6d2715c0bc4b22a767f69111132f04ab.ppt

- Количество слайдов: 24

The Chinese Government Bond Market: Opportunities and Challenges S. Ghon Rhee, Ph. D. K. J. Luke Distinguished Professor of Finance Executive Director Asia-Pacific Financial Markets Research Center University of Hawai‘i Presentation at US Central Intelligence Agency March 26, 2004 Asia-Pacific Financial Markets Research Center, University of Hawaii 1

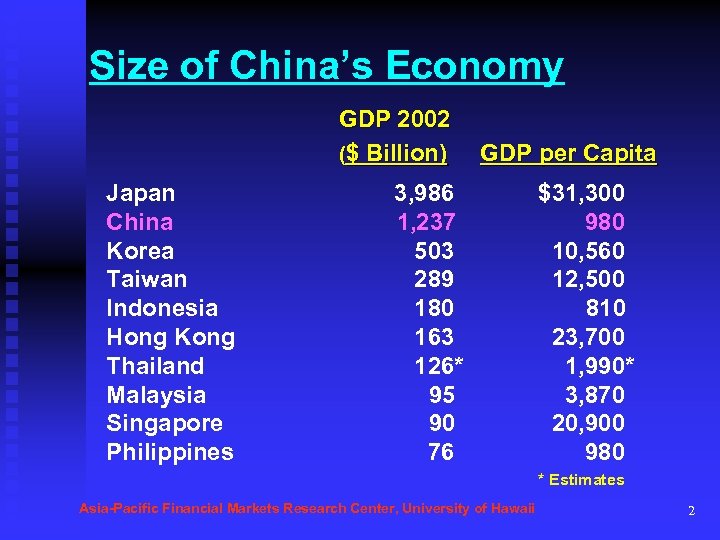

Size of China’s Economy GDP 2002 ($ Billion) Japan China Korea Taiwan Indonesia Hong Kong Thailand Malaysia Singapore Philippines GDP per Capita 3, 986 1, 237 503 289 180 163 126* 95 90 76 $31, 300 980 10, 560 12, 500 810 23, 700 1, 990* 3, 870 20, 900 980 * Estimates Asia-Pacific Financial Markets Research Center, University of Hawaii 2

Asian Stock Market Performance 1995 – 2000 China Hong Kong Indonesia Japan Korea Malaysia Philippines Singapore Taiwan Thailand USA 20. 32% 10. 19 -2. 01 -5. 97 -11. 85 -5. 95 -10. 38 -2. 51 -6. 78 -27. 00 17. 24 2001 2002 -24. 70% -28. 10 -6. 01 -39. 67 31. 82 2. 39 -24. 64 -17. 12 15. 72 12. 11 -7. 36 -18. 79% -20. 01 8. 06 -20. 61 -10. 02 -7. 42 -13. 71 -19. 12 -22. 06 15. 97 -18. 35 2003 10. 05% 29. 95 48. 75 21. 87 25. 61 20. 57 34. 80 27. 44 27. 99 77. 29 22. 57 Asia-Pacific Financial Markets Research Center, University of Hawaii 3

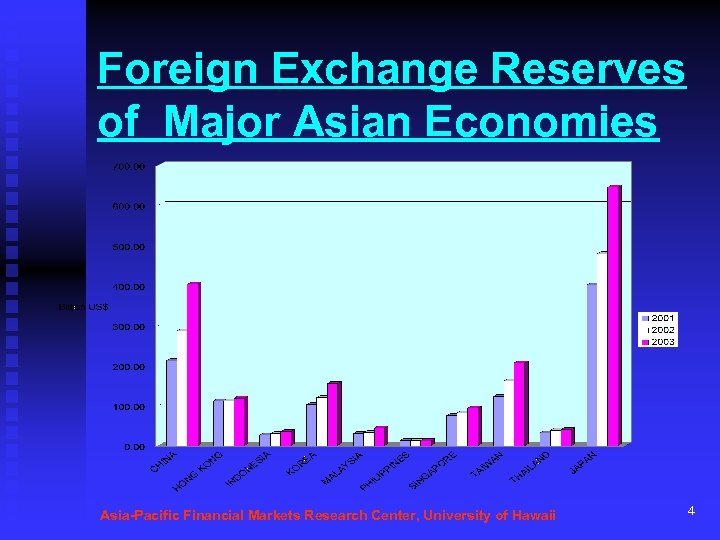

Foreign Exchange Reserves of Major Asian Economies Asia-Pacific Financial Markets Research Center, University of Hawaii 4

Foreign Holdings of US Treasury Securities Asia-Pacific Financial Markets Research Center, University of Hawaii 5

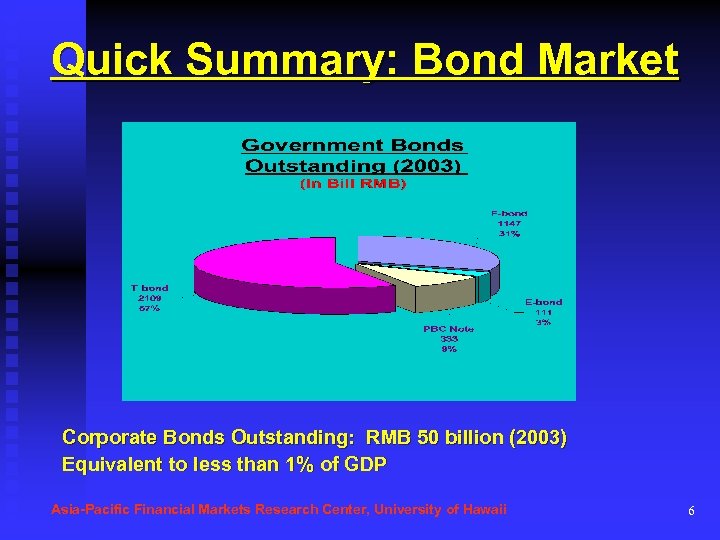

Quick Summary: Bond Market Corporate Bonds Outstanding: RMB 50 billion (2003) Equivalent to less than 1% of GDP Asia-Pacific Financial Markets Research Center, University of Hawaii 6

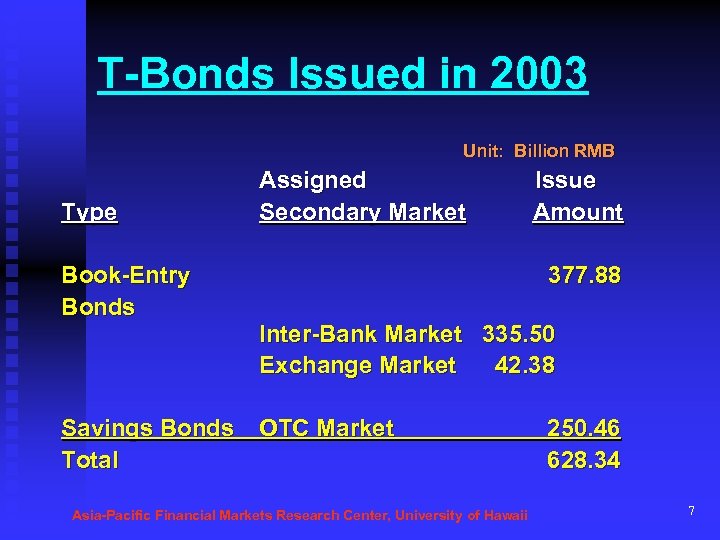

T-Bonds Issued in 2003 Unit: Billion RMB Type Book-Entry Bonds Assigned Secondary Market Issue Amount 377. 88 Inter-Bank Market 335. 50 Exchange Market 42. 38 Savings Bonds OTC Market Total Asia-Pacific Financial Markets Research Center, University of Hawaii 250. 46 628. 34 7

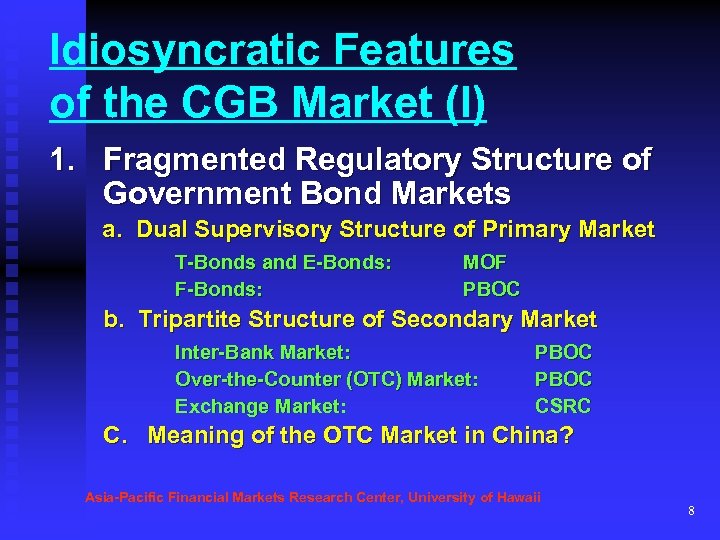

Idiosyncratic Features of the CGB Market (I) 1. Fragmented Regulatory Structure of Government Bond Markets a. Dual Supervisory Structure of Primary Market T-Bonds and E-Bonds: F-Bonds: MOF PBOC b. Tripartite Structure of Secondary Market Inter-Bank Market: Over-the-Counter (OTC) Market: Exchange Market: PBOC CSRC C. Meaning of the OTC Market in China? Asia-Pacific Financial Markets Research Center, University of Hawaii 8

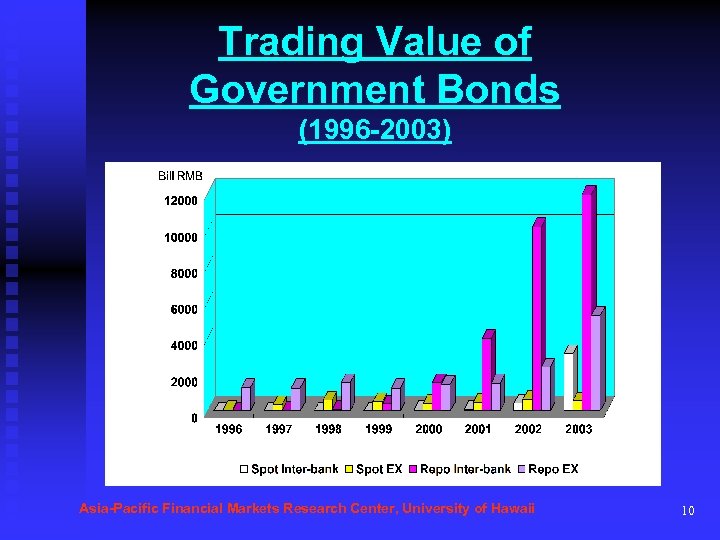

Idiosyncratic Features of the CGB Market (II) 2. Secondary Markets: Money Market rather than Bond Market Trading: 10% Spot Transactions 90% REPO Transactions Inter-bank Market: REPOs are bond collateral loans among banks Exchange Market: REPOs are short-term loans among securities companies Asia-Pacific Financial Markets Research Center, University of Hawaii 9

Trading Value of Government Bonds (1996 -2003) Asia-Pacific Financial Markets Research Center, University of Hawaii 10

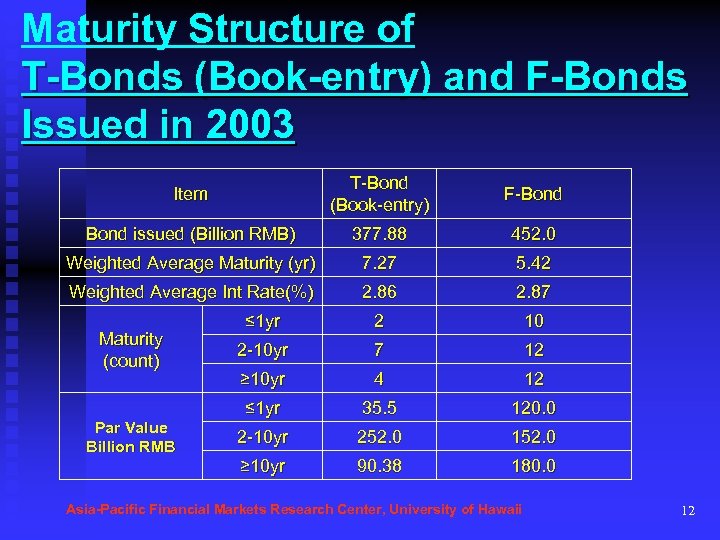

Idiosyncratic Features of the CGB Market (III) 3. Missing Links in the Market a. T-Bills: Money Market in China has been developed without T-Bills Maturity Structure of Bonds Issued in 2001 2 years: 4% of total issues 3 years: 34% 5 years: 21% 7 years: 14% 10 years: 16% 15 years: 3% 20 years: 8% b. Interest Rate Risk Hedging Instruments Bond Futures: Banned in 1995 Short-term Interest Rate Futures: Not Available No Short Sales Asia-Pacific Financial Markets Research Center, University of Hawaii 11

Maturity Structure of T-Bonds (Book-entry) and F-Bonds Issued in 2003 Item T-Bond (Book-entry) F-Bond issued (Billion RMB) 377. 88 452. 0 Weighted Average Maturity (yr) 7. 27 5. 42 Weighted Average Int Rate(%) 2. 86 2. 87 ≤ 1 yr 2 10 2 -10 yr 7 12 ≥ 10 yr 4 12 ≤ 1 yr 35. 5 120. 0 2 -10 yr 252. 0 152. 0 ≥ 10 yr 90. 38 180. 0 Maturity (count) Par Value Billion RMB Asia-Pacific Financial Markets Research Center, University of Hawaii 12

Idiosyncratic Features of the CGB Market (IV) 4. Missing Links in the Market-Continued c. d. e. Foreign Participation in Primary and Secondary Markets except QFIIs Asset-Backed and Mortgage-Backed Securities Municipal Bonds Revenue Source: 1/2 from Municipal Governments Expenditures: 2/3 by Municipal Governments Municipal Bonds may rely on ABS scheme using future cash flow of municipal governments Asia-Pacific Financial Markets Research Center, University of Hawaii 13

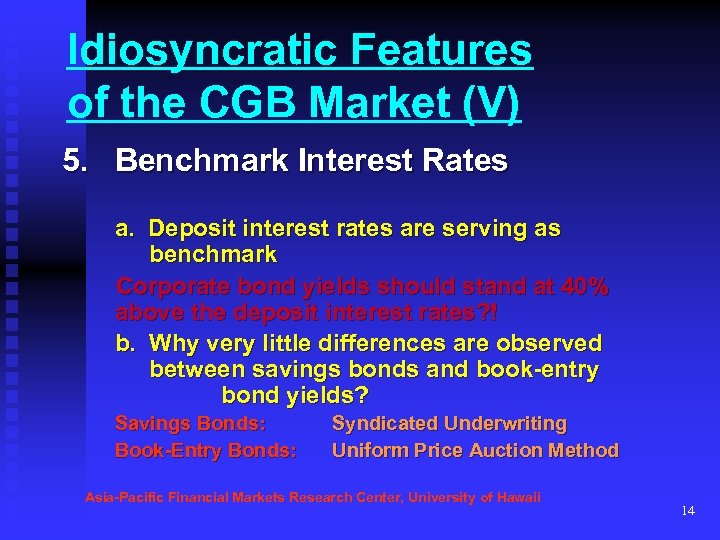

Idiosyncratic Features of the CGB Market (V) 5. Benchmark Interest Rates a. Deposit interest rates are serving as benchmark Corporate bond yields should stand at 40% above the deposit interest rates? ! b. Why very little differences are observed between savings bonds and book-entry bond yields? Savings Bonds: Book-Entry Bonds: Syndicated Underwriting Uniform Price Auction Method Asia-Pacific Financial Markets Research Center, University of Hawaii 14

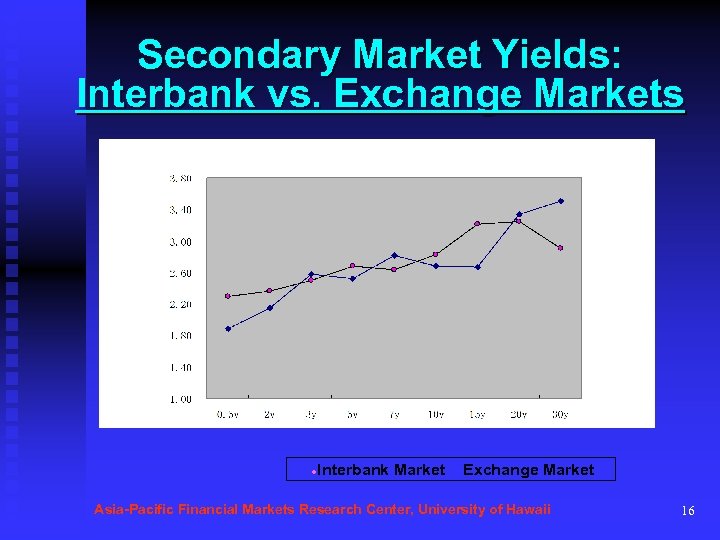

Idiosyncratic Features of the CGB Market (VI) 6. Segmented Secondary Markets a. Yield Differentials between Interbank and Exchange Market are Puzzling b. The only way to block arbitrage transactions are institutional constraints imposed by the Chinese authorities Asia-Pacific Financial Markets Research Center, University of Hawaii 15

Secondary Market Yields: Interbank vs. Exchange Markets Interbank Market ● Exchange Market ◆ Asia-Pacific Financial Markets Research Center, University of Hawaii 16

Recommendation 1: Benchmark Interest Rates Make T-Bond Yields Serve as Benchmark Interest Rates a. Stop MOF’s practice of setting a range of bidding spreads at the primary market auction b. Introduce T-Bills c. Create Balanced Maturity Structure d. Make all T-bond issues fungible Asia-Pacific Financial Markets Research Center, University of Hawaii 17

Recommendation 2: Consolidation of Primary Market Under the current structure, PBOC does not serve as “ears and hands” of MOF. a. b. c. d. d. Allow PBOC serve as the Fiscal Agent for All Government Bonds Regulatory Harmonization and Functional Delineation among PBOC, MOF, and CRSC CSRC as the Market Regulator for both Primary and Secondary Markets Clearing & Settlement by PBOC: DVP for All Government Bonds Regularity of Issue Cycle Asia-Pacific Financial Markets Research Center, University of Hawaii 18

Recommendation 3: Consolidation of Tripartite Secondary Market Mere functional integration cannot achieve consolidation of three markets into a single market a. b. c. Interbank market will remain as the money market mainly for PBOC’s open market operations Exchange market has limitations because automated trading system can not offer pre-trading negotiations and personal relationships among bond dealers……Korea’s Experience Create a “true” OTC market with all types of financial institutions participating Asia-Pacific Financial Markets Research Center, University of Hawaii 19

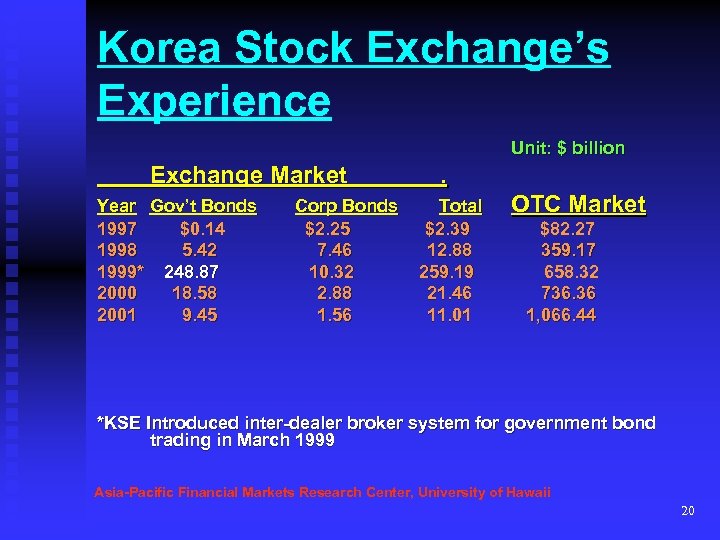

Korea Stock Exchange’s Experience Unit: $ billion Exchange Market Year Gov’t Bonds 1997 $0. 14 1998 5. 42 1999* 248. 87 2000 18. 58 2001 9. 45 Corp Bonds $2. 25 7. 46 10. 32 2. 88 1. 56 . Total $2. 39 12. 88 259. 19 21. 46 11. 01 OTC Market $82. 27 359. 17 658. 32 736. 36 1, 066. 44 *KSE Introduced inter-dealer broker system for government bond trading in March 1999 Asia-Pacific Financial Markets Research Center, University of Hawaii 20

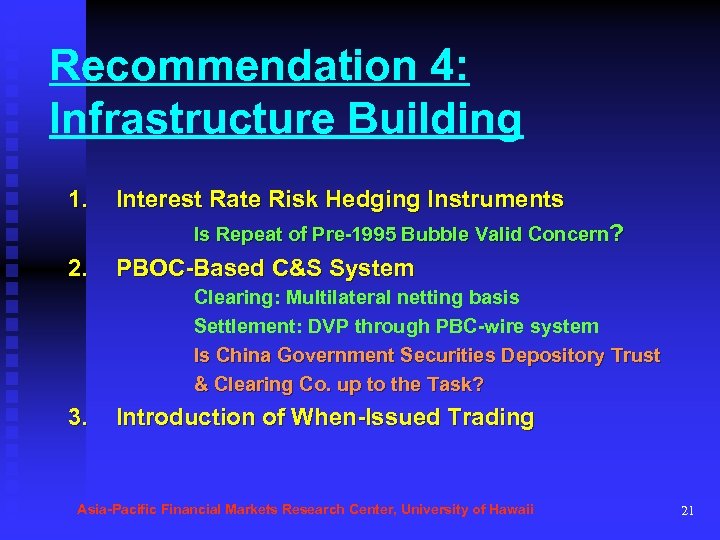

Recommendation 4: Infrastructure Building 1. Interest Rate Risk Hedging Instruments Is Repeat of Pre-1995 Bubble Valid Concern? 2. PBOC-Based C&S System Clearing: Multilateral netting basis Settlement: DVP through PBC-wire system Is China Government Securities Depository Trust & Clearing Co. up to the Task? 3. Introduction of When-Issued Trading Asia-Pacific Financial Markets Research Center, University of Hawaii 21

Recommendation 5: Infrastructure Building 3. Bond Fund a. Institutionalization of Individual Bond Holdings 4. Inter-Dealer Broker System a. Brings market makers together b. Disseminates to the market via telephone, screen or a combination of the two c. Promote secondary market liquidity, depth, transparency Asia-Pacific Financial Markets Research Center, University of Hawaii 22

Recommendation 6: Infrastructure Building 5. Credit Rating Culture Be Promoted 6. Credit Guarantee and Credit Enhancement Mechanism are urgently needed for SMEs 7. Fiscal Autonomy for Municipal Governments: Development of a municipal bond market is an extremely important policy agenda Asia-Pacific Financial Markets Research Center, University of Hawaii 23

Thank You! For Further References, Please visit http: //www 2. hawaii. edu/~rheesg Asia-Pacific Financial Markets Research Center, University of Hawaii

6d2715c0bc4b22a767f69111132f04ab.ppt