![The ARM [ No LEG(S) ! ] Bob Uhorchak, CSP, ALCM, ARM reuhorchak@mindspring. com The ARM [ No LEG(S) ! ] Bob Uhorchak, CSP, ALCM, ARM reuhorchak@mindspring. com](https://present5.com/presentation/c90b9eb076a37a5f3a140e342b473c35/image-2.jpg)

The ARM [ No LEG(S) ! ] Bob Uhorchak, CSP, ALCM, ARM reuhorchak@mindspring. com

Questions to consider: Why can the VP of Operations be pleased with a declining OSHA Incident Rate, yet the VP of Finance be displeased ? ? or What is “Enterprise Risk Management” and how does it apply to EH & S ? ? or (for HPS members) How can insurance possibly be related to radiation safety, especially since “radioactivity” is excluded in virtually all property & casualty policies ? ?

Associate in Risk Management (ARM) Sponsoring organization: American Institute of Chartered Property & Casualty Underwriters/Insurance Institute of America, (AICPCU / IIA) Translation: An independent, continuing education organization(s) for the property & casualty insurance industry

General Requirements for Designations - no specific prerequisites; guidelines only - interest in property & casualty insurance - desire to show qualifications to current and/or prospective/future employers - ability to pass a national, multiple choice, examination; each ARM course exam is 2 hour, 85 questions Note: The Certified Risk Manager (CRM), designation is offered by another insurance, continuing education organization; the National Alliance for Insurance Education and Research

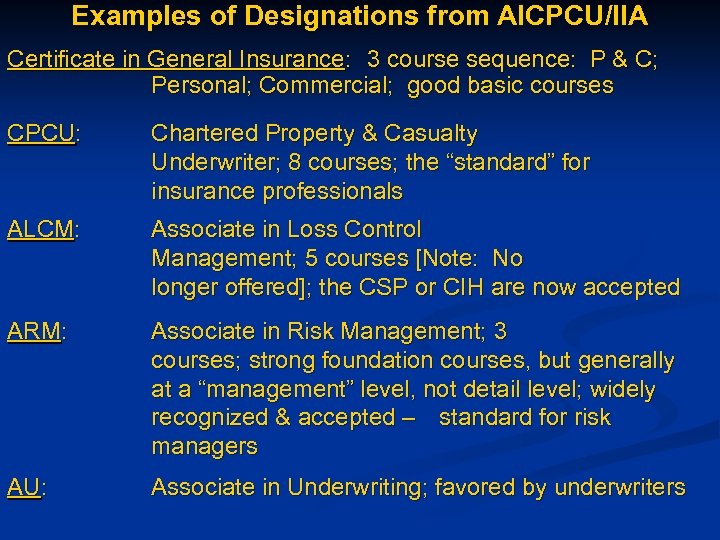

Examples of Designations from AICPCU/IIA Certificate in General Insurance: 3 course sequence: P & C; Personal; Commercial; good basic courses CPCU: Chartered Property & Casualty Underwriter; 8 courses; the “standard” for insurance professionals ALCM: Associate in Loss Control Management; 5 courses [Note: No longer offered]; the CSP or CIH are now accepted ARM: Associate in Risk Management; 3 courses; strong foundation courses, but generally at a “management” level, not detail level; widely recognized & accepted – standard for risk managers AU: Associate in Underwriting; favored by underwriters

Why pursue the ARM? “Chance favors the prepared mind” Louis Pasteur “… I took the one less traveled by, and that has made all the difference” Robert Frost

… recall the alchemist’s goal was to turn lead into gold … “… from technical nerd to administrator…” Bob Uhorchak i. e. potential for promotion/more $$$

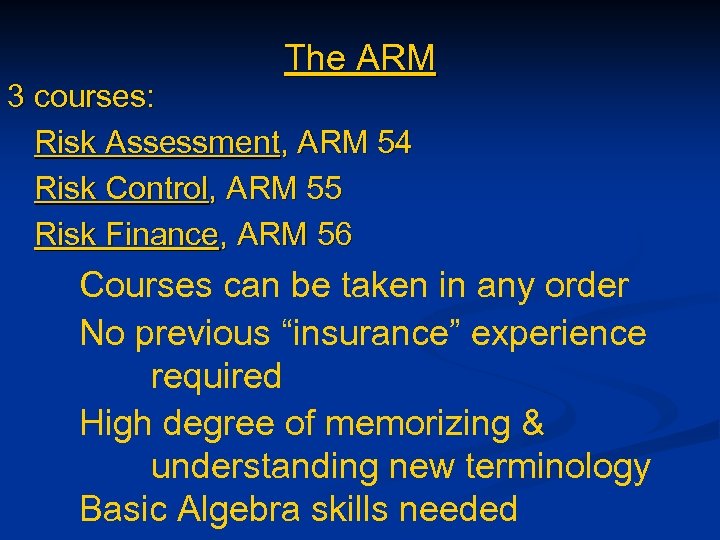

The ARM 3 courses: Risk Assessment, ARM 54 Risk Control, ARM 55 Risk Finance, ARM 56 Courses can be taken in any order No previous “insurance” experience required High degree of memorizing & understanding new terminology Basic Algebra skills needed

My Observations From Teaching Review Sessions For Each Course Risk Assessment, ARM 54: Introductory; Overview of Risk Management; Overview of 4 primary loss concerns [property; liability; personnel; net income] & risk control concerns; Basic concepts of probability & statistics & application to risk management (forecasting); Basics of evaluating insurance costs using Present Value concepts Probability & statistics applied to scenarios can be confusing if never exposed to these topics before

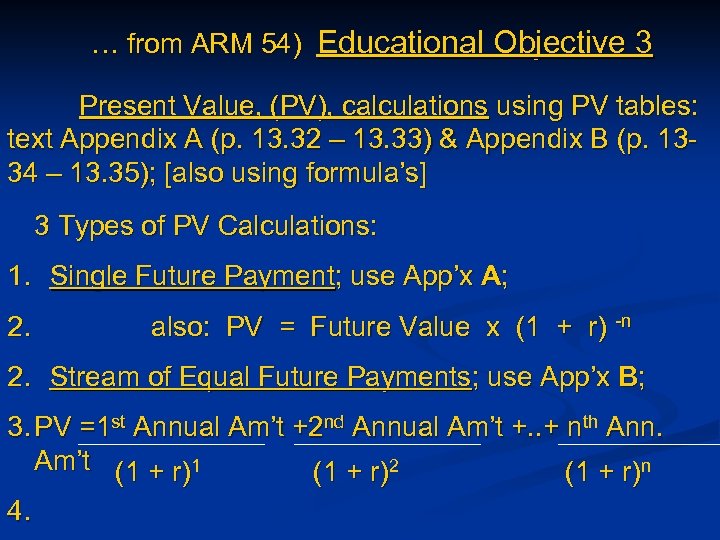

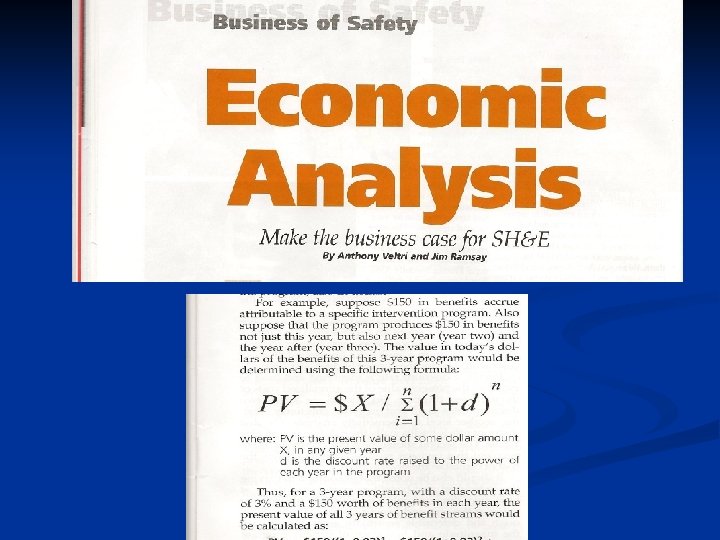

… from ARM 54) Educational Objective 3 Present Value, (PV), calculations using PV tables: text Appendix A (p. 13. 32 – 13. 33) & Appendix B (p. 1334 – 13. 35); [also using formula’s] 3 Types of PV Calculations: 1. Single Future Payment; use App’x A; 2. also: PV = Future Value x (1 + r) -n 2. Stream of Equal Future Payments; use App’x B; 3. PV =1 st Annual Am’t +2 nd Annual Am’t +. . + nth Ann. Am’t (1 + r)1 (1 + r)2 (1 + r)n 4.

Risk Control, ARM 55 Descriptive, no math; primarily understanding definitions; generally familiar territory for most safety folks Course outline explores risk control concepts for 4 primary loss exposures [property; liability; personnel; net income] with some detail regarding each

Risk Finance, ARM 56 New territory for most “safety” professionals Various risk finance concepts are explored and contrasted e. g. retrospective & prospective financing plans – cash flow advantages & disadvantages of each; the use of “captive” insurers; present value issues Basic familiarity with balance sheets & income statements is helpful

![Other: Cost: [per course] Basic package: Text, CD, Course Guide ~ $160; Additional aids Other: Cost: [per course] Basic package: Text, CD, Course Guide ~ $160; Additional aids](https://present5.com/presentation/c90b9eb076a37a5f3a140e342b473c35/image-16.jpg)

Other: Cost: [per course] Basic package: Text, CD, Course Guide ~ $160; Additional aids available Exam: $170 - $380 depending on timing & one exam or segmented exam Exam: AICPCU/IIA currently uses Prometric as the examiner; Some insurance companies will host the exam

Preparing for ARM Exams Options are available: - self study at home - on-line tutorials/trial exams - join a study group, either formal or informal Also: AICPCU/IIA offers many study aids Other companies, e. g. Keir, offer study aids

Why can the VP of Operations be pleased with a declining OSHA Incident Rate, yet the VP of Finance be displeased ? ? Answer: Because of “the disconnect” 1 that can occur between IR and Loss Costs i. e. IR can be declining, but loss costs can be increasing Enterprise Risk Management is an example of a management system that attempts to integrate the organization to solve this problem

Question: What is “enterprise risk management”? Enterprise Risk Management is: “an approach to managing all of an organization’s key business risks & opportunities with the intent of maximizing shareholder value” - it encompasses both hazard risk and business risk - it focuses on the organization as a whole

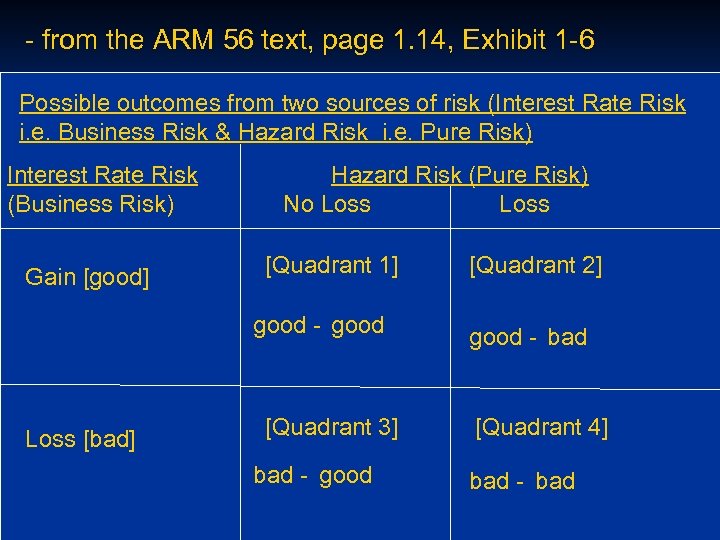

- from the ARM 56 text, page 1. 14, Exhibit 1 -6 Possible outcomes from two sources of risk (Interest Rate Risk i. e. Business Risk & Hazard Risk i. e. Pure Risk) Interest Rate Risk (Business Risk) Gain [good] Hazard Risk (Pure Risk) No Loss [Quadrant 1] good - good Loss [bad] [Quadrant 3] bad - good [Quadrant 2] good - bad [Quadrant 4] bad - bad

How can insurance possibly be related to radiation safety, especially since “radioactivity” is excluded in virtually all property & casualty policies ? ? Answer: Because several “radiation” endorsements (additions which have been court tested) can be added to a basic property policy that give some coverage for radiation related accidents

Useful Websites & References www. aicpcu. org; the website for additional information regarding many certifications, examination information, practice exams, etc. www. asse. org; web site for the American Society of Safety Engineers; their “Risk & Insurance” specialty practice is particularly helpful www. rims. org; web site for “Risk & Insurance Management Society”; the professional society for risk managers Glossary of Insurance & Risk Management Terms, International Risk Management Institute, Dallas, TX; a must have reference

Footnote 1 “Beware the Disconnect: Overcoming the Conflict Between Measures & Results”, Daniel Zahlis & Larry Hansen, Professional Safety, November 2005, ppgs. 18 - 24 A similar article: “Employee Injury: Effects on a Company, Workers’ Compensation & OSHA Compliance”, Robert Ray, RM/Insight, 2007, Vol. 6, No. 3, ppgs. 1, 8 - 10

Any Questions ? ?