b77ad6d7ae7cf989fcfc4b4ff6d45fb0.ppt

- Количество слайдов: 37

The Bank of Israel’s New DSGE Model Project Team: David Elkayam, Eyal Argov, Emanuel Barnea, Alon Binyamini, Eliezer Borenstein, Irit Rozenshtrom Updated: 22 October 2009 Prepared for presentation at the Central Bank Macroeconomic Modeling Workshop, Jerusalem 28/10/2009

Contents n n n Overview of the project. Short description of the New Area Wide Model (NAWM). 4 main deviations from NAWM: q q Imports in exports. UIP condition. Time varying long-run real interest rate. Rest of the world model.

Project Motivation n From 2005 until today, the main monetary model operated at the Bank of Israel to support interest rate decisions is: q “Open-economy New-Keynesian small DSGE ‘lite’ model”. q Four blocks: n n n What's missing? q q n Inflation Output gap Exchange rate Interest-rate The model is too small – real sector not rich enough, does not cover GDP components, no labor market, no investment-capital dynamics. Limited amounts of questions you can ask. Loose ends on theory – ad hoc imported inflation equation, exogenous investment, ad hoc “closing open-economy model”. HP filtered gaps – hard to present growth forecasts. In 2008 the Bo. I Monetary Models Forum initiated the development of a new DSGE model for use in forecasting and policy analysis.

The Project n Starting point – ECB’s “New Area Wide Model” q n Similar (RAMSES, NEMO, TOTEM) Stages of the project: q q q Study and replicate the NAWM – done. Derive analytical solution to steady state – done. Calibrate version for Israel – done. Implementing the model for practical use – ongoing Bayesian estimation of the model – ongoing Extensions of the model – future work n n n Financial frictions Search and matching labor market Distinction of business sector vs. government output.

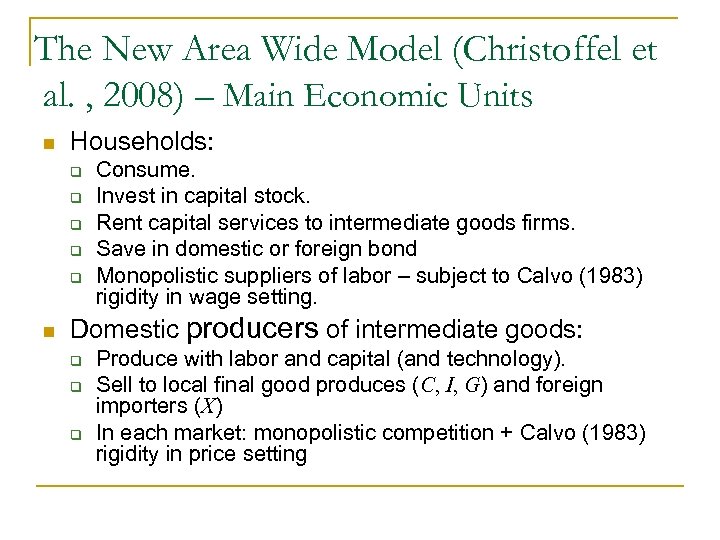

The New Area Wide Model (Christoffel et al. , 2008) – Main Economic Units n Households: q q q n Consume. Invest in capital stock. Rent capital services to intermediate goods firms. Save in domestic or foreign bond Monopolistic suppliers of labor – subject to Calvo (1983) rigidity in wage setting. Domestic producers of intermediate goods: q q q Produce with labor and capital (and technology). Sell to local final good produces (C, I, G) and foreign importers (X) In each market: monopolistic competition + Calvo (1983) rigidity in price setting

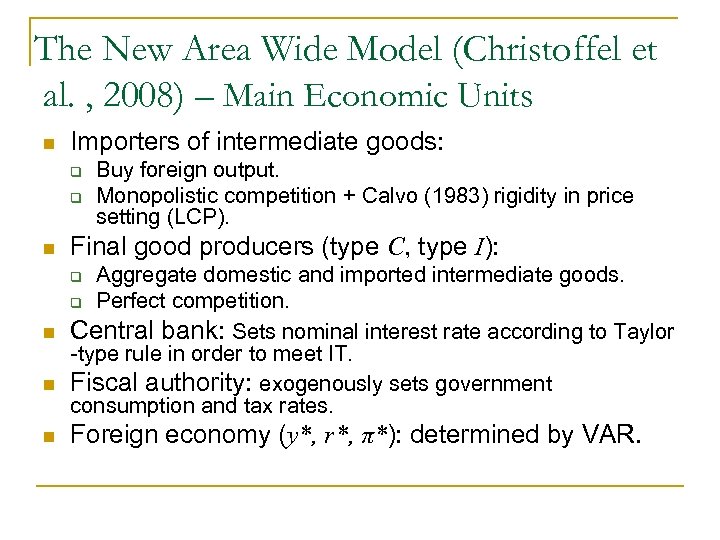

The New Area Wide Model (Christoffel et al. , 2008) – Main Economic Units n Importers of intermediate goods: q q Buy foreign output. Monopolistic competition + Calvo (1983) rigidity in price setting (LCP). n Final good producers (type C, type I): n Aggregate domestic and imported intermediate goods. q Perfect competition. Central bank: Sets nominal interest rate according to Taylor -type rule in order to meet IT. Fiscal authority: exogenously sets government consumption and tax rates. q n n Foreign economy (y*, r*, π*): determined by VAR.

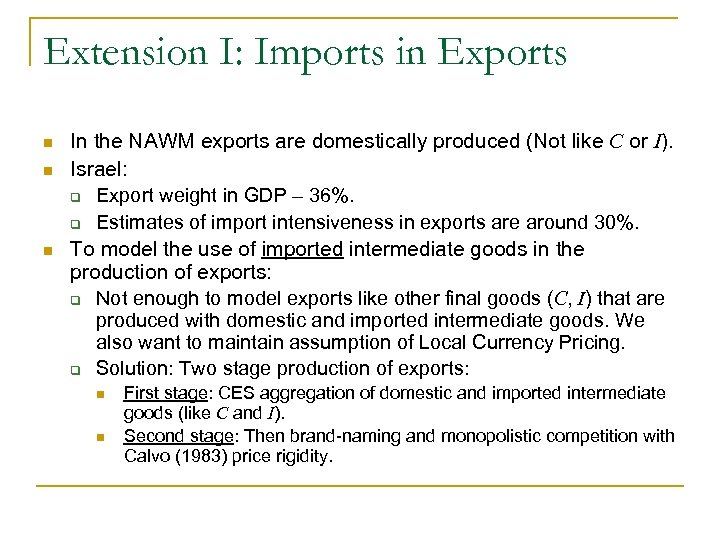

Extension I: Imports in Exports n n n In the NAWM exports are domestically produced (Not like C or I). Israel: q Export weight in GDP – 36%. q Estimates of import intensiveness in exports are around 30%. To model the use of imported intermediate goods in the production of exports: q Not enough to model exports like other final goods (C, I) that are produced with domestic and imported intermediate goods. We also want to maintain assumption of Local Currency Pricing. q Solution: Two stage production of exports: n n First stage: CES aggregation of domestic and imported intermediate goods (like C and I). Second stage: Then brand-naming and monopolistic competition with Calvo (1983) price rigidity.

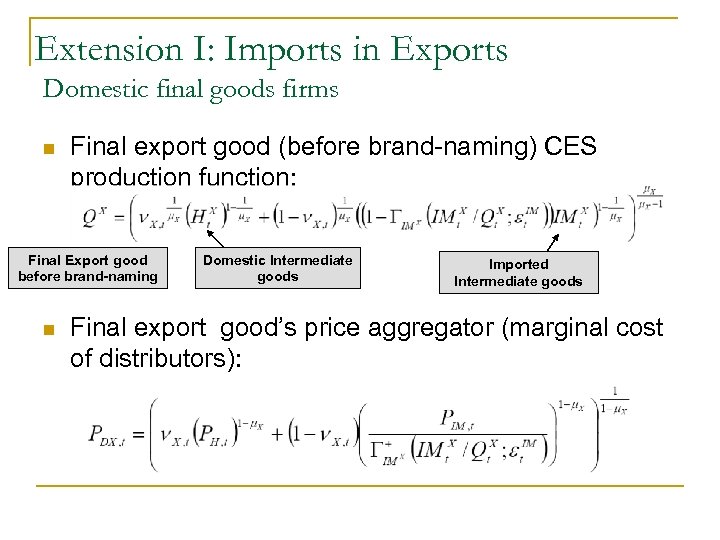

Extension I: Imports in Exports Domestic final goods firms n Final export good (before brand-naming) CES production function: Final Export good before brand-naming n Domestic Intermediate goods Imported Intermediate goods Final export good’s price aggregator (marginal cost of distributors):

Extension I: Imports in Exports Exporters n n n Domestic monopolistic exporting firms buy the homogenous export good ( ) at constant marginal cost – Differentiate it using a simple production function: Sell it abroad at a marked-up price, , to foreign retail firms. They set their price in foreign currency (LCP), and face a Calvo (1983) problem.

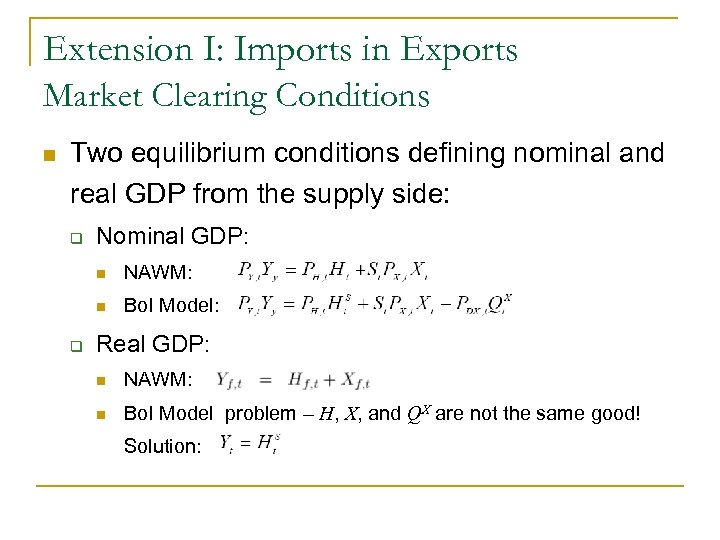

Extension I: Imports in Exports Market Clearing Conditions n Two equilibrium conditions defining nominal and real GDP from the supply side: q Nominal GDP: n n q NAWM: Bo. I Model: Real GDP: n NAWM: n Bo. I Model problem – H, X, and QX are not the same good! Solution:

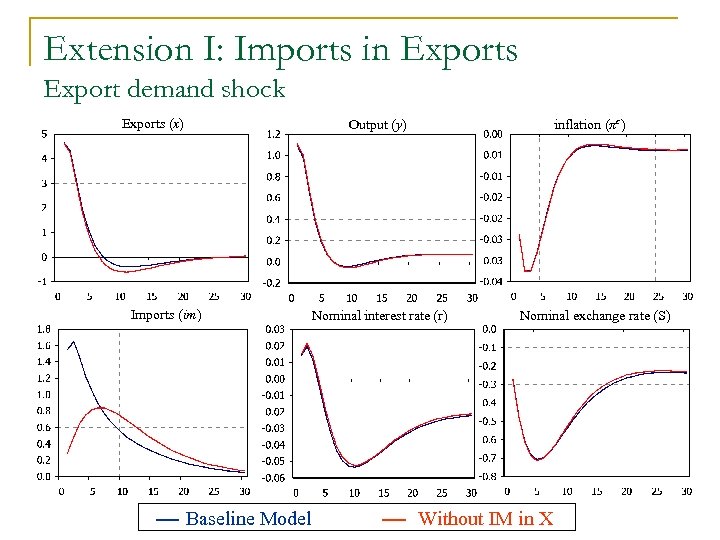

Extension I: Imports in Exports Export demand shock Exports (x) Output (y) Imports (im) Baseline Model inflation (πc) Nominal interest rate (r) Nominal exchange rate (S) Without IM in X

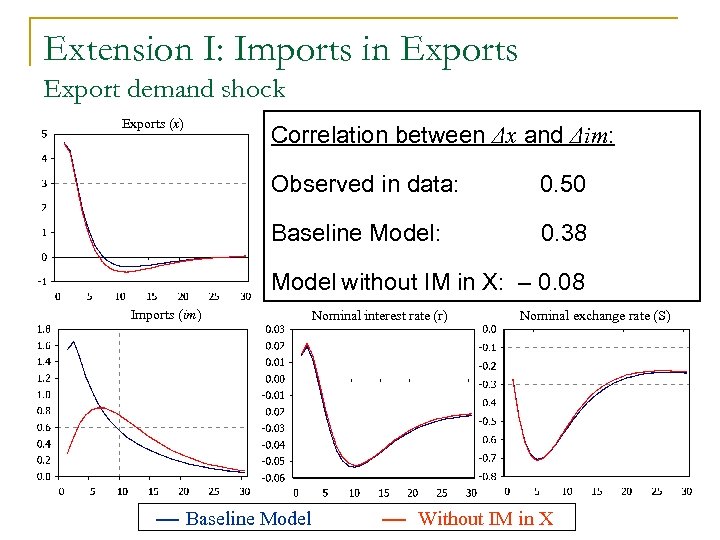

Extension I: Imports in Exports Export demand shock Exports (x) Output (y) inflation (πc) Correlation between Δx and Δim: Observed in data: 0. 50 Baseline Model: 0. 38 Model without IM in X: – 0. 08 Imports (im) Baseline Model Nominal interest rate (r) Nominal exchange rate (S) Without IM in X

Extension II: UIP Modifications General Overview Three Modifications to the UIP condition: n I. III. Incomplete financial markets – external risk premium depends on foreign asset position (Benigno, 2001). “Modified” UIP – external risk premium depends on expected and lagged nominal exchange rate (Adolfson et al. , 2007). “Modified” UIP compatible with persistent inflation target differentials.

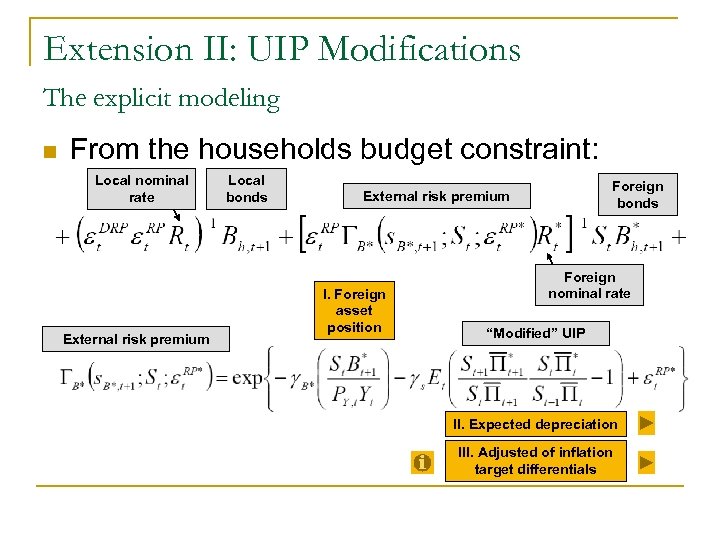

Extension II: UIP Modifications The explicit modeling n From the households budget constraint: Local nominal rate External risk premium Local bonds Foreign bonds External risk premium I. Foreign asset position Foreign nominal rate “Modified” UIP II. Expected depreciation III. Adjusted of inflation target differentials

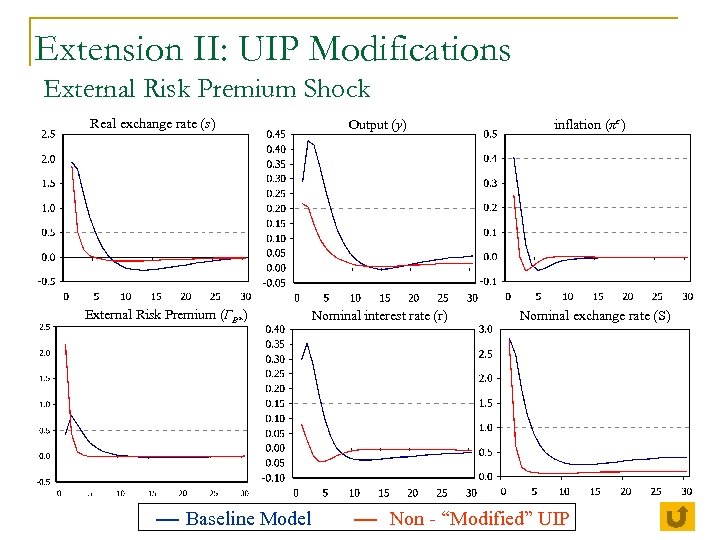

Extension II: UIP Modifications External Risk Premium Shock Real exchange rate (s) External Risk Premium (ΓB*) Baseline Model Output (y) Nominal interest rate (r) inflation (πc) Nominal exchange rate (S) Non - “Modified” UIP

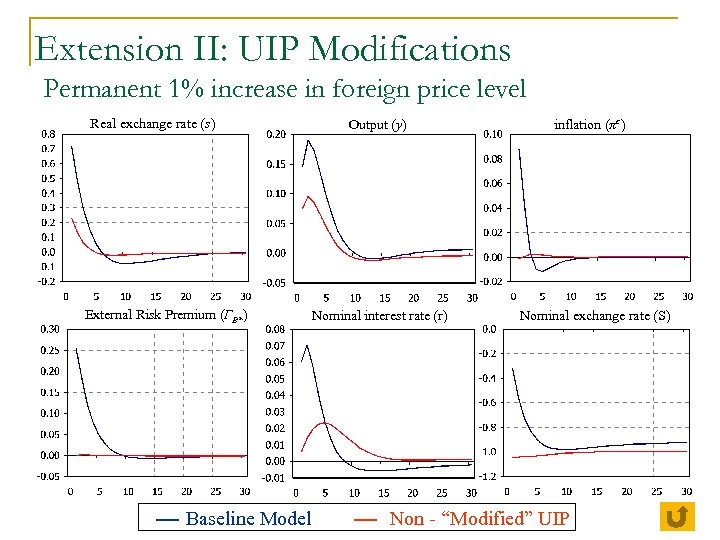

Extension II: UIP Modifications Permanent 1% increase in foreign price level Real exchange rate (s) External Risk Premium (ΓB*) Baseline Model Output (y) Nominal interest rate (r) inflation (πc) Nominal exchange rate (S) Non - “Modified” UIP

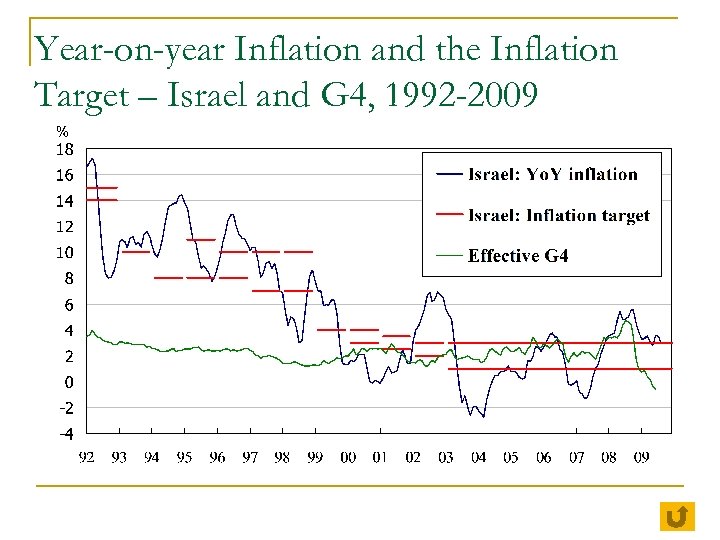

Year-on-year Inflation and the Inflation Target – Israel and G 4, 1992 -2009

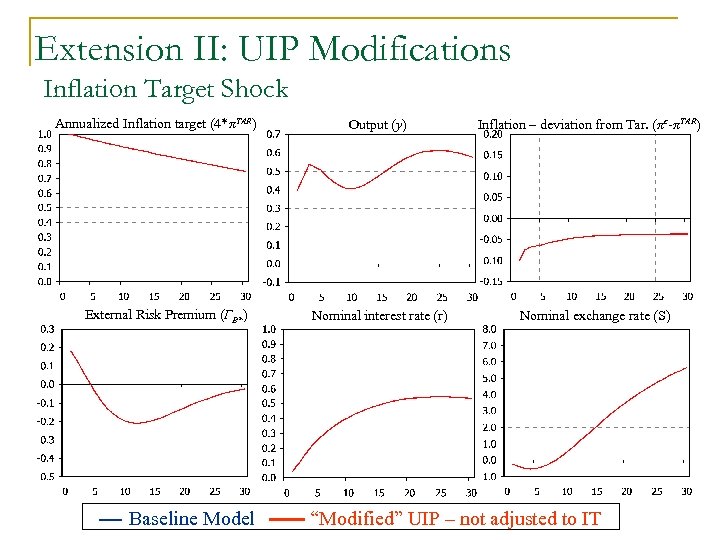

Extension II: UIP Modifications Inflation Target Shock Annualized Inflation target (4*πTAR) External Risk Premium (ΓB*) Baseline Model Output (y) Nominal interest rate (r) Inflation – deviation from Tar. (πc-πTAR) Nominal exchange rate (S) “Modified” UIP – not adjusted to IT

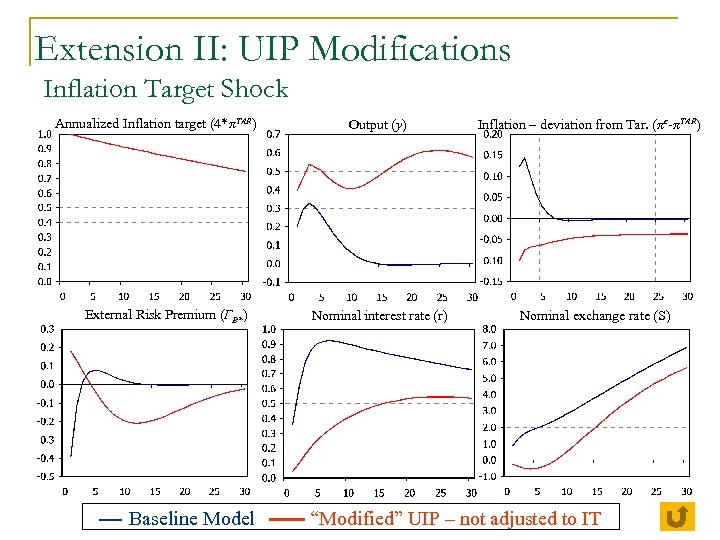

Extension II: UIP Modifications Inflation Target Shock Annualized Inflation target (4*πTAR) External Risk Premium (ΓB*) Baseline Model Output (y) Nominal interest rate (r) Inflation – deviation from Tar. (πc-πTAR) Nominal exchange rate (S) “Modified” UIP – not adjusted to IT

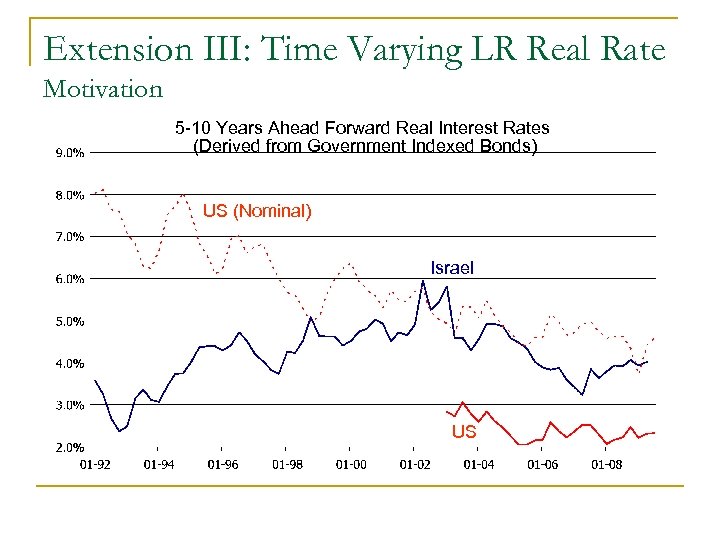

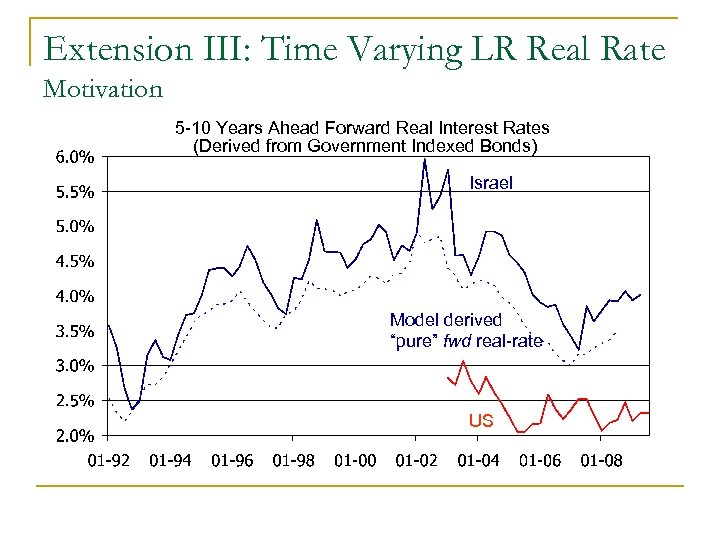

Extension III: Time Varying LR Real Rate Motivation 5 -10 Years Ahead Forward Real Interest Rates (Derived from Government Indexed Bonds) US (Nominal) Israel US

Extension III: Time Varying LR Real Rate n We add to the model: q q q Financial shock and structure that allow expected long-run (5 to 10 years) interest rates to change over time. Monetary policy uses long-run interest rates (forward 5 to 10 years ahead) as benchmark rates. Use data on long-run interest rates in estimation.

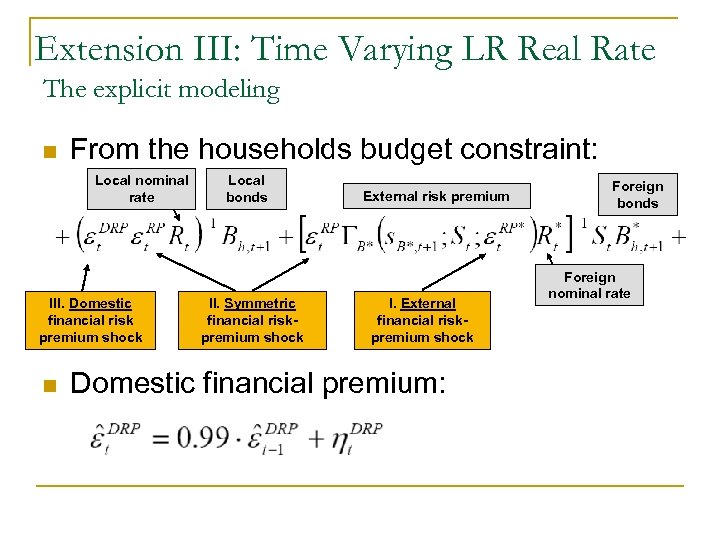

Extension III: Time Varying LR Real Rate The explicit modeling n From the households budget constraint: Local nominal rate III. Domestic financial risk premium shock n Local bonds II. Symmetric financial riskpremium shock External risk premium I. External financial riskpremium shock Domestic financial premium: Foreign bonds Foreign nominal rate

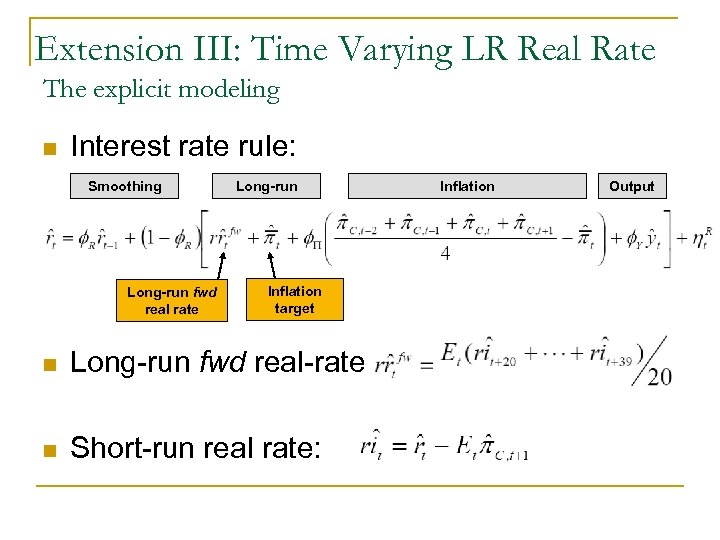

Extension III: Time Varying LR Real Rate The explicit modeling n Interest rate rule: Smoothing Long-run fwd real rate Long-run Inflation target n Long-run fwd real-rate: n Short-run real rate: Inflation Output

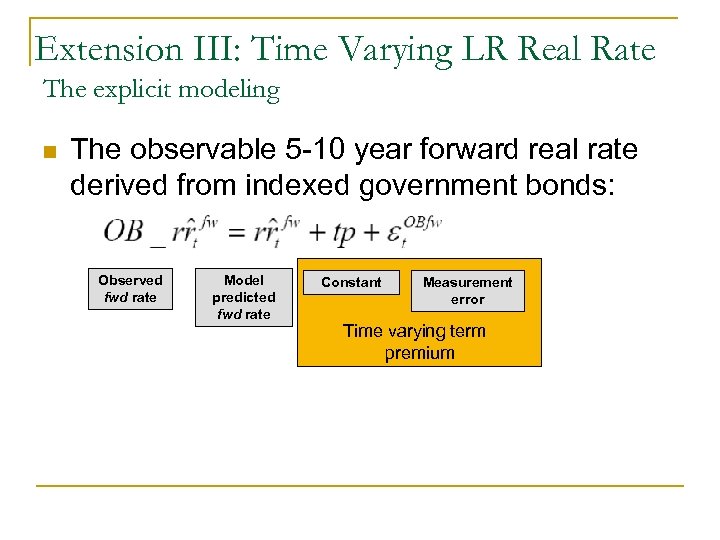

Extension III: Time Varying LR Real Rate The explicit modeling n The observable 5 -10 year forward real rate derived from indexed government bonds: Observed fwd rate Model predicted fwd rate Constant Measurement error Time varying term premium

Extension III: Time Varying LR Real Rate Motivation 5 -10 Years Ahead Forward Real Interest Rates (Derived from Government Indexed Bonds) Israel Model derived “pure” fwd real-rate US

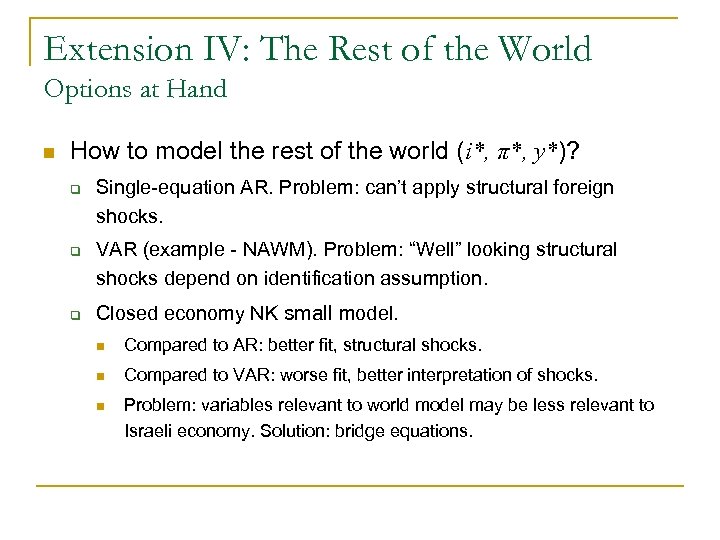

Extension IV: The Rest of the World Options at Hand n How to model the rest of the world (i*, π*, y*)? q q q Single-equation AR. Problem: can’t apply structural foreign shocks. VAR (example - NAWM). Problem: “Well” looking structural shocks depend on identification assumption. Closed economy NK small model. n Compared to AR: better fit, structural shocks. n Compared to VAR: worse fit, better interpretation of shocks. n Problem: variables relevant to world model may be less relevant to Israeli economy. Solution: bridge equations.

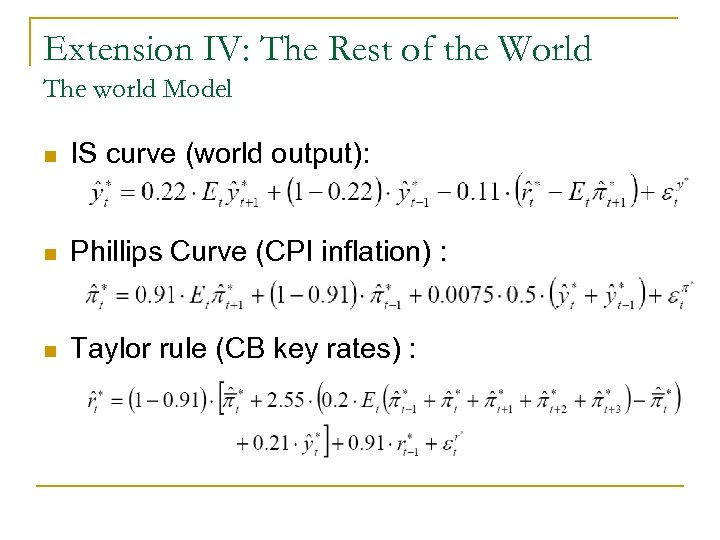

Extension IV: The Rest of the World The world Model n IS curve (world output): n Phillips Curve (CPI inflation) : n Taylor rule (CB key rates) :

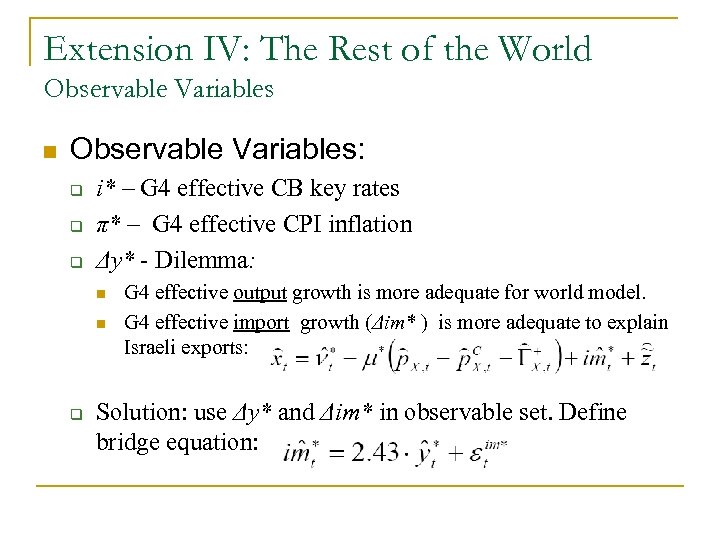

Extension IV: The Rest of the World Observable Variables n Observable Variables: q q q i* – G 4 effective CB key rates π* – G 4 effective CPI inflation Δy* - Dilemma: n n q G 4 effective output growth is more adequate for world model. G 4 effective import growth (Δim* ) is more adequate to explain Israeli exports: Solution: use Δy* and Δim* in observable set. Define bridge equation:

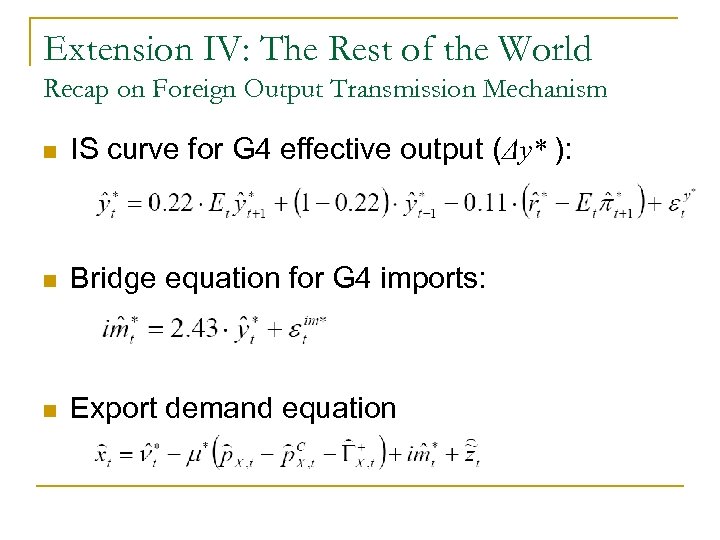

Extension IV: The Rest of the World Recap on Foreign Output Transmission Mechanism n IS curve for G 4 effective output (Δy* ): n Bridge equation for G 4 imports: n Export demand equation

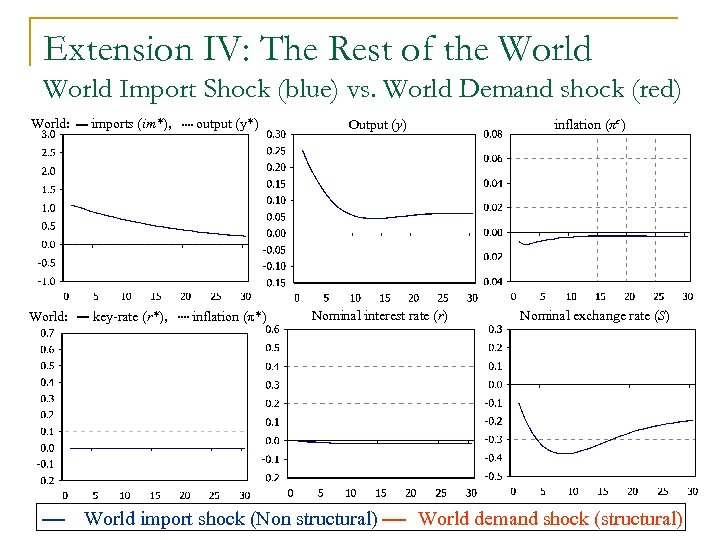

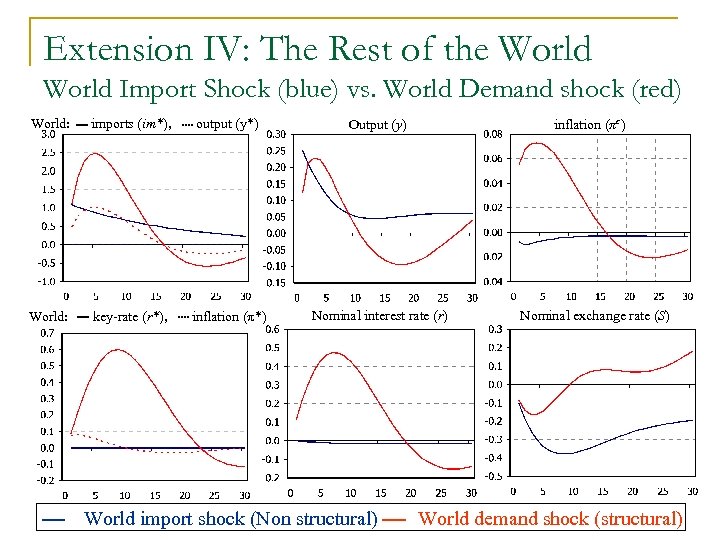

Extension IV: The Rest of the World Import Shock (blue) vs. World Demand shock (red) World: imports (im*), output (y*) Output (y) World: key-rate (r*), inflation (π*) Nominal interest rate (r) World import shock (Non structural) inflation (πc) Nominal exchange rate (S) World demand shock (structural)

Extension IV: The Rest of the World Import Shock (blue) vs. World Demand shock (red) World: imports (im*), output (y*) Output (y) World: key-rate (r*), inflation (π*) Nominal interest rate (r) World import shock (Non structural) inflation (πc) Nominal exchange rate (S) World demand shock (structural)

The End Thank You

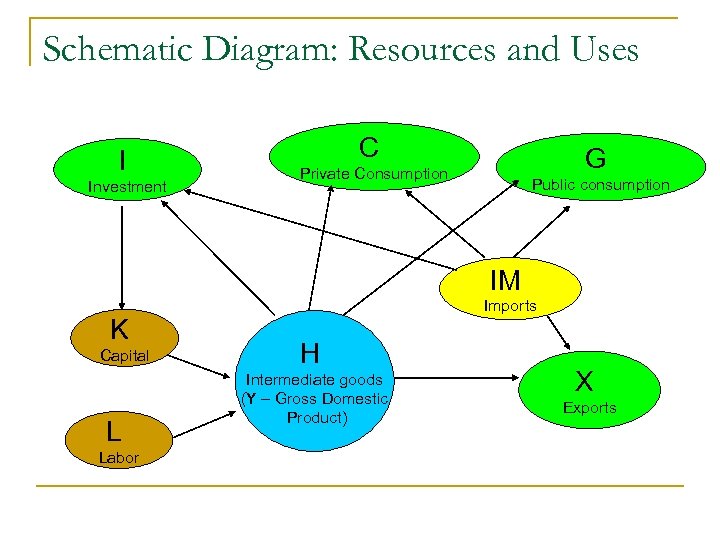

Schematic Diagram: Resources and Uses I Investment C G Private Consumption Public consumption IM K Capital L Labor Imports H Intermediate goods (Y – Gross Domestic Product) X Exports

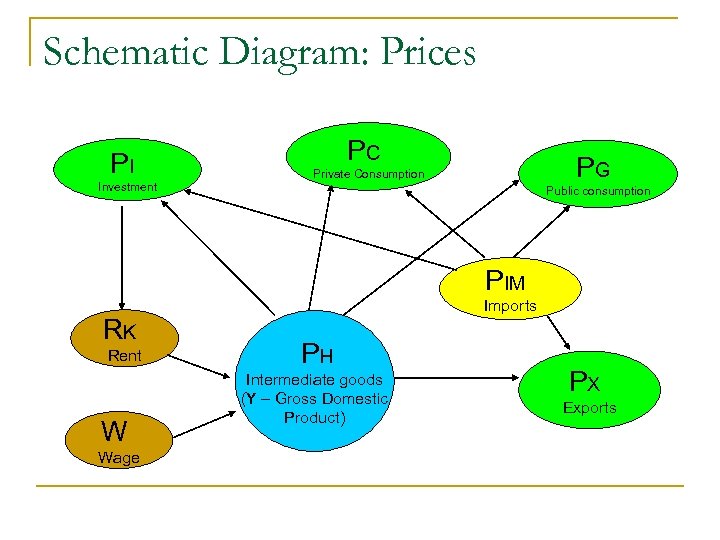

Schematic Diagram: Prices PI Investment PC PG Private Consumption Public consumption PIM RK Rent W Wage Imports PH Intermediate goods (Y – Gross Domestic Product) PX Exports

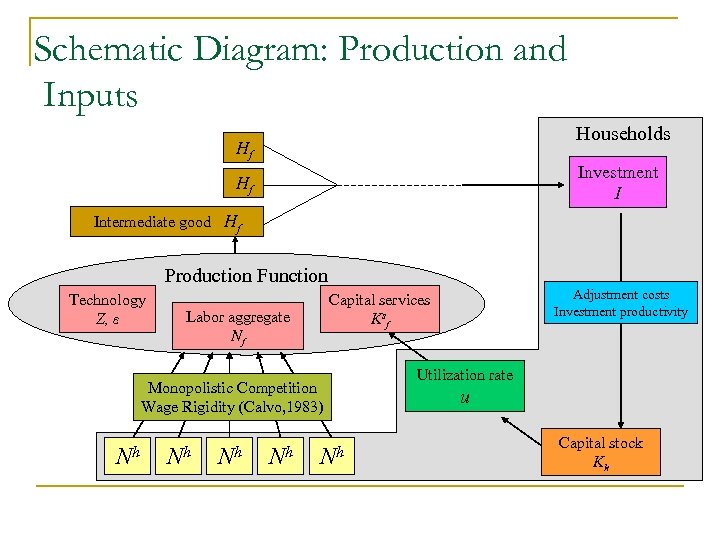

Schematic Diagram: Production and Inputs Households Hf Investment I Hf Intermediate good Hf Production Function Technology Z, ε Labor aggregate Nf Monopolistic Competition Wage Rigidity (Calvo, 1983) Nh Nh Adjustment costs Investment productivity Capital services Ksf Nh Utilization rate u Capital stock Kh

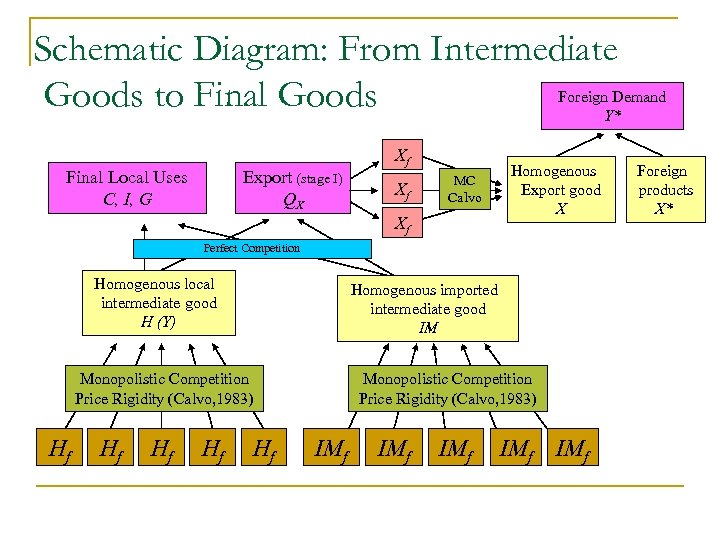

Schematic Diagram: From Intermediate Foreign Demand Goods to Final Goods Y* Final Local Uses C, I, G Export (stage I) QX Xf Xf MC Calvo Xf Homogenous Export good X Perfect Competition Homogenous local intermediate good H (Y) Homogenous imported intermediate good IM Monopolistic Competition Price Rigidity (Calvo, 1983) Hf Hf Hf Monopolistic Competition Price Rigidity (Calvo, 1983) IMf IMf IMf Foreign products X*

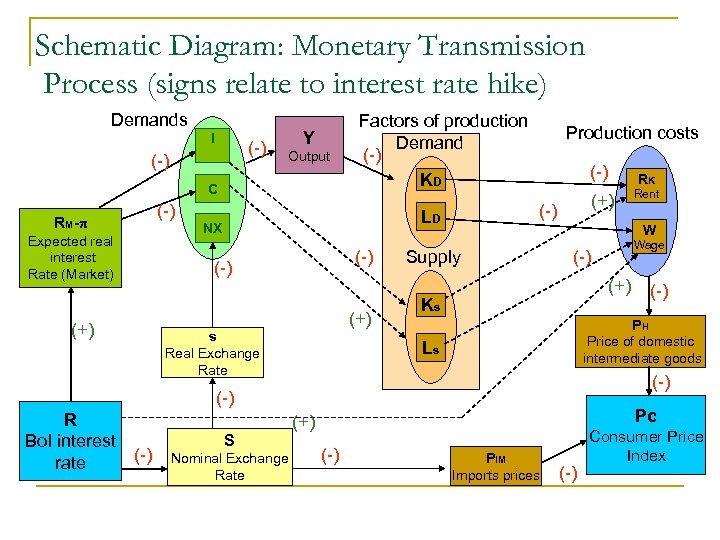

Schematic Diagram: Monetary Transmission Process (signs relate to interest rate hike) Demands I (-) Y Output C R M -π Expected real interest Rate (Market) (+) (-) Factors of production Demand (-) KD (-) (+) s Real Exchange Rate (-) Supply Nominal Exchange Rate Wage (-) (+) Ks (-) PH Price of domestic intermediate goods Ls (-) Pc (+) S Rent W (-) R Bo. I interest (-) rate RK (+) (-) LD NX Production costs (-) PIM Imports prices (-) Consumer Price Index

b77ad6d7ae7cf989fcfc4b4ff6d45fb0.ppt