de74d1a05b54bacb82539f140ce2423a.ppt

- Количество слайдов: 19

The Affordable Care Act in Year 4 —Are We There Yet? August 2013 Prepared by Consulting Health & U. S. Health & Benefits Legal Consulting | Proprietary & Confidential | 06/2013 1

Agenda—How We Got Here, How It’s Going, and Where We Go Now What are the ACA’s goals? Is the ACA legal? Will the ACA be repealed? Implementing the ACA (Theory vs. Reality) ACA changes – what happens when the employer mandate is delayed? Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 2

Goals of the Affordable Care Act—How We Got Here Offer access to health insurance for the uninsured Pay for expanded access through increased taxes and spending cuts Bend the health care cost curve downward Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 3

Is it Legal? The Supreme Court answered “the Broccoli Question”… Q: If the government can make you buy health insurance, can the government make you buy broccoli too? A: No, the government can’t make you buy health insurance or broccoli. But if you don’t, they can tax you. Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 4

…And Rewrote the Affordable Care Act—Slightly Expanded Health Insurance Coverage Health Insurance Exchanges with Reformed Rules Optional State Expansion of Medicaid Federal Subsidies to Buy Health Insurance In Exchanges Medicare/Medicaid Payment Changes ACA Penalties and Fees on Employer Mandate Increased Medicare Taxes on High. Income Individuals 2. 3% tax on Advanced Medical Devices Individual Mandate to buy Health insurance Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 Paying for Expanded Coverage “Tax” on Individuals without health insurance 5 Taxation of High-Cost Employer Health Care Coverage

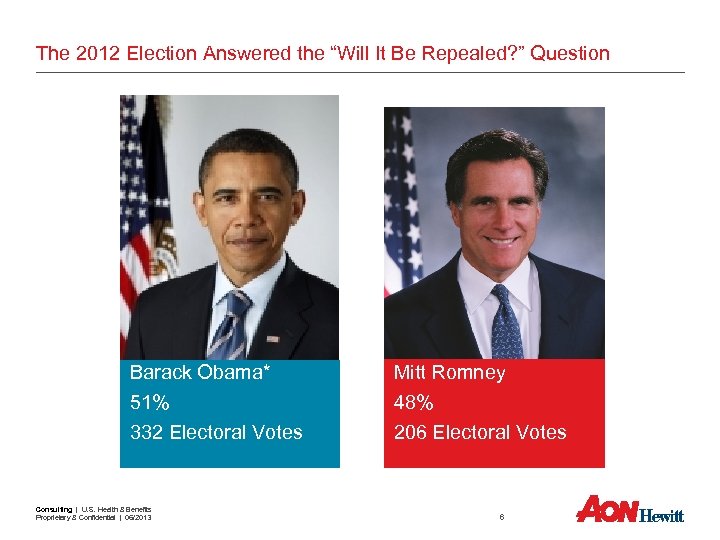

The 2012 Election Answered the “Will It Be Repealed? ” Question Barack Obama* 51% Mitt Romney 48% 332 Electoral Votes 206 Electoral Votes Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 6

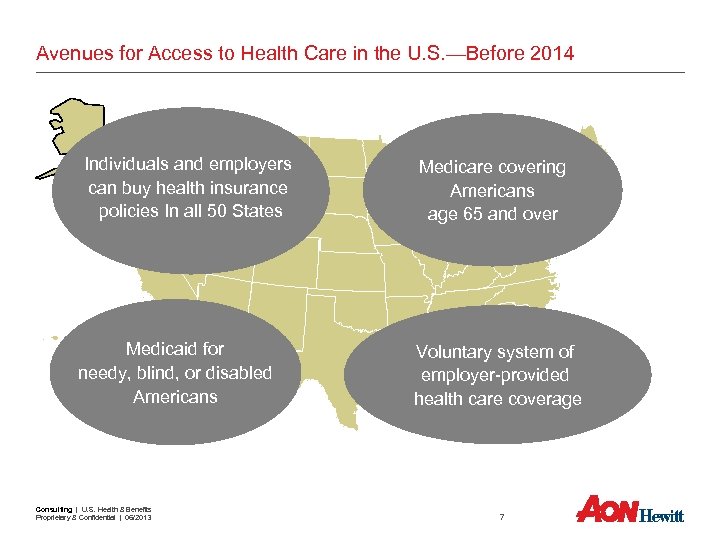

Avenues for Access to Health Care in the U. S. —Before 2014 Individuals and employers can buy health insurance policies In all 50 States Medicaid for needy, blind, or disabled Americans Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 Medicare covering Americans age 65 and over Voluntary system of employer-provided health care coverage 7

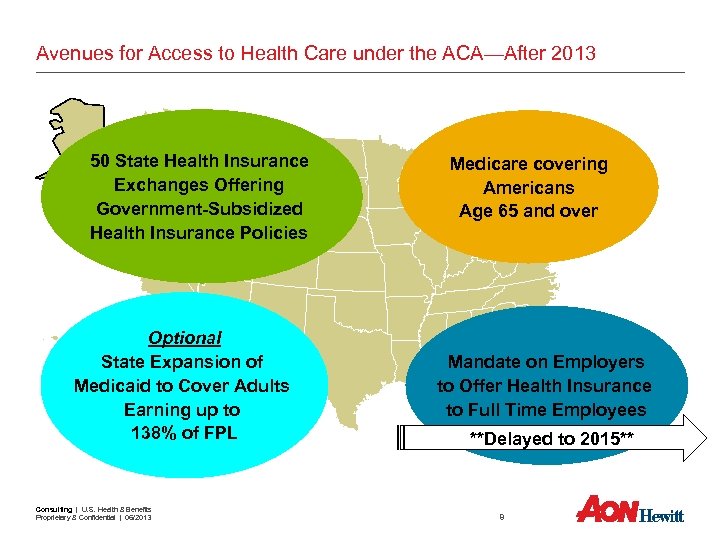

Avenues for Access to Health Care under the ACA—After 2013 50 State Health Insurance Exchanges Offering Government-Subsidized Health Insurance Policies Optional State Expansion of Medicaid to Cover Adults Earning up to 138% of FPL Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 Medicare covering Americans Age 65 and over Mandate on Employers to Offer Health Insurance to Full Time Employees **Delayed to 2015** 8

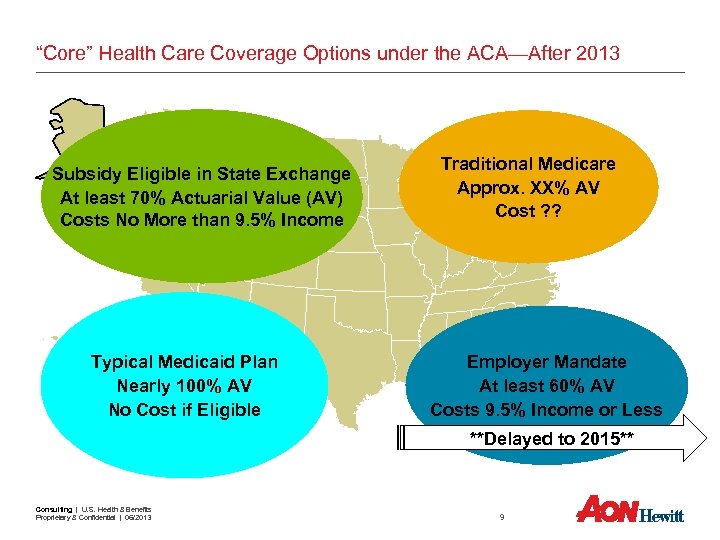

“Core” Health Care Coverage Options under the ACA—After 2013 Subsidy Eligible in State Exchange At least 70% Actuarial Value (AV) Costs No More than 9. 5% Income Typical Medicaid Plan Nearly 100% AV No Cost if Eligible Traditional Medicare Approx. XX% AV Cost ? ? Employer Mandate At least 60% AV Costs 9. 5% Income or Less **Delayed to 2015** Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 9

Less Than Half of the States Are Creating Health Care Exchanges in 2014 ME AK WA MT OR ND MN MA ID WY WI SD PA NV UT IL CO KS CA AZ Creating Exchange NY MI IA NE HI NH VT OH IN MO WV SC MS TX AL DE GA MD LA Won’t Create Exchange FL Partnership Exchange with Feds Democrat Governor Republican Governor Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 CT NC TN AR NM VA KY OK RI NJ 10

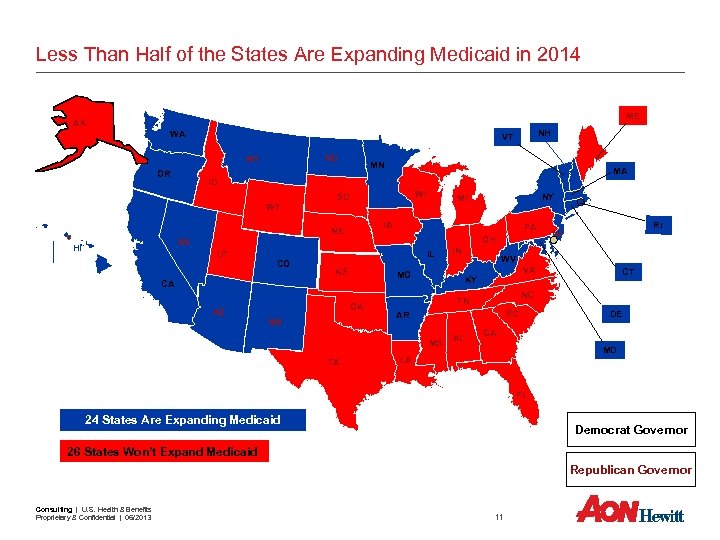

Less Than Half of the States Are Expanding Medicaid in 2014 ME AK WA ND MT OR MN MA ID WY WI SD PA OH NV UT CO IL KS OK NM VA CT NC TN SC AR AL RI NJ WV KY MS TX IN MO CA AZ NY MI IA NE HI NH VT DE GA MD LA FL 24 States Are Expanding Medicaid Democrat Governor 26 States Won’t Expand Medicaid Republican Governor Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 11

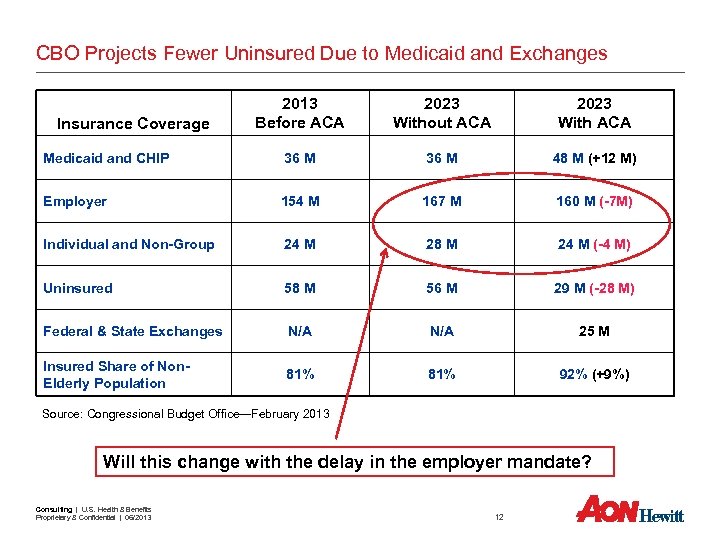

CBO Projects Fewer Uninsured Due to Medicaid and Exchanges 2013 Before ACA 2023 Without ACA 2023 With ACA Medicaid and CHIP 36 M 48 M (+12 M) Employer 154 M 167 M 160 M (-7 M) Individual and Non-Group 24 M 28 M 24 M (-4 M) Uninsured 58 M 56 M 29 M (-28 M) Federal & State Exchanges N/A 25 M Insured Share of Non. Elderly Population 81% 92% (+9%) Insurance Coverage Source: Congressional Budget Office—February 2013 Will this change with the delay in the employer mandate? Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 12

Delayed Employer Penalties – What Does It Mean? § Employer “shared responsibility” penalties are delayed until 2015 – No way to enforce the employer “mandate” in 2014 – Employers are unlikely to expand coverage to full-time employees who are not yet eligible – …also unlikely to adjust their benefits to meet the affordability and actuarial value requirements § Employers aren’t off the hook – Group market reforms still apply, including • Maximum 90 -day waiting period for coverage; • Coverage in approved clinical trials; and • Cost-sharing limits for group health plans tied to HDHP/HSA deductibles and OOP max. – Fees will still be assessed • Patient Centered Outcomes Research Institute fee • Transitional reinsurance • Fully insured plan fees § And they still have to tell their employees about the Exchanges! – Notify employees of the Exchanges – Inform employees whether employer coverage meets the definition of Minimum Essential Coverage Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 13

No Delays for the Individual Mandate § The ACA, as interpreted by the Supreme Court, offers individuals a choice – Buy minimum essential coverage or – Pay a “shared responsibility” tax § Most Americans already have minimum essential coverage via, e. g. , – Employer group health plans (insured, self-insured, grandfathered, non-grandfathered) – Government health plans (Medicare, Medicaid, CHIP, Tricare) – Individual health insurance policies – U. S. residents or U. S. citizens in foreign nation or U. S. possession § Others are exempt – An individual may be exempt from the requirement to have MEC if cost of coverage exceeds 8% of household income – Certain groups are exempt from the requirement to have coverage • Religious exemption • Prisoners • Aliens • Members of Indian tribes • Insufficient income to file a Federal income tax return • Short gaps in health care coverage • Eligible for a hardship exemption Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 14

Delayed Employer Penalties – Who Wins and Who Loses in 2014? § Some employers win – Can delay a costly expansion of benefit eligibility – More time to develop a measurement mechanism to identify full time employees – …and more time to convert staffing model to accommodate more part time employees § Many employers are neutral – No change for employers who already offer coverage to most employees § Ineligible employees win (probably) – Subsidized exchange coverage will likely be better and cheaper than employer coverage – Limited data sharing means some employees may be able to game the system for one year – But purchasing insurance on the exchange coverage won’t exactly be an Amazon. com experience § Federal Government loses – Less employer coverage means more subsidies are paid out in the exchanges – More enrollment in the exchanges could tax an under-developed system – Fewer covered in employer plans means lower transitional reinsurance fee revenue § Insurance companies and health care providers– What do you all think? Is this good or bad? Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 15

Delayed Employer Penalties – What Happens in 2015? § Employers comply with mandate – Offer 60% AV plans – Charge close to 9. 5% of employee’s income for coverage § Employees are forced out of exchange subsidies by employer coverage – Unless they switch to part-time employment – Penalty for waiving coverage increases 3 -fold § Federal Government rebalances – Pays less in subsidies – Collects more penalties § Where does that leave insurance companies and health care providers? Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 16

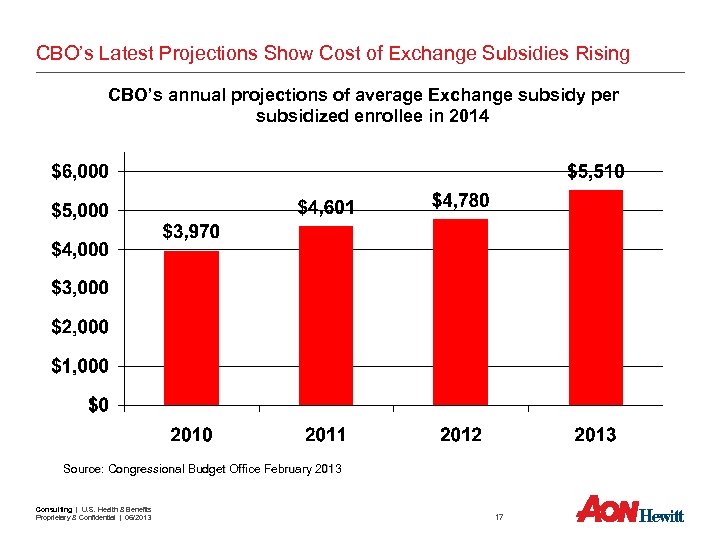

CBO’s Latest Projections Show Cost of Exchange Subsidies Rising CBO’s annual projections of average Exchange subsidy per subsidized enrollee in 2014 Source: Congressional Budget Office February 2013 Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 17

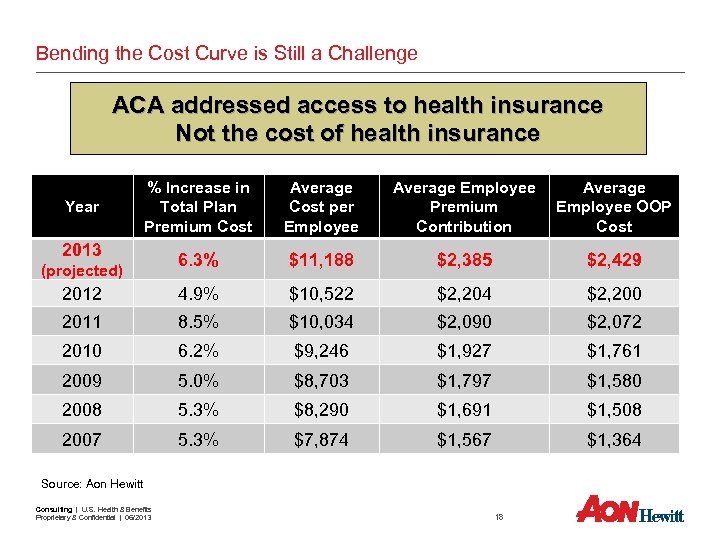

Bending the Cost Curve is Still a Challenge ACA addressed access to health insurance Not the cost of health insurance % Increase in Total Plan Premium Cost Average Cost per Employee Average Employee Premium Contribution Average Employee OOP Cost 6. 3% $11, 188 $2, 385 $2, 429 2012 4. 9% $10, 522 $2, 204 $2, 200 2011 8. 5% $10, 034 $2, 090 $2, 072 2010 6. 2% $9, 246 $1, 927 $1, 761 2009 5. 0% $8, 703 $1, 797 $1, 580 2008 5. 3% $8, 290 $1, 691 $1, 508 2007 5. 3% $7, 874 $1, 567 $1, 364 Year 2013 (projected) Source: Aon Hewitt Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 18

Are We There Yet? No…but It Sure Is an Interesting Drive! QUESTIONS? ? ? Consulting | U. S. Health & Benefits Proprietary & Confidential | 06/2013 19

de74d1a05b54bacb82539f140ce2423a.ppt