018c349f286be5181a6904c02f1ab35e.ppt

- Количество слайдов: 46

The ACA Five- Years Later—An Update on Health Care Reform Al Heuer, Ph. D, MBA, RRT, RPFT Professor & Program Director Rutgers School of Health Related Professions

The ACA Five- Years Later—An Update on Health Care Reform Al Heuer, Ph. D, MBA, RRT, RPFT Professor & Program Director Rutgers School of Health Related Professions

Learning Objectives Summarize Key Facts about Our Health Care System Review the History & Legislative Process of Health Care Reform Summarize the Some Major Features of the Law. Describe the Reality of It’s Impact on: Us as Clinicians and Consumers Health Care Organizations Review Future Implications Furnish Additional Resources

Learning Objectives Summarize Key Facts about Our Health Care System Review the History & Legislative Process of Health Care Reform Summarize the Some Major Features of the Law. Describe the Reality of It’s Impact on: Us as Clinicians and Consumers Health Care Organizations Review Future Implications Furnish Additional Resources

US Health Care System—The Best & the Worst Strengths: Strong Investment in Technology & Research Safety Net for Elderly, Disabled & Disadvantaged. Weaknesses: Cost In 2010. 47 mil. (16%) of Americans were Uninsured Unequal access to care Uneven clinical outcomes Health catastrophes are leading cause of U. S. bankruptcies. Inefficient use of services ER as primary care Futile Care—We don’t know how to say “no mas”!

US Health Care System—The Best & the Worst Strengths: Strong Investment in Technology & Research Safety Net for Elderly, Disabled & Disadvantaged. Weaknesses: Cost In 2010. 47 mil. (16%) of Americans were Uninsured Unequal access to care Uneven clinical outcomes Health catastrophes are leading cause of U. S. bankruptcies. Inefficient use of services ER as primary care Futile Care—We don’t know how to say “no mas”!

Health Care Systems of Other Countries • US Health Care cost twice that of other developed countries; approximates 6 th largest national GDP. • Universal Health Care - Canada-national public policy provides disincentives for using private health insurance. * National Health Care-England-National Health Service founded in 1948. Co-lateral private health insurance is allowed. * Germany spends approx. 10% of it’s GDP on Health Care; 5 -6% for many European countries

Health Care Systems of Other Countries • US Health Care cost twice that of other developed countries; approximates 6 th largest national GDP. • Universal Health Care - Canada-national public policy provides disincentives for using private health insurance. * National Health Care-England-National Health Service founded in 1948. Co-lateral private health insurance is allowed. * Germany spends approx. 10% of it’s GDP on Health Care; 5 -6% for many European countries

Initial Attempts at Reform FDR wanted national health care to be included in the 1935 Social Security Act. President Truman attempted to initiate a national health care insurance program. Was on Jimmy Carter’s agenda. 1993 Hillary Clinton —Ultimately unsuccessful, largely due to insurance industry opposition.

Initial Attempts at Reform FDR wanted national health care to be included in the 1935 Social Security Act. President Truman attempted to initiate a national health care insurance program. Was on Jimmy Carter’s agenda. 1993 Hillary Clinton —Ultimately unsuccessful, largely due to insurance industry opposition.

Contentious Political Process for This Law President Obama’s 2010 budget set aside $600 Billion for Health Care reform. July 15, 2009 - Senate Health Committee passes its bill. August/Sept. - White House loses control of the debate. November 2009 - Dems introduce new Senate bill, including an increased payroll tax on the wealthy. December 2009 - 25 day debate in the Senate. February 2010 - Bi-Partisan summit with Obama. March 2010 - To avoid a Senate Republican filibuster, House passes the Senate version with “sidecar” of fixes. Final Votes: House 228 -207; Senate 56 -43. Signed into Law March 23, 2010. (974 pages long)

Contentious Political Process for This Law President Obama’s 2010 budget set aside $600 Billion for Health Care reform. July 15, 2009 - Senate Health Committee passes its bill. August/Sept. - White House loses control of the debate. November 2009 - Dems introduce new Senate bill, including an increased payroll tax on the wealthy. December 2009 - 25 day debate in the Senate. February 2010 - Bi-Partisan summit with Obama. March 2010 - To avoid a Senate Republican filibuster, House passes the Senate version with “sidecar” of fixes. Final Votes: House 228 -207; Senate 56 -43. Signed into Law March 23, 2010. (974 pages long)

Features of the Bill – Impact Many Stakeholders Individuals Small Businesses Insurance Companies Hospitals, Doctors & Clinicians

Features of the Bill – Impact Many Stakeholders Individuals Small Businesses Insurance Companies Hospitals, Doctors & Clinicians

Initial Features of the Bill - Individuals Mandates that all Americans have Health Insurance. Creates Health Insurance Exchanges for Uninsured Self-employed Subsidies for low-income individuals/families (133% to 400% of the poverty level). Expands Medicaid coverage. Prescription “Donut Hole” Rebate, Fills some of the limits for prescriptions under Medicare.

Initial Features of the Bill - Individuals Mandates that all Americans have Health Insurance. Creates Health Insurance Exchanges for Uninsured Self-employed Subsidies for low-income individuals/families (133% to 400% of the poverty level). Expands Medicaid coverage. Prescription “Donut Hole” Rebate, Fills some of the limits for prescriptions under Medicare.

Initial Features of the Bill Individuals (cont. ) Must cover preventative care, including checks ups with no deductible. Asthma management Smoking cessation Coverage for adults with pre-existing conditions. Young adults can continue on parents plan until age 26. Mandated Coverage: Penalty of $695/Indiv. in 2016.

Initial Features of the Bill Individuals (cont. ) Must cover preventative care, including checks ups with no deductible. Asthma management Smoking cessation Coverage for adults with pre-existing conditions. Young adults can continue on parents plan until age 26. Mandated Coverage: Penalty of $695/Indiv. in 2016.

Features of the Bill - Small Businesses Creates similar exchanges for smallmedium sized businesses. Small Business tax Credits – 50% of health ins. premiums applied as credits for businesses with less than 50 employees. Companies with 50 or more employees must cover 95% of full-time employees by 2016.

Features of the Bill - Small Businesses Creates similar exchanges for smallmedium sized businesses. Small Business tax Credits – 50% of health ins. premiums applied as credits for businesses with less than 50 employees. Companies with 50 or more employees must cover 95% of full-time employees by 2016.

Initial Features of the Bill - Insurance Companies End of Rescissions-Insurance Co’s can’t cut someone when he/she gets sick. Insurance Company Transparency-Must reveal amount spent on overhead. Higher loss-ratio requirements (now 85%) for insurance companies to take advantage of tax benefits. Customer Appeals-Any new plan must implement an appeal process for coverage determinations and claims. 40% tax on insurance companies offering Cadillac H. I. Plans.

Initial Features of the Bill - Insurance Companies End of Rescissions-Insurance Co’s can’t cut someone when he/she gets sick. Insurance Company Transparency-Must reveal amount spent on overhead. Higher loss-ratio requirements (now 85%) for insurance companies to take advantage of tax benefits. Customer Appeals-Any new plan must implement an appeal process for coverage determinations and claims. 40% tax on insurance companies offering Cadillac H. I. Plans.

Initial Features of the Bill – Hospitals & Doctor’s Practices Decreases Medicare coverage but Temporarily increased reimbursements for general practice physicians/surgeons. Medicare pay’t protections extended to rural hospitals.

Initial Features of the Bill – Hospitals & Doctor’s Practices Decreases Medicare coverage but Temporarily increased reimbursements for general practice physicians/surgeons. Medicare pay’t protections extended to rural hospitals.

ACA Re-Emphasizes Emerging Themes VALUE OVER VOLUME & PAY-FOR-PERFORMANCE (P 4 P)

ACA Re-Emphasizes Emerging Themes VALUE OVER VOLUME & PAY-FOR-PERFORMANCE (P 4 P)

What Does Value over Volume Mean to an RT? Old Philosophy – If a patient stays on a ventilator longer or has a stay, that’s is good for our Job Security! New Philosophy - Fewer Vent Days, shorter LOS and Happier patients are Rewarded! How does this work?

What Does Value over Volume Mean to an RT? Old Philosophy – If a patient stays on a ventilator longer or has a stay, that’s is good for our Job Security! New Philosophy - Fewer Vent Days, shorter LOS and Happier patients are Rewarded! How does this work?

The Answer: – The ACA’s Value. Based Purchasing Provision Value Based Purchasing Program (VBP) Begin to pay hospitals for their actual performance Requires a portion of Medicare reimbursement to be withheld and returned in proportion to how the Hospital performs, Initially in 3, Now in 4 Categories.

The Answer: – The ACA’s Value. Based Purchasing Provision Value Based Purchasing Program (VBP) Begin to pay hospitals for their actual performance Requires a portion of Medicare reimbursement to be withheld and returned in proportion to how the Hospital performs, Initially in 3, Now in 4 Categories.

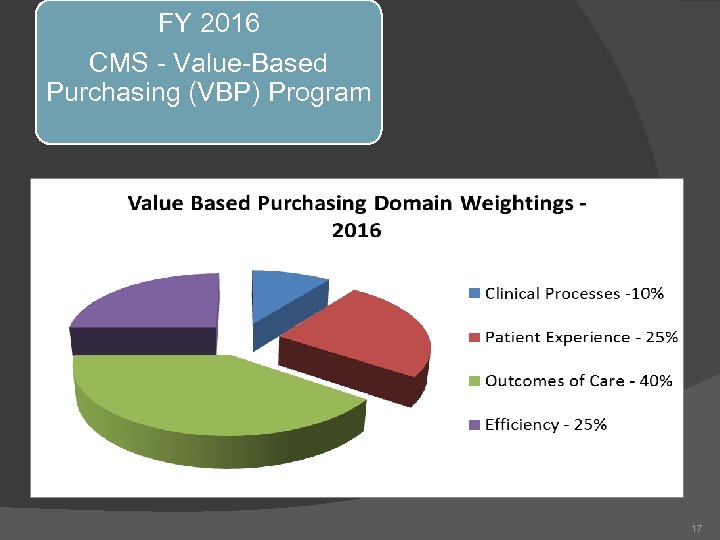

FY 2016 CMS - Value-Based Purchasing (VBP) Program 17

FY 2016 CMS - Value-Based Purchasing (VBP) Program 17

Soooo, VBP Can Reward Clinicians for Contributing to Better Outcomes! Patient weans off ventilator sooner. Shorter LOS. Better clinical outcome and happier patient means higher VBP performance. Better VBP performance means more $ reimbursement to the hospital. More reimbursement means more $ for resources, including staff, equipment…

Soooo, VBP Can Reward Clinicians for Contributing to Better Outcomes! Patient weans off ventilator sooner. Shorter LOS. Better clinical outcome and happier patient means higher VBP performance. Better VBP performance means more $ reimbursement to the hospital. More reimbursement means more $ for resources, including staff, equipment…

Another Form of Pay-for Performance – The Hospital Readmission Reduction Program (HRRP) ACA created the HRRP, which will reduce Medicare payment rates for hospitals with higher than expected readmission rates for specific conditions.

Another Form of Pay-for Performance – The Hospital Readmission Reduction Program (HRRP) ACA created the HRRP, which will reduce Medicare payment rates for hospitals with higher than expected readmission rates for specific conditions.

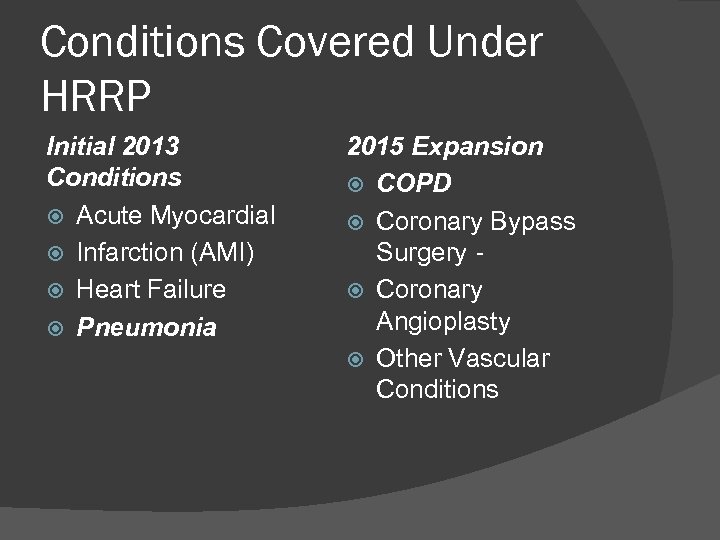

Conditions Covered Under HRRP Initial 2013 Conditions Acute Myocardial Infarction (AMI) Heart Failure Pneumonia 2015 Expansion COPD Coronary Bypass Surgery‐ Coronary Angioplasty Other Vascular Conditions

Conditions Covered Under HRRP Initial 2013 Conditions Acute Myocardial Infarction (AMI) Heart Failure Pneumonia 2015 Expansion COPD Coronary Bypass Surgery‐ Coronary Angioplasty Other Vascular Conditions

Shhh! Don’t Say “Frequent Flyer”!, HRRP Rewards Less Frequent Flying …and Here’s How! Patient is admitted but gets enrolled in a Readmission Reduction Protocol Patient gets educated about their condition and the importance of adhering to their Tx. plan. Potential barrier to successful discharge are addressed and post discharge follow-up done. Patient stays out of the hospital. Better HRRP performance means more $ reimbursement to the hospital. More reimbursement means more $ for resources, including staff, equipment, etc.

Shhh! Don’t Say “Frequent Flyer”!, HRRP Rewards Less Frequent Flying …and Here’s How! Patient is admitted but gets enrolled in a Readmission Reduction Protocol Patient gets educated about their condition and the importance of adhering to their Tx. plan. Potential barrier to successful discharge are addressed and post discharge follow-up done. Patient stays out of the hospital. Better HRRP performance means more $ reimbursement to the hospital. More reimbursement means more $ for resources, including staff, equipment, etc.

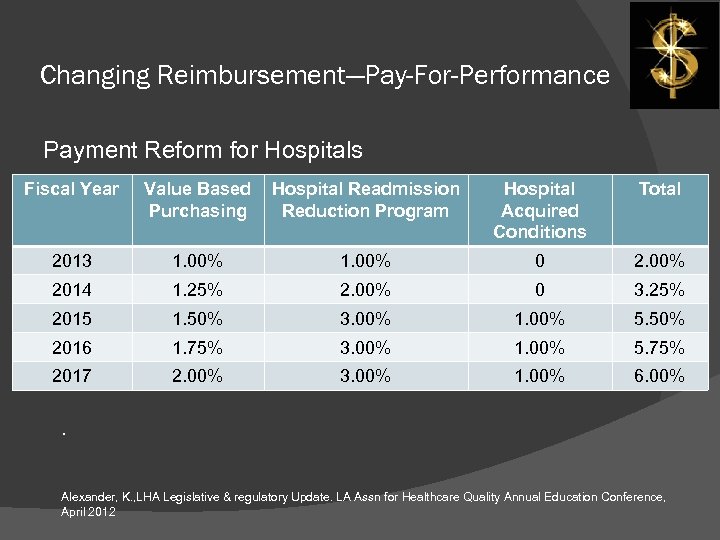

Changing Reimbursement—Pay-For-Performance Payment Reform for Hospitals Fiscal Year Value Based Purchasing Hospital Readmission Reduction Program Hospital Acquired Conditions Total 2013 1. 00% 0 2. 00% 2014 1. 25% 2. 00% 0 3. 25% 2015 1. 50% 3. 00% 1. 00% 5. 50% 2016 1. 75% 3. 00% 1. 00% 5. 75% 2017 2. 00% 3. 00% 1. 00% 6. 00% . Alexander, K. , LHA Legislative & regulatory Update. LA Assn for Healthcare Quality Annual Education Conference, April 2012

Changing Reimbursement—Pay-For-Performance Payment Reform for Hospitals Fiscal Year Value Based Purchasing Hospital Readmission Reduction Program Hospital Acquired Conditions Total 2013 1. 00% 0 2. 00% 2014 1. 25% 2. 00% 0 3. 25% 2015 1. 50% 3. 00% 1. 00% 5. 50% 2016 1. 75% 3. 00% 1. 00% 5. 75% 2017 2. 00% 3. 00% 1. 00% 6. 00% . Alexander, K. , LHA Legislative & regulatory Update. LA Assn for Healthcare Quality Annual Education Conference, April 2012

2013 (Interim) Reimbursement Penalties—The Facts 2, 211 American hospitals received reimbursement penalties for high readmission rates Together they will forfeit about $280 million in Medicare funds over next year According to Medicare, 2 out of 3 hospitals evaluated failed to meet its new standards for preventing 30 day readmissions. Hence, more hospitals lost $ than gained.

2013 (Interim) Reimbursement Penalties—The Facts 2, 211 American hospitals received reimbursement penalties for high readmission rates Together they will forfeit about $280 million in Medicare funds over next year According to Medicare, 2 out of 3 hospitals evaluated failed to meet its new standards for preventing 30 day readmissions. Hence, more hospitals lost $ than gained.

Five years Later-- Public Remains Divided on ACA Late June 2015 Favorable: 43% Unfavorable: 40%

Five years Later-- Public Remains Divided on ACA Late June 2015 Favorable: 43% Unfavorable: 40%

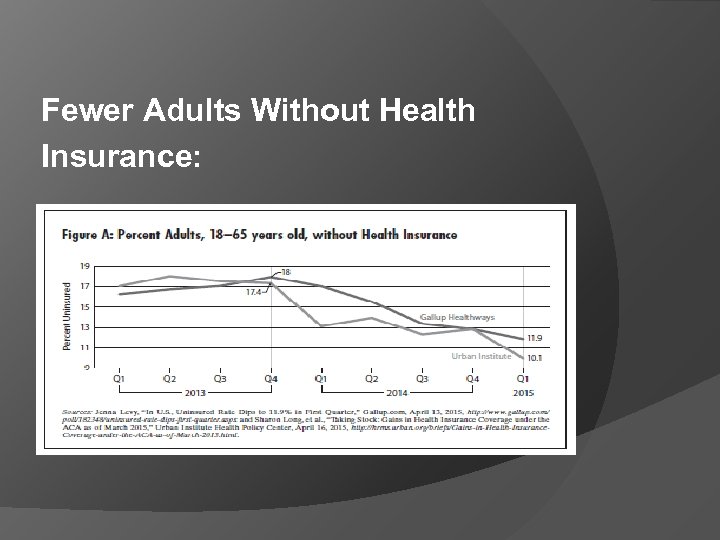

Other Realities -- ACA--Five Years Later Health Ins. Coverage 15 million Fewer uninsured individuals since 2010 But, 35 million Individuals still without insurance Most gains are from expanded Medicaid expansion 12 million More people enrolled in Medicaid since 2010.

Other Realities -- ACA--Five Years Later Health Ins. Coverage 15 million Fewer uninsured individuals since 2010 But, 35 million Individuals still without insurance Most gains are from expanded Medicaid expansion 12 million More people enrolled in Medicaid since 2010.

Health Ins. Coverage - Reality * 5. 8 million people gained coverage in the individual market. * 4. 9 million individuals lost employer coverage during the same period. * In other words, for that period in which raw data are available, almost 90% of coverage gains were in the Medicaid program.

Health Ins. Coverage - Reality * 5. 8 million people gained coverage in the individual market. * 4. 9 million individuals lost employer coverage during the same period. * In other words, for that period in which raw data are available, almost 90% of coverage gains were in the Medicaid program.

Fewer Adults Without Health Insurance:

Fewer Adults Without Health Insurance:

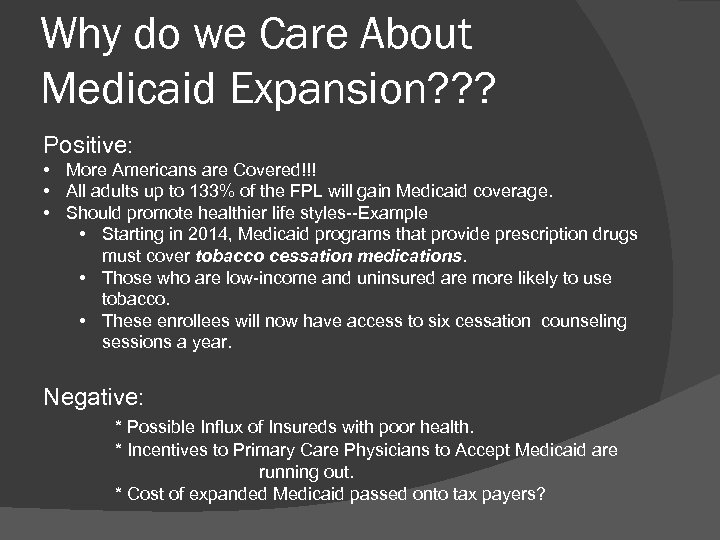

Why do we Care About Medicaid Expansion? ? ? Positive: • More Americans are Covered!!! • All adults up to 133% of the FPL will gain Medicaid coverage. • Should promote healthier life styles--Example • Starting in 2014, Medicaid programs that provide prescription drugs must cover tobacco cessation medications. • Those who are low-income and uninsured are more likely to use tobacco. • These enrollees will now have access to six cessation counseling sessions a year. Negative: * Possible Influx of Insureds with poor health. * Incentives to Primary Care Physicians to Accept Medicaid are running out. * Cost of expanded Medicaid passed onto tax payers?

Why do we Care About Medicaid Expansion? ? ? Positive: • More Americans are Covered!!! • All adults up to 133% of the FPL will gain Medicaid coverage. • Should promote healthier life styles--Example • Starting in 2014, Medicaid programs that provide prescription drugs must cover tobacco cessation medications. • Those who are low-income and uninsured are more likely to use tobacco. • These enrollees will now have access to six cessation counseling sessions a year. Negative: * Possible Influx of Insureds with poor health. * Incentives to Primary Care Physicians to Accept Medicaid are running out. * Cost of expanded Medicaid passed onto tax payers?

ACA—Positives Five Years Later - Individuals 2. 3 million young adults gained coverage from 2010 through Sept. 2013 by staying on their parents' plan. 11 million Individuals have insurance through a state or federal exchanges. 7. 7 million Individuals receiving tax subsidies for coverage through an exchange.

ACA—Positives Five Years Later - Individuals 2. 3 million young adults gained coverage from 2010 through Sept. 2013 by staying on their parents' plan. 11 million Individuals have insurance through a state or federal exchanges. 7. 7 million Individuals receiving tax subsidies for coverage through an exchange.

ACA—Negatives Five Years Later - Individuals 900, 000 Americans’ individual or employersponsored health policies were cancelled for 2015 because they did not comply with the ACA. Individual Premiums have increased dramatically. 1 in 2 Number of American households eligible for a premium subsidy in 2014, paid some money back to the government in 2015 because of income changes… $794 Estimated average payment these households will owe the government in 2015.

ACA—Negatives Five Years Later - Individuals 900, 000 Americans’ individual or employersponsored health policies were cancelled for 2015 because they did not comply with the ACA. Individual Premiums have increased dramatically. 1 in 2 Number of American households eligible for a premium subsidy in 2014, paid some money back to the government in 2015 because of income changes… $794 Estimated average payment these households will owe the government in 2015.

ACA--Five Years Later Large Corporations Group Health Insurance Premiums have Skyrocketed. Corporations with 50 Employees must provide Health Insurance to 95% of emplyees Both of the Above have caused Corporations to: Be cautious in hiring If they do hire, keeping hours below 30/wk. Sent more job overseas Future uncertainties have curbed other forms of corporate spending

ACA--Five Years Later Large Corporations Group Health Insurance Premiums have Skyrocketed. Corporations with 50 Employees must provide Health Insurance to 95% of emplyees Both of the Above have caused Corporations to: Be cautious in hiring If they do hire, keeping hours below 30/wk. Sent more job overseas Future uncertainties have curbed other forms of corporate spending

Accountable Care Organizations (ACO’s) In section 2706 & 3022 of the ACA An ACO is a network of physicians, hospitals, and other health providers that collaborate to improve care and reduce costs for Medicare participants. The ACA, created a shared savings program, providing incentive payments for improving quality and reducing cost. A Pioneer ACO--one which has experience in coordinating care across settings.

Accountable Care Organizations (ACO’s) In section 2706 & 3022 of the ACA An ACO is a network of physicians, hospitals, and other health providers that collaborate to improve care and reduce costs for Medicare participants. The ACA, created a shared savings program, providing incentive payments for improving quality and reducing cost. A Pioneer ACO--one which has experience in coordinating care across settings.

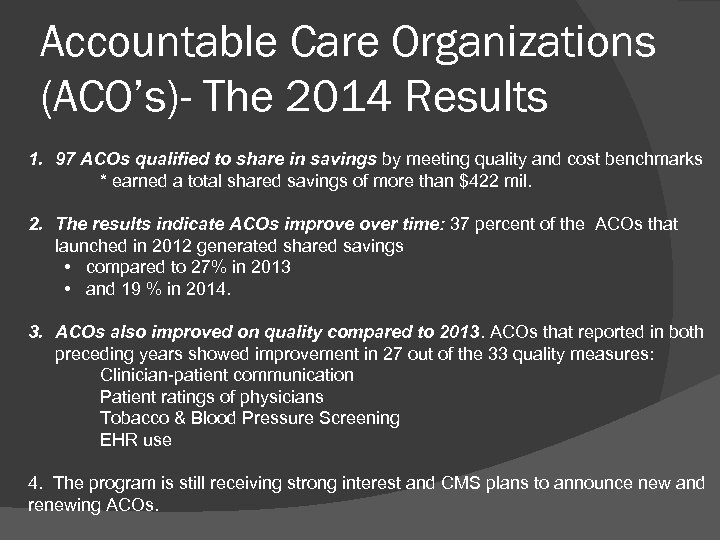

Accountable Care Organizations (ACO’s)- The 2014 Results 1. 97 ACOs qualified to share in savings by meeting quality and cost benchmarks * earned a total shared savings of more than $422 mil. 2. The results indicate ACOs improve over time: 37 percent of the ACOs that launched in 2012 generated shared savings • compared to 27% in 2013 • and 19 % in 2014. 3. ACOs also improved on quality compared to 2013. ACOs that reported in both preceding years showed improvement in 27 out of the 33 quality measures: Clinician-patient communication Patient ratings of physicians Tobacco & Blood Pressure Screening EHR use 4. The program is still receiving strong interest and CMS plans to announce new and renewing ACOs.

Accountable Care Organizations (ACO’s)- The 2014 Results 1. 97 ACOs qualified to share in savings by meeting quality and cost benchmarks * earned a total shared savings of more than $422 mil. 2. The results indicate ACOs improve over time: 37 percent of the ACOs that launched in 2012 generated shared savings • compared to 27% in 2013 • and 19 % in 2014. 3. ACOs also improved on quality compared to 2013. ACOs that reported in both preceding years showed improvement in 27 out of the 33 quality measures: Clinician-patient communication Patient ratings of physicians Tobacco & Blood Pressure Screening EHR use 4. The program is still receiving strong interest and CMS plans to announce new and renewing ACOs.

ACO’s-Why Should you Care? May explain increased emphasis on interprofessional collaboration between and among disciplines/care settings. Better coordination = better outcomes. If your organization is receiving shared savings, there’s more $ for staffing, supplies, equip. & education. Can counteract reductions elsewhere, from VBP, Short-term Re-admit penalties, and reimburse. reductions.

ACO’s-Why Should you Care? May explain increased emphasis on interprofessional collaboration between and among disciplines/care settings. Better coordination = better outcomes. If your organization is receiving shared savings, there’s more $ for staffing, supplies, equip. & education. Can counteract reductions elsewhere, from VBP, Short-term Re-admit penalties, and reimburse. reductions.

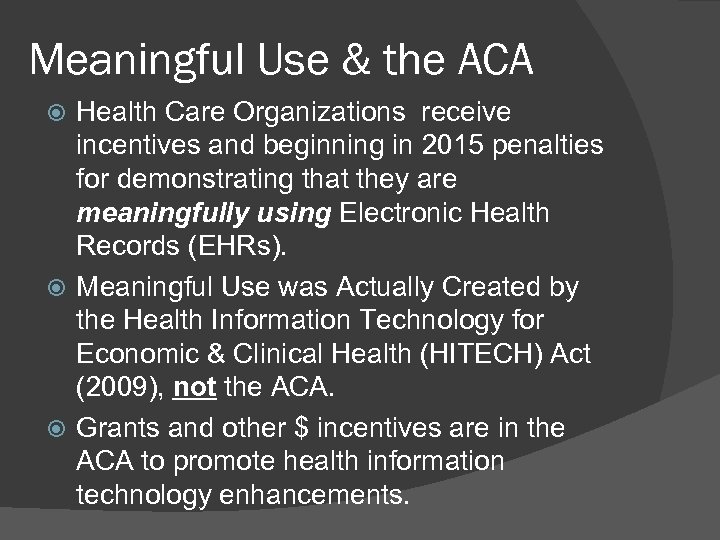

Meaningful Use & the ACA Health Care Organizations receive incentives and beginning in 2015 penalties for demonstrating that they are meaningfully using Electronic Health Records (EHRs). Meaningful Use was Actually Created by the Health Information Technology for Economic & Clinical Health (HITECH) Act (2009), not the ACA. Grants and other $ incentives are in the ACA to promote health information technology enhancements.

Meaningful Use & the ACA Health Care Organizations receive incentives and beginning in 2015 penalties for demonstrating that they are meaningfully using Electronic Health Records (EHRs). Meaningful Use was Actually Created by the Health Information Technology for Economic & Clinical Health (HITECH) Act (2009), not the ACA. Grants and other $ incentives are in the ACA to promote health information technology enhancements.

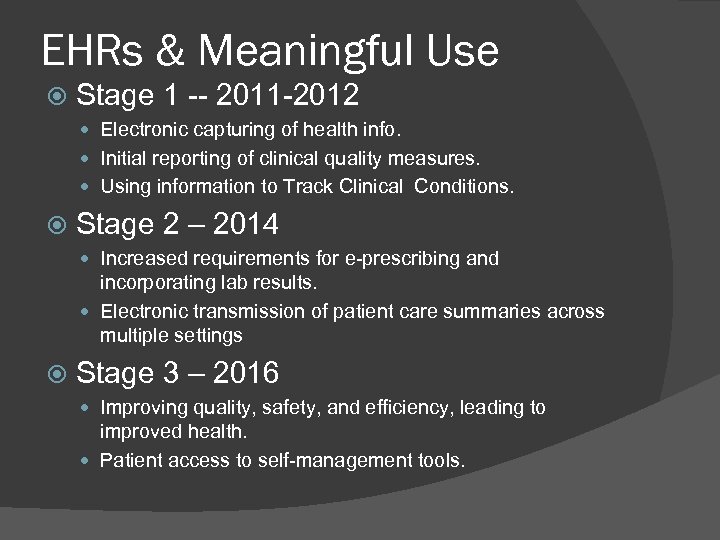

EHRs & Meaningful Use Stage 1 -- 2011 -2012 Electronic capturing of health info. Initial reporting of clinical quality measures. Using information to Track Clinical Conditions. Stage 2 – 2014 Increased requirements for e-prescribing and incorporating lab results. Electronic transmission of patient care summaries across multiple settings Stage 3 – 2016 Improving quality, safety, and efficiency, leading to improved health. Patient access to self-management tools.

EHRs & Meaningful Use Stage 1 -- 2011 -2012 Electronic capturing of health info. Initial reporting of clinical quality measures. Using information to Track Clinical Conditions. Stage 2 – 2014 Increased requirements for e-prescribing and incorporating lab results. Electronic transmission of patient care summaries across multiple settings Stage 3 – 2016 Improving quality, safety, and efficiency, leading to improved health. Patient access to self-management tools.

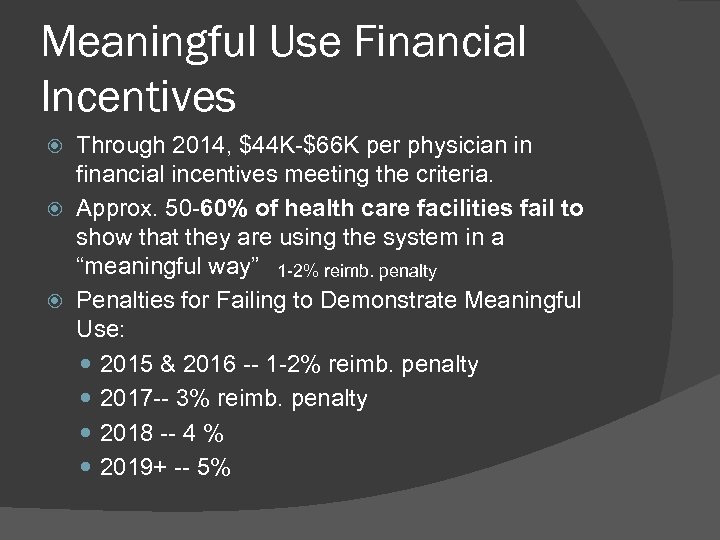

Meaningful Use Financial Incentives Through 2014, $44 K-$66 K per physician in financial incentives meeting the criteria. Approx. 50 -60% of health care facilities fail to show that they are using the system in a “meaningful way” 1 -2% reimb. penalty Penalties for Failing to Demonstrate Meaningful Use: 2015 & 2016 -- 1 -2% reimb. penalty 2017 -- 3% reimb. penalty 2018 -- 4 % 2019+ -- 5%

Meaningful Use Financial Incentives Through 2014, $44 K-$66 K per physician in financial incentives meeting the criteria. Approx. 50 -60% of health care facilities fail to show that they are using the system in a “meaningful way” 1 -2% reimb. penalty Penalties for Failing to Demonstrate Meaningful Use: 2015 & 2016 -- 1 -2% reimb. penalty 2017 -- 3% reimb. penalty 2018 -- 4 % 2019+ -- 5%

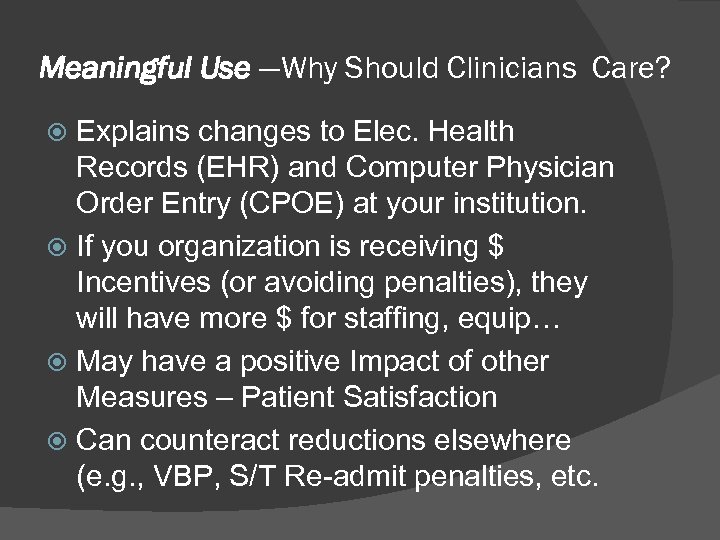

Meaningful Use —Why Should Clinicians Care? Explains changes to Elec. Health Records (EHR) and Computer Physician Order Entry (CPOE) at your institution. If you organization is receiving $ Incentives (or avoiding penalties), they will have more $ for staffing, equip… May have a positive Impact of other Measures – Patient Satisfaction Can counteract reductions elsewhere (e. g. , VBP, S/T Re-admit penalties, etc.

Meaningful Use —Why Should Clinicians Care? Explains changes to Elec. Health Records (EHR) and Computer Physician Order Entry (CPOE) at your institution. If you organization is receiving $ Incentives (or avoiding penalties), they will have more $ for staffing, equip… May have a positive Impact of other Measures – Patient Satisfaction Can counteract reductions elsewhere (e. g. , VBP, S/T Re-admit penalties, etc.

Meaningful Use —Why Else Should Clinicians Care? Meaningful Use (Stage 3) promotes Telemedicine and Digital Resource Development and other similar Stage 3 Criteria: “Outcomes for Improving quality, safety, and efficiency, leading to improved health outcomes. ” Applications in Respiratory Care Virtual Pulmonary Rehabilitation Progs. Digital Disease Management—COPD, Asthma Computerized Educational Resources Care Plan Compliance Monitoring Smoking Cessation Aids

Meaningful Use —Why Else Should Clinicians Care? Meaningful Use (Stage 3) promotes Telemedicine and Digital Resource Development and other similar Stage 3 Criteria: “Outcomes for Improving quality, safety, and efficiency, leading to improved health outcomes. ” Applications in Respiratory Care Virtual Pulmonary Rehabilitation Progs. Digital Disease Management—COPD, Asthma Computerized Educational Resources Care Plan Compliance Monitoring Smoking Cessation Aids

Original Projections: Paying for the Plan Increased Medicare Tax for Singles earning > $200 K and Couples > $250 K. (Beginning 2013) From 1. 45% to 2. 35% on earned income New 3. 8% tax on interest, capital gains. W-2 reporting of employer H. I. Premium value. ○ Will this lead to future taxing of those benefits? Reductions for Medical Expense Itemization. From expenses over 7. 5% earned income to over 10% earned income. Medicare Reductions.

Original Projections: Paying for the Plan Increased Medicare Tax for Singles earning > $200 K and Couples > $250 K. (Beginning 2013) From 1. 45% to 2. 35% on earned income New 3. 8% tax on interest, capital gains. W-2 reporting of employer H. I. Premium value. ○ Will this lead to future taxing of those benefits? Reductions for Medical Expense Itemization. From expenses over 7. 5% earned income to over 10% earned income. Medicare Reductions.

Original Claims -- The ACA Would be A Deficit Reducer Actually President and congress claims it will! OMB estimates savings of $138 Billion over 1 st 10 years & $1. 2 Trillion over next 10 years…. Reality is Appearing Different.

Original Claims -- The ACA Would be A Deficit Reducer Actually President and congress claims it will! OMB estimates savings of $138 Billion over 1 st 10 years & $1. 2 Trillion over next 10 years…. Reality is Appearing Different.

Reality--Paying for the Bill Claim 1. Health reform would reduce the typical family's healthcare costs by $2, 500 a year 2. The law is a deficit reducer. 3. Health Exchanges will increase competition and lower premiums Reality 1. 2. 3. Consumers have experienced sharp, double-digit premium increases, combined with breathtaking increases in their deductibles. The law locks in massive entitlement spending, last estimated at $1. 7 trillion over the next 10 years. Exchanges are 21. 5% less competitive (offer few choices)

Reality--Paying for the Bill Claim 1. Health reform would reduce the typical family's healthcare costs by $2, 500 a year 2. The law is a deficit reducer. 3. Health Exchanges will increase competition and lower premiums Reality 1. 2. 3. Consumers have experienced sharp, double-digit premium increases, combined with breathtaking increases in their deductibles. The law locks in massive entitlement spending, last estimated at $1. 7 trillion over the next 10 years. Exchanges are 21. 5% less competitive (offer few choices)

Other Looming Concerns… Many provisions didn’t activate until 2013 -15. Little to no mention of Tort Reform, governing Med-Mal Lawsuits. Some only apply to “new” insurance companies. Originally was to tax cosmetic surgery, but due to apparent lobbying efforts, will tax tanning shops instead.

Other Looming Concerns… Many provisions didn’t activate until 2013 -15. Little to no mention of Tort Reform, governing Med-Mal Lawsuits. Some only apply to “new” insurance companies. Originally was to tax cosmetic surgery, but due to apparent lobbying efforts, will tax tanning shops instead.

The Future of the ACA? U. S. House of Representatives has voted 50 times to repeal the entire law. Public remains divided on law. President Obama works to shore up his legacy. Will ACA be a 2016 presidential campaign issue?

The Future of the ACA? U. S. House of Representatives has voted 50 times to repeal the entire law. Public remains divided on law. President Obama works to shore up his legacy. Will ACA be a 2016 presidential campaign issue?

Take Home Notes There are many facets to the Health Care Reform and the ACA. The public remain relatively uninformed. Pluses: Increased the number of those with insurance More emphasis on prevention/community care. Coverage for pre-existing conditions. Big Minuses: Cost and No Public Option. Changes/amendments are Likely. Get informed…Keep informed!

Take Home Notes There are many facets to the Health Care Reform and the ACA. The public remain relatively uninformed. Pluses: Increased the number of those with insurance More emphasis on prevention/community care. Coverage for pre-existing conditions. Big Minuses: Cost and No Public Option. Changes/amendments are Likely. Get informed…Keep informed!

Selected Resources http: //www. healthreform. gov https: //www. cms. gov/cciio/resources/Fact. Sheets-and-FAQs/index. html http: //www. whitehouse. gov/issues/health-care http: //voices. washingtonpost. com/health-carereform http: //www. nytimes. com/2010/02/23/health/poli cy/23 health. html Longest, BB; Health Policymaking in the US; ed 5, 2009

Selected Resources http: //www. healthreform. gov https: //www. cms. gov/cciio/resources/Fact. Sheets-and-FAQs/index. html http: //www. whitehouse. gov/issues/health-care http: //voices. washingtonpost. com/health-carereform http: //www. nytimes. com/2010/02/23/health/poli cy/23 health. html Longest, BB; Health Policymaking in the US; ed 5, 2009