The Aggregate Expenditures Model 28 McGraw-Hill/Irwin Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

The Aggregate Expenditures Model 28 McGraw-Hill/Irwin Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Assumptions and Simplifications Use the Keynesian aggregate expenditures model Prices are fixed GDP = DI Begin with private, closed economy Consumption spending Investment spending LO1 28-2

Assumptions and Simplifications Use the Keynesian aggregate expenditures model Prices are fixed GDP = DI Begin with private, closed economy Consumption spending Investment spending LO1 28-2

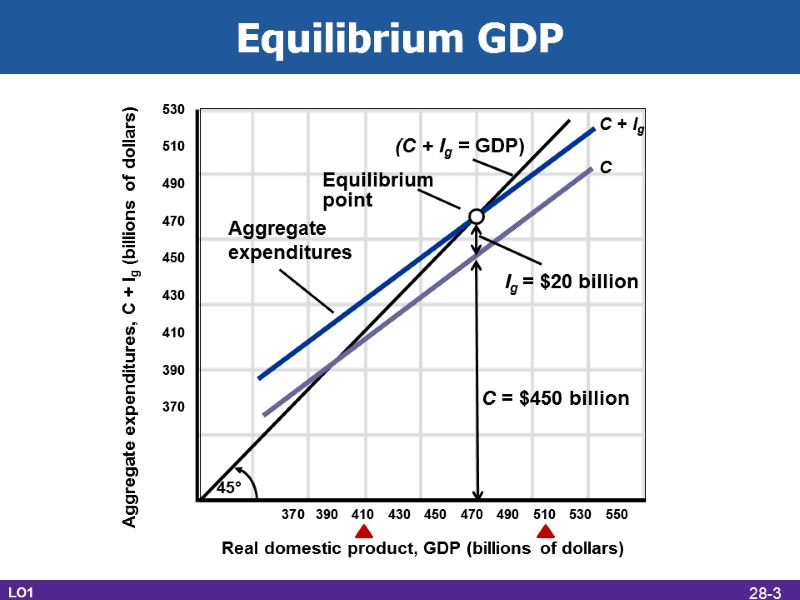

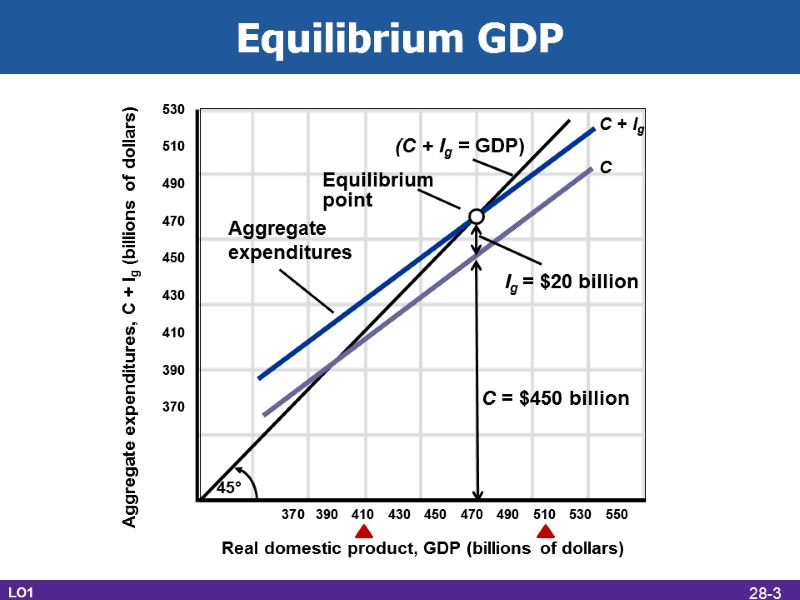

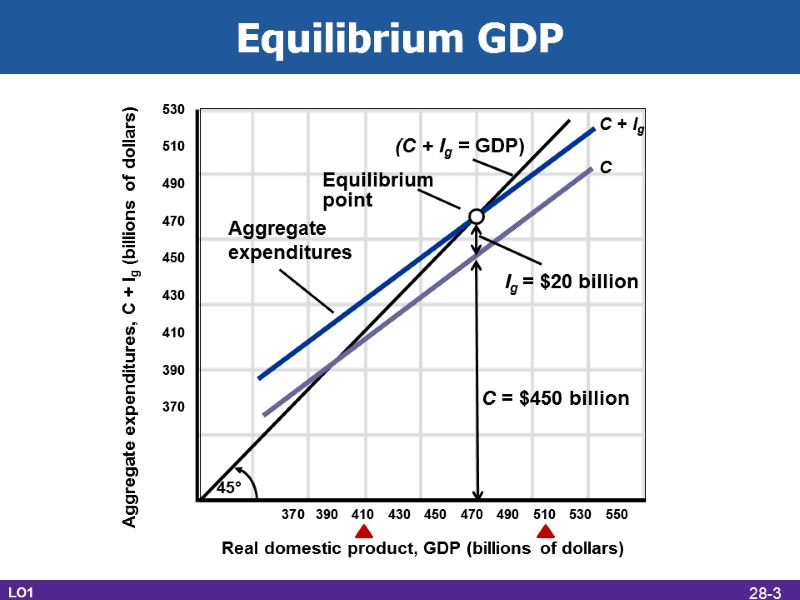

Equilibrium GDP C Ig = $20 billion Aggregate expenditures C = $450 billion C + Ig (C + Ig = GDP) Equilibrium point LO1 28-3

Equilibrium GDP C Ig = $20 billion Aggregate expenditures C = $450 billion C + Ig (C + Ig = GDP) Equilibrium point LO1 28-3

Other Features of Equilibrium GDP Saving equals planned investment Saving is a leakage of spending Investment is an injection of spending No unplanned changes in inventories Firms do not change production LO2 28-4

Other Features of Equilibrium GDP Saving equals planned investment Saving is a leakage of spending Investment is an injection of spending No unplanned changes in inventories Firms do not change production LO2 28-4

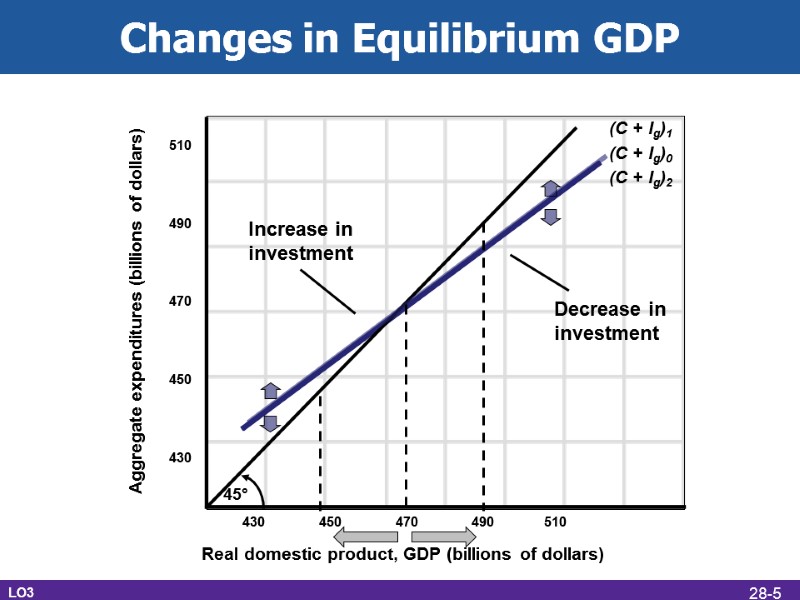

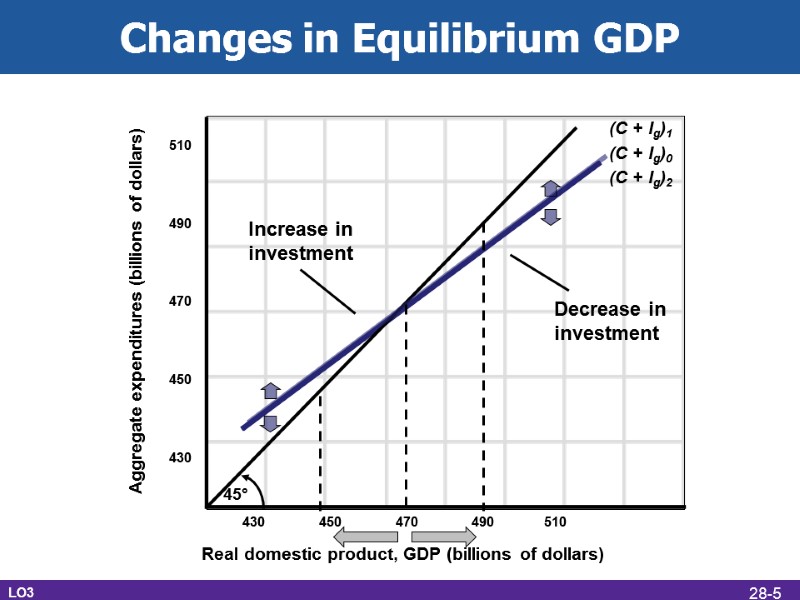

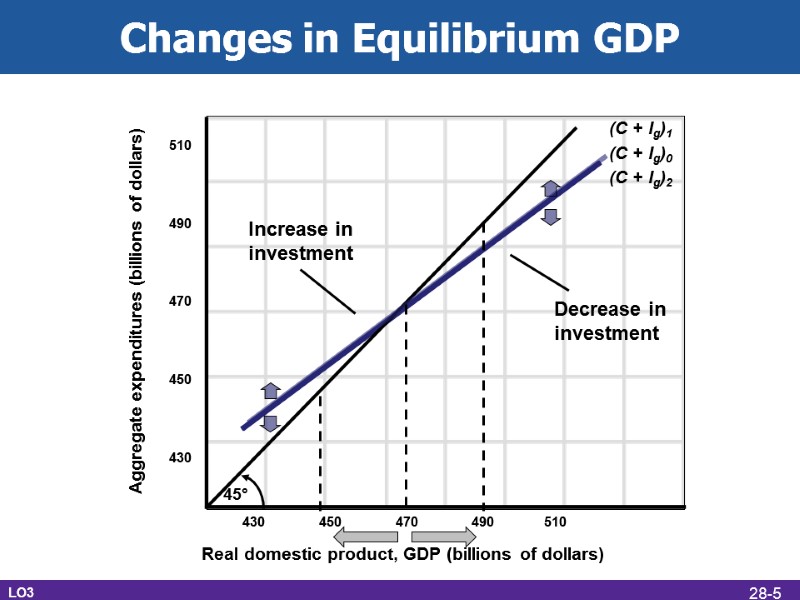

Changes in Equilibrium GDP Increase in investment (C + Ig)0 Decrease in investment (C + Ig)2 (C + Ig)1 LO3 28-5

Changes in Equilibrium GDP Increase in investment (C + Ig)0 Decrease in investment (C + Ig)2 (C + Ig)1 LO3 28-5

Adding International Trade Include net exports spending in aggregate expenditures Private, open economy Exports create production, employment, and income Subtract spending on imports Xn can be positive or negative LO4 28-6

Adding International Trade Include net exports spending in aggregate expenditures Private, open economy Exports create production, employment, and income Subtract spending on imports Xn can be positive or negative LO4 28-6

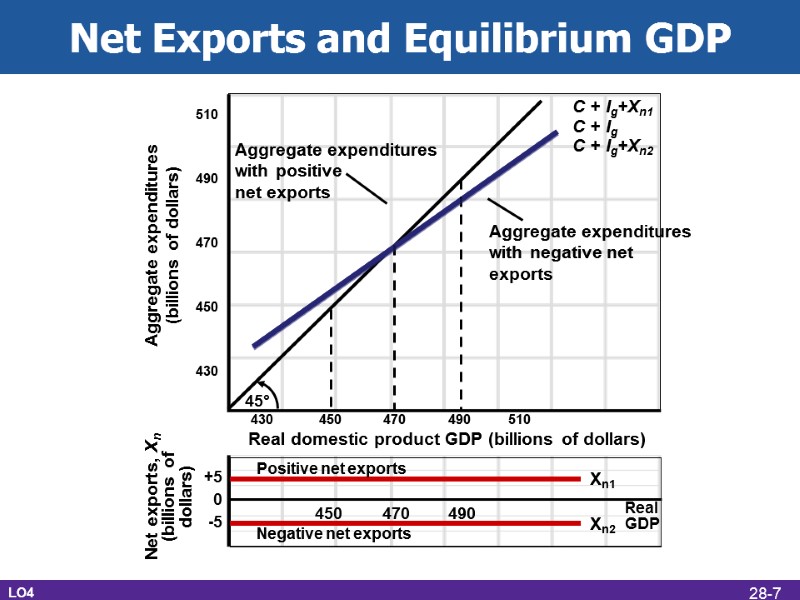

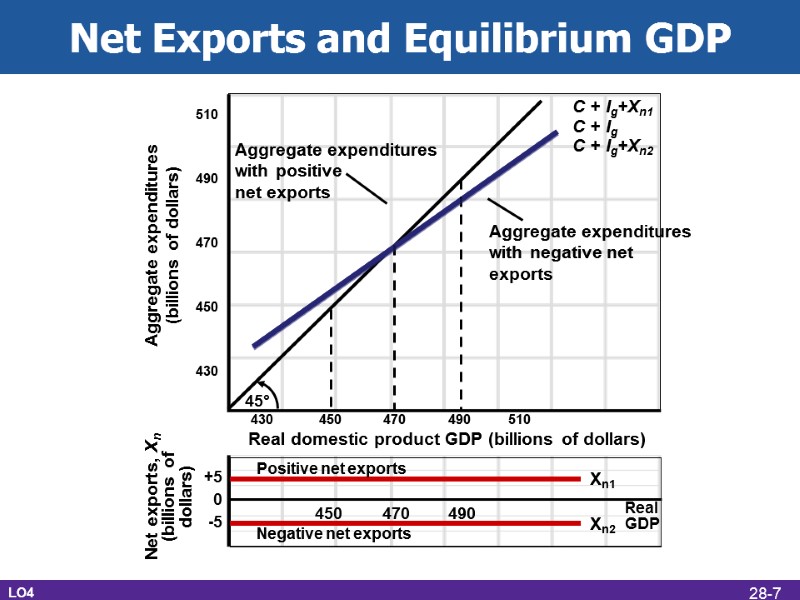

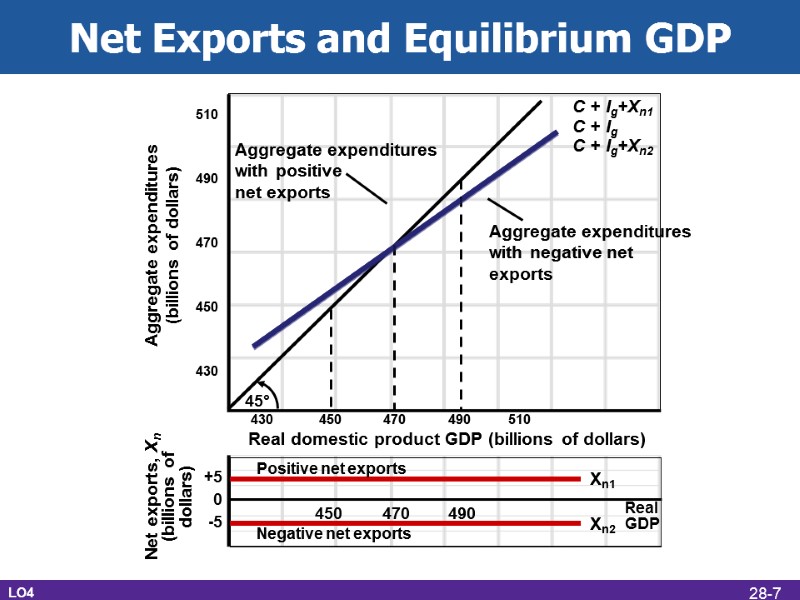

Net Exports and Equilibrium GDP Aggregate expenditures with positive net exports C + Ig Aggregate expenditures with negative net exports C + Ig+Xn2 C + Ig+Xn1 Xn1 Xn2 Positive net exports Negative net exports 450 470 490 LO4 28-7

Net Exports and Equilibrium GDP Aggregate expenditures with positive net exports C + Ig Aggregate expenditures with negative net exports C + Ig+Xn2 C + Ig+Xn1 Xn1 Xn2 Positive net exports Negative net exports 450 470 490 LO4 28-7

International Economic Linkages Prosperity abroad Can increase U.S. exports Exchange rates Depreciate the dollar to increase exports A caution on tariffs and devaluations Other countries may retaliate Lower GDP for all LO4 28-8

International Economic Linkages Prosperity abroad Can increase U.S. exports Exchange rates Depreciate the dollar to increase exports A caution on tariffs and devaluations Other countries may retaliate Lower GDP for all LO4 28-8

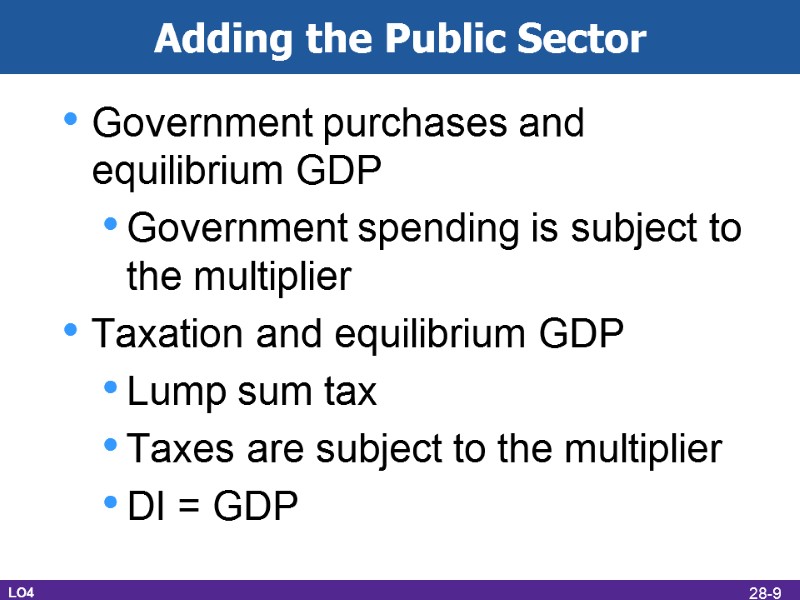

Adding the Public Sector Government purchases and equilibrium GDP Government spending is subject to the multiplier Taxation and equilibrium GDP Lump sum tax Taxes are subject to the multiplier DI = GDP LO4 28-9

Adding the Public Sector Government purchases and equilibrium GDP Government spending is subject to the multiplier Taxation and equilibrium GDP Lump sum tax Taxes are subject to the multiplier DI = GDP LO4 28-9

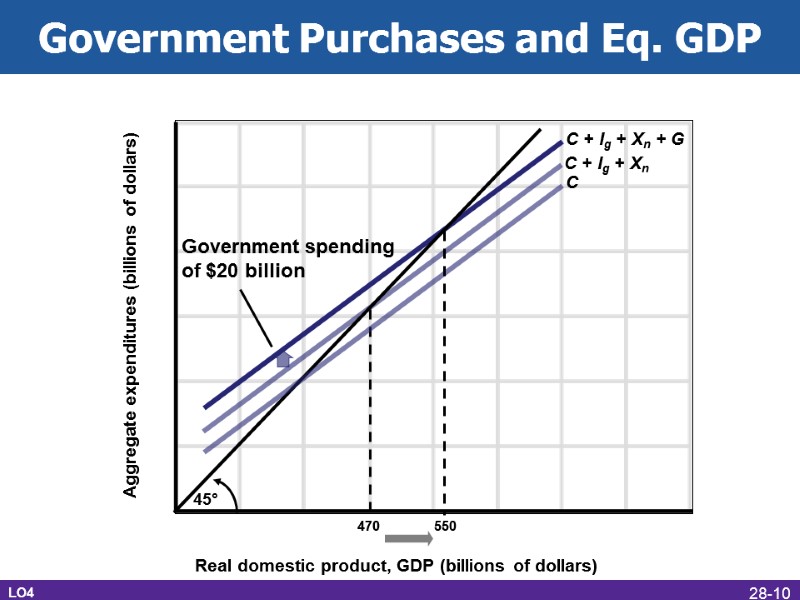

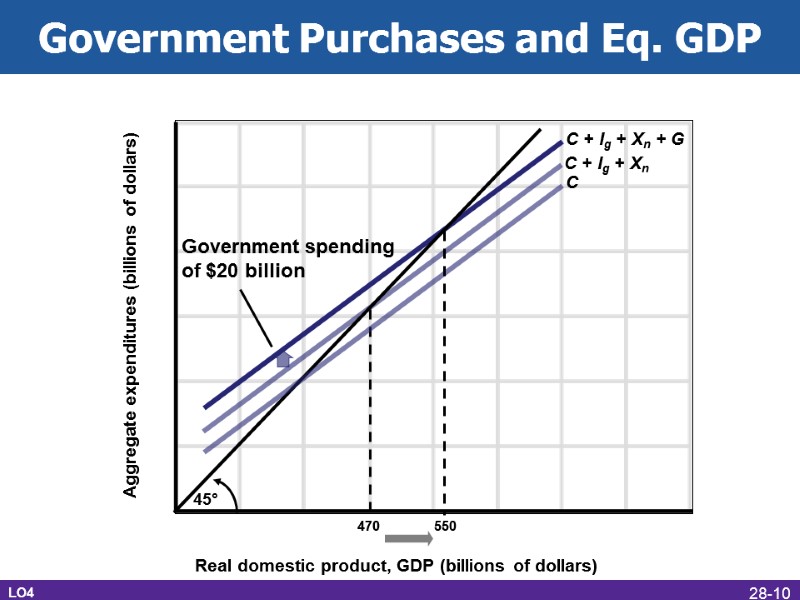

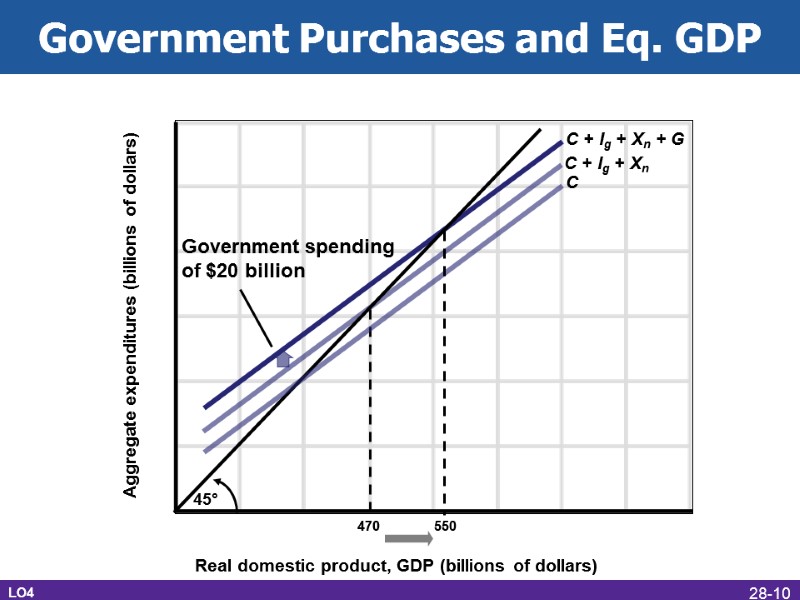

Government Purchases and Eq. GDP C Government spending of $20 billion C + Ig + Xn C + Ig + Xn + G LO4 28-10

Government Purchases and Eq. GDP C Government spending of $20 billion C + Ig + Xn C + Ig + Xn + G LO4 28-10

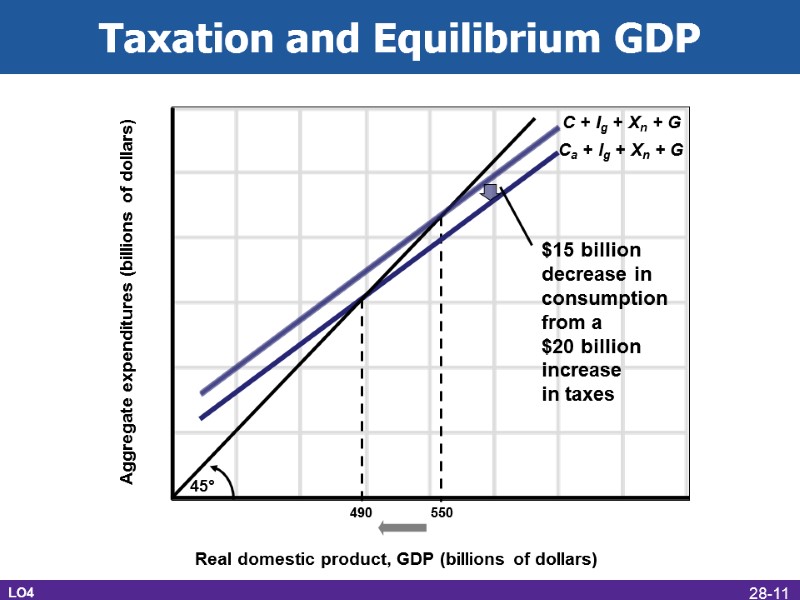

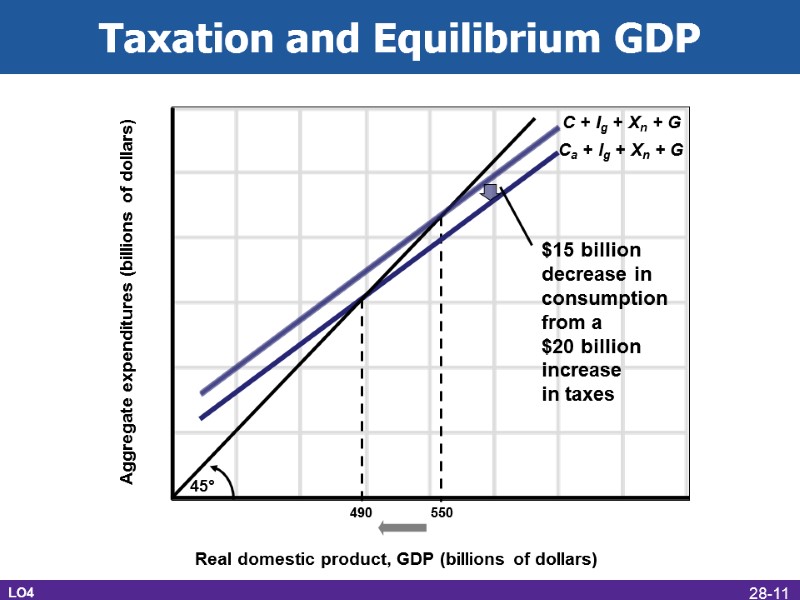

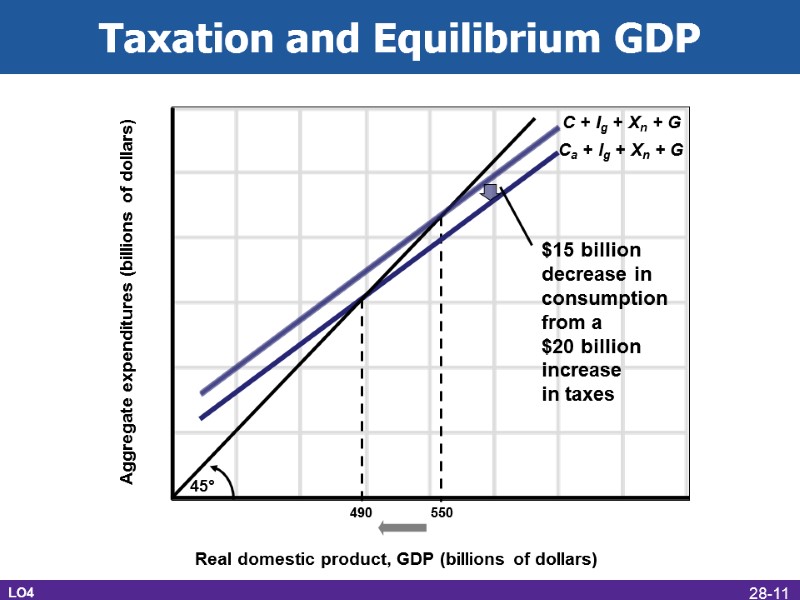

Taxation and Equilibrium GDP $15 billion decrease in consumption from a $20 billion increase in taxes Ca + Ig + Xn + G C + Ig + Xn + G LO4 28-11

Taxation and Equilibrium GDP $15 billion decrease in consumption from a $20 billion increase in taxes Ca + Ig + Xn + G C + Ig + Xn + G LO4 28-11

Equilibrium versus Full-Employment Recessionary expenditure gap Insufficient aggregate spending Spending below full-employment GDP Increase G and/or decrease T Inflationary expenditure gap Too much aggregate spending Spending exceeds full-employment GDP Decrease G and/or increase T LO5 28-12

Equilibrium versus Full-Employment Recessionary expenditure gap Insufficient aggregate spending Spending below full-employment GDP Increase G and/or decrease T Inflationary expenditure gap Too much aggregate spending Spending exceeds full-employment GDP Decrease G and/or increase T LO5 28-12

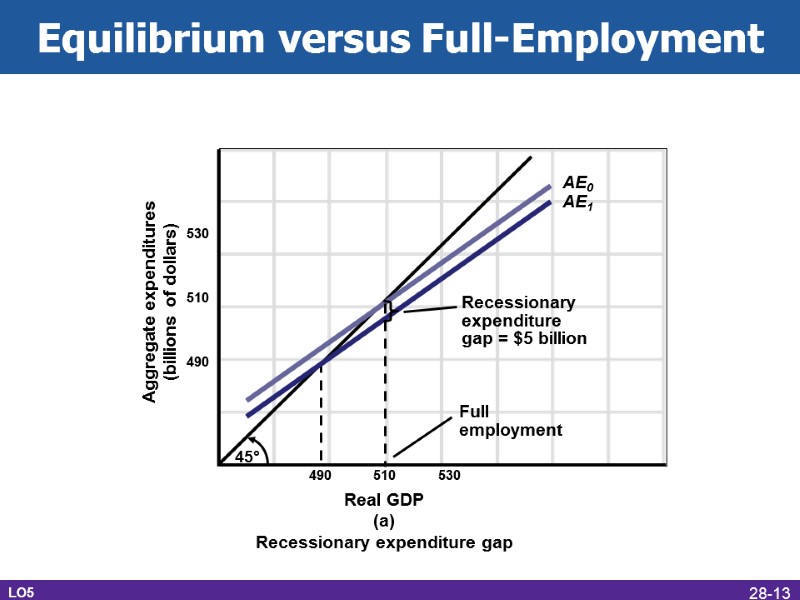

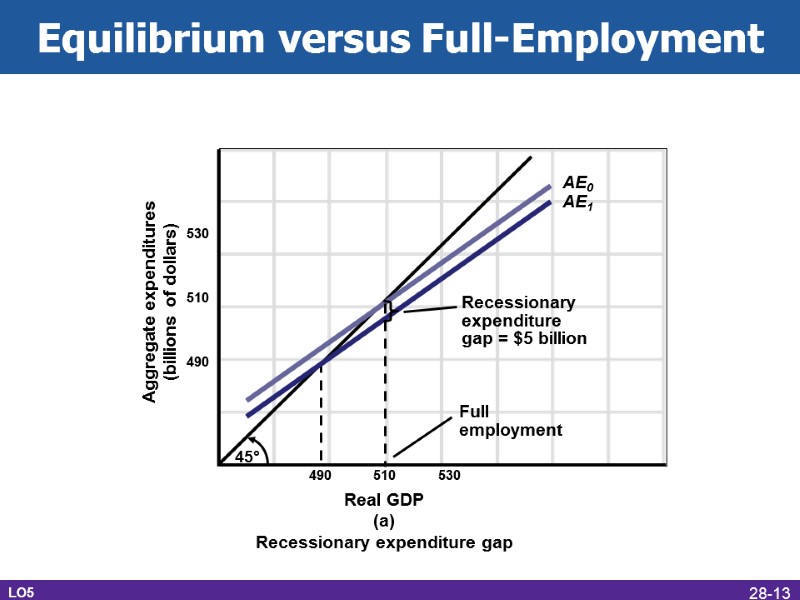

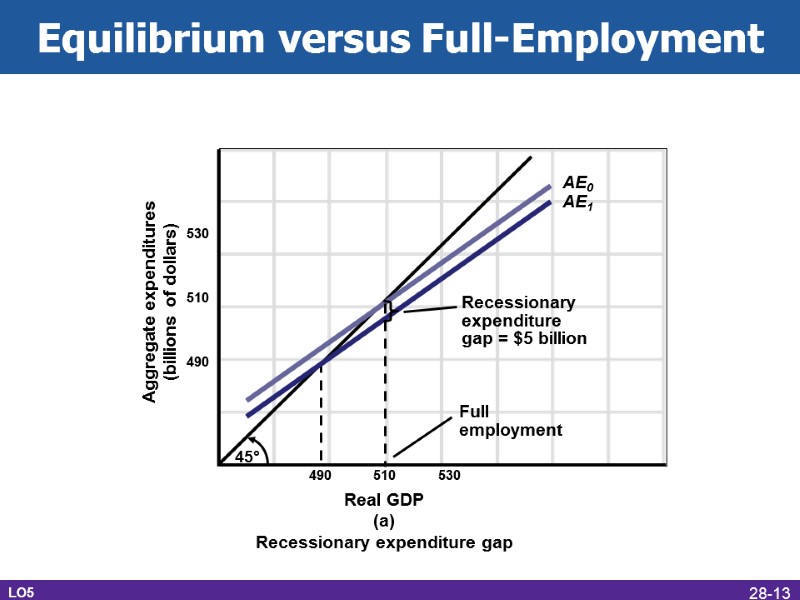

Equilibrium versus Full-Employment AE0 AE1 Full employment Recessionary expenditure gap = $5 billion LO5 28-13

Equilibrium versus Full-Employment AE0 AE1 Full employment Recessionary expenditure gap = $5 billion LO5 28-13

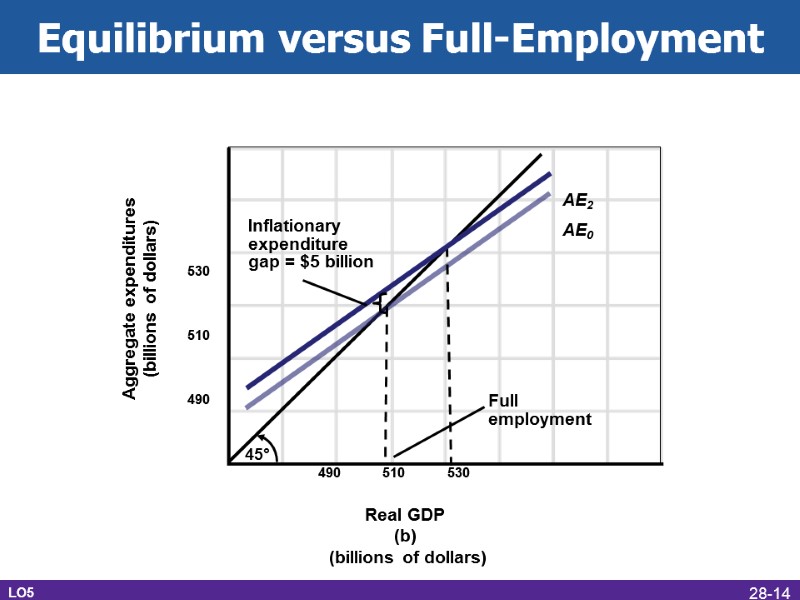

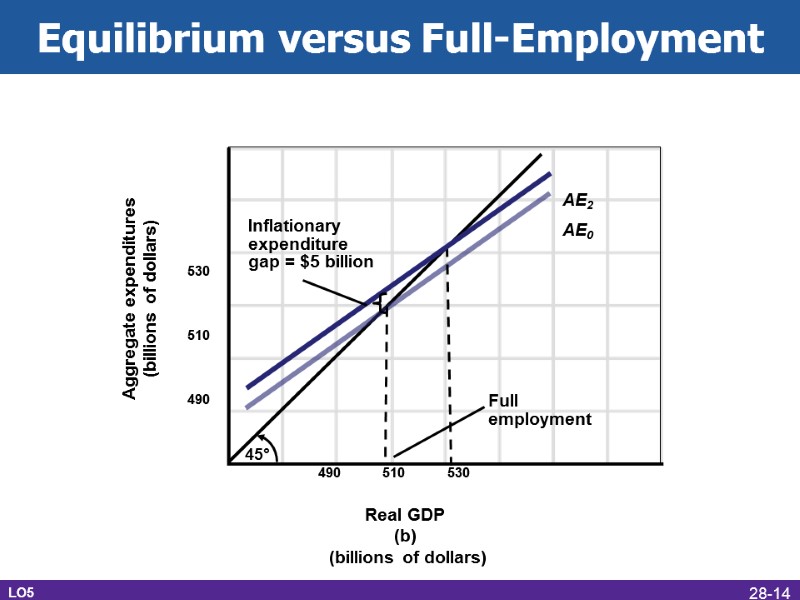

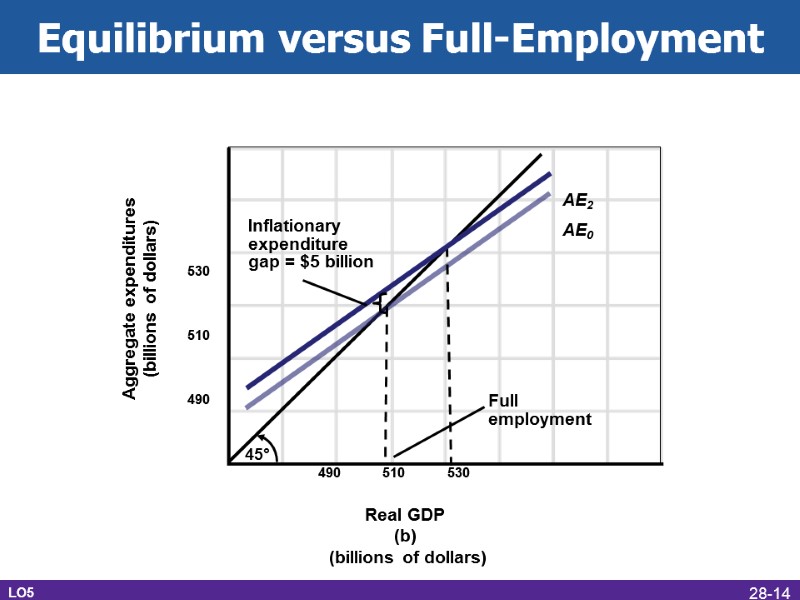

Equilibrium versus Full-Employment AE0 AE2 Full employment Inflationary expenditure gap = $5 billion LO5 28-14

Equilibrium versus Full-Employment AE0 AE2 Full employment Inflationary expenditure gap = $5 billion LO5 28-14