a6c40ad5647c57793549fb8b6d08db93.ppt

- Количество слайдов: 12

The Apprenticeship Levy & wider reforms Information for OCC Schools These slides have been developed from the most up to date information available, provided by the Department for Education

The Apprenticeship Levy & wider reforms Information for OCC Schools These slides have been developed from the most up to date information available, provided by the Department for Education

What is the Levy? The Apprenticeship Levy is a levy on UK employers with an annual pay bill of more than £ 3 million, to fund apprenticeship training from 6 April 2017. The new funding system will apply from 1 st May 2017. The levy will be 0. 5% of the pay bill, paid through PAYE. OCC’s liability is c. £ 1. 22 million. This includes c. £ 640, 000 from maintained schools payroll. Levy funds will be converted into digital vouchers, and can only be used for apprenticeship training, not salary or management costs. Training can be for existing staff on normal salary grades as well as new entrants. The new mechanism for employers to access their digital vouchers is called the Digital Apprenticeship Service. As OCC needs to follow a procurement process to buy apprenticeship training at scale, we need your feedback about what sort of apprenticeship training schools want, and which providers are tried and trusted 2

What is the Levy? The Apprenticeship Levy is a levy on UK employers with an annual pay bill of more than £ 3 million, to fund apprenticeship training from 6 April 2017. The new funding system will apply from 1 st May 2017. The levy will be 0. 5% of the pay bill, paid through PAYE. OCC’s liability is c. £ 1. 22 million. This includes c. £ 640, 000 from maintained schools payroll. Levy funds will be converted into digital vouchers, and can only be used for apprenticeship training, not salary or management costs. Training can be for existing staff on normal salary grades as well as new entrants. The new mechanism for employers to access their digital vouchers is called the Digital Apprenticeship Service. As OCC needs to follow a procurement process to buy apprenticeship training at scale, we need your feedback about what sort of apprenticeship training schools want, and which providers are tried and trusted 2

The Levy is part of a broader programme of reforms The government aims to significantly increase the quantity and quality of apprenticeships in England, achieving 3 million starts in 2020: • Apprenticeship targets for public sector bodies – a new duty on public sector bodies to have 2. 3% of its workforce comprised of apprenticeships. • OCC’s target likely to be 96 apprenticeships per year • Schools target likely to be 194 (at least 1 apprentice per school) • We will have to publish information annually on progress towards meeting the target, but no sanction for failure to meet it • Employers placed at the heart of designing new Apprenticeships Standards through the Trailblazer programme, moving away from traditional Frameworks approach There is a lot changing at once: the following information is based on most up to date information and guidance from central government 3

The Levy is part of a broader programme of reforms The government aims to significantly increase the quantity and quality of apprenticeships in England, achieving 3 million starts in 2020: • Apprenticeship targets for public sector bodies – a new duty on public sector bodies to have 2. 3% of its workforce comprised of apprenticeships. • OCC’s target likely to be 96 apprenticeships per year • Schools target likely to be 194 (at least 1 apprentice per school) • We will have to publish information annually on progress towards meeting the target, but no sanction for failure to meet it • Employers placed at the heart of designing new Apprenticeships Standards through the Trailblazer programme, moving away from traditional Frameworks approach There is a lot changing at once: the following information is based on most up to date information and guidance from central government 3

Paying the levy - What this means for schools Schools where the local authority is the employer Where a school is a community school maintained by the local authority, the local authority is generally the employer. It is the LA who has the responsibility to pay ‘employer’ National Insurance contributions on the earnings of the school staff, and so these earnings will be considered as part of the LA’s pay bill for levy liability calculation. The cost of the levy is to be passed on to schools in the same way as employer National Insurance. Effectively, this reduces the schools available budget by 0. 5% of the payroll bill. This is also the likely model where the school is Voluntary Controlled OCC will have just one Digital Apprenticeship Service (DAS) account for the whole of the Council including our schools. Processes are being developed to enable schools to access funds that they are entitled to, within the account. OCC’s HR team will be responsible for the DAS Account. Your contacts are Rose Rolle-Rowan and Michelle Jones, email workforce. initiatives@oxfordshire. gov. uk 4

Paying the levy - What this means for schools Schools where the local authority is the employer Where a school is a community school maintained by the local authority, the local authority is generally the employer. It is the LA who has the responsibility to pay ‘employer’ National Insurance contributions on the earnings of the school staff, and so these earnings will be considered as part of the LA’s pay bill for levy liability calculation. The cost of the levy is to be passed on to schools in the same way as employer National Insurance. Effectively, this reduces the schools available budget by 0. 5% of the payroll bill. This is also the likely model where the school is Voluntary Controlled OCC will have just one Digital Apprenticeship Service (DAS) account for the whole of the Council including our schools. Processes are being developed to enable schools to access funds that they are entitled to, within the account. OCC’s HR team will be responsible for the DAS Account. Your contacts are Rose Rolle-Rowan and Michelle Jones, email workforce. initiatives@oxfordshire. gov. uk 4

Paying the levy - What this means for schools Schools where the local authority is not the employer Standalone academies. With an academy, the trust of the academy is generally the employer with the responsibility to pay employer NI. They will therefore accrue levy liability based on the pay bill of the academy. Academies that are part of multi-academy trusts. Multi-academy trusts (MATs) encompass multiple academies. In a MAT, it is generally the MAT itself that is the employer of the staff at any academies that are encompassed by it. This means that it is the MAT that accrues the levy liability based on the pay bill of all the academies. Foundation schools and Voluntary Aided Schools. Generally the governing body is considered to be the employer for the purposes of employer NI. Therefore they will accrue and pay levy liability based on their own pay bill. Our understanding is that no VA schools in Oxfordshire are large enough to pay the Levy. The IBC have got a system for excluding VA and Foundation schools from the Levy charge when they run payroll which is being tested during February. 5

Paying the levy - What this means for schools Schools where the local authority is not the employer Standalone academies. With an academy, the trust of the academy is generally the employer with the responsibility to pay employer NI. They will therefore accrue levy liability based on the pay bill of the academy. Academies that are part of multi-academy trusts. Multi-academy trusts (MATs) encompass multiple academies. In a MAT, it is generally the MAT itself that is the employer of the staff at any academies that are encompassed by it. This means that it is the MAT that accrues the levy liability based on the pay bill of all the academies. Foundation schools and Voluntary Aided Schools. Generally the governing body is considered to be the employer for the purposes of employer NI. Therefore they will accrue and pay levy liability based on their own pay bill. Our understanding is that no VA schools in Oxfordshire are large enough to pay the Levy. The IBC have got a system for excluding VA and Foundation schools from the Levy charge when they run payroll which is being tested during February. 5

Paying the levy - What this means for schools Summary There a variety of pay bill arrangements in the education sector so there is no single approach. You are advised to read the government’s full published guidance on calculating, paying and spending the levy and seek appropriate professional advice on their liability. Your Education Finance Services contact can help you to include a forecast in your budget based on your projected payroll costs. 6

Paying the levy - What this means for schools Summary There a variety of pay bill arrangements in the education sector so there is no single approach. You are advised to read the government’s full published guidance on calculating, paying and spending the levy and seek appropriate professional advice on their liability. Your Education Finance Services contact can help you to include a forecast in your budget based on your projected payroll costs. 6

A silver lining Apprenticeship Training as CPD for any school employee It will be possible to use Levy funding to allow individuals to take higher, equivalent and lower level qualifications The training must allow an individual to acquire substantive new skills, and the content of the training must be materially different from any prior training or previous apprenticeship It might be surprising to see the wide range of qualifications that are available e. g. management; supporting teaching & learning; early years educator; finance; IT technician; administration. Individuals/managers can search for available apprenticeship training options independently to research options. To access Levy funds, there will be an approval process and a short business case will be required. OCC is working on the procedure for this. All Apprenticeship training will require some day release from work 7

A silver lining Apprenticeship Training as CPD for any school employee It will be possible to use Levy funding to allow individuals to take higher, equivalent and lower level qualifications The training must allow an individual to acquire substantive new skills, and the content of the training must be materially different from any prior training or previous apprenticeship It might be surprising to see the wide range of qualifications that are available e. g. management; supporting teaching & learning; early years educator; finance; IT technician; administration. Individuals/managers can search for available apprenticeship training options independently to research options. To access Levy funds, there will be an approval process and a short business case will be required. OCC is working on the procedure for this. All Apprenticeship training will require some day release from work 7

Examples of apprenticeships in schools Schools across Oxfordshire have experienced the benefits of using apprenticeship training in these areas (for new entrants & as CPD): • • • Supporting teaching and learning in schools Early years educator Lab technician Business Administration IT technician Caretaker/property maintenance PE teaching Catering Cleaning and support services Search for available apprenticeship training options to research options and see further details

Examples of apprenticeships in schools Schools across Oxfordshire have experienced the benefits of using apprenticeship training in these areas (for new entrants & as CPD): • • • Supporting teaching and learning in schools Early years educator Lab technician Business Administration IT technician Caretaker/property maintenance PE teaching Catering Cleaning and support services Search for available apprenticeship training options to research options and see further details

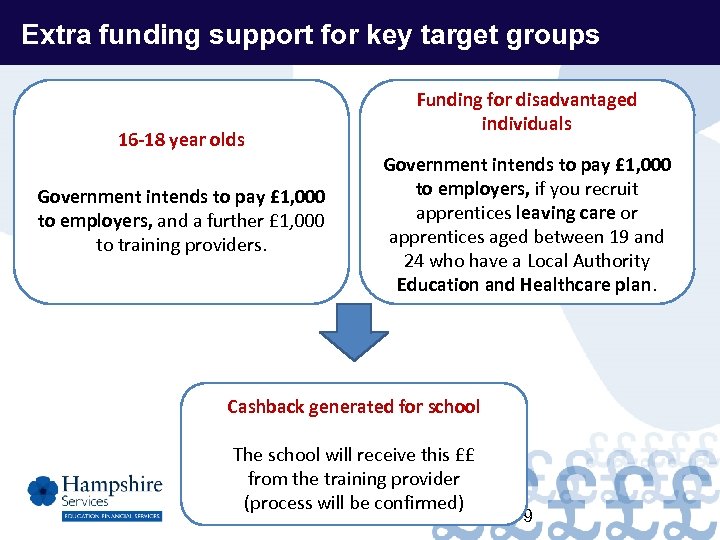

Extra funding support for key target groups 16 -18 year olds Government intends to pay £ 1, 000 to employers, and a further £ 1, 000 to training providers. Funding for disadvantaged individuals Government intends to pay £ 1, 000 to employers, if you recruit apprentices leaving care or apprentices aged between 19 and 24 who have a Local Authority Education and Healthcare plan. Cashback generated for school The school will receive this ££ from the training provider (process will be confirmed) 9

Extra funding support for key target groups 16 -18 year olds Government intends to pay £ 1, 000 to employers, and a further £ 1, 000 to training providers. Funding for disadvantaged individuals Government intends to pay £ 1, 000 to employers, if you recruit apprentices leaving care or apprentices aged between 19 and 24 who have a Local Authority Education and Healthcare plan. Cashback generated for school The school will receive this ££ from the training provider (process will be confirmed) 9

Frequently Asked Questions How long will our funds be available? Levy funds will expire 24 months after entering OCC’s digital account. Funding accrues monthly. If the actual cost of salaries is not reduced, where will we get the money from instead? Schools will have to absorb the cost of the Levy and to fund salaries by redistributing resources from elsewhere If we opted out of the IBC payroll service would we not lose this money from our payroll budgets? If you are a maintained or VC school, any other payroll provider will also have to deduct the Levy Will we get this money reinstated if/when we convert to academy status? If an academy or MAT has a pay bill of over £ 3 million, you will still be liable for the Levy. If you will be an independent academy, and you have a pay bill of less than £ 3 million, you will not be liable for the Levy. 10

Frequently Asked Questions How long will our funds be available? Levy funds will expire 24 months after entering OCC’s digital account. Funding accrues monthly. If the actual cost of salaries is not reduced, where will we get the money from instead? Schools will have to absorb the cost of the Levy and to fund salaries by redistributing resources from elsewhere If we opted out of the IBC payroll service would we not lose this money from our payroll budgets? If you are a maintained or VC school, any other payroll provider will also have to deduct the Levy Will we get this money reinstated if/when we convert to academy status? If an academy or MAT has a pay bill of over £ 3 million, you will still be liable for the Levy. If you will be an independent academy, and you have a pay bill of less than £ 3 million, you will not be liable for the Levy. 10

Frequently Asked Questions How will the money be taken from our cost centres? We will advise schools once the process has been confirmed. What will we have to do to access the money back for training? Whether you are recruiting a new apprentice or using Levy funds as CPD for existing staff, please liaise with OCC HR – Rose Rolle-Rowan and Michelle Jones workforce. initiatives@oxfordshire. gov. uk. They will advise you about suitable training providers, and job descriptions/recruitment processes. Guidance is available on Schools Intranet pages. How much do we have to pay an apprentice? OCC has specific pay scales for apprentices who are new to the organisation, up to date information is available on the Schools intranet. If an existing staff member starts an apprenticeship as CPD, their grade is not affected. 11

Frequently Asked Questions How will the money be taken from our cost centres? We will advise schools once the process has been confirmed. What will we have to do to access the money back for training? Whether you are recruiting a new apprentice or using Levy funds as CPD for existing staff, please liaise with OCC HR – Rose Rolle-Rowan and Michelle Jones workforce. initiatives@oxfordshire. gov. uk. They will advise you about suitable training providers, and job descriptions/recruitment processes. Guidance is available on Schools Intranet pages. How much do we have to pay an apprentice? OCC has specific pay scales for apprentices who are new to the organisation, up to date information is available on the Schools intranet. If an existing staff member starts an apprenticeship as CPD, their grade is not affected. 11

Frequently Asked Questions Where can I get more information? Financial forecasting and understanding the impact on your budget: Contact your usual Education Finance Services contact Recruiting and sourcing apprenticeships training: Contact OCC HR team – Rose Rolle-Rowan and Michelle Jones workforce. initiatives@oxfordshire. gov. uk Reminder – please let Rose and Michelle know about any apprenticeship training providers you are currently working with, who you would want to continue to work with in future 12

Frequently Asked Questions Where can I get more information? Financial forecasting and understanding the impact on your budget: Contact your usual Education Finance Services contact Recruiting and sourcing apprenticeships training: Contact OCC HR team – Rose Rolle-Rowan and Michelle Jones workforce. initiatives@oxfordshire. gov. uk Reminder – please let Rose and Michelle know about any apprenticeship training providers you are currently working with, who you would want to continue to work with in future 12