The Aggregate Expenditure Model

The Aggregate Expenditure Model

o

o

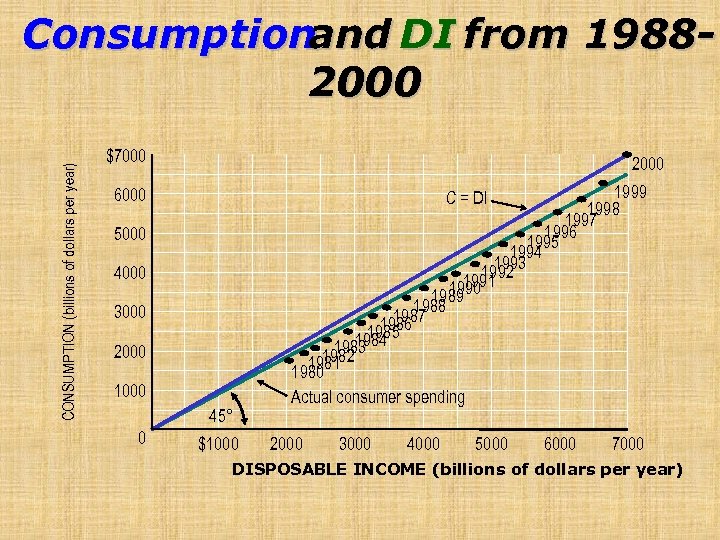

CONSUMPTION (billions of dollars per year) Consumption and DI from 19882000 $7000 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 6000 C = DI 5000 4000 3000 2000 1000 45° 0 $1000 Actual consumer spending 2000 3000 4000 5000 6000 7000 DISPOSABLE INCOME (billions of dollars per year)

CONSUMPTION (billions of dollars per year) Consumption and DI from 19882000 $7000 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 6000 C = DI 5000 4000 3000 2000 1000 45° 0 $1000 Actual consumer spending 2000 3000 4000 5000 6000 7000 DISPOSABLE INCOME (billions of dollars per year)

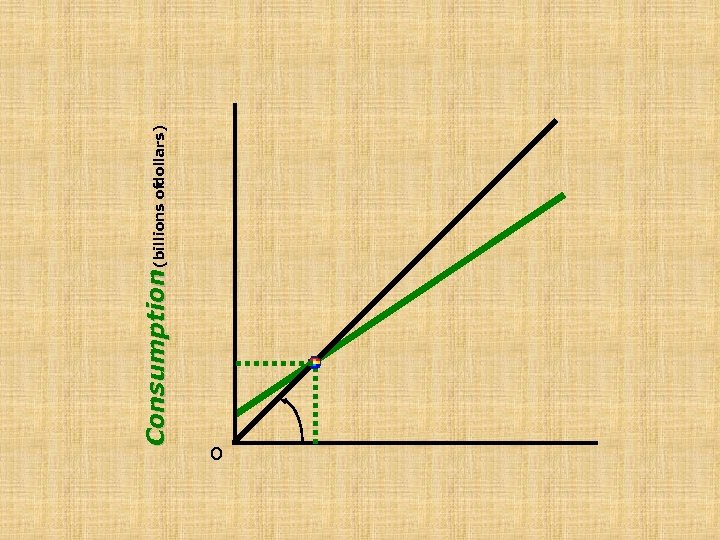

Consumption (billions ofdollars) o

Consumption (billions ofdollars) o

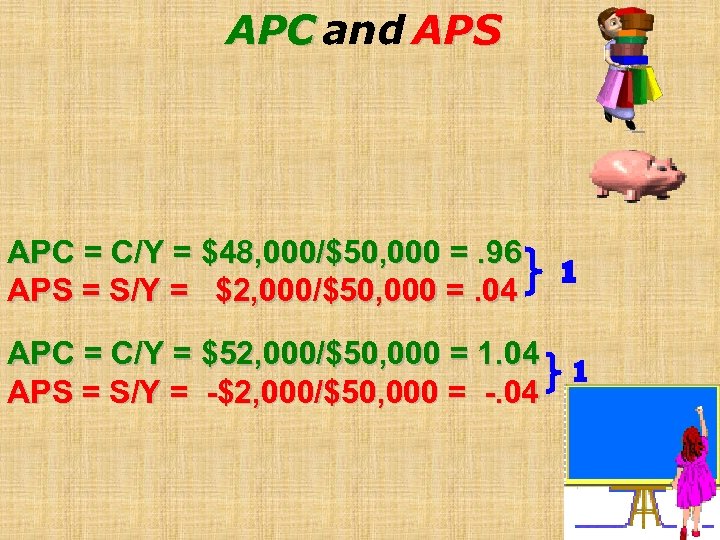

APC and APS APC = C/Y = $48, 000/$50, 000 =. 96 APS = S/Y = $2, 000/$50, 000 =. 04 1 APC = C/Y = $52, 000/$50, 000 = 1. 04 1 APS = S/Y = -$2, 000/$50, 000 = -. 04

APC and APS APC = C/Y = $48, 000/$50, 000 =. 96 APS = S/Y = $2, 000/$50, 000 =. 04 1 APC = C/Y = $52, 000/$50, 000 = 1. 04 1 APS = S/Y = -$2, 000/$50, 000 = -. 04

1

1

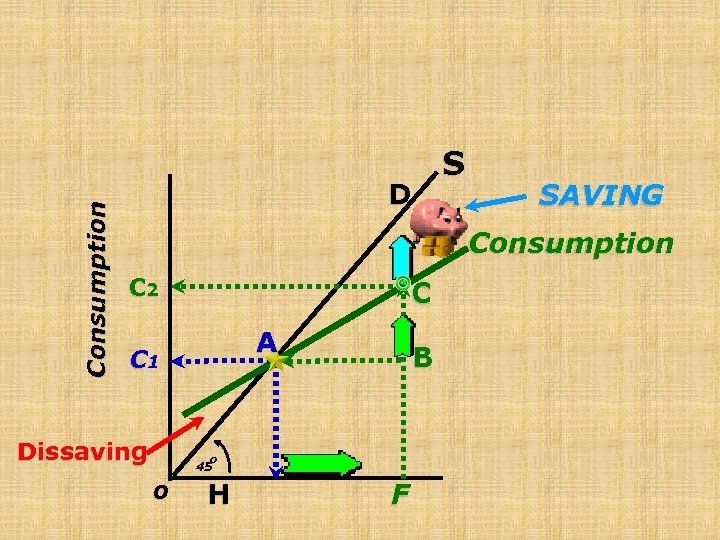

Consumption D S SAVING Consumption C 2 C A C 1 Dissaving B o 45 o H F

Consumption D S SAVING Consumption C 2 C A C 1 Dissaving B o 45 o H F

o

o

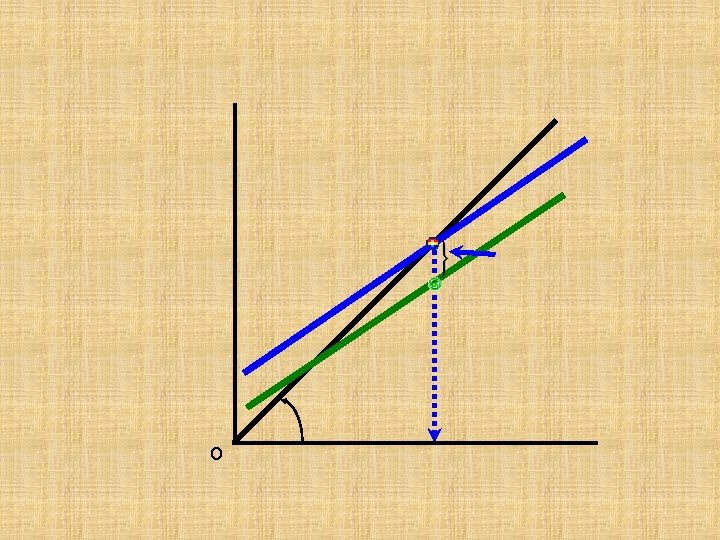

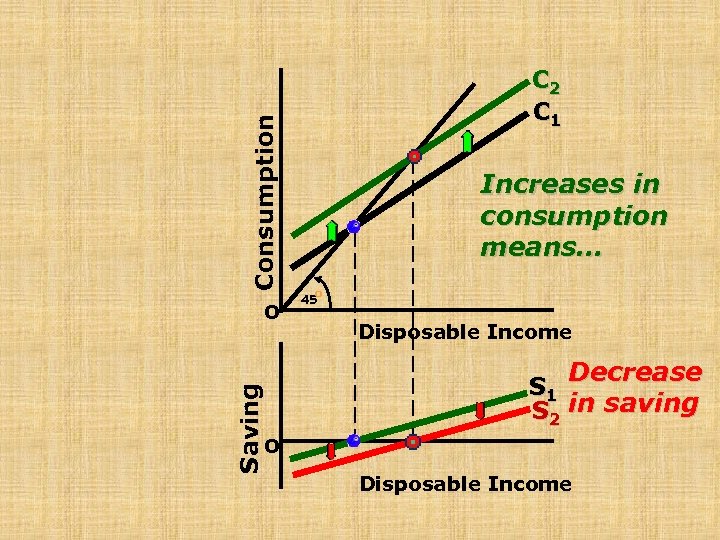

Consumption Saving o C 2 C 1 Increases in consumption means… o 45 Disposable Income Decrease o S 1 S 2 in saving Disposable Income

Consumption Saving o C 2 C 1 Increases in consumption means… o 45 Disposable Income Decrease o S 1 S 2 in saving Disposable Income

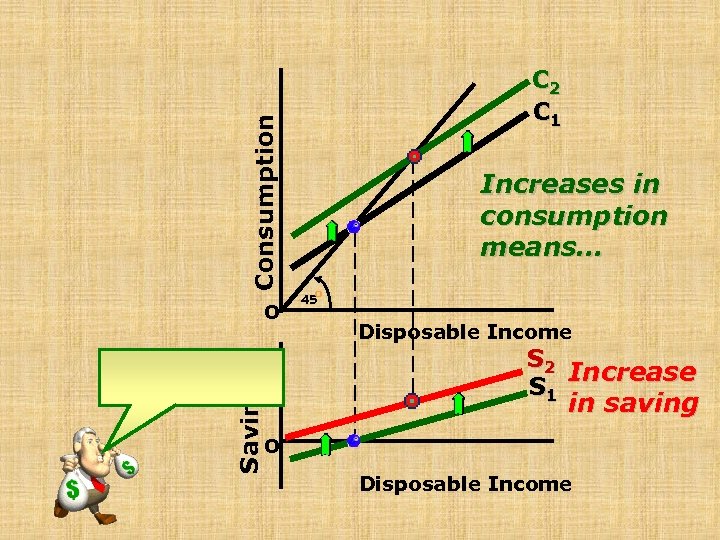

Consumption Saving o C 2 C 1 Increases in consumption means… o 45 Disposable Income S 2 Increase S 1 in saving o Disposable Income

Consumption Saving o C 2 C 1 Increases in consumption means… o 45 Disposable Income S 2 Increase S 1 in saving o Disposable Income

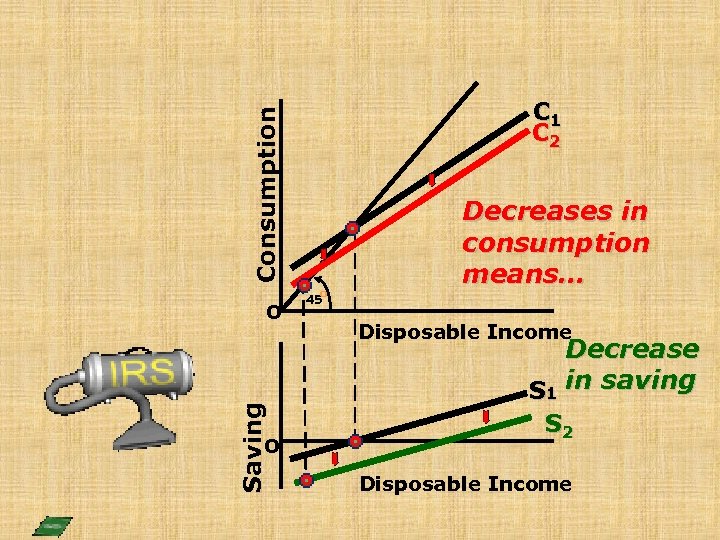

Consumption C 1 C 2 Saving o o o Decreases in consumption means… 45 Disposable Income Decrease S 1 in saving S 2 Disposable Income

Consumption C 1 C 2 Saving o o o Decreases in consumption means… 45 Disposable Income Decrease S 1 in saving S 2 Disposable Income

o

o

Should A New Drill Press Purchased? Be Drill Press - $1, 000 A. Expected returns (profits) $1, 100 or a 10% = B. return. [$100/$1, 000 = 10%] B. Nominal interest rate = 12%, C. Inflation rate = 4%

Should A New Drill Press Purchased? Be Drill Press - $1, 000 A. Expected returns (profits) $1, 100 or a 10% = B. return. [$100/$1, 000 = 10%] B. Nominal interest rate = 12%, C. Inflation rate = 4%

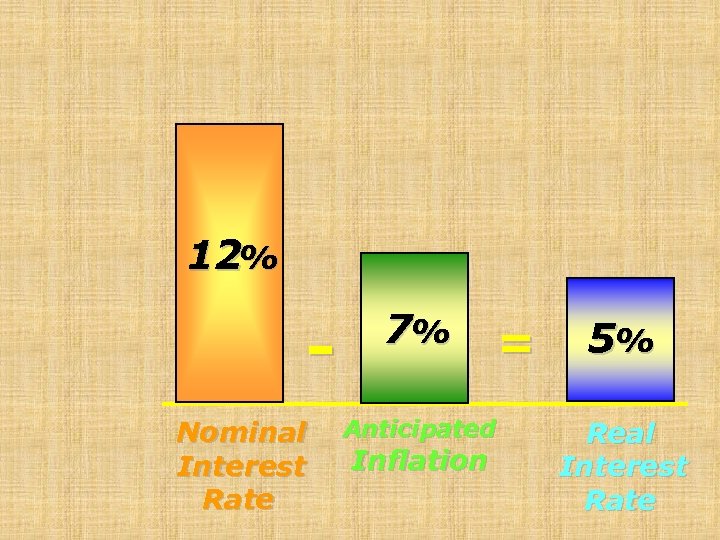

12% Nominal Interest Rate 7% = Anticipated Inflation 5% Real Interest Rate

12% Nominal Interest Rate 7% = Anticipated Inflation 5% Real Interest Rate

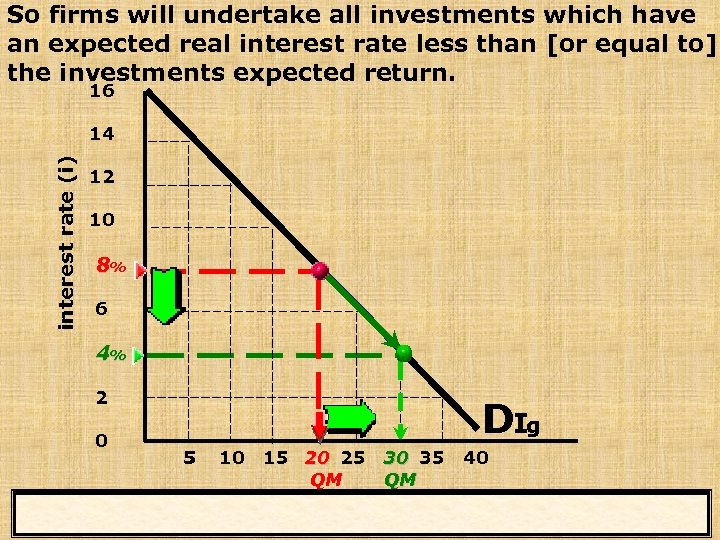

So firms will undertake all investments which have an expected real interest rate less than [or equal to] the investments expected return. 16 interest rate (i) 14 12 10 8% 6 4% 2 0 DIg 5 10 15 20 25 30 35 QM QM 40

So firms will undertake all investments which have an expected real interest rate less than [or equal to] the investments expected return. 16 interest rate (i) 14 12 10 8% 6 4% 2 0 DIg 5 10 15 20 25 30 35 QM QM 40

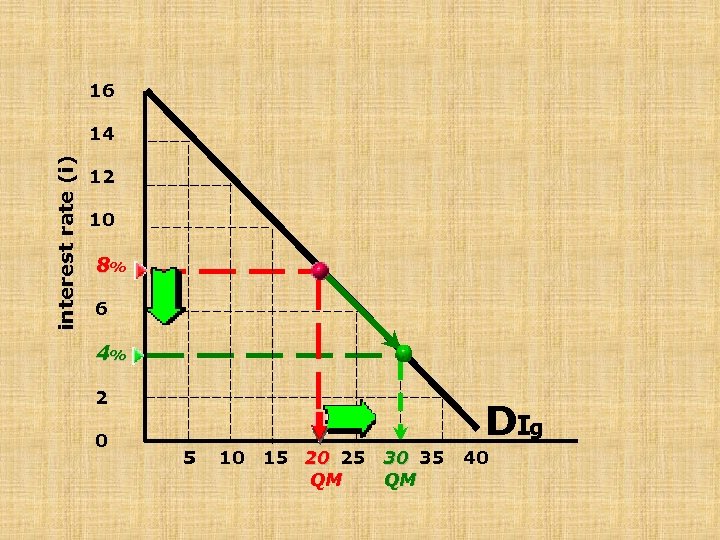

16 interest rate (i) 14 12 10 8% 6 4% 2 0 DIg 5 10 15 20 25 30 35 QM QM 40

16 interest rate (i) 14 12 10 8% 6 4% 2 0 DIg 5 10 15 20 25 30 35 QM QM 40

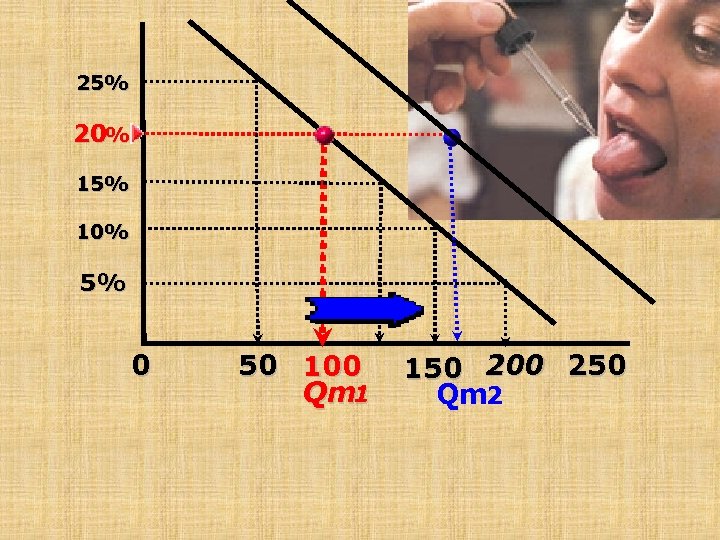

25% 20% 15% 10% 5% 0 50 100 Qm 1 150 200 250 Qm 2

25% 20% 15% 10% 5% 0 50 100 Qm 1 150 200 250 Qm 2

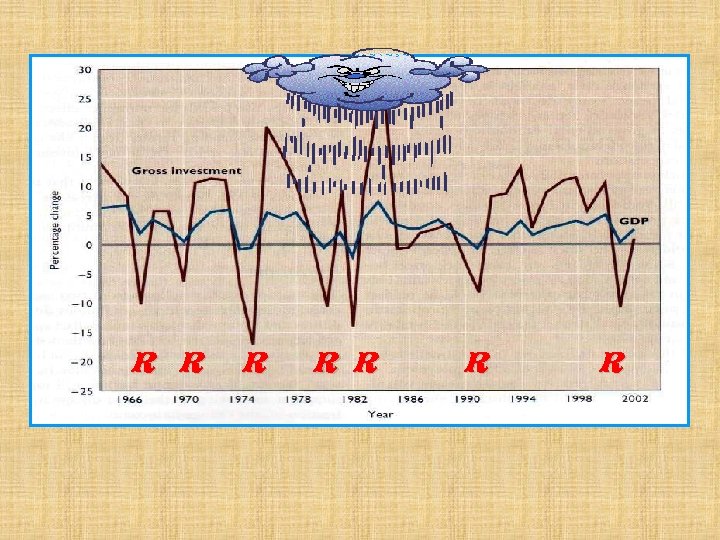

R R R R

R R R R

• Durability of Capital; some machines are more durable than other. The more durable them capital the less need for replacing it.

• Durability of Capital; some machines are more durable than other. The more durable them capital the less need for replacing it.

• Irregularity of innovations; new products and processes stimulate investment but they occur irregularly.

• Irregularity of innovations; new products and processes stimulate investment but they occur irregularly.

• Expectations; pessimism about future profits will cause firms to keep older equipment and avoid investment.

• Expectations; pessimism about future profits will cause firms to keep older equipment and avoid investment.

o

o

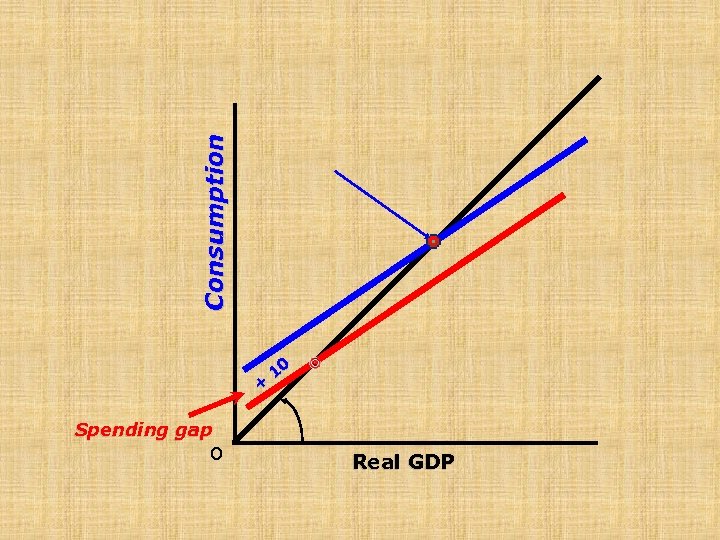

Consumption + 10 Spending gap o Real GDP

Consumption + 10 Spending gap o Real GDP

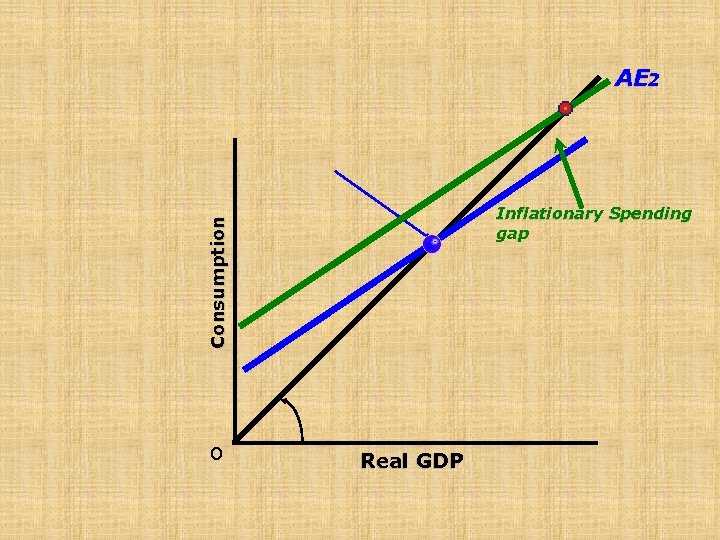

AE 2 Consumption Inflationary Spending gap o Real GDP

AE 2 Consumption Inflationary Spending gap o Real GDP