33097479e77b6b2d4e4d8d4c21ed1cd8.ppt

- Количество слайдов: 33

The Changing Needs of HNW Clients K Pun kimmispun@yahoo. com. hk

The Changing Needs of HNW Clients K Pun kimmispun@yahoo. com. hk

2

2

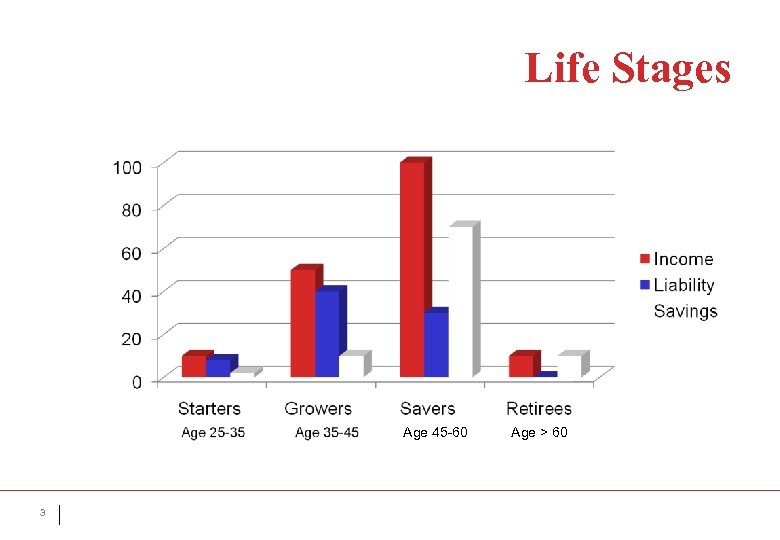

Life Stages Age 45 -60 3 Age > 60

Life Stages Age 45 -60 3 Age > 60

Life Cycle Death/ Disability Succession Planning Inheritance Retirement Investments Capital / Pension Purchase / Sale Real Estate Revenue / Wealth Fluctuation 4 Birth Estate & Tax Planning Gift Insurance Financing Financial Planning Business Start-up Education Planning Retirement Planning Investment Career Development Job / Marriage Children / Education Separation / Divorce Change of Residence

Life Cycle Death/ Disability Succession Planning Inheritance Retirement Investments Capital / Pension Purchase / Sale Real Estate Revenue / Wealth Fluctuation 4 Birth Estate & Tax Planning Gift Insurance Financing Financial Planning Business Start-up Education Planning Retirement Planning Investment Career Development Job / Marriage Children / Education Separation / Divorce Change of Residence

Life Events n Marriage / Divorce n Birth / Death n Changing Career / Entrepreneur n Illnesses / Handicap n Losses / Bankruptcy Overseas Education / Migration n 5

Life Events n Marriage / Divorce n Birth / Death n Changing Career / Entrepreneur n Illnesses / Handicap n Losses / Bankruptcy Overseas Education / Migration n 5

Changing. . . Simple, Domestic Sophisticated, Cosmopolitan 6

Changing. . . Simple, Domestic Sophisticated, Cosmopolitan 6

Internationally Bound 7

Internationally Bound 7

Needs n n Save for future goals n Invest the idle money n Plan the taxes n 8 Insure against the uncertainties Pass to the children

Needs n n Save for future goals n Invest the idle money n Plan the taxes n 8 Insure against the uncertainties Pass to the children

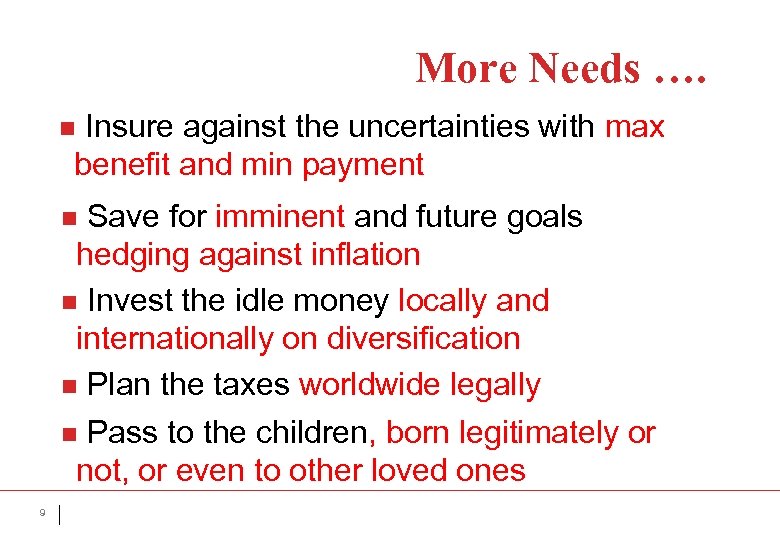

More Needs …. Insure against the uncertainties with max benefit and min payment n Save for imminent and future goals hedging against inflation n Invest the idle money locally and internationally on diversification n Plan the taxes worldwide legally n Pass to the children, born legitimately or not, or even to other loved ones n 9

More Needs …. Insure against the uncertainties with max benefit and min payment n Save for imminent and future goals hedging against inflation n Invest the idle money locally and internationally on diversification n Plan the taxes worldwide legally n Pass to the children, born legitimately or not, or even to other loved ones n 9

Need For Planners n Knowledgeable n Qualified n Professional n Initiative n Trusted Advisers 10

Need For Planners n Knowledgeable n Qualified n Professional n Initiative n Trusted Advisers 10

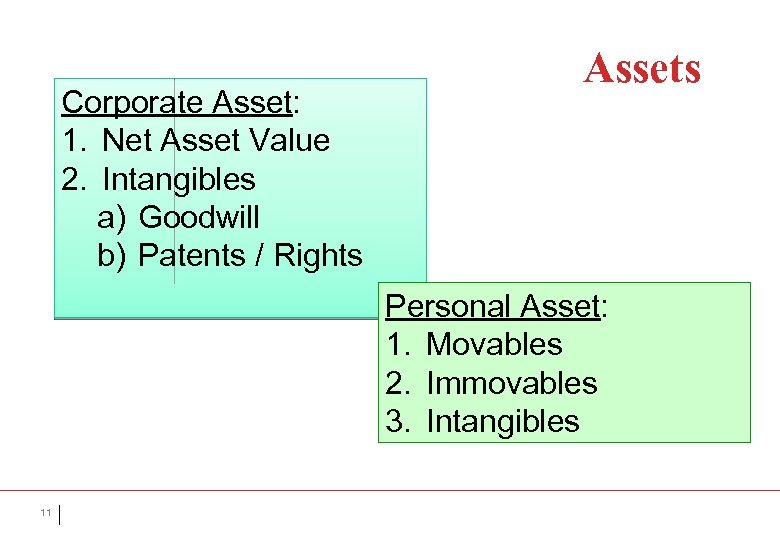

Corporate Asset: 1. Net Asset Value 2. Intangibles a) Goodwill b) Patents / Rights Assets Personal Asset: 1. Movables 2. Immovables 3. Intangibles 11

Corporate Asset: 1. Net Asset Value 2. Intangibles a) Goodwill b) Patents / Rights Assets Personal Asset: 1. Movables 2. Immovables 3. Intangibles 11

Personal Assets Movable Immovable Your country Residential Properties / Commercial Properties – Shop House/ Office / Industrial Properties Overseas 12 Cash/Deposit/Shares/Bonds/Unit Trusts/Provident Fund/Life Insurance Policies/Net Asset Value inside Local Private Companies/ Collectibles / Car / Clubs Cash/Deposit/Shares/Bonds/Unit Trusts/Life Insurance Policies/Net Asset Value inside Overseas Private Company/ Collectibles / Car / Clubs Residential Properties / Commercial Properties – Shop House/ Office / Industrial Properties

Personal Assets Movable Immovable Your country Residential Properties / Commercial Properties – Shop House/ Office / Industrial Properties Overseas 12 Cash/Deposit/Shares/Bonds/Unit Trusts/Provident Fund/Life Insurance Policies/Net Asset Value inside Local Private Companies/ Collectibles / Car / Clubs Cash/Deposit/Shares/Bonds/Unit Trusts/Life Insurance Policies/Net Asset Value inside Overseas Private Company/ Collectibles / Car / Clubs Residential Properties / Commercial Properties – Shop House/ Office / Industrial Properties

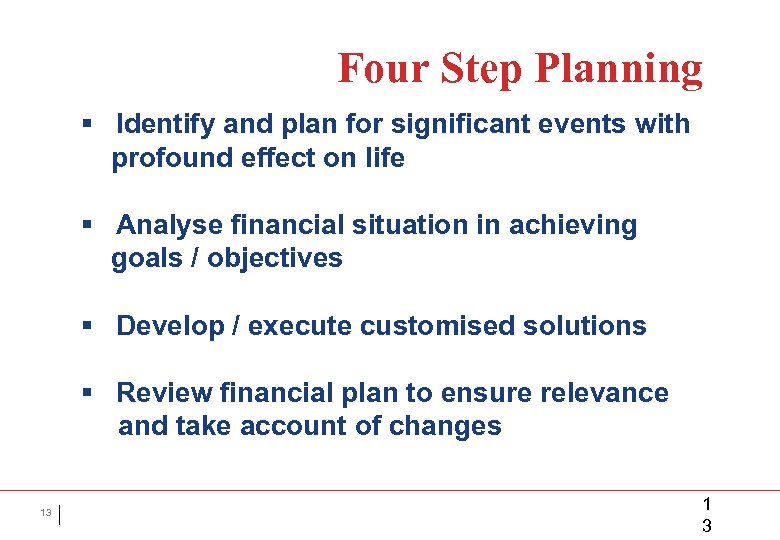

Four Step Planning § Identify and plan for significant events with profound effect on life § Analyse financial situation in achieving goals / objectives § Develop / execute customised solutions § Review financial plan to ensure relevance and take account of changes 13 1 3

Four Step Planning § Identify and plan for significant events with profound effect on life § Analyse financial situation in achieving goals / objectives § Develop / execute customised solutions § Review financial plan to ensure relevance and take account of changes 13 1 3

Asset Ownership § Own Assets And Control Movement? § Transfer Assets To Loved Ones During Life? § § Assets subject to creditor claims against the recipient, including divorce claims Use Nominees To Hold Assets? § The use of nominees subject to § § The legality/validity of the structure in case of challenges § 14 Their integrity The estate claim in case of intestate death

Asset Ownership § Own Assets And Control Movement? § Transfer Assets To Loved Ones During Life? § § Assets subject to creditor claims against the recipient, including divorce claims Use Nominees To Hold Assets? § The use of nominees subject to § § The legality/validity of the structure in case of challenges § 14 Their integrity The estate claim in case of intestate death

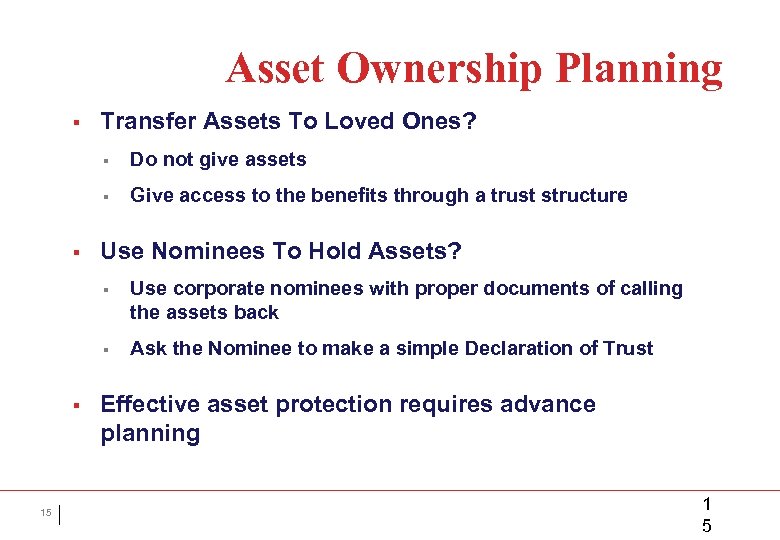

Asset Ownership Planning § Transfer Assets To Loved Ones? § § § Do not give assets Give access to the benefits through a trust structure Use Nominees To Hold Assets? § § § 15 Use corporate nominees with proper documents of calling the assets back Ask the Nominee to make a simple Declaration of Trust Effective asset protection requires advance planning 1 5

Asset Ownership Planning § Transfer Assets To Loved Ones? § § § Do not give assets Give access to the benefits through a trust structure Use Nominees To Hold Assets? § § § 15 Use corporate nominees with proper documents of calling the assets back Ask the Nominee to make a simple Declaration of Trust Effective asset protection requires advance planning 1 5

§ Self directed Investment § Sound knowledge on economics § Clear understanding of risks and returns § Close monitor of positions § Professionally managed § Good knowledge on economics § Clear objective of risks versus returns § Close monitor of the performance § Review periodically with the professional 16

§ Self directed Investment § Sound knowledge on economics § Clear understanding of risks and returns § Close monitor of positions § Professionally managed § Good knowledge on economics § Clear objective of risks versus returns § Close monitor of the performance § Review periodically with the professional 16

§ Set objectives Investment Planning § Set duration of investment § Get the suitable service provider § Practice asset / class allocation § Traditional / Derivative / Alternative § Monitor positions § Determine the loss strategy 17

§ Set objectives Investment Planning § Set duration of investment § Get the suitable service provider § Practice asset / class allocation § Traditional / Derivative / Alternative § Monitor positions § Determine the loss strategy 17

Tax Payment Local Tax Overseas Tax n n Income Tax n Capital Gain Tax n Gift Tax n Transfer Tax n 18 Income Tax Estate Duty n Inheritance Tax

Tax Payment Local Tax Overseas Tax n n Income Tax n Capital Gain Tax n Gift Tax n Transfer Tax n 18 Income Tax Estate Duty n Inheritance Tax

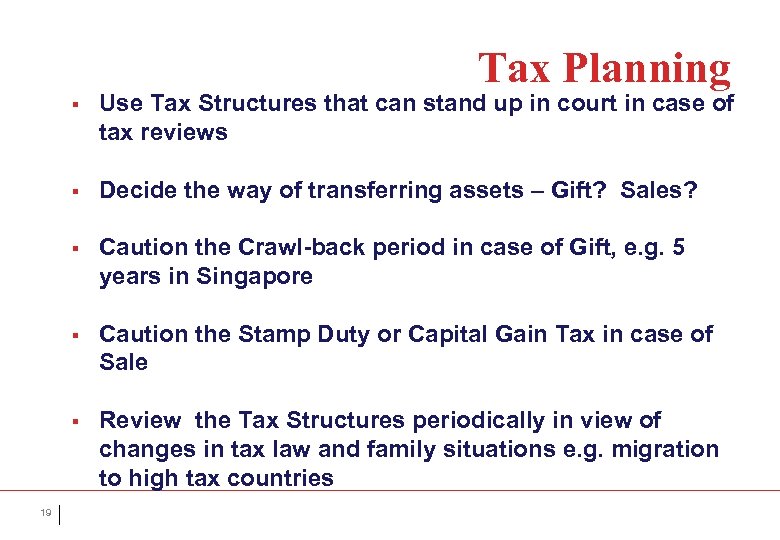

Tax Planning § § Decide the way of transferring assets – Gift? Sales? § Caution the Crawl-back period in case of Gift, e. g. 5 years in Singapore § Caution the Stamp Duty or Capital Gain Tax in case of Sale § 19 Use Tax Structures that can stand up in court in case of tax reviews Review the Tax Structures periodically in view of changes in tax law and family situations e. g. migration to high tax countries

Tax Planning § § Decide the way of transferring assets – Gift? Sales? § Caution the Crawl-back period in case of Gift, e. g. 5 years in Singapore § Caution the Stamp Duty or Capital Gain Tax in case of Sale § 19 Use Tax Structures that can stand up in court in case of tax reviews Review the Tax Structures periodically in view of changes in tax law and family situations e. g. migration to high tax countries

Succession § Families with § § Incapable / weak children § Incapacitated / mentally challenged children § Discernible members fighting for power § Disinterested members ignoring family business § Legitimate and illegitimate children § 20 Wastrel squandering money First and other wives

Succession § Families with § § Incapable / weak children § Incapacitated / mentally challenged children § Discernible members fighting for power § Disinterested members ignoring family business § Legitimate and illegitimate children § 20 Wastrel squandering money First and other wives

Succession Planning § § Post life distribution subject to cumbersome Probate procedures and Estate Duty § 21 Inter Vivo / during life distribution not recommended unless the recipients are discreet and ready to accept responsibilities Will ? Will Substitute? PICs ? Trusts? Charities ? Family Office?

Succession Planning § § Post life distribution subject to cumbersome Probate procedures and Estate Duty § 21 Inter Vivo / during life distribution not recommended unless the recipients are discreet and ready to accept responsibilities Will ? Will Substitute? PICs ? Trusts? Charities ? Family Office?

Glance at Tool Kit 22

Glance at Tool Kit 22

Personal Investment Company n Jurisdiction - British Virgin Islands (BVI) / Cayman Islands /Jersey Islands / Bahamas Islands / Labuan / Singapore / Hong Kong n Types - Standalone / Underneath a trust n Benefits – Confidentiality / Continuity / Tax efficiency / Asset consolidation n Weakness – Asset claw-back (personal shareholding) / Taxable ( depend on domicile) 23

Personal Investment Company n Jurisdiction - British Virgin Islands (BVI) / Cayman Islands /Jersey Islands / Bahamas Islands / Labuan / Singapore / Hong Kong n Types - Standalone / Underneath a trust n Benefits – Confidentiality / Continuity / Tax efficiency / Asset consolidation n Weakness – Asset claw-back (personal shareholding) / Taxable ( depend on domicile) 23

PIC - Structure contract Nominee Person PIC Movable Assets 24 Immovable Assets Business contract Universal Life Policy

PIC - Structure contract Nominee Person PIC Movable Assets 24 Immovable Assets Business contract Universal Life Policy

Trust n. A Trust established by the Settlor, in which he severs part or all his powers of his assets to the Trustee who represents the interest of the Beneficiaries named under the Trust via Letter Of Wishes n The Trust is governed by the laws of the origin n Common Law proposition – 3 Certainties n Certainty of subject n Certainty 25 of intention of object

Trust n. A Trust established by the Settlor, in which he severs part or all his powers of his assets to the Trustee who represents the interest of the Beneficiaries named under the Trust via Letter Of Wishes n The Trust is governed by the laws of the origin n Common Law proposition – 3 Certainties n Certainty of subject n Certainty 25 of intention of object

Trust § The Trustee must act for the overall benefit of the beneficiaries, regardless of the beneficiaries’ personal, social or political views § Trustee owes a fiduciary duty to the beneficiaries should negligence and malice occurred in its management of the trust assets 26

Trust § The Trustee must act for the overall benefit of the beneficiaries, regardless of the beneficiaries’ personal, social or political views § Trustee owes a fiduciary duty to the beneficiaries should negligence and malice occurred in its management of the trust assets 26

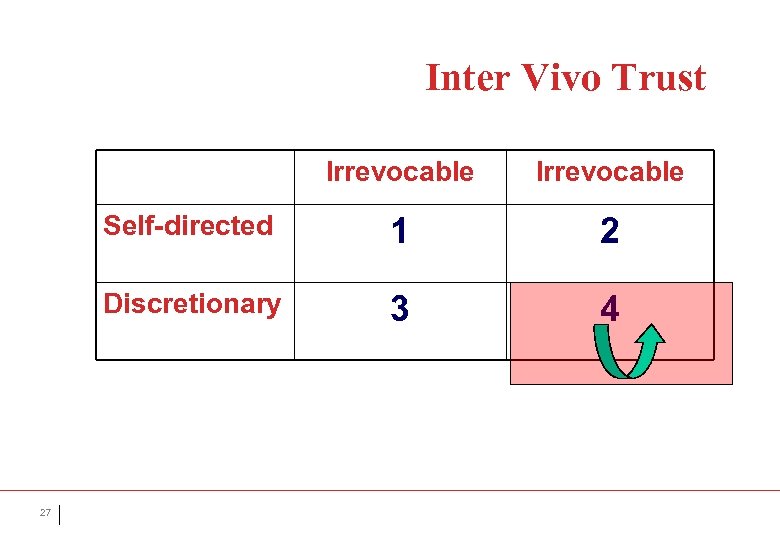

Inter Vivo Trust Irrevocable Self-directed 1 2 Discretionary 27 Irrevocable 3 4

Inter Vivo Trust Irrevocable Self-directed 1 2 Discretionary 27 Irrevocable 3 4

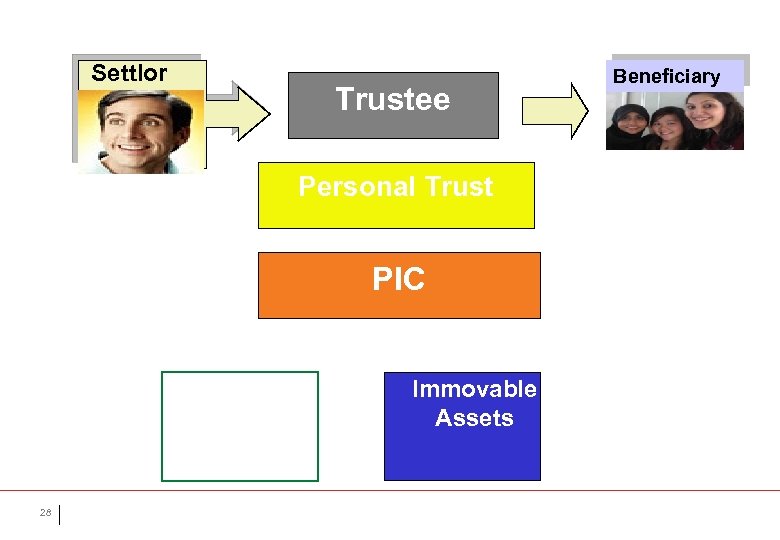

Settlor Trustee Personal Trust PIC Movable Assets 28 Immovable Assets Beneficiary

Settlor Trustee Personal Trust PIC Movable Assets 28 Immovable Assets Beneficiary

Settlor Trustee Beneficiary Business Trust Director PIC Property Com Subsidiary 29 Subsidiary Com

Settlor Trustee Beneficiary Business Trust Director PIC Property Com Subsidiary 29 Subsidiary Com

Settlor Family/Bank /Professional Advisor Trustee Charitable Trust Movable Assets 30 Beneficiary or charitable bodies Immovable Assets

Settlor Family/Bank /Professional Advisor Trustee Charitable Trust Movable Assets 30 Beneficiary or charitable bodies Immovable Assets

Family Office n Systematically manage: n. How the family members enter the business entities and work harmoniously to promote family culture and preserve values n. How to enhance the accumulated family wealth n. How to grow the business and attract more talents 31

Family Office n Systematically manage: n. How the family members enter the business entities and work harmoniously to promote family culture and preserve values n. How to enhance the accumulated family wealth n. How to grow the business and attract more talents 31

Family Office Advisers Family Member Management ¨Family rules ¨Education ¨Family activities ¨Charities 32 Wealth Management ¨Asset allocation ¨Investment direction and management ¨Collateral for loans Business Management ¨Management training/succession planning ¨Staff options

Family Office Advisers Family Member Management ¨Family rules ¨Education ¨Family activities ¨Charities 32 Wealth Management ¨Asset allocation ¨Investment direction and management ¨Collateral for loans Business Management ¨Management training/succession planning ¨Staff options

Thank 33 You

Thank 33 You