the contents of financial statementsDTOI.pptx

- Количество слайдов: 96

The contents of financial statements

The contents of financial statements

Introduction the two most fundamental components of a set of financial accounts are • the balance sheet • and the income statement

Introduction the two most fundamental components of a set of financial accounts are • the balance sheet • and the income statement

Balance sheet • • • presents a statement of the assets, liabilities and owner's equity, at the balance sheet date • It is prepared from the accounting records

Balance sheet • • • presents a statement of the assets, liabilities and owner's equity, at the balance sheet date • It is prepared from the accounting records

Balance sheet • Some US corporations call the balance sheet • a 'statement of financial position', • the IASB announced proposals to adopt that term in 2006

Balance sheet • Some US corporations call the balance sheet • a 'statement of financial position', • the IASB announced proposals to adopt that term in 2006

The income statement • has as its focus the financial performance of the reporting period • Taking into account the revenues and expenses of the period

The income statement • has as its focus the financial performance of the reporting period • Taking into account the revenues and expenses of the period

The income statement • Until recently, the income statement did not include all income and expense items (For example, gains on the revaluation (but not sale) of buildings meet the IASB's definition of income but are not yet realized in cash or promises of cash) traditionally they have been taken to reserves

The income statement • Until recently, the income statement did not include all income and expense items (For example, gains on the revaluation (but not sale) of buildings meet the IASB's definition of income but are not yet realized in cash or promises of cash) traditionally they have been taken to reserves

The income statement • From the 1990 s • under IASB, UK or US rules, • second type of income statement - a statement of other comprehensive income (SOCI): – a statement of changes in equity, – a statement of total recognized gains and losses (recognised income and expense) , – or a statement of other comprehensive income

The income statement • From the 1990 s • under IASB, UK or US rules, • second type of income statement - a statement of other comprehensive income (SOCI): – a statement of changes in equity, – a statement of total recognized gains and losses (recognised income and expense) , – or a statement of other comprehensive income

The income statement • In 2006, the IASB announced the intention • to require entities to present • a SOCI + P/L = Statement of Total Comprehensive Income • instead of the conventional income statement

The income statement • In 2006, the IASB announced the intention • to require entities to present • a SOCI + P/L = Statement of Total Comprehensive Income • instead of the conventional income statement

Cash flow statement • To provide a focus on the cash position • This statement seeks to highlight • The movements of cash into and out of the business • during the period under review

Cash flow statement • To provide a focus on the cash position • This statement seeks to highlight • The movements of cash into and out of the business • during the period under review

Cash flow statement It is possible • to be profitable – in the short term and still run out of money, because of delayed receipts or advance payments, – or because of investment policies. • to be making losses – while still having large amounts of cash A cash flow statement is thus essential

Cash flow statement It is possible • to be profitable – in the short term and still run out of money, because of delayed receipts or advance payments, – or because of investment policies. • to be making losses – while still having large amounts of cash A cash flow statement is thus essential

annual financial report includes discussions • by the company chairman • and the management team of the activities and results of the business, and various graphs, photographs and other material designed to – ensure the 'right' impression of the performance of the business and the management

annual financial report includes discussions • by the company chairman • and the management team of the activities and results of the business, and various graphs, photographs and other material designed to – ensure the 'right' impression of the performance of the business and the management

annual financial report • • • It is unclear to what extent the company and its auditors are legally responsible for the validity and overall fairness of these voluntary sections

annual financial report • • • It is unclear to what extent the company and its auditors are legally responsible for the validity and overall fairness of these voluntary sections

Auditors • are required • to give an opinion on the financial statements (including the notes) • and to check that the directors' report is consistent with those statements

Auditors • are required • to give an opinion on the financial statements (including the notes) • and to check that the directors' report is consistent with those statements

Basic financial statements

Basic financial statements

Introduction • • both IAS 1 and the EU Fourth Directive have a significant effect on the general contents of basic financial statements

Introduction • • both IAS 1 and the EU Fourth Directive have a significant effect on the general contents of basic financial statements

Introduction • In Europe, the EU Fourth Directive is still relevant for those financial statements not prepared under the EU Regulation of 2002 • For non-EU countries, there is relevance in that several elements of the Fourth Directive have influenced IAS 1

Introduction • In Europe, the EU Fourth Directive is still relevant for those financial statements not prepared under the EU Regulation of 2002 • For non-EU countries, there is relevance in that several elements of the Fourth Directive have influenced IAS 1

IAS 1 • financial statements should be clearly distinguished from any other information that is included in the same published document • Figures, components and separate pages must be fully and clearly described • Financial statements should be presented at least annually – any exceptions should be clearly explained

IAS 1 • financial statements should be clearly distinguished from any other information that is included in the same published document • Figures, components and separate pages must be fully and clearly described • Financial statements should be presented at least annually – any exceptions should be clearly explained

Balance sheets Required to present • current and non-current assets, • and current and non-current liabilities, order of the liquidity • European practice for assets to end with cash • North American, Japanese and Australian practice to start with cash

Balance sheets Required to present • current and non-current assets, • and current and non-current liabilities, order of the liquidity • European practice for assets to end with cash • North American, Japanese and Australian practice to start with cash

Current asset – IAS 1 • is expected to be realized in, • or is held for sale or consumption in the normal operating cycle • is held primarily for trading purposes • is expected to be realized within twelve months of the balance sheet date • cash or a cash equivalent that is not restricted in its use

Current asset – IAS 1 • is expected to be realized in, • or is held for sale or consumption in the normal operating cycle • is held primarily for trading purposes • is expected to be realized within twelve months of the balance sheet date • cash or a cash equivalent that is not restricted in its use

European laws • based on the Fourth Directive • Define fixed assets as those intended for continuing use in the business • and all other assets as current

European laws • based on the Fourth Directive • Define fixed assets as those intended for continuing use in the business • and all other assets as current

European laws • if an entity has an operating cycle greater than 12 months • an asset expected to be realized within that operating cycle is a current asset • even if the expected realization is more than 12 months away • in 2003, the Directive to allow a current/non-current split – based on the entity's operating cycle

European laws • if an entity has an operating cycle greater than 12 months • an asset expected to be realized within that operating cycle is a current asset • even if the expected realization is more than 12 months away • in 2003, the Directive to allow a current/non-current split – based on the entity's operating cycle

European laws • a non-current asset remains non-current throughout its useful life, – as it is not held primarily for trading purposes • It does not become 'current' merely because its expected disposal is within less than 12 months

European laws • a non-current asset remains non-current throughout its useful life, – as it is not held primarily for trading purposes • It does not become 'current' merely because its expected disposal is within less than 12 months

non-current assets • under IFRS 5 (based on US GAAP) • When formerly non-current assets are held for sale • they are separated from non-current assets • and valued like inventories

non-current assets • under IFRS 5 (based on US GAAP) • When formerly non-current assets are held for sale • they are separated from non-current assets • and valued like inventories

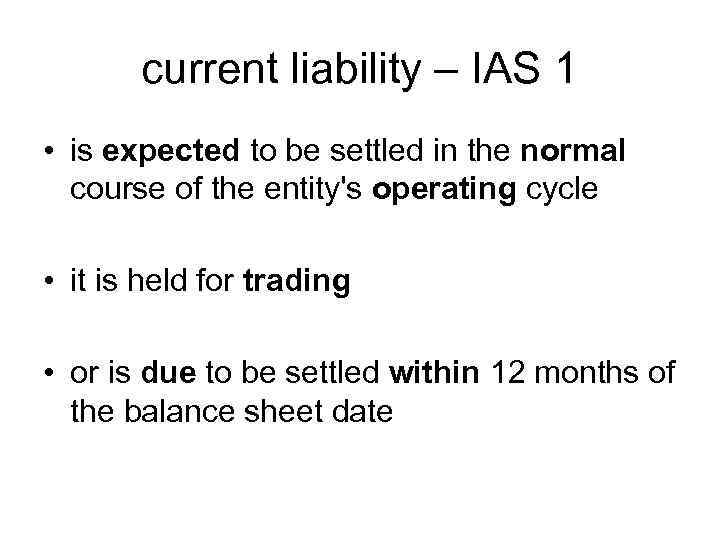

current liability – IAS 1 • is expected to be settled in the normal course of the entity's operating cycle • it is held for trading • or is due to be settled within 12 months of the balance sheet date

current liability – IAS 1 • is expected to be settled in the normal course of the entity's operating cycle • it is held for trading • or is due to be settled within 12 months of the balance sheet date

liabilities • In the case of liabilities • the 'current' portion of long-term interestbearing liabilities • is generally to be classified as current, • unless refinance is arranged by the balance sheet date

liabilities • In the case of liabilities • the 'current' portion of long-term interestbearing liabilities • is generally to be classified as current, • unless refinance is arranged by the balance sheet date

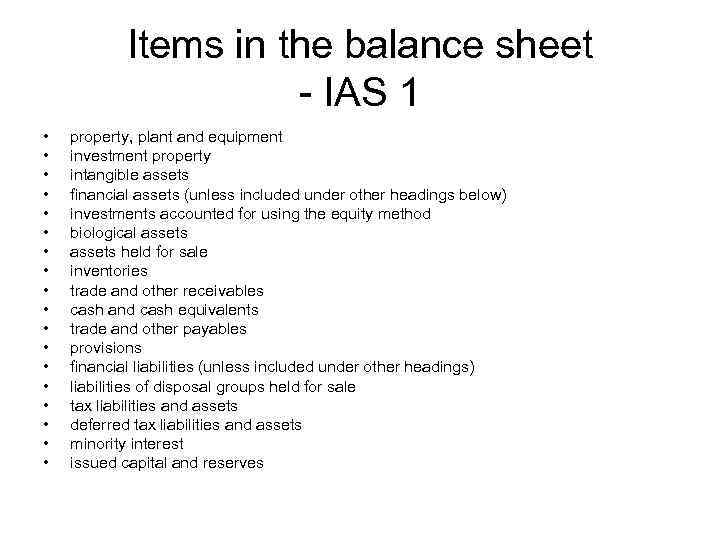

Items in the balance sheet - IAS 1 • • • • • property, plant and equipment investment property intangible assets financial assets (unless included under other headings below) investments accounted for using the equity method biological assets held for sale inventories trade and other receivables cash and cash equivalents trade and other payables provisions financial liabilities (unless included under other headings) liabilities of disposal groups held for sale tax liabilities and assets deferred tax liabilities and assets minority interest issued capital and reserves

Items in the balance sheet - IAS 1 • • • • • property, plant and equipment investment property intangible assets financial assets (unless included under other headings below) investments accounted for using the equity method biological assets held for sale inventories trade and other receivables cash and cash equivalents trade and other payables provisions financial liabilities (unless included under other headings) liabilities of disposal groups held for sale tax liabilities and assets deferred tax liabilities and assets minority interest issued capital and reserves

IAS 1 • The above represents a minimum • Additional line items, headings and subtotals – should also be included if other IFRS requires it, – or when such additional presentation is necessary in order to 'present fairly' the entity's financial position

IAS 1 • The above represents a minimum • Additional line items, headings and subtotals – should also be included if other IFRS requires it, – or when such additional presentation is necessary in order to 'present fairly' the entity's financial position

Bayer Group consolidated balance sheet – example Noncurrent assets • Goodwill and other intangible assets 7, 688 • Property, plant and equipment 8, 321 • Investments in associates 795 • Other financial assets 1, 429 • Other receivables 199 • Deferred taxes 1, 698 20, 130 Current assets • Inventories 5, 504 • Trade accounts receivable 5, 204 • Other financial assets 214 • Other receivables 1, 421 • Claims for tax refunds 726 • Liquid assets • Marketable securities and other instruments 233 • Cash and cash equivalents 3, 290 16, 592 Total current assets 16, 592 Assets 36, 722 Equity attributable to Bayer AG stockholders • Capital stock of Bayer AG 1, 870 • Capital reserves of Bayer AG 2, 942 • Other reserves 6, 265 • 11, 077 • Equity attributable to minority interest 80 Stockholders‘ equity 11, 157 Noncurrent liabilities • Provisions for pensions and other post-employment benefits 7, 174 • Other provisions 1, 340 • Financial liabilities 7, 185 • Miscellaneous liabilities 516 • Deferred taxes 280 16, 495 Current liabilities • Other provisions 3, 009 • Financial liabilities 1, 767 • Trade accounts payable 1, 974 • Tax liabilities 304 • Miscellaneous liabilities 2, 016 Total current liabilities 9, 070 Liabilities 25, 565 Stockholders' equity and liabilities 36, 722

Bayer Group consolidated balance sheet – example Noncurrent assets • Goodwill and other intangible assets 7, 688 • Property, plant and equipment 8, 321 • Investments in associates 795 • Other financial assets 1, 429 • Other receivables 199 • Deferred taxes 1, 698 20, 130 Current assets • Inventories 5, 504 • Trade accounts receivable 5, 204 • Other financial assets 214 • Other receivables 1, 421 • Claims for tax refunds 726 • Liquid assets • Marketable securities and other instruments 233 • Cash and cash equivalents 3, 290 16, 592 Total current assets 16, 592 Assets 36, 722 Equity attributable to Bayer AG stockholders • Capital stock of Bayer AG 1, 870 • Capital reserves of Bayer AG 2, 942 • Other reserves 6, 265 • 11, 077 • Equity attributable to minority interest 80 Stockholders‘ equity 11, 157 Noncurrent liabilities • Provisions for pensions and other post-employment benefits 7, 174 • Other provisions 1, 340 • Financial liabilities 7, 185 • Miscellaneous liabilities 516 • Deferred taxes 280 16, 495 Current liabilities • Other provisions 3, 009 • Financial liabilities 1, 767 • Trade accounts payable 1, 974 • Tax liabilities 304 • Miscellaneous liabilities 2, 016 Total current liabilities 9, 070 Liabilities 25, 565 Stockholders' equity and liabilities 36, 722

The Fourth Directive – balance sheet • sets out more detail in its specifications regarding balance sheets • It requires that member states • should prescribe one or both of the layouts – specified by its Articles 9 and 10

The Fourth Directive – balance sheet • sets out more detail in its specifications regarding balance sheets • It requires that member states • should prescribe one or both of the layouts – specified by its Articles 9 and 10

The Fourth Directive – balance sheet - 'horizontal' format • this is relevant for EU companies not following IFRS • Article 9 gives a 'horizontal' format – the debits on one side and – the credits on the other • following the general continental European tradition

The Fourth Directive – balance sheet - 'horizontal' format • this is relevant for EU companies not following IFRS • Article 9 gives a 'horizontal' format – the debits on one side and – the credits on the other • following the general continental European tradition

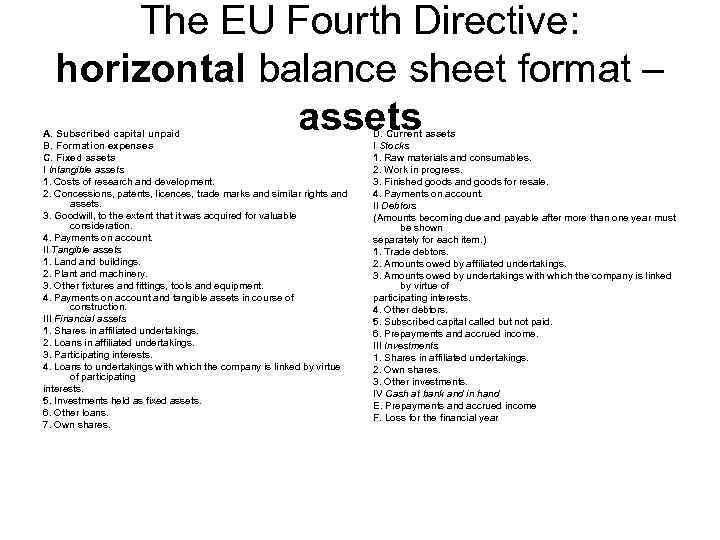

The EU Fourth Directive: horizontal balance sheet format – assets A. Subscribed capital unpaid B. Formation expenses C. Fixed assets I Intangible assets 1. Costs of research and development. 2. Concessions, patents, licences, trade marks and similar rights and assets. 3. Goodwill, to the extent that it was acquired for valuable consideration. 4. Payments on account. II Tangible assets 1. Land buildings. 2. Plant and machinery. 3. Other fixtures and fittings, tools and equipment. 4. Payments on account and tangible assets in course of construction. III Financial assets 1. Shares in affiliated undertakings. 2. Loans in affiliated undertakings. 3. Participating interests. 4. Loans to undertakings with which the company is linked by virtue of participating interests. 5. Investments held as fixed assets. 6. Other loans. 7. Own shares. D. Current assets I Stocks 1. Raw materials and consumables. 2. Work in progress. 3. Finished goods and goods for resale. 4. Payments on account. II Debtors (Amounts becoming due and payable after more than one year must be shown separately for each item. ) 1. Trade debtors. 2. Amounts owed by affiliated undertakings. 3. Amounts owed by undertakings with which the company is linked by virtue of participating interests. 4. Other debtors. 5. Subscribed capital called but not paid. 6. Prepayments and accrued income. III Investments 1. Shares in affiliated undertakings. 2. Own shares. 3. Other investments. IV Cash at bank and in hand E. Prepayments and accrued income F. Loss for the financial year

The EU Fourth Directive: horizontal balance sheet format – assets A. Subscribed capital unpaid B. Formation expenses C. Fixed assets I Intangible assets 1. Costs of research and development. 2. Concessions, patents, licences, trade marks and similar rights and assets. 3. Goodwill, to the extent that it was acquired for valuable consideration. 4. Payments on account. II Tangible assets 1. Land buildings. 2. Plant and machinery. 3. Other fixtures and fittings, tools and equipment. 4. Payments on account and tangible assets in course of construction. III Financial assets 1. Shares in affiliated undertakings. 2. Loans in affiliated undertakings. 3. Participating interests. 4. Loans to undertakings with which the company is linked by virtue of participating interests. 5. Investments held as fixed assets. 6. Other loans. 7. Own shares. D. Current assets I Stocks 1. Raw materials and consumables. 2. Work in progress. 3. Finished goods and goods for resale. 4. Payments on account. II Debtors (Amounts becoming due and payable after more than one year must be shown separately for each item. ) 1. Trade debtors. 2. Amounts owed by affiliated undertakings. 3. Amounts owed by undertakings with which the company is linked by virtue of participating interests. 4. Other debtors. 5. Subscribed capital called but not paid. 6. Prepayments and accrued income. III Investments 1. Shares in affiliated undertakings. 2. Own shares. 3. Other investments. IV Cash at bank and in hand E. Prepayments and accrued income F. Loss for the financial year

The EU Fourth Directive: horizontal balance sheet format – liabilities A. Capital and reserves I Subscribed capital II Share premium account III Revaluation reserve IV Reserves 1. Legal reserve. 2. Reserve for own shares. 3. Reserves provided for by the articles of association. 4. Other reserves. V Profit or loss brought forward VI Profit or loss for the financial year B. Provisions 1. Provisions for pensions and similar obligations. 2. Provisions for taxation. 3. Other provisions C Creditors (Amounts becoming due and payable within one year and amounts becoming due and payable after more than one year must be shown separately for each item and for the aggregate of these items. ) 1. Debenture loans, showing convertible loans separately. 2. Amounts owed to credit institutions. 3. Payments received on account of orders in so far as they are now shown separately as deductions from stocks. 4. Trade creditors. 5. Bills of exchange payable. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the company is linked by virtue of participating interests. 8. Other creditors including tax and social security. 9. Accruals and deferred income. D. Accruals and deferred income E. Profit for the financial year

The EU Fourth Directive: horizontal balance sheet format – liabilities A. Capital and reserves I Subscribed capital II Share premium account III Revaluation reserve IV Reserves 1. Legal reserve. 2. Reserve for own shares. 3. Reserves provided for by the articles of association. 4. Other reserves. V Profit or loss brought forward VI Profit or loss for the financial year B. Provisions 1. Provisions for pensions and similar obligations. 2. Provisions for taxation. 3. Other provisions C Creditors (Amounts becoming due and payable within one year and amounts becoming due and payable after more than one year must be shown separately for each item and for the aggregate of these items. ) 1. Debenture loans, showing convertible loans separately. 2. Amounts owed to credit institutions. 3. Payments received on account of orders in so far as they are now shown separately as deductions from stocks. 4. Trade creditors. 5. Bills of exchange payable. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the company is linked by virtue of participating interests. 8. Other creditors including tax and social security. 9. Accruals and deferred income. D. Accruals and deferred income E. Profit for the financial year

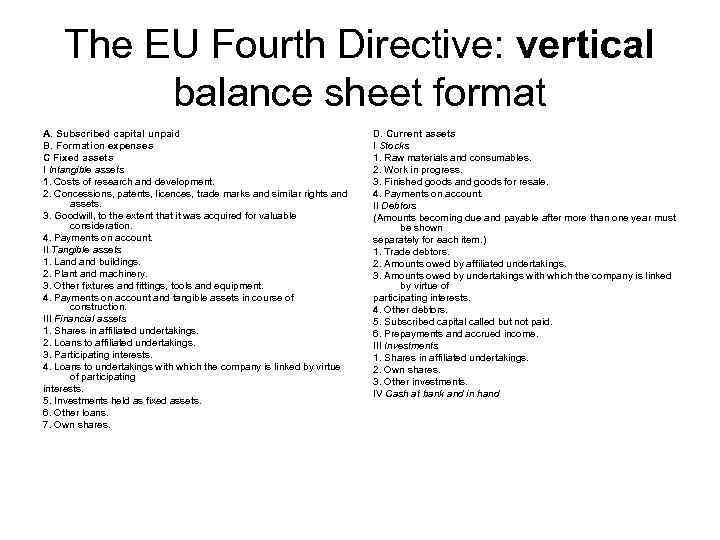

The Fourth Directive – balance sheet - 'vertical' format • Article 10 gives a 'vertical' format • more traditional in the UK • Companies are required to show the items in these tables in the order specified, • (except that the headings preceded by Arabic numbers may be combined or taken to the Notes)

The Fourth Directive – balance sheet - 'vertical' format • Article 10 gives a 'vertical' format • more traditional in the UK • Companies are required to show the items in these tables in the order specified, • (except that the headings preceded by Arabic numbers may be combined or taken to the Notes)

The EU Fourth Directive: vertical balance sheet format A. Subscribed capital unpaid B. Formation expenses C Fixed assets I Intangible assets 1. Costs of research and development. 2. Concessions, patents, licences, trade marks and similar rights and assets. 3. Goodwill, to the extent that it was acquired for valuable consideration. 4. Payments on account. II Tangible assets 1. Land buildings. 2. Plant and machinery. 3. Other fixtures and fittings, tools and equipment. 4. Payments on account and tangible assets in course of construction. III Financial assets 1. Shares in affiliated undertakings. 2. Loans to affiliated undertakings. 3. Participating interests. 4. Loans to undertakings with which the company is linked by virtue of participating interests. 5. Investments held as fixed assets. 6. Other loans. 7. Own shares. D. Current assets I Stocks 1. Raw materials and consumables. 2. Work in progress. 3. Finished goods and goods for resale. 4. Payments on account. II Debtors (Amounts becoming due and payable after more than one year must be shown separately for each item. ) 1. Trade debtors. 2. Amounts owed by affiliated undertakings. 3. Amounts owed by undertakings with which the company is linked by virtue of participating interests. 4. Other debtors. 5. Subscribed capital called but not paid. 6. Prepayments and accrued income. III Investments 1. Shares in affiliated undertakings. 2. Own shares. 3. Other investments. IV Cash at bank and in hand

The EU Fourth Directive: vertical balance sheet format A. Subscribed capital unpaid B. Formation expenses C Fixed assets I Intangible assets 1. Costs of research and development. 2. Concessions, patents, licences, trade marks and similar rights and assets. 3. Goodwill, to the extent that it was acquired for valuable consideration. 4. Payments on account. II Tangible assets 1. Land buildings. 2. Plant and machinery. 3. Other fixtures and fittings, tools and equipment. 4. Payments on account and tangible assets in course of construction. III Financial assets 1. Shares in affiliated undertakings. 2. Loans to affiliated undertakings. 3. Participating interests. 4. Loans to undertakings with which the company is linked by virtue of participating interests. 5. Investments held as fixed assets. 6. Other loans. 7. Own shares. D. Current assets I Stocks 1. Raw materials and consumables. 2. Work in progress. 3. Finished goods and goods for resale. 4. Payments on account. II Debtors (Amounts becoming due and payable after more than one year must be shown separately for each item. ) 1. Trade debtors. 2. Amounts owed by affiliated undertakings. 3. Amounts owed by undertakings with which the company is linked by virtue of participating interests. 4. Other debtors. 5. Subscribed capital called but not paid. 6. Prepayments and accrued income. III Investments 1. Shares in affiliated undertakings. 2. Own shares. 3. Other investments. IV Cash at bank and in hand

The EU Fourth Directive: vertical balance sheet format E. Prepayments and accrued income F. Creditors: amounts becoming due and payable within one year 1. Debenture loans, showing convertible loans separately. 2. Amounts owed to credit institutions. 3. Payments received on account of orders in so far as they are not shown separately as deductions from stocks. 4. Trade creditors. 5. Bills of exchange payable. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the company is linked by virtue of participating interests. 8. Other creditors including tax and social security. 9. Accrual and deferred income. G. Net current assets/liabilities H. Total assets less current liabilities I. Creditors: amounts becoming due and payable after more than one year 1. Debenture loans, showing convertible loans separately. 2. Amounts owed to credit institutions. 3. Payments received on account of orders in so far as they are now shown separately as deductions from stocks. 4. Trade creditors. 5. Bills of exchange payable. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the company is linked by virtue of participating interests. 8. Other creditors including tax and social security. 9. Accruals and deferred income. J. Provisions 1. Provisions for pensions and similar obligations. 2. Provisions for taxation. 3. Other provisions. K. Accruals and deferred income L. Capital and reserves I Subscribed capital II Share premium account III Revaluation reserve IV Reserves 1. Legal reserve. 2. Reserve for own shares. 3. Reserves provided for by the articles of association. 4. Other reserves. V Profit or loss brought forward VI Profit or loss for the financial year

The EU Fourth Directive: vertical balance sheet format E. Prepayments and accrued income F. Creditors: amounts becoming due and payable within one year 1. Debenture loans, showing convertible loans separately. 2. Amounts owed to credit institutions. 3. Payments received on account of orders in so far as they are not shown separately as deductions from stocks. 4. Trade creditors. 5. Bills of exchange payable. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the company is linked by virtue of participating interests. 8. Other creditors including tax and social security. 9. Accrual and deferred income. G. Net current assets/liabilities H. Total assets less current liabilities I. Creditors: amounts becoming due and payable after more than one year 1. Debenture loans, showing convertible loans separately. 2. Amounts owed to credit institutions. 3. Payments received on account of orders in so far as they are now shown separately as deductions from stocks. 4. Trade creditors. 5. Bills of exchange payable. 6. Amounts owed to affiliated undertakings. 7. Amounts owed to undertakings with which the company is linked by virtue of participating interests. 8. Other creditors including tax and social security. 9. Accruals and deferred income. J. Provisions 1. Provisions for pensions and similar obligations. 2. Provisions for taxation. 3. Other provisions. K. Accruals and deferred income L. Capital and reserves I Subscribed capital II Share premium account III Revaluation reserve IV Reserves 1. Legal reserve. 2. Reserve for own shares. 3. Reserves provided for by the articles of association. 4. Other reserves. V Profit or loss brought forward VI Profit or loss for the financial year

European Union • In the EU • companies that fall below a given size limit, • which is updated as circumstances change, • may be permitted (by the laws of member states) to produce abridged accounts

European Union • In the EU • companies that fall below a given size limit, • which is updated as circumstances change, • may be permitted (by the laws of member states) to produce abridged accounts

Requirements • • In some cases, more specific international standards provide precise requirements for presentation In sum: the fundamental requirement is to give a fair presentation

Requirements • • In some cases, more specific international standards provide precise requirements for presentation In sum: the fundamental requirement is to give a fair presentation

Income statements

Income statements

IASB proposal • the IASB announced proposals in 2006 • to replace (or expand) the income statement • with the statement of recognized income and expense (SORIE)

IASB proposal • the IASB announced proposals in 2006 • to replace (or expand) the income statement • with the statement of recognized income and expense (SORIE)

IAS 1 - income statement • IAS 1 requires • certain disclosures on the face of the income statement, • and other disclosures either on the face of the statement • or in the Notes

IAS 1 - income statement • IAS 1 requires • certain disclosures on the face of the income statement, • and other disclosures either on the face of the statement • or in the Notes

Minimum income statement items • revenues • finance costs • share of the after-tax profits and losses of associates and joint ventures • accounted for using the equity method • tax expense • pre-tax gain or loss on disposal of assets/liabilities of discontinuing operations • profit or loss • the amounts of profit attributable to the parent and to minority interest

Minimum income statement items • revenues • finance costs • share of the after-tax profits and losses of associates and joint ventures • accounted for using the equity method • tax expense • pre-tax gain or loss on disposal of assets/liabilities of discontinuing operations • profit or loss • the amounts of profit attributable to the parent and to minority interest

income statement • Additional line items, headings and subtotals • should be presented • when required by more specific IFRSs, • or when such additions are necessary to present fairly the financial performance

income statement • Additional line items, headings and subtotals • should be presented • when required by more specific IFRSs, • or when such additions are necessary to present fairly the financial performance

IAS 1 - income statement • IAS 1 explicitly accepts that • considerations of materiality • and the nature of the entity's operations may require – additions to, – deletions from, – or amendments of descriptions

IAS 1 - income statement • IAS 1 explicitly accepts that • considerations of materiality • and the nature of the entity's operations may require – additions to, – deletions from, – or amendments of descriptions

Requirement A requirement that an entity should present – either on the face of the income statement – or in the Notes to the income statement an analysis using a classification • based on either the nature of expenses • or their function

Requirement A requirement that an entity should present – either on the face of the income statement – or in the Notes to the income statement an analysis using a classification • based on either the nature of expenses • or their function

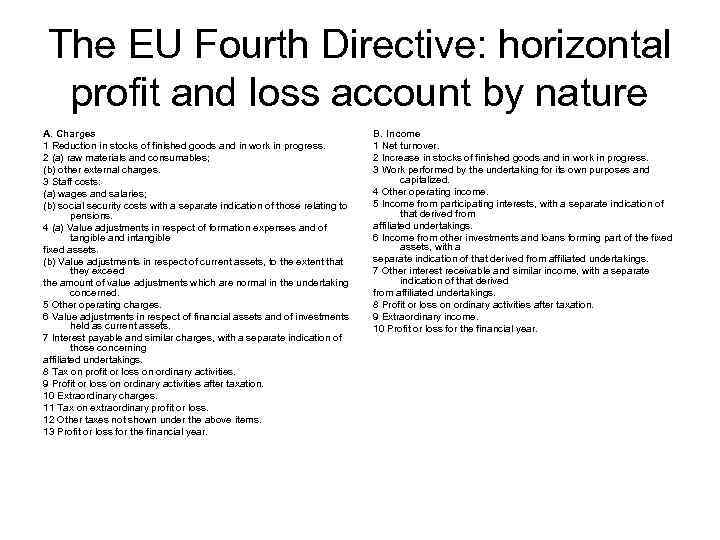

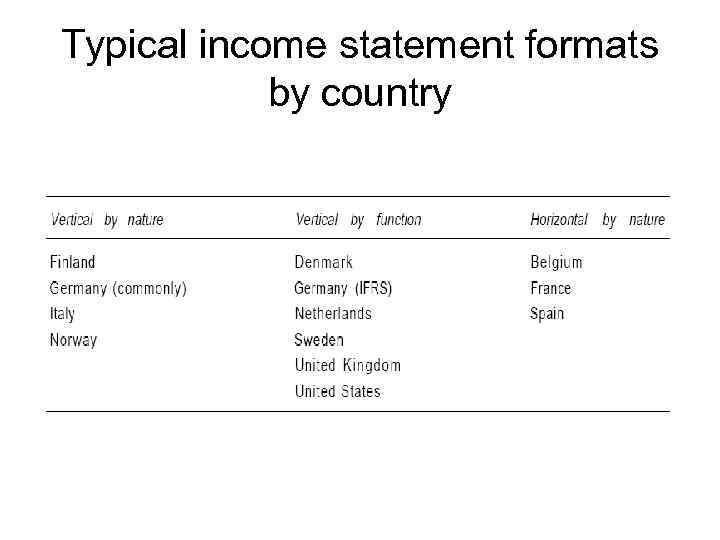

Formats of income statements Distinction between • classification by nature and • classification by function The Directive requires that • member states allow one or more of the four layouts given in its • Articles 23 to 26

Formats of income statements Distinction between • classification by nature and • classification by function The Directive requires that • member states allow one or more of the four layouts given in its • Articles 23 to 26

Four layouts It is possible to follow • an analysis by nature • an analysis by function, combined with either a – horizontal-type presentation – or a vertical-type presentation

Four layouts It is possible to follow • an analysis by nature • an analysis by function, combined with either a – horizontal-type presentation – or a vertical-type presentation

Income statement - vertical in style treating • the revenues (credits) as pluses • and the expenses (debits) as minuses the Directive allows: – a horizontal double-entry style of income statement – there are lines for 'extraordinary' items

Income statement - vertical in style treating • the revenues (credits) as pluses • and the expenses (debits) as minuses the Directive allows: – a horizontal double-entry style of income statement – there are lines for 'extraordinary' items

Extraordinary activities • In France and Italy, – such activities were taken to include the sale of fixed assets • in the UK – ordinary was defined so widely as to leave nothing as extraordinary The revision to IAS 1 of 2003 abolished the concept of extraordinary

Extraordinary activities • In France and Italy, – such activities were taken to include the sale of fixed assets • in the UK – ordinary was defined so widely as to leave nothing as extraordinary The revision to IAS 1 of 2003 abolished the concept of extraordinary

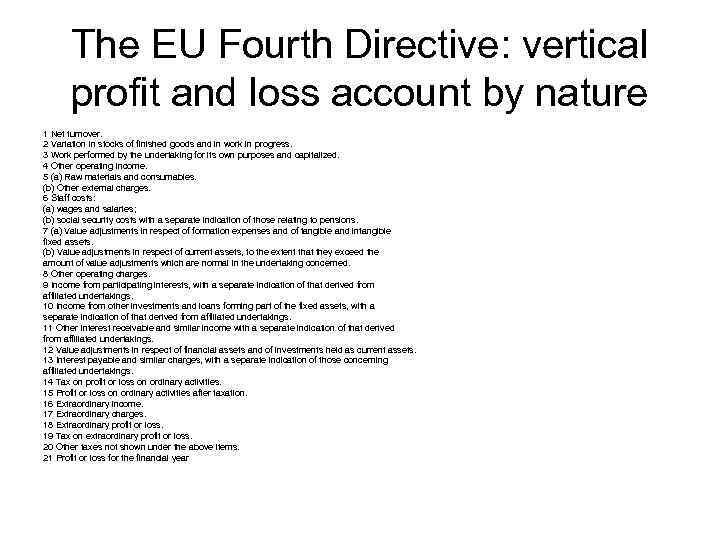

The EU Fourth Directive: vertical profit and loss account by nature 1 Net turnover. 2 Variation in stocks of finished goods and in work in progress. 3 Work performed by the undertaking for its own purposes and capitalized. 4 Other operating income. 5 (a) Raw materials and consumables. (b) Other external charges. 6 Staff costs: (a) wages and salaries; (b) social security costs with a separate indication of those relating to pensions. 7 (a) Value adjustments in respect of formation expenses and of tangible and intangible fixed assets. (b) Value adjustments in respect of current assets, to the extent that they exceed the amount of value adjustments which are normal in the undertaking concerned. 8 Other operating charges. 9 Income from participating interests, with a separate indication of that derived from affiliated undertakings. 10 Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 11 Other interest receivable and similar income with a separate indication of that derived from affiliated undertakings. 12 Value adjustments in respect of financial assets and of investments held as current assets. 13 Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 14 Tax on profit or loss on ordinary activities. 15 Profit or loss on ordinary activities after taxation. 16 Extraordinary income. 17 Extraordinary charges. 18 Extraordinary profit or loss. 19 Tax on extraordinary profit or loss. 20 Other taxes not shown under the above items. 21 Profit or loss for the financial year

The EU Fourth Directive: vertical profit and loss account by nature 1 Net turnover. 2 Variation in stocks of finished goods and in work in progress. 3 Work performed by the undertaking for its own purposes and capitalized. 4 Other operating income. 5 (a) Raw materials and consumables. (b) Other external charges. 6 Staff costs: (a) wages and salaries; (b) social security costs with a separate indication of those relating to pensions. 7 (a) Value adjustments in respect of formation expenses and of tangible and intangible fixed assets. (b) Value adjustments in respect of current assets, to the extent that they exceed the amount of value adjustments which are normal in the undertaking concerned. 8 Other operating charges. 9 Income from participating interests, with a separate indication of that derived from affiliated undertakings. 10 Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 11 Other interest receivable and similar income with a separate indication of that derived from affiliated undertakings. 12 Value adjustments in respect of financial assets and of investments held as current assets. 13 Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 14 Tax on profit or loss on ordinary activities. 15 Profit or loss on ordinary activities after taxation. 16 Extraordinary income. 17 Extraordinary charges. 18 Extraordinary profit or loss. 19 Tax on extraordinary profit or loss. 20 Other taxes not shown under the above items. 21 Profit or loss for the financial year

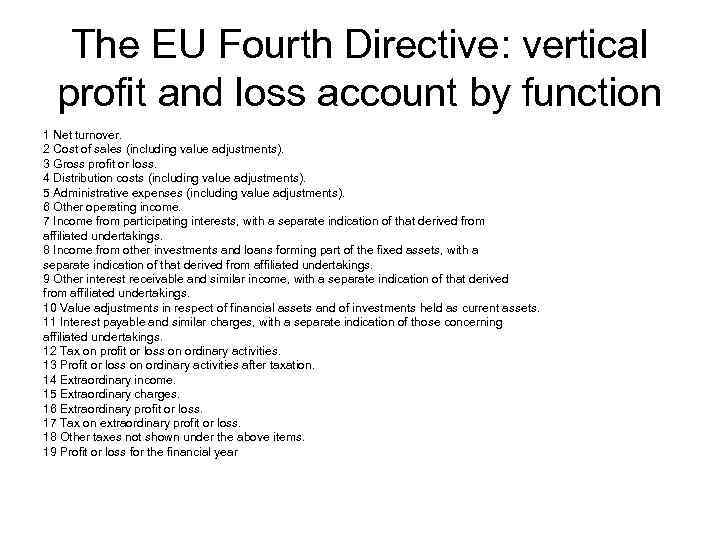

The EU Fourth Directive: vertical profit and loss account by function 1 Net turnover. 2 Cost of sales (including value adjustments). 3 Gross profit or loss. 4 Distribution costs (including value adjustments). 5 Administrative expenses (including value adjustments). 6 Other operating income. 7 Income from participating interests, with a separate indication of that derived from affiliated undertakings. 8 Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 9 Other interest receivable and similar income, with a separate indication of that derived from affiliated undertakings. 10 Value adjustments in respect of financial assets and of investments held as current assets. 11 Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 12 Tax on profit or loss on ordinary activities. 13 Profit or loss on ordinary activities after taxation. 14 Extraordinary income. 15 Extraordinary charges. 16 Extraordinary profit or loss. 17 Tax on extraordinary profit or loss. 18 Other taxes not shown under the above items. 19 Profit or loss for the financial year

The EU Fourth Directive: vertical profit and loss account by function 1 Net turnover. 2 Cost of sales (including value adjustments). 3 Gross profit or loss. 4 Distribution costs (including value adjustments). 5 Administrative expenses (including value adjustments). 6 Other operating income. 7 Income from participating interests, with a separate indication of that derived from affiliated undertakings. 8 Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 9 Other interest receivable and similar income, with a separate indication of that derived from affiliated undertakings. 10 Value adjustments in respect of financial assets and of investments held as current assets. 11 Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 12 Tax on profit or loss on ordinary activities. 13 Profit or loss on ordinary activities after taxation. 14 Extraordinary income. 15 Extraordinary charges. 16 Extraordinary profit or loss. 17 Tax on extraordinary profit or loss. 18 Other taxes not shown under the above items. 19 Profit or loss for the financial year

Advantages and usefulness of the four Directive formats for the income statement The vertical presentations are increasingly predominant As between the by-nature and by-function classification both methods have advantages

Advantages and usefulness of the four Directive formats for the income statement The vertical presentations are increasingly predominant As between the by-nature and by-function classification both methods have advantages

Expenses by nature • requires less analysis and less judgement but is arguably less informative • It fails to reveal the cost of sales, • therefore the gross profit, it has the disadvantage: changes in inventory are an expense or a revenue

Expenses by nature • requires less analysis and less judgement but is arguably less informative • It fails to reveal the cost of sales, • therefore the gross profit, it has the disadvantage: changes in inventory are an expense or a revenue

Expenses by nature • IAS 1 and the Directive • require additional disclosure on the nature of expenses, • including – depreciation and amortization – expenses and – staff costs, • when the by-function classification is used

Expenses by nature • IAS 1 and the Directive • require additional disclosure on the nature of expenses, • including – depreciation and amortization – expenses and – staff costs, • when the by-function classification is used

different formats • the different formats do not lead to differences in reported net income • Different formats do not imply different measurements

different formats • the different formats do not lead to differences in reported net income • Different formats do not imply different measurements

The EU Fourth Directive: horizontal profit and loss account by nature A. Charges 1 Reduction in stocks of finished goods and in work in progress. 2 (a) raw materials and consumables; (b) other external charges. 3 Staff costs: (a) wages and salaries; (b) social security costs with a separate indication of those relating to pensions. 4 (a) Value adjustments in respect of formation expenses and of tangible and intangible fixed assets. (b) Value adjustments in respect of current assets, to the extent that they exceed the amount of value adjustments which are normal in the undertaking concerned. 5 Other operating charges. 6 Value adjustments in respect of financial assets and of investments held as current assets. 7 Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 8 Tax on profit or loss on ordinary activities. 9 Profit or loss on ordinary activities after taxation. 10 Extraordinary charges. 11 Tax on extraordinary profit or loss. 12 Other taxes not shown under the above items. 13 Profit or loss for the financial year. B. Income 1 Net turnover. 2 Increase in stocks of finished goods and in work in progress. 3 Work performed by the undertaking for its own purposes and capitalized. 4 Other operating income. 5 Income from participating interests, with a separate indication of that derived from affiliated undertakings. 6 Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 7 Other interest receivable and similar income, with a separate indication of that derived from affiliated undertakings. 8 Profit or loss on ordinary activities after taxation. 9 Extraordinary income. 10 Profit or loss for the financial year.

The EU Fourth Directive: horizontal profit and loss account by nature A. Charges 1 Reduction in stocks of finished goods and in work in progress. 2 (a) raw materials and consumables; (b) other external charges. 3 Staff costs: (a) wages and salaries; (b) social security costs with a separate indication of those relating to pensions. 4 (a) Value adjustments in respect of formation expenses and of tangible and intangible fixed assets. (b) Value adjustments in respect of current assets, to the extent that they exceed the amount of value adjustments which are normal in the undertaking concerned. 5 Other operating charges. 6 Value adjustments in respect of financial assets and of investments held as current assets. 7 Interest payable and similar charges, with a separate indication of those concerning affiliated undertakings. 8 Tax on profit or loss on ordinary activities. 9 Profit or loss on ordinary activities after taxation. 10 Extraordinary charges. 11 Tax on extraordinary profit or loss. 12 Other taxes not shown under the above items. 13 Profit or loss for the financial year. B. Income 1 Net turnover. 2 Increase in stocks of finished goods and in work in progress. 3 Work performed by the undertaking for its own purposes and capitalized. 4 Other operating income. 5 Income from participating interests, with a separate indication of that derived from affiliated undertakings. 6 Income from other investments and loans forming part of the fixed assets, with a separate indication of that derived from affiliated undertakings. 7 Other interest receivable and similar income, with a separate indication of that derived from affiliated undertakings. 8 Profit or loss on ordinary activities after taxation. 9 Extraordinary income. 10 Profit or loss for the financial year.

Typical income statement formats by country

Typical income statement formats by country

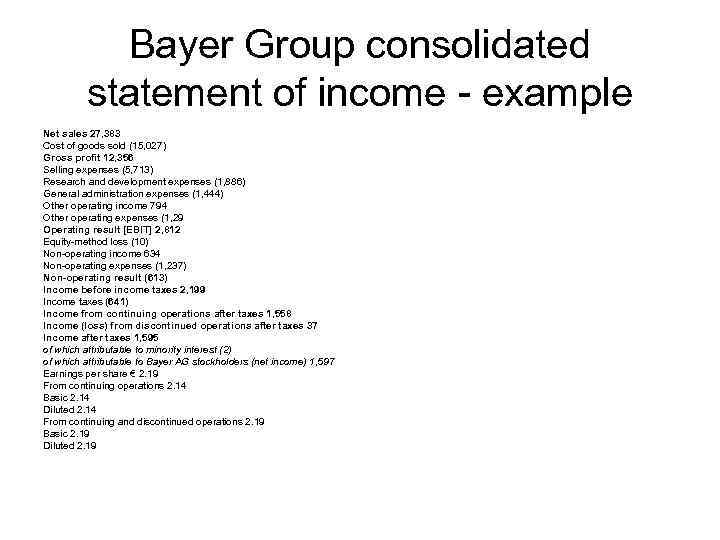

Bayer Group consolidated statement of income - example Net sales 27, 383 Cost of goods sold (15, 027) Gross profit 12, 356 Selling expenses (5, 713) Research and development expenses (1, 886) General administration expenses (1, 444) Other operating income 794 Other operating expenses (1, 29 Operating result [EBIT] 2, 812 Equity-method loss (10) Non-operating income 634 Non-operating expenses (1, 237) Non-operating result (613) Income before income taxes 2, 199 Income taxes (641) Income from continuing operations after taxes 1, 558 Income (loss) from discontinued operations after taxes 37 Income after taxes 1, 595 of which attributable to minority interest (2) of which attributable to Bayer AG stockholders (net income) 1, 597 Earnings per share € 2. 19 From continuing operations 2. 14 Basic 2. 14 Diluted 2. 14 From continuing and discontinued operations 2. 19 Basic 2. 19 Diluted 2. 19

Bayer Group consolidated statement of income - example Net sales 27, 383 Cost of goods sold (15, 027) Gross profit 12, 356 Selling expenses (5, 713) Research and development expenses (1, 886) General administration expenses (1, 444) Other operating income 794 Other operating expenses (1, 29 Operating result [EBIT] 2, 812 Equity-method loss (10) Non-operating income 634 Non-operating expenses (1, 237) Non-operating result (613) Income before income taxes 2, 199 Income taxes (641) Income from continuing operations after taxes 1, 558 Income (loss) from discontinued operations after taxes 37 Income after taxes 1, 595 of which attributable to minority interest (2) of which attributable to Bayer AG stockholders (net income) 1, 597 Earnings per share € 2. 19 From continuing operations 2. 14 Basic 2. 14 Diluted 2. 14 From continuing and discontinued operations 2. 19 Basic 2. 19 Diluted 2. 19

Comprehensive income • discussion in recent years over the issue of – reporting total, – or comprehensive income Why? • only realized profits should be included in the income statement

Comprehensive income • discussion in recent years over the issue of – reporting total, – or comprehensive income Why? • only realized profits should be included in the income statement

Comprehensive income - problems • the definition of 'realized' is unclear • a wide variety of other value changes affecting assets and liabilities – may have taken place during the year • fair presentation may well require their separate reporting

Comprehensive income - problems • the definition of 'realized' is unclear • a wide variety of other value changes affecting assets and liabilities – may have taken place during the year • fair presentation may well require their separate reporting

Comprehensive income • Such value changes will inevitably affect owner's equity • Any event - other than a transfer of resources between the owners and the entity - must represent a gain or a loss • These gains or losses are all part of 'comprehensive income'

Comprehensive income • Such value changes will inevitably affect owner's equity • Any event - other than a transfer of resources between the owners and the entity - must represent a gain or a loss • These gains or losses are all part of 'comprehensive income'

Tendency in the past • preparers and users of financial statements • to focus attention on the income statement in general • and the final net profit figure in particular

Tendency in the past • preparers and users of financial statements • to focus attention on the income statement in general • and the final net profit figure in particular

Focus on net profit • from a creditor perspective: only gains – received in cash – or near-cash are reliable • However, other recognized changes in assets and liabilities – carry significant information content!

Focus on net profit • from a creditor perspective: only gains – received in cash – or near-cash are reliable • However, other recognized changes in assets and liabilities – carry significant information content!

Nowadays IASB • explicitly in its Framework • And generally in recent standards, • puts emphasis on asset and liability definitions and measurement, (rather than on revenue and expense definitions and measurement) (for example, increases in assets are recognized as income)

Nowadays IASB • explicitly in its Framework • And generally in recent standards, • puts emphasis on asset and liability definitions and measurement, (rather than on revenue and expense definitions and measurement) (for example, increases in assets are recognized as income)

the idea of an additional reporting statement a statement of total recognized gains and losses should show the • net profit or loss for the period, • each other item of income, expense, • gain or loss, and • the cumulative effect of changes in accounting policy • and the correction of fundamental errors

the idea of an additional reporting statement a statement of total recognized gains and losses should show the • net profit or loss for the period, • each other item of income, expense, • gain or loss, and • the cumulative effect of changes in accounting policy • and the correction of fundamental errors

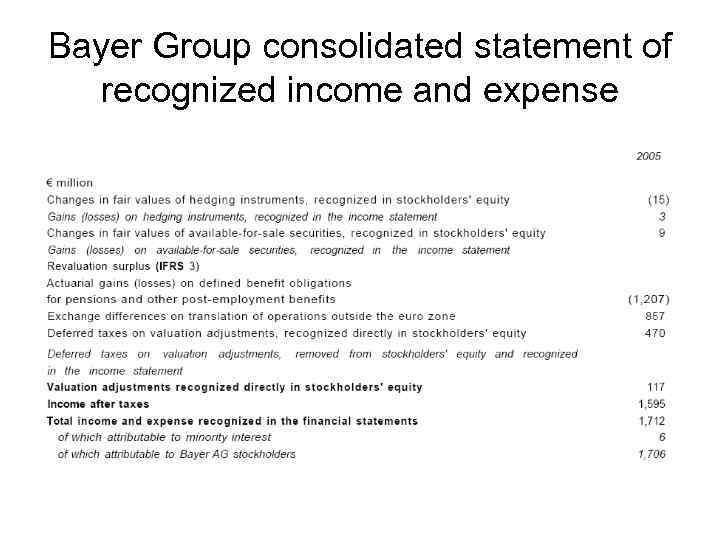

Bayer Group consolidated statement of recognized income and expense

Bayer Group consolidated statement of recognized income and expense

Statement of changes in equity • The alternative method of presentation (allowed by IAS 1) • It includes the items in the SORIE • and also transactions with owners – such as dividend payments and new share issues

Statement of changes in equity • The alternative method of presentation (allowed by IAS 1) • It includes the items in the SORIE • and also transactions with owners – such as dividend payments and new share issues

US reporting • These two types of statement are also allowed in the USA • it is also allowed to combine • the income statement with the SORIE – as a statement of comprehensive income

US reporting • These two types of statement are also allowed in the USA • it is also allowed to combine • the income statement with the SORIE – as a statement of comprehensive income

statement of comprehensive income – advantages • has relevance to the determination of business wealth, • and therefore • to shareholder wealth, security for creditors, etc.

statement of comprehensive income – advantages • has relevance to the determination of business wealth, • and therefore • to shareholder wealth, security for creditors, etc.

statement of comprehensive income • a statement of comprehensive income does not try • to present so much detail on one page • it becomes incomprehensible instead of comprehensive

statement of comprehensive income • a statement of comprehensive income does not try • to present so much detail on one page • it becomes incomprehensible instead of comprehensive

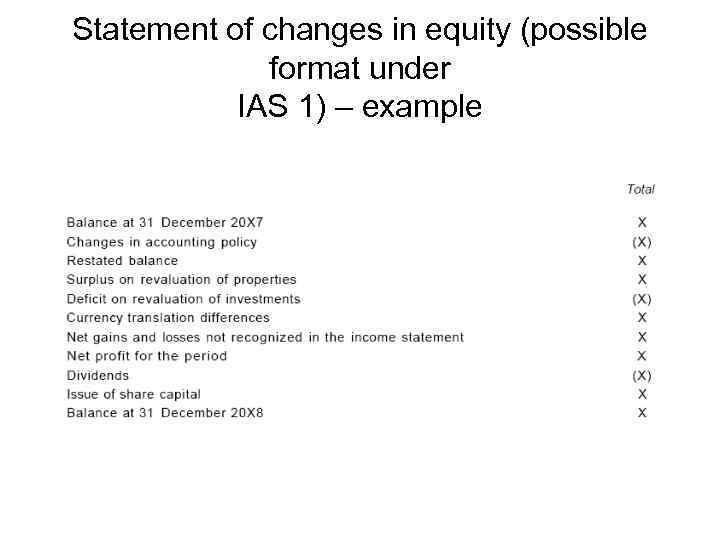

Statement of changes in equity (possible format under IAS 1) – example

Statement of changes in equity (possible format under IAS 1) – example

Cash flow statements • There is a need • not only to focus on earnings as derived under the accruals convention, • but also on – the cash position and – cash movements of the reporting entity

Cash flow statements • There is a need • not only to focus on earnings as derived under the accruals convention, • but also on – the cash position and – cash movements of the reporting entity

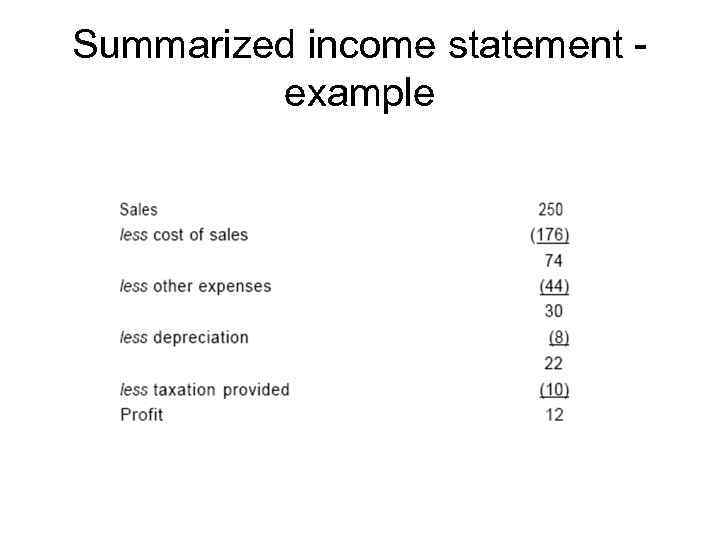

Summarized income statement example

Summarized income statement example

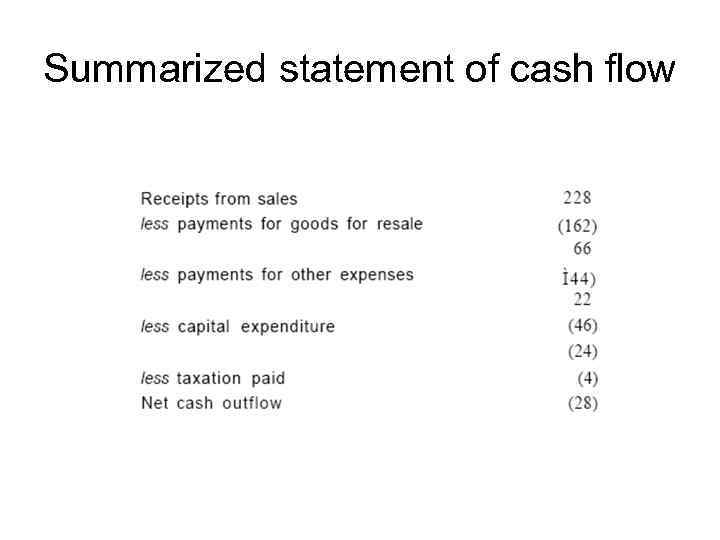

Summarized statement of cash flow

Summarized statement of cash flow

Example • This shows a reduction in the cash resources of the business • In any one year such a reduction may be sensible – even desirable - as part of the process of strategic development • in the long run such annual reductions cannot be allowed

Example • This shows a reduction in the cash resources of the business • In any one year such a reduction may be sensible – even desirable - as part of the process of strategic development • in the long run such annual reductions cannot be allowed

Cash flow – the difference • CF is a report on the cash or liquid funds • provides useful and important information • different in focus and information content from the income statement • (IAS 7)

Cash flow – the difference • CF is a report on the cash or liquid funds • provides useful and important information • different in focus and information content from the income statement • (IAS 7)

Notes to the financial statements – contents • the basis of preparation of the financial statements • the specific accounting policies • to disclose any information required that is not included elsewhere • to provide additional information, which is necessary to ensure a fair presentation

Notes to the financial statements – contents • the basis of preparation of the financial statements • the specific accounting policies • to disclose any information required that is not included elsewhere • to provide additional information, which is necessary to ensure a fair presentation

Notes to the financial statements • need to be presented systematically • with each item on the face of – the balance sheet, – income statement and – cash flow statement • cross-referenced to any related information in the Notes

Notes to the financial statements • need to be presented systematically • with each item on the face of – the balance sheet, – income statement and – cash flow statement • cross-referenced to any related information in the Notes

It is usual to begin the Notes • with a statement of compliance with the appropriate set of accounting principles • Each specific accounting policy that has been used • and which is necessary for a proper understanding of the financial statements

It is usual to begin the Notes • with a statement of compliance with the appropriate set of accounting principles • Each specific accounting policy that has been used • and which is necessary for a proper understanding of the financial statements

Other general disclosure requirements • segment reporting • discontinued operations • earnings per share • interim financial reports

Other general disclosure requirements • segment reporting • discontinued operations • earnings per share • interim financial reports

Segment reporting • Many large companies are 'conglomerate' entities • they are involved in a number of distinct industries or types of business • or multinational corporations operating in several different countries or regions – that have different economic and political characteristics

Segment reporting • Many large companies are 'conglomerate' entities • they are involved in a number of distinct industries or types of business • or multinational corporations operating in several different countries or regions – that have different economic and political characteristics

Segment reporting • Understanding the past and potential • performance of the entity • as a whole requires an • understanding of the separate component parts

Segment reporting • Understanding the past and potential • performance of the entity • as a whole requires an • understanding of the separate component parts

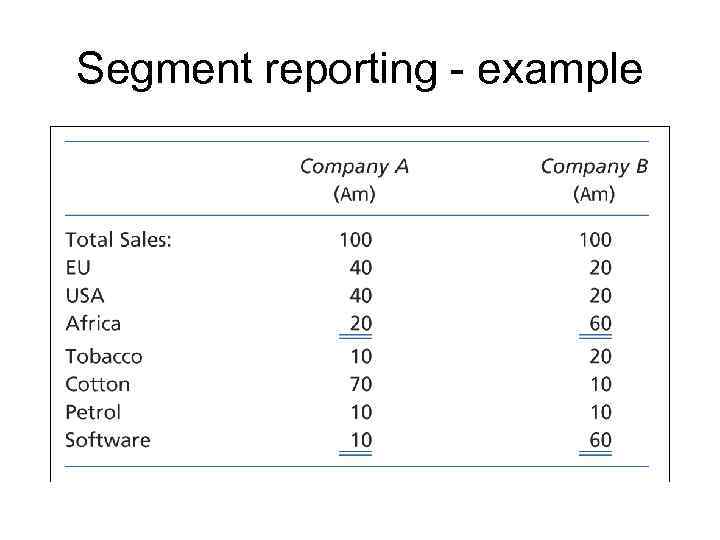

Segment reporting - example

Segment reporting - example

IAS 14 - Segment Reporting • distinguishes between two reporting formats: – business segments – geographical segments

IAS 14 - Segment Reporting • distinguishes between two reporting formats: – business segments – geographical segments

IAS 14 - Segment Reporting • The IAS requires entities to provide segment information about both dimensions – as a primary reporting format – and a secondary reporting format The primary reporting format generally follows the way in which the business is organized and managed

IAS 14 - Segment Reporting • The IAS requires entities to provide segment information about both dimensions – as a primary reporting format – and a secondary reporting format The primary reporting format generally follows the way in which the business is organized and managed

IAS 14 - Segment Reporting • A segment of a company's operations should be reported separately – if its revenue, results or assets are 10 % or more of the total • The segment information reported should be prepared – same way used in the financial statements

IAS 14 - Segment Reporting • A segment of a company's operations should be reported separately – if its revenue, results or assets are 10 % or more of the total • The segment information reported should be prepared – same way used in the financial statements

The principal disclosures for an entity's primary segment reporting • • segment revenue; segment result; segment assets and segment liabilities; a reconciliation – between the information disclosed for reportable segments – and the aggregate total figures reported in the financial statements

The principal disclosures for an entity's primary segment reporting • • segment revenue; segment result; segment assets and segment liabilities; a reconciliation – between the information disclosed for reportable segments – and the aggregate total figures reported in the financial statements

Segment Reporting • In 2006 • the IASB issued IFRS 8 – requires reporting on the basis of the segments reported to the entity's chief operating officer • IFRS 8 is compulsory from 2009

Segment Reporting • In 2006 • the IASB issued IFRS 8 – requires reporting on the basis of the segments reported to the entity's chief operating officer • IFRS 8 is compulsory from 2009

Discontinued operations - IFRS 5 A relatively large component that has been disposed of completely or substantially. • The effects of such discontinuation are likely to be significant – both in their own right – and in changing the likely future results of the remaining parts of the entity

Discontinued operations - IFRS 5 A relatively large component that has been disposed of completely or substantially. • The effects of such discontinuation are likely to be significant – both in their own right – and in changing the likely future results of the remaining parts of the entity

Discontinued operations - IFRS 5 • Fair presentation requires • the discontinued and continuing operations are distinguished • This will improve the ability of – investors, creditors and other users of statements – to make projections of • cash flows, • earnings-generating capacity • and financial position

Discontinued operations - IFRS 5 • Fair presentation requires • the discontinued and continuing operations are distinguished • This will improve the ability of – investors, creditors and other users of statements – to make projections of • cash flows, • earnings-generating capacity • and financial position

IAS 33 - Earnings per Share • EPS, is an important summary indicator of entity performance • for investors and • other users of financial statements • provides a basis of comparison between listed entities • and is an indicator of market confidence

IAS 33 - Earnings per Share • EPS, is an important summary indicator of entity performance • for investors and • other users of financial statements • provides a basis of comparison between listed entities • and is an indicator of market confidence

IAS 33 - Earnings per Share • two forms 'basic' and 'diluted' – The basic EPS reports the EPS essentially as under current circumstances – The diluted EPS calculates the ratio as if • the dilutive effect of potential ordinary or common shares currently foreseeable had already taken place

IAS 33 - Earnings per Share • two forms 'basic' and 'diluted' – The basic EPS reports the EPS essentially as under current circumstances – The diluted EPS calculates the ratio as if • the dilutive effect of potential ordinary or common shares currently foreseeable had already taken place

Interim financial reports - IAS 34 • Annual financial statements • Cover a long period, • It is helpful to many users of financial statements • to receive • one or more progress reports • at interim points through the year

Interim financial reports - IAS 34 • Annual financial statements • Cover a long period, • It is helpful to many users of financial statements • to receive • one or more progress reports • at interim points through the year

Interim financial reports - IAS 43 • This is a requirement for most • stock exchanges, • which are likely to have regulations on such interim statements

Interim financial reports - IAS 43 • This is a requirement for most • stock exchanges, • which are likely to have regulations on such interim statements

Interim financial reports - IAS 34 • IAS 34 sets out the minimum content of an interim financial report: a condensed – balance sheet, – income statement, – cash flow statement and – statement of changes in equity, with selected notes to the statements

Interim financial reports - IAS 34 • IAS 34 sets out the minimum content of an interim financial report: a condensed – balance sheet, – income statement, – cash flow statement and – statement of changes in equity, with selected notes to the statements

The objective of IAS 34 • to provide a report that updates the most recent annual financial statements • by focusing on those items that are significant to an understanding of the changes in – financial position and – performance of the entity • Policies should be consistent with those used in the annual accounts

The objective of IAS 34 • to provide a report that updates the most recent annual financial statements • by focusing on those items that are significant to an understanding of the changes in – financial position and – performance of the entity • Policies should be consistent with those used in the annual accounts

IAS 34 – main principles • Measurements for interim purposes – are generally made on a year-to-date basis • Seasonal or cyclical revenues or expenses – should not be smoothed or averaged over the various interim periods

IAS 34 – main principles • Measurements for interim purposes – are generally made on a year-to-date basis • Seasonal or cyclical revenues or expenses – should not be smoothed or averaged over the various interim periods