aa2ae906a93b07bad86b051e975ccacf.ppt

- Количество слайдов: 23

The Buy Sell Agreement For Private Corporations and Partnerships Insurance Concepts

This presentation is for educational or informational purposes only. It is not intended to provide anyone with legal, taxation, accounting or other professional advice and no one should act upon the information provided here without a thorough review of the specific facts with the appropriate professional advisory team.

Corporate Buy Sell Arrangements The death of a shareholder creates two significant problems for those who are left behind. 1. The family is left without the support of their loved one 2. The remaining shareholders are left without the advice of one of the team, plus they are now “in the business” with a new, unknown, and possibly inexperienced shareholder.

The latter may not be a problem for large public companies, but it is a major difficulty for smaller private companies that rely on the stability and continuity in management. Both these problems can be solved using an Insured Buy Sell Arrangement, but the options have become more complex due to changes in the Income Tax Act.

Normally, shares of an operating company (Opco) or a holding company (Holdco), that are owned by a deceased shareholder, can be purchased by the survivors or their holding companies outright. Or, alternatively, the operating company itself could purchase the shares for cancellation from the deceased shareholder or their holding company.

To accomplish any type of Buy Sell Arrangement, the shareholders should enter into a binding Buy Sell Agreement that will trigger in the event of death, disability, retirement or even bankruptcy of a shareholder. This sort of agreement is universally recognized as a solution that will provide for a smooth transfer of ownership, more confidence for the employees and creditors and security for the heir of the deceased shareholder.

Since the interests of the remaining shareholders will, in most cases, differ from those of the heirs of the deceased, it is usually best to arrange for a seamless transfer of ownership at a fair market price to avoid confrontation and financial hardship. The agreement provides for a mechanism to identify the buyers and sellers and the conditions and price involved in the sale. This is commonly solved by using a corporate owned life insurance policy on the lives of the shareholders, as an ideal vehicle for a buyout on death.

Taxes – consequences of sale/redemption of shares A shareholder is deemed to dispose of their capital property at death for value equal to the fair market value immediately prior to death. This can result in a capital gain unless the property is transferred to a spouse or a testamentary spousal trust, in which case the tax is deferred until the spouse disposes of it. However, the ownership of the shares by the spouse is usually what a Buy Sell Arrangement is designed to avoid.

Rollover provisions not useful… For the rollover to work, the property must vest “indefeasibly” in the spouse or spousal trust not later than 15 months after the death of the taxpayer. To vest indefeasibly, the spouse must obtain a right to absolute ownership of that property in such a manner that such right cannot be defeated by any future event, even though that person may not be entitled to the immediate enjoyment of all the benefits arising from that right. This means that a Buy Sell arrangement which enforces the sale of shares, will not permit a tax-free rollover to the surviving spouse of the deceased shareholder.

Put Call Arrangements One way to arrange for the rollover of the shares to the spouse is to use a Put Call arrangement, where the sale is not mandatory if the put and call are not exercised. The estate could exercise a put (a desire to sell) and the survivors a call ( a desire to buy) on the shares of the deceased. To make this type of agreement most effective, the spouse should be a party in the agreement and it should be made binding on the parties, that any put or call will be binding. In this way, the shares may vest indefeasibly in the spouse.

Arm’s Length and Non Arm’s Length Occasionally, family members will agree that the shares in the corporation will be sold to a family member on the death of the parent, say, for less than the fair market value. This, however is a dangerous tactic since the Income Tax Act (ITA) views this type of tactic with disdain and will value the shares without regard to the Buy Sell arrangement. This can have very negative implications to both parties.

First, the heirs of the deceased have received less than the value of the shares while being assessed tax on the full fair market value. This may result in tax that eats up most of the proceeds. As well, the new shareholders have obtained shares at a lower than fair market value, which means that they have not received a full increase in the cost base of the shares acquired. A subsequent sale, (or the death of a shareholder), will result in higher tax than normal due to the low cost base of the shares, causing double taxation.

How does Buy Sell work? Objective To allow the surviving shareholder(s) to run the company without interference from, or concern for, other non active shareholders, plus to free the heirs of the deceased shareholder from the worry that a significant portion of their wealth is not under their control.

How can you fund the agreement? There at least five options to fund the agreement : Pay Cash Borrow Use promissory note Sell assets Use life insurance

Cash Option…. . Would sufficient cash be available? Earnings may already be depressed Purchase price to be paid with after-tax dollars

Borrow……. . Ø Lenders may be unwilling Ø No cash liquidity - interest and principal payments strain cash flow Ø Loan repaid with after-tax dollars

Use promissory note…… v Repayment of note strains cash liquidity v Note is repaid using after-tax dollars

Sell Assets……. . ü Reduces Company’s potential for earnings ü Market Value of shares impacted negatively ü Additional costs associated with selling assets: - will there be transaction costs? will the value received be depressed? will taxes have to be paid on sale of assets?

Life Insurance………. Ü Clearly provides high benefit with a low annual cost Ü Immediate access to funds Ü Tax free death benefit Ü Requires premium payments

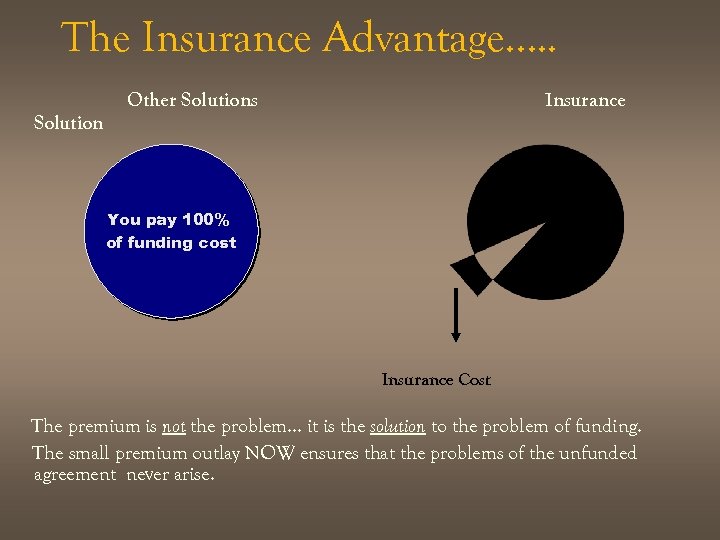

The Insurance Advantage…. . Other Solutions Insurance Solution You pay 100% of funding cost Insurance Cost The premium is not the problem… it is the solution to the problem of funding. The small premium outlay NOW ensures that the problems of the unfunded agreement never arise.

Next Steps……. . Ü Establish a value for your business. Ü Decide on the most appropriate structure for the purchase or redemption of shares. Ü Arrange a buy-sell agreement. Ü Apply for the necessary insurance protection.

Types of Buy Sell Agreements Ü Criss Cross Buy Sell Ü Hybrid Buy Sell Ü Corporate Criss Cross Buy Sell Ü Corporate Share Redemption

The Buy Sell Agreement Thank You For more information, e-mail us at: info@insuranceconcepts. ca

aa2ae906a93b07bad86b051e975ccacf.ppt