cea5c8fa984793879f650c94bd2c16ba.ppt

- Количество слайдов: 8

The ADR Directive and what it means Richard Goodman, Policy Director © May not be reproduced without permission of Financial Ombudsman Service Ltd 1

The ADR Directive and what it means Richard Goodman, Policy Director © May not be reproduced without permission of Financial Ombudsman Service Ltd 1

what is the ADR Directive? • The Alternative Dispute Resolution (ADR) Directive is an EU law that comes into force in July 2015 • It will set some common standards for ADR providers • Using ADR will be voluntary for traders • These will be complemented with the Online Dispute Resolution (ODR) Regulations, which come into force in early 2016 • In 2010 consumer financial losses were estimated at 0. 4% of the EU’s GDP • It is estimated that wider availability of ADR could save around € 22. 5 billion a year © May not be reproduced without permission of Financial Ombudsman Service Ltd 2

what is the ADR Directive? • The Alternative Dispute Resolution (ADR) Directive is an EU law that comes into force in July 2015 • It will set some common standards for ADR providers • Using ADR will be voluntary for traders • These will be complemented with the Online Dispute Resolution (ODR) Regulations, which come into force in early 2016 • In 2010 consumer financial losses were estimated at 0. 4% of the EU’s GDP • It is estimated that wider availability of ADR could save around € 22. 5 billion a year © May not be reproduced without permission of Financial Ombudsman Service Ltd 2

what does it do in theory? • The spirit of the legislation is to encourage growth in the EU single market • It aims to provide low-cost, simple and fast procedures, beneficial to consumers and traders • Provide full ADR coverage at EU level • The ODR regulations provide for an ODR platform – an online area where consumers can submit complaint about an online purchase • The ODR platform will route the complaint to the appropriate ADR scheme, supporting the resolution of cross-border disputes • The Commission is working with the UK on testing the platform now © May not be reproduced without permission of Financial Ombudsman Service Ltd 3

what does it do in theory? • The spirit of the legislation is to encourage growth in the EU single market • It aims to provide low-cost, simple and fast procedures, beneficial to consumers and traders • Provide full ADR coverage at EU level • The ODR regulations provide for an ODR platform – an online area where consumers can submit complaint about an online purchase • The ODR platform will route the complaint to the appropriate ADR scheme, supporting the resolution of cross-border disputes • The Commission is working with the UK on testing the platform now © May not be reproduced without permission of Financial Ombudsman Service Ltd 3

principles of the Directive The UK has an obligation to ensure that ADR is available to all businesses – though they are not required to use it. However, there are some principles which ADR providers must be able to meet: • accessibility – consumers should be able to submit a complaint both online and offline, and the process should be free (or a nominal charge) to use • expertise, independence and impartiality – case handlers must be sufficiently independent and knowledgeable in their field • transparency – ADR bodies are required to publish, either online or in their annual review, certain information such as complaints volumes and the time it takes to deal with these • effectiveness – the ADR procedure is easily accessible to both parties, it must be timely and parties are not required to use a lawyer or legal advisor to partake in the process • fairness – parties are able to withdraw from the process and are made aware of the legal effect of the outcome © May not be reproduced without permission of Financial Ombudsman Service Ltd 4

principles of the Directive The UK has an obligation to ensure that ADR is available to all businesses – though they are not required to use it. However, there are some principles which ADR providers must be able to meet: • accessibility – consumers should be able to submit a complaint both online and offline, and the process should be free (or a nominal charge) to use • expertise, independence and impartiality – case handlers must be sufficiently independent and knowledgeable in their field • transparency – ADR bodies are required to publish, either online or in their annual review, certain information such as complaints volumes and the time it takes to deal with these • effectiveness – the ADR procedure is easily accessible to both parties, it must be timely and parties are not required to use a lawyer or legal advisor to partake in the process • fairness – parties are able to withdraw from the process and are made aware of the legal effect of the outcome © May not be reproduced without permission of Financial Ombudsman Service Ltd 4

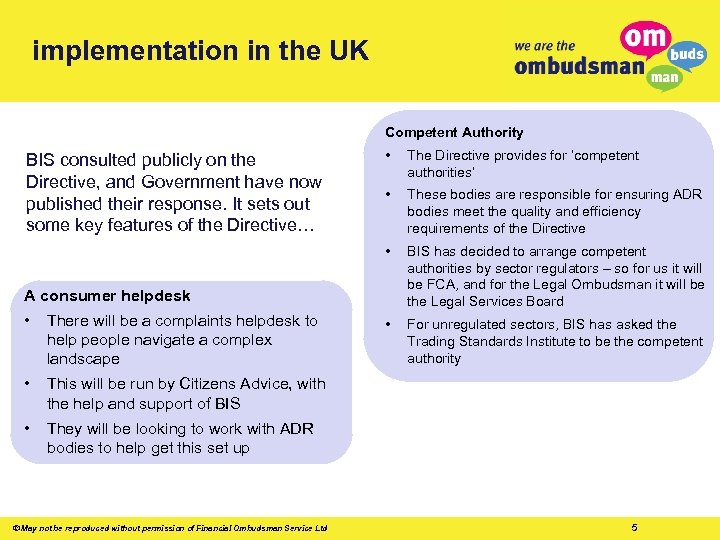

implementation in the UK Competent Authority • The Directive provides for ‘competent authorities’ • These bodies are responsible for ensuring ADR bodies meet the quality and efficiency requirements of the Directive • BIS consulted publicly on the Directive, and Government have now published their response. It sets out some key features of the Directive… BIS has decided to arrange competent authorities by sector regulators – so for us it will be FCA, and for the Legal Ombudsman it will be the Legal Services Board • For unregulated sectors, BIS has asked the Trading Standards Institute to be the competent authority A consumer helpdesk • There will be a complaints helpdesk to help people navigate a complex landscape • This will be run by Citizens Advice, with the help and support of BIS • They will be looking to work with ADR bodies to help get this set up © May not be reproduced without permission of Financial Ombudsman Service Ltd 5

implementation in the UK Competent Authority • The Directive provides for ‘competent authorities’ • These bodies are responsible for ensuring ADR bodies meet the quality and efficiency requirements of the Directive • BIS consulted publicly on the Directive, and Government have now published their response. It sets out some key features of the Directive… BIS has decided to arrange competent authorities by sector regulators – so for us it will be FCA, and for the Legal Ombudsman it will be the Legal Services Board • For unregulated sectors, BIS has asked the Trading Standards Institute to be the competent authority A consumer helpdesk • There will be a complaints helpdesk to help people navigate a complex landscape • This will be run by Citizens Advice, with the help and support of BIS • They will be looking to work with ADR bodies to help get this set up © May not be reproduced without permission of Financial Ombudsman Service Ltd 5

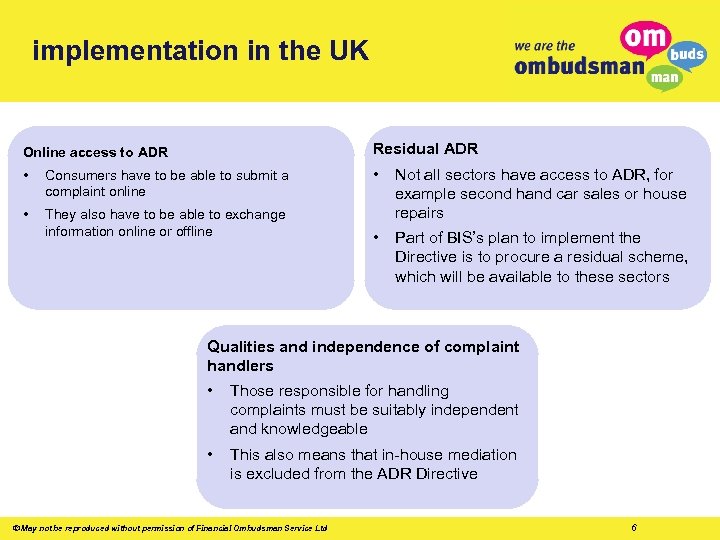

implementation in the UK Online access to ADR Residual ADR • Consumers have to be able to submit a complaint online • • They also have to be able to exchange information online or offline Not all sectors have access to ADR, for example second hand car sales or house repairs • Part of BIS’s plan to implement the Directive is to procure a residual scheme, which will be available to these sectors Qualities and independence of complaint handlers • Those responsible for handling complaints must be suitably independent and knowledgeable • This also means that in-house mediation is excluded from the ADR Directive © May not be reproduced without permission of Financial Ombudsman Service Ltd 6

implementation in the UK Online access to ADR Residual ADR • Consumers have to be able to submit a complaint online • • They also have to be able to exchange information online or offline Not all sectors have access to ADR, for example second hand car sales or house repairs • Part of BIS’s plan to implement the Directive is to procure a residual scheme, which will be available to these sectors Qualities and independence of complaint handlers • Those responsible for handling complaints must be suitably independent and knowledgeable • This also means that in-house mediation is excluded from the ADR Directive © May not be reproduced without permission of Financial Ombudsman Service Ltd 6

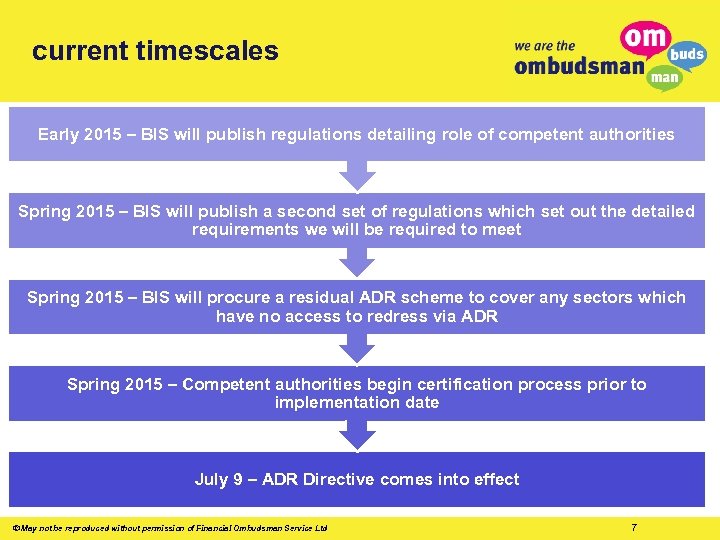

current timescales Early 2015 – BIS will publish regulations detailing role of competent authorities Spring 2015 – BIS will publish a second set of regulations which set out the detailed requirements we will be required to meet Spring 2015 – BIS will procure a residual ADR scheme to cover any sectors which have no access to redress via ADR Spring 2015 – Competent authorities begin certification process prior to implementation date July 9 – ADR Directive comes into effect © May not be reproduced without permission of Financial Ombudsman Service Ltd 7

current timescales Early 2015 – BIS will publish regulations detailing role of competent authorities Spring 2015 – BIS will publish a second set of regulations which set out the detailed requirements we will be required to meet Spring 2015 – BIS will procure a residual ADR scheme to cover any sectors which have no access to redress via ADR Spring 2015 – Competent authorities begin certification process prior to implementation date July 9 – ADR Directive comes into effect © May not be reproduced without permission of Financial Ombudsman Service Ltd 7

discussion: the year ahead © May not be reproduced without permission of Financial Ombudsman Service Ltd 8

discussion: the year ahead © May not be reproduced without permission of Financial Ombudsman Service Ltd 8