ea6c34ec3e7a7ade6fa979d7b972f885.ppt

- Количество слайдов: 57

The Actuarial Profession An Introduction

The Actuarial Profession An Introduction

What is an Actuary?

What is an Actuary?

Is an Actuary a fortune teller?

Is an Actuary a fortune teller?

Is an Actuary a professional gambler?

Is an Actuary a professional gambler?

Doctrine of False Cause A false cause fallacy is a misidentification of the cause for an observed effect. “Why do…” u u u People who have root canals get cancer more often. People who attend the symphony live longer. People who floss their teeth live longer.

Doctrine of False Cause A false cause fallacy is a misidentification of the cause for an observed effect. “Why do…” u u u People who have root canals get cancer more often. People who attend the symphony live longer. People who floss their teeth live longer.

Two Branches of Actuarial Science u Life & Health / Pension - Society of Actuaries : SOA - around 17, 000 in United States u Property and Casualty (or Property / Liability) - Casualty Actuarial Society : CAS - 3, 425 in United States / 3, 857 total

Two Branches of Actuarial Science u Life & Health / Pension - Society of Actuaries : SOA - around 17, 000 in United States u Property and Casualty (or Property / Liability) - Casualty Actuarial Society : CAS - 3, 425 in United States / 3, 857 total

P&C Lines of Business Examples Homeowners u Earthquake u Automobile u Mortgage u General Liability u Medical Malpractice u Workers’ Compensation u Products Liability u Reinsurance u

P&C Lines of Business Examples Homeowners u Earthquake u Automobile u Mortgage u General Liability u Medical Malpractice u Workers’ Compensation u Products Liability u Reinsurance u

Example Actuarial Problems - Pricing New Products Price Classification Modeling Catastrophes Strategic Planning Graphing Size of Loss Distributions Establishing Loss Reserves Solvency Monitoring - Rate Adequacy Studies - Trending and Development of Losses Current Leveling of Premiums Credibility Measures

Example Actuarial Problems - Pricing New Products Price Classification Modeling Catastrophes Strategic Planning Graphing Size of Loss Distributions Establishing Loss Reserves Solvency Monitoring - Rate Adequacy Studies - Trending and Development of Losses Current Leveling of Premiums Credibility Measures

Pricing New Products

Pricing New Products

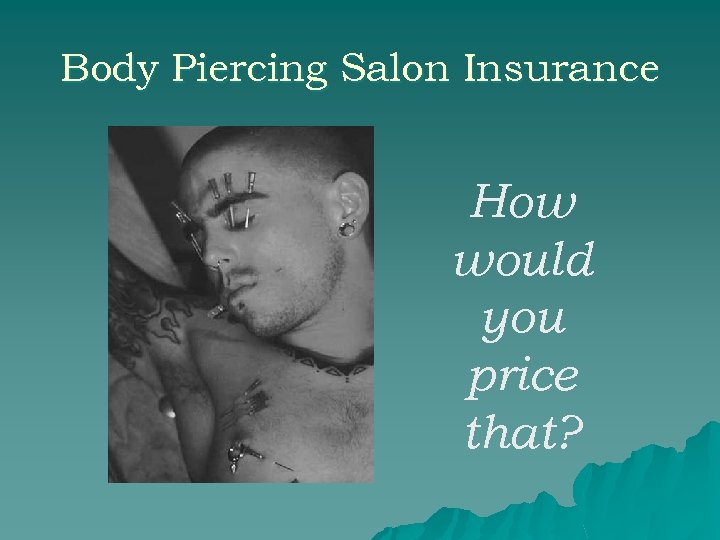

Body Piercing Salon Insurance How would you price that?

Body Piercing Salon Insurance How would you price that?

Loss Development

Loss Development

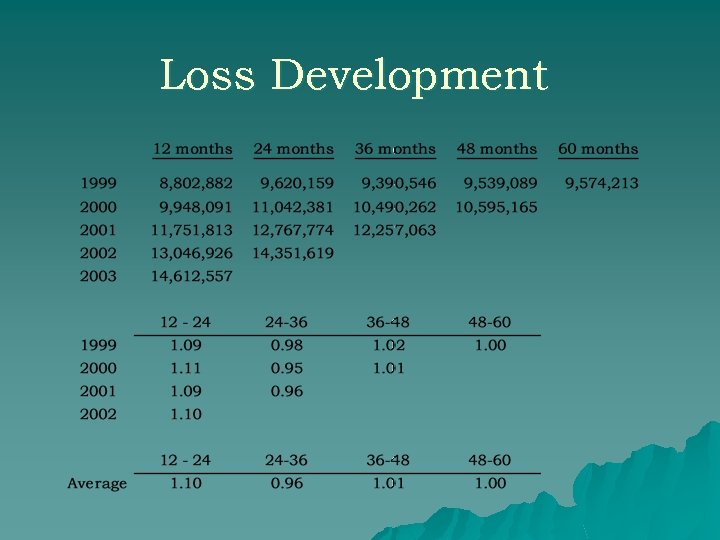

Loss Development

Loss Development

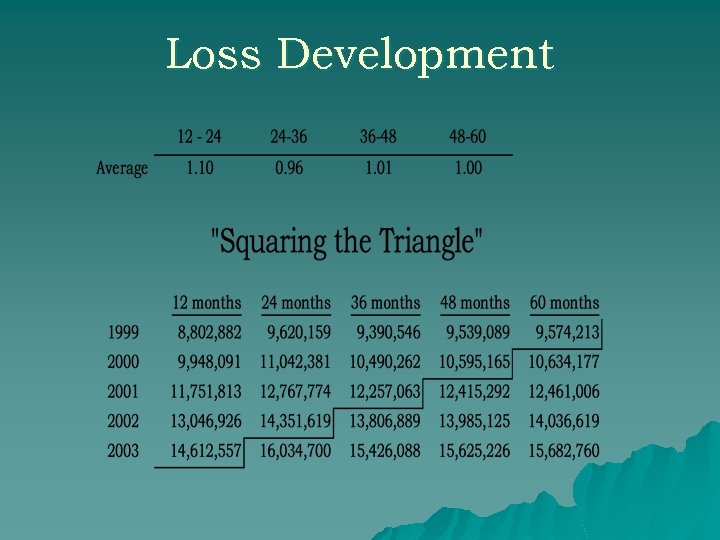

Loss Development

Loss Development

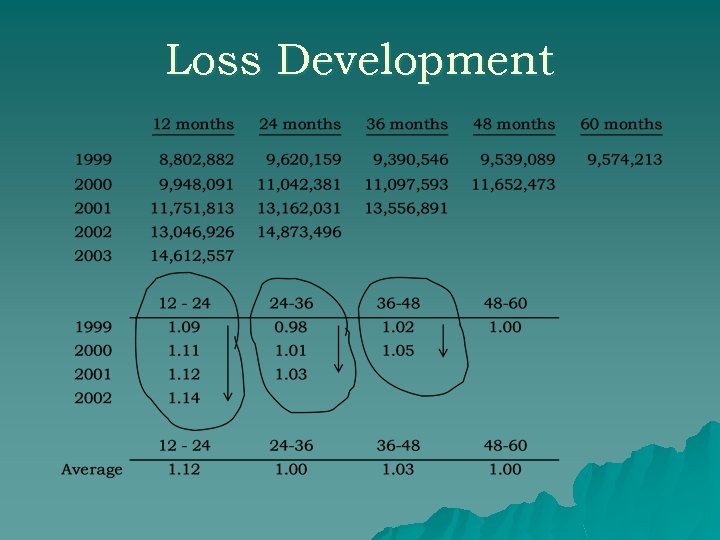

Loss Development

Loss Development

Graphing Size of Loss Distributions

Graphing Size of Loss Distributions

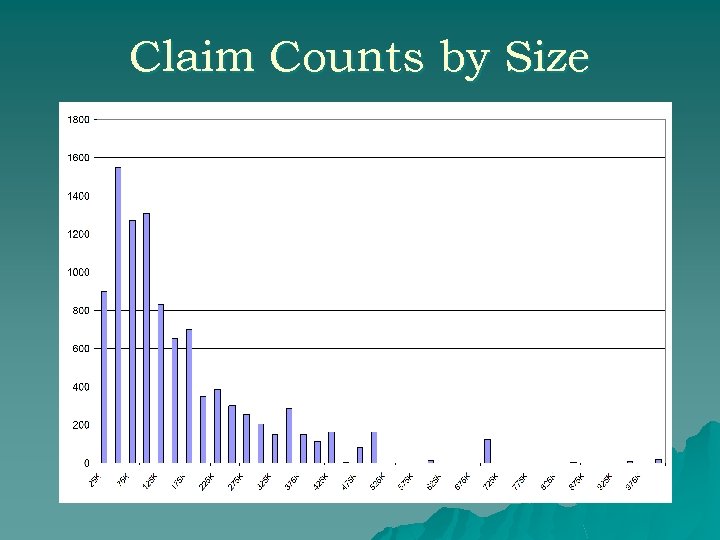

Claim Counts by Size

Claim Counts by Size

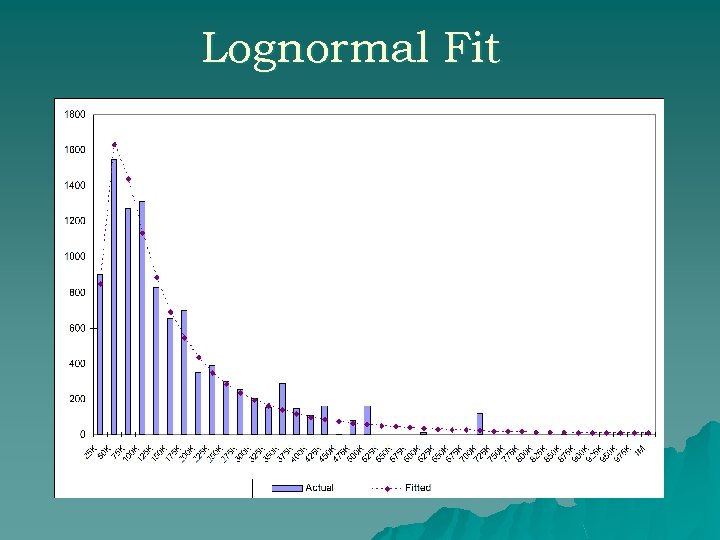

Lognormal Fit

Lognormal Fit

Modeling Catastrophes

Modeling Catastrophes

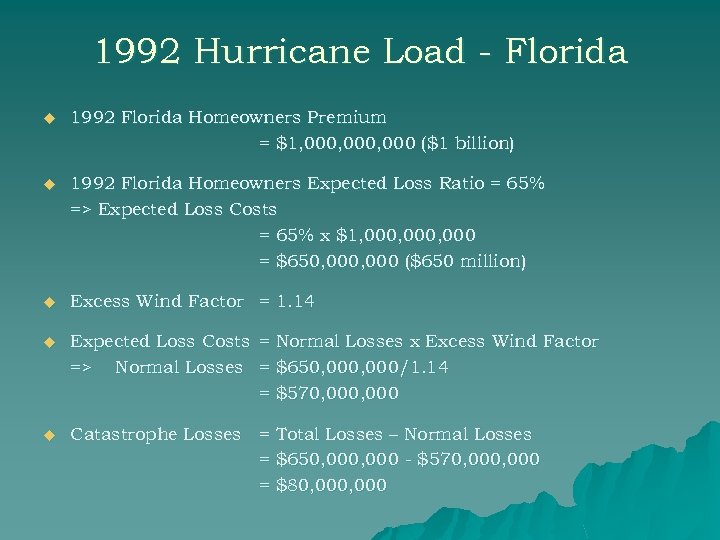

1992 Hurricane Load - Florida u 1992 Florida Homeowners Premium = $1, 000, 000 ($1 billion) u 1992 Florida Homeowners Expected Loss Ratio = 65% => Expected Loss Costs = 65% x $1, 000, 000 = $650, 000 ($650 million) u Excess Wind Factor = 1. 14 u Expected Loss Costs = Normal Losses x Excess Wind Factor => Normal Losses = $650, 000/1. 14 = $570, 000 u Catastrophe Losses = Total Losses – Normal Losses = $650, 000 - $570, 000 = $80, 000

1992 Hurricane Load - Florida u 1992 Florida Homeowners Premium = $1, 000, 000 ($1 billion) u 1992 Florida Homeowners Expected Loss Ratio = 65% => Expected Loss Costs = 65% x $1, 000, 000 = $650, 000 ($650 million) u Excess Wind Factor = 1. 14 u Expected Loss Costs = Normal Losses x Excess Wind Factor => Normal Losses = $650, 000/1. 14 = $570, 000 u Catastrophe Losses = Total Losses – Normal Losses = $650, 000 - $570, 000 = $80, 000

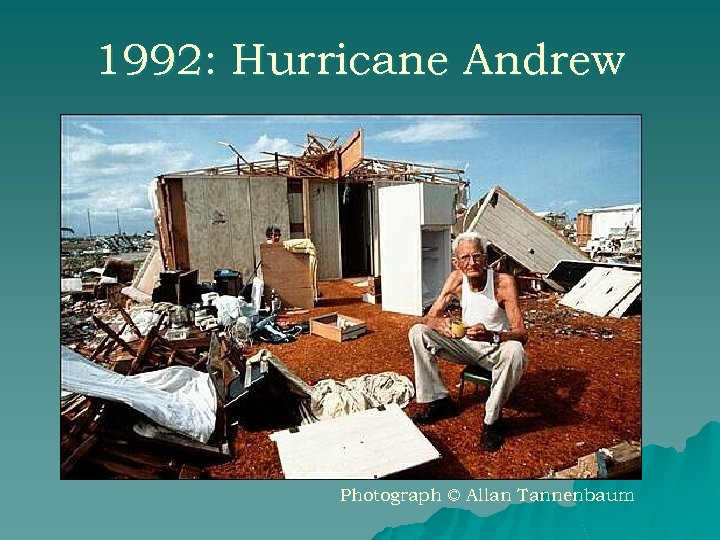

1992: Hurricane Andrew Photograph © Allan Tannenbaum

1992: Hurricane Andrew Photograph © Allan Tannenbaum

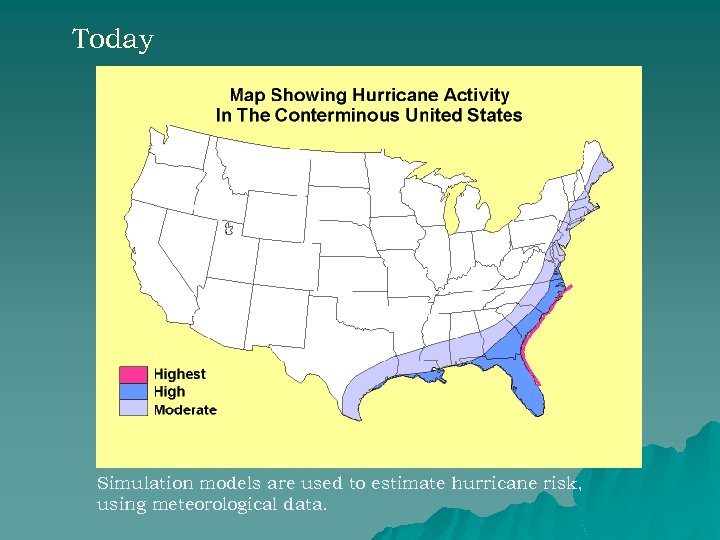

Today Simulation models are used to estimate hurricane risk, using meteorological data.

Today Simulation models are used to estimate hurricane risk, using meteorological data.

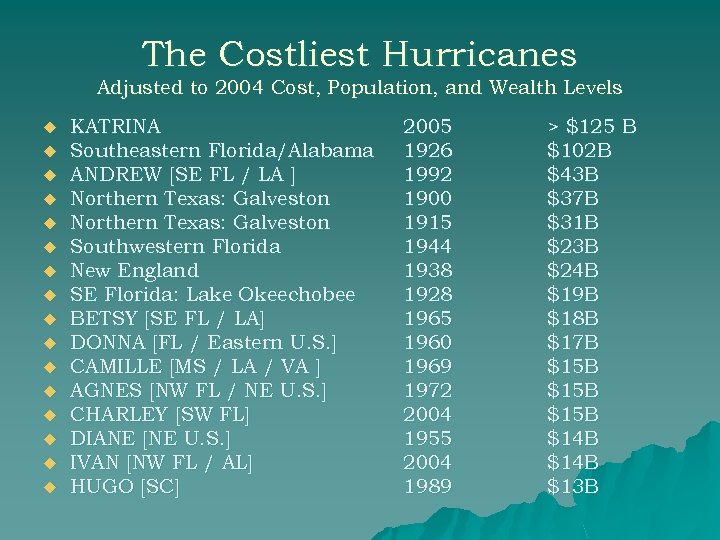

The Costliest Hurricanes Adjusted to 2004 Cost, Population, and Wealth Levels u u u u KATRINA Southeastern Florida/Alabama ANDREW [SE FL / LA ] Northern Texas: Galveston Southwestern Florida New England SE Florida: Lake Okeechobee BETSY [SE FL / LA] DONNA [FL / Eastern U. S. ] CAMILLE [MS / LA / VA ] AGNES [NW FL / NE U. S. ] CHARLEY [SW FL] DIANE [NE U. S. ] IVAN [NW FL / AL] HUGO [SC] 2005 1926 1992 1900 1915 1944 1938 1928 1965 1960 1969 1972 2004 1955 2004 1989 > $125 B $102 B $43 B $37 B $31 B $23 B $24 B $19 B $18 B $17 B $15 B $14 B $13 B

The Costliest Hurricanes Adjusted to 2004 Cost, Population, and Wealth Levels u u u u KATRINA Southeastern Florida/Alabama ANDREW [SE FL / LA ] Northern Texas: Galveston Southwestern Florida New England SE Florida: Lake Okeechobee BETSY [SE FL / LA] DONNA [FL / Eastern U. S. ] CAMILLE [MS / LA / VA ] AGNES [NW FL / NE U. S. ] CHARLEY [SW FL] DIANE [NE U. S. ] IVAN [NW FL / AL] HUGO [SC] 2005 1926 1992 1900 1915 1944 1938 1928 1965 1960 1969 1972 2004 1955 2004 1989 > $125 B $102 B $43 B $37 B $31 B $23 B $24 B $19 B $18 B $17 B $15 B $14 B $13 B

Solvency Monitoring

Solvency Monitoring

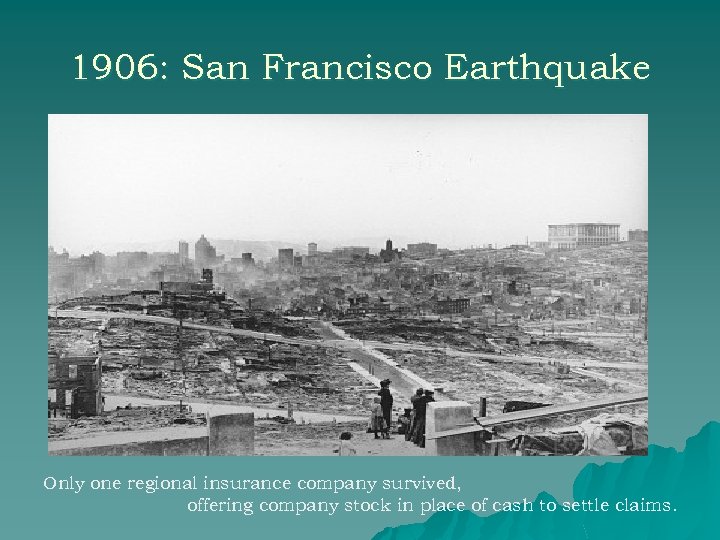

1906: San Francisco Earthquake Only one regional insurance company survived, offering company stock in place of cash to settle claims.

1906: San Francisco Earthquake Only one regional insurance company survived, offering company stock in place of cash to settle claims.

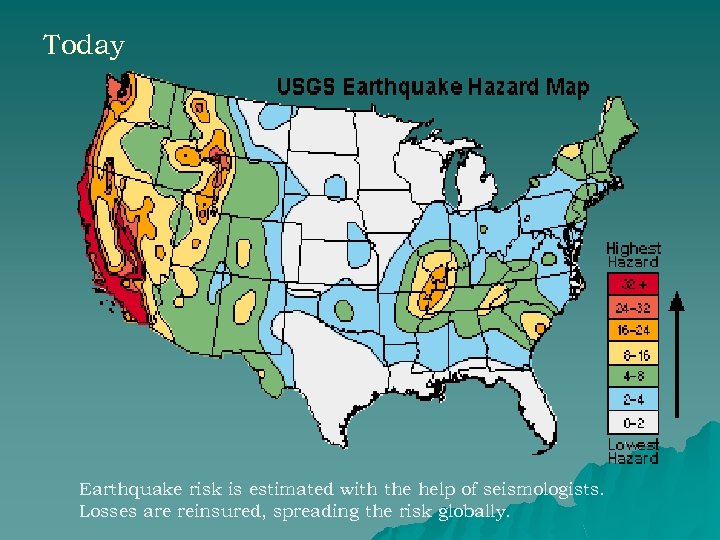

Today Earthquake risk is estimated with the help of seismologists. Losses are reinsured, spreading the risk globally.

Today Earthquake risk is estimated with the help of seismologists. Losses are reinsured, spreading the risk globally.

Are all losses predictable?

Are all losses predictable?

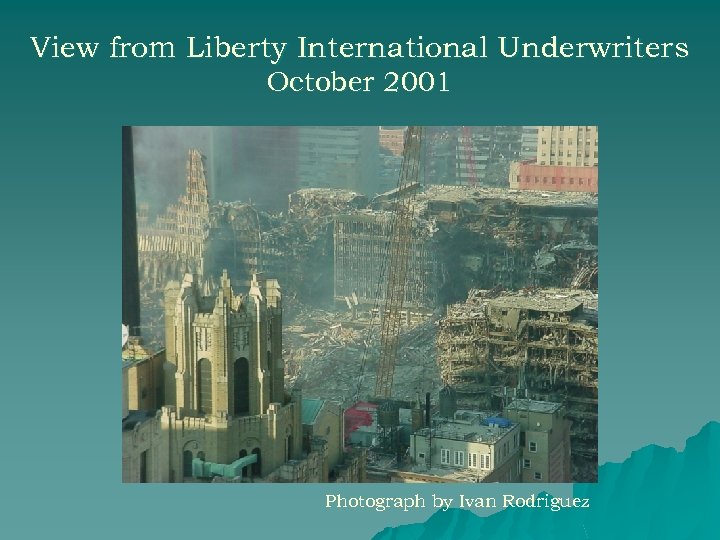

View from Liberty International Underwriters October 2001 Photograph by Ivan Rodriguez

View from Liberty International Underwriters October 2001 Photograph by Ivan Rodriguez

2004 Prediction National Oceanic and Atmospheric Administration “In virtually every coastal city from Texas to Maine, the present Tropical Prediction Center Director (Max Mayfield) former National Hurricane Center Directors have stated that the United States is building towards its next hurricane disaster. … The areas along the United States Gulf and Atlantic coasts where most of this country’s hurricane related fatalities have occurred are also now experiencing the country’s most significant growth in population. This situation, in combination with continued building along the coast, will lead to serious problems for many areas in hurricanes. ”

2004 Prediction National Oceanic and Atmospheric Administration “In virtually every coastal city from Texas to Maine, the present Tropical Prediction Center Director (Max Mayfield) former National Hurricane Center Directors have stated that the United States is building towards its next hurricane disaster. … The areas along the United States Gulf and Atlantic coasts where most of this country’s hurricane related fatalities have occurred are also now experiencing the country’s most significant growth in population. This situation, in combination with continued building along the coast, will lead to serious problems for many areas in hurricanes. ”

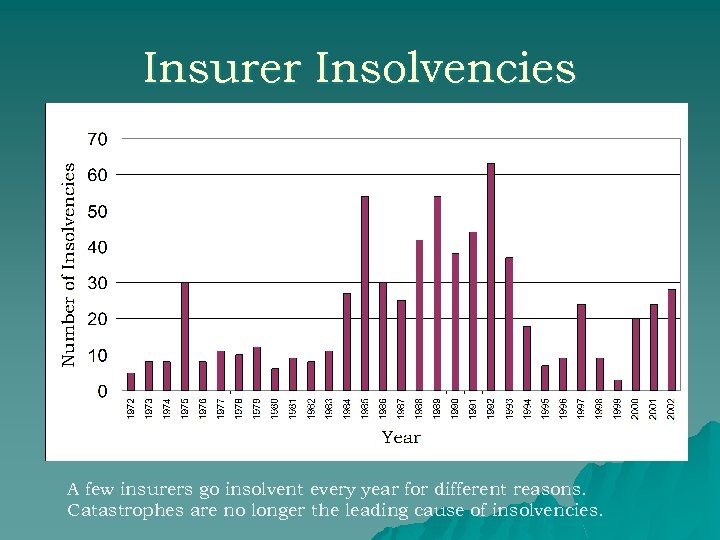

Insurer Insolvencies A few insurers go insolvent every year for different reasons. Catastrophes are no longer the leading cause of insolvencies.

Insurer Insolvencies A few insurers go insolvent every year for different reasons. Catastrophes are no longer the leading cause of insolvencies.

Who do actuaries work for? u u u u u Insurance companies Consulting firms Government insurance departments Colleges and universities Banks and investment firms Large corporations Public accounting firms Failure Analysis firms Reinsurers Themselves

Who do actuaries work for? u u u u u Insurance companies Consulting firms Government insurance departments Colleges and universities Banks and investment firms Large corporations Public accounting firms Failure Analysis firms Reinsurers Themselves

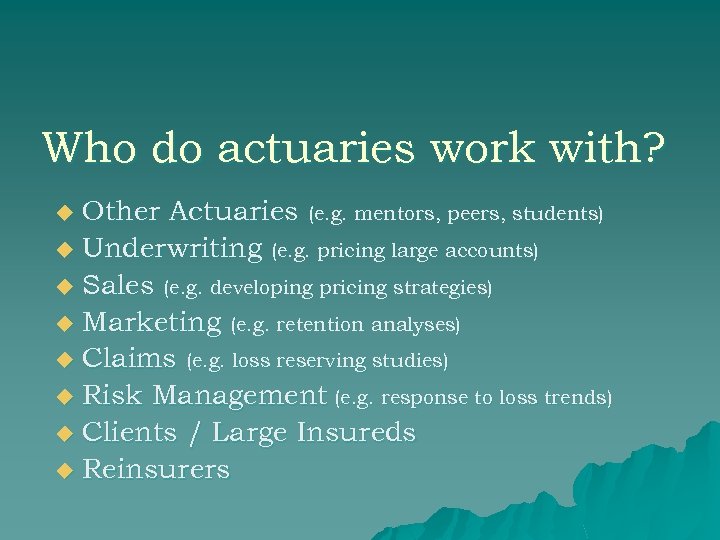

Who do actuaries work with? Other Actuaries (e. g. mentors, peers, students) u Underwriting (e. g. pricing large accounts) u Sales (e. g. developing pricing strategies) u Marketing (e. g. retention analyses) u Claims (e. g. loss reserving studies) u Risk Management (e. g. response to loss trends) u Clients / Large Insureds u Reinsurers u

Who do actuaries work with? Other Actuaries (e. g. mentors, peers, students) u Underwriting (e. g. pricing large accounts) u Sales (e. g. developing pricing strategies) u Marketing (e. g. retention analyses) u Claims (e. g. loss reserving studies) u Risk Management (e. g. response to loss trends) u Clients / Large Insureds u Reinsurers u

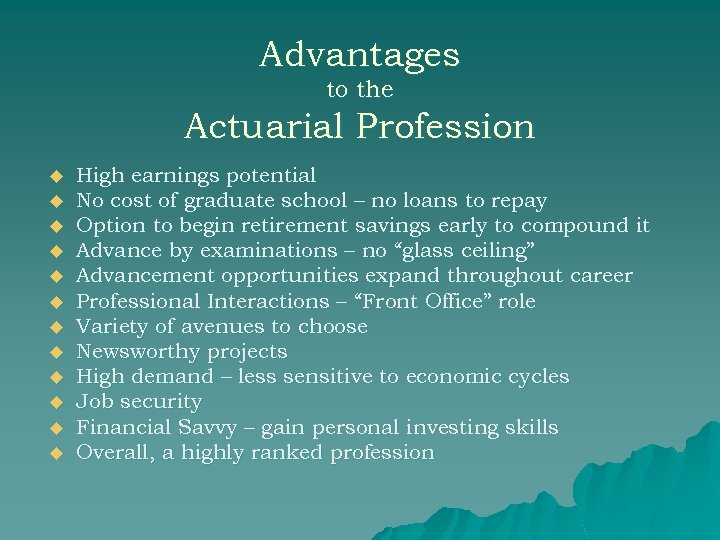

Advantages to the Actuarial Profession u u u High earnings potential No cost of graduate school – no loans to repay Option to begin retirement savings early to compound it Advance by examinations – no “glass ceiling” Advancement opportunities expand throughout career Professional Interactions – “Front Office” role Variety of avenues to choose Newsworthy projects High demand – less sensitive to economic cycles Job security Financial Savvy – gain personal investing skills Overall, a highly ranked profession

Advantages to the Actuarial Profession u u u High earnings potential No cost of graduate school – no loans to repay Option to begin retirement savings early to compound it Advance by examinations – no “glass ceiling” Advancement opportunities expand throughout career Professional Interactions – “Front Office” role Variety of avenues to choose Newsworthy projects High demand – less sensitive to economic cycles Job security Financial Savvy – gain personal investing skills Overall, a highly ranked profession

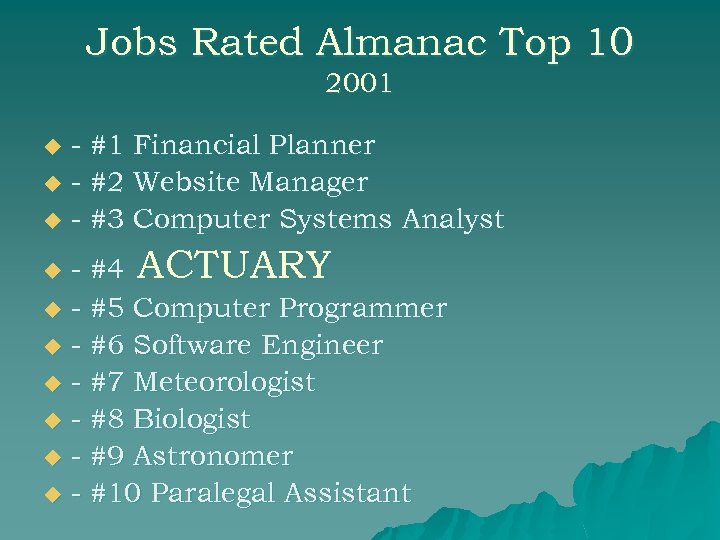

The Jobs Rated Almanac ranks careers according to: Environment u Income u Outlook u Physical Demands u Security u Stress u

The Jobs Rated Almanac ranks careers according to: Environment u Income u Outlook u Physical Demands u Security u Stress u

Jobs Rated Almanac Top 10 2001 - #1 Financial Planner u - #2 Website Manager u - #3 Computer Systems Analyst u - #4 ACTUARY u - #5 Computer Programmer u - #6 Software Engineer u - #7 Meteorologist u - #8 Biologist u - #9 Astronomer u - #10 Paralegal Assistant u

Jobs Rated Almanac Top 10 2001 - #1 Financial Planner u - #2 Website Manager u - #3 Computer Systems Analyst u - #4 ACTUARY u - #5 Computer Programmer u - #6 Software Engineer u - #7 Meteorologist u - #8 Biologist u - #9 Astronomer u - #10 Paralegal Assistant u

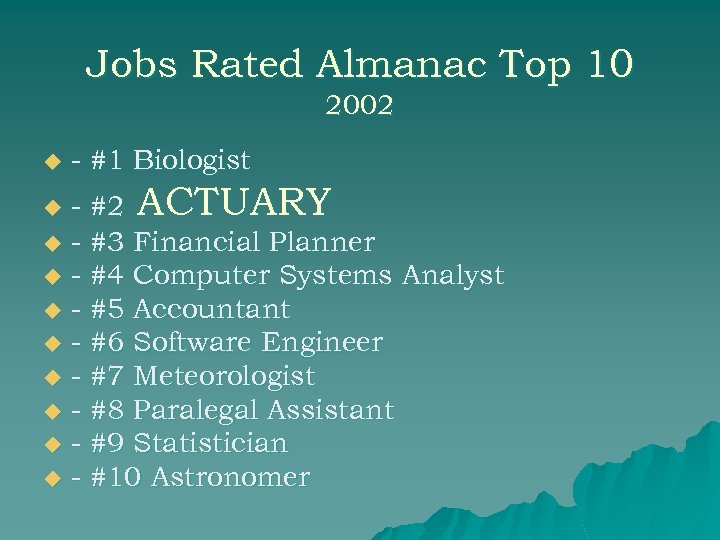

Jobs Rated Almanac Top 10 2002 u - #1 Biologist - #2 ACTUARY u - #3 Financial Planner u - #4 Computer Systems Analyst u - #5 Accountant u - #6 Software Engineer u - #7 Meteorologist u - #8 Paralegal Assistant u - #9 Statistician u - #10 Astronomer u

Jobs Rated Almanac Top 10 2002 u - #1 Biologist - #2 ACTUARY u - #3 Financial Planner u - #4 Computer Systems Analyst u - #5 Accountant u - #6 Software Engineer u - #7 Meteorologist u - #8 Paralegal Assistant u - #9 Statistician u - #10 Astronomer u

Average Earnings based on level of formal education u High School: u Bachelor’s: u Master’s: u Ph. D: $12, 900 $49, 700 $61, 000 $80, 000

Average Earnings based on level of formal education u High School: u Bachelor’s: u Master’s: u Ph. D: $12, 900 $49, 700 $61, 000 $80, 000

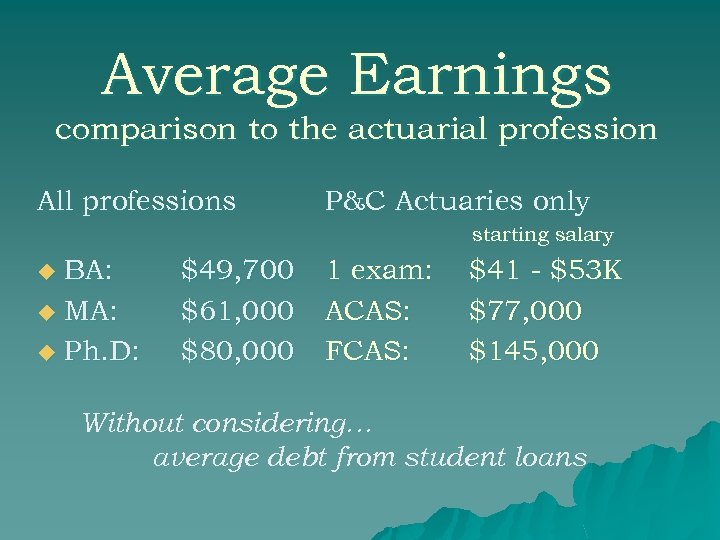

Average Earnings comparison to the actuarial profession All professions P&C Actuaries only starting salary BA: u MA: u Ph. D: u $49, 700 $61, 000 $80, 000 1 exam: ACAS: FCAS: $41 - $53 K $77, 000 $145, 000 Without considering… average debt from student loans

Average Earnings comparison to the actuarial profession All professions P&C Actuaries only starting salary BA: u MA: u Ph. D: u $49, 700 $61, 000 $80, 000 1 exam: ACAS: FCAS: $41 - $53 K $77, 000 $145, 000 Without considering… average debt from student loans

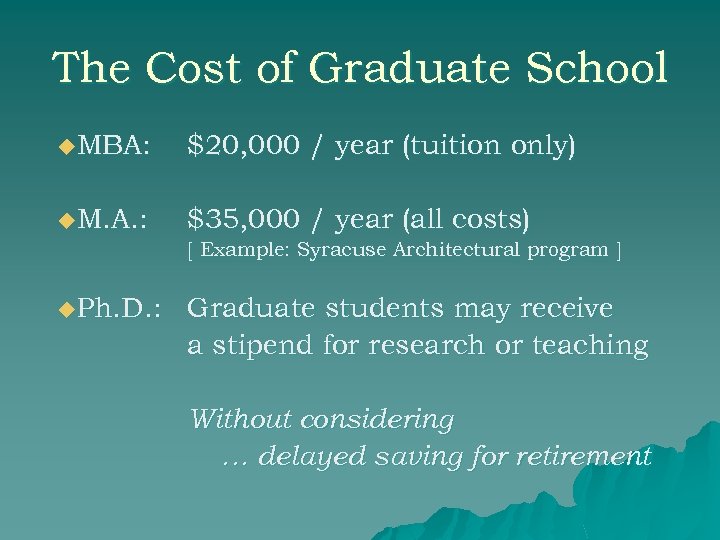

The Cost of Graduate School u. MBA: $20, 000 / year (tuition only) u. M. A. : $35, 000 / year (all costs) [ Example: Syracuse Architectural program ] u. Ph. D. : Graduate students may receive a stipend for research or teaching Without considering … delayed saving for retirement

The Cost of Graduate School u. MBA: $20, 000 / year (tuition only) u. M. A. : $35, 000 / year (all costs) [ Example: Syracuse Architectural program ] u. Ph. D. : Graduate students may receive a stipend for research or teaching Without considering … delayed saving for retirement

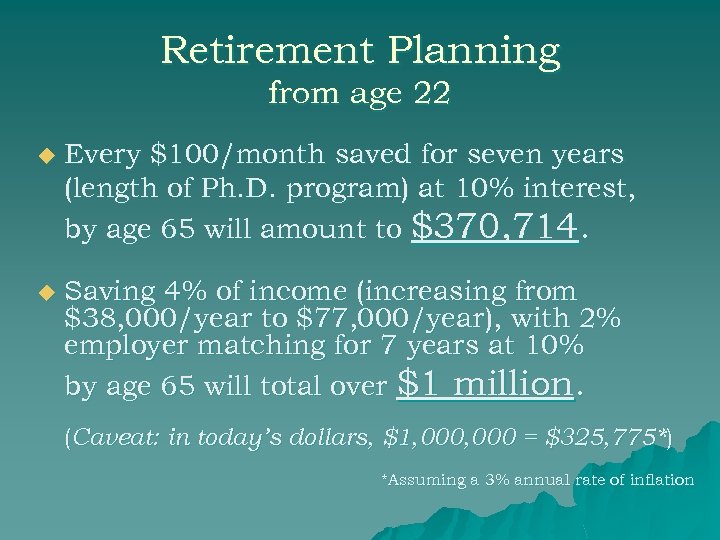

Retirement Planning from age 22 u Every $100/month saved for seven years (length of Ph. D. program) at 10% interest, by age 65 will amount to $370, 714. u Saving 4% of income (increasing from $38, 000/year to $77, 000/year), with 2% employer matching for 7 years at 10% by age 65 will total over $1 million. (Caveat: in today’s dollars, $1, 000 = $325, 775*) *Assuming a 3% annual rate of inflation

Retirement Planning from age 22 u Every $100/month saved for seven years (length of Ph. D. program) at 10% interest, by age 65 will amount to $370, 714. u Saving 4% of income (increasing from $38, 000/year to $77, 000/year), with 2% employer matching for 7 years at 10% by age 65 will total over $1 million. (Caveat: in today’s dollars, $1, 000 = $325, 775*) *Assuming a 3% annual rate of inflation

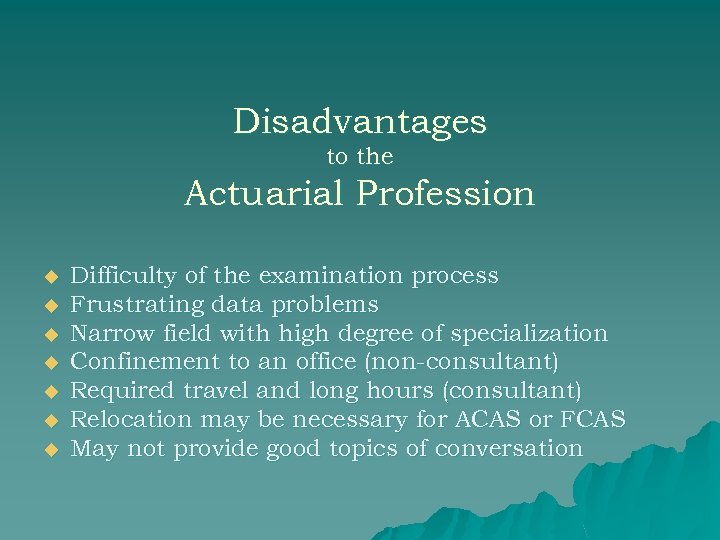

Disadvantages to the Actuarial Profession u u u u Difficulty of the examination process Frustrating data problems Narrow field with high degree of specialization Confinement to an office (non-consultant) Required travel and long hours (consultant) Relocation may be necessary for ACAS or FCAS May not provide good topics of conversation

Disadvantages to the Actuarial Profession u u u u Difficulty of the examination process Frustrating data problems Narrow field with high degree of specialization Confinement to an office (non-consultant) Required travel and long hours (consultant) Relocation may be necessary for ACAS or FCAS May not provide good topics of conversation

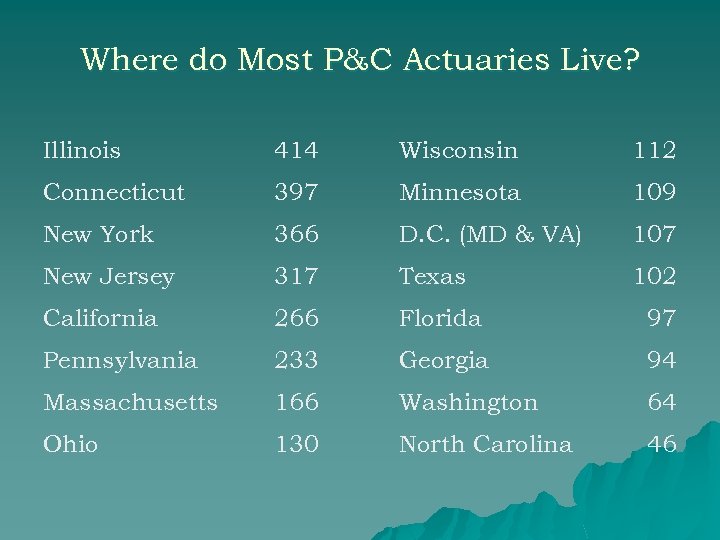

Where do Most P&C Actuaries Live? Illinois 414 Wisconsin 112 Connecticut 397 Minnesota 109 New York 366 D. C. (MD & VA) 107 New Jersey 317 Texas 102 California 266 Florida 97 Pennsylvania 233 Georgia 94 Massachusetts 166 Washington 64 Ohio 130 North Carolina 46

Where do Most P&C Actuaries Live? Illinois 414 Wisconsin 112 Connecticut 397 Minnesota 109 New York 366 D. C. (MD & VA) 107 New Jersey 317 Texas 102 California 266 Florida 97 Pennsylvania 233 Georgia 94 Massachusetts 166 Washington 64 Ohio 130 North Carolina 46

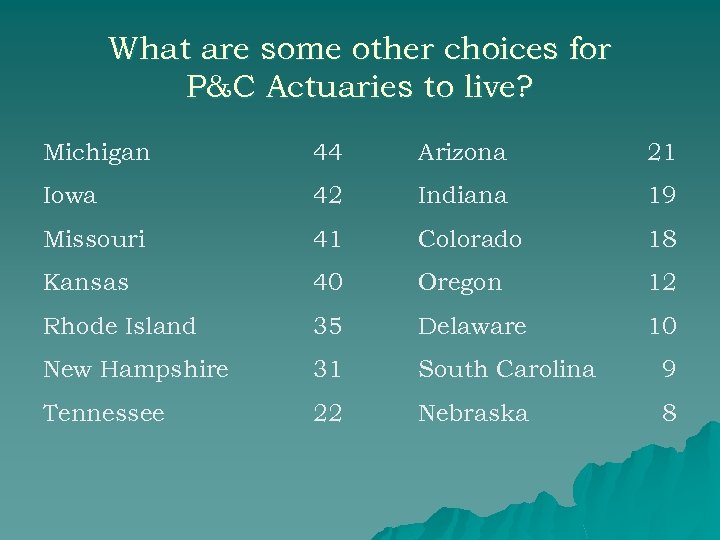

What are some other choices for P&C Actuaries to live? Michigan 44 Arizona 21 Iowa 42 Indiana 19 Missouri 41 Colorado 18 Kansas 40 Oregon 12 Rhode Island 35 Delaware 10 New Hampshire 31 South Carolina 9 Tennessee 22 Nebraska 8

What are some other choices for P&C Actuaries to live? Michigan 44 Arizona 21 Iowa 42 Indiana 19 Missouri 41 Colorado 18 Kansas 40 Oregon 12 Rhode Island 35 Delaware 10 New Hampshire 31 South Carolina 9 Tennessee 22 Nebraska 8

Where might a P&C actuary be hard pressed to find a job? Alabama 7 Idaho 2 Louisiana 6 Montana 2 Maine 6 Oklahoma 2 Nevada 6 West Virginia 2 Kentucky 4 Arkansas 1 Vermont 4 Hawaii 1 Mississippi 3 North Dakota 1 New Mexico 3 Utah 1 Alaska 2 Wyoming 0

Where might a P&C actuary be hard pressed to find a job? Alabama 7 Idaho 2 Louisiana 6 Montana 2 Maine 6 Oklahoma 2 Nevada 6 West Virginia 2 Kentucky 4 Arkansas 1 Vermont 4 Hawaii 1 Mississippi 3 North Dakota 1 New Mexico 3 Utah 1 Alaska 2 Wyoming 0

International CAS Members Canada 246 China 3 Bermuda 73 Mexico 3 United Kingdom 31 South Korea 3 Switzerland 22 Brazil 2 Singapore 7 Israel 2 Taiwan 7 Barbados (W. I. ) 1 Australia 6 Cayman Islands 1 France 6 Italy 1 Germany 6 Japan 1 Hong Kong 6 South Africa 1 Ireland 4

International CAS Members Canada 246 China 3 Bermuda 73 Mexico 3 United Kingdom 31 South Korea 3 Switzerland 22 Brazil 2 Singapore 7 Israel 2 Taiwan 7 Barbados (W. I. ) 1 Australia 6 Cayman Islands 1 France 6 Italy 1 Germany 6 Japan 1 Hong Kong 6 South Africa 1 Ireland 4

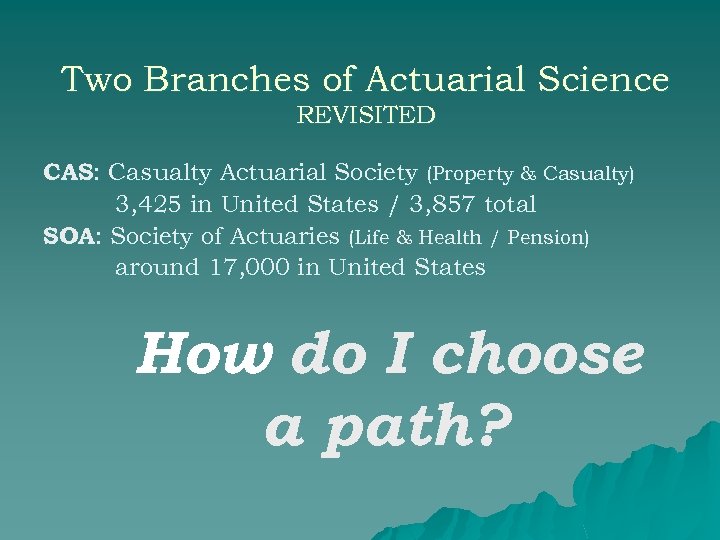

Two Branches of Actuarial Science REVISITED CAS: Casualty Actuarial Society (Property & Casualty) 3, 425 in United States / 3, 857 total SOA: Society of Actuaries (Life & Health / Pension) around 17, 000 in United States How do I choose a path?

Two Branches of Actuarial Science REVISITED CAS: Casualty Actuarial Society (Property & Casualty) 3, 425 in United States / 3, 857 total SOA: Society of Actuaries (Life & Health / Pension) around 17, 000 in United States How do I choose a path?

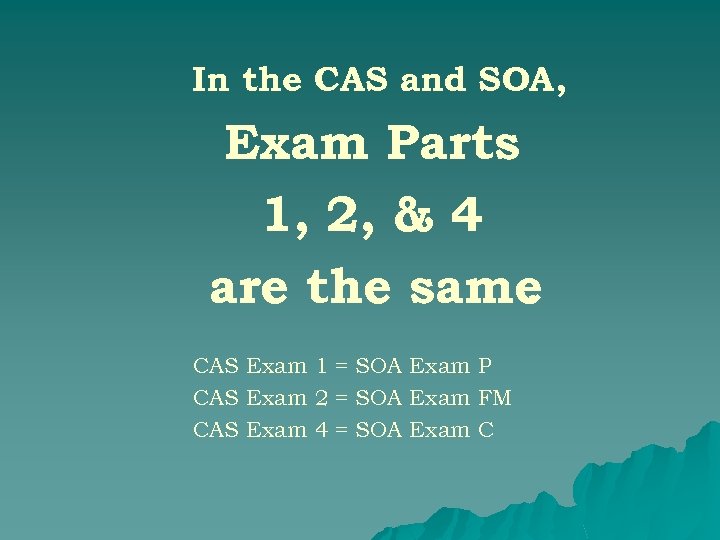

In the CAS and SOA, Exam Parts 1, 2, & 4 are the same. CAS Exam 1 = SOA Exam P CAS Exam 2 = SOA Exam FM CAS Exam 4 = SOA Exam C

In the CAS and SOA, Exam Parts 1, 2, & 4 are the same. CAS Exam 1 = SOA Exam P CAS Exam 2 = SOA Exam FM CAS Exam 4 = SOA Exam C

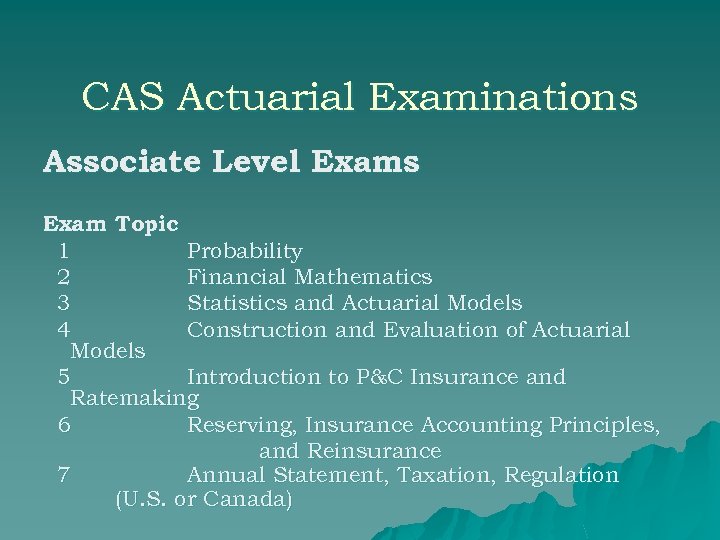

CAS Actuarial Examinations Associate Level Exams Exam Topic 1 Probability 2 Financial Mathematics 3 Statistics and Actuarial Models 4 Construction and Evaluation of Actuarial Models 5 Introduction to P&C Insurance and Ratemaking 6 Reserving, Insurance Accounting Principles, and Reinsurance 7 Annual Statement, Taxation, Regulation (U. S. or Canada)

CAS Actuarial Examinations Associate Level Exams Exam Topic 1 Probability 2 Financial Mathematics 3 Statistics and Actuarial Models 4 Construction and Evaluation of Actuarial Models 5 Introduction to P&C Insurance and Ratemaking 6 Reserving, Insurance Accounting Principles, and Reinsurance 7 Annual Statement, Taxation, Regulation (U. S. or Canada)

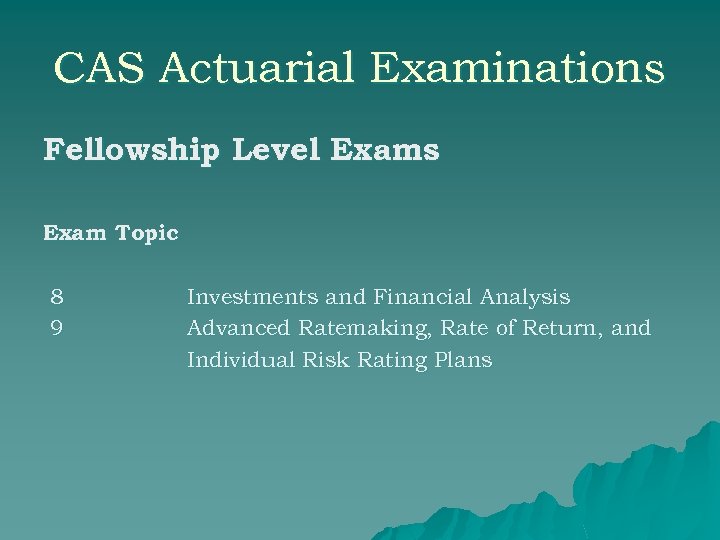

CAS Actuarial Examinations Fellowship Level Exams Exam Topic 8 9 Investments and Financial Analysis Advanced Ratemaking, Rate of Return, and Individual Risk Rating Plans

CAS Actuarial Examinations Fellowship Level Exams Exam Topic 8 9 Investments and Financial Analysis Advanced Ratemaking, Rate of Return, and Individual Risk Rating Plans

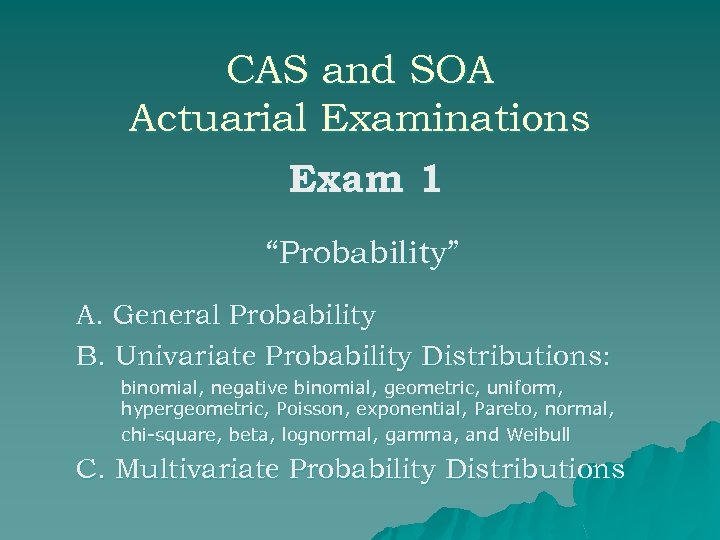

CAS and SOA Actuarial Examinations Exam 1 “Probability” A. General Probability B. Univariate Probability Distributions: binomial, negative binomial, geometric, uniform, hypergeometric, Poisson, exponential, Pareto, normal, chi-square, beta, lognormal, gamma, and Weibull C. Multivariate Probability Distributions

CAS and SOA Actuarial Examinations Exam 1 “Probability” A. General Probability B. Univariate Probability Distributions: binomial, negative binomial, geometric, uniform, hypergeometric, Poisson, exponential, Pareto, normal, chi-square, beta, lognormal, gamma, and Weibull C. Multivariate Probability Distributions

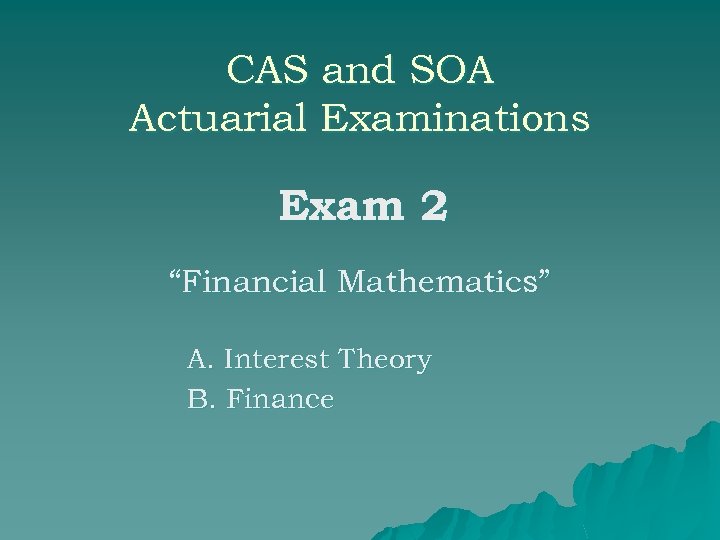

CAS and SOA Actuarial Examinations Exam 2 “Financial Mathematics” A. Interest Theory B. Finance

CAS and SOA Actuarial Examinations Exam 2 “Financial Mathematics” A. Interest Theory B. Finance

Validation by Educational Experience (“VEE”) 1. Applied Statistical Methods 2. Corporate Finance 3. Economics

Validation by Educational Experience (“VEE”) 1. Applied Statistical Methods 2. Corporate Finance 3. Economics

Skills and Personality Traits to succeed as an Actuary • • • Analytic thinking Problem solving Good common sense / “business” sense Facility with Mathematics Ability to explain complex ideas Organized, concise writer Determination Independence Disciplined study habits Tendency to start projects early Comfortable using computer programs like Excel, Access, Word, SAS

Skills and Personality Traits to succeed as an Actuary • • • Analytic thinking Problem solving Good common sense / “business” sense Facility with Mathematics Ability to explain complex ideas Organized, concise writer Determination Independence Disciplined study habits Tendency to start projects early Comfortable using computer programs like Excel, Access, Word, SAS

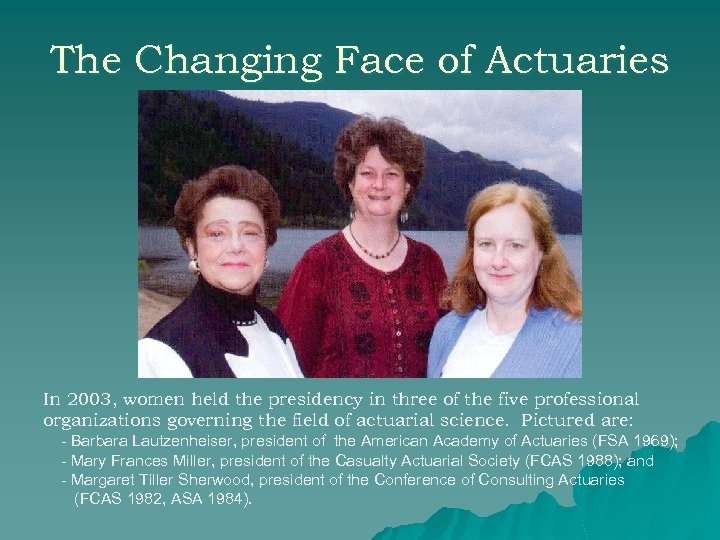

The Changing Face of Actuaries In 2003, women held the presidency in three of the five professional organizations governing the field of actuarial science. Pictured are: - Barbara Lautzenheiser, president of the American Academy of Actuaries (FSA 1969); - Mary Frances Miller, president of the Casualty Actuarial Society (FCAS 1988); and - Margaret Tiller Sherwood, president of the Conference of Consulting Actuaries (FCAS 1982, ASA 1984).

The Changing Face of Actuaries In 2003, women held the presidency in three of the five professional organizations governing the field of actuarial science. Pictured are: - Barbara Lautzenheiser, president of the American Academy of Actuaries (FSA 1969); - Mary Frances Miller, president of the Casualty Actuarial Society (FCAS 1988); and - Margaret Tiller Sherwood, president of the Conference of Consulting Actuaries (FCAS 1982, ASA 1984).

The International Association of Black Actuaries IABA’s 2002 Annual Meeting Membership in IABA is growing.

The International Association of Black Actuaries IABA’s 2002 Annual Meeting Membership in IABA is growing.

Advancing Diversity u Minority Students: – African American, Latino, or Native American u Scholarships for Minority Students – Individual awards of $500 - $3, 000, annually – Demonstrated performance and commitment u Exam Fee Reimbursement for Minority Students – Reimbursed for successfully passing Exam 1 – $175 exam fee reimbursed, up to two times ($350) u Visit the website www. Be. An. Actuary. org Minority Programs: Scholarship applications, exam fee reimbursement forms, internships, and more.

Advancing Diversity u Minority Students: – African American, Latino, or Native American u Scholarships for Minority Students – Individual awards of $500 - $3, 000, annually – Demonstrated performance and commitment u Exam Fee Reimbursement for Minority Students – Reimbursed for successfully passing Exam 1 – $175 exam fee reimbursed, up to two times ($350) u Visit the website www. Be. An. Actuary. org Minority Programs: Scholarship applications, exam fee reimbursement forms, internships, and more.

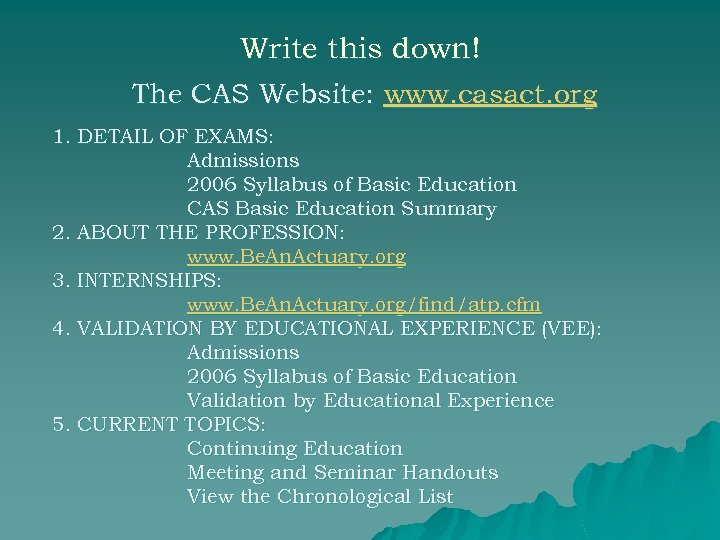

Write this down! The CAS Website: www. casact. org 1. DETAIL OF EXAMS: Admissions 2006 Syllabus of Basic Education CAS Basic Education Summary 2. ABOUT THE PROFESSION: www. Be. An. Actuary. org 3. INTERNSHIPS: www. Be. An. Actuary. org/find/atp. cfm 4. VALIDATION BY EDUCATIONAL EXPERIENCE (VEE): Admissions 2006 Syllabus of Basic Education Validation by Educational Experience 5. CURRENT TOPICS: Continuing Education Meeting and Seminar Handouts View the Chronological List

Write this down! The CAS Website: www. casact. org 1. DETAIL OF EXAMS: Admissions 2006 Syllabus of Basic Education CAS Basic Education Summary 2. ABOUT THE PROFESSION: www. Be. An. Actuary. org 3. INTERNSHIPS: www. Be. An. Actuary. org/find/atp. cfm 4. VALIDATION BY EDUCATIONAL EXPERIENCE (VEE): Admissions 2006 Syllabus of Basic Education Validation by Educational Experience 5. CURRENT TOPICS: Continuing Education Meeting and Seminar Handouts View the Chronological List

The End

The End