3bdb11b338c09ee97174ed3e96fedf55.ppt

- Количество слайдов: 33

The BOEING Company Presented by: • Xuhao Yang; • Thanh Le; • Liefeng(Richard) Zhang; • Wenjie (Emma) Zhang Nov-29 -2011 BOEING is a trademark of Boeing Management Company. Copyright © 2007 Boeing. All rights reserved.

Overview § Founded in 1916 in the Puget Sound region of Washington state § Became a leading producer of military and commercial aircraft § Customers and customer support in 150 countries § Total revenue in 2010: $64. 3 billion § 70 percent of commercial airplane revenue historically from customers outside the United States § More than 165, 000 Boeing employees in 50 states and 70 countries Source: http: //www. boeing. com/companyoffices/aboutus/brief. html

Business Overview § Design, assemble and support commercial jetliners § Boeing 7 -series family of airplanes lead the industry § Commercial Aviation Services (CAS) offers broad range of services to passenger and freight carriers § Design, assemble and support defense systems § World’s largest designer and manufacturer of military transports, tankers, fighters and helicopters § Support Systems provides services to government customers worldwide § Design and assemble satellites and launch vehicles § World’s largest provider of commercial and military satellites; largest NASA contractor § Integrate large-scale systems; develop networking technology and network-centric solutions § Provide financing solutions focused on customer requirements § Develop advanced systems and technology to meet future customer needs Source: http: //www. boeing. com/companyoffices/aboutus/brief. html

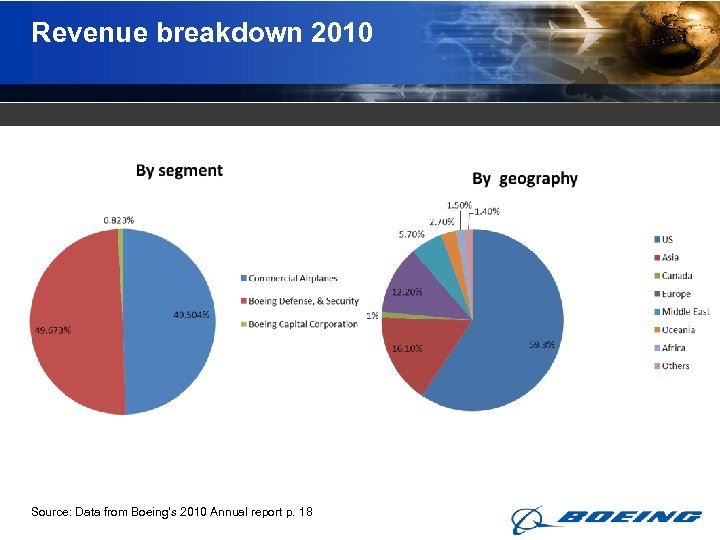

Revenue breakdown 2010 Source: Data from Boeing’s 2010 Annual report p. 18

Boeing Commercial Airplanes § Offering a family of airplanes and a broad portfolio of aviation services for passenger and cargo carriers worldwide § Boeing airplanes represent three quarters of the world’s fleet, with nearly 12, 000 jetliners in service § Approximately 70 percent of Boeing commercial airplane sales (by value) go to customers outside of the United States § 2010 revenues of $31. 8 billion § In 2010, the company delivered 462 airplanes, including 376 Boeing 737 s § Boeing 787 -8 and 747 -8 completed fight testing activities and achieved FAA certification in 3 rd quarter of 2011 Source: http: //www. boeing. com/companyoffices/aboutus/brief. html

Boeing Defense, Space & Security § Involve research, development, production, modification and support of global strike systems, global mobility systems, rotorcraft systems, airborne surveillance and reconnaissance aircraft, network and tactical systems, intelligence and security systems, missile defense systems, and space and intelligence systems § Boeing Military Aircraft § Network & Space systems § Global services & support § 2010 revenues of $31. 9 billion § In 2010, delivered 115 new and 66 remanufactured aircrafts, more than 10, 000 precision-guided weapons systems, two launch vehicles, and 4 satellites. Source: http: //www. boeing. com/companyoffices/aboutus/brief. html

Boeing Capital Corporation § Financing subsidiary of The Boeing Company § Focused on assets that are critical to the core operations of Boeing customers § Arranging and/or providing financing for customers of Boeing products § Midyear 2011 portfolio valued at approximately $4. 5 billion Source: http: //www. boeing. com/companyoffices/aboutus/brief. html

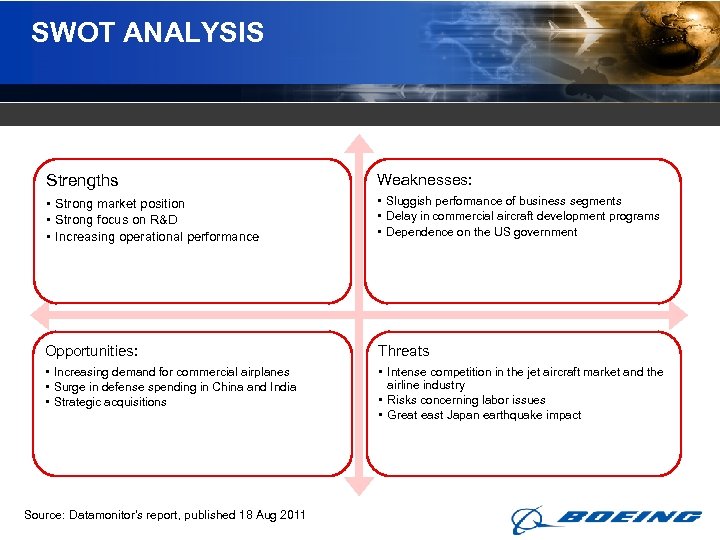

SWOT ANALYSIS Strengths Weaknesses: • Strong market position • Strong focus on R&D • Increasing operational performance • Sluggish performance of business segments • Delay in commercial aircraft development programs • Dependence on the US government Opportunities: Threats • Increasing demand for commercial airplanes • Surge in defense spending in China and India • Strategic acquisitions • Intense competition in the jet aircraft market and the airline industry • Risks concerning labor issues • Great east Japan earthquake impact Source: Datamonitor’s report, published 18 Aug 2011

Historical stock performance Source: Bloomberg

Industry Analysis § Global Civil Aerospace Products Manufacturing § Products and Services § Geographic Spread § North America and Europe companies are the largest products and services suppliers. In 2010, 48. 5% revenue goes to North America; 43% goes to Europe companies Source: IBIS World: Global Civil Aerospace Products Manufacturing Reports

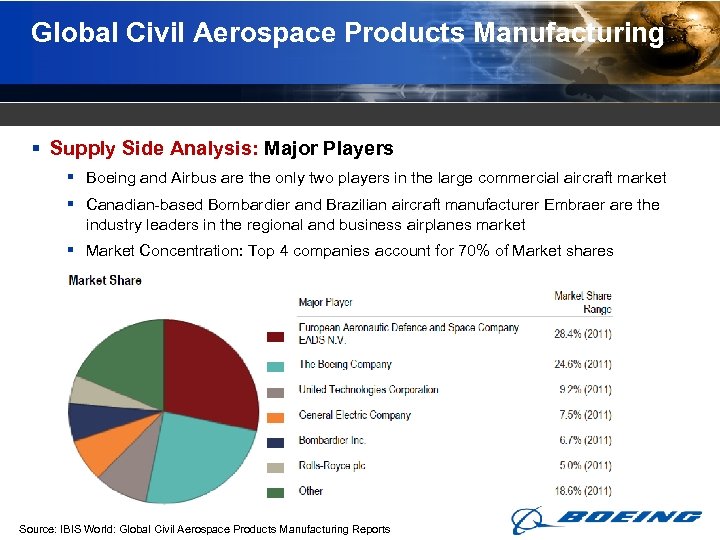

Global Civil Aerospace Products Manufacturing § Supply Side Analysis: Major Players § Boeing and Airbus are the only two players in the large commercial aircraft market § Canadian-based Bombardier and Brazilian aircraft manufacturer Embraer are the industry leaders in the regional and business airplanes market § Market Concentration: Top 4 companies account for 70% of Market shares Source: IBIS World: Global Civil Aerospace Products Manufacturing Reports

Global Civil Aerospace Products Manufacturing § Commercial Aircraft Demand Determinant: § Major airlines are the largest customers for civil aerospace product manufactures. (78. 5% Market Shares) Their demand is driven by the need and desire for airlines to expand their fleet or replace ageing models § Product Innovation: § Fuel efficiency § Lower maintenance & operating cost § Timing § The average LCA has a life of about 30 years. Therefore, when the time comes to replace these older models, demand for aircraft increases. Source: IBIS World: Global Civil Aerospace Products Manufacturing Reports

Market Drivers § Total Immigration § The level of immigration in the world may boost the demand for air travel. § The fastest growing regions will be in Asia, where economic growth and infrastructure improvements will lead to a rapid rise in passenger numbers. Boeing expects that passenger numbers will increase globally at 5. 0% per annum over the next 20 years § World GDP § The industry is in the mature stage of its Life Cycle. The historical industry annual growth is in line with global real GDP growth. (1. 9% in the past 5 yrs. ) § Price of Crude Oil § High crude oil prices will increase the operating cost of air carriers and aircraft owners, which will deter them from acquiring new aircraft. Source: IBIS World: Global Civil Aerospace Products Manufacturing Reports

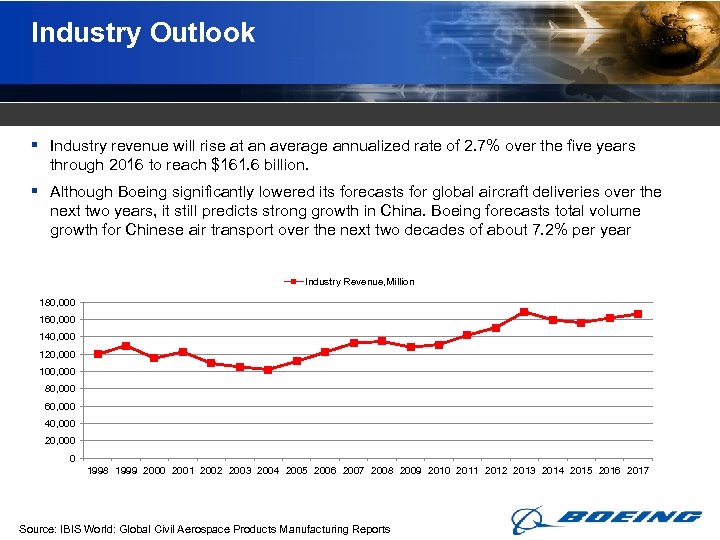

Industry Outlook § Industry revenue will rise at an average annualized rate of 2. 7% over the five years through 2016 to reach $161. 6 billion. § Although Boeing significantly lowered its forecasts for global aircraft deliveries over the next two years, it still predicts strong growth in China. Boeing forecasts total volume growth for Chinese air transport over the next two decades of about 7. 2% per year Industry Revenue, Million 180, 000 160, 000 140, 000 120, 000 100, 000 80, 000 60, 000 40, 000 20, 000 0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Source: IBIS World: Global Civil Aerospace Products Manufacturing Reports

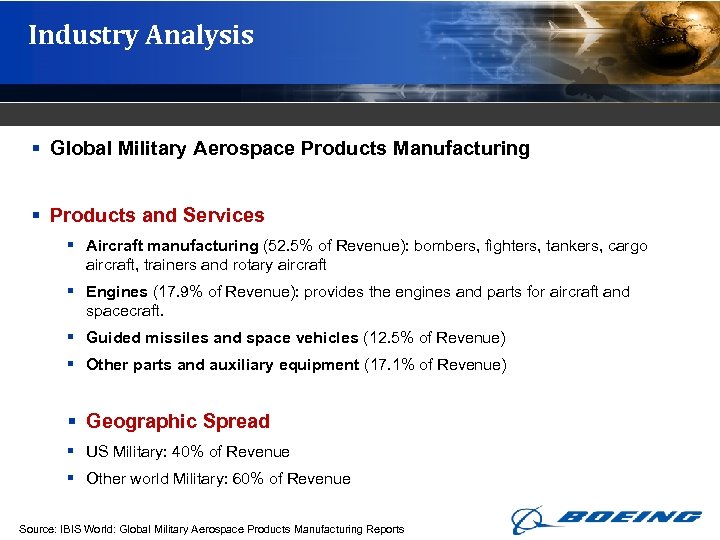

Industry Analysis § Global Military Aerospace Products Manufacturing § Products and Services § Aircraft manufacturing (52. 5% of Revenue): bombers, fighters, tankers, cargo aircraft, trainers and rotary aircraft § Engines (17. 9% of Revenue): provides the engines and parts for aircraft and spacecraft. § Guided missiles and space vehicles (12. 5% of Revenue) § Other parts and auxiliary equipment (17. 1% of Revenue) § Geographic Spread § US Military: 40% of Revenue § Other world Military: 60% of Revenue Source: IBIS World: Global Military Aerospace Products Manufacturing Reports

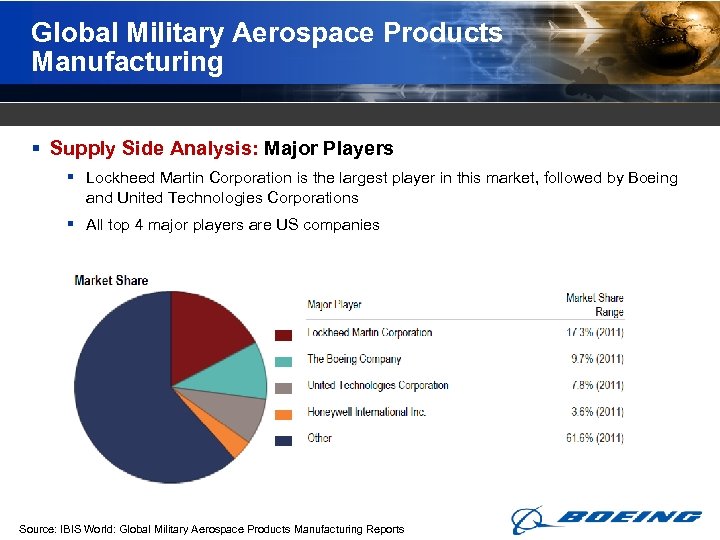

Global Military Aerospace Products Manufacturing § Supply Side Analysis: Major Players § Lockheed Martin Corporation is the largest player in this market, followed by Boeing and United Technologies Corporations § All top 4 major players are US companies Source: IBIS World: Global Military Aerospace Products Manufacturing Reports

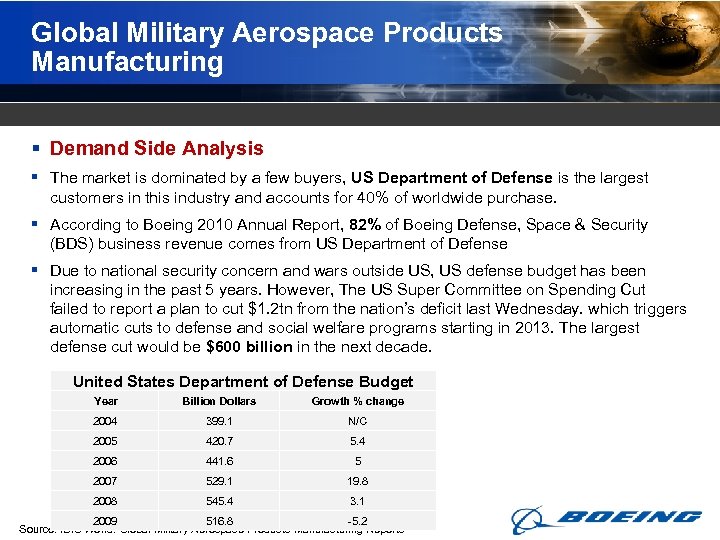

Global Military Aerospace Products Manufacturing § Demand Side Analysis § The market is dominated by a few buyers, US Department of Defense is the largest customers in this industry and accounts for 40% of worldwide purchase. § According to Boeing 2010 Annual Report, 82% of Boeing Defense, Space & Security (BDS) business revenue comes from US Department of Defense § Due to national security concern and wars outside US, US defense budget has been increasing in the past 5 years. However, The US Super Committee on Spending Cut failed to report a plan to cut $1. 2 tn from the nation’s deficit last Wednesday. which triggers automatic cuts to defense and social welfare programs starting in 2013. The largest defense cut would be $600 billion in the next decade. United States Department of Defense Budget Year Billion Dollars Growth % change 2004 399. 1 N/C 2005 420. 7 5. 4 2006 441. 6 5 2007 529. 1 19. 8 2008 545. 4 3. 1 2009 516. 8 -5. 2 Source: IBIS World: Global Military Aerospace Products Manufacturing Reports

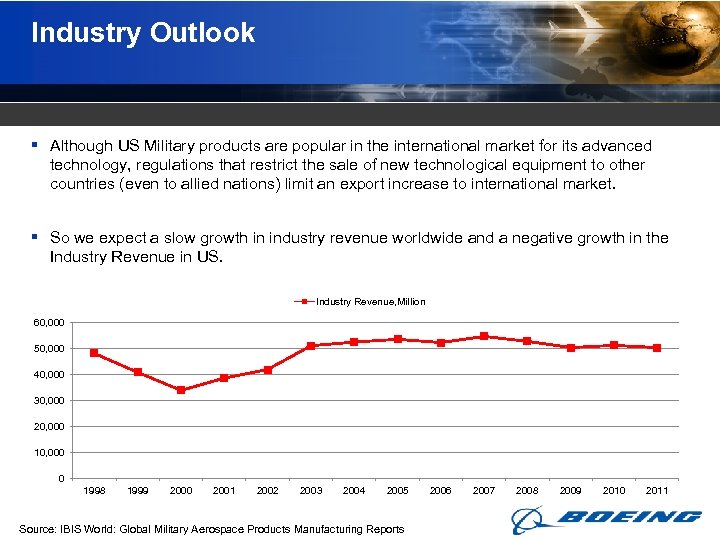

Industry Outlook § Although US Military products are popular in the international market for its advanced technology, regulations that restrict the sale of new technological equipment to other countries (even to allied nations) limit an export increase to international market. § So we expect a slow growth in industry revenue worldwide and a negative growth in the Industry Revenue in US. Industry Revenue, Million 60, 000 50, 000 40, 000 30, 000 20, 000 10, 000 0 1998 1999 2000 2001 2002 2003 2004 2005 Source: IBIS World: Global Military Aerospace Products Manufacturing Reports 2006 2007 2008 2009 2010 2011

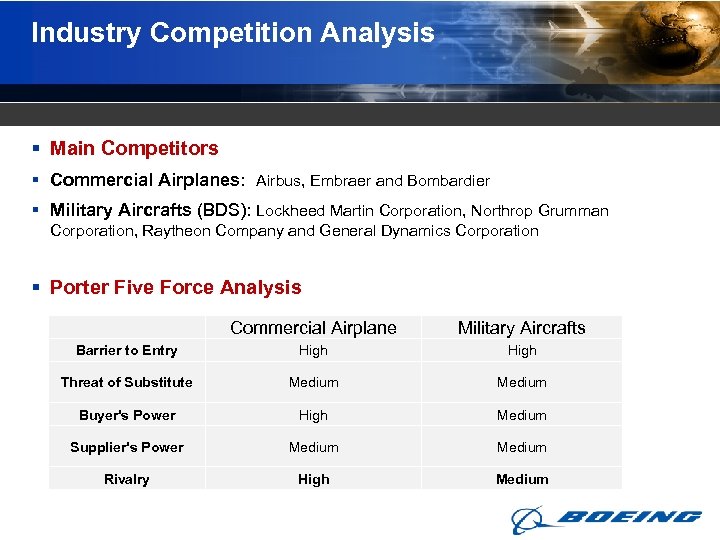

Industry Competition Analysis § Main Competitors § Commercial Airplanes: Airbus, Embraer and Bombardier § Military Aircrafts (BDS): Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Company and General Dynamics Corporation § Porter Five Force Analysis Commercial Airplane Military Aircrafts Barrier to Entry High Threat of Substitute Medium Buyer's Power High Medium Supplier's Power Medium Rivalry High Medium

Duopoly Boeing and Airbus compete in a near-duopoly in the global market for large commercial jets comprising narrow-body aircrafts, wide-body aircrafts and jumbo jets. • Acquired former arch-rival, Mcdonnell Douglas, in 1997 • The largest global aircraft manufacturer by revenue, orders and deliveries. • Began as a consortium of aerospace manufacturers. • Subsidiary of European Aeronautic Defense and Space Company (EADS)

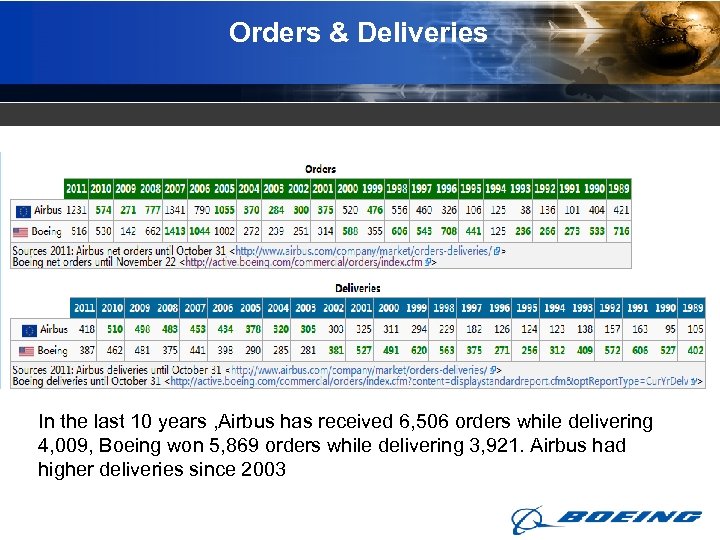

Orders & Deliveries In the last 10 years , Airbus has received 6, 506 orders while delivering 4, 009, Boeing won 5, 869 orders while delivering 3, 921. Airbus had higher deliveries since 2003

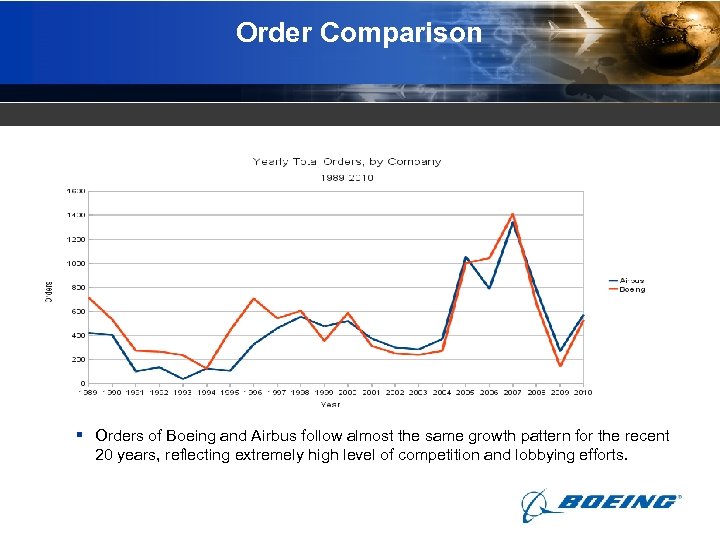

Order Comparison § Orders of Boeing and Airbus follow almost the same growth pattern for the recent 20 years, reflecting extremely high level of competition and lobbying efforts.

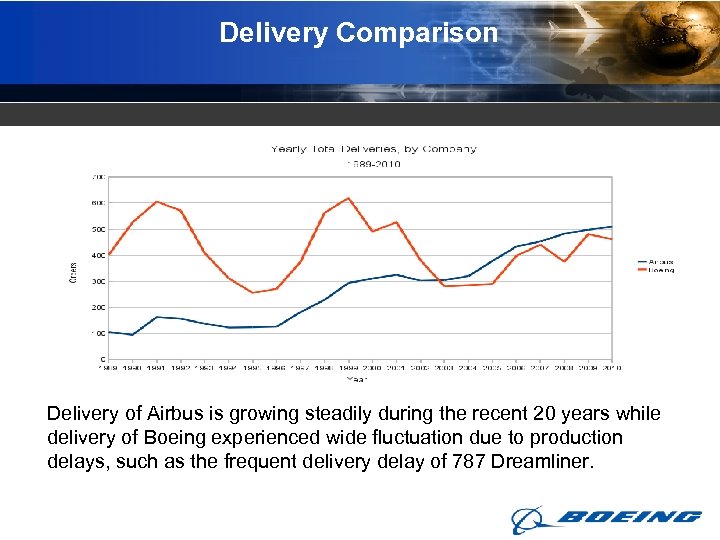

Delivery Comparison Delivery of Airbus is growing steadily during the recent 20 years while delivery of Boeing experienced wide fluctuation due to production delays, such as the frequent delivery delay of 787 Dreamliner.

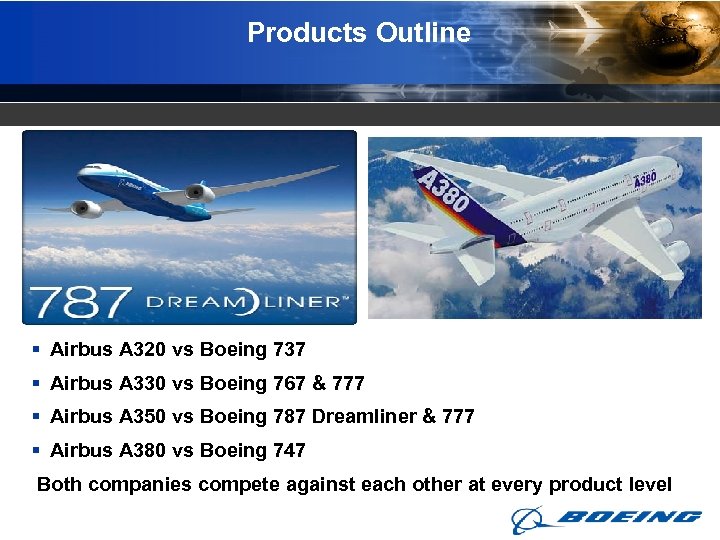

Products Outline § Airbus A 320 vs Boeing 737 § Airbus A 330 vs Boeing 767 & 777 § Airbus A 350 vs Boeing 787 Dreamliner & 777 § Airbus A 380 vs Boeing 747 Both companies compete against each other at every product level

Range Overlap Though both companies have a broad product range varying from single-aisle to wide-body, they do not always compete head-to-head. As listed below they respond with slightly different models. §The Airbus A 380, for example, is substantially larger than the Boeing 747. §The Airbus A 350 competes with the high end of the Boeing 787 Dreamliner and the Boeing 777. §The Airbus A 320 is larger than the Boeing 737 -700 but smaller than the 737 -800. §The Airbus A 321 is larger than the Boeing 737 -900 but smaller than the previous Boeing 757 -200. §The Airbus A 330 -200 competes with the smaller Boeing 767 -300 ER. Airline companies benefit from this competition as they get an array of diversified products ranging from 100 -500 seats, than if both companies offered identical aircraft.

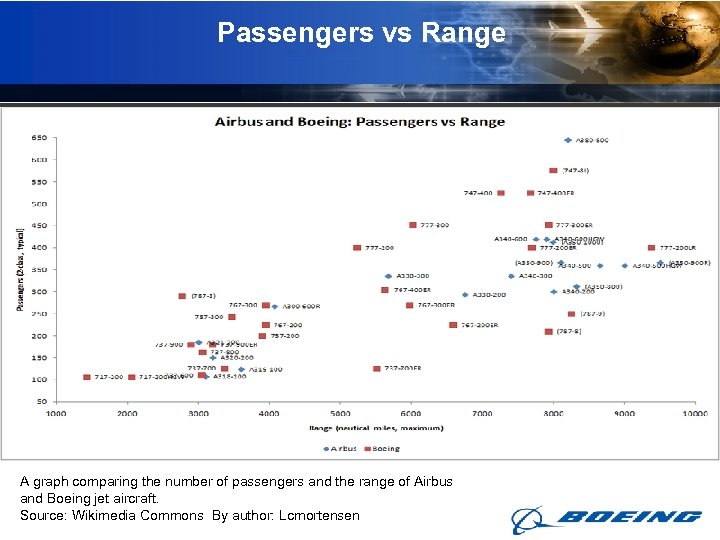

Passengers vs Range A graph comparing the number of passengers and the range of Airbus and Boeing jet aircraft. Source: Wikimedia Commons By author: Lcmortensen

Competition by outsourcing § Because many of the world’s airlines are wholly or partially government owned, aircraft procurement decisions are often taken according to political and commercial criteria. Boeing and Airbus seek to exploit this by subcontracting production of aircraft components or assemblies to manufacturers in countries of strategic importance in order to gain a competitive advantage. § For example, Boeing has offered longstanding relationships with Japanese suppliers including Mitsubishi Heavy Industries and Kawasaki Heavy Industries , a process which helped Boeing achieve almost total dominance of the Japanese market for commercial jets. § Partly because of its origins as a consortium of European companies, Airbus had fewer opportunities to outsource significant parts of its production beyond its own European plants.

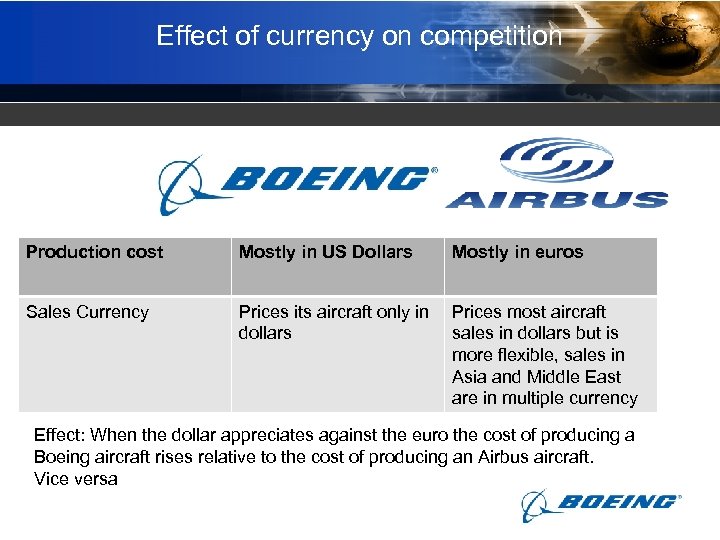

Effect of currency on competition Production cost Mostly in US Dollars Mostly in euros Sales Currency Prices its aircraft only in dollars Prices most aircraft sales in dollars but is more flexible, sales in Asia and Middle East are in multiple currency Effect: When the dollar appreciates against the euro the cost of producing a Boeing aircraft rises relative to the cost of producing an Airbus aircraft. Vice versa

Competition in Defense Industry § While actively competing with Airbus in commercial aviation, Boeing also faces fierce competition with major rivalries such as Lockheed Martin, Honeywell, Northrop Grumman, and General Dynamics in defense industry. Sales are split 50/50 between the airplane and defense segments.

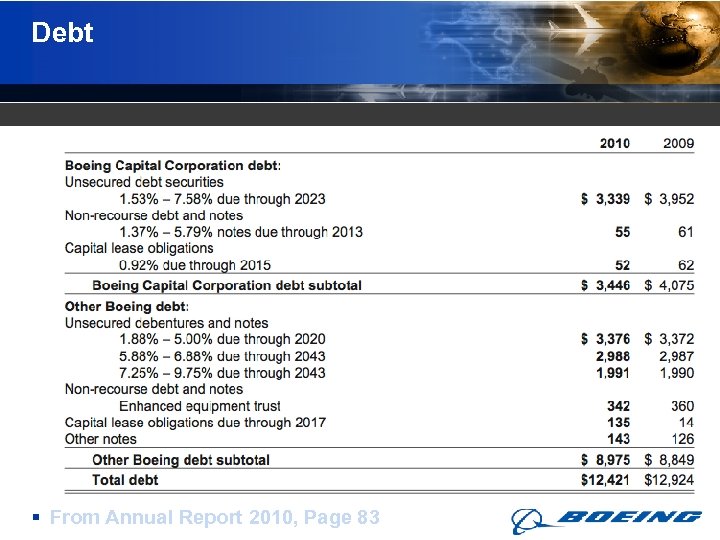

Debt § From Annual Report 2010, Page 83

Projections Reasoning § At Boeing Defense, Space & Security, while global security threats remain high, we foresee an extended period of flat to declining defense budgets both in the United States and Europe. § Our 20 -year forecast is for a long-term average growth rate of 5% per year for passenger and cargo traffic based on a projected average annual worldwide real economic growth rate of 3%. § GS&s was awarded modernization and upgrade contracts from US Air force From 10 Q, 3 rd quarter of 2011

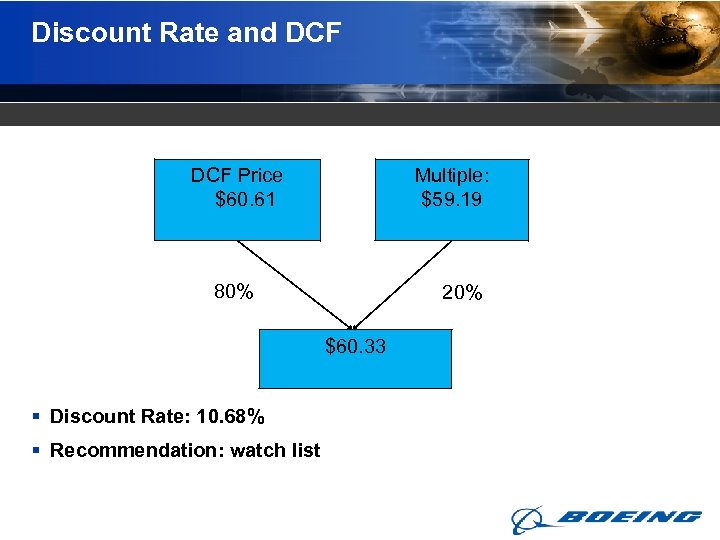

Discount Rate and DCF Price $60. 61 Multiple: $59. 19 80% 20% $60. 33 § Discount Rate: 10. 68% § Recommendation: watch list

§Thank you

3bdb11b338c09ee97174ed3e96fedf55.ppt