8151e42851ffa92630ac6e305c517e51.ppt

- Количество слайдов: 36

The Airline Industry in the Middle East Past, Present and Future Prospects Ahmad Abdullah Alzabin Chairman and CEO ALAFCO Aviation Lease and Finance Company K. S. C. (Closed)

The Airline Industry in the Middle East Past, Present and Future Prospects Ahmad Abdullah Alzabin Chairman and CEO ALAFCO Aviation Lease and Finance Company K. S. C. (Closed)

Airline Industry Transformation Ø Economic Transformation. Ø Technological Transformation. Ø Customer Services Transformation. Ø Niche & Low Cost Carrier (LCC) Phenomena. 2

Airline Industry Transformation Ø Economic Transformation. Ø Technological Transformation. Ø Customer Services Transformation. Ø Niche & Low Cost Carrier (LCC) Phenomena. 2

Economic Transformation Ø Adoption of new aero-policies of deregulation (1978 -USA), liberalization (1990 -Europe), and privatization of state-owned airlines. Ø The results were takeovers & mergers giving rise to mega carriers (BA, AF-KLM Group). Ø Emergence of Alliances. 3

Economic Transformation Ø Adoption of new aero-policies of deregulation (1978 -USA), liberalization (1990 -Europe), and privatization of state-owned airlines. Ø The results were takeovers & mergers giving rise to mega carriers (BA, AF-KLM Group). Ø Emergence of Alliances. 3

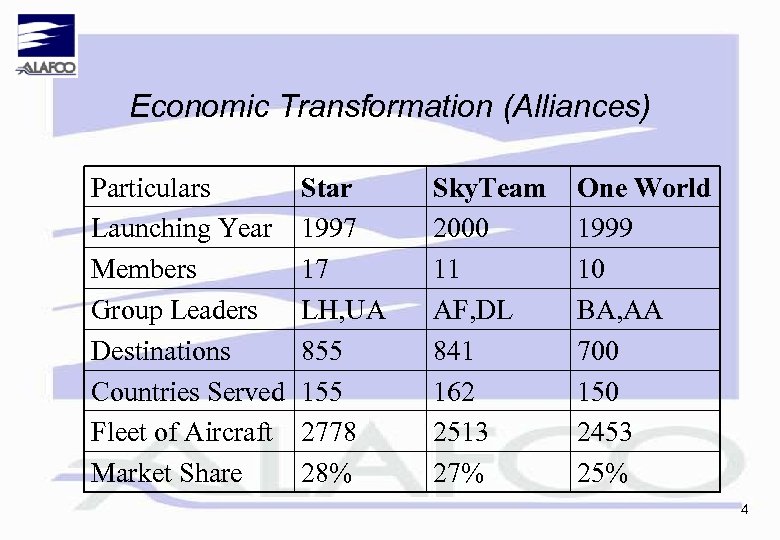

Economic Transformation (Alliances) Particulars Launching Year Members Group Leaders Destinations Countries Served Fleet of Aircraft Market Share Star 1997 17 LH, UA 855 155 2778 28% Sky. Team 2000 11 AF, DL 841 162 2513 27% One World 1999 10 BA, AA 700 150 2453 25% 4

Economic Transformation (Alliances) Particulars Launching Year Members Group Leaders Destinations Countries Served Fleet of Aircraft Market Share Star 1997 17 LH, UA 855 155 2778 28% Sky. Team 2000 11 AF, DL 841 162 2513 27% One World 1999 10 BA, AA 700 150 2453 25% 4

Technological Transformation (Big Strides) Ø Noise abatement rules in Europe (Chaps I, III). Ø Technological advances § Fly-by-wire. § Fuel efficient engines. § Light weight composites. § Fleet design commonality. 5

Technological Transformation (Big Strides) Ø Noise abatement rules in Europe (Chaps I, III). Ø Technological advances § Fly-by-wire. § Fuel efficient engines. § Light weight composites. § Fleet design commonality. 5

Technological Transformation - Resulted In Ø Larger airplanes with higher payloads (B 747 -8 , A 380) Ø Longer range airplanes (B 777, A 340). Ø Improved operating economics (B 787, A 350), higher reliability, availability, hence more utilization. 6

Technological Transformation - Resulted In Ø Larger airplanes with higher payloads (B 747 -8 , A 380) Ø Longer range airplanes (B 777, A 340). Ø Improved operating economics (B 787, A 350), higher reliability, availability, hence more utilization. 6

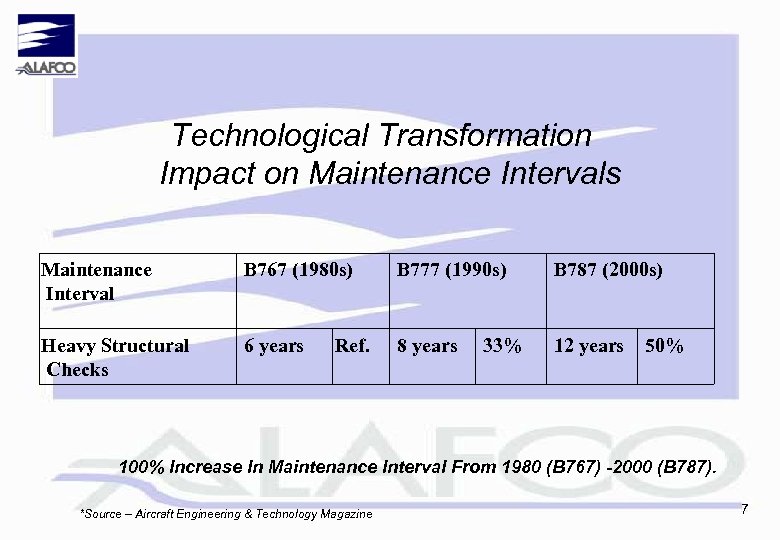

Technological Transformation Impact on Maintenance Intervals Maintenance Interval B 767 (1980 s) B 777 (1990 s) B 787 (2000 s) Heavy Structural Checks 6 years 8 years 12 years Ref. 33% 50% 100% Increase In Maintenance Interval From 1980 (B 767) -2000 (B 787). *Source – Aircraft Engineering & Technology Magazine 7

Technological Transformation Impact on Maintenance Intervals Maintenance Interval B 767 (1980 s) B 777 (1990 s) B 787 (2000 s) Heavy Structural Checks 6 years 8 years 12 years Ref. 33% 50% 100% Increase In Maintenance Interval From 1980 (B 767) -2000 (B 787). *Source – Aircraft Engineering & Technology Magazine 7

Customer Services Transformation Ø New airlines with new concepts of customer care. Ø New routes, more frequencies, and more non-stop flights. Ø Flexible fare structures. Ø Greater in-flight comfort and services. 8

Customer Services Transformation Ø New airlines with new concepts of customer care. Ø New routes, more frequencies, and more non-stop flights. Ø Flexible fare structures. Ø Greater in-flight comfort and services. 8

Niche & Low Cost Carrier Phenomena Ø Mega carriers concentrated on larger markets with denser routes for dominance. Ø Niche and Low Cost Carriers emerged to: § Serve specific niche markets. § Satisfy the low paying passengers segment. 9

Niche & Low Cost Carrier Phenomena Ø Mega carriers concentrated on larger markets with denser routes for dominance. Ø Niche and Low Cost Carriers emerged to: § Serve specific niche markets. § Satisfy the low paying passengers segment. 9

Industry Harvest of Transformation Resulted In Industry Being More Ø Efficient. Ø Innovative. Ø Competitive. Ø Customer focused. The Customers Are The Beneficiaries Who Get Real Value For Money. 10

Industry Harvest of Transformation Resulted In Industry Being More Ø Efficient. Ø Innovative. Ø Competitive. Ø Customer focused. The Customers Are The Beneficiaries Who Get Real Value For Money. 10

Airline Industry In The Middle East 11

Airline Industry In The Middle East 11

Growth Drivers Ø Geography of the Region (cross roads & hubbing potentials). Ø Economic Growth of the Region (4% vs 3. 1% world average). Ø Demographics (high mass demand for LCC). Ø Constructive Competition (among native & foreign airlines). 12

Growth Drivers Ø Geography of the Region (cross roads & hubbing potentials). Ø Economic Growth of the Region (4% vs 3. 1% world average). Ø Demographics (high mass demand for LCC). Ø Constructive Competition (among native & foreign airlines). 12

Growth Indicators Ø Traffic. Ø Number of Airlines. Ø Fleet of Aircraft. Ø Maintenance Facilities. Ø Airports. Ø Aircraft Leasing. Ø Support Services. 13

Growth Indicators Ø Traffic. Ø Number of Airlines. Ø Fleet of Aircraft. Ø Maintenance Facilities. Ø Airports. Ø Aircraft Leasing. Ø Support Services. 13

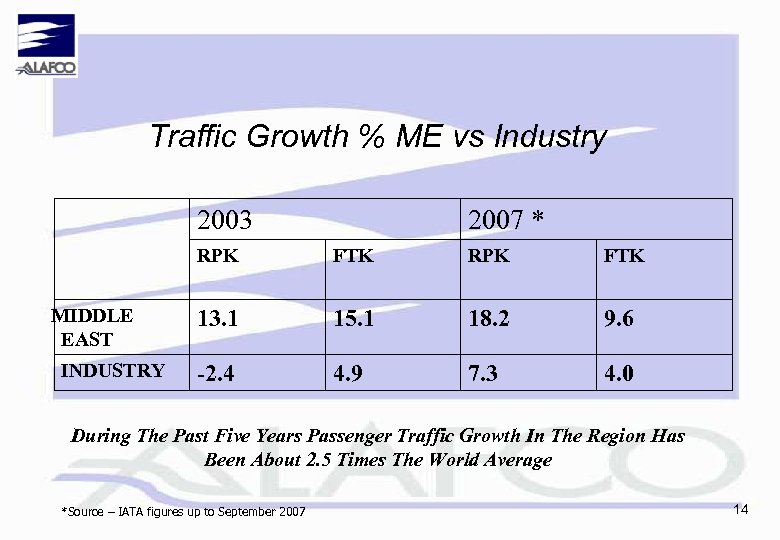

Traffic Growth % ME vs Industry 2003 2007 * RPK MIDDLE EAST INDUSTRY FTK RPK FTK 13. 1 15. 1 18. 2 9. 6 -2. 4 4. 9 7. 3 4. 0 During The Past Five Years Passenger Traffic Growth In The Region Has Been About 2. 5 Times The World Average *Source – IATA figures up to September 2007 14

Traffic Growth % ME vs Industry 2003 2007 * RPK MIDDLE EAST INDUSTRY FTK RPK FTK 13. 1 15. 1 18. 2 9. 6 -2. 4 4. 9 7. 3 4. 0 During The Past Five Years Passenger Traffic Growth In The Region Has Been About 2. 5 Times The World Average *Source – IATA figures up to September 2007 14

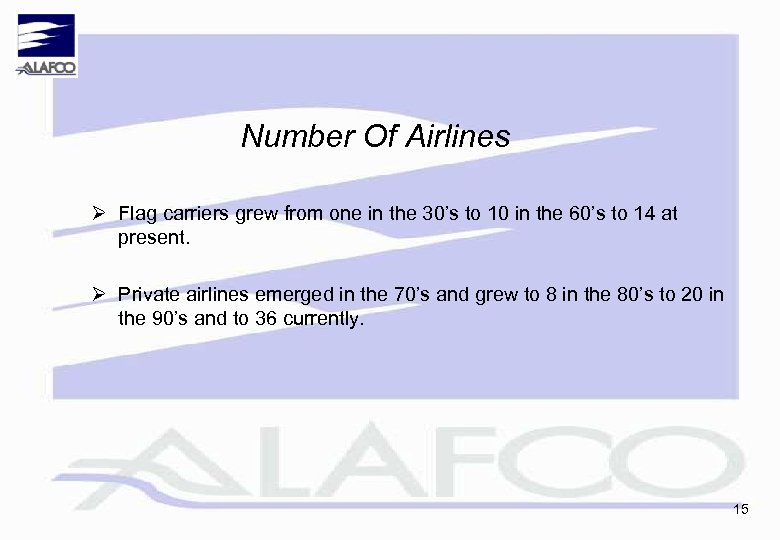

Number Of Airlines Ø Flag carriers grew from one in the 30’s to 10 in the 60’s to 14 at present. Ø Private airlines emerged in the 70’s and grew to 8 in the 80’s to 20 in the 90’s and to 36 currently. 15

Number Of Airlines Ø Flag carriers grew from one in the 30’s to 10 in the 60’s to 14 at present. Ø Private airlines emerged in the 70’s and grew to 8 in the 80’s to 20 in the 90’s and to 36 currently. 15

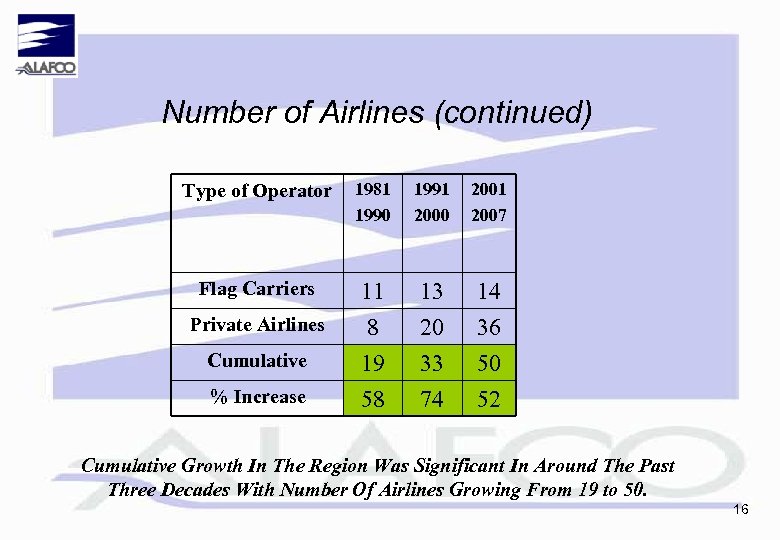

Number of Airlines (continued) Type of Operator 1981 1990 1991 2000 2001 2007 Flag Carriers 11 13 14 Private Airlines 8 19 58 20 33 74 36 50 52 Cumulative % Increase Cumulative Growth In The Region Was Significant In Around The Past Three Decades With Number Of Airlines Growing From 19 to 50. 16

Number of Airlines (continued) Type of Operator 1981 1990 1991 2000 2001 2007 Flag Carriers 11 13 14 Private Airlines 8 19 58 20 33 74 36 50 52 Cumulative % Increase Cumulative Growth In The Region Was Significant In Around The Past Three Decades With Number Of Airlines Growing From 19 to 50. 16

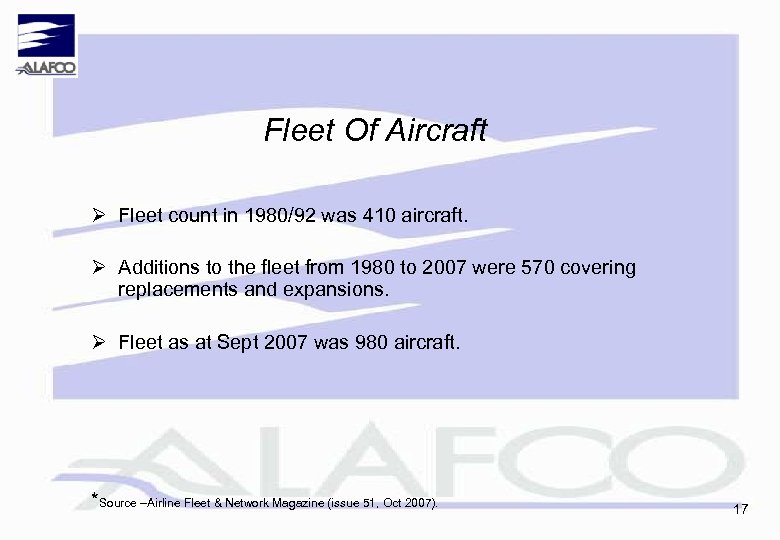

Fleet Of Aircraft Ø Fleet count in 1980/92 was 410 aircraft. Ø Additions to the fleet from 1980 to 2007 were 570 covering replacements and expansions. Ø Fleet as at Sept 2007 was 980 aircraft. *Source –Airline Fleet & Network Magazine (issue 51, Oct 2007). 17

Fleet Of Aircraft Ø Fleet count in 1980/92 was 410 aircraft. Ø Additions to the fleet from 1980 to 2007 were 570 covering replacements and expansions. Ø Fleet as at Sept 2007 was 980 aircraft. *Source –Airline Fleet & Network Magazine (issue 51, Oct 2007). 17

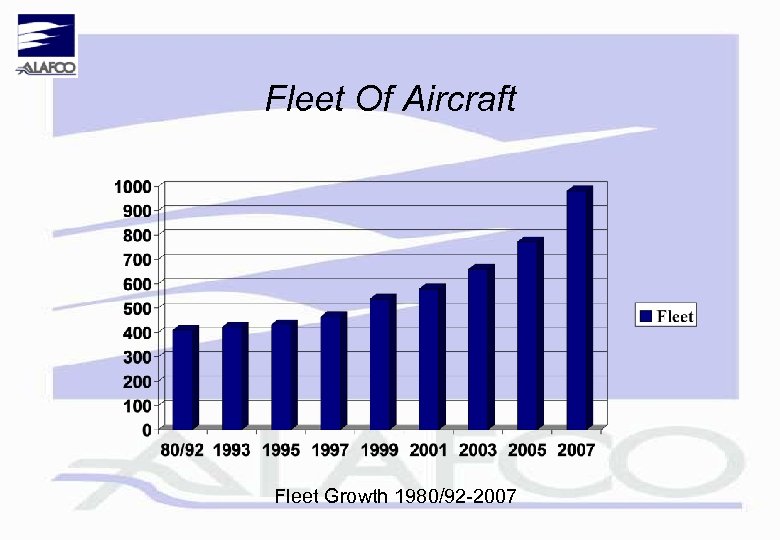

Fleet Of Aircraft Fleet Growth 1980/92 -2007

Fleet Of Aircraft Fleet Growth 1980/92 -2007

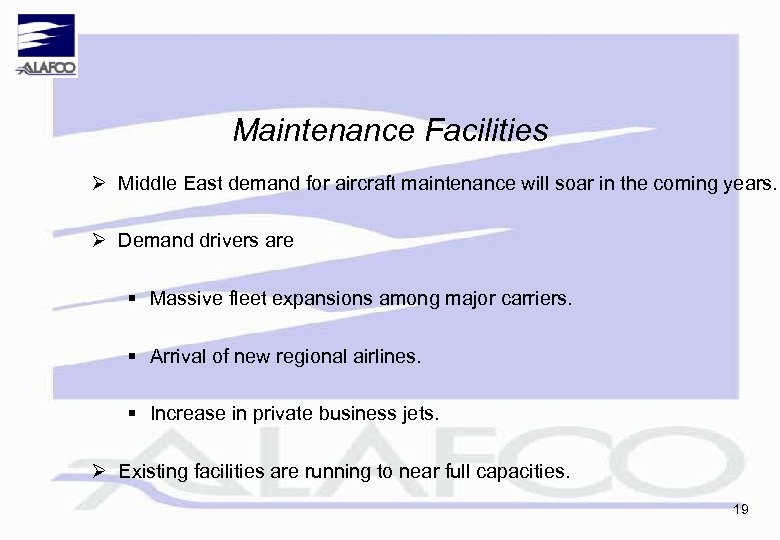

Maintenance Facilities Ø Middle East demand for aircraft maintenance will soar in the coming years. Ø Demand drivers are § Massive fleet expansions among major carriers. § Arrival of new regional airlines. § Increase in private business jets. Ø Existing facilities are running to near full capacities. 19

Maintenance Facilities Ø Middle East demand for aircraft maintenance will soar in the coming years. Ø Demand drivers are § Massive fleet expansions among major carriers. § Arrival of new regional airlines. § Increase in private business jets. Ø Existing facilities are running to near full capacities. 19

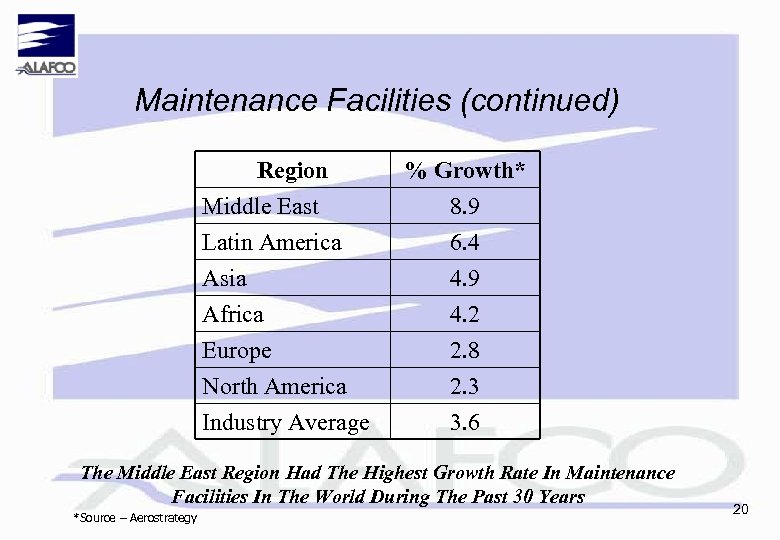

Maintenance Facilities (continued) Region Middle East Latin America Asia Africa Europe North America Industry Average % Growth* 8. 9 6. 4 4. 9 4. 2 2. 8 2. 3 3. 6 The Middle East Region Had The Highest Growth Rate In Maintenance Facilities In The World During The Past 30 Years *Source – Aerostrategy 20

Maintenance Facilities (continued) Region Middle East Latin America Asia Africa Europe North America Industry Average % Growth* 8. 9 6. 4 4. 9 4. 2 2. 8 2. 3 3. 6 The Middle East Region Had The Highest Growth Rate In Maintenance Facilities In The World During The Past 30 Years *Source – Aerostrategy 20

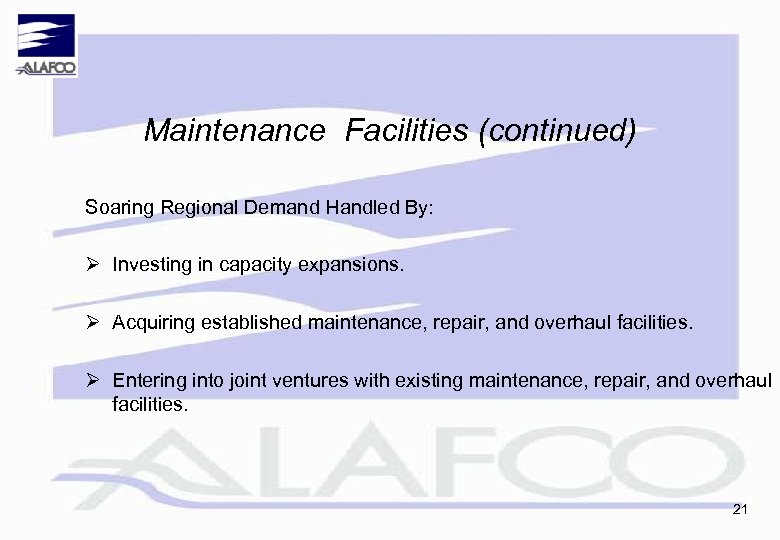

Maintenance Facilities (continued) Soaring Regional Demand Handled By: Ø Investing in capacity expansions. Ø Acquiring established maintenance, repair, and overhaul facilities. Ø Entering into joint ventures with existing maintenance, repair, and overhaul facilities. 21

Maintenance Facilities (continued) Soaring Regional Demand Handled By: Ø Investing in capacity expansions. Ø Acquiring established maintenance, repair, and overhaul facilities. Ø Entering into joint ventures with existing maintenance, repair, and overhaul facilities. 21

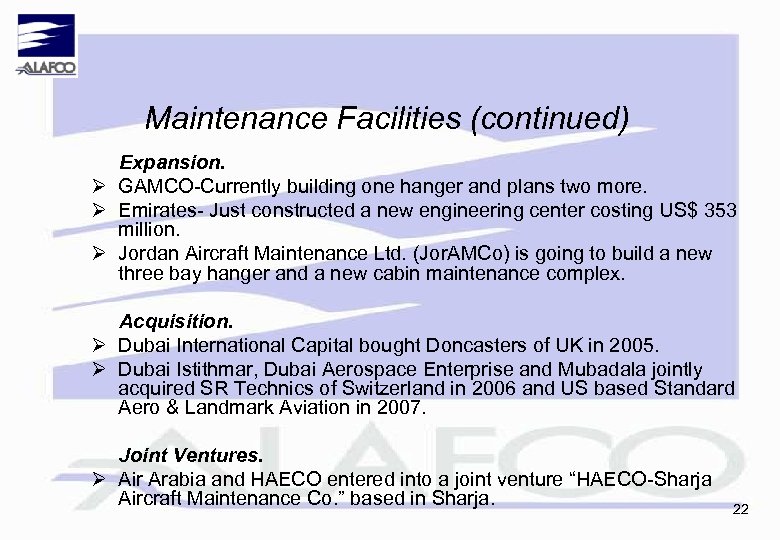

Maintenance Facilities (continued) Expansion. Ø GAMCO-Currently building one hanger and plans two more. Ø Emirates- Just constructed a new engineering center costing US$ 353 million. Ø Jordan Aircraft Maintenance Ltd. (Jor. AMCo) is going to build a new three bay hanger and a new cabin maintenance complex. Acquisition. Ø Dubai International Capital bought Doncasters of UK in 2005. Ø Dubai Istithmar, Dubai Aerospace Enterprise and Mubadala jointly acquired SR Technics of Switzerland in 2006 and US based Standard Aero & Landmark Aviation in 2007. Joint Ventures. Ø Air Arabia and HAECO entered into a joint venture “HAECO-Sharja Aircraft Maintenance Co. ” based in Sharja. 22

Maintenance Facilities (continued) Expansion. Ø GAMCO-Currently building one hanger and plans two more. Ø Emirates- Just constructed a new engineering center costing US$ 353 million. Ø Jordan Aircraft Maintenance Ltd. (Jor. AMCo) is going to build a new three bay hanger and a new cabin maintenance complex. Acquisition. Ø Dubai International Capital bought Doncasters of UK in 2005. Ø Dubai Istithmar, Dubai Aerospace Enterprise and Mubadala jointly acquired SR Technics of Switzerland in 2006 and US based Standard Aero & Landmark Aviation in 2007. Joint Ventures. Ø Air Arabia and HAECO entered into a joint venture “HAECO-Sharja Aircraft Maintenance Co. ” based in Sharja. 22

Airports Ø US$ 38 billion expansion of Kuwait, Dubai, Abu Dhabi, Jeddah, Madinah, Tabuk, Queen Alia, and Bahrain International airports and new construction of Doha, Dubai and Cairo International airports. 23

Airports Ø US$ 38 billion expansion of Kuwait, Dubai, Abu Dhabi, Jeddah, Madinah, Tabuk, Queen Alia, and Bahrain International airports and new construction of Doha, Dubai and Cairo International airports. 23

Aircraft Leasing Firms Ø ALAFCO Aviation Lease And Finance Company. Ø Oasis International Leasing Company. Ø Dubai Aerospace Enterprise Capital. Soaring Demand For Aircraft & Long Lead Times By Manufacturers Helped Growth Of Aircraft Leasing Industry In The Region. 24

Aircraft Leasing Firms Ø ALAFCO Aviation Lease And Finance Company. Ø Oasis International Leasing Company. Ø Dubai Aerospace Enterprise Capital. Soaring Demand For Aircraft & Long Lead Times By Manufacturers Helped Growth Of Aircraft Leasing Industry In The Region. 24

ALAFCO Aviation Lease And Finance Co. Ø Established in Bermuda in 1992 by Kuwait Airways Corp. Ø Registered in Kuwait upon acquisition by Kuwait Finance House and converted to an innovative Shariah compliant aircraft leasing company. Ø Main products - operating leases, sale & lease back and lease management solutions. Ø Current portfolio includes 27 owned and managed wide & narrow-body modern jet aircraft leased to 15 airlines in 11 countries. Ø 66 new Airbus & Boeing aircraft on order including new technology (22) B 787, (12) A 350 XWB, (6)B 737 -800, (2)737 -900 ER and (24) A 320 -200. Ø Listed on Kuwait Stock Exchange in Oct 2006. 25

ALAFCO Aviation Lease And Finance Co. Ø Established in Bermuda in 1992 by Kuwait Airways Corp. Ø Registered in Kuwait upon acquisition by Kuwait Finance House and converted to an innovative Shariah compliant aircraft leasing company. Ø Main products - operating leases, sale & lease back and lease management solutions. Ø Current portfolio includes 27 owned and managed wide & narrow-body modern jet aircraft leased to 15 airlines in 11 countries. Ø 66 new Airbus & Boeing aircraft on order including new technology (22) B 787, (12) A 350 XWB, (6)B 737 -800, (2)737 -900 ER and (24) A 320 -200. Ø Listed on Kuwait Stock Exchange in Oct 2006. 25

ALAFCO Aviation Lease And Finance Co. Ø Total assets US$ 876 million (69% average annual growth rate). Ø Shareholders’ equity – US$ 281 million (35% average annual growth sinception). Ø Cumulative net profit since 2001 US$ 92. 6 million (130% average annual growth rate sinception). Ø Market capitalization as at 12 Jan 2008 US$ 541. 6 million. Ø Aircraft portfolio value ranked 13 th among international lessors. * *Source - Airfinance Journal Sep 2007 26

ALAFCO Aviation Lease And Finance Co. Ø Total assets US$ 876 million (69% average annual growth rate). Ø Shareholders’ equity – US$ 281 million (35% average annual growth sinception). Ø Cumulative net profit since 2001 US$ 92. 6 million (130% average annual growth rate sinception). Ø Market capitalization as at 12 Jan 2008 US$ 541. 6 million. Ø Aircraft portfolio value ranked 13 th among international lessors. * *Source - Airfinance Journal Sep 2007 26

Oasis International Leasing Company Ø Formed in 1997, the company specializes in lease & finance in the sectors of aviation, sea transport, and infrastructure. Ø Portfolio of 29 modern wide, narrow, and regional jets leased out to 13 customers around the world. Ø Aircraft portfolio size ranked 16 th among international lessors. * *Source - Airfinance Journal Sep 2007 27

Oasis International Leasing Company Ø Formed in 1997, the company specializes in lease & finance in the sectors of aviation, sea transport, and infrastructure. Ø Portfolio of 29 modern wide, narrow, and regional jets leased out to 13 customers around the world. Ø Aircraft portfolio size ranked 16 th among international lessors. * *Source - Airfinance Journal Sep 2007 27

Dubai Aerospace Enterprise Capital Ø The aircraft leasing and financing division of Dubai Aerospace Enterprise. Ø Signed memorandums of understanding with both Boeing and Airbus to buy 200 new jet aircraft. Ø Concluded sale and leaseback for 8 A 330 -200 aircraft with Emirates valued at US$ 500 million. Ø Purchased US$ 1 billion aircraft portfolio from GECAS. Ø Earmarked US$ 40 billion for aircraft acquisitions. 28

Dubai Aerospace Enterprise Capital Ø The aircraft leasing and financing division of Dubai Aerospace Enterprise. Ø Signed memorandums of understanding with both Boeing and Airbus to buy 200 new jet aircraft. Ø Concluded sale and leaseback for 8 A 330 -200 aircraft with Emirates valued at US$ 500 million. Ø Purchased US$ 1 billion aircraft portfolio from GECAS. Ø Earmarked US$ 40 billion for aircraft acquisitions. 28

Support Services Ø Regional economic boom gave rise to activities such as industrial & commercial fairs, air shows and tourism. Ø More international participants to all sectors of the economy are attracted, hence giving prosperity to airlines of the region. Ø Likewise the support services such as airport services, travel & tourism, limousine & taxi, hotels & resorts, catering & cuisine services, shopping and free zone trading are booming. 29

Support Services Ø Regional economic boom gave rise to activities such as industrial & commercial fairs, air shows and tourism. Ø More international participants to all sectors of the economy are attracted, hence giving prosperity to airlines of the region. Ø Likewise the support services such as airport services, travel & tourism, limousine & taxi, hotels & resorts, catering & cuisine services, shopping and free zone trading are booming. 29

Issues Of Concern Ø Regional Markets Liberalization. Ø Airline Privatization. Ø Airline Industry Alliances. Ø Partnership In Maintenance Consortiums. 30

Issues Of Concern Ø Regional Markets Liberalization. Ø Airline Privatization. Ø Airline Industry Alliances. Ø Partnership In Maintenance Consortiums. 30

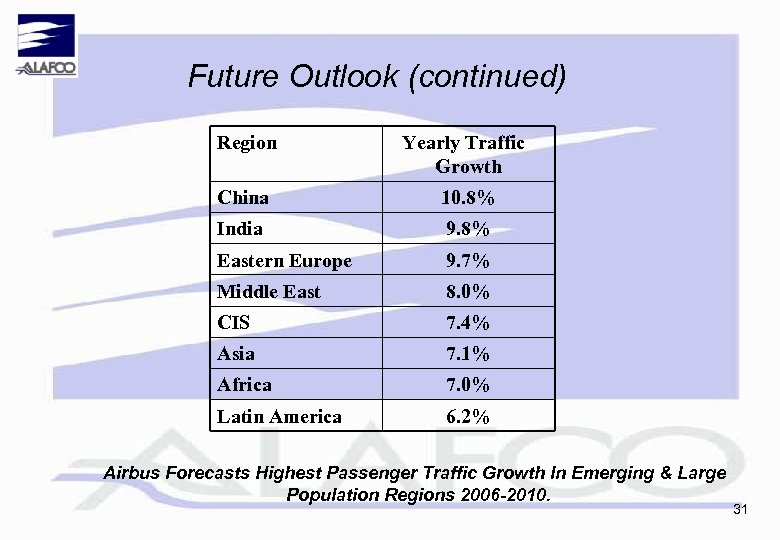

Future Outlook (continued) Region Yearly Traffic Growth China 10. 8% India 9. 8% Eastern Europe 9. 7% Middle East 8. 0% CIS 7. 4% Asia 7. 1% Africa 7. 0% Latin America 6. 2% Airbus Forecasts Highest Passenger Traffic Growth In Emerging & Large Population Regions 2006 -2010. 31

Future Outlook (continued) Region Yearly Traffic Growth China 10. 8% India 9. 8% Eastern Europe 9. 7% Middle East 8. 0% CIS 7. 4% Asia 7. 1% Africa 7. 0% Latin America 6. 2% Airbus Forecasts Highest Passenger Traffic Growth In Emerging & Large Population Regions 2006 -2010. 31

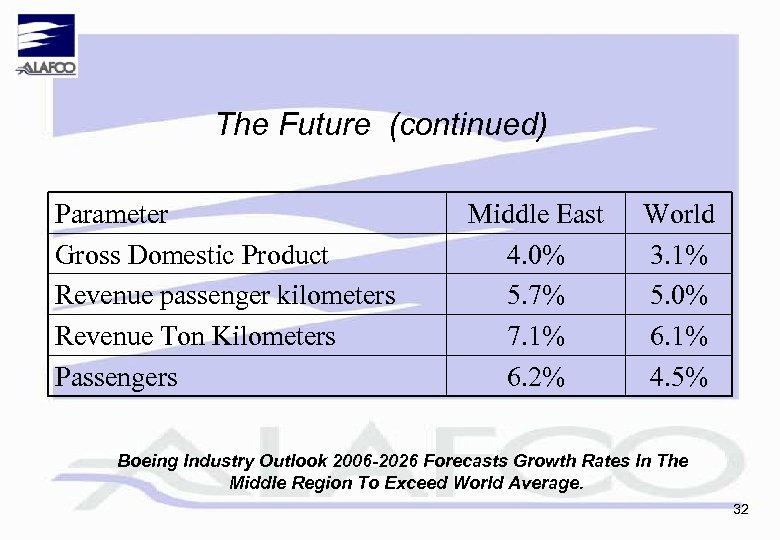

The Future (continued) Parameter Gross Domestic Product Revenue passenger kilometers Revenue Ton Kilometers Passengers Middle East 4. 0% 5. 7% 7. 1% 6. 2% World 3. 1% 5. 0% 6. 1% 4. 5% Boeing Industry Outlook 2006 -2026 Forecasts Growth Rates In The Middle Region To Exceed World Average. 32

The Future (continued) Parameter Gross Domestic Product Revenue passenger kilometers Revenue Ton Kilometers Passengers Middle East 4. 0% 5. 7% 7. 1% 6. 2% World 3. 1% 5. 0% 6. 1% 4. 5% Boeing Industry Outlook 2006 -2026 Forecasts Growth Rates In The Middle Region To Exceed World Average. 32

The Future Outlook (continued) Ø Boeing predicts 1160 new airplanes consisting of 110 large aircraft, 600 twin aisle, 380 single aisle and 70 regional aircraft. Ø Airbus predicts a similar figure of 1140 new airplanes. Ø Boeing estimate for a market value of the new airplanes is US$ 196 billion of which IATA reported a value of US$ 80 billion for orders already placed by Emirates, Qatar Airways and Etihad Airways in the last 3 years. 33

The Future Outlook (continued) Ø Boeing predicts 1160 new airplanes consisting of 110 large aircraft, 600 twin aisle, 380 single aisle and 70 regional aircraft. Ø Airbus predicts a similar figure of 1140 new airplanes. Ø Boeing estimate for a market value of the new airplanes is US$ 196 billion of which IATA reported a value of US$ 80 billion for orders already placed by Emirates, Qatar Airways and Etihad Airways in the last 3 years. 33

Summary The airline industry in the Middle East is headed for a bright future. This conclusion is firmly supported by: Ø Growth predictions by Boeing and Airbus. Ø Outstanding performance of the airlines. Ø Facilitated access to the financial markets. Ø Business freedom in a region moving towards free market economy. Ø Thoughtful and visionary leadership. 34

Summary The airline industry in the Middle East is headed for a bright future. This conclusion is firmly supported by: Ø Growth predictions by Boeing and Airbus. Ø Outstanding performance of the airlines. Ø Facilitated access to the financial markets. Ø Business freedom in a region moving towards free market economy. Ø Thoughtful and visionary leadership. 34

Conclusion Aviation industry is a strategic and essential element for any economy to flourish. With the favorable economic environment and the massive infrastructure projects in the region, the outlook of aviation industry is bright and we believe more investments will be channeled to this industry in the region benefiting all related sectors of the economy. 35

Conclusion Aviation industry is a strategic and essential element for any economy to flourish. With the favorable economic environment and the massive infrastructure projects in the region, the outlook of aviation industry is bright and we believe more investments will be channeled to this industry in the region benefiting all related sectors of the economy. 35

Thank You 36

Thank You 36