61be38f5e60d4d6a0f29d0ca215dca09.ppt

- Количество слайдов: 58

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Research Report The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks December 2011 Terry Norman and Richard Linton © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Research Report The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks December 2011 Terry Norman and Richard Linton © Analysys Mason Limited 2011

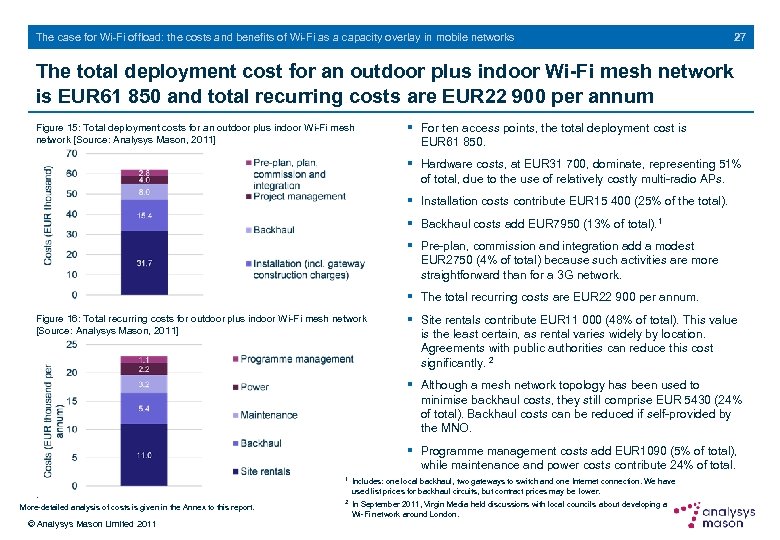

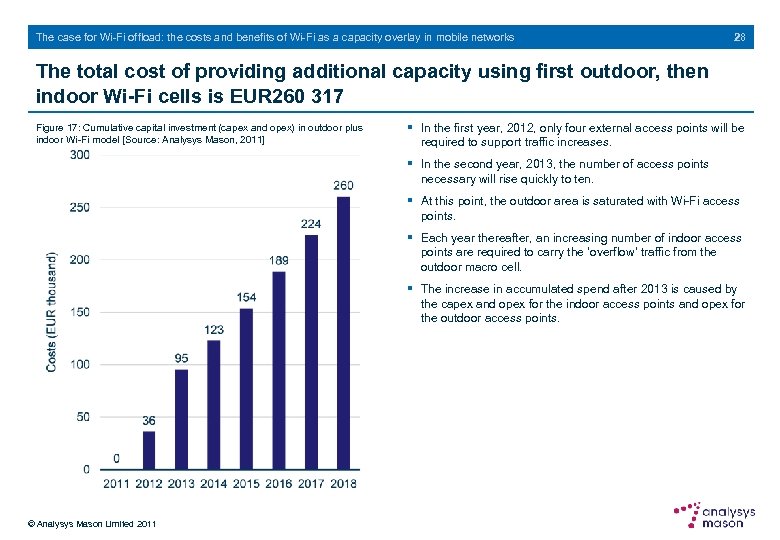

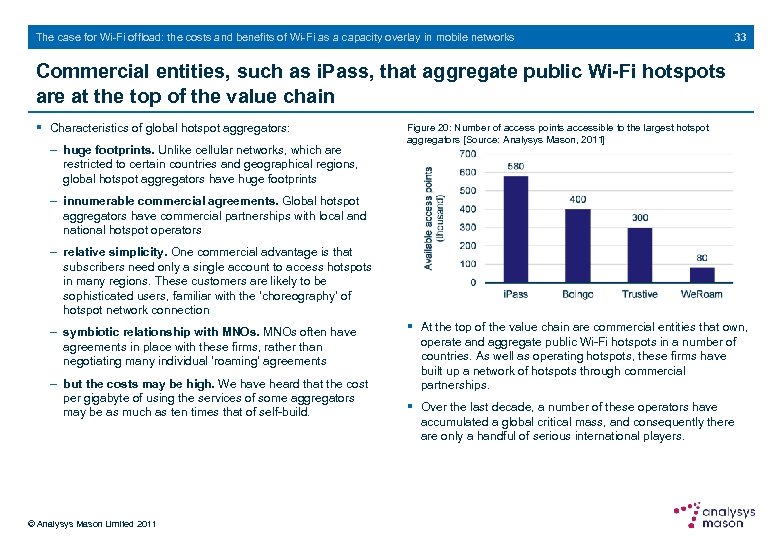

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 2 Contents Slide no. 5. 6. 7. 8. 9. 10. 11. 12. 13. 22. Indoor Wi-Fi only model 23. The total deployment costs for an indoor Wi-Fi access point are EUR 480 and total recurring costs are EUR 560 per annum 24. The total cost of providing additional capacity using the indoor Wi-Fi only model is EUR 124 910 25. Outdoor plus indoor Wi-Fi model 26. Our outdoor plus indoor Wi-Fi model assumes a mesh architecture 27. The total deployment cost for an outdoor plus indoor Wi-Fi mesh network is EUR 61 850 and total recurring costs are EUR 22 900 per annum 28. The total cost of providing additional capacity using first outdoor, then indoor Wi-Fi cells is EUR 260 317 29. The cost of capacity required to relieve congestion in a 3 G macro-cell is lowest for indoor Wi-Fi only 30. The leading operators’ propositions 31. In the near future, next-generation Wi-Fi hotspots will be an important strategic element in MNOs’ churn reduction 32. The Wi-Fi hotspot value chain encompasses a number of commercial relationships 33. Commercial entities, such as i. Pass, that aggregate public Wi-Fi hotspots are at the top of the value chain 34. National, local and regional operators of Wi-Fi hotspots 35. Operators may form partnerships to expand their hotspot footprints, but should complement this with their own deployments 14. 15. 16. 17. 18. 19. 20. 21. Executive summary [1] Executive summary [2] Executive summary [3] Recommendations [1] Recommendations [2] The drivers of Wi-Fi offload Growth in mobile traffic and number of connections will be substantial up to 2016 Traffic growth and falling revenue are the principal drivers of Wi-Fi offload To meet traffic demand through macro network expansion would be prohibitively expensive Mobile network operators will need to reduce network carriage costs by 50% Operators are seeking ways to reduce costs and Wi-Fi is one such way The cost of deploying commercial Wi-Fi cells We present an analysis of coverage costs in three scenarios The LTE-only model To provide additional capacity using 4 G only, a total of more than EUR 600 000 may be spent on a single, congested site © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 2 Contents Slide no. 5. 6. 7. 8. 9. 10. 11. 12. 13. 22. Indoor Wi-Fi only model 23. The total deployment costs for an indoor Wi-Fi access point are EUR 480 and total recurring costs are EUR 560 per annum 24. The total cost of providing additional capacity using the indoor Wi-Fi only model is EUR 124 910 25. Outdoor plus indoor Wi-Fi model 26. Our outdoor plus indoor Wi-Fi model assumes a mesh architecture 27. The total deployment cost for an outdoor plus indoor Wi-Fi mesh network is EUR 61 850 and total recurring costs are EUR 22 900 per annum 28. The total cost of providing additional capacity using first outdoor, then indoor Wi-Fi cells is EUR 260 317 29. The cost of capacity required to relieve congestion in a 3 G macro-cell is lowest for indoor Wi-Fi only 30. The leading operators’ propositions 31. In the near future, next-generation Wi-Fi hotspots will be an important strategic element in MNOs’ churn reduction 32. The Wi-Fi hotspot value chain encompasses a number of commercial relationships 33. Commercial entities, such as i. Pass, that aggregate public Wi-Fi hotspots are at the top of the value chain 34. National, local and regional operators of Wi-Fi hotspots 35. Operators may form partnerships to expand their hotspot footprints, but should complement this with their own deployments 14. 15. 16. 17. 18. 19. 20. 21. Executive summary [1] Executive summary [2] Executive summary [3] Recommendations [1] Recommendations [2] The drivers of Wi-Fi offload Growth in mobile traffic and number of connections will be substantial up to 2016 Traffic growth and falling revenue are the principal drivers of Wi-Fi offload To meet traffic demand through macro network expansion would be prohibitively expensive Mobile network operators will need to reduce network carriage costs by 50% Operators are seeking ways to reduce costs and Wi-Fi is one such way The cost of deploying commercial Wi-Fi cells We present an analysis of coverage costs in three scenarios The LTE-only model To provide additional capacity using 4 G only, a total of more than EUR 600 000 may be spent on a single, congested site © Analysys Mason Limited 2011

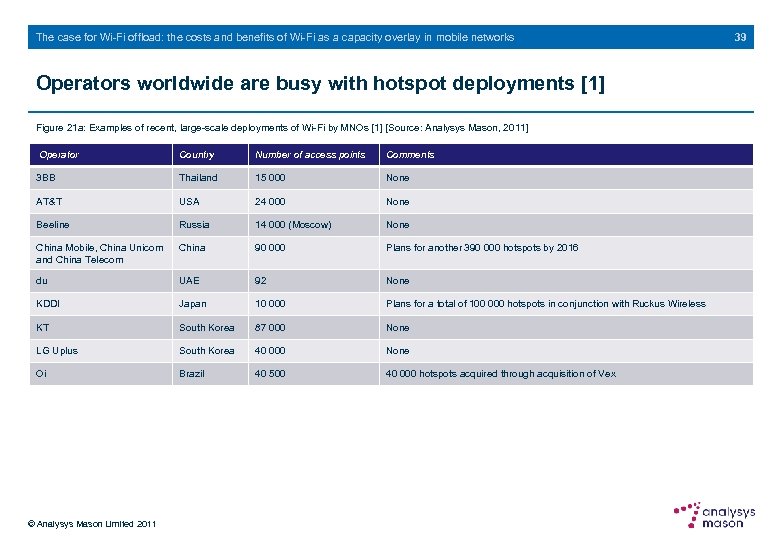

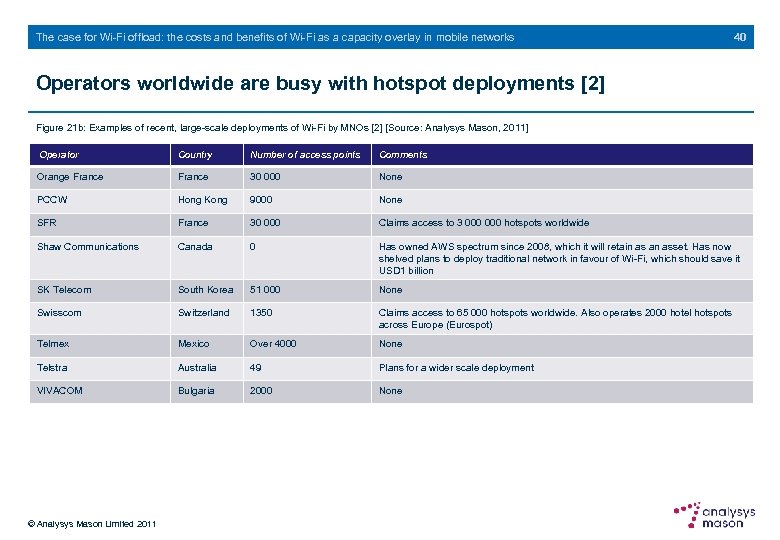

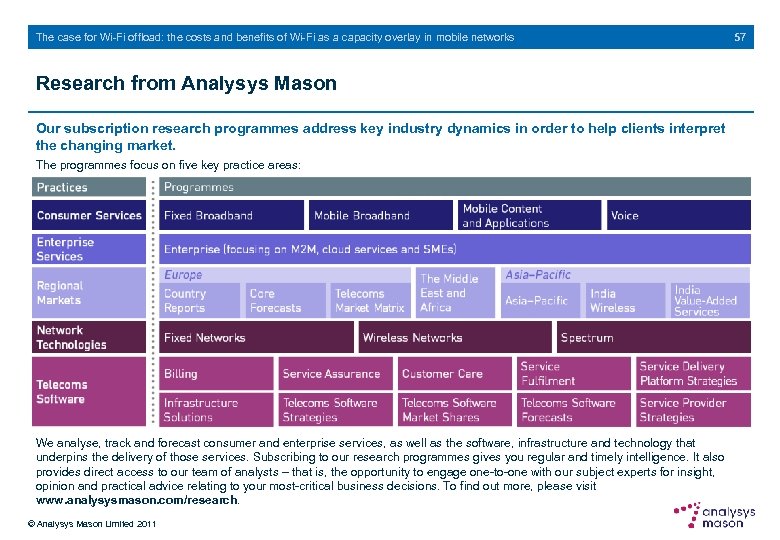

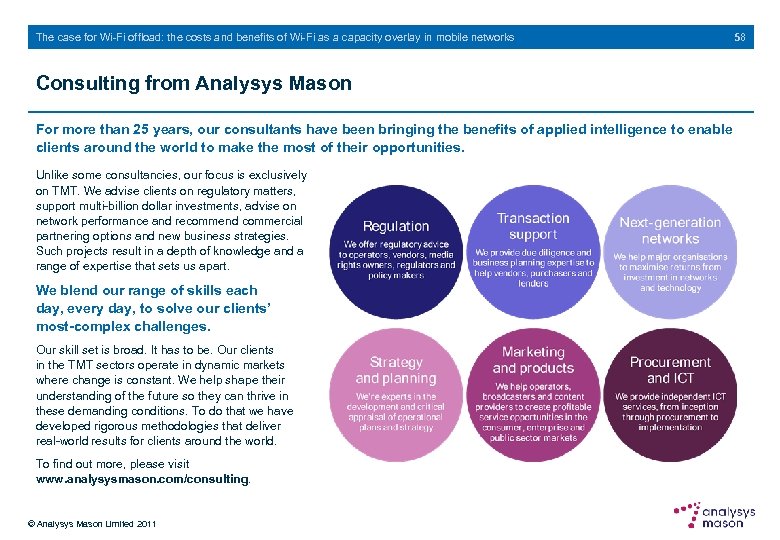

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Contents Slide no. 36. In the UK, only one MNO has so far announced plans to deploy its own Wi-Fi network 37. Elsewhere, a number of large-scale Wi-Fi roll-outs have recently been announced 38. Recent developments support the claim that Wi-Fi is on the verge of becoming an integral network component for MNOs 39. Operators worldwide are busy with hotspot deployments [1] 40. Operators worldwide are busy with hotspot deployments [2] 41. Customers have come to expect that certain commercial premises will have Wi-Fi access points and this helps to stimulate the market 42. The emergence of NGH signals the end of Wi-Fi’s role as a complementary component of MNOs’ service offering 43. Alternatives to, and problems with, Wi-Fi offload 44. Wi-Fi is cheaper than LTE and operates in free spectrum, so is there a catch? 45. Connecting to a Wi-Fi hotspot should be as simple as connecting to a mobile network and problems may harm the user’s bond with the operator 46. The Wi-Fi industry must standardise in order to deliver carrier-grade products and services 47. Backhaul is still a challenge for all small-cell solutions, not only for Wi-Fi 48. MNOs will need the services of trusted partners to backhaul Wi-Fi 49. Annex: additional data 50. Indoor Wi-Fi only model assumptions: breakdown of total deployment and recurring costs 51. Outdoor Wi-Fi unit assumptions: breakdown of total deployment and recurring costs 52. Mesh networks in more detail [1] 53. Mesh networks in more detail [2] 54. About the authors and Analysys Mason 55. About the authors 56. About Analysys Mason 57. Research from Analysys Mason 58. Consulting from Analysys Mason © Analysys Mason Limited 2011 3

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Contents Slide no. 36. In the UK, only one MNO has so far announced plans to deploy its own Wi-Fi network 37. Elsewhere, a number of large-scale Wi-Fi roll-outs have recently been announced 38. Recent developments support the claim that Wi-Fi is on the verge of becoming an integral network component for MNOs 39. Operators worldwide are busy with hotspot deployments [1] 40. Operators worldwide are busy with hotspot deployments [2] 41. Customers have come to expect that certain commercial premises will have Wi-Fi access points and this helps to stimulate the market 42. The emergence of NGH signals the end of Wi-Fi’s role as a complementary component of MNOs’ service offering 43. Alternatives to, and problems with, Wi-Fi offload 44. Wi-Fi is cheaper than LTE and operates in free spectrum, so is there a catch? 45. Connecting to a Wi-Fi hotspot should be as simple as connecting to a mobile network and problems may harm the user’s bond with the operator 46. The Wi-Fi industry must standardise in order to deliver carrier-grade products and services 47. Backhaul is still a challenge for all small-cell solutions, not only for Wi-Fi 48. MNOs will need the services of trusted partners to backhaul Wi-Fi 49. Annex: additional data 50. Indoor Wi-Fi only model assumptions: breakdown of total deployment and recurring costs 51. Outdoor Wi-Fi unit assumptions: breakdown of total deployment and recurring costs 52. Mesh networks in more detail [1] 53. Mesh networks in more detail [2] 54. About the authors and Analysys Mason 55. About the authors 56. About Analysys Mason 57. Research from Analysys Mason 58. Consulting from Analysys Mason © Analysys Mason Limited 2011 3

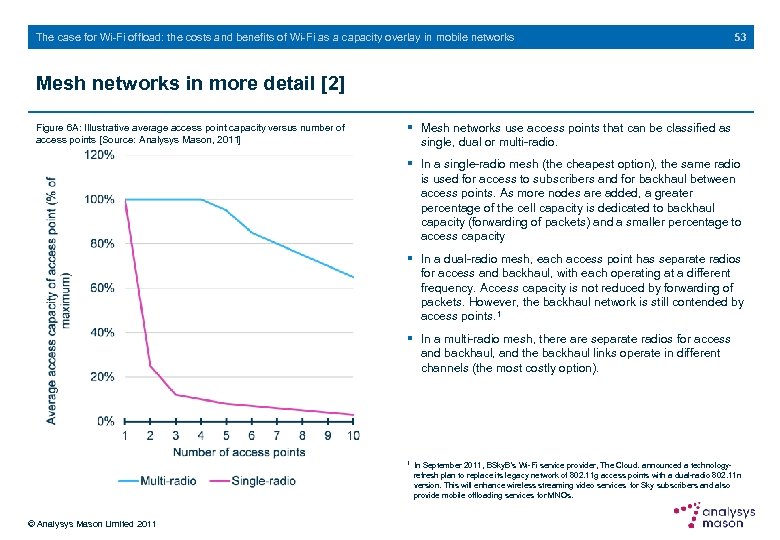

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 4 List of figures Figure 1: Comparison of cumulative RAN costs (opex + capex) for capacity upgrade investments Figure 2: Average mobile network traffic per month per connection, 2011– 2016 Figure 3: Average number of mobile network connections, 2011– 2016 Figure 4: Monthly traffic from mobile connections, 2011– 2016 Figure 5: Revenue per gigabyte of mobile broadband traffic, 2011– 2016 Figure 6: Annual capex on RAN, Western Europe, 2011– 2016 Figure 7: Annual capex in RAN assuming 50% reduction in network carriage costs, Western Europe, 2011– 2016 Figure 8: Capex for new LTE build Figure 9: Opex for new LTE build Figure 10: Cumulative capital investment (capex and opex) in LTE-only model Figure 11: Total deployment costs for an indoor Wi-Fi access point 1 Figure 12: Total recurring costs for an indoor Wi-Fi access point Figure 13: Cumulative capital investment (capex and opex) in indoor Wi-Fi only model Figure 14: Outdoor plus indoor Wi-Fi model architecture Figure 15: Total deployment costs for an outdoor plus indoor Wi-Fi mesh network © Analysys Mason Limited 2011 Figure 16: Total recurring costs for outdoor plus indoor Wi-Fi mesh network Figure 17: Cumulative capital investment (capex and opex) in outdoor plus indoor Wi-Fi model Figure 18: Comparison of cumulative costs for three deployment models Figure 19: The Wi-Fi hotspot value chain Figure 20: Number of access points accessible to the largest hotspot aggregators Figure 21 a: Examples of recent, large-scale deployments of Wi-Fi by MNOs [1] Figure 21 b: Examples of recent, large-scale deployments of Wi-Fi by MNOs [2] Figure 1 A: Total deployment costs for an indoor access point Figure 2 A: Total recurring costs for an indoor access point Figure 3 A: Total deployments costs for outdoor Wi-Fi network Figure 4 A: Total recurring costs for outdoor Wi-Fi network Figure 5 A: Outdoor Wi-Fi model architecture Figure 6 A: Illustrative average access point capacity versus number of access points

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 4 List of figures Figure 1: Comparison of cumulative RAN costs (opex + capex) for capacity upgrade investments Figure 2: Average mobile network traffic per month per connection, 2011– 2016 Figure 3: Average number of mobile network connections, 2011– 2016 Figure 4: Monthly traffic from mobile connections, 2011– 2016 Figure 5: Revenue per gigabyte of mobile broadband traffic, 2011– 2016 Figure 6: Annual capex on RAN, Western Europe, 2011– 2016 Figure 7: Annual capex in RAN assuming 50% reduction in network carriage costs, Western Europe, 2011– 2016 Figure 8: Capex for new LTE build Figure 9: Opex for new LTE build Figure 10: Cumulative capital investment (capex and opex) in LTE-only model Figure 11: Total deployment costs for an indoor Wi-Fi access point 1 Figure 12: Total recurring costs for an indoor Wi-Fi access point Figure 13: Cumulative capital investment (capex and opex) in indoor Wi-Fi only model Figure 14: Outdoor plus indoor Wi-Fi model architecture Figure 15: Total deployment costs for an outdoor plus indoor Wi-Fi mesh network © Analysys Mason Limited 2011 Figure 16: Total recurring costs for outdoor plus indoor Wi-Fi mesh network Figure 17: Cumulative capital investment (capex and opex) in outdoor plus indoor Wi-Fi model Figure 18: Comparison of cumulative costs for three deployment models Figure 19: The Wi-Fi hotspot value chain Figure 20: Number of access points accessible to the largest hotspot aggregators Figure 21 a: Examples of recent, large-scale deployments of Wi-Fi by MNOs [1] Figure 21 b: Examples of recent, large-scale deployments of Wi-Fi by MNOs [2] Figure 1 A: Total deployment costs for an indoor access point Figure 2 A: Total recurring costs for an indoor access point Figure 3 A: Total deployments costs for outdoor Wi-Fi network Figure 4 A: Total recurring costs for outdoor Wi-Fi network Figure 5 A: Outdoor Wi-Fi model architecture Figure 6 A: Illustrative average access point capacity versus number of access points

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 5

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 5

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 6 Executive summary [1] § The demand for mobile data traffic and falling revenue per gigabyte are forcing operators to seek ways to reduce network carriage costs and to restore margins. We estimate that, on average, the global demand for mobile data traffic will grow at a CAGR of 52%. If operators endeavour to meet this demand using conventional macro site solutions, the cost of RAN equipment will increase eightfold. We argue that this is prohibitively expensive. In Western Europe alone, capex on RAN would increase from USD 5 billion in 2011 to approximately USD 40 billion in 2016. § In order to reduce capex on RAN to a manageable level, operators will need to improve the efficiency of traffic delivery and to reduce network carriage costs by 50%. In Western Europe, for example, taking these steps would cause capex on RAN to rise not to about USD 40 billion, but instead to about USD 10 billion in 2016, which would represent an acceptable growth in capex over the period 2011 to 2016. § One way to reduce network carriage costs, which is attracting a great deal of interest from MNOs, involves carrying a proportion of the traffic on a cost-efficient small cell. Because it is widely deployed and competitively priced, Wi-Fi is the leading candidate ‘small cell’ technology. § During September 2011, a number of large-scale Wi-Fi roll-outs were announced by MNOs. For example, KDDI in Japan (in conjunction with Ruckus Wireless) has plans for a total of 100 000 hotspots. Companies are also being set up to offer wholesale and aggregate Wi-Fi services. Towerstream is deploying 1000 routers in seven square miles of Manhattan, NY, USA, which is equivalent to 54 hotspots per square kilometre. § We have modelled the cost to build and operate mobile radio coverage over an urban area of 0. 8 km 2, which is typical of an urban 3 G site. We have compared the cost to upgrade the site in three different ways, each designed to support a CAGR of 52% in mobile data traffic. In the first scenario, we assumed that the 3 G site was upgraded to LTE and that further LTE sites were built as necessary to meet the traffic growth. In the second, indoor Wi-Fi access points are used to augment capacity so that total mobiledata traffic may grow at a rate of 52% per annum. In the third case, a mix of outdoor and indoor Wi-Fi access points are used to augment capacity to allow total mobile-data traffic to rise at a CAGR of 52%. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 6 Executive summary [1] § The demand for mobile data traffic and falling revenue per gigabyte are forcing operators to seek ways to reduce network carriage costs and to restore margins. We estimate that, on average, the global demand for mobile data traffic will grow at a CAGR of 52%. If operators endeavour to meet this demand using conventional macro site solutions, the cost of RAN equipment will increase eightfold. We argue that this is prohibitively expensive. In Western Europe alone, capex on RAN would increase from USD 5 billion in 2011 to approximately USD 40 billion in 2016. § In order to reduce capex on RAN to a manageable level, operators will need to improve the efficiency of traffic delivery and to reduce network carriage costs by 50%. In Western Europe, for example, taking these steps would cause capex on RAN to rise not to about USD 40 billion, but instead to about USD 10 billion in 2016, which would represent an acceptable growth in capex over the period 2011 to 2016. § One way to reduce network carriage costs, which is attracting a great deal of interest from MNOs, involves carrying a proportion of the traffic on a cost-efficient small cell. Because it is widely deployed and competitively priced, Wi-Fi is the leading candidate ‘small cell’ technology. § During September 2011, a number of large-scale Wi-Fi roll-outs were announced by MNOs. For example, KDDI in Japan (in conjunction with Ruckus Wireless) has plans for a total of 100 000 hotspots. Companies are also being set up to offer wholesale and aggregate Wi-Fi services. Towerstream is deploying 1000 routers in seven square miles of Manhattan, NY, USA, which is equivalent to 54 hotspots per square kilometre. § We have modelled the cost to build and operate mobile radio coverage over an urban area of 0. 8 km 2, which is typical of an urban 3 G site. We have compared the cost to upgrade the site in three different ways, each designed to support a CAGR of 52% in mobile data traffic. In the first scenario, we assumed that the 3 G site was upgraded to LTE and that further LTE sites were built as necessary to meet the traffic growth. In the second, indoor Wi-Fi access points are used to augment capacity so that total mobiledata traffic may grow at a rate of 52% per annum. In the third case, a mix of outdoor and indoor Wi-Fi access points are used to augment capacity to allow total mobile-data traffic to rise at a CAGR of 52%. © Analysys Mason Limited 2011

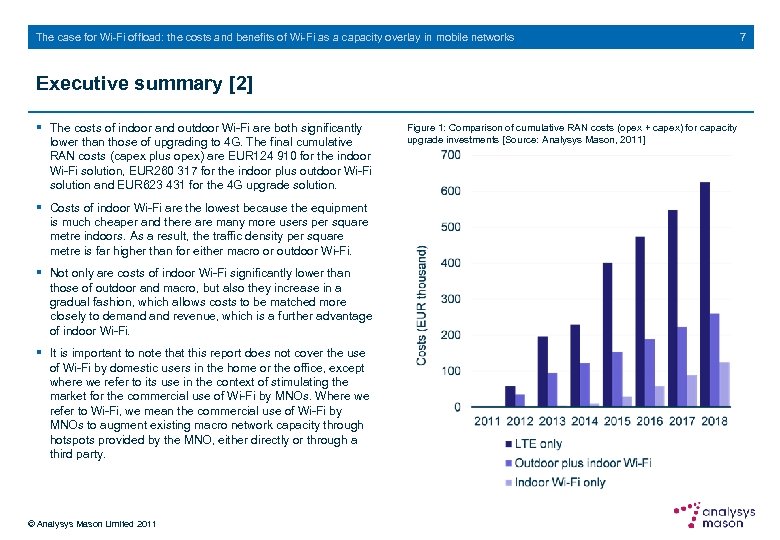

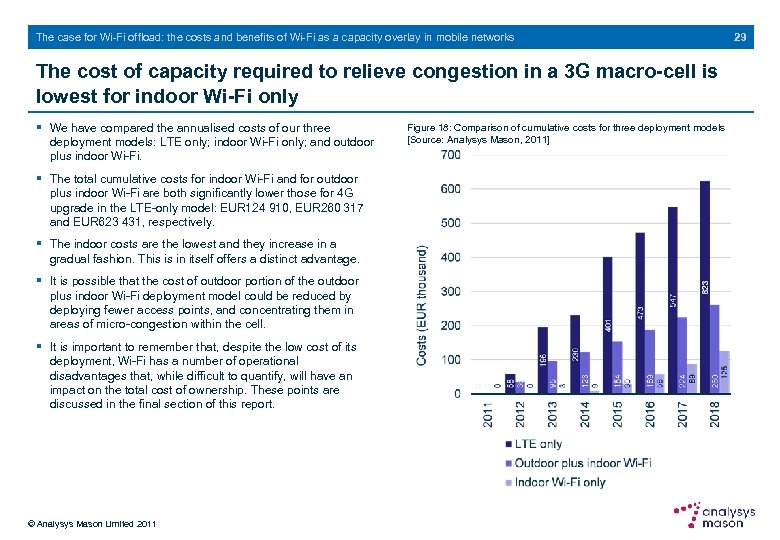

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary [2] § The costs of indoor and outdoor Wi-Fi are both significantly lower than those of upgrading to 4 G. The final cumulative RAN costs (capex plus opex) are EUR 124 910 for the indoor Wi-Fi solution, EUR 260 317 for the indoor plus outdoor Wi-Fi solution and EUR 623 431 for the 4 G upgrade solution. § Costs of indoor Wi-Fi are the lowest because the equipment is much cheaper and there are many more users per square metre indoors. As a result, the traffic density per square metre is far higher than for either macro or outdoor Wi-Fi. § Not only are costs of indoor Wi-Fi significantly lower than those of outdoor and macro, but also they increase in a gradual fashion, which allows costs to be matched more closely to demand revenue, which is a further advantage of indoor Wi-Fi. § It is important to note that this report does not cover the use of Wi-Fi by domestic users in the home or the office, except where we refer to its use in the context of stimulating the market for the commercial use of Wi-Fi by MNOs. Where we refer to Wi-Fi, we mean the commercial use of Wi-Fi by MNOs to augment existing macro network capacity through hotspots provided by the MNO, either directly or through a third party. © Analysys Mason Limited 2011 Figure 1: Comparison of cumulative RAN costs (opex + capex) for capacity upgrade investments [Source: Analysys Mason, 2011] 7

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary [2] § The costs of indoor and outdoor Wi-Fi are both significantly lower than those of upgrading to 4 G. The final cumulative RAN costs (capex plus opex) are EUR 124 910 for the indoor Wi-Fi solution, EUR 260 317 for the indoor plus outdoor Wi-Fi solution and EUR 623 431 for the 4 G upgrade solution. § Costs of indoor Wi-Fi are the lowest because the equipment is much cheaper and there are many more users per square metre indoors. As a result, the traffic density per square metre is far higher than for either macro or outdoor Wi-Fi. § Not only are costs of indoor Wi-Fi significantly lower than those of outdoor and macro, but also they increase in a gradual fashion, which allows costs to be matched more closely to demand revenue, which is a further advantage of indoor Wi-Fi. § It is important to note that this report does not cover the use of Wi-Fi by domestic users in the home or the office, except where we refer to its use in the context of stimulating the market for the commercial use of Wi-Fi by MNOs. Where we refer to Wi-Fi, we mean the commercial use of Wi-Fi by MNOs to augment existing macro network capacity through hotspots provided by the MNO, either directly or through a third party. © Analysys Mason Limited 2011 Figure 1: Comparison of cumulative RAN costs (opex + capex) for capacity upgrade investments [Source: Analysys Mason, 2011] 7

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 8 Executive summary [3] § The mobile operator may find it very difficult to attach enough users to the outdoor Wi-Fi unit completely to relieve the congested macro cell that it is supporting. Almost 95% of tablet users and 70% of smartphone users will be found indoors, leaving very few heavy users of data outdoors. Wi-Fi carrier frequencies do not penetrate into buildings, so outdoor Wi-Fi units alone can at best carry only 10% of the heavy data traffic. This will not be sufficient to prevent the macro site becoming overloaded. It is likely that indoor Wi-Fi units will also be required. § Although outdoor Wi-Fi could theoretically be used as a cost-effective means of providing radio mobile data coverage to an entire macro cell area, could be reduced by deploying fewer access points and concentrating them on areas of micro-congestion within the cell. § The capacity limitations of copper backhaul may well constrain traffic growth on indoor Wi-Fi units within a very short time – one to two years. Wi-Fi is best deployed as an indoor solution, when fixed backhaul, using copper pairs, should be readily available. However, the capacity of fixed copper backhaul, typically less than 30 Mbps, will quickly be exceeded by the traffic throughput required of the Wi-Fi unit. § For indoor deployments, the operator’s challenge is to access and acquire the site. This may mean leasing access to the site from the site owner, or establishing a commercial relationship with the site owner, for example a chain of cafés. This can be a complex, difficult and time-consuming process. § The Wi-Fi industry must overcome significant issues in order to deliver ‘carrier-grade’ products and services. In order to drive global adoption of Wi-Fi by mobile operators, the areas of authentication, encryption and policy control must be standardised. Femtocells overcome these issues, but are not yet competitively priced. We expect the current battle between the technologies to be decided during the next two years. The final resolution will probably be the convergence of the two technologies. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 8 Executive summary [3] § The mobile operator may find it very difficult to attach enough users to the outdoor Wi-Fi unit completely to relieve the congested macro cell that it is supporting. Almost 95% of tablet users and 70% of smartphone users will be found indoors, leaving very few heavy users of data outdoors. Wi-Fi carrier frequencies do not penetrate into buildings, so outdoor Wi-Fi units alone can at best carry only 10% of the heavy data traffic. This will not be sufficient to prevent the macro site becoming overloaded. It is likely that indoor Wi-Fi units will also be required. § Although outdoor Wi-Fi could theoretically be used as a cost-effective means of providing radio mobile data coverage to an entire macro cell area, could be reduced by deploying fewer access points and concentrating them on areas of micro-congestion within the cell. § The capacity limitations of copper backhaul may well constrain traffic growth on indoor Wi-Fi units within a very short time – one to two years. Wi-Fi is best deployed as an indoor solution, when fixed backhaul, using copper pairs, should be readily available. However, the capacity of fixed copper backhaul, typically less than 30 Mbps, will quickly be exceeded by the traffic throughput required of the Wi-Fi unit. § For indoor deployments, the operator’s challenge is to access and acquire the site. This may mean leasing access to the site from the site owner, or establishing a commercial relationship with the site owner, for example a chain of cafés. This can be a complex, difficult and time-consuming process. § The Wi-Fi industry must overcome significant issues in order to deliver ‘carrier-grade’ products and services. In order to drive global adoption of Wi-Fi by mobile operators, the areas of authentication, encryption and policy control must be standardised. Femtocells overcome these issues, but are not yet competitively priced. We expect the current battle between the technologies to be decided during the next two years. The final resolution will probably be the convergence of the two technologies. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 9

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 9

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 10 Recommendations [1] § Operators must reduce network carriage costs by 50% in order to support a CAGR of 50% in data traffic. There are various techniques at their disposal to achieve this. In particular: network sharing, small cell solutions, such as Wi-Fi, self-optimising networks and low-frequency spectrum, such as 800 MHz. Operators should investigate the costs and benefits of these major network carriage cost-reduction techniques. § Operators should trial Wi-Fi as a service delivery technology. Most operators are already trialling Wi-Fi as an offload technology, and should continue these trials, but extend them to consider the services that these Wi-Fi solutions can deliver, for example video. They should determine how this affects their strategies and business models. In terms of business models, operators should contrast and compare two fundamentally different models: B 2 B and B 2 C. Both have their advantages and disadvantages. § Operators should seek appropriate Wi-Fi partners. It is unlikely that MNOs will have the operational capability to deliver an effective Wi-Fi network. The partners should be able to deliver carrier-class Wi-Fi immediately. They should also be able to deliver Wi-Fi capability on the scale and density of access points that operators require. Few partners have this capability currently. § Pure mobile MNOs should seek trusted fixed partners. If the operator is ‘mobile only’, having no fixed sister company, it should establish partnerships for Wi-Fi backhaul with trusted fixed partners. A pure MNO Wi-Fi strategy is particularly vulnerable to the strategies of a fixed backhaul provider. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 10 Recommendations [1] § Operators must reduce network carriage costs by 50% in order to support a CAGR of 50% in data traffic. There are various techniques at their disposal to achieve this. In particular: network sharing, small cell solutions, such as Wi-Fi, self-optimising networks and low-frequency spectrum, such as 800 MHz. Operators should investigate the costs and benefits of these major network carriage cost-reduction techniques. § Operators should trial Wi-Fi as a service delivery technology. Most operators are already trialling Wi-Fi as an offload technology, and should continue these trials, but extend them to consider the services that these Wi-Fi solutions can deliver, for example video. They should determine how this affects their strategies and business models. In terms of business models, operators should contrast and compare two fundamentally different models: B 2 B and B 2 C. Both have their advantages and disadvantages. § Operators should seek appropriate Wi-Fi partners. It is unlikely that MNOs will have the operational capability to deliver an effective Wi-Fi network. The partners should be able to deliver carrier-class Wi-Fi immediately. They should also be able to deliver Wi-Fi capability on the scale and density of access points that operators require. Few partners have this capability currently. § Pure mobile MNOs should seek trusted fixed partners. If the operator is ‘mobile only’, having no fixed sister company, it should establish partnerships for Wi-Fi backhaul with trusted fixed partners. A pure MNO Wi-Fi strategy is particularly vulnerable to the strategies of a fixed backhaul provider. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 11 Recommendations [2] § Companies that intend to establish an outdoor Wi-Fi footprint should carefully consider the available technology options. The cost–performance characteristics of mesh networks vary significantly. Some operators with existing footprints are refreshing the technology in their networks in order to deliver better streaming video services to subscribers. Wi-Fi vendors are lining up to provide a range of innovative products and services into the marketplace. § Fixed broadband service providers should consider providing managed Wi-Fi services. This strategy is supported by the experience of such companies in providing managed services to end users. Also, since both indoor and outdoor Wi-Fi deployments often require fixed backhaul connections, service providers can promote the use of their fixed broadband products. Note that fixed broadband service providers, especially those that do not offer cellular services, can use (fast) Wi-Fi to dampen the impact of 4 G services, when they arrive. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 11 Recommendations [2] § Companies that intend to establish an outdoor Wi-Fi footprint should carefully consider the available technology options. The cost–performance characteristics of mesh networks vary significantly. Some operators with existing footprints are refreshing the technology in their networks in order to deliver better streaming video services to subscribers. Wi-Fi vendors are lining up to provide a range of innovative products and services into the marketplace. § Fixed broadband service providers should consider providing managed Wi-Fi services. This strategy is supported by the experience of such companies in providing managed services to end users. Also, since both indoor and outdoor Wi-Fi deployments often require fixed backhaul connections, service providers can promote the use of their fixed broadband products. Note that fixed broadband service providers, especially those that do not offer cellular services, can use (fast) Wi-Fi to dampen the impact of 4 G services, when they arrive. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 12

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 12

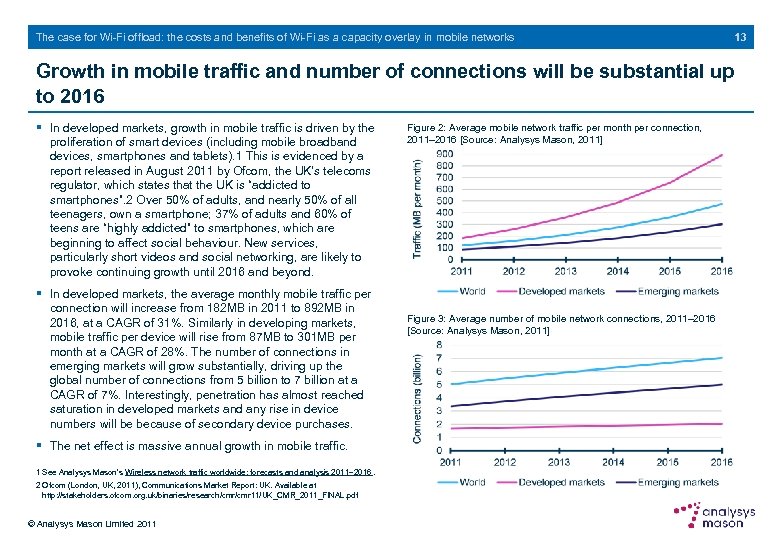

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 13 Growth in mobile traffic and number of connections will be substantial up to 2016 § In developed markets, growth in mobile traffic is driven by the proliferation of smart devices (including mobile broadband devices, smartphones and tablets). 1 This is evidenced by a report released in August 2011 by Ofcom, the UK’s telecoms regulator, which states that the UK is “addicted to smartphones”. 2 Over 50% of adults, and nearly 50% of all teenagers, own a smartphone; 37% of adults and 60% of teens are “highly addicted” to smartphones, which are beginning to affect social behaviour. New services, particularly short videos and social networking, are likely to provoke continuing growth until 2016 and beyond. § In developed markets, the average monthly mobile traffic per connection will increase from 182 MB in 2011 to 892 MB in 2016, at a CAGR of 31%. Similarly in developing markets, mobile traffic per device will rise from 87 MB to 301 MB per month at a CAGR of 28%. The number of connections in emerging markets will grow substantially, driving up the global number of connections from 5 billion to 7 billion at a CAGR of 7%. Interestingly, penetration has almost reached saturation in developed markets and any rise in device numbers will be because of secondary device purchases. § The net effect is massive annual growth in mobile traffic. 1 See Analysys Mason’s Wireless network traffic worldwide: forecasts and analysis 2011– 2016. 2 Ofcom (London, UK, 2011), Communications Market Report: UK. Available at http: //stakeholders. ofcom. org. uk/binaries/research/cmr 11/UK_CMR_2011_FINAL. pdf © Analysys Mason Limited 2011 Figure 2: Average mobile network traffic per month per connection, 2011– 2016 [Source: Analysys Mason, 2011] Figure 3: Average number of mobile network connections, 2011– 2016 [Source: Analysys Mason, 2011]

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 13 Growth in mobile traffic and number of connections will be substantial up to 2016 § In developed markets, growth in mobile traffic is driven by the proliferation of smart devices (including mobile broadband devices, smartphones and tablets). 1 This is evidenced by a report released in August 2011 by Ofcom, the UK’s telecoms regulator, which states that the UK is “addicted to smartphones”. 2 Over 50% of adults, and nearly 50% of all teenagers, own a smartphone; 37% of adults and 60% of teens are “highly addicted” to smartphones, which are beginning to affect social behaviour. New services, particularly short videos and social networking, are likely to provoke continuing growth until 2016 and beyond. § In developed markets, the average monthly mobile traffic per connection will increase from 182 MB in 2011 to 892 MB in 2016, at a CAGR of 31%. Similarly in developing markets, mobile traffic per device will rise from 87 MB to 301 MB per month at a CAGR of 28%. The number of connections in emerging markets will grow substantially, driving up the global number of connections from 5 billion to 7 billion at a CAGR of 7%. Interestingly, penetration has almost reached saturation in developed markets and any rise in device numbers will be because of secondary device purchases. § The net effect is massive annual growth in mobile traffic. 1 See Analysys Mason’s Wireless network traffic worldwide: forecasts and analysis 2011– 2016. 2 Ofcom (London, UK, 2011), Communications Market Report: UK. Available at http: //stakeholders. ofcom. org. uk/binaries/research/cmr 11/UK_CMR_2011_FINAL. pdf © Analysys Mason Limited 2011 Figure 2: Average mobile network traffic per month per connection, 2011– 2016 [Source: Analysys Mason, 2011] Figure 3: Average number of mobile network connections, 2011– 2016 [Source: Analysys Mason, 2011]

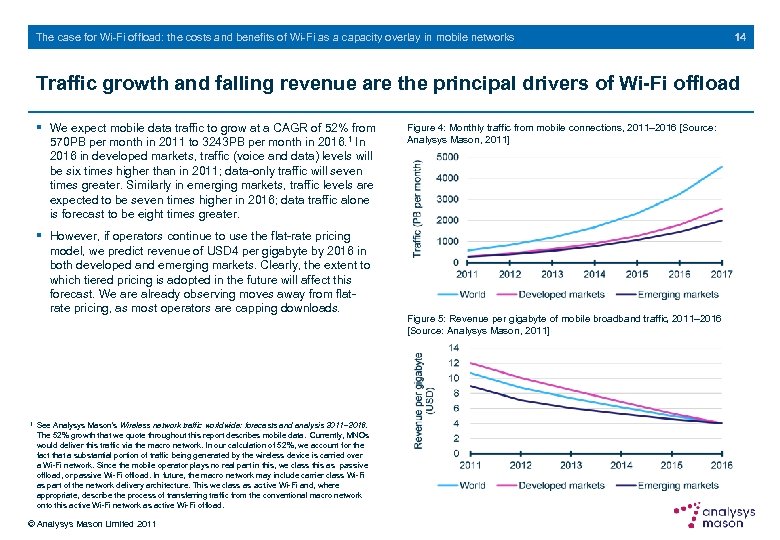

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 14 Traffic growth and falling revenue are the principal drivers of Wi-Fi offload § We expect mobile data traffic to grow at a CAGR of 52% from 570 PB per month in 2011 to 3243 PB per month in 2016. 1 In 2016 in developed markets, traffic (voice and data) levels will be six times higher than in 2011; data-only traffic will seven times greater. Similarly in emerging markets, traffic levels are expected to be seven times higher in 2016; data traffic alone is forecast to be eight times greater. § However, if operators continue to use the flat-rate pricing model, we predict revenue of USD 4 per gigabyte by 2016 in both developed and emerging markets. Clearly, the extent to which tiered pricing is adopted in the future will affect this forecast. We are already observing moves away from flatrate pricing, as most operators are capping downloads. 1 See Analysys Mason’s Wireless network traffic worldwide: forecasts and analysis 2011– 2016. The 52% growth that we quote throughout this report describes mobile data. Currently, MNOs would deliver this traffic via the macro network. In our calculation of 52%, we account for the fact that a substantial portion of traffic being generated by the wireless device is carried over a Wi-Fi network. Since the mobile operator plays no real part in this, we class this as passive offload, or passive Wi-Fi offload. In future, the macro network may include carrier class Wi-Fi as part of the network delivery architecture. This we class as active Wi-Fi and, where appropriate, describe the process of transferring traffic from the conventional macro network onto this active Wi-Fi network as active Wi-Fi offload. © Analysys Mason Limited 2011 Figure 4: Monthly traffic from mobile connections, 2011– 2016 [Source: Analysys Mason, 2011] Figure 5: Revenue per gigabyte of mobile broadband traffic, 2011– 2016 [Source: Analysys Mason, 2011]

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 14 Traffic growth and falling revenue are the principal drivers of Wi-Fi offload § We expect mobile data traffic to grow at a CAGR of 52% from 570 PB per month in 2011 to 3243 PB per month in 2016. 1 In 2016 in developed markets, traffic (voice and data) levels will be six times higher than in 2011; data-only traffic will seven times greater. Similarly in emerging markets, traffic levels are expected to be seven times higher in 2016; data traffic alone is forecast to be eight times greater. § However, if operators continue to use the flat-rate pricing model, we predict revenue of USD 4 per gigabyte by 2016 in both developed and emerging markets. Clearly, the extent to which tiered pricing is adopted in the future will affect this forecast. We are already observing moves away from flatrate pricing, as most operators are capping downloads. 1 See Analysys Mason’s Wireless network traffic worldwide: forecasts and analysis 2011– 2016. The 52% growth that we quote throughout this report describes mobile data. Currently, MNOs would deliver this traffic via the macro network. In our calculation of 52%, we account for the fact that a substantial portion of traffic being generated by the wireless device is carried over a Wi-Fi network. Since the mobile operator plays no real part in this, we class this as passive offload, or passive Wi-Fi offload. In future, the macro network may include carrier class Wi-Fi as part of the network delivery architecture. This we class as active Wi-Fi and, where appropriate, describe the process of transferring traffic from the conventional macro network onto this active Wi-Fi network as active Wi-Fi offload. © Analysys Mason Limited 2011 Figure 4: Monthly traffic from mobile connections, 2011– 2016 [Source: Analysys Mason, 2011] Figure 5: Revenue per gigabyte of mobile broadband traffic, 2011– 2016 [Source: Analysys Mason, 2011]

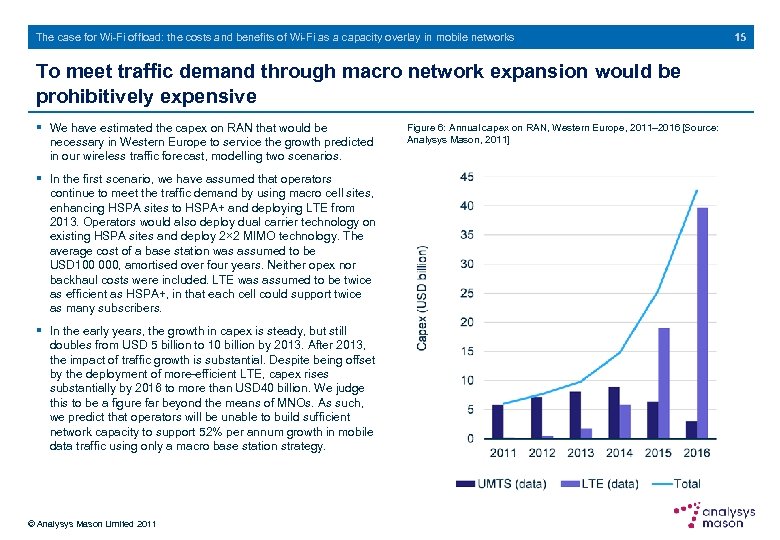

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks To meet traffic demand through macro network expansion would be prohibitively expensive § We have estimated the capex on RAN that would be necessary in Western Europe to service the growth predicted in our wireless traffic forecast, modelling two scenarios. § In the first scenario, we have assumed that operators continue to meet the traffic demand by using macro cell sites, enhancing HSPA sites to HSPA+ and deploying LTE from 2013. Operators would also deploy dual carrier technology on existing HSPA sites and deploy 2× 2 MIMO technology. The average cost of a base station was assumed to be USD 100 000, amortised over four years. Neither opex nor backhaul costs were included. LTE was assumed to be twice as efficient as HSPA+, in that each cell could support twice as many subscribers. § In the early years, the growth in capex is steady, but still doubles from USD 5 billion to 10 billion by 2013. After 2013, the impact of traffic growth is substantial. Despite being offset by the deployment of more-efficient LTE, capex rises substantially by 2016 to more than USD 40 billion. We judge this to be a figure far beyond the means of MNOs. As such, we predict that operators will be unable to build sufficient network capacity to support 52% per annum growth in mobile data traffic using only a macro base station strategy. © Analysys Mason Limited 2011 Figure 6: Annual capex on RAN, Western Europe, 2011– 2016 [Source: Analysys Mason, 2011] 15

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks To meet traffic demand through macro network expansion would be prohibitively expensive § We have estimated the capex on RAN that would be necessary in Western Europe to service the growth predicted in our wireless traffic forecast, modelling two scenarios. § In the first scenario, we have assumed that operators continue to meet the traffic demand by using macro cell sites, enhancing HSPA sites to HSPA+ and deploying LTE from 2013. Operators would also deploy dual carrier technology on existing HSPA sites and deploy 2× 2 MIMO technology. The average cost of a base station was assumed to be USD 100 000, amortised over four years. Neither opex nor backhaul costs were included. LTE was assumed to be twice as efficient as HSPA+, in that each cell could support twice as many subscribers. § In the early years, the growth in capex is steady, but still doubles from USD 5 billion to 10 billion by 2013. After 2013, the impact of traffic growth is substantial. Despite being offset by the deployment of more-efficient LTE, capex rises substantially by 2016 to more than USD 40 billion. We judge this to be a figure far beyond the means of MNOs. As such, we predict that operators will be unable to build sufficient network capacity to support 52% per annum growth in mobile data traffic using only a macro base station strategy. © Analysys Mason Limited 2011 Figure 6: Annual capex on RAN, Western Europe, 2011– 2016 [Source: Analysys Mason, 2011] 15

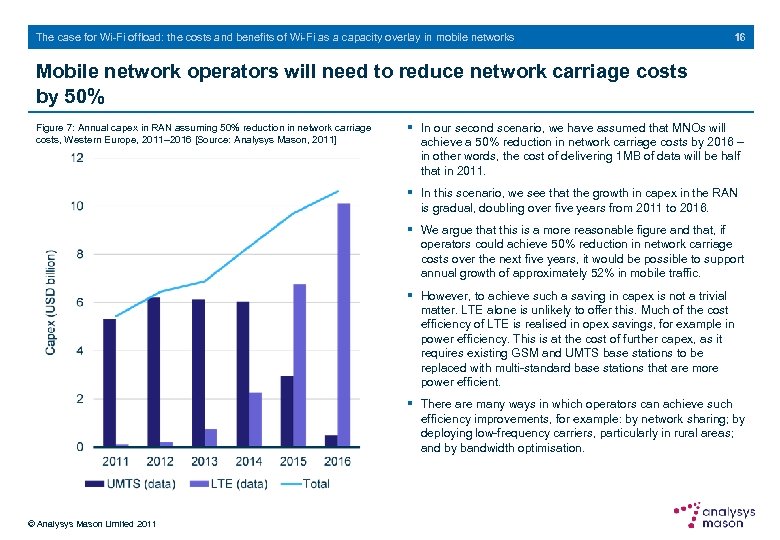

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 16 Mobile network operators will need to reduce network carriage costs by 50% Figure 7: Annual capex in RAN assuming 50% reduction in network carriage costs, Western Europe, 2011– 2016 [Source: Analysys Mason, 2011] § In our second scenario, we have assumed that MNOs will achieve a 50% reduction in network carriage costs by 2016 – in other words, the cost of delivering 1 MB of data will be half that in 2011. § In this scenario, we see that the growth in capex in the RAN is gradual, doubling over five years from 2011 to 2016. § We argue that this is a more reasonable figure and that, if operators could achieve 50% reduction in network carriage costs over the next five years, it would be possible to support annual growth of approximately 52% in mobile traffic. § However, to achieve such a saving in capex is not a trivial matter. LTE alone is unlikely to offer this. Much of the cost efficiency of LTE is realised in opex savings, for example in power efficiency. This is at the cost of further capex, as it requires existing GSM and UMTS base stations to be replaced with multi-standard base stations that are more power efficient. § There are many ways in which operators can achieve such efficiency improvements, for example: by network sharing; by deploying low-frequency carriers, particularly in rural areas; and by bandwidth optimisation. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 16 Mobile network operators will need to reduce network carriage costs by 50% Figure 7: Annual capex in RAN assuming 50% reduction in network carriage costs, Western Europe, 2011– 2016 [Source: Analysys Mason, 2011] § In our second scenario, we have assumed that MNOs will achieve a 50% reduction in network carriage costs by 2016 – in other words, the cost of delivering 1 MB of data will be half that in 2011. § In this scenario, we see that the growth in capex in the RAN is gradual, doubling over five years from 2011 to 2016. § We argue that this is a more reasonable figure and that, if operators could achieve 50% reduction in network carriage costs over the next five years, it would be possible to support annual growth of approximately 52% in mobile traffic. § However, to achieve such a saving in capex is not a trivial matter. LTE alone is unlikely to offer this. Much of the cost efficiency of LTE is realised in opex savings, for example in power efficiency. This is at the cost of further capex, as it requires existing GSM and UMTS base stations to be replaced with multi-standard base stations that are more power efficient. § There are many ways in which operators can achieve such efficiency improvements, for example: by network sharing; by deploying low-frequency carriers, particularly in rural areas; and by bandwidth optimisation. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 17 Operators are seeking ways to reduce costs and Wi-Fi is one such way § Operators will employ a number of strategies to enhance their network capacities and to reduce network carriage costs (the cost of delivering each megabyte of data). § Wherever possible, operators will upgrade existing HSPA cells to HSPA+, increasing the peak download rate from 14. 4 Mbps to 21 Mbps. MIMO antenna enhancements may further increase this peak to 42 Mbps. Operators will also employ dual carrier technology for HSPA cells where possible, effecting a dual-carrier trunking gain. § From 2013, mass deployments of LTE are expected. LTE as a technology has better spectrum-utilisation properties than HSPA: the spectral efficiency per hertz of bandwidth is similar, but the bandwidth per cell can be twice or four times that of an HSPA cell. § Operators will employ low-frequency spectrum – typically digital dividend spectrum – in order to take advantage of its greater coverage per cell, compared with that of higher frequencies. Typically, the area of a cell at 800 MHz is three times that of a cell at 2. 1 GHz. § Operators will refarm existing spectrum (GSM 900) as it becomes available and instead deploy more-spectrally efficient HSPA+ or LTE. § Wherever possible, operators will seek to share networks. Passive networks can reduce capex by as much as 20– 30%. 1 § Operators will use other cost-saving techniques, such as self-optimising networks and capacity management and optimisation techniques. § Even with these cost-reduction techniques, operators are still facing a dilemma. Dramatic growth in traffic levels are not challenging for operators, but the combination of traffic growth and falling revenue per gigabyte is putting pressure on operators’ cash flow. § Unless operators find ways to reduce the cost of delivering traffic, they will be caught up in a spiral of decreasing profit as they roll out expensive networks to maintain a competitive network quality of service and so retain customers. Wi-Fi may be one means of reducing the cost of data delivery substantially. 2 1 See Analysys Mason’s Transform the economics of your wireless business with infrastructure sharing. 2 It is important to note that this report is not concerned with the use of Wi-Fi by domestic users in the home. Where it refers to Wi-Fi, this is the commercial use of Wi-Fi by MNOs to augment existing macro network capacity by providing Wi-Fi hotspots, either directly or through a third party. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 17 Operators are seeking ways to reduce costs and Wi-Fi is one such way § Operators will employ a number of strategies to enhance their network capacities and to reduce network carriage costs (the cost of delivering each megabyte of data). § Wherever possible, operators will upgrade existing HSPA cells to HSPA+, increasing the peak download rate from 14. 4 Mbps to 21 Mbps. MIMO antenna enhancements may further increase this peak to 42 Mbps. Operators will also employ dual carrier technology for HSPA cells where possible, effecting a dual-carrier trunking gain. § From 2013, mass deployments of LTE are expected. LTE as a technology has better spectrum-utilisation properties than HSPA: the spectral efficiency per hertz of bandwidth is similar, but the bandwidth per cell can be twice or four times that of an HSPA cell. § Operators will employ low-frequency spectrum – typically digital dividend spectrum – in order to take advantage of its greater coverage per cell, compared with that of higher frequencies. Typically, the area of a cell at 800 MHz is three times that of a cell at 2. 1 GHz. § Operators will refarm existing spectrum (GSM 900) as it becomes available and instead deploy more-spectrally efficient HSPA+ or LTE. § Wherever possible, operators will seek to share networks. Passive networks can reduce capex by as much as 20– 30%. 1 § Operators will use other cost-saving techniques, such as self-optimising networks and capacity management and optimisation techniques. § Even with these cost-reduction techniques, operators are still facing a dilemma. Dramatic growth in traffic levels are not challenging for operators, but the combination of traffic growth and falling revenue per gigabyte is putting pressure on operators’ cash flow. § Unless operators find ways to reduce the cost of delivering traffic, they will be caught up in a spiral of decreasing profit as they roll out expensive networks to maintain a competitive network quality of service and so retain customers. Wi-Fi may be one means of reducing the cost of data delivery substantially. 2 1 See Analysys Mason’s Transform the economics of your wireless business with infrastructure sharing. 2 It is important to note that this report is not concerned with the use of Wi-Fi by domestic users in the home. Where it refers to Wi-Fi, this is the commercial use of Wi-Fi by MNOs to augment existing macro network capacity by providing Wi-Fi hotspots, either directly or through a third party. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 18

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Executive summary Recommendations The drivers of Wi-Fi offload The cost of deploying commercial Wi-Fi cells The leading operators’ propositions Alternatives to, and problems with, Wi-Fi offload Annex: additional data About the authors and Analysys Mason © Analysys Mason Limited 2011 18

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 19 We present an analysis of coverage costs in three scenarios § In this section, we describe the cost of building and operating mobile radio coverage with and without the benefit of Wi-Fi over an urban area of 0. 8 km 2 (with a radius of 500 m), which is typical of an urban 3 G site. We assume that mobile services are provided to the area by a 3 G radio site, but that the radio site is congested and unable to support further traffic without being upgraded in some way. We compare the cost of upgrading the site in three different ways, each designed to support 52% growth per annum in mobile data traffic growth: - in the first scenario, we assume that the 3 G site is upgraded to LTE and that further LTE sites are built as necessary throughout the timeline of the model (2012– 2018) to meet the growth in traffic. No Wi-Fi is involved in this base line LTE-only model - in the second, the 3 G site is not upgraded so it remains fully utilised, and Wi-Fi access points are used to augment capacity in order to meet growth in total mobile data traffic of 52% per annum. The Wi-Fi access points are assumed to be located only indoors only in this indoor Wi-Fi only model - in the third case, the 3 G site is again not upgraded, but this time a mix of outdoor and indoor Wi-Fi access points are used to augment capacity in order to meet growth in total mobile data traffic of 52% per annum. This is the outdoor plus indoor Wi-Fi model. § In the following sections, we estimate and compare the cost of building and operating each of these upgrade solutions. § In all three scenarios, we have assumed that 95% of laptop use is indoors and 5% outdoors, while smartphone use is 30% outdoors and 70% indoors. We have not modelled the mobility of users through the day. § All equipment costs assume annual inflation of 3% and annual price reduction of 5% on equipment. The net effect is a reduction in equipment costs of 2% per annum. § There are several methods of accounting for the cost of capital, including DCF, NPV and WACC. Given that these are sensitive to the underlying assumptions made, we have instead presented our results as unamortised expenditure without cost of capital allowances. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 19 We present an analysis of coverage costs in three scenarios § In this section, we describe the cost of building and operating mobile radio coverage with and without the benefit of Wi-Fi over an urban area of 0. 8 km 2 (with a radius of 500 m), which is typical of an urban 3 G site. We assume that mobile services are provided to the area by a 3 G radio site, but that the radio site is congested and unable to support further traffic without being upgraded in some way. We compare the cost of upgrading the site in three different ways, each designed to support 52% growth per annum in mobile data traffic growth: - in the first scenario, we assume that the 3 G site is upgraded to LTE and that further LTE sites are built as necessary throughout the timeline of the model (2012– 2018) to meet the growth in traffic. No Wi-Fi is involved in this base line LTE-only model - in the second, the 3 G site is not upgraded so it remains fully utilised, and Wi-Fi access points are used to augment capacity in order to meet growth in total mobile data traffic of 52% per annum. The Wi-Fi access points are assumed to be located only indoors only in this indoor Wi-Fi only model - in the third case, the 3 G site is again not upgraded, but this time a mix of outdoor and indoor Wi-Fi access points are used to augment capacity in order to meet growth in total mobile data traffic of 52% per annum. This is the outdoor plus indoor Wi-Fi model. § In the following sections, we estimate and compare the cost of building and operating each of these upgrade solutions. § In all three scenarios, we have assumed that 95% of laptop use is indoors and 5% outdoors, while smartphone use is 30% outdoors and 70% indoors. We have not modelled the mobility of users through the day. § All equipment costs assume annual inflation of 3% and annual price reduction of 5% on equipment. The net effect is a reduction in equipment costs of 2% per annum. § There are several methods of accounting for the cost of capital, including DCF, NPV and WACC. Given that these are sensitive to the underlying assumptions made, we have instead presented our results as unamortised expenditure without cost of capital allowances. © Analysys Mason Limited 2011

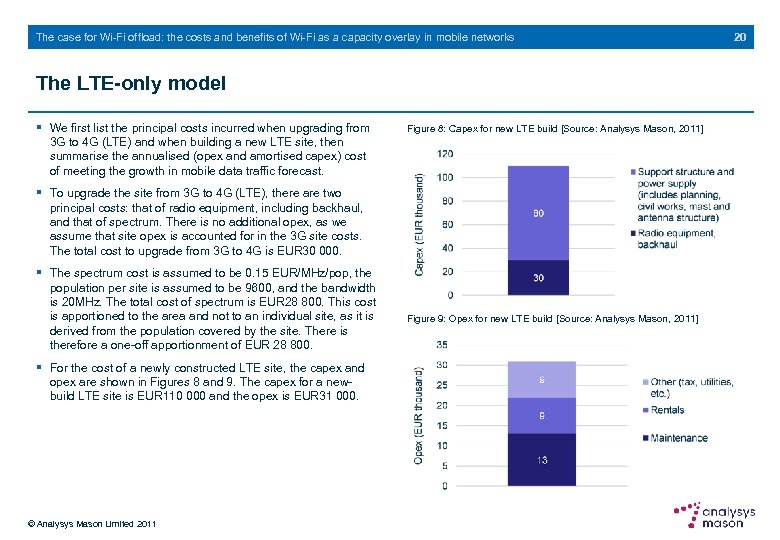

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks The LTE-only model § We first list the principal costs incurred when upgrading from 3 G to 4 G (LTE) and when building a new LTE site, then summarise the annualised (opex and amortised capex) cost of meeting the growth in mobile data traffic forecast. Figure 8: Capex for new LTE build [Source: Analysys Mason, 2011] § To upgrade the site from 3 G to 4 G (LTE), there are two principal costs: that of radio equipment, including backhaul, and that of spectrum. There is no additional opex, as we assume that site opex is accounted for in the 3 G site costs. The total cost to upgrade from 3 G to 4 G is EUR 30 000. § The spectrum cost is assumed to be 0. 15 EUR/MHz/pop, the population per site is assumed to be 9600, and the bandwidth is 20 MHz. The total cost of spectrum is EUR 28 800. This cost is apportioned to the area and not to an individual site, as it is derived from the population covered by the site. There is therefore a one-off apportionment of EUR 28 800. § For the cost of a newly constructed LTE site, the capex and opex are shown in Figures 8 and 9. The capex for a newbuild LTE site is EUR 110 000 and the opex is EUR 31 000. © Analysys Mason Limited 2011 Figure 9: Opex for new LTE build [Source: Analysys Mason, 2011] 20

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks The LTE-only model § We first list the principal costs incurred when upgrading from 3 G to 4 G (LTE) and when building a new LTE site, then summarise the annualised (opex and amortised capex) cost of meeting the growth in mobile data traffic forecast. Figure 8: Capex for new LTE build [Source: Analysys Mason, 2011] § To upgrade the site from 3 G to 4 G (LTE), there are two principal costs: that of radio equipment, including backhaul, and that of spectrum. There is no additional opex, as we assume that site opex is accounted for in the 3 G site costs. The total cost to upgrade from 3 G to 4 G is EUR 30 000. § The spectrum cost is assumed to be 0. 15 EUR/MHz/pop, the population per site is assumed to be 9600, and the bandwidth is 20 MHz. The total cost of spectrum is EUR 28 800. This cost is apportioned to the area and not to an individual site, as it is derived from the population covered by the site. There is therefore a one-off apportionment of EUR 28 800. § For the cost of a newly constructed LTE site, the capex and opex are shown in Figures 8 and 9. The capex for a newbuild LTE site is EUR 110 000 and the opex is EUR 31 000. © Analysys Mason Limited 2011 Figure 9: Opex for new LTE build [Source: Analysys Mason, 2011] 20

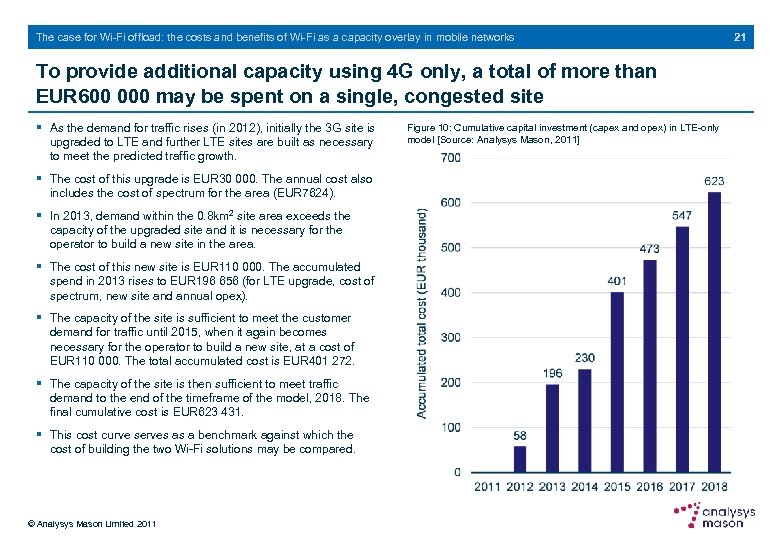

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks To provide additional capacity using 4 G only, a total of more than EUR 600 000 may be spent on a single, congested site § As the demand for traffic rises (in 2012), initially the 3 G site is upgraded to LTE and further LTE sites are built as necessary to meet the predicted traffic growth. § The cost of this upgrade is EUR 30 000. The annual cost also includes the cost of spectrum for the area (EUR 7624). § In 2013, demand within the 0. 8 km 2 site area exceeds the capacity of the upgraded site and it is necessary for the operator to build a new site in the area. § The cost of this new site is EUR 110 000. The accumulated spend in 2013 rises to EUR 196 656 (for LTE upgrade, cost of spectrum, new site and annual opex). § The capacity of the site is sufficient to meet the customer demand for traffic until 2015, when it again becomes necessary for the operator to build a new site, at a cost of EUR 110 000. The total accumulated cost is EUR 401 272. § The capacity of the site is then sufficient to meet traffic demand to the end of the timeframe of the model, 2018. The final cumulative cost is EUR 623 431. § This cost curve serves as a benchmark against which the cost of building the two Wi-Fi solutions may be compared. © Analysys Mason Limited 2011 Figure 10: Cumulative capital investment (capex and opex) in LTE-only model [Source: Analysys Mason, 2011] 21

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks To provide additional capacity using 4 G only, a total of more than EUR 600 000 may be spent on a single, congested site § As the demand for traffic rises (in 2012), initially the 3 G site is upgraded to LTE and further LTE sites are built as necessary to meet the predicted traffic growth. § The cost of this upgrade is EUR 30 000. The annual cost also includes the cost of spectrum for the area (EUR 7624). § In 2013, demand within the 0. 8 km 2 site area exceeds the capacity of the upgraded site and it is necessary for the operator to build a new site in the area. § The cost of this new site is EUR 110 000. The accumulated spend in 2013 rises to EUR 196 656 (for LTE upgrade, cost of spectrum, new site and annual opex). § The capacity of the site is sufficient to meet the customer demand for traffic until 2015, when it again becomes necessary for the operator to build a new site, at a cost of EUR 110 000. The total accumulated cost is EUR 401 272. § The capacity of the site is then sufficient to meet traffic demand to the end of the timeframe of the model, 2018. The final cumulative cost is EUR 623 431. § This cost curve serves as a benchmark against which the cost of building the two Wi-Fi solutions may be compared. © Analysys Mason Limited 2011 Figure 10: Cumulative capital investment (capex and opex) in LTE-only model [Source: Analysys Mason, 2011] 21

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 22 Indoor Wi-Fi only model § In the indoor Wi-Fi only model the fundamental assumption is again that mobile services are provided to the area by a 3 G radio site, but that the radio site is congested and is not able to support any further traffic. The operator’s solution is to build several indoor Wi-Fi sites. The number of indoor Wi-Fi sites is chosen to be just enough to ensure that the 3 G site is kept at the point of capacity saturation. § The purpose of this model is to understand how much this might cost the MNO, and to provide a comparison with an LTE-only alternative. § An indoor Wi-Fi-only model should be very cost effective. The capex and opex are low and indoor Wi-Fi should be able to carry a large proportion of the traffic load, since we assume that 95% of laptop users and 70% of smartphone use is indoors. § The model assumes that the operator has the ability to transfer indoor users onto the Wi-Fi network in preference to the congested 3 G network. § As with the LTE-only model, we first list the principle cost items incurred when upgrading from 3 G to 4 G (LTE) and when building a new LTE site. We then summarise the annualised cost (opex and amortised capex) of meeting the 52% per annum growth in mobile data traffic. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 22 Indoor Wi-Fi only model § In the indoor Wi-Fi only model the fundamental assumption is again that mobile services are provided to the area by a 3 G radio site, but that the radio site is congested and is not able to support any further traffic. The operator’s solution is to build several indoor Wi-Fi sites. The number of indoor Wi-Fi sites is chosen to be just enough to ensure that the 3 G site is kept at the point of capacity saturation. § The purpose of this model is to understand how much this might cost the MNO, and to provide a comparison with an LTE-only alternative. § An indoor Wi-Fi-only model should be very cost effective. The capex and opex are low and indoor Wi-Fi should be able to carry a large proportion of the traffic load, since we assume that 95% of laptop users and 70% of smartphone use is indoors. § The model assumes that the operator has the ability to transfer indoor users onto the Wi-Fi network in preference to the congested 3 G network. § As with the LTE-only model, we first list the principle cost items incurred when upgrading from 3 G to 4 G (LTE) and when building a new LTE site. We then summarise the annualised cost (opex and amortised capex) of meeting the 52% per annum growth in mobile data traffic. © Analysys Mason Limited 2011

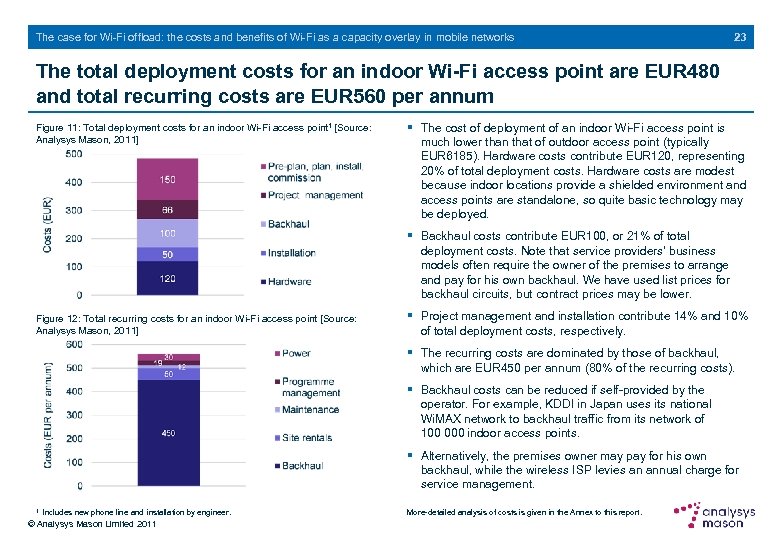

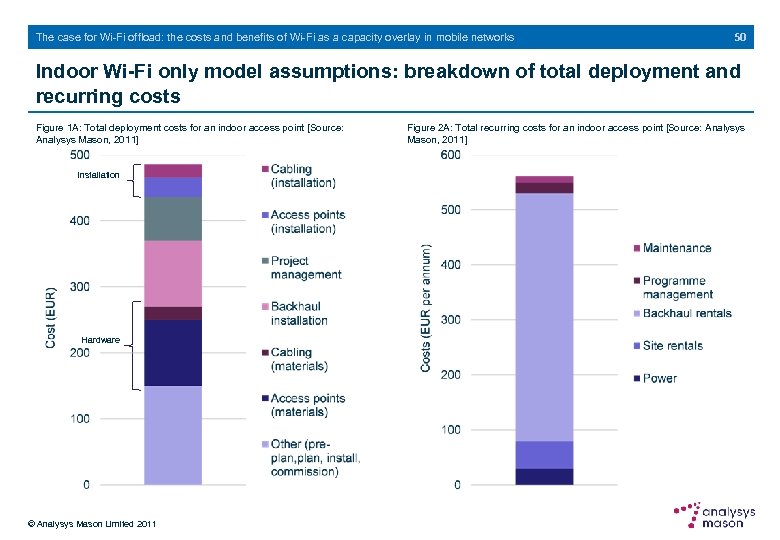

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 23 The total deployment costs for an indoor Wi-Fi access point are EUR 480 and total recurring costs are EUR 560 per annum Figure 11: Total deployment costs for an indoor Wi-Fi access point 1 [Source: Analysys Mason, 2011] § The cost of deployment of an indoor Wi-Fi access point is much lower than that of outdoor access point (typically EUR 6185). Hardware costs contribute EUR 120, representing 20% of total deployment costs. Hardware costs are modest because indoor locations provide a shielded environment and access points are standalone, so quite basic technology may be deployed. § Backhaul costs contribute EUR 100, or 21% of total deployment costs. Note that service providers’ business models often require the owner of the premises to arrange and pay for his own backhaul. We have used list prices for backhaul circuits, but contract prices may be lower. Figure 12: Total recurring costs for an indoor Wi-Fi access point [Source: Analysys Mason, 2011] § Project management and installation contribute 14% and 10% of total deployment costs, respectively. § The recurring costs are dominated by those of backhaul, which are EUR 450 per annum (80% of the recurring costs). § Backhaul costs can be reduced if self-provided by the operator. For example, KDDI in Japan uses its national Wi. MAX network to backhaul traffic from its network of 100 000 indoor access points. § Alternatively, the premises owner may pay for his own backhaul, while the wireless ISP levies an annual charge for service management. 1 Includes new phone line and installation by engineer. © Analysys Mason Limited 2011 More-detailed analysis of costs is given in the Annex to this report.

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 23 The total deployment costs for an indoor Wi-Fi access point are EUR 480 and total recurring costs are EUR 560 per annum Figure 11: Total deployment costs for an indoor Wi-Fi access point 1 [Source: Analysys Mason, 2011] § The cost of deployment of an indoor Wi-Fi access point is much lower than that of outdoor access point (typically EUR 6185). Hardware costs contribute EUR 120, representing 20% of total deployment costs. Hardware costs are modest because indoor locations provide a shielded environment and access points are standalone, so quite basic technology may be deployed. § Backhaul costs contribute EUR 100, or 21% of total deployment costs. Note that service providers’ business models often require the owner of the premises to arrange and pay for his own backhaul. We have used list prices for backhaul circuits, but contract prices may be lower. Figure 12: Total recurring costs for an indoor Wi-Fi access point [Source: Analysys Mason, 2011] § Project management and installation contribute 14% and 10% of total deployment costs, respectively. § The recurring costs are dominated by those of backhaul, which are EUR 450 per annum (80% of the recurring costs). § Backhaul costs can be reduced if self-provided by the operator. For example, KDDI in Japan uses its national Wi. MAX network to backhaul traffic from its network of 100 000 indoor access points. § Alternatively, the premises owner may pay for his own backhaul, while the wireless ISP levies an annual charge for service management. 1 Includes new phone line and installation by engineer. © Analysys Mason Limited 2011 More-detailed analysis of costs is given in the Annex to this report.

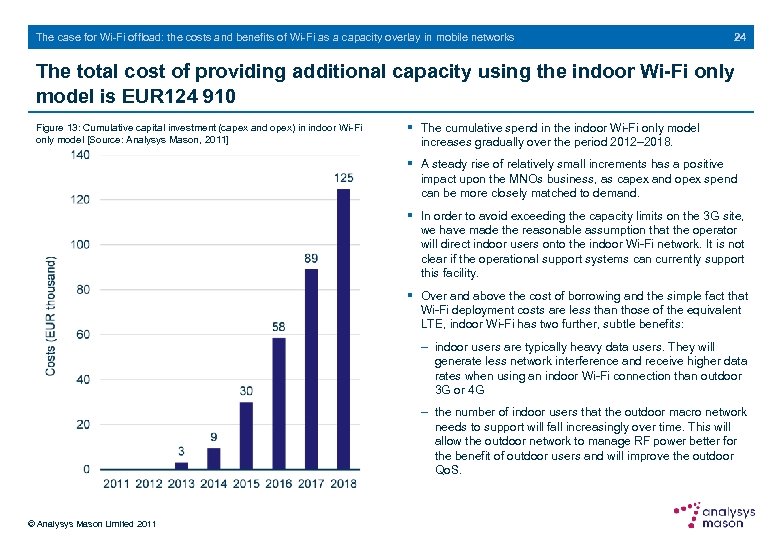

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 24 The total cost of providing additional capacity using the indoor Wi-Fi only model is EUR 124 910 Figure 13: Cumulative capital investment (capex and opex) in indoor Wi-Fi only model [Source: Analysys Mason, 2011] § The cumulative spend in the indoor Wi-Fi only model increases gradually over the period 2012– 2018. § A steady rise of relatively small increments has a positive impact upon the MNOs business, as capex and opex spend can be more closely matched to demand. § In order to avoid exceeding the capacity limits on the 3 G site, we have made the reasonable assumption that the operator will direct indoor users onto the indoor Wi-Fi network. It is not clear if the operational support systems can currently support this facility. § Over and above the cost of borrowing and the simple fact that Wi-Fi deployment costs are less than those of the equivalent LTE, indoor Wi-Fi has two further, subtle benefits: - indoor users are typically heavy data users. They will generate less network interference and receive higher data rates when using an indoor Wi-Fi connection than outdoor 3 G or 4 G - the number of indoor users that the outdoor macro network needs to support will fall increasingly over time. This will allow the outdoor network to manage RF power better for the benefit of outdoor users and will improve the outdoor Qo. S. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 24 The total cost of providing additional capacity using the indoor Wi-Fi only model is EUR 124 910 Figure 13: Cumulative capital investment (capex and opex) in indoor Wi-Fi only model [Source: Analysys Mason, 2011] § The cumulative spend in the indoor Wi-Fi only model increases gradually over the period 2012– 2018. § A steady rise of relatively small increments has a positive impact upon the MNOs business, as capex and opex spend can be more closely matched to demand. § In order to avoid exceeding the capacity limits on the 3 G site, we have made the reasonable assumption that the operator will direct indoor users onto the indoor Wi-Fi network. It is not clear if the operational support systems can currently support this facility. § Over and above the cost of borrowing and the simple fact that Wi-Fi deployment costs are less than those of the equivalent LTE, indoor Wi-Fi has two further, subtle benefits: - indoor users are typically heavy data users. They will generate less network interference and receive higher data rates when using an indoor Wi-Fi connection than outdoor 3 G or 4 G - the number of indoor users that the outdoor macro network needs to support will fall increasingly over time. This will allow the outdoor network to manage RF power better for the benefit of outdoor users and will improve the outdoor Qo. S. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 25 Outdoor plus indoor Wi-Fi model § In the outdoor plus indoor Wi-Fi model, the fundamental assumption is again that mobile services are provided to the area by a 3 G radio site, but that the radio site is congested and is not able to support any further traffic. The operator’s solution is to build several outdoor Wi-Fi sites. § For the sake of cost comparison, it would have been consistent to have modelled a pure outdoor Wi-Fi scenario. However, the majority of customers will be found indoors and, as outdoor Wi-Fi will not penetrate effectively into buildings, it is unlikely that outdoor Wi-Fi alone will offload sufficient traffic to prevent the outdoor 3 G site from becoming overloaded as traffic increases. We therefore designed the model incorporating deployment of extra indoor sites. § The model was designed such that the outdoor 3 G site is maintained just below capacity saturation, and the number of outdoor and indoor Wi-Fi access points deployed is sufficient to support the surplus traffic. § Outdoor sites are deployed wherever possible in preference to indoor sites. In effect, this is an outdoor and indoor Wi-Fi coverage model, but in which outdoor Wi-Fi deployments are prioritised. § Unlike the indoor case, in which access points are deployed in single units, we decided to model the outdoor Wi-Fi network according to a mesh architecture, which is discussed in more detail in the next slide. © Analysys Mason Limited 2011

The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks 25 Outdoor plus indoor Wi-Fi model § In the outdoor plus indoor Wi-Fi model, the fundamental assumption is again that mobile services are provided to the area by a 3 G radio site, but that the radio site is congested and is not able to support any further traffic. The operator’s solution is to build several outdoor Wi-Fi sites. § For the sake of cost comparison, it would have been consistent to have modelled a pure outdoor Wi-Fi scenario. However, the majority of customers will be found indoors and, as outdoor Wi-Fi will not penetrate effectively into buildings, it is unlikely that outdoor Wi-Fi alone will offload sufficient traffic to prevent the outdoor 3 G site from becoming overloaded as traffic increases. We therefore designed the model incorporating deployment of extra indoor sites. § The model was designed such that the outdoor 3 G site is maintained just below capacity saturation, and the number of outdoor and indoor Wi-Fi access points deployed is sufficient to support the surplus traffic. § Outdoor sites are deployed wherever possible in preference to indoor sites. In effect, this is an outdoor and indoor Wi-Fi coverage model, but in which outdoor Wi-Fi deployments are prioritised. § Unlike the indoor case, in which access points are deployed in single units, we decided to model the outdoor Wi-Fi network according to a mesh architecture, which is discussed in more detail in the next slide. © Analysys Mason Limited 2011

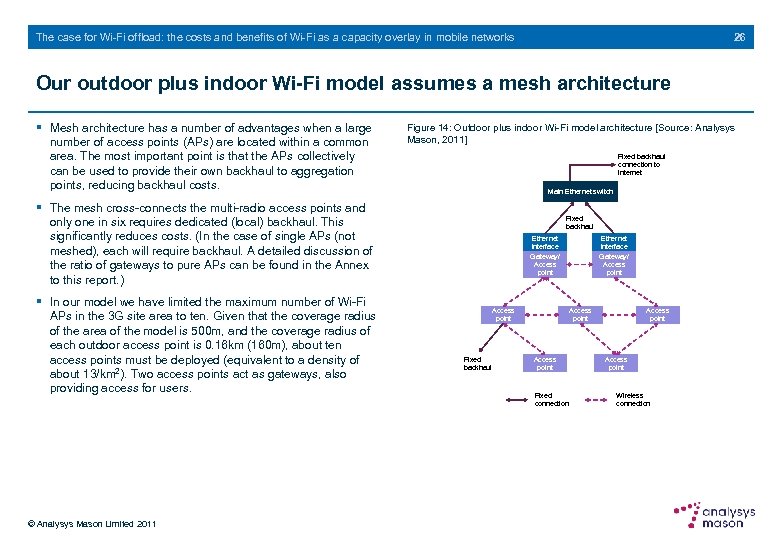

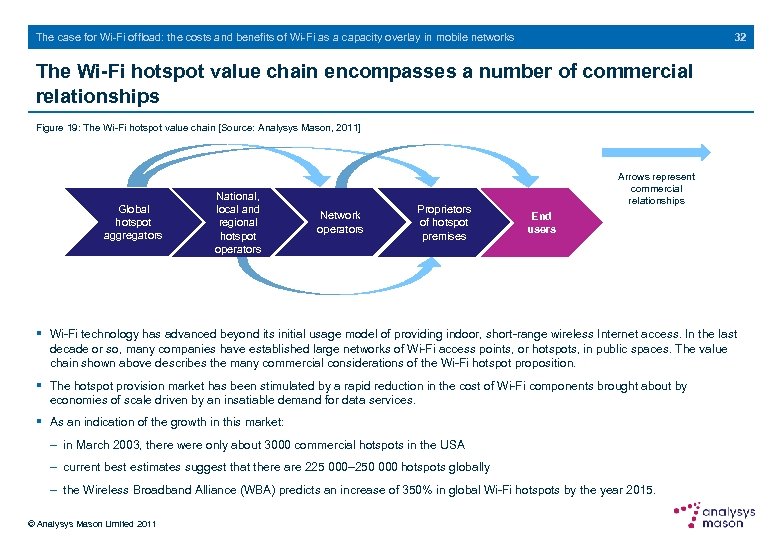

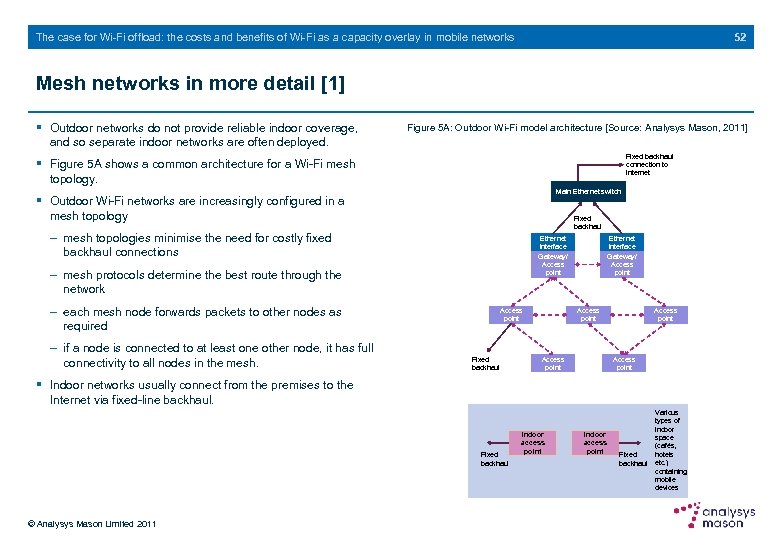

26 The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Our outdoor plus indoor Wi-Fi model assumes a mesh architecture § Mesh architecture has a number of advantages when a large number of access points (APs) are located within a common area. The most important point is that the APs collectively can be used to provide their own backhaul to aggregation points, reducing backhaul costs. Figure 14: Outdoor plus indoor Wi-Fi model architecture [Source: Analysys Mason, 2011] Fixed backhaul connection to Internet Main Ethernet switch § The mesh cross-connects the multi-radio access points and only one in six requires dedicated (local) backhaul. This significantly reduces costs. (In the case of single APs (not meshed), each will require backhaul. A detailed discussion of the ratio of gateways to pure APs can be found in the Annex to this report. ) § In our model we have limited the maximum number of Wi-Fi APs in the 3 G site area to ten. Given that the coverage radius of the area of the model is 500 m, and the coverage radius of each outdoor access point is 0. 16 km (160 m), about ten access points must be deployed (equivalent to a density of about 13/km 2). Two access points act as gateways, also providing access for users. © Analysys Mason Limited 2011 Fixed backhaul Ethernet interface Gateway/ Access point Fixed backhaul Access point Fixed connection Access point Wireless connection

26 The case for Wi-Fi offload: the costs and benefits of Wi-Fi as a capacity overlay in mobile networks Our outdoor plus indoor Wi-Fi model assumes a mesh architecture § Mesh architecture has a number of advantages when a large number of access points (APs) are located within a common area. The most important point is that the APs collectively can be used to provide their own backhaul to aggregation points, reducing backhaul costs. Figure 14: Outdoor plus indoor Wi-Fi model architecture [Source: Analysys Mason, 2011] Fixed backhaul connection to Internet Main Ethernet switch § The mesh cross-connects the multi-radio access points and only one in six requires dedicated (local) backhaul. This significantly reduces costs. (In the case of single APs (not meshed), each will require backhaul. A detailed discussion of the ratio of gateways to pure APs can be found in the Annex to this report. ) § In our model we have limited the maximum number of Wi-Fi APs in the 3 G site area to ten. Given that the coverage radius of the area of the model is 500 m, and the coverage radius of each outdoor access point is 0. 16 km (160 m), about ten access points must be deployed (equivalent to a density of about 13/km 2). Two access points act as gateways, also providing access for users. © Analysys Mason Limited 2011 Fixed backhaul Ethernet interface Gateway/ Access point Fixed backhaul Access point Fixed connection Access point Wireless connection