5dc8c4b1300f7ab0f62271793f1f17c5.ppt

- Количество слайдов: 35

The Changing Business Model in IC Design House Jeremy Wang, Asia Pacific Executive Director, FSA 亞太區執行長 全球 IC設計與委外代 協會

Agenda Ø Review of the Fabless Semiconductor Association Ø Status of the Global Fabless Segment Ø Regional Fabless Company Progress Ø Trends Creating Opportunities for Asia Ø Summary

About the FSA Ø Ø History: Established in ‘ 94 to achieve a more optimal balance between wafer supply and demand Today: Improve growth and increase the return on invested capital of the global fabless business model through a conducive environment for innovation. § Provide a platform for meaningful global collaboration between fabless companies, their partners and among partners; § Identify, debate and discuss business and technical issues and a focused effort to impact solutions to certain challenges § Provide members with timely research, resources, publications and survey information § Promote the fabless business model

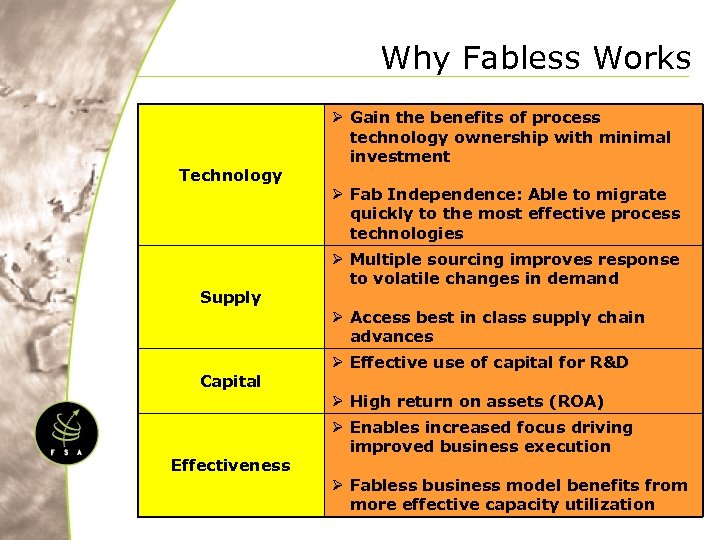

Why Fabless Works Technology Supply Capital Effectiveness Ø Gain the benefits of process technology ownership with minimal investment Ø Fab Independence: Able to migrate quickly to the most effective process technologies Ø Multiple sourcing improves response to volatile changes in demand Ø Access best in class supply chain advances Ø Effective use of capital for R&D Ø High return on assets (ROA) Ø Enables increased focus driving improved business execution Ø Fabless business model benefits from more effective capacity utilization

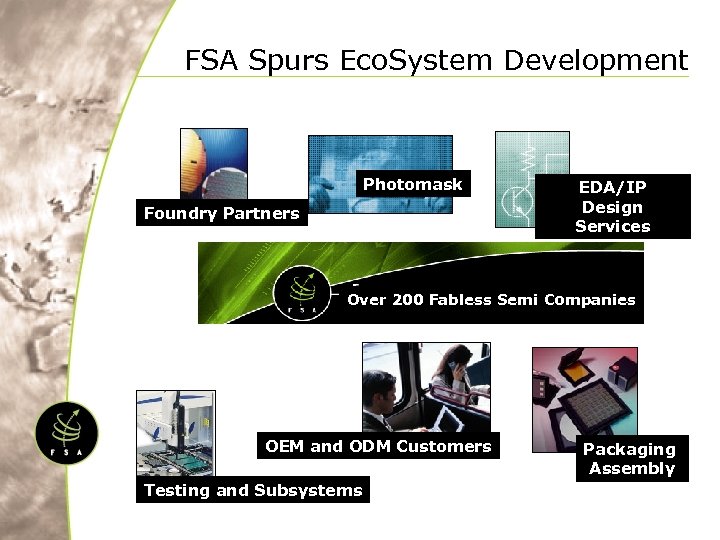

FSA Spurs Eco. System Development Photomask Foundry Partners EDA/IP Design Services Over 200 Fabless Semi Companies OEM and ODM Customers Testing and Subsystems Packaging Assembly

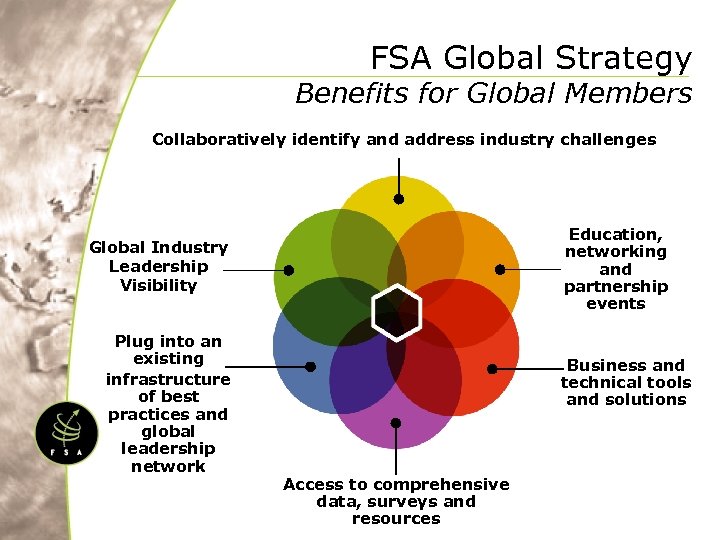

FSA Global Strategy Benefits for Global Members Collaboratively identify and address industry challenges Education, networking and partnership events Global Industry Leadership Visibility Plug into an existing infrastructure of best practices and global leadership network Business and technical tools and solutions Access to comprehensive data, surveys and resources

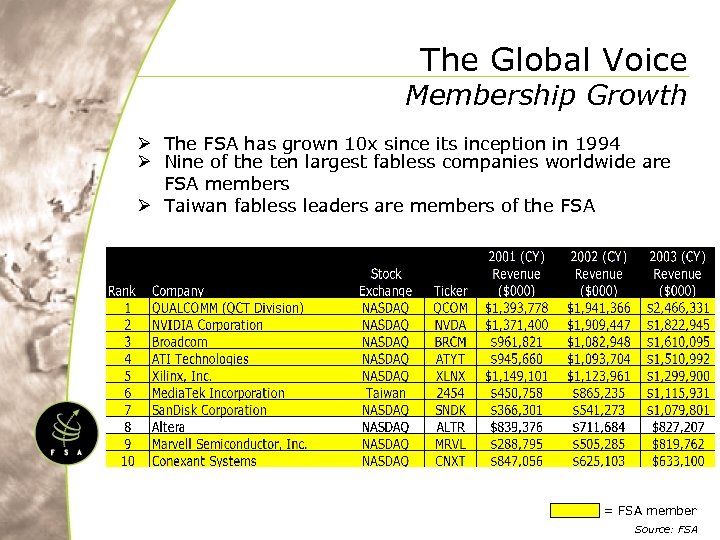

The Global Voice Membership Growth Ø The FSA has grown 10 x since its inception in 1994 Ø Nine of the ten largest fabless companies worldwide are FSA members Ø Taiwan fabless leaders are members of the FSA = FSA member Source: FSA

A Global Community of Leaders Dr. Chin Wu ALi Jensen Huang NVidia Jimmy S. M. Lee ISSI Bob Bailey PMC Sierra Dwight Decker Conexant Sanjay Jha Qualcomm Woody Yang Silicon 7 Ming Kai Tsai Media. Tek Wim Roelandts Xilinx David French Cirrus Logic Chia Song Hwee Chartered Over 450 corporate members worldwide Dr. Morris Chang TSMC Richard Chang ASE Robert Tsao UMC KY Ho ATI Dr. Nicky Lu Etron

Leadership Council Members Chairman Dr. Nicky Lu Etron Ming Kai Tsai Media. Tek Gordon Gau Holtek Chou-Chye Huang Sunplus Japanese Delegate Dr. Chin Wu ALi Wen-Chi Chen VIA H. P. Lin Faraday Dr. Woodward Yang Silicon 7 Korean Delegate Chinese Delegate

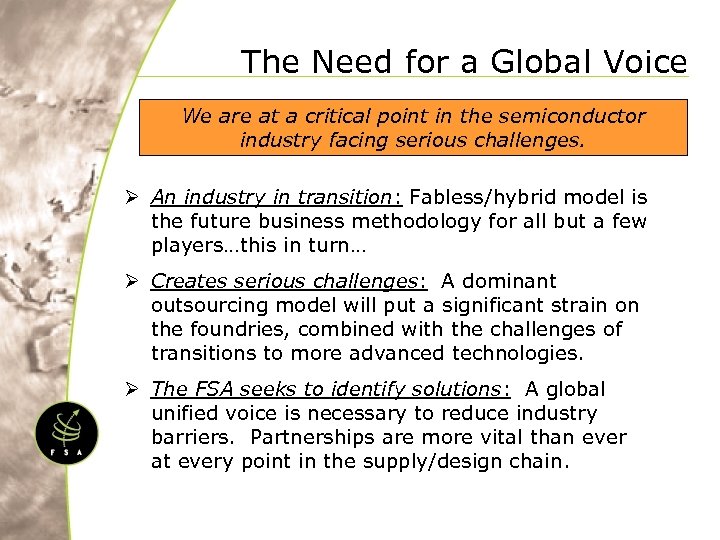

The Need for a Global Voice We are at a critical point in the semiconductor industry facing serious challenges. Ø An industry in transition: Fabless/hybrid model is the future business methodology for all but a few players…this in turn… Ø Creates serious challenges: A dominant outsourcing model will put a significant strain on the foundries, combined with the challenges of transitions to more advanced technologies. Ø The FSA seeks to identify solutions: A global unified voice is necessary to reduce industry barriers. Partnerships are more vital than ever at every point in the supply/design chain.

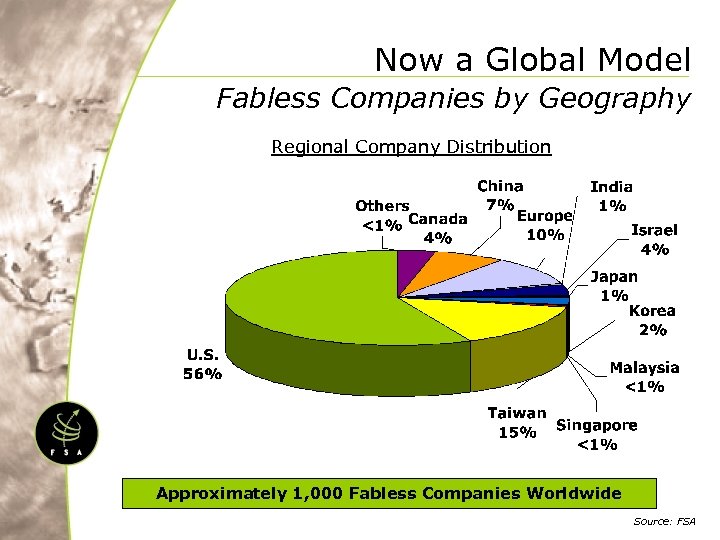

Now a Global Model Fabless Companies by Geography Regional Company Distribution Approximately 1, 000 Fabless Companies Worldwide Source: FSA

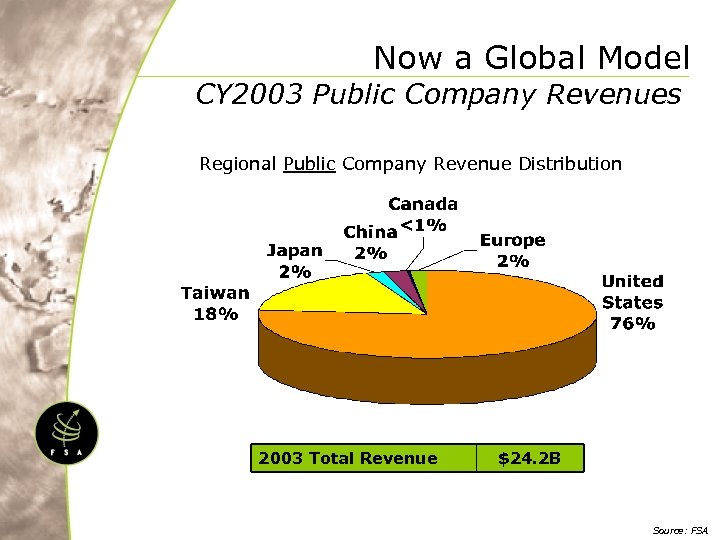

Now a Global Model CY 2003 Public Company Revenues Regional Public Company Revenue Distribution 2003 Total Revenue $24. 2 B Source: FSA

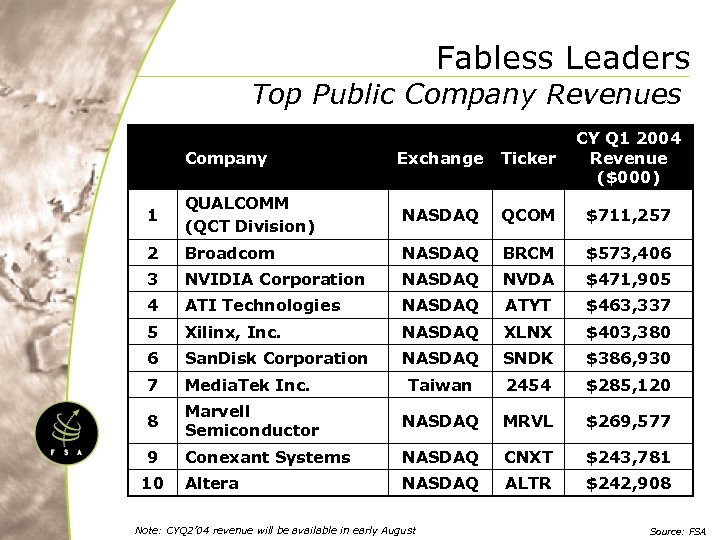

Fabless Leaders Top Public Company Revenues Company Exchange Ticker CY Q 1 2004 Revenue ($000) 1 QUALCOMM (QCT Division) NASDAQ QCOM $711, 257 2 Broadcom NASDAQ BRCM $573, 406 3 NVIDIA Corporation NASDAQ NVDA $471, 905 4 ATI Technologies NASDAQ ATYT $463, 337 5 Xilinx, Inc. NASDAQ XLNX $403, 380 6 San. Disk Corporation NASDAQ SNDK $386, 930 7 Media. Tek Inc. Taiwan 2454 $285, 120 8 Marvell Semiconductor NASDAQ MRVL $269, 577 9 Conexant Systems NASDAQ CNXT $243, 781 Altera NASDAQ ALTR $242, 908 10 Note: CYQ 2’ 04 revenue will be available in early August Source: FSA

Fabless Leaders Market Capitalization Company Exchange Ticker April 2004 Market Cap ($000) 1 Broadcom NASDAQ BRCM $13, 131, 781 2 Xilinx, Inc. NASDAQ XLNX $12, 387, 111 3 Altera NASDAQ ALTR $8, 155, 664 4 Media. Tek Inc. Taiwan 2454 $5, 886, 103 5 Marvell Semiconductor NASDAQ MRVL $5, 818, 844 6 San. Disk Corporation NASDAQ SNDK $4, 337, 329 7 NVIDIA Corporation NASDAQ NVDA $3, 774, 831 8 ATI Technologies NASDAQ ATYT $3, 650, 075 9 Silicon Laboratories NASDAQ SLAB $2, 615, 217 10 QLogic Corporation NASDAQ QLGC $2, 524, 277 Source: FSA

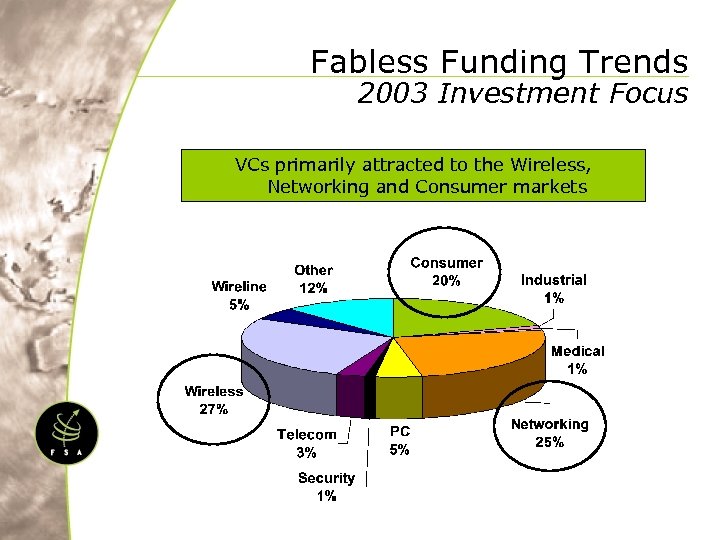

Fabless Funding Trends 2003 Investment Focus VCs primarily attracted to the Wireless, Networking and Consumer markets

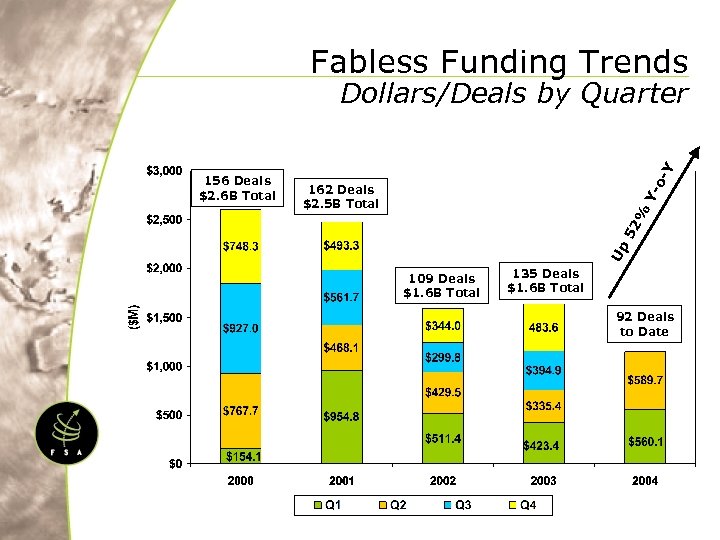

Fabless Funding Trends 52 % Y- 162 Deals $2. 5 B Total Up 156 Deals $2. 6 B Total o. Y Dollars/Deals by Quarter 109 Deals $1. 6 B Total 135 Deals $1. 6 B Total 92 Deals to Date

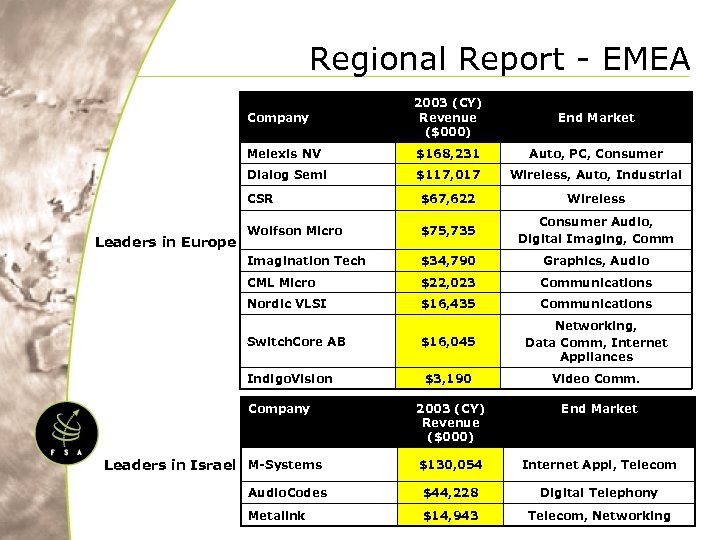

Regional Report - EMEA Company End Market Melexis NV $168, 231 Auto, PC, Consumer Dialog Semi $117, 017 Wireless, Auto, Industrial CSR $67, 622 Wireless Wolfson Micro $75, 735 Consumer Audio, Digital Imaging, Comm Imagination Tech $34, 790 Graphics, Audio CML Micro $22, 023 Communications Nordic VLSI Leaders in Europe 2003 (CY) Revenue ($000) $16, 435 Communications $16, 045 Networking, Data Comm, Internet Appliances $3, 190 Video Comm. 2003 (CY) Revenue ($000) End Market $130, 054 Internet Appl, Telecom Audio. Codes $44, 228 Digital Telephony Metalink $14, 943 Telecom, Networking Switch. Core AB Indigo. Vision Company Leaders in Israel M-Systems

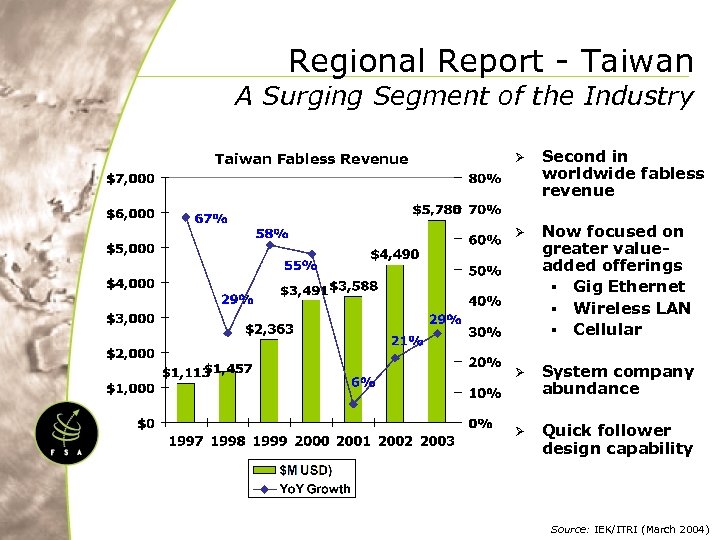

Regional Report - Taiwan A Surging Segment of the Industry Taiwan Fabless Revenue Ø Second in worldwide fabless revenue Ø Now focused on greater valueadded offerings § Gig Ethernet § Wireless LAN § Cellular Ø System company abundance Ø Quick follower design capability Source: IEK/ITRI (March 2004)

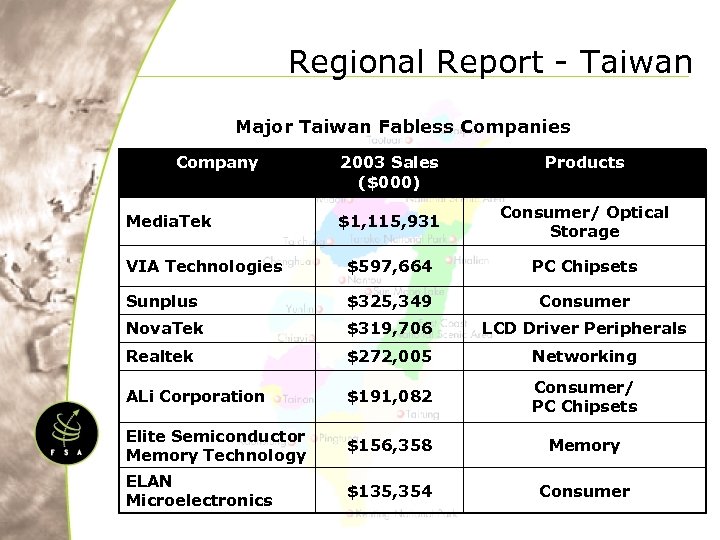

Regional Report - Taiwan Major Taiwan Fabless Companies Company 2003 Sales ($000) Products $1, 115, 931 Consumer/ Optical Storage VIA Technologies $597, 664 PC Chipsets Sunplus $325, 349 Consumer Nova. Tek $319, 706 LCD Driver Peripherals Realtek $272, 005 Networking ALi Corporation $191, 082 Consumer/ PC Chipsets Elite Semiconductor Memory Technology $156, 358 Memory ELAN Microelectronics $135, 354 Consumer Media. Tek

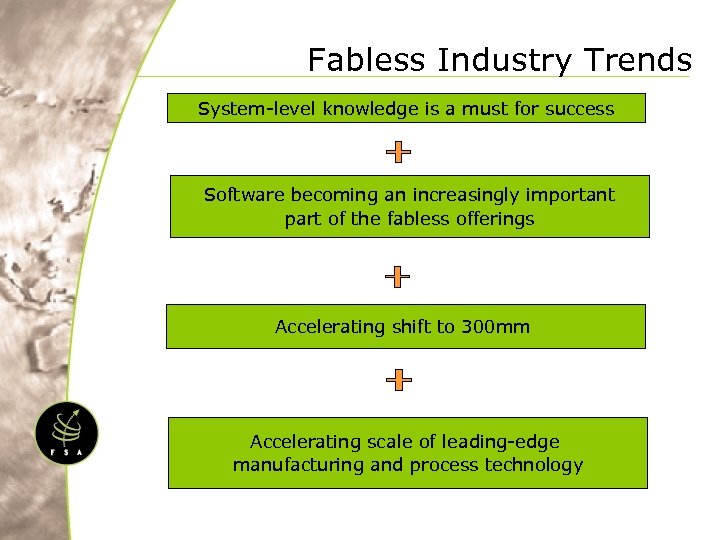

Fabless Industry Trends System-level knowledge is a must for success Software becoming an increasingly important part of the fabless offerings Accelerating shift to 300 mm Accelerating scale of leading-edge manufacturing and process technology

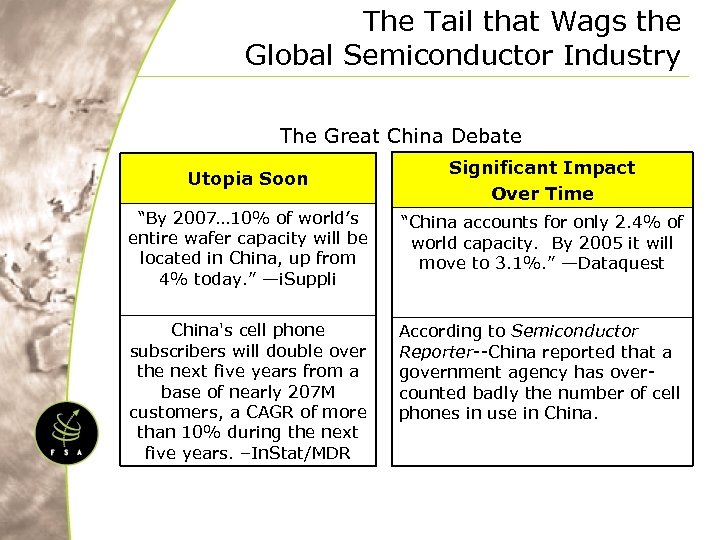

The Tail that Wags the Global Semiconductor Industry The Great China Debate Utopia Soon Significant Impact Over Time “By 2007… 10% of world’s entire wafer capacity will be located in China, up from 4% today. ” —i. Suppli “China accounts for only 2. 4% of world capacity. By 2005 it will move to 3. 1%. ” —Dataquest China's cell phone subscribers will double over the next five years from a base of nearly 207 M customers, a CAGR of more than 10% during the next five years. –In. Stat/MDR According to Semiconductor Reporter--China reported that a government agency has overcounted badly the number of cell phones in use in China.

China’s Role in the Global Semiconductor Industry Ø Ø The Customer — a Huge Silicon Consumer The Manufacturing Ally A Huge Reservoir of Design Talent Potential Design Partner or Competitor

China—As The Customer Ø Large potential market base Ø China accounted for approximately 18% of global semiconductor consumption in 2003. Ø China used $25 billion in microchips in 2003 Ø Consumer Demand § 1. 3 billion consumers § Domestic demand for television sets exceeds 30 million units per year with 380 million TVs installed. § Yearly demand for PCs in China is expected to grow by more than 17% over the next three years. § Domestic Chinese cell phone manufacturing is forecast to reach 140 million in 2005.

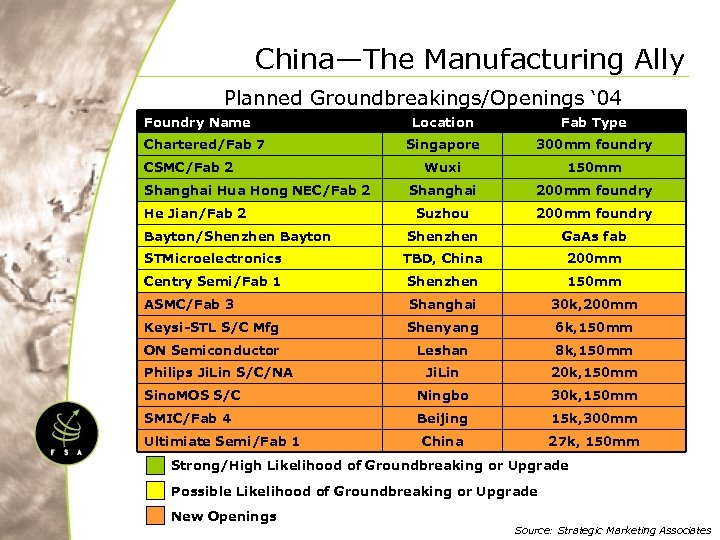

China—The Manufacturing Ally Planned Groundbreakings/Openings ‘ 04 Foundry Name Location Fab Type Singapore 300 mm foundry Wuxi 150 mm Shanghai 200 mm foundry Suzhou 200 mm foundry Shenzhen Ga. As fab STMicroelectronics TBD, China 200 mm Centry Semi/Fab 1 Shenzhen 150 mm ASMC/Fab 3 Shanghai 30 k, 200 mm Keysi-STL S/C Mfg Shenyang 6 k, 150 mm ON Semiconductor Leshan 8 k, 150 mm Ji. Lin 20 k, 150 mm Sino. MOS S/C Ningbo 30 k, 150 mm SMIC/Fab 4 Beijing 15 k, 300 mm China 27 k, 150 mm Chartered/Fab 7 CSMC/Fab 2 Shanghai Hua Hong NEC/Fab 2 He Jian/Fab 2 Bayton/Shenzhen Bayton Philips Ji. Lin S/C/NA Ultimiate Semi/Fab 1 Strong/High Likelihood of Groundbreaking or Upgrade Possible Likelihood of Groundbreaking or Upgrade New Openings Source: Strategic Marketing Associates

![China—The Manufacturing Ally “WTO membership will bring China into [compliance] with normal global business China—The Manufacturing Ally “WTO membership will bring China into [compliance] with normal global business](https://present5.com/presentation/5dc8c4b1300f7ab0f62271793f1f17c5/image-25.jpg)

China—The Manufacturing Ally “WTO membership will bring China into [compliance] with normal global business practices. ” —Chris Chang, SMIC Grace Semiconductor Commodity Flash, DRAMs, SRAMs SMIC Hua Hong NEC (HHNEC) CMOS CSMC Logic, Flash, SRAM, SDRAM Logic, mixedsignal, RF, LCD Drivers 25 K/month by end of 2003 10 k 4”/11 k 5”/6 k 6 -inch/month Fab conversion— 300 mm 5 um down to 0. 8 um Expanding to 0. 35 um Foreign investment, domestic investment and future IPO Received $67 M to expand 6 -inch capabilities 45 K/month by end of 2003 300 mm fab in Bejing in 2004 Next fab 300 mm Foreign investment, domestic investment and IPO 3/04 Foreign investment, domestic investment and future IPO

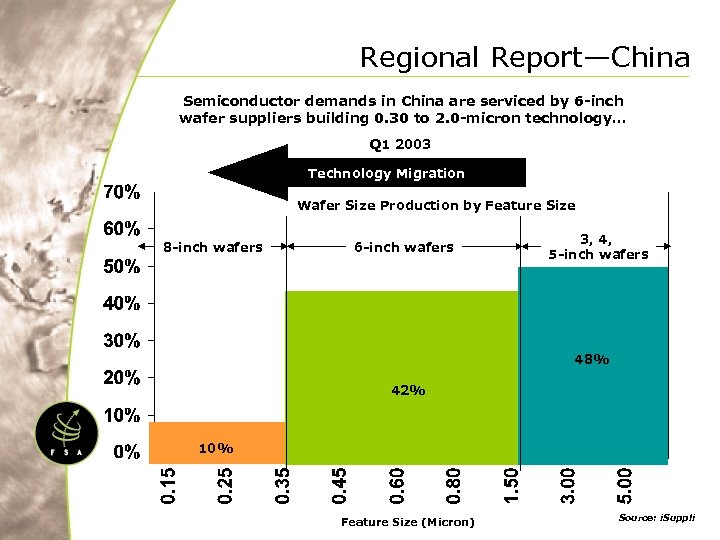

Regional Report—China Semiconductor demands in China are serviced by 6 -inch wafer suppliers building 0. 30 to 2. 0 -micron technology… Q 1 2003 Technology Migration Wafer Size Production by Feature Size 8 -inch wafers 6 -inch wafers 3, 4, 5 -inch wafers 48% 42% 10% Feature Size (Micron) Source: i. Suppli

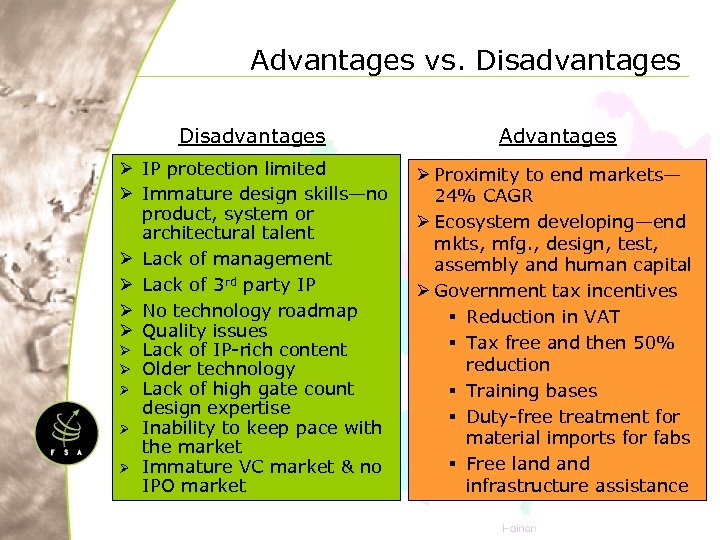

Advantages vs. Disadvantages Advantages Ø IP protection limited Ø Immature design skills—no product, system or architectural talent Ø Lack of management Ø Lack of 3 rd party IP Ø No technology roadmap Ø Quality issues Ø Lack of IP-rich content Ø Older technology Ø Lack of high gate count design expertise Ø Inability to keep pace with the market Ø Immature VC market & no IPO market Ø Proximity to end markets— 24% CAGR Ø Ecosystem developing—end mkts, mfg. , design, test, assembly and human capital Ø Government tax incentives § Reduction in VAT § Tax free and then 50% reduction § Training bases § Duty-free treatment for material imports for fabs § Free land infrastructure assistance

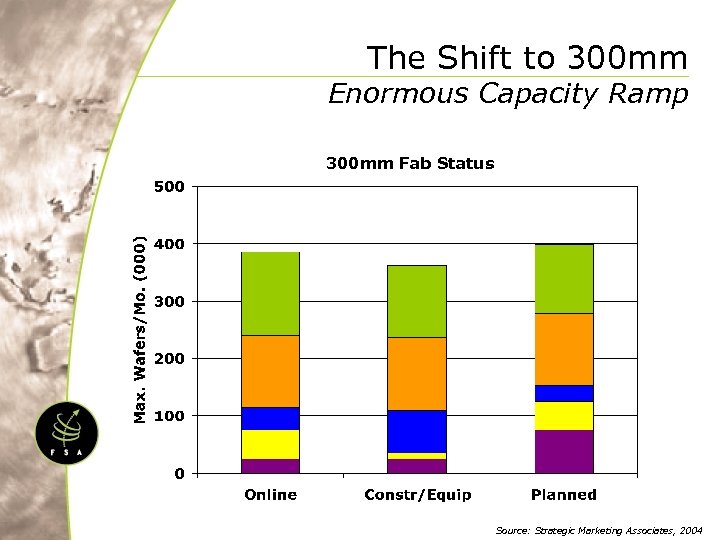

The Shift to 300 mm Enormous Capacity Ramp 300 mm Fab Status Source: Strategic Marketing Associates, 2004

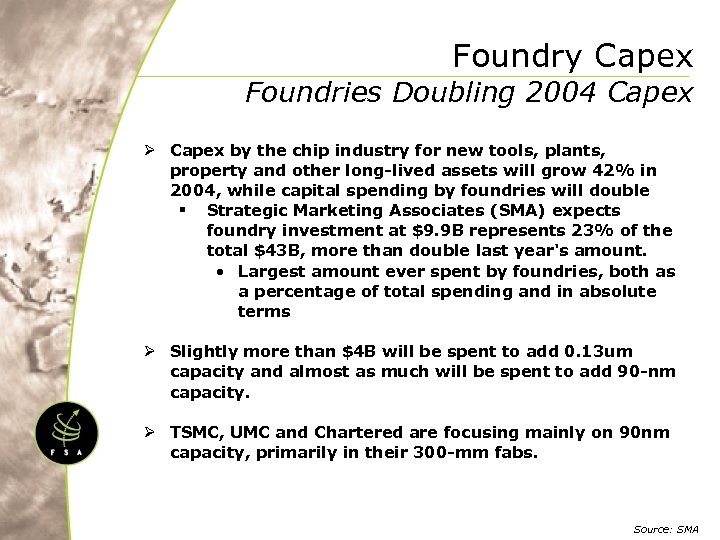

Foundry Capex Foundries Doubling 2004 Capex Ø Capex by the chip industry for new tools, plants, property and other long-lived assets will grow 42% in 2004, while capital spending by foundries will double § Strategic Marketing Associates (SMA) expects foundry investment at $9. 9 B represents 23% of the total $43 B, more than double last year's amount. • Largest amount ever spent by foundries, both as a percentage of total spending and in absolute terms Ø Slightly more than $4 B will be spent to add 0. 13 um capacity and almost as much will be spent to add 90 -nm capacity. Ø TSMC, UMC and Chartered are focusing mainly on 90 nm capacity, primarily in their 300 -mm fabs. Source: SMA

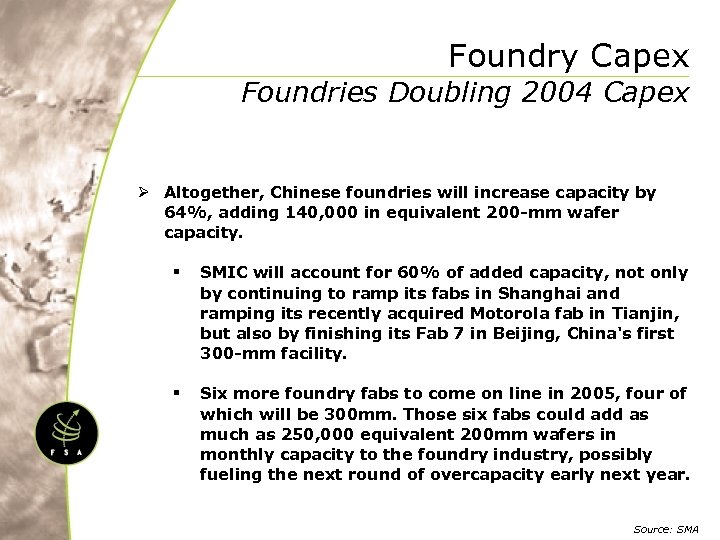

Foundry Capex Foundries Doubling 2004 Capex Ø Altogether, Chinese foundries will increase capacity by 64%, adding 140, 000 in equivalent 200 -mm wafer capacity. § SMIC will account for 60% of added capacity, not only by continuing to ramp its fabs in Shanghai and ramping its recently acquired Motorola fab in Tianjin, but also by finishing its Fab 7 in Beijing, China's first 300 -mm facility. § Six more foundry fabs to come on line in 2005, four of which will be 300 mm. Those six fabs could add as much as 250, 000 equivalent 200 mm wafers in monthly capacity to the foundry industry, possibly fueling the next round of overcapacity early next year. Source: SMA

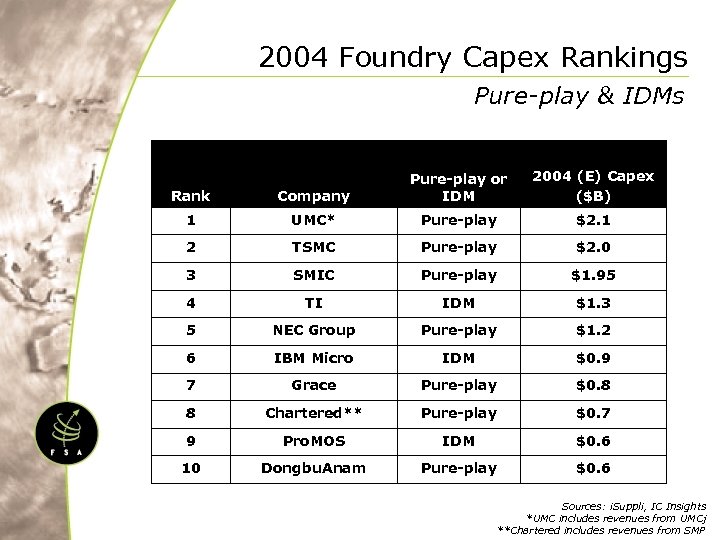

2004 Foundry Capex Rankings Pure-play & IDMs 2004 (E) Capex ($B) Rank Company Pure-play or IDM 1 UMC* Pure-play $2. 1 2 TSMC Pure-play $2. 0 3 SMIC Pure-play $1. 95 4 TI IDM $1. 3 5 NEC Group Pure-play $1. 2 6 IBM Micro IDM $0. 9 7 Grace Pure-play $0. 8 8 Chartered** Pure-play $0. 7 9 Pro. MOS IDM $0. 6 10 Dongbu. Anam Pure-play $0. 6 Sources: i. Suppli, IC Insights *UMC includes revenues from UMCj **Chartered includes revenues from SMP

Fabless Industry Challenges Increasingly complex supply chain Aggressive product, process and packaging roadmaps—developed independently Escalating product development costs Accelerating scale of leading-edge manufacturing and process technology

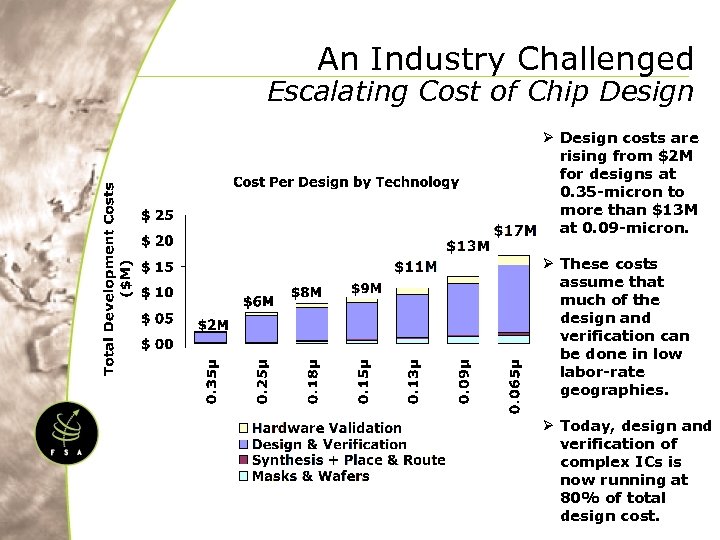

An Industry Challenged Escalating Cost of Chip Design Ø Design costs are rising from $2 M for designs at 0. 35 -micron to more than $13 M at 0. 09 -micron. Ø These costs assume that much of the design and verification can be done in low labor-rate geographies. Ø Today, design and verification of complex ICs is now running at 80% of total design cost.

Summary Ø The fabless model is now considered the future of the semiconductor industry Ø The FSA is The Global Voice for this critical industry segment Ø Difficult technology transitions and increasing product development complexity challenge our members Ø Taiwan/China are uniquely positioned to take advantage of certain industry trends and challenges

Thank you! 王智立博士 亞太區執行長 e-mail: jwang@fsa. org 全球 IC設計與委外代 協會 Fabless Semiconductor Association (FSA)

5dc8c4b1300f7ab0f62271793f1f17c5.ppt