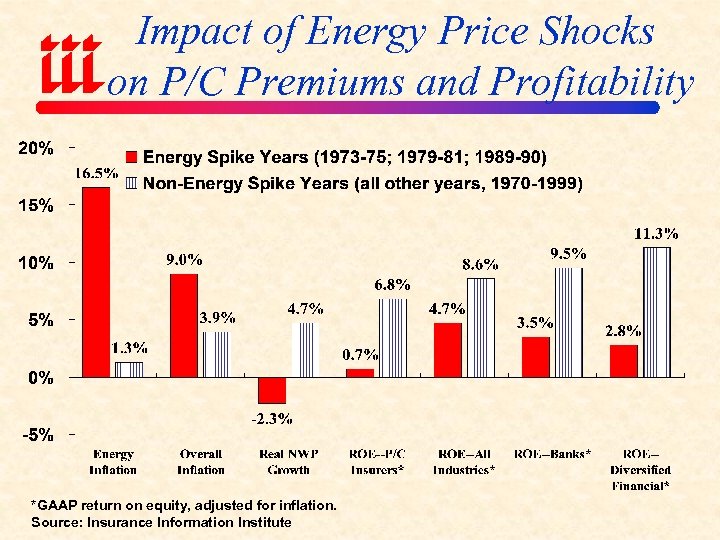

Impact of Energy Price Shocks on P/C Premiums and Profitability *GAAP return on equity, adjusted for inflation. Source: Insurance Information Institute

Impact of Energy Price Shocks on P/C Premiums and Profitability *GAAP return on equity, adjusted for inflation. Source: Insurance Information Institute

THE ECONOMIC SLOWDOWN SELECTED IMPACTS ON EXPOSURE

THE ECONOMIC SLOWDOWN SELECTED IMPACTS ON EXPOSURE

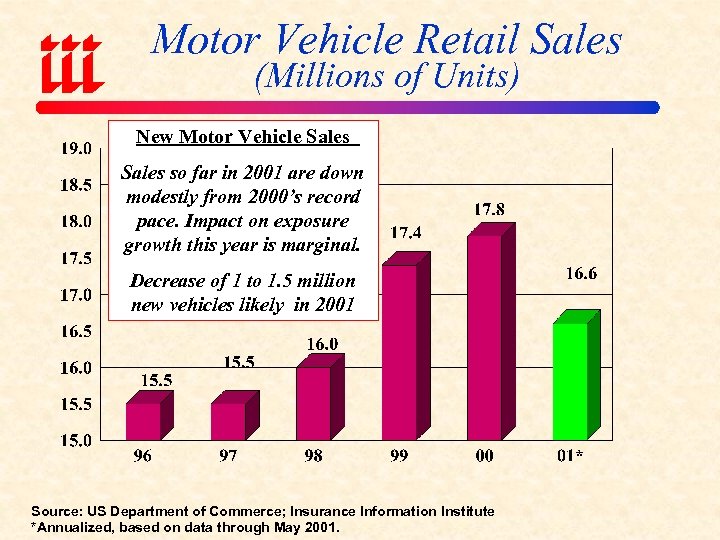

Motor Vehicle Retail Sales (Millions of Units) New Motor Vehicle Sales so far in 2001 are down modestly from 2000’s record pace. Impact on exposure growth this year is marginal. Decrease of 1 to 1. 5 million new vehicles likely in 2001 Source: US Department of Commerce; Insurance Information Institute *Annualized, based on data through May 2001.

Motor Vehicle Retail Sales (Millions of Units) New Motor Vehicle Sales so far in 2001 are down modestly from 2000’s record pace. Impact on exposure growth this year is marginal. Decrease of 1 to 1. 5 million new vehicles likely in 2001 Source: US Department of Commerce; Insurance Information Institute *Annualized, based on data through May 2001.

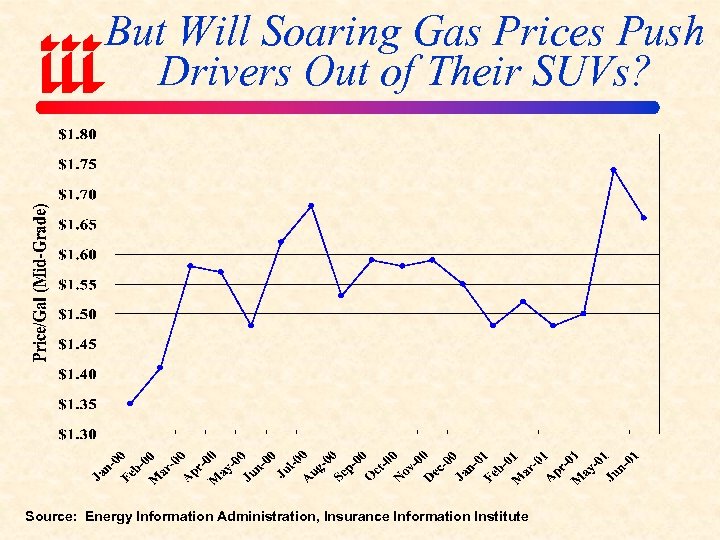

But Will Soaring Gas Prices Push Drivers Out of Their SUVs? Source: Energy Information Administration, Insurance Information Institute

But Will Soaring Gas Prices Push Drivers Out of Their SUVs? Source: Energy Information Administration, Insurance Information Institute

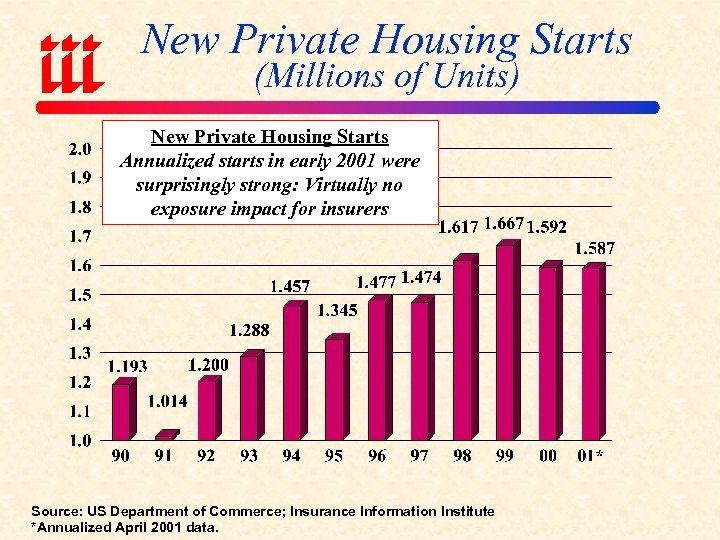

New Private Housing Starts (Millions of Units) New Private Housing Starts Annualized starts in early 2001 were surprisingly strong: Virtually no exposure impact for insurers Source: US Department of Commerce; Insurance Information Institute *Annualized April 2001 data.

New Private Housing Starts (Millions of Units) New Private Housing Starts Annualized starts in early 2001 were surprisingly strong: Virtually no exposure impact for insurers Source: US Department of Commerce; Insurance Information Institute *Annualized April 2001 data.

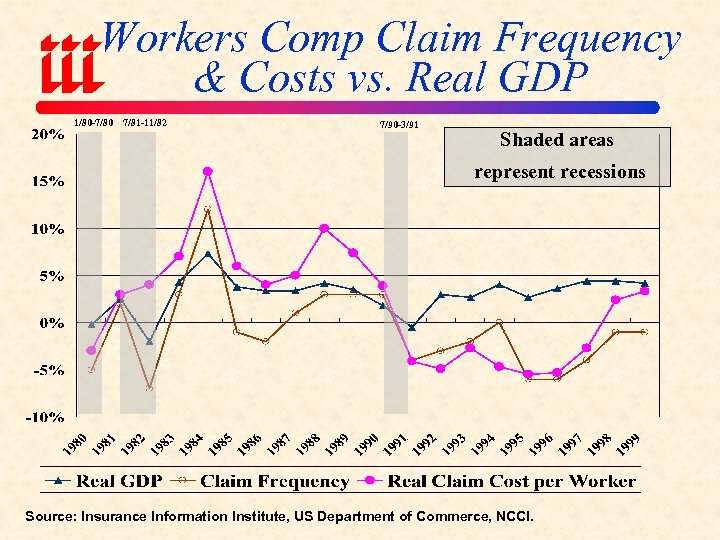

Workers Comp Claim Frequency & Costs vs. Real GDP 1/80 -7/80 7/81 -11/82 7/90 -3/91 Shaded areas represent recessions Source: Insurance Information Institute, US Department of Commerce, NCCI.

Workers Comp Claim Frequency & Costs vs. Real GDP 1/80 -7/80 7/81 -11/82 7/90 -3/91 Shaded areas represent recessions Source: Insurance Information Institute, US Department of Commerce, NCCI.

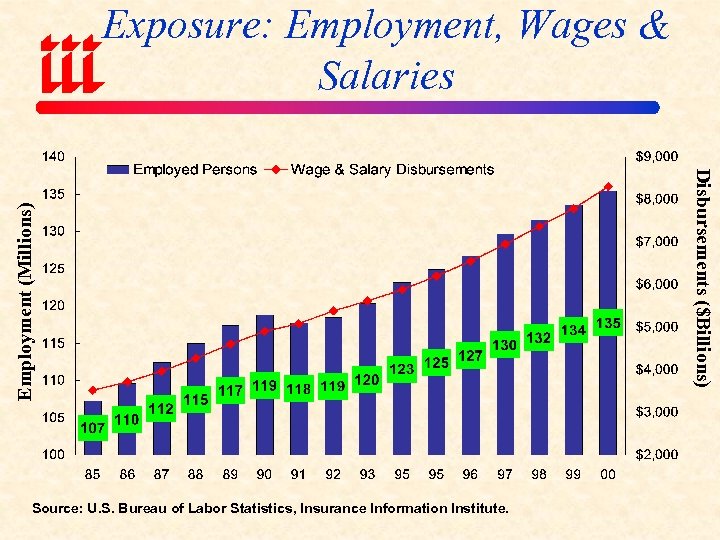

Source: U. S. Bureau of Labor Statistics, Insurance Information Institute. Disbursements ($Billions) Employment (Millions) Exposure: Employment, Wages & Salaries

Source: U. S. Bureau of Labor Statistics, Insurance Information Institute. Disbursements ($Billions) Employment (Millions) Exposure: Employment, Wages & Salaries

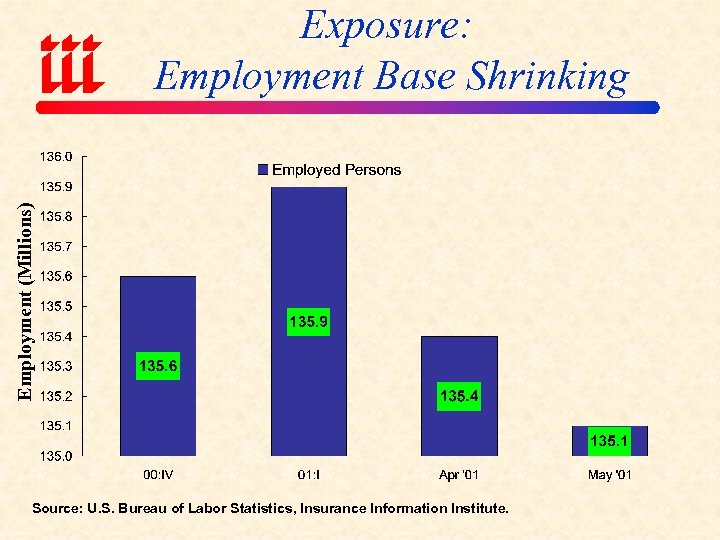

Employment (Millions) Exposure: Employment Base Shrinking Source: U. S. Bureau of Labor Statistics, Insurance Information Institute.

Employment (Millions) Exposure: Employment Base Shrinking Source: U. S. Bureau of Labor Statistics, Insurance Information Institute.

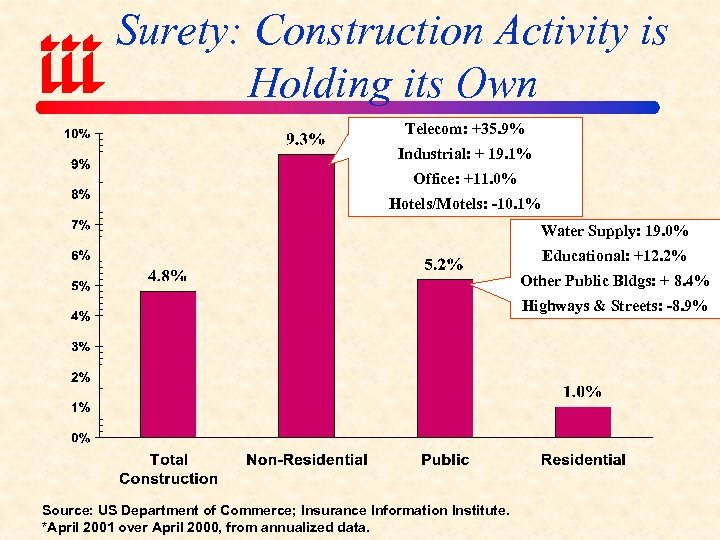

Surety: Construction Activity is Holding its Own Telecom: +35. 9% Industrial: + 19. 1% Office: +11. 0% Hotels/Motels: -10. 1% Water Supply: 19. 0% Educational: +12. 2% Other Public Bldgs: + 8. 4% Highways & Streets: -8. 9% Source: US Department of Commerce; Insurance Information Institute. *April 2001 over April 2000, from annualized data.

Surety: Construction Activity is Holding its Own Telecom: +35. 9% Industrial: + 19. 1% Office: +11. 0% Hotels/Motels: -10. 1% Water Supply: 19. 0% Educational: +12. 2% Other Public Bldgs: + 8. 4% Highways & Streets: -8. 9% Source: US Department of Commerce; Insurance Information Institute. *April 2001 over April 2000, from annualized data.

OTHER “BIG MONEY” ISSUES

OTHER “BIG MONEY” ISSUES

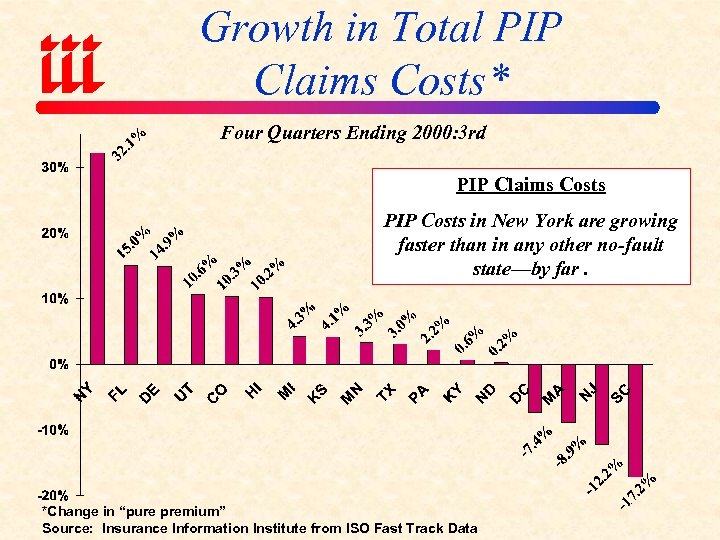

Growth in Total PIP Claims Costs* Four Quarters Ending 2000: 3 rd PIP Claims Costs PIP Costs in New York are growing faster than in any other no-fault state—by far. *Change in “pure premium” Source: Insurance Information Institute from ISO Fast Track Data

Growth in Total PIP Claims Costs* Four Quarters Ending 2000: 3 rd PIP Claims Costs PIP Costs in New York are growing faster than in any other no-fault state—by far. *Change in “pure premium” Source: Insurance Information Institute from ISO Fast Track Data

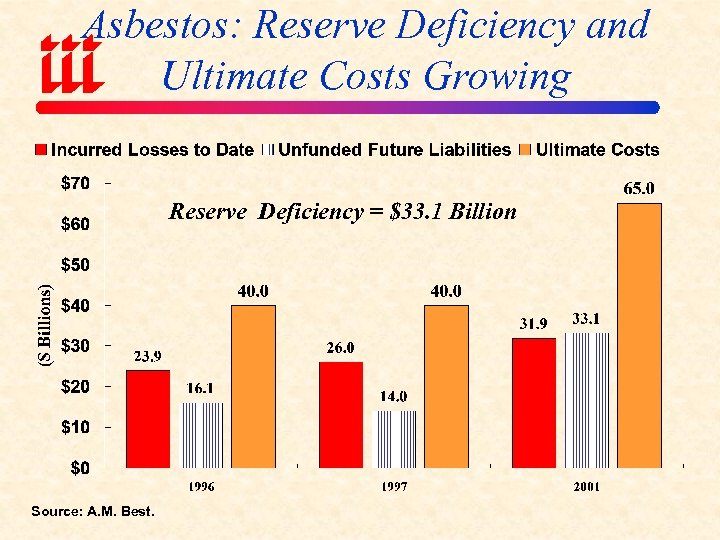

Asbestos: Reserve Deficiency and Ultimate Costs Growing Reserve Deficiency = $33. 1 Billion Source: A. M. Best.

Asbestos: Reserve Deficiency and Ultimate Costs Growing Reserve Deficiency = $33. 1 Billion Source: A. M. Best.

Insurance Information Institute On-Line This presentation is available by e-mail upon request.

Insurance Information Institute On-Line This presentation is available by e-mail upon request.