6fbc53b0a1f2aab07922355aff8e0377.ppt

- Количество слайдов: 20

The determinants of university license arrangements EXTRA- DIME Conference Lausanne September 29 -30 2006 Stéphane Lhuillery CEMI - Collège du Management de la Technologie EPFL - École Polytechnique Fédérale de Lausanne Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

The determinants of university license arrangements EXTRA- DIME Conference Lausanne September 29 -30 2006 Stéphane Lhuillery CEMI - Collège du Management de la Technologie EPFL - École Polytechnique Fédérale de Lausanne Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Motivations • What kinds of firms are sourcing at university technologies through transactions? • What is the outcome of negociations between a famous European University and firms Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Motivations • What kinds of firms are sourcing at university technologies through transactions? • What is the outcome of negociations between a famous European University and firms Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Motivations • What kinds of firms are sourcing at university technologies through transactions? • What is the outcome of negociations between a famous European University and firms Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Motivations • What kinds of firms are sourcing at university technologies through transactions? • What is the outcome of negociations between a famous European University and firms Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Determining factors of Tech transaction provisions • Theoretical and empirical research: – Scope, strength and height of patents – TTOs governance – Need for long life technological transfers? – Geographic localization – Differentiation of licensors – Financial capabilities licensors – Turnover or product forcasts – Institutional aspects (industry or country level) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Determining factors of Tech transaction provisions • Theoretical and empirical research: – Scope, strength and height of patents – TTOs governance – Need for long life technological transfers? – Geographic localization – Differentiation of licensors – Financial capabilities licensors – Turnover or product forcasts – Institutional aspects (industry or country level) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Data • EPFL data (1993 -2005) - 618 declared inventions, 502 technologies, 382 patents - 298 transactions (first transaction + renegotiation + software + university to PROs transactions) -> Final sample: 194 technology first transactions with firms (110 inventions, 160 technologies, 60 labs). • Swiss innovation survey (KOF) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Data • EPFL data (1993 -2005) - 618 declared inventions, 502 technologies, 382 patents - 298 transactions (first transaction + renegotiation + software + university to PROs transactions) -> Final sample: 194 technology first transactions with firms (110 inventions, 160 technologies, 60 labs). • Swiss innovation survey (KOF) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Explained variable ? • Technology transaction provisions 7 dichotomic variables - License or patent selling Exclusivity (is always 1 for patent selling) Royalties Lump sum Patent costs Equity Options Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Explained variable ? • Technology transaction provisions 7 dichotomic variables - License or patent selling Exclusivity (is always 1 for patent selling) Royalties Lump sum Patent costs Equity Options Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis on determinants(1) • On size of licensees: H 1: Large firms are more likely to buy than rent a technology (bargaining power). H 2: Large firms are less likely to negotiate options (absorptive capa). H 3: Large firms are less likely to be able to negotiate equities (uncertain dividends and low capital gain) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis on determinants(1) • On size of licensees: H 1: Large firms are more likely to buy than rent a technology (bargaining power). H 2: Large firms are less likely to negotiate options (absorptive capa). H 3: Large firms are less likely to be able to negotiate equities (uncertain dividends and low capital gain) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (2) • On start-ups: H 4: Start-ups are more likely to negotiate equities since royalties or even lump sums are often impossible (or on long run). H 5: Start-ups are more likely to obtain an exclusive licence. Without exclusivity, a startup can always be threaten by potential entrants or imitators but as a consequence will have more difficulties to convince people to invest in shares. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (2) • On start-ups: H 4: Start-ups are more likely to negotiate equities since royalties or even lump sums are often impossible (or on long run). H 5: Start-ups are more likely to obtain an exclusive licence. Without exclusivity, a startup can always be threaten by potential entrants or imitators but as a consequence will have more difficulties to convince people to invest in shares. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (3) • On localization of licensees: H 6: Firms localized nearby the EPFL are more likely to negotiate equities (due to lower asymmetries of information on managerial skills) H 7: Firms localized nearby the EPFL are more likely to buy patents (localised spillovers) H 8: Firms localized nearby the EPFL are less likely to negotiate variable fees (local spillovers reduce the need to involve the lab. into the Tech Transfer) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (3) • On localization of licensees: H 6: Firms localized nearby the EPFL are more likely to negotiate equities (due to lower asymmetries of information on managerial skills) H 7: Firms localized nearby the EPFL are more likely to buy patents (localised spillovers) H 8: Firms localized nearby the EPFL are less likely to negotiate variable fees (local spillovers reduce the need to involve the lab. into the Tech Transfer) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (3) • On localization of licensees: H 6: Firms localized nearby the EPFL are more likely to negotiate equities (due to lower asymmetries of information on managerial skills) H 7: Firms localized nearby the EPFL are more likely to buy patents (localised spillovers) H 8: Firms localized nearby the EPFL are less likely to negotiate variable fees (local spillovers reduce the need to involve the lab. into the Tech Transfer) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (3) • On localization of licensees: H 6: Firms localized nearby the EPFL are more likely to negotiate equities (due to lower asymmetries of information on managerial skills) H 7: Firms localized nearby the EPFL are more likely to buy patents (localised spillovers) H 8: Firms localized nearby the EPFL are less likely to negotiate variable fees (local spillovers reduce the need to involve the lab. into the Tech Transfer) Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

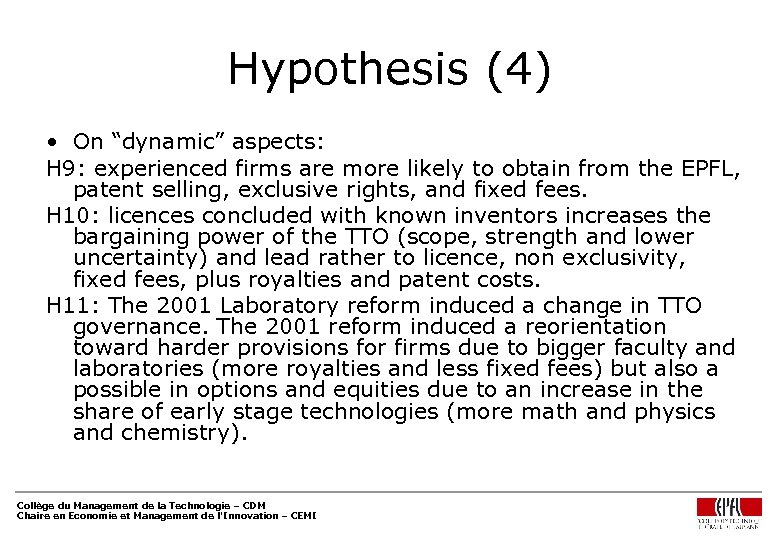

Hypothesis (4) • On “dynamic” aspects: H 9: experienced firms are more likely to obtain from the EPFL, patent selling, exclusive rights, and fixed fees. H 10: licences concluded with known inventors increases the bargaining power of the TTO (scope, strength and lower uncertainty) and lead rather to licence, non exclusivity, fixed fees, plus royalties and patent costs. H 11: The 2001 Laboratory reform induced a change in TTO governance. The 2001 reform induced a reorientation toward harder provisions for firms due to bigger faculty and laboratories (more royalties and less fixed fees) but also a possible in options and equities due to an increase in the share of early stage technologies (more math and physics and chemistry). Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (4) • On “dynamic” aspects: H 9: experienced firms are more likely to obtain from the EPFL, patent selling, exclusive rights, and fixed fees. H 10: licences concluded with known inventors increases the bargaining power of the TTO (scope, strength and lower uncertainty) and lead rather to licence, non exclusivity, fixed fees, plus royalties and patent costs. H 11: The 2001 Laboratory reform induced a change in TTO governance. The 2001 reform induced a reorientation toward harder provisions for firms due to bigger faculty and laboratories (more royalties and less fixed fees) but also a possible in options and equities due to an increase in the share of early stage technologies (more math and physics and chemistry). Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

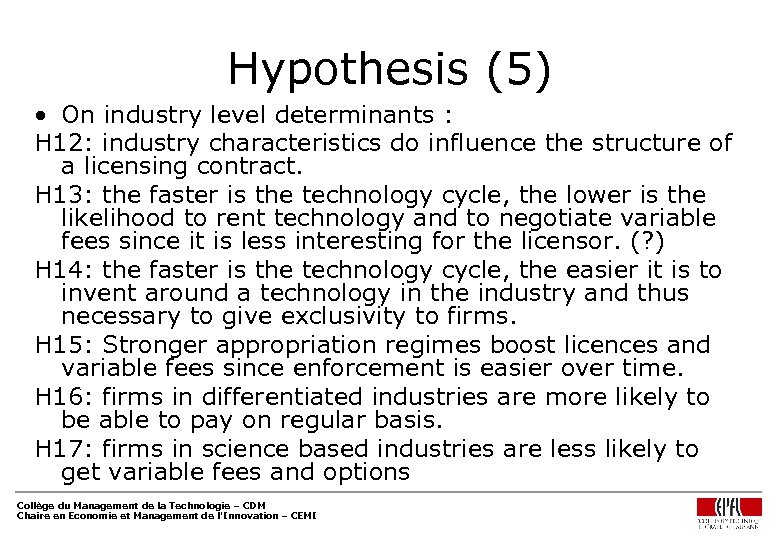

Hypothesis (5) • On industry level determinants : H 12: industry characteristics do influence the structure of a licensing contract. H 13: the faster is the technology cycle, the lower is the likelihood to rent technology and to negotiate variable fees since it is less interesting for the licensor. (? ) H 14: the faster is the technology cycle, the easier it is to invent around a technology in the industry and thus necessary to give exclusivity to firms. H 15: Stronger appropriation regimes boost licences and variable fees since enforcement is easier over time. H 16: firms in differentiated industries are more likely to be able to pay on regular basis. H 17: firms in science based industries are less likely to get variable fees and options Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Hypothesis (5) • On industry level determinants : H 12: industry characteristics do influence the structure of a licensing contract. H 13: the faster is the technology cycle, the lower is the likelihood to rent technology and to negotiate variable fees since it is less interesting for the licensor. (? ) H 14: the faster is the technology cycle, the easier it is to invent around a technology in the industry and thus necessary to give exclusivity to firms. H 15: Stronger appropriation regimes boost licences and variable fees since enforcement is easier over time. H 16: firms in differentiated industries are more likely to be able to pay on regular basis. H 17: firms in science based industries are less likely to get variable fees and options Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

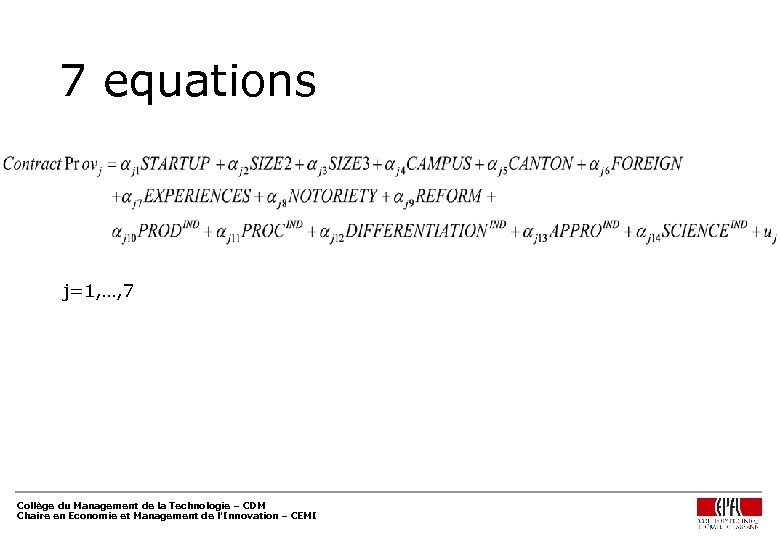

7 equations j=1, …, 7 Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

7 equations j=1, …, 7 Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

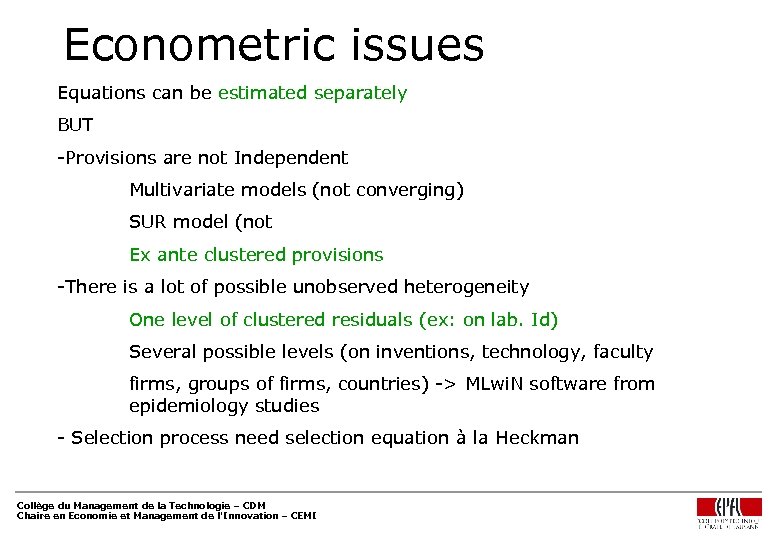

Econometric issues Equations can be estimated separately BUT -Provisions are not Independent Multivariate models (not converging) SUR model (not Ex ante clustered provisions -There is a lot of possible unobserved heterogeneity One level of clustered residuals (ex: on lab. Id) Several possible levels (on inventions, technology, faculty firms, groups of firms, countries) -> MLwi. N software from epidemiology studies - Selection process need selection equation à la Heckman Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Econometric issues Equations can be estimated separately BUT -Provisions are not Independent Multivariate models (not converging) SUR model (not Ex ante clustered provisions -There is a lot of possible unobserved heterogeneity One level of clustered residuals (ex: on lab. Id) Several possible levels (on inventions, technology, faculty firms, groups of firms, countries) -> MLwi. N software from epidemiology studies - Selection process need selection equation à la Heckman Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

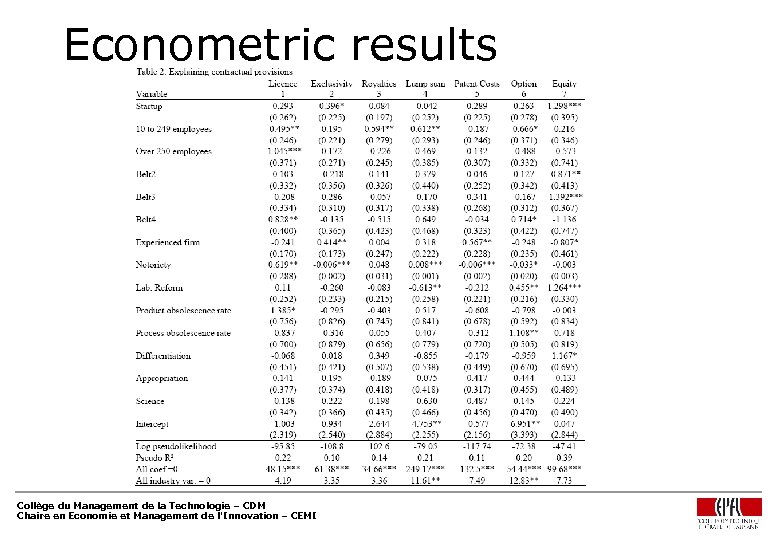

Econometric results Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Econometric results Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (1) • SMEs and large firms are less likely than very small firms (under 10 emp. ) to negotiate license rather than patent selling. • Royalties payment schemes are more likely to be negotiated with SMEs than with very small (no cash flow) or very large firms that would prefer lump sum. However, Lump sum are explained significantly only by SMEs. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (1) • SMEs and large firms are less likely than very small firms (under 10 emp. ) to negotiate license rather than patent selling. • Royalties payment schemes are more likely to be negotiated with SMEs than with very small (no cash flow) or very large firms that would prefer lump sum. However, Lump sum are explained significantly only by SMEs. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (2) • Equity are more likely to be settled by Start-ups. But start-ups are not different for other provisions!!! • A further result is that equity is reserved to firms located on campus or abroad. • Options are more proposed to very small firms or large firms than SMEs. • More surprising, licences are more likely to be settled with foreign firms. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (2) • Equity are more likely to be settled by Start-ups. But start-ups are not different for other provisions!!! • A further result is that equity is reserved to firms located on campus or abroad. • Options are more proposed to very small firms or large firms than SMEs. • More surprising, licences are more likely to be settled with foreign firms. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (3) • As expected, exclusivity are more likely to be proposed to start-up firms but are not restricted to firms located near university as in Mowery and Zedionis (2004). • Experienced firms are also more likely to get exclusive rights as well as patent costs to pay. • Transaction on technologies created by inventors, who previously commercialized technologies, are more widely diffused since there are fewer selling, fewer exclusivity and patent costs. • If equity and option are more likely to be settled since the 2001 reform. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (3) • As expected, exclusivity are more likely to be proposed to start-up firms but are not restricted to firms located near university as in Mowery and Zedionis (2004). • Experienced firms are also more likely to get exclusive rights as well as patent costs to pay. • Transaction on technologies created by inventors, who previously commercialized technologies, are more widely diffused since there are fewer selling, fewer exclusivity and patent costs. • If equity and option are more likely to be settled since the 2001 reform. Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (4) • Industry characteristics hardly explain contract provisions. • Patent costs and equity are however influenced by industry (but on Option and Lump sum). • The faster is the technological change in processes in a industry, the more options are given. • Equities are negotiated only in differentiated industries Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

Main results (4) • Industry characteristics hardly explain contract provisions. • Patent costs and equity are however influenced by industry (but on Option and Lump sum). • The faster is the technological change in processes in a industry, the more options are given. • Equities are negotiated only in differentiated industries Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

For the next draft! • Econometric issues (selection, multi level grouping of residuals, complementarity) • Efforts on RHS variables: 4 aspects – Scope of inventions – Academic records from inventors (SCI data) – Carreer profiles of inventors (HR data) – Patent portofolio of licensees (PAT Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI

For the next draft! • Econometric issues (selection, multi level grouping of residuals, complementarity) • Efforts on RHS variables: 4 aspects – Scope of inventions – Academic records from inventors (SCI data) – Carreer profiles of inventors (HR data) – Patent portofolio of licensees (PAT Collège du Management de la Technologie – CDM Chaire en Economie et Management de l'Innovation – CEMI