25cdc1aa960368e23b72cb8f444050ca.ppt

- Количество слайдов: 20

The dynamics of buying reinsurance to protect a green card portfolio Nick Goulder International Casualty Director, Willis Re July 3 2007

Lots to Discuss … • Deductible € 200, 000 • Reinstatements • Cover at the Low Level • Cover at the Middle Level • Unlimited Layer Issues • Reinsurer Security • The Future 2

How Big Is € 200, 000 ? • Personal injury compensation in Russia • Do the award levels feels right ? • Very low compared to e. g. German or UK court awards • Every country has a different view – nobody is “right” • Severe injury e. g. Paraplegic/Tetraplegic • Could cost € 5 m to € 25 m+ in the UK • Would often cost € 2 m to € 10 m or more in other EC countries • So reinsurers are wary of low deductibles 3

Ways to make Reinsurers more Comfortable? – (1) Territory • Obtain transparent analysis of where Green Card vehicles are going • If it’s to the Ukraine, Belarus, Moldova, Poland, Czech, Slovakia, Hungary or the smaller Baltic states, the XL risk is very low • If it’s to Germany, France, Spain or UK the risk is very much more serious • Good information helps create good reinsurance pricing 4

Ways to make Reinsurers more Comfortable? – (2) Vehicles • Maintain transparent statistics as to which vehicles are being insured • Small engine private cars – the XL risk is very low • 40 -tonne lorries – the risk is very much more serious • Good underwriting is going to price to select the better risks • Cheaper prices for 1000 cc cars, higher for 2000 cc + cars • Cheaper prices for light commercial, higher for heavy lorries & “bad” fleets • Good information helps create good reinsurance pricing 5

Making Reinsurers more Comfortable? – (3) Claims • Very important concern for Reinsurers is your claims handling • Are you going to be aware quickly that you may have a big claim ? • Reinsurers have a great fear of their reinsureds piling up liabilities without reporting them • Work hard to report quickly ! 6

One More on Claim Handling • Reinsurers can help in larger claim situations • They have wide experience of this • They can advise on tactics • It’s going to be their money – they will really want to help you get the best result • Don’t be afraid to report early, it works for the best for everyone 7

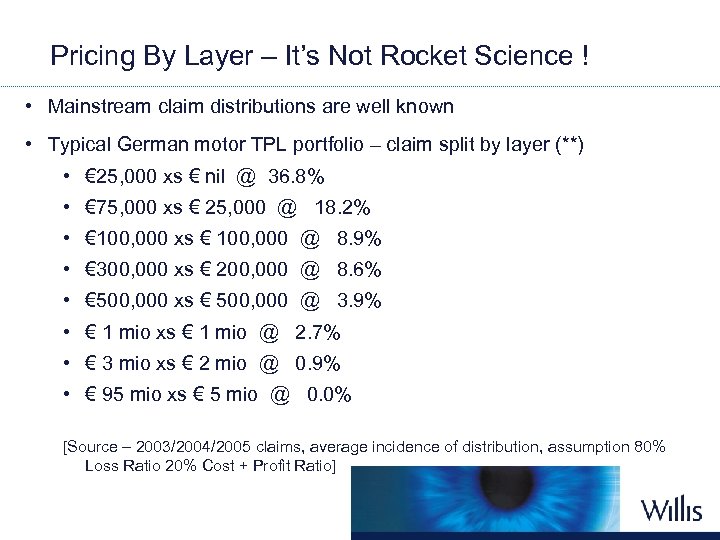

Pricing By Layer – It’s Not Rocket Science ! • Mainstream claim distributions are well known • Typical German motor TPL portfolio – claim split by layer (**) • € 25, 000 xs € nil @ 36. 8% • € 75, 000 xs € 25, 000 @ 18. 2% • € 100, 000 xs € 100, 000 @ 8. 9% • € 300, 000 xs € 200, 000 @ 8. 6% • € 500, 000 xs € 500, 000 @ 3. 9% • € 1 mio xs € 1 mio @ 2. 7% • € 3 mio xs € 2 mio @ 0. 9% • € 95 mio xs € 5 mio @ 0. 0% [Source – 2003/2004/2005 claims, average incidence of distribution, assumption 80% Loss Ratio 20% Cost + Profit Ratio] 8

Reinstatements • Tradition in larger EC countries has been to give unlimited reinstatements for motor • Reinsurers generally are trying to reduce this • Willis doesn’t approve • We think reinsurers can easily calculate the right premiums • But (right or wrong) this seems to be the trend 9

Reinstatements (2) • Especially for East European countries, the pattern is for limited reinstatements • Commercial reality • However … significant problem … • RUMI has 23 insurer members • XL Cover is one arrangement across all 23 • Consider 1 st XL layer … 10

1 st Layer reinstatement problem • Cover is € 300, 000 xs 200, 000 per loss • Could have many losses • Usual pricing would be about 10% of primary premium in largeraward EC countries (see German example) • Should cost less for Russian Green Cards (since big % of risk is in e. g. Ukraine etc) • If total Green Card GNPI is € 15 mio … • … then 10% rate pays for 5 losses … 11

1 st Layer Problem (ctd) • Suppose we obtain cover for 10 losses (shared across 23 insurers) • Suppose Insurer X and Insurer Y both have 5 losses each • Then the cover is exhausted • But what happens for Insurer Z ? ? ? • Insurer Z has paid premium … • … but no cover is left now … 12

Coverage vs Cost question • We hope reinsurers should realise that 10% would be a very fair rate for 100 reinstatements • (We at Willis think it is generous to reinsurers – it would be enough for e. g. a 100% German portfolio) • Then the cover could be given with at least two losses cover available to each of 23 insurers • The larger insurers might want more reinstatements … • Depth of cover should (roughly) match premiums paid 13

Middle Layers - Example • Here’s another country … four insurers all buying € 14 mio xs € 1 mio • All rates include domestic GNPI • Ins A (GNPI € 72 m) pays 0. 51% • Ins B (GNPI € 46 m) pays 0. 68% • Ins C (GNPI € 20 m) pays 0. 70% • Ins D (GNPI € 20 m) pays 1. 33% (why? ) 14

Unlimited Layers • Reinsurers trying to avoid writing unlimited • But they have done it for years • Philosophy, philosophy … • Commercial truth – it’s hard for them to stop • Insurers badly want the cover • We have the Willis Facility 15

Long Tail, Long Worries • Property XL is easy … you know very soon whether you have a loss • Motor XL goes on for DECADES • Average time delay for large personal injury claim to settle in major European countries is seven years • Many claims take longer than this • NB - the biggest claims usually take the longest time • Children can be 18 years or more 16

Motor XL Security Issues • So … you need to be friends with your Motor XL reinsurers for a VERY long time • They need to be financially robust • Willis recommends always to avoid anything BBB+ or worse (S&P) • Willis recommends a cautious position • we always try very hard to get best security • Some of our clients only accept AA- (S&P) 17

The Future • Each insurer is going to want to buy its own motor XL programme • Clear reinstatements • Good portfolios judged on merits • Quality of reinsurer security becomes own decision • Best planning will include … 18

Planning for the Future • Keep very clear statistics • Where your green card risks are going • How long for • What types of vehicle you are insuring • What your claims experience is • Keep clear claims information and report it • Work with reinsurers to settle claims quickly • Use a good reinsurance broker ! 19

Questions ?

25cdc1aa960368e23b72cb8f444050ca.ppt