5f474aee47117a372969b095dc432b2f.ppt

- Количество слайдов: 40

THE A-B-C’s OF COMPLIANCE Matching The Ask to The Books to The Contract Joanne Montagner-Hull CPA September 30, 2013

Goals of This Session • A frank discussion on the proven required connections between the development cycle, the accounting cycle, & the compliance • Do the right thing, your organization can keep doing the good works • Don’t – and it won’t

Ground Rules • No question is dumb except the one (s) not asked; but, in interests of time, let’s use the software to send in questions • All in this together, alone • No grades here; you are safe here • Participants on this webinar are from varied backgrounds, varied positions…

Participant Mix • From all across the US • As of last week, – Program officers 37% – Finance folk 20% – Leadership (including board) 18% – Development 8% – Other CDC positions 17%

Assumptions of Participant Skills • That each of you has at least one program that mandates contract compliance where failure would require repayment of funds • That each of you is in control of at least one critical part of the contract compliance, or • You are supervising the people who are directly in control of all the compliance • That most if not all of you are either subject to an A-133 audit already are will be. • RIGHT?

Over-Arching Theme • “Begin with the end in mind” • This is what should be driving your procedures, your methods, your processes • But you do NOT want this end like…

Big Brothers, Big Sisters - Philadelphia • What you see in the newspaper simply says, “Youth agency closed: Lack of funding shutters… Board decided to close at end of December. . Most of staff resigned first week of December

But here’s the rest of the story. . • 23 million of spending disallowed • But it was already spent • So what would YOU do if you were the board, responsible for the behaviors of results of the organization? Yes, you too would board it up.

1 st – The Explanation of Ask vs. Books vs. Contract

Compliance Requires Health: You cannot just “start” to perform. This behavior requires HABITS.

Compliance Requires Health: A weaker organization struggles to fulfill the challenges of contract compliance

PART 1: Assessing NPO Financial Strength ü Sufficient unrestricted cash ü Sufficient working capital ü Healthy revenue mix ü Diverse “customer” base ü Assets managed ü Risks managed ü Quality, followed P&P to minimize risk ü Adequate, quality oversight ü Depth of staff & capacity

Financial Health – Know it before you enter… • Do NOT wait until you enter. . • Check things out ahead of time • Last two years’ audits • Last two years’ Form 990 • Clean opinions? • A-133 = No findings?

Financial Health. . before you enter… • How many months of cash on hand? • How dependent on funding sources? • How late was audit? • How many audit “issues”? Seriousness? • How many financial folks vs. complexities & # of programs? (Adequate capacity? )

How About YOU? • Do you feel confident, “kingly” about making such assessments? • Can you “read” an audit & 990 and see items and items? • Can you see the warning signs?

PART 2: Assessing NPO Financial Capacity ü Depth of staff ü Fullness & structure of policies & procedures ü Depth of oversight ü Depth of management ü Are complexity of programs understood & planned for success? ü Program data – capture & reporting

PART 2: Assessing NPO Financial Capacity ü How many self-standing programs does NPO have? ü Does its processes & procedures gather documentation, FOR EACH, FROM EACH CONTROL POINT, BEFORE any $ is spent? ü Usually 70 -80% of $ for human performance – ü Are you getting what you need – before hand?

Spending on HUMANS Means DOCUMENTATION! • Staffing – – Timesheets, timely & personally completed – reflecting all time; signed as accurate; approved by manager; in B 4 needed! – Processes to ensure no conflicts of interest, adequate qualifications, adequate background checks – Benefits? Drug free? • Consultants – Qualifications Bidding process Form W-9 Documentation of insurance, licensing, etc. – Invoices for time incurred at agreed-to rate – –

Spending on HUMANS Means DOCUMENTATION! (con’t) • Contractors – Qualifications Bidding process Form W-9 Documentation of licensing, insurance, bonding, workers’ compensation – Licensed staff? Background checks? Drug free? – Occupational health/safety performance – – – Contract (including Certificate of Insurance and other such requirements) – Billing processes per contact with performance proof & lien releases – Inspections satisfied – Documented change orders – Retainage

Financial Capacity Equals Depth • Grave misunderstanding that financial is 2 dimensional. • Financial reporting must be 3 dimensional. • Just like buildings, many features height, layout, materials, design of space, change affect

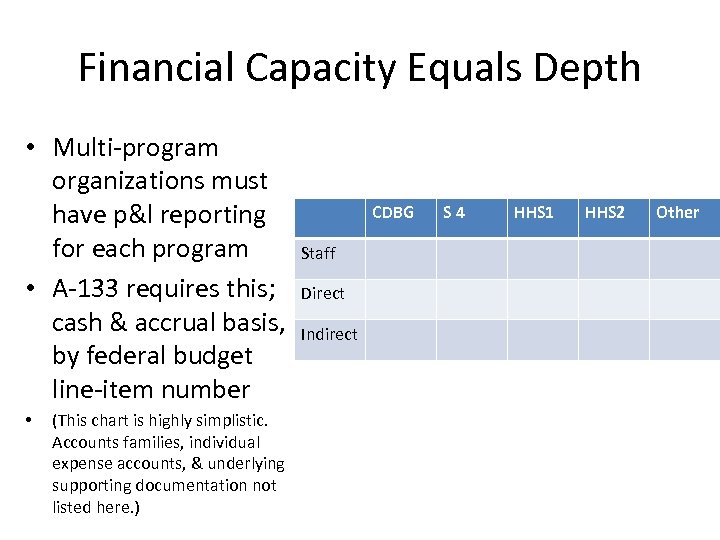

Financial Capacity Equals Depth • Multi-program organizations must have p&l reporting for each program • A-133 requires this; cash & accrual basis, by federal budget line-item number • (This chart is highly simplistic. Accounts families, individual expense accounts, & underlying supporting documentation not listed here. ) CDBG Staff Direct Indirect S 4 HHS 1 HHS 2 Other

Financial Capacity Also Means Balance Sheet Management • Does the contract require: – Separated, segregated cash? – If fixed assets purchased, must they be separately tagged as Property of Federal Government? (meaning, you must give it back at some point? Insured in between time? Etc. ) – No encumbrances permitted on fixed assets? That means no borrowing! – Payroll tax impounds? Workers’ Comp impounds?

Financial Capacity Really Means… Does all your applicable, involved staff know exactly what the contract actually says? Do you?

A Sample Program: Beginning with the End in Mind Real Life; Facts: • 10 person NPO with ½ time bookkeeper w/o accounting degree • Founder left $300 k debt, defunded by key funders; “game player” • ED sets goal of 5 years to 1 mill gov’t grant

First Year • Begins building Finance Committee & Board; seeks his own training, mentors • Sits w/ key funders, gets advice; follows it • Many sits with Bkpr + staff, shares objective, sets goals; gets buy-in

First Year (con’t) • Holds staff comp. while implementing year end bonus plan • Fully implements payroll service with impounds • Actively seeks formal training for bookkeeper • Changes to “stronger” audit firm

First Year (con’t) • Chart of accounts reworked; implemented “program” tracking for ALL programs • No bill processed, recorded or paid (all 3) without required approval, account & program

First Year (con’t) • Establishes annual budget process w/ full staff; monthly full F/S issuance, accrual basis, with remainder of year forecast • Full f/s package reviewed in detail with Fin Com, monthly

Second Year • Debt restructured; 10 year repayment plan implemented • Finance Com. builds Financial P&P • Timesheets, payment request forms, vendor RFQ/RFP process

Second Year (con’t) • No payments issued without key documentation in hand; no exceptions • Timesheets & vendor sign-offs with Penalty of Perjury clause • Raising cash reserve

Third Year • Wins 2 $35 K gov’t contracts, foundation support has tripled • All funders very excited about NPO deliverables in community; more applications in • Strategic plan

Third Year (con’t) • Audits now formality; all done by end of 4 th month • Continually increasing programs with high performance & audit marks • All staff share in

Fourth Year • Development support & earned income in better mix; income = over double last year of founder • Major players coming to board • Consistent restricted gift performance

Fourth Year (con’t) • Budget process now extensive; starts with top-down, then bottom-up with full staff buy-in; takes 3 months • Consistent performance on restricted gifts

Fifth Year • Great Recession hits • Continued consistent behavior • More gifts, more programs • Profit & cash increases • Application for $1. 7 mill to State

Sixth Year • Continued consistent behavior • More income, more programs, more profit, more cash • Staff salaries still in lower ½; bonuses bring into middle of upper ½

Sixth Year (con’t) • But staff love it there-all known as “winners, ” great @ what they do • Very low staff turnover • State awards 1. 5 million

Seventh Year • Full A-133 audit, perfectly clean • State audit of documents, perfectly clean • All examiners loved 102 page Fin’l P&P AND how well it was followed

What did they do right? So… • What did YOU catch them doing right? • What would you have done differently? • What did YOU do to get YOU caught doing it right?

Questions? joannemh@yourbeancounters. com

5f474aee47117a372969b095dc432b2f.ppt