9de1879af7006ab25571419683b97ba4.ppt

- Количество слайдов: 19

The Budget and the Macroeconomy Suman Bery March 7, 2007 India Habitat Centre

About NCAER • Golden Jubilee Year • Joint work with Shashanka Bhide who coordinates QRE, Macrotrack • Views personal

Overview • Budget affects growth, equity through multiple micro (supply-side) channels: incentive effects; provision of public goods, income transfers. Discussed by other speakers. • But Budget also drives the macro framework: mix of fiscal, monetary, debt and exchange rate policies which boosts growth by providing a stable investment climate. • Latter is focus of my remarks.

Key Questions • Is the economy “overheated”? • If so, is there a “correct” mix of fiscal, monetary and exchange rate policies to sustain high growth? • Does the budget move us in the right direction?

Analytic Framework • India increasingly open both on trade and financial side. • Changes the way we need to think about assignment of instruments to targets. • Particularly important as we move to “fuller” capital account convertibility.

Analytic Framework • Useful frameworks: “impossible trinity” and “real exchange rate”. • Impossible trinity: open capital account, stable exchange rate, independent monetary policy. • “Real exchange rate”: internal price of non-tradables to tradables.

Analytic Framework • Useful frameworks: “impossible trinity”; “monetary approach to the balance of payments”; “real exchange rate”. • Impossible trinity: open capital account, stable exchange rate, independent monetary policy. • “Monetary approach”; with open capital account, agents will respond to domestic tightening through capital inflow. • “Real exchange rate”: internal price of tradables to non-tradables (See Lal-Bery-Pant 2003).

Analytic Framework • Like much of developing Asia, India trying to operate an “intermediate” currency regime; the question is at what risk and cost. • Lesson from Latin America: sterilised intervention of capital inflows ineffective, fiscally costly. LBP argue there is also a growth cost.

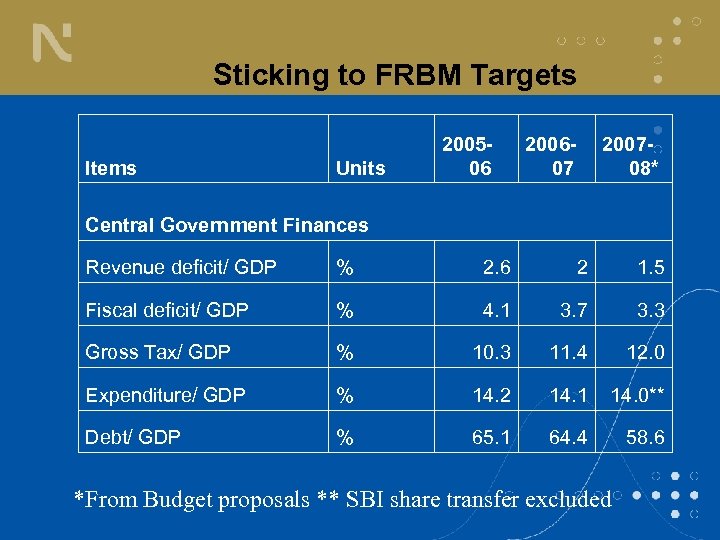

Sticking to FRBM Targets Items Units 200506 200607 200708* Central Government Finances Revenue deficit/ GDP % 2. 6 2 1. 5 Fiscal deficit/ GDP % 4. 1 3. 7 3. 3 Gross Tax/ GDP % 10. 3 11. 4 12. 0 Expenditure/ GDP % 14. 2 14. 1 14. 0** Debt/ GDP % 65. 1 64. 4 58. 6 *From Budget proposals ** SBI share transfer excluded

Sticking to FRBM (continued) • Growth has led to revenue buoyancy • Revenue growth has made higher expenditure on social sectors feasible • The Eleventh FYP had, however, looked at the potential need for some relaxation of FRBM to enable higher spending • If anything this year’s budget shows that revenue growth may be under-estimated

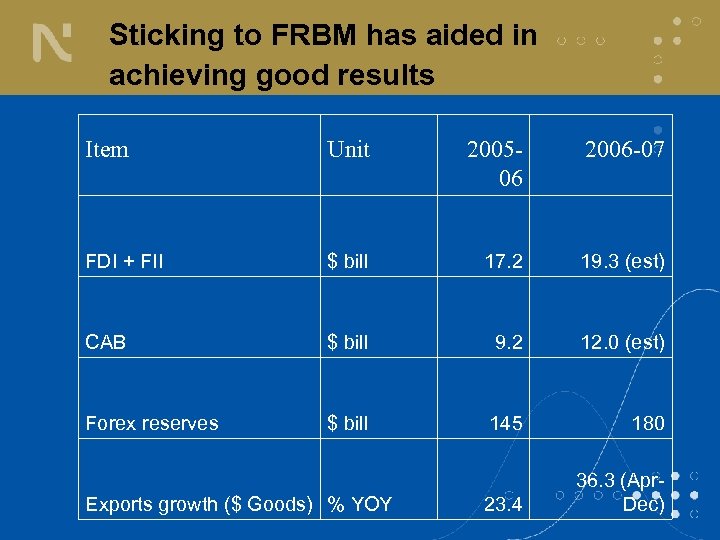

Sticking to FRBM has aided in achieving good results Item Unit 200506 2006 -07 FDI + FII $ bill 17. 2 19. 3 (est) CAB $ bill 9. 2 12. 0 (est) Forex reserves $ bill 145 180 23. 4 36. 3 (Apr. Dec) Exports growth ($ Goods) % YOY

Sticking to FRBM (continued) • However: • FRBM alone can not guarantee there are no off-budget spending • FRBM can not guarantee that there will be no inflationary tendencies • More is required from the Budget and from other Policies

Fighting Inflation • Budget has observed FRBM framework • Budget has reduced duties and taxes in some key input sectors • RBI has tightened excess liquidity: higher interest rate, higher CRR

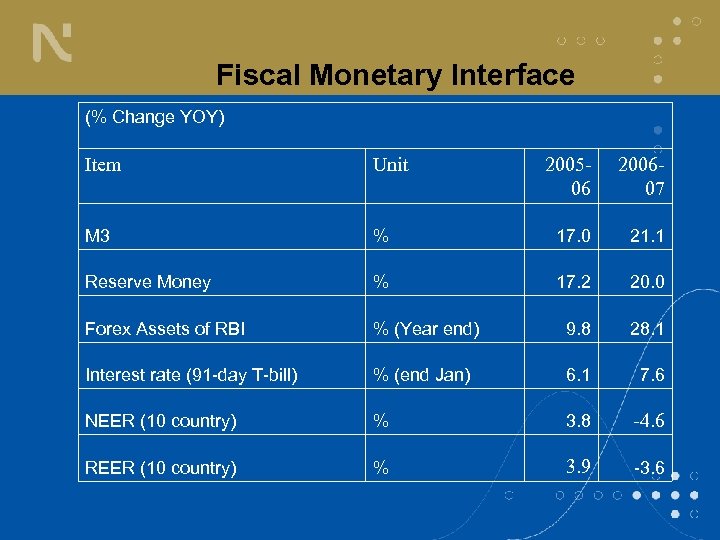

Fiscal Monetary Interface (% Change YOY) Item Unit 200506 200607 M 3 % 17. 0 21. 1 Reserve Money % 17. 2 20. 0 Forex Assets of RBI % (Year end) 9. 8 28. 1 Interest rate (91 -day T-bill) % (end Jan) 6. 1 7. 6 NEER (10 country) % 3. 8 -4. 6 REER (10 country) % 3. 9 -3. 6

Current Context • Given continued strong autonomous (and induced) capital inflows, for both cyclical and secular reasons the real exchange rate (the relative price of non-tradables) in India will tend to appreciate. • This happens through appreciation of the nominal exchange rate (against a basket) or through domestic inflation. • A widening current account deficit is an essential element of the adjustment/anti-inflationary process. • Aggregate fiscal adjustment can help mitigate the real exchange rate appreciation; sterilisation on the other hand complicates both the fiscal and the exchange rate problem.

Policy Assignment • The current goals of an open capital account and autonomous monetary policy should entail freedom for the nominal exchange rate. In this case exchange market intervention should be abandoned (Korea, Thailand, Brazil). • Alternatively, RBI could intervene and not sterilise. • In all cases fiscal policy could play a useful counter-cyclical role.

Fiscal Monetary Interface • • • High growth Capital inflows and build up of reserves Inflation High interest rates Exchange rate depreciation • Should there not be a different policy response?

Another Reform in the Fiscal- Monetary Interface • Separation of debt management from monetary policy body: The DMO

Thank You

9de1879af7006ab25571419683b97ba4.ppt