f3a35941577accd5b9682d01905e5ed0.ppt

- Количество слайдов: 14

The Anatomy of Speculation: A National Analysis of Housing Markets in the UK By Mark Andrew Faculty of Finance, Cass Business School and Alan Evans Centre for Spatial and Real Estate Economics, Department of Economics, The University of Reading Business School

The Anatomy of Speculation: A National Analysis of Housing Markets in the UK By Mark Andrew Faculty of Finance, Cass Business School and Alan Evans Centre for Spatial and Real Estate Economics, Department of Economics, The University of Reading Business School

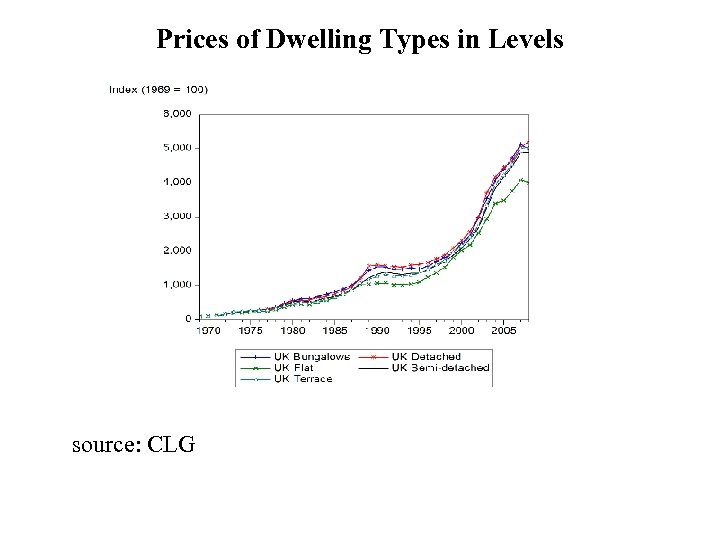

Prices of Dwelling Types in Levels source: CLG

Prices of Dwelling Types in Levels source: CLG

Structure § Aim § To examine if there are long-run relationships between the prices of dwelling types § To examine and explain the ‘apparent’ lead in flat prices and its greater downswing § Data § CLG average dwelling price index: annual 1969 – 2008 § HBOS average dwelling price index: quarterly 1983 Q 1 – 2007 Q 4 § Real household income, real gross wealth, UCC § Economic Explanations § Statistical Methodology § Unit root and Cointegration tests § Conditional VAR § Simulation analysis

Structure § Aim § To examine if there are long-run relationships between the prices of dwelling types § To examine and explain the ‘apparent’ lead in flat prices and its greater downswing § Data § CLG average dwelling price index: annual 1969 – 2008 § HBOS average dwelling price index: quarterly 1983 Q 1 – 2007 Q 4 § Real household income, real gross wealth, UCC § Economic Explanations § Statistical Methodology § Unit root and Cointegration tests § Conditional VAR § Simulation analysis

Economic Explanation § Standard Theoretical Framework § housing user cost § real house price = rent/UCC § housing is lumpy => dwelling type prices Speculation § buy/sell if prices anticipated to rise/fall § The Stock Market § fewer trade frictions § The Housing Market § high transactions costs § financial/psychological; search times § consumption aspects § credit market constraints § i. e. certain groups more opportunities to time entry and exit i. e. the speculators

Economic Explanation § Standard Theoretical Framework § housing user cost § real house price = rent/UCC § housing is lumpy => dwelling type prices Speculation § buy/sell if prices anticipated to rise/fall § The Stock Market § fewer trade frictions § The Housing Market § high transactions costs § financial/psychological; search times § consumption aspects § credit market constraints § i. e. certain groups more opportunities to time entry and exit i. e. the speculators

Economic Explanation § The Non-Speculators (mid-size to larger properties) § The Expanding Family § The Completed Family § strong consumption motive/high transactions cost § rely on housing capital gains to trade upwards § capital loss not crystallized if they do not have to move § The Speculators (smaller properties) § Potential First-Time Buyers (FTBs) § no home to sell § credit constrained § capital gains/insurance demand/wait for falling prices to stabilise § Private Landlords (late 1990 s) § invest or disinvest § initially terraced but later tended to acquire flats § Would be ‘Retired’ Households § disinvestment § little evidence of trading down behaviour § Flat prices are likely to more responsive to common economic shocks

Economic Explanation § The Non-Speculators (mid-size to larger properties) § The Expanding Family § The Completed Family § strong consumption motive/high transactions cost § rely on housing capital gains to trade upwards § capital loss not crystallized if they do not have to move § The Speculators (smaller properties) § Potential First-Time Buyers (FTBs) § no home to sell § credit constrained § capital gains/insurance demand/wait for falling prices to stabilise § Private Landlords (late 1990 s) § invest or disinvest § initially terraced but later tended to acquire flats § Would be ‘Retired’ Households § disinvestment § little evidence of trading down behaviour § Flat prices are likely to more responsive to common economic shocks

Economic Explanations Long-Run Interrelationships § Prices between smaller and larger properties track each other closely § ‘compression’ hypothesis -> participants adjust their housing positions § Higher Price Rises for Detached and Bungalow Properties § UK house price income elasticity around 2. 5 to 3 § Detached § larger dwelling § Land content § higher for bungalows and detached houses § planning restrictions and developers response

Economic Explanations Long-Run Interrelationships § Prices between smaller and larger properties track each other closely § ‘compression’ hypothesis -> participants adjust their housing positions § Higher Price Rises for Detached and Bungalow Properties § UK house price income elasticity around 2. 5 to 3 § Detached § larger dwelling § Land content § higher for bungalows and detached houses § planning restrictions and developers response

Statistical Methodology § Unit root tests § CLG and HBOS data: all I ~ (1) § Real income and wealth: all I ~ (I) § Note: UCC could be I(0) § Johansen cointegration tests on CLG annual data (Trace Test) § few observations relative to parameters estimated § VAR contains dwelling prices only § 1 CV (no trend); 2 CVs (restricted trend) § VAR contains dwelling prices, real income, real wealth and housing user cost § 3 CVs § 2 cointegrating relations very stationary, 2 actual and fitted plots track very well, 1 less so. § Johansen cointegration tests on HBOS quarterly data (Trace Test) § VAR contains dwelling price terms only § 1 to 2 CVs but VAR fails instability tests § VAR contains dwelling prices, real income, real gross wealth & housing user cost § 3 CVs § 2 cointegrating relations very stationary, 1 ambiguous § 2 actual and fitted plots track well, 1 less so

Statistical Methodology § Unit root tests § CLG and HBOS data: all I ~ (1) § Real income and wealth: all I ~ (I) § Note: UCC could be I(0) § Johansen cointegration tests on CLG annual data (Trace Test) § few observations relative to parameters estimated § VAR contains dwelling prices only § 1 CV (no trend); 2 CVs (restricted trend) § VAR contains dwelling prices, real income, real wealth and housing user cost § 3 CVs § 2 cointegrating relations very stationary, 2 actual and fitted plots track very well, 1 less so. § Johansen cointegration tests on HBOS quarterly data (Trace Test) § VAR contains dwelling price terms only § 1 to 2 CVs but VAR fails instability tests § VAR contains dwelling prices, real income, real gross wealth & housing user cost § 3 CVs § 2 cointegrating relations very stationary, 1 ambiguous § 2 actual and fitted plots track well, 1 less so

Statistical Methodology Conditional VAR Analysis § Examine how dwelling prices respond to excess demand in the market § Estimate a house price equation with a long-run solution (cointegrating vector) § Invert the long-run house price solution to obtain a measure of desired housing demand § Disequilibrium = desired demand – actual stock

Statistical Methodology Conditional VAR Analysis § Examine how dwelling prices respond to excess demand in the market § Estimate a house price equation with a long-run solution (cointegrating vector) § Invert the long-run house price solution to obtain a measure of desired housing demand § Disequilibrium = desired demand – actual stock

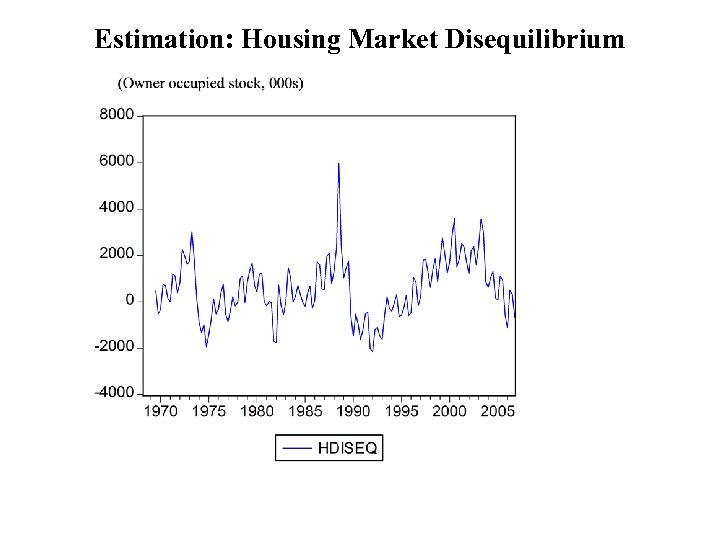

Estimation: Housing Market Disequilibrium

Estimation: Housing Market Disequilibrium

Estimation: The Conditional VAR

Estimation: The Conditional VAR

Estimation: Simulation Results

Estimation: Simulation Results

Conclusion § Results seem consistent with our depiction of the housing market § Evidence of mean reversion to an economic shock (long-run relationship exists between the prices of dwelling types) § Flat market leads adjustment to economic shocks § Regional analysis

Conclusion § Results seem consistent with our depiction of the housing market § Evidence of mean reversion to an economic shock (long-run relationship exists between the prices of dwelling types) § Flat market leads adjustment to economic shocks § Regional analysis

Estimation: The Simulation Model § Use simulation model to look at response to a change in interest rates § The simulation model comprises of four equations i. the ECM house price equation ii. the long-run house price equation iii. the equation to measure disequilibrium iv. the conditional VAR

Estimation: The Simulation Model § Use simulation model to look at response to a change in interest rates § The simulation model comprises of four equations i. the ECM house price equation ii. the long-run house price equation iii. the equation to measure disequilibrium iv. the conditional VAR

Statistical Methodology: Conditional VAR note: bungalows dropped

Statistical Methodology: Conditional VAR note: bungalows dropped