f5e7aec7948c80b8297e2313402f4649.ppt

- Количество слайдов: 22

The Budget

Review terms: l Budget: – A policy document allocating burdens (taxes) and benefits (expenditures). l Expenditures: – What the government spends money on. l Revenues: – Sources of money for the government.

I. Federal Expenditures l A. National Security – 20% l B. Social Services – makeup nearly 2/3 of budget! l C. Uncontrollable Expenditures <why? > – Entitlements l Social Security/ Medicare – Interest on Debt -

D. Incrementalism v. zero based budgeting l Incrementalism – taking last year’s budget and increasing it in a small increment, amount, to minimize increased spending. l Zero-based Budgeting – Mandates the budget request be re-evaluated completely starting from the zero-base

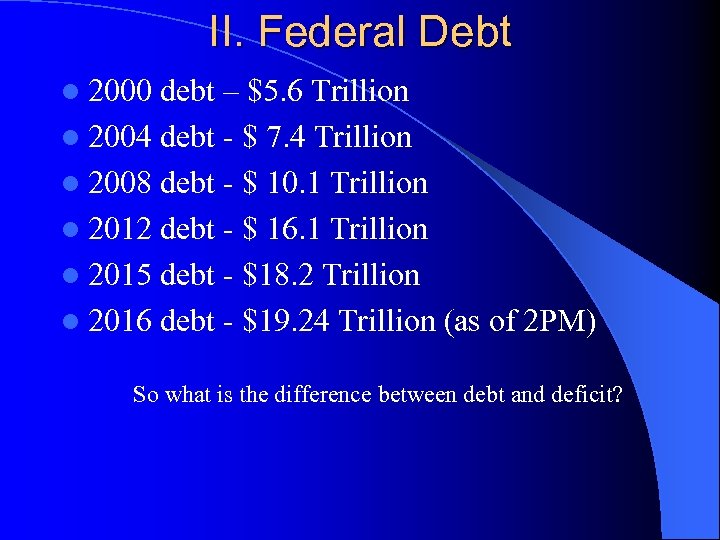

II. Federal Debt l 2000 debt – $5. 6 Trillion l 2004 debt - $ 7. 4 Trillion l 2008 debt - $ 10. 1 Trillion l 2012 debt - $ 16. 1 Trillion l 2015 debt - $18. 2 Trillion l 2016 debt - $19. 24 Trillion (as of 2 PM) So what is the difference between debt and deficit?

A. Deficit v. debt l Deficit: An excess of federal expenditures over federal revenues in a single year l Debt: The accumulation of deficits over time. Deficit by year: 2004 $377 billion – 2007 $160 billion 2009 deficit = $1. 4 Trillion – 2011 $1. 3 Trillion 2013 = $680 Billion –Projected next 5 years = avg. of 580 Billion l People often confused when they hear the “deficit is being reduced” when they think it is the debt.

B. Balanced Budget Amendment Gramm-Rudman-Hollings l The 1985 law provided for automatic spending cuts to take effect if the president and Congress failed to reach established targets. l Attempted to slow down federal spending but has failed to do so. – Why would Congress not vote to cut programs instead?

C. Current Debt/ Fiscal Cliff l As of April 29 2015 18, 206, 395, 000 – Spending 1. 5 million per minute we do not have! – Fiscal cliff was part of the deal to raise debt limit. In exchange for increasing the limit both parties agreed that if no agreement on the budget/spending was reached in 18 months automatic spending cuts “sequestration” would occur Jan 1, 2013. – At the same time the 2001 tax cuts, extended by president Obama in 2011, were set to expire Jan 1, 2013 – Fact – the US actually has promised 95 TRILLION dollars in SS, Medicare, pension, health care. .

III Budgetary Process l Budget and Accounting Act 1921 – President must submit budget to Congress l Congressional Budget and Impoundment Control Act of 1974. – Creates Fiscal Year = Oct 1 to Sept 30. – Creates CBO – Creates budget committee in each house

A. OMB l Stands for? l How does the OMB make the budget? l Gives the Budget to the president, president adds items, submits to Congress 10/16

B. House Ways and Means and Senate Finance Committee l House Ways and Means – writes tax code. All revenue bills must originate in the House! l Senate Finance Committee – Works with HWM to pass tax codes.

C. CBO l Created in 1974 by Congressional Budget and Impoundment Control Act of 1974 – Works to “score” / budget bills – Helps determine revenue and expenditures over time/ projections on spending

D. Budget Resolution l Agreed upon by the House and Senate near the start of the budgetary process that will create an agreed upon spending limit. Then Congress may work towards adding additional spending items on the budget.

E. Appropriations Committees l One of the most powerful committees in Congress. l Determine “who gets what” with spending. l Will hold hearings on agency/department requests.

F. Continuing Resolution l This is how the U. S. government has functioned (primarily) with regards to a budget from 2009 present. When the two houses can not agree, they pass this! l Defined – Resolutions that set appropriations for a specified amount of time. – Example – A CR that sets spending at 2014 levels +2% for 3 months.

IV. Revenue l 16 th Amendment – l Largest source of federal revenue? l Payroll taxes collected for ? ? l Tax expenditures – what are these? Sample Questions

SAMPLE AP QUESTION #1 l The largest source of federal revenue is the l A. capital gains tax l B. Social Security tax l C. property tax l D. income tax l E. sales tax

Sample Question #2 l Federal spending for which of the following is determined by laws that lie outside the regular budgetary process? A. Military procurement B. Regular agency spending funding C. Government-subsidized housing programs D. Educational assistance programs such as student loans E. Entitlement programs such as Social Security

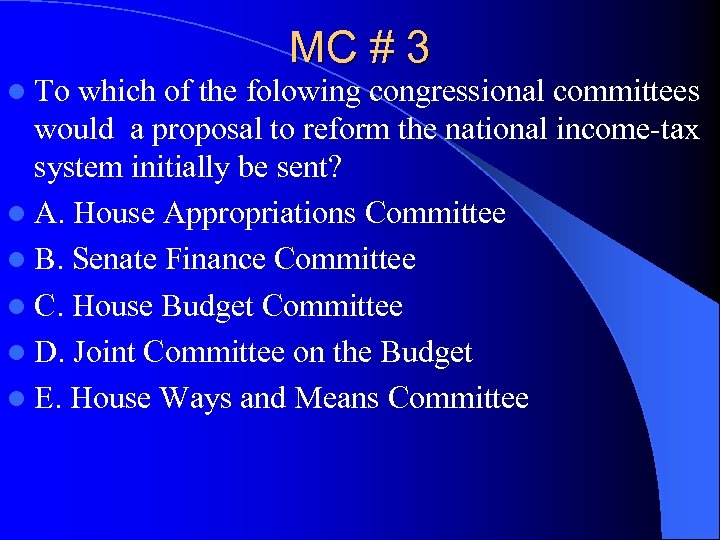

MC # 3 l To which of the folowing congressional committees would a proposal to reform the national income-tax system initially be sent? l A. House Appropriations Committee l B. Senate Finance Committee l C. House Budget Committee l D. Joint Committee on the Budget l E. House Ways and Means Committee

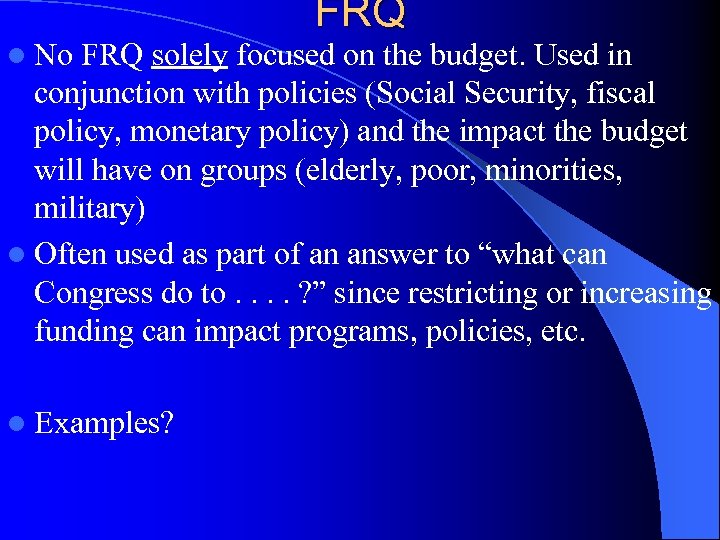

FRQ l No FRQ solely focused on the budget. Used in conjunction with policies (Social Security, fiscal policy, monetary policy) and the impact the budget will have on groups (elderly, poor, minorities, military) l Often used as part of an answer to “what can Congress do to. . ? ” since restricting or increasing funding can impact programs, policies, etc. l Examples?

END

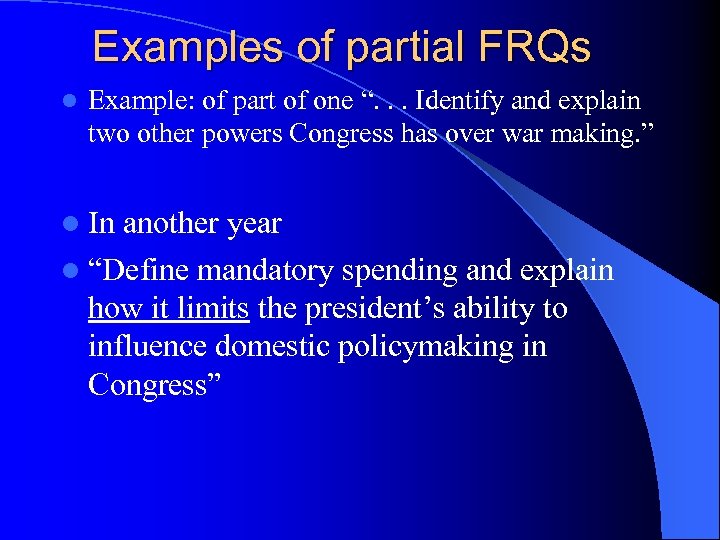

Examples of partial FRQs l Example: of part of one “. . . Identify and explain two other powers Congress has over war making. ” l In another year l “Define mandatory spending and explain how it limits the president’s ability to influence domestic policymaking in Congress”

f5e7aec7948c80b8297e2313402f4649.ppt