Group_7_Coca-Cola_task-1.pptx

- Количество слайдов: 12

THE COCA-COLA COMPANY Done by group #7: Anna Perelygina Alina Yakovleva Azuolas Zilius Olga Lutsenko Lera Pogorelova

Plan 1. Key financial indicators of Coca-Cola. Its competitive strengths. 2. Strategy choice of Coca-Cola company. Levers and implications. 3. SWOT analysis. 4. TOP 3 activities to achieve further growth. WIUU. Group #7. Coca-Cola analysis. 2

Key Financial Indicators (part 1) For our key financial indicators part we have chosen some financials that will show different measures of financial performance. Du Pont formula: ROE=NPM*ATO*EM - it examines trends and causes of ROE. WIUU. Group #7. Coca-Cola analysis. 3

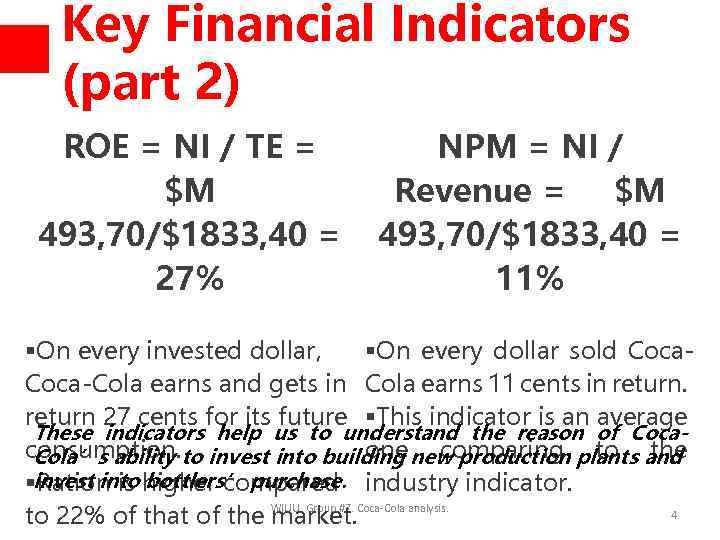

Key Financial Indicators (part 2) ROE = NI / TE = $M 493, 70/$1833, 40 = 27% NPM = NI / Revenue = $M 493, 70/$1833, 40 = 11% §On every invested dollar, §On every dollar sold Coca-Cola earns and gets in Cola earns 11 cents in return 27 cents for its future §This indicator is an average These indicators help us to understand the reason of Cocaconsumption. to invest into building new production plants and one comparing to the Cola’s ability §invest into higher compared industry indicator. Ration is bottlers’ purchase. WIUU. Group #7. Coca-Cola analysis. 4 to 22% of that of the market.

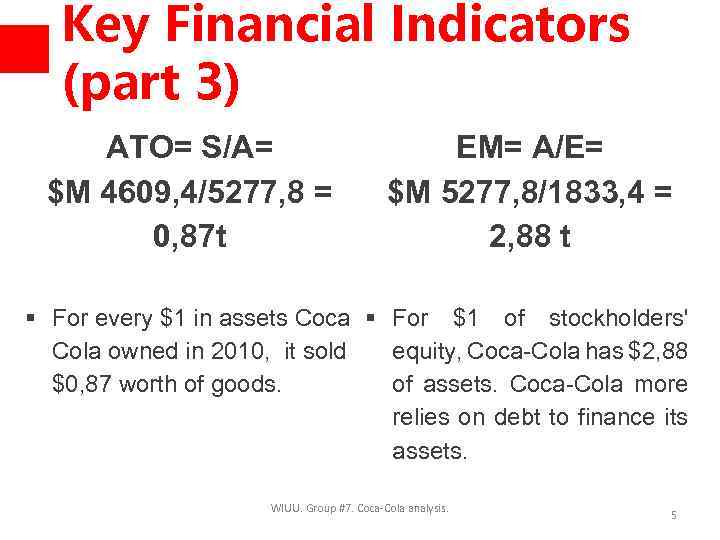

Key Financial Indicators (part 3) ATO= S/A= $M 4609, 4/5277, 8 = 0, 87 t EM= A/E= $M 5277, 8/1833, 4 = 2, 88 t § For every $1 in assets Coca § For $1 of stockholders' Cola owned in 2010, it sold equity, Coca-Cola has $2, 88 $0, 87 worth of goods. of assets. Coca-Cola more relies on debt to finance its assets. WIUU. Group #7. Coca-Cola analysis. 5

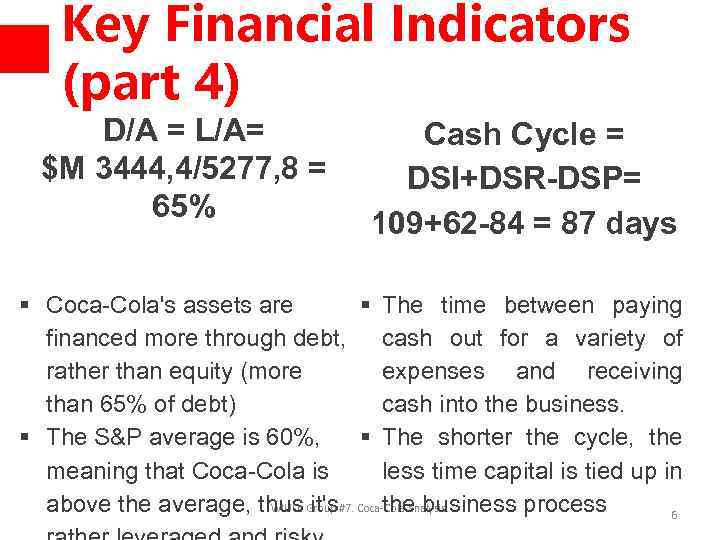

Key Financial Indicators (part 4) D/A = L/A= $M 3444, 4/5277, 8 = 65% Cash Cycle = DSI+DSR-DSP= 109+62 -84 = 87 days § Coca-Cola's assets are § The time between paying financed more through debt, cash out for a variety of rather than equity (more expenses and receiving than 65% of debt) cash into the business. § The S&P average is 60%, § The shorter the cycle, the meaning that Coca-Cola is less time capital is tied up in above the average, thus it's Coca-Cola analysis. the business process WIUU. Group #7. 6

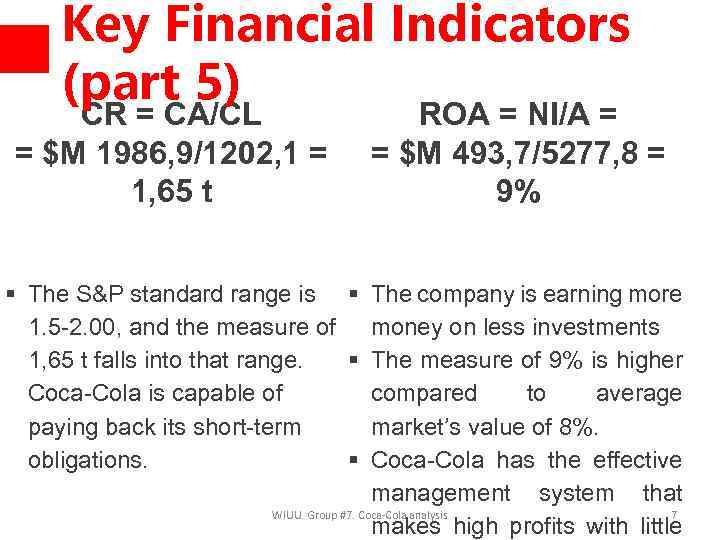

Key Financial Indicators (part 5) CR = CA/CL = $M 1986, 9/1202, 1 = 1, 65 t ROA = NI/A = = $M 493, 7/5277, 8 = 9% § The S&P standard range is § 1. 5 -2. 00, and the measure of 1, 65 t falls into that range. § Coca-Cola is capable of paying back its short-term obligations. § The company is earning more money on less investments The measure of 9% is higher compared to average market’s value of 8%. Coca-Cola has the effective management system that WIUU. Group #7. Coca-Cola analysis 7 makes high profits with little

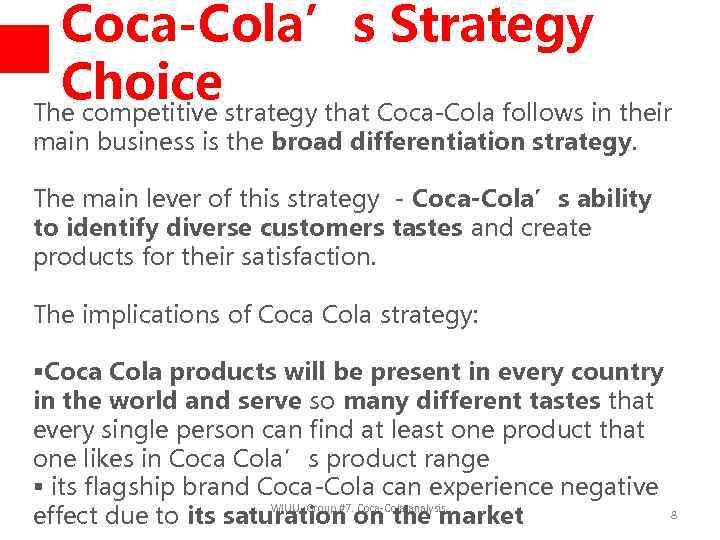

Coca-Cola’s Strategy Choice strategy that Coca-Cola follows in their The competitive main business is the broad differentiation strategy. The main lever of this strategy - Coca-Cola’s ability to identify diverse customers tastes and create products for their satisfaction. The implications of Coca Cola strategy: §Coca Cola products will be present in every country in the world and serve so many different tastes that every single person can find at least one product that one likes in Coca Cola’s product range § its flagship brand Coca-Cola can experience negative WIUU. Group #7. Coca-Cola analysis. 8 effect due to its saturation on the market

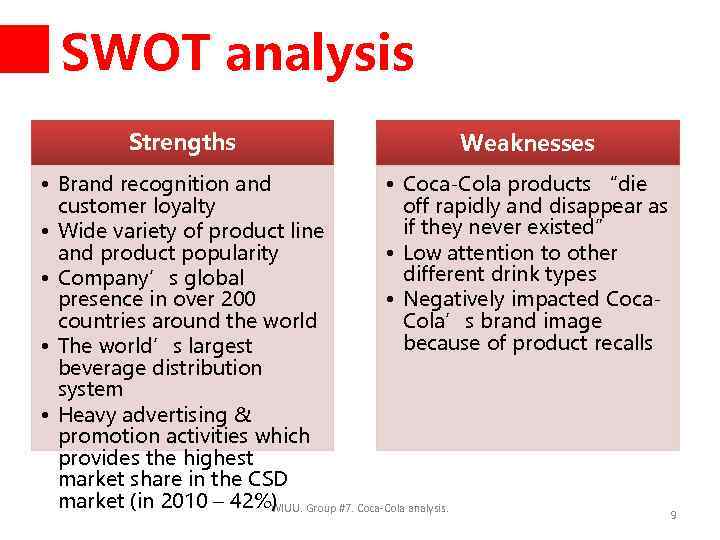

SWOT analysis Strengths Weaknesses • Brand recognition and • Coca-Cola products “die customer loyalty off rapidly and disappear as if they never existed” • Wide variety of product line and product popularity • Low attention to other different drink types • Company’s global presence in over 200 • Negatively impacted Cocacountries around the world Cola’s brand image because of product recalls • The world’s largest beverage distribution system • Heavy advertising & promotion activities which provides the highest market share in the CSD market (in 2010 – 42%) Group #7. Coca-Cola analysis. WIUU. 9

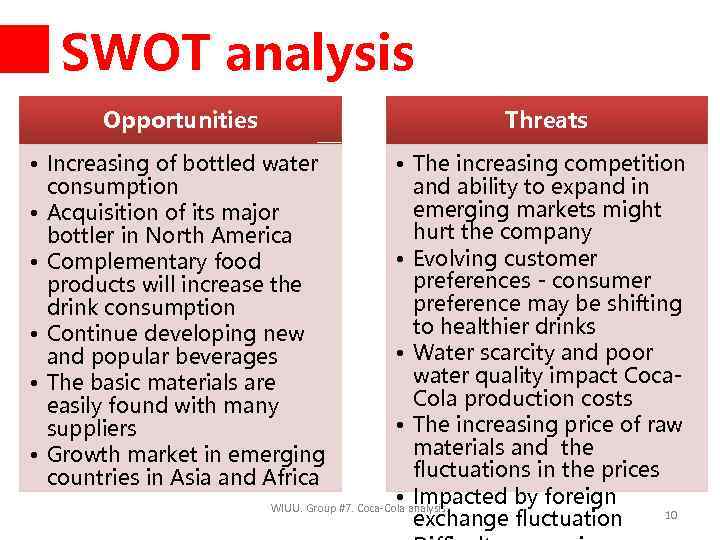

SWOT analysis Opportunities Threats • Increasing of bottled water consumption • Acquisition of its major bottler in North America • Complementary food products will increase the drink consumption • Continue developing new and popular beverages • The basic materials are easily found with many suppliers • Growth market in emerging countries in Asia and Africa • The increasing competition and ability to expand in emerging markets might hurt the company • Evolving customer preferences - consumer preference may be shifting to healthier drinks • Water scarcity and poor water quality impact Coca. Cola production costs • The increasing price of raw materials and the fluctuations in the prices • Impacted by foreign WIUU. Group #7. Coca-Cola analysis. 10 exchange fluctuation

TOP 3 activities 1. Expanding into emerging markets 2. Focus on Innovations thus providing innovative and healthier products to consumers 3. Focus on advertising and sales activities to establish customers’ loyalty to the products other than its flagship product coca-cola WIUU. Group #7. Coca-Cola analysis. 11

Thank You very much for Your attention. Any questions? WIUU. Group #7. Coca-Cola analysis. 12

Group_7_Coca-Cola_task-1.pptx