1a101df1337acc543e9ceb44ceef92d9.ppt

- Количество слайдов: 24

The Dividend Decision Will it Affect shareholder Value? copyright anbirts

The Dividend Decision Will it Affect shareholder Value? copyright anbirts

Agenda • - Theoretical Positions Dividend irrelevance Dividend relevance Leftists and rightists • The Possible Policies • Practical Issues copyright anbirts 2

Agenda • - Theoretical Positions Dividend irrelevance Dividend relevance Leftists and rightists • The Possible Policies • Practical Issues copyright anbirts 2

Theoretical Discussion • Irrelevance of Dividend Decision, the residual argument - Company X has net assets of £ 3, 000 at day 1 - 1, 000 shares issued, share price = £ 3 -00 - Co X earns £ 300, 000 in year - If no distribution net assets = £ 3, 300, 000 so share price £ 3 -30 - If distributes, net assets £ 3, 000 so share price £ 3 -00 and each shareholder receives 30 pence div copyright anbirts • Shareholder total value £ 3 -30 i. e. the same 3

Theoretical Discussion • Irrelevance of Dividend Decision, the residual argument - Company X has net assets of £ 3, 000 at day 1 - 1, 000 shares issued, share price = £ 3 -00 - Co X earns £ 300, 000 in year - If no distribution net assets = £ 3, 300, 000 so share price £ 3 -30 - If distributes, net assets £ 3, 000 so share price £ 3 -00 and each shareholder receives 30 pence div copyright anbirts • Shareholder total value £ 3 -30 i. e. the same 3

The Buts (Dividend Relevance) • But what about shareholders that need income? - No problem, sell shares and manufacture a dividend • But what about tax? • But what about transaction costs? • But what about behavioural finance, the information effect and the bird in the hand? copyright anbirts 4

The Buts (Dividend Relevance) • But what about shareholders that need income? - No problem, sell shares and manufacture a dividend • But what about tax? • But what about transaction costs? • But what about behavioural finance, the information effect and the bird in the hand? copyright anbirts 4

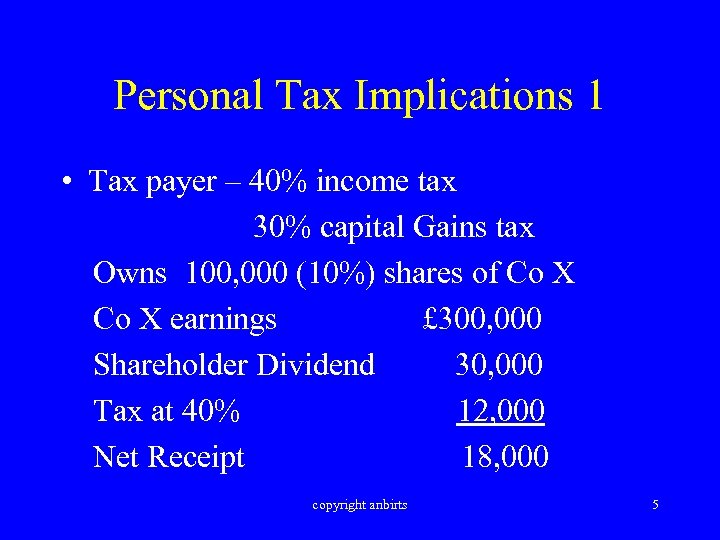

Personal Tax Implications 1 • Tax payer – 40% income tax 30% capital Gains tax Owns 100, 000 (10%) shares of Co X earnings £ 300, 000 Shareholder Dividend 30, 000 Tax at 40% 12, 000 Net Receipt 18, 000 copyright anbirts 5

Personal Tax Implications 1 • Tax payer – 40% income tax 30% capital Gains tax Owns 100, 000 (10%) shares of Co X earnings £ 300, 000 Shareholder Dividend 30, 000 Tax at 40% 12, 000 Net Receipt 18, 000 copyright anbirts 5

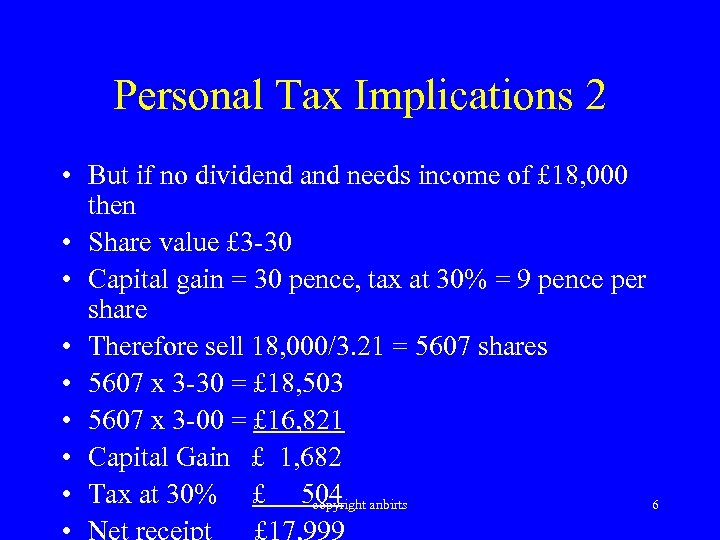

Personal Tax Implications 2 • But if no dividend and needs income of £ 18, 000 then • Share value £ 3 -30 • Capital gain = 30 pence, tax at 30% = 9 pence per share • Therefore sell 18, 000/3. 21 = 5607 shares • 5607 x 3 -30 = £ 18, 503 • 5607 x 3 -00 = £ 16, 821 • Capital Gain £ 1, 682 • Tax at 30% £ 504 anbirts copyright 6

Personal Tax Implications 2 • But if no dividend and needs income of £ 18, 000 then • Share value £ 3 -30 • Capital gain = 30 pence, tax at 30% = 9 pence per share • Therefore sell 18, 000/3. 21 = 5607 shares • 5607 x 3 -30 = £ 18, 503 • 5607 x 3 -00 = £ 16, 821 • Capital Gain £ 1, 682 • Tax at 30% £ 504 anbirts copyright 6

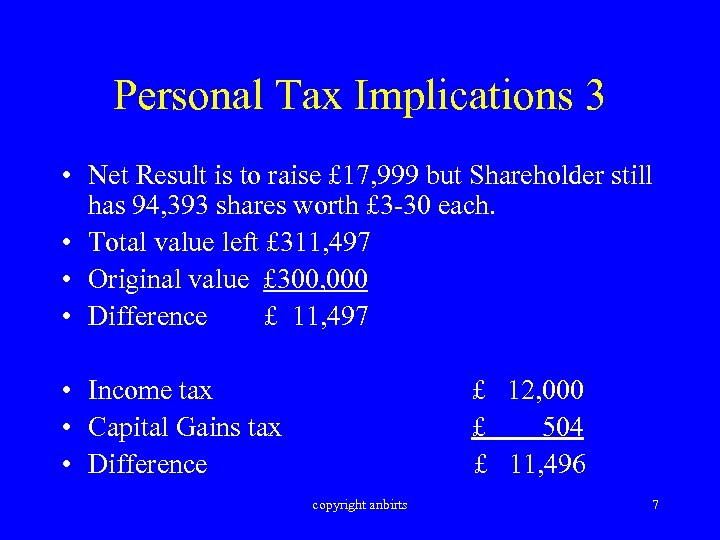

Personal Tax Implications 3 • Net Result is to raise £ 17, 999 but Shareholder still has 94, 393 shares worth £ 3 -30 each. • Total value left £ 311, 497 • Original value £ 300, 000 • Difference £ 11, 497 • Income tax • Capital Gains tax • Difference £ 12, 000 £ 504 £ 11, 496 copyright anbirts 7

Personal Tax Implications 3 • Net Result is to raise £ 17, 999 but Shareholder still has 94, 393 shares worth £ 3 -30 each. • Total value left £ 311, 497 • Original value £ 300, 000 • Difference £ 11, 497 • Income tax • Capital Gains tax • Difference £ 12, 000 £ 504 £ 11, 496 copyright anbirts 7

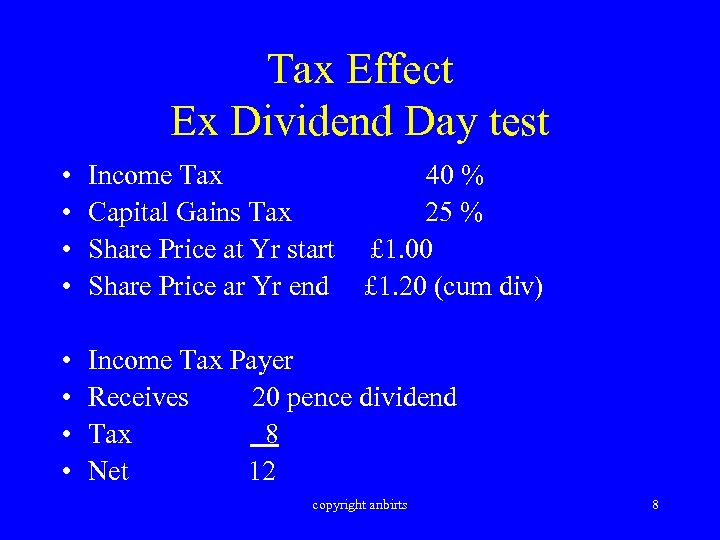

Tax Effect Ex Dividend Day test • • Income Tax Capital Gains Tax Share Price at Yr start Share Price ar Yr end • • Income Tax Payer Receives 20 pence dividend Tax 8 Net 12 40 % 25 % £ 1. 00 £ 1. 20 (cum div) copyright anbirts 8

Tax Effect Ex Dividend Day test • • Income Tax Capital Gains Tax Share Price at Yr start Share Price ar Yr end • • Income Tax Payer Receives 20 pence dividend Tax 8 Net 12 40 % 25 % £ 1. 00 £ 1. 20 (cum div) copyright anbirts 8

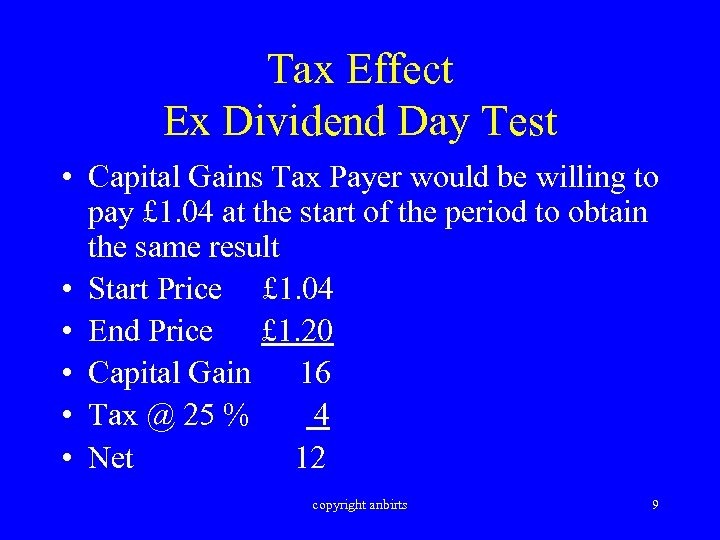

Tax Effect Ex Dividend Day Test • Capital Gains Tax Payer would be willing to pay £ 1. 04 at the start of the period to obtain the same result • Start Price £ 1. 04 • End Price £ 1. 20 • Capital Gain 16 • Tax @ 25 % 4 • Net 12 copyright anbirts 9

Tax Effect Ex Dividend Day Test • Capital Gains Tax Payer would be willing to pay £ 1. 04 at the start of the period to obtain the same result • Start Price £ 1. 04 • End Price £ 1. 20 • Capital Gain 16 • Tax @ 25 % 4 • Net 12 copyright anbirts 9

The Buts (part deux) • Transaction costs • Divisibility • Flotation costs • Dilution copyright anbirts 10

The Buts (part deux) • Transaction costs • Divisibility • Flotation costs • Dilution copyright anbirts 10

Leftists and Rightists • Leftists. Apart from a residual dividend policy dividends are harmful. - costs of funding - tax • Rightists. A high payout ratio is a good thing for information effects, clientele effects and psychology copyright anbirts 11

Leftists and Rightists • Leftists. Apart from a residual dividend policy dividends are harmful. - costs of funding - tax • Rightists. A high payout ratio is a good thing for information effects, clientele effects and psychology copyright anbirts 11

‘Middle of the Roaders’ • Dividend policy does not matter except in so far as tax and transaction costs effect value copyright anbirts 12

‘Middle of the Roaders’ • Dividend policy does not matter except in so far as tax and transaction costs effect value copyright anbirts 12

Information Effect • • John Lintner (American Economic Review, May 1956) Firms have long run target dividend pay out ratios Focus is on changes rather than absolute levels Changes in dividend follow shifts in long run sustainable earnings (Healy and Palepu, J of Fin Ec 21, 1988) Managers are reluctant to reverse dividend decisions copyright anbirts 13

Information Effect • • John Lintner (American Economic Review, May 1956) Firms have long run target dividend pay out ratios Focus is on changes rather than absolute levels Changes in dividend follow shifts in long run sustainable earnings (Healy and Palepu, J of Fin Ec 21, 1988) Managers are reluctant to reverse dividend decisions copyright anbirts 13

Clientele Effect • Widows and orphans • Legal restrictions/dividend paying shares • Capital gains versus income Behavioural Effect • Bird in the hand • Dilution • Management discipline copyright anbirts 14

Clientele Effect • Widows and orphans • Legal restrictions/dividend paying shares • Capital gains versus income Behavioural Effect • Bird in the hand • Dilution • Management discipline copyright anbirts 14

Policies • Argued that there is no right or wrong policy but - There should be one and - It should be consistent • Possible policies are - Residual Stable amount Constant percentage No dividend copyright anbirts 15

Policies • Argued that there is no right or wrong policy but - There should be one and - It should be consistent • Possible policies are - Residual Stable amount Constant percentage No dividend copyright anbirts 15

Practicalities 1 • Financial - Liquidity/ cash flow - Debt repayment - Asset expansion - Profit growth - Stability of earnings - Access to capital markets copyright anbirts 16

Practicalities 1 • Financial - Liquidity/ cash flow - Debt repayment - Asset expansion - Profit growth - Stability of earnings - Access to capital markets copyright anbirts 16

Practicalities 2 • Legal/ Technical - Restrictive loan agreements - Private limited Cos, only from realised profits copyright anbirts 17

Practicalities 2 • Legal/ Technical - Restrictive loan agreements - Private limited Cos, only from realised profits copyright anbirts 17

Practicalities 3 - Timing Cum dividend – includes accrued dividend when the share is sold Ex dividend – excludes the dividend when the share is sold - Shareholder agreement at AGM Interim Final copyright anbirts 18

Practicalities 3 - Timing Cum dividend – includes accrued dividend when the share is sold Ex dividend – excludes the dividend when the share is sold - Shareholder agreement at AGM Interim Final copyright anbirts 18

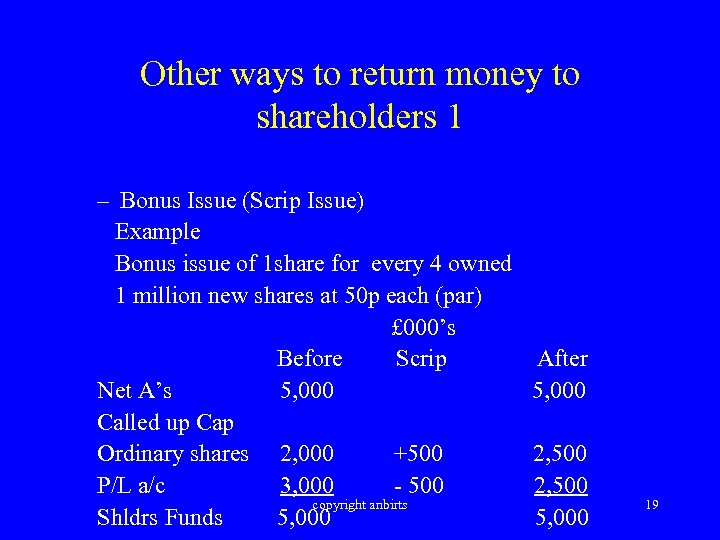

Other ways to return money to shareholders 1 – Bonus Issue (Scrip Issue) Example Bonus issue of 1 share for every 4 owned 1 million new shares at 50 p each (par) £ 000’s Before Scrip Net A’s 5, 000 Called up Cap Ordinary shares 2, 000 +500 P/L a/c 3, 000 - 500 copyright anbirts Shldrs Funds 5, 000 After 5, 000 2, 500 5, 000 19

Other ways to return money to shareholders 1 – Bonus Issue (Scrip Issue) Example Bonus issue of 1 share for every 4 owned 1 million new shares at 50 p each (par) £ 000’s Before Scrip Net A’s 5, 000 Called up Cap Ordinary shares 2, 000 +500 P/L a/c 3, 000 - 500 copyright anbirts Shldrs Funds 5, 000 After 5, 000 2, 500 5, 000 19

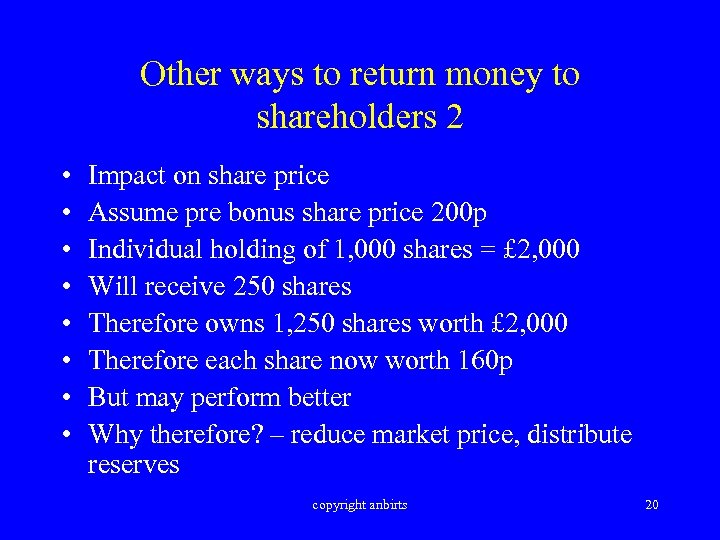

Other ways to return money to shareholders 2 • • Impact on share price Assume pre bonus share price 200 p Individual holding of 1, 000 shares = £ 2, 000 Will receive 250 shares Therefore owns 1, 250 shares worth £ 2, 000 Therefore each share now worth 160 p But may perform better Why therefore? – reduce market price, distribute reserves copyright anbirts 20

Other ways to return money to shareholders 2 • • Impact on share price Assume pre bonus share price 200 p Individual holding of 1, 000 shares = £ 2, 000 Will receive 250 shares Therefore owns 1, 250 shares worth £ 2, 000 Therefore each share now worth 160 p But may perform better Why therefore? – reduce market price, distribute reserves copyright anbirts 20

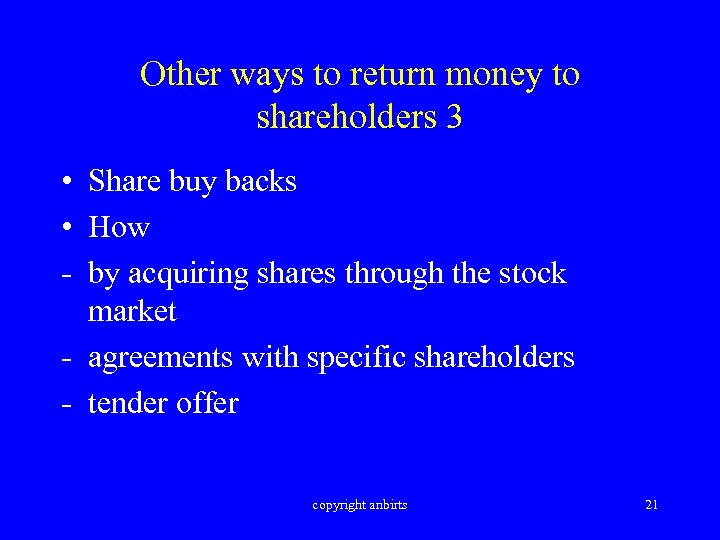

Other ways to return money to shareholders 3 • Share buy backs • How - by acquiring shares through the stock market - agreements with specific shareholders - tender offer copyright anbirts 21

Other ways to return money to shareholders 3 • Share buy backs • How - by acquiring shares through the stock market - agreements with specific shareholders - tender offer copyright anbirts 21

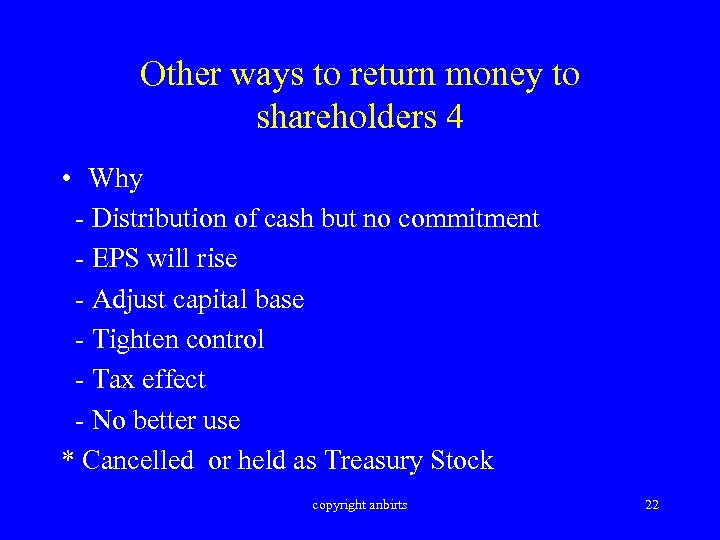

Other ways to return money to shareholders 4 • Why - Distribution of cash but no commitment - EPS will rise - Adjust capital base - Tighten control - Tax effect - No better use * Cancelled or held as Treasury Stock copyright anbirts 22

Other ways to return money to shareholders 4 • Why - Distribution of cash but no commitment - EPS will rise - Adjust capital base - Tighten control - Tax effect - No better use * Cancelled or held as Treasury Stock copyright anbirts 22

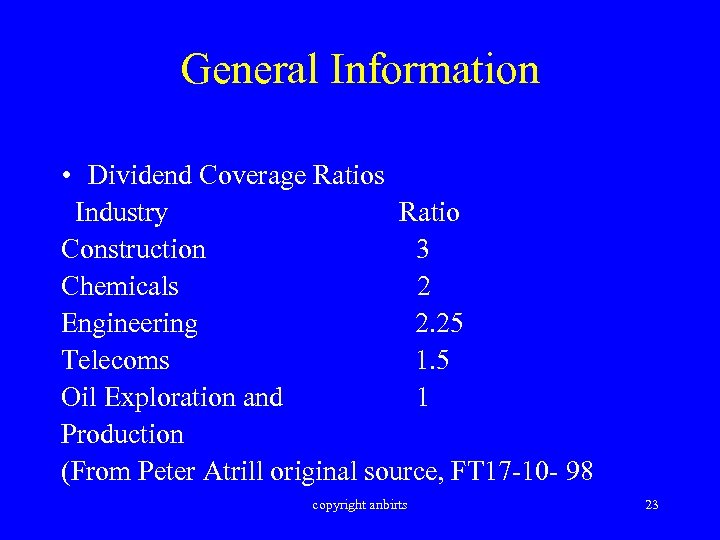

General Information • Dividend Coverage Ratios Industry Ratio Construction 3 Chemicals 2 Engineering 2. 25 Telecoms 1. 5 Oil Exploration and 1 Production (From Peter Atrill original source, FT 17 -10 - 98 copyright anbirts 23

General Information • Dividend Coverage Ratios Industry Ratio Construction 3 Chemicals 2 Engineering 2. 25 Telecoms 1. 5 Oil Exploration and 1 Production (From Peter Atrill original source, FT 17 -10 - 98 copyright anbirts 23

General Information • Country Differences • Dividend Payment, what it looks like! • Dividend Reinvestment Plans copyright anbirts 24

General Information • Country Differences • Dividend Payment, what it looks like! • Dividend Reinvestment Plans copyright anbirts 24