d20f422da858b44e475f6a2a9c20d8fa.ppt

- Количество слайдов: 22

The Changing Role Of Inter-Dealer Brokers Fin. Expo - 16 th October 2008 Cathryn Lyall COO Exchange Projects

Contents • Overview of ICAP • Developments in OTC Markets • IDBs and Exchanges: Protagonists or Partners? • Evolving IDB business models • Electronic, Voice, and Hybrid business • Product Innovation and Diversification • Post-Trade Services

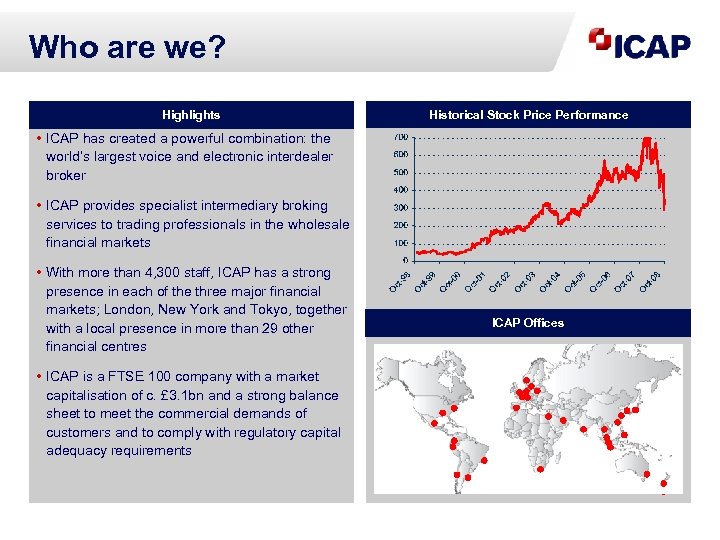

Who are we? Highlights Historical Stock Price Performance • ICAP has created a powerful combination: the world’s largest voice and electronic interdealer broker • ICAP provides specialist intermediary broking services to trading professionals in the wholesale financial markets • With more than 4, 300 staff, ICAP has a strong presence in each of the three major financial markets; London, New York and Tokyo, together with a local presence in more than 29 other financial centres • ICAP is a FTSE 100 company with a market capitalisation of c. £ 3. 1 bn and a strong balance sheet to meet the commercial demands of customers and to comply with regulatory capital adequacy requirements ICAP Offices . .

Who are we? Total Revenue (£m) Highlights • ICAP covers a very broad range of OTC (overthe-counter) financial products and services in commodities, foreign exchange, interest rates, credit and equity markets, as well as data, commentary and indices • Today, ICAP is the world’s largest interdealer broker with daily average transactions in excess of US$1. 5 trillion, 60% of which are electronic. We are active in both established and emerging markets and our electronic networks deliver global connectivity to customers • There is growing demand for electronic broking of liquid products, which is totally complementary to voice broking of more bespoke, less liquid products Diversification of revenues, 2007/8 Interest Rates 42% Information 3% Emerging Markets 10% Equities 8% Credit 12% Commodities 10% Source: ICAP Foreign Exchange 15%

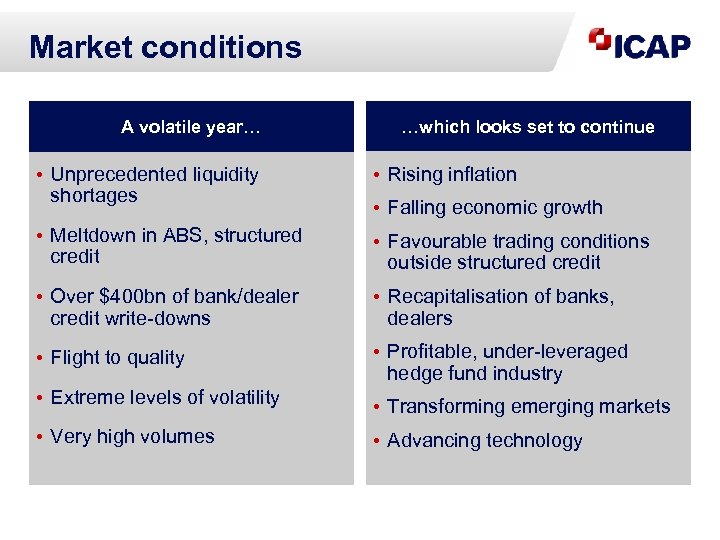

Market conditions A volatile year… …which looks set to continue • Unprecedented liquidity shortages • Rising inflation • Meltdown in ABS, structured credit • Favourable trading conditions outside structured credit • Over $400 bn of bank/dealer credit write-downs • Recapitalisation of banks, dealers • Flight to quality • Profitable, under-leveraged hedge fund industry • Extreme levels of volatility • Transforming emerging markets • Very high volumes • Advancing technology • Falling economic growth

Developments in OTC Markets • • • Growth of derivatives trading Growth of electronic trading Best execution requirements Rapid growth/change in buy-side demographics Bank/dealer consolidation Need to improve dealers/clients post trade processing capabilities • Counterparty credit risk • Potential for increased regulation

Developments in OTC Markets: Derivatives • Credit derivatives are the priority – rate of growth, size, delays in affirmation, and volatility in prices • Equity derivatives – trade affirmation longer than CDS, volumes only 20% of credit • Interest rate derivatives – larger volumes, prices and valuations less volatile, affirmation process faster • Energy derivatives – much is cleared already • FX derivatives – small compared with others • Spot FX – T+2 is a real credit risk but not today’s burning problem

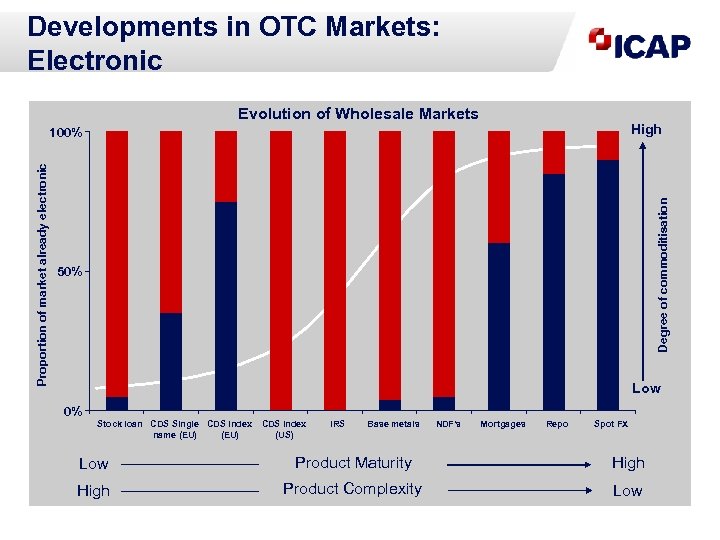

Developments in OTC Markets: Electronic Evolution of Wholesale Markets High Degree of commoditisation Proportion of market already electronic 100% 50% Low 0% Stock loan CDS Single CDS Index name (EU) CDS Index (US) IRS Base metals NDF's Mortgages Repo Spot FX Low Product Maturity High Product Complexity Low

IDBs and Exchanges: Protagonists or Partners? • ICAP currently operates 7 MTFs: Brokertec, i. Swap, i. Sec, My. Treasury, ICAP Energy, ICAP Hyde Tanker Derivatives and WCLK (Gilts), with Blockcross and the full exchange project to follow • The Clearing Corp/Markit/ICE initiative for CDS • ICE purchase of Creditex • Number of Exchanges clearing OTC eg: CME Group/Clearport, ENX Liffe/B Clear, Eurex/Repo and Bonds, ICE, SGX

Evolving IDB Business Models • Current market turmoil will create opportunities despite the wider customer base consolidating and the continued de-leveraging • OTC market structures functioned very successfully during exceptionally busy period following collapse of Lehman Brothers • Diversified across asset classes and customer types: no single customer accounts for more than 5% of ICAP Group revenues • Reducing counterparty, market and operational risk: increasing capacity and lowering costs for customers and other market participants • Clearing of OTC products will become more prevalent • Significant portion of ICAP’s OTC business is cleared • Post Trade Services: processing, portfolio compression, reconciliation, risk management • Opportunities in exchange traded and clearing space

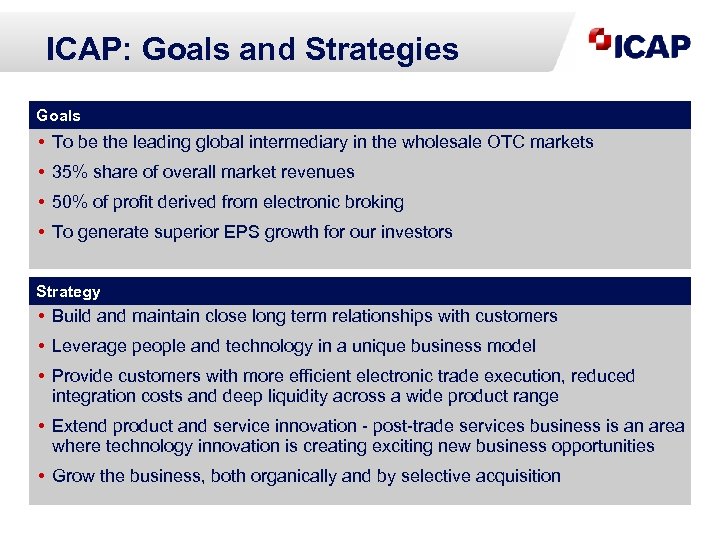

ICAP: Goals and Strategies Goals • To be the leading global intermediary in the wholesale OTC markets • 35% share of overall market revenues • 50% of profit derived from electronic broking • To generate superior EPS growth for our investors Strategy • Build and maintain close long term relationships with customers • Leverage people and technology in a unique business model • Provide customers with more efficient electronic trade execution, reduced integration costs and deep liquidity across a wide product range • Extend product and service innovation - post-trade services business is an area where technology innovation is creating exciting new business opportunities • Grow the business, both organically and by selective acquisition

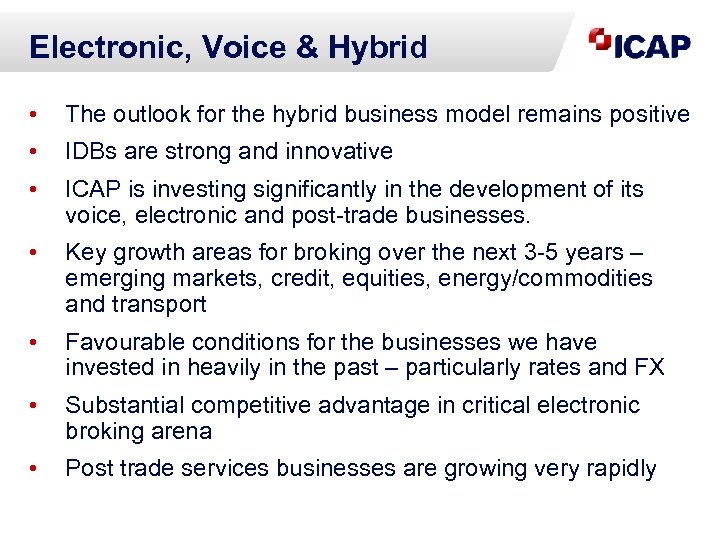

Electronic, Voice & Hybrid • The outlook for the hybrid business model remains positive • IDBs are strong and innovative • ICAP is investing significantly in the development of its voice, electronic and post-trade businesses. • Key growth areas for broking over the next 3 -5 years – emerging markets, credit, equities, energy/commodities and transport • Favourable conditions for the businesses we have invested in heavily in the past – particularly rates and FX • Substantial competitive advantage in critical electronic broking arena • Post trade services businesses are growing very rapidly

Technology • Well developed e-commerce strategy • Evolution from spot/cash markets to complex derivatives • ICAP operates a number of globally distributed electronic platforms: Brokertec, EBS, MIT • Competitors recognise value in the strategy eg: GFI purchase of Trayport, BGC/Espeed, ICE/Creditex

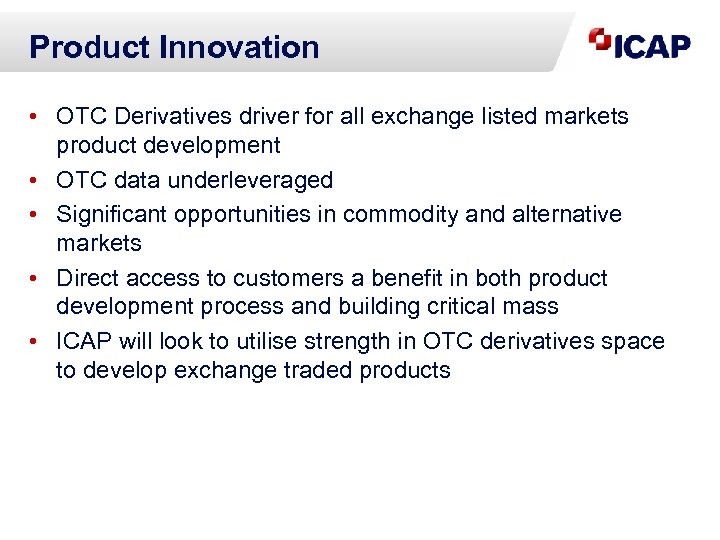

Product Innovation • OTC Derivatives driver for all exchange listed markets product development • OTC data underleveraged • Significant opportunities in commodity and alternative markets • Direct access to customers a benefit in both product development process and building critical mass • ICAP will look to utilise strength in OTC derivatives space to develop exchange traded products

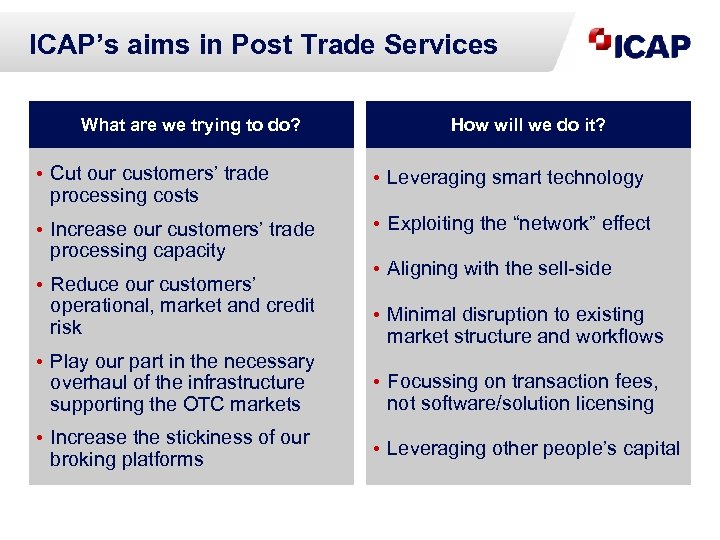

ICAP’s aims in Post Trade Services What are we trying to do? How will we do it? • Cut our customers’ trade processing costs • Leveraging smart technology • Increase our customers’ trade processing capacity • Exploiting the “network” effect • Reduce our customers’ operational, market and credit risk • Aligning with the sell-side • Minimal disruption to existing market structure and workflows • Play our part in the necessary overhaul of the infrastructure supporting the OTC markets • Focussing on transaction fees, not software/solution licensing • Increase the stickiness of our broking platforms • Leveraging other people’s capital

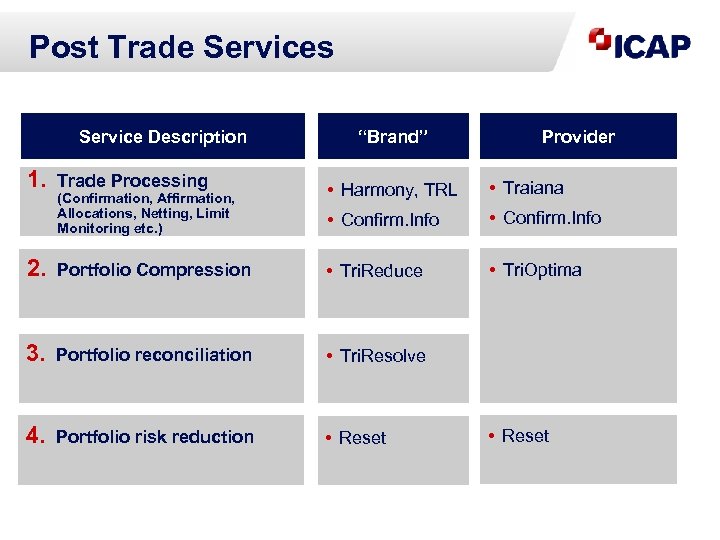

Post Trade Services Service Description 1. Trade Processing (Confirmation, Affirmation, Allocations, Netting, Limit Monitoring etc. ) “Brand” Provider • Harmony, TRL • Traiana • Confirm. Info • Tri. Optima 2. Portfolio Compression • Tri. Reduce 3. Portfolio reconciliation • Tri. Resolve 4. Portfolio risk reduction • Reset

Post Trade Services: Traiana • The leading post trade processing service provider for FX • Comprehensive confirmation/affirmation, allocation, limit monitoring and netting services to prime brokers and banks • Overall market size: 1 million tickets/day wholesale plus 1 m tickets/day retail – and growing • Harmony ticket numbers growing +40 % pa. In July 08 daily tickets were 134 k. • Harmony volumes growing +50% pa.

Post Trade Services: Tri. Optima • The first ever portfolio compression (trade tear-up) service, started in 2003 • Over $62 trillion of tear-ups, equivalent to [35%] of entire inter-dealer market notional outstandings • $16 trillion of CDS tear-ups in 1 H 2008 alone – half the entire CDS index market • 1 H 2008 growth [ ]% v 1 H 2007 • Significant contribution to industry risk reduction efforts

Post Trade Services: Reset • The leading LIBOR reset matching engine for the wholesale IRS market • Total addressable market: ~$[125] trillion outstanding • Eliminated floating rate reset risk of $36. 8 trillion IRS in 1 H 2008 approximately 30% of entire outstanding inter-dealer IRS market • 1 H 2008 volume growth 110% vs. 1 H 2007 • Very substantial reduction in basis risk for dealers (at a time of high volatility) • Technique applicable in other asset classes

Improving Post Trade Processing • Better trade capture • Improved trade affirmation/matching/confirmation tools • Efficient OTC central counterparty clearing • Better collateral management tools • Robust, automated, independent valuation tools • Payment processing as close to T+0 a possible • Securities settlement as close to real time as possible

OTC and the CCPs • Competition in clearing: EMCF, OCC/NYSE Euronext • Horizontal (independent) v Vertical (integrated) models • Proliferation of MTFs altered CCPs attitude to potential customers/partners • Diversified Independent CCP preferred • Shift to clearing OTC a major focus post sub prime fallout

Outlook • Powerful, structural reasons to be optimistic about the medium term future for diversified IDBs • The credit and liquidity squeeze continues to drive volume growth and volatile markets look set to continue for the foreseeable future • Favourable conditions for the big businesses ICAP have invested in – particularly rates and FX • More attractive opportunities to acquire businesses and hire people than there have been for a long time. 2008/9 - a year of investment in the future • Key growth areas for IDBs over the next 3 -5 years – emerging markets, credit, equities, energy/commodities and transport • ICAP has a significant competitive advantage in critical electronic broking arena • Post trade services businesses are growing very rapidly

d20f422da858b44e475f6a2a9c20d8fa.ppt