86f98bf62dd8476983156c84af846002.ppt

- Количество слайдов: 33

THE 2015 EUROPEAN SEMESTER: Targeted policy advice to foster growth and sustainability Marco Buti Director-General for Economic and Financial Affairs European Commission 26 May 2015

THE 2015 EUROPEAN SEMESTER: Targeted policy advice to foster growth and sustainability Marco Buti Director-General for Economic and Financial Affairs European Commission 26 May 2015

Agenda 1. The May 2015 package 2. Economic situation and policy challenges 3. 2015 CSRs 4. Next steps 2

Agenda 1. The May 2015 package 2. Economic situation and policy challenges 3. 2015 CSRs 4. Next steps 2

1. The May 2015 package 3

1. The May 2015 package 3

What's in the May Package? • A Communication sets out the new approach to the 2015 European Semester • Country-specific recommendations for: • 26 Member States (not Cyprus or Greece ) • the Euro Area • Decisions under the Stability and Growth Pact for a few Member States; No action taken under the Macroeconomic Imbalances Procedure • Technical assessment of the Stability and Convergence programmes (SWDs coming out soon) 4

What's in the May Package? • A Communication sets out the new approach to the 2015 European Semester • Country-specific recommendations for: • 26 Member States (not Cyprus or Greece ) • the Euro Area • Decisions under the Stability and Growth Pact for a few Member States; No action taken under the Macroeconomic Imbalances Procedure • Technical assessment of the Stability and Convergence programmes (SWDs coming out soon) 4

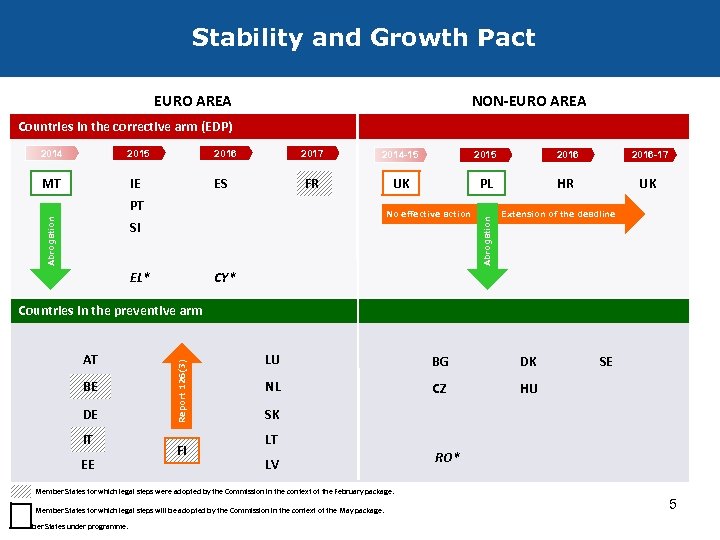

Stability and Growth Pact EURO AREA NON-EURO AREA Countries in the corrective arm (EDP) 2015 2016 MT IE 2017 ES 2014 -15 2016 -17 FR UK PL HR UK Abrogation PT No effective action SI EL* Abrogation 2014 Extension of the deadline CY* AT BE DE IT EE Report 126(3) Countries in the preventive arm FI LU BG DK NL CZ HU SK LT LV Member States for which legal steps were adopted by the Commission in the context of the February package. Member States for which legal steps will be adopted by the Commission in the context of the May package. *Member States under programme. SE RO* 5

Stability and Growth Pact EURO AREA NON-EURO AREA Countries in the corrective arm (EDP) 2015 2016 MT IE 2017 ES 2014 -15 2016 -17 FR UK PL HR UK Abrogation PT No effective action SI EL* Abrogation 2014 Extension of the deadline CY* AT BE DE IT EE Report 126(3) Countries in the preventive arm FI LU BG DK NL CZ HU SK LT LV Member States for which legal steps were adopted by the Commission in the context of the February package. Member States for which legal steps will be adopted by the Commission in the context of the May package. *Member States under programme. SE RO* 5

2. Economic situation and policy challenges 6

2. Economic situation and policy challenges 6

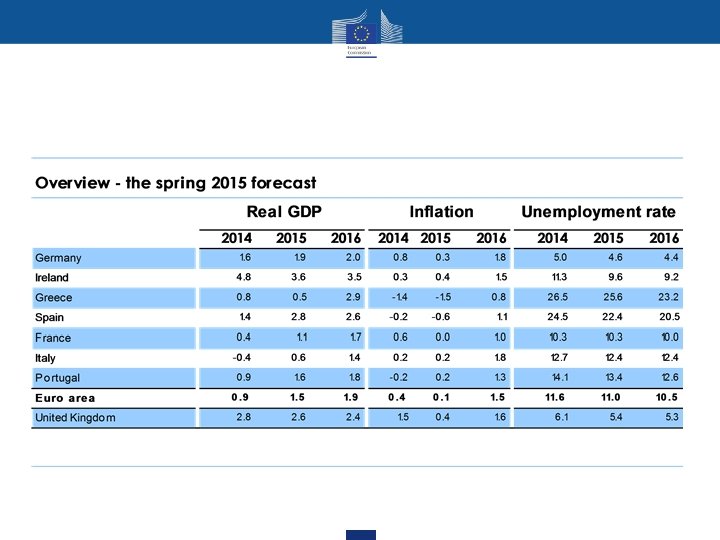

Economic situation • Economic tailwinds are breathing extra vitality into an otherwise mild cyclical upswing • EU GDP growth expected at 1. 8% this year, 2. 1% next • Labour markets are slowly improving • EU unemployment down to 9. 2% next year from 9. 6% in 2015 • HICP inflation to recover later this year • Set to increase from 0. 1% this year to 1. 5% in 2016 • The fiscal outlook continues to improve • Deficit at 2. 5% this year and debt on decreasing path

Economic situation • Economic tailwinds are breathing extra vitality into an otherwise mild cyclical upswing • EU GDP growth expected at 1. 8% this year, 2. 1% next • Labour markets are slowly improving • EU unemployment down to 9. 2% next year from 9. 6% in 2015 • HICP inflation to recover later this year • Set to increase from 0. 1% this year to 1. 5% in 2016 • The fiscal outlook continues to improve • Deficit at 2. 5% this year and debt on decreasing path

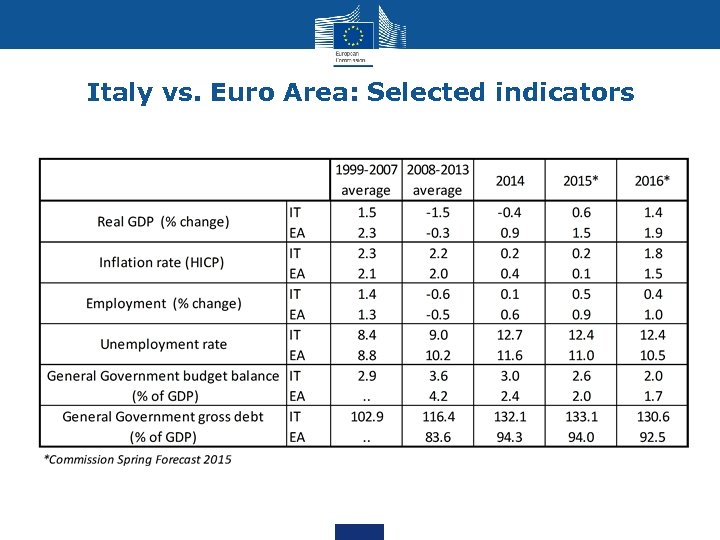

Italy vs. Euro Area: Selected indicators

Italy vs. Euro Area: Selected indicators

Key policy challenges: Tackling the legacy of the crisis CHALLENGES • Lower growth potential The AGS three-pillar approach • High private and public debt 3 -pillar approach for a determined response at EU/EA and national level: • Financial stability, credit • A boost to investment provision and NPL • Unemployment and the social impact • Ambitious structural reforms • Fiscal responsibility 10

Key policy challenges: Tackling the legacy of the crisis CHALLENGES • Lower growth potential The AGS three-pillar approach • High private and public debt 3 -pillar approach for a determined response at EU/EA and national level: • Financial stability, credit • A boost to investment provision and NPL • Unemployment and the social impact • Ambitious structural reforms • Fiscal responsibility 10

3. Country-Specific Recommendations (CSRs) – approach and main features 11

3. Country-Specific Recommendations (CSRs) – approach and main features 11

2015 CSRs – A new approach • Engagement with governments, parliaments and social partners • Fewer and more focused CSRs • Only key priority issues of macro-economic relevance • Reflecting the degree of macroeconomic imbalances • Actions to be taken within one year • The Commission implementation will closely monitor • Implementation at national level the three– pillar approach: investment, structural reforms and fiscal responsibility 12

2015 CSRs – A new approach • Engagement with governments, parliaments and social partners • Fewer and more focused CSRs • Only key priority issues of macro-economic relevance • Reflecting the degree of macroeconomic imbalances • Actions to be taken within one year • The Commission implementation will closely monitor • Implementation at national level the three– pillar approach: investment, structural reforms and fiscal responsibility 12

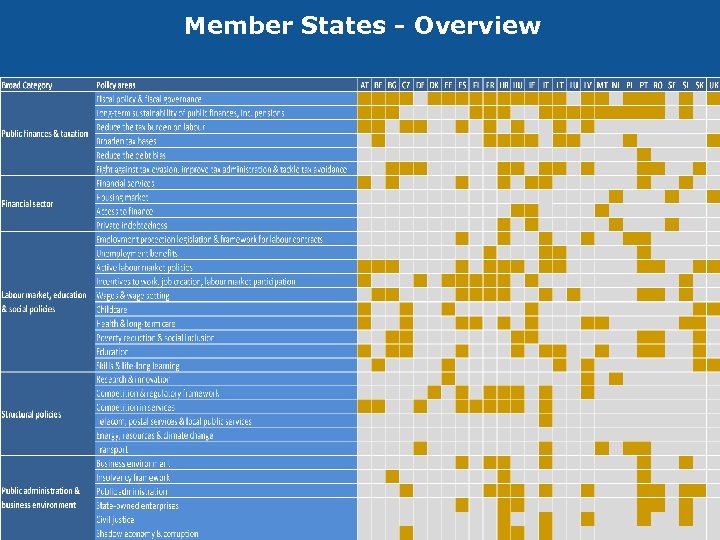

Member States - Overview

Member States - Overview

Italy: 6 CSRs Transports & management of EU funds Financial sector Public administration & civil justice Labour market & education Business environment & competition

Italy: 6 CSRs Transports & management of EU funds Financial sector Public administration & civil justice Labour market & education Business environment & competition

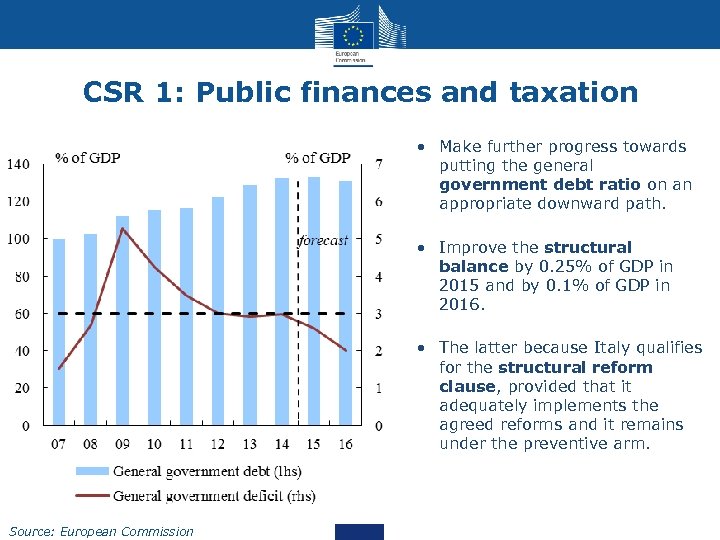

CSR 1: Public finances and taxation • Make further progress towards putting the general government debt ratio on an appropriate downward path. • Improve the structural balance by 0. 25% of GDP in 2015 and by 0. 1% of GDP in 2016. • The latter because Italy qualifies for the structural reform clause, provided that it adequately implements the agreed reforms and it remains under the preventive arm. Source: European Commission

CSR 1: Public finances and taxation • Make further progress towards putting the general government debt ratio on an appropriate downward path. • Improve the structural balance by 0. 25% of GDP in 2015 and by 0. 1% of GDP in 2016. • The latter because Italy qualifies for the structural reform clause, provided that it adequately implements the agreed reforms and it remains under the preventive arm. Source: European Commission

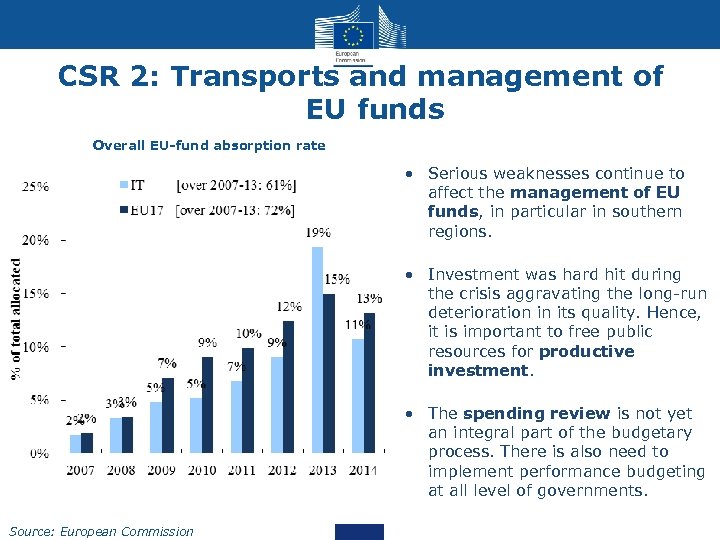

CSR 2: Transports and management of EU funds Overall EU-fund absorption rate • Serious weaknesses continue to affect the management of EU funds, in particular in southern regions. • Investment was hard hit during the crisis aggravating the long-run deterioration in its quality. Hence, it is important to free public resources for productive investment. • The spending review is not yet an integral part of the budgetary process. There is also need to implement performance budgeting at all level of governments. Source: European Commission

CSR 2: Transports and management of EU funds Overall EU-fund absorption rate • Serious weaknesses continue to affect the management of EU funds, in particular in southern regions. • Investment was hard hit during the crisis aggravating the long-run deterioration in its quality. Hence, it is important to free public resources for productive investment. • The spending review is not yet an integral part of the budgetary process. There is also need to implement performance budgeting at all level of governments. Source: European Commission

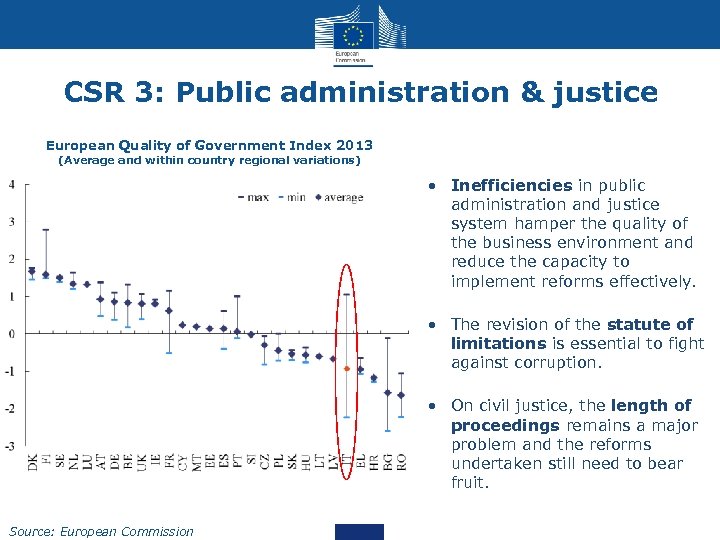

CSR 3: Public administration & justice European Quality of Government Index 2013 (Average and within country regional variations) • Inefficiencies in public administration and justice system hamper the quality of the business environment and reduce the capacity to implement reforms effectively. • The revision of the statute of limitations is essential to fight against corruption. • On civil justice, the length of proceedings remains a major problem and the reforms undertaken still need to bear fruit. Source: European Commission

CSR 3: Public administration & justice European Quality of Government Index 2013 (Average and within country regional variations) • Inefficiencies in public administration and justice system hamper the quality of the business environment and reduce the capacity to implement reforms effectively. • The revision of the statute of limitations is essential to fight against corruption. • On civil justice, the length of proceedings remains a major problem and the reforms undertaken still need to bear fruit. Source: European Commission

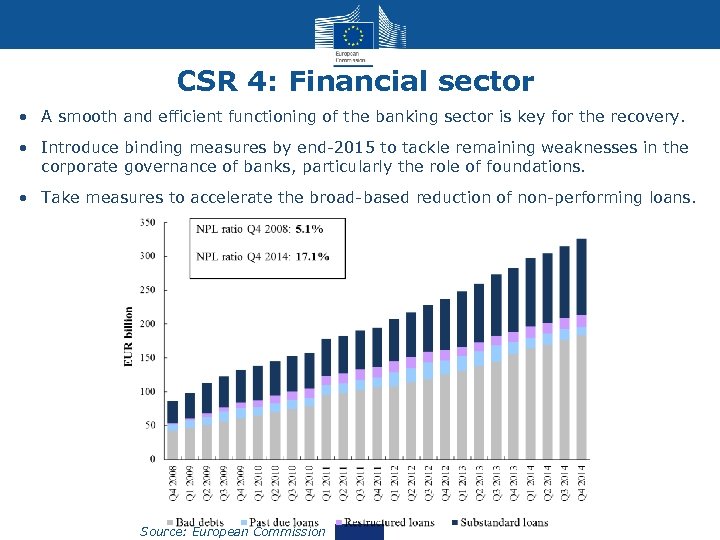

CSR 4: Financial sector • A smooth and efficient functioning of the banking sector is key for the recovery. • Introduce binding measures by end-2015 to tackle remaining weaknesses in the corporate governance of banks, particularly the role of foundations. • Take measures to accelerate the broad-based reduction of non-performing loans. Source: European Commission

CSR 4: Financial sector • A smooth and efficient functioning of the banking sector is key for the recovery. • Introduce binding measures by end-2015 to tackle remaining weaknesses in the corporate governance of banks, particularly the role of foundations. • Take measures to accelerate the broad-based reduction of non-performing loans. Source: European Commission

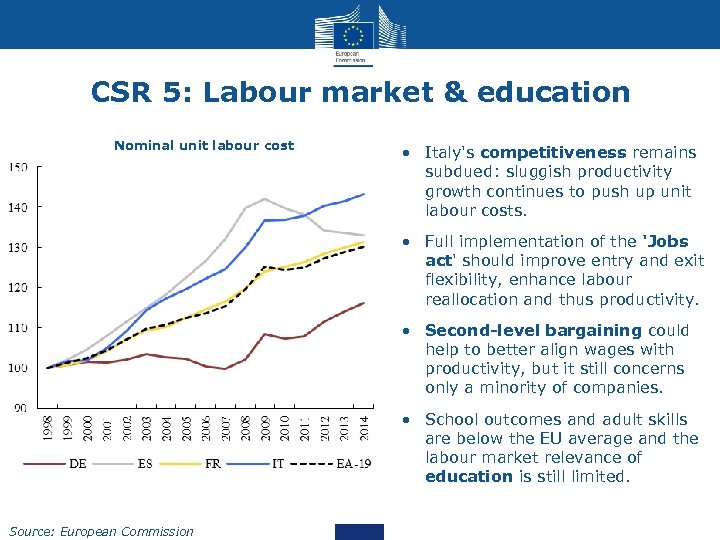

CSR 5: Labour market & education Nominal unit labour cost • Italy's competitiveness remains subdued: sluggish productivity growth continues to push up unit labour costs. • Full implementation of the 'Jobs act' should improve entry and exit flexibility, enhance labour reallocation and thus productivity. • Second-level bargaining could help to better align wages with productivity, but it still concerns only a minority of companies. • School outcomes and adult skills are below the EU average and the labour market relevance of education is still limited. Source: European Commission

CSR 5: Labour market & education Nominal unit labour cost • Italy's competitiveness remains subdued: sluggish productivity growth continues to push up unit labour costs. • Full implementation of the 'Jobs act' should improve entry and exit flexibility, enhance labour reallocation and thus productivity. • Second-level bargaining could help to better align wages with productivity, but it still concerns only a minority of companies. • School outcomes and adult skills are below the EU average and the labour market relevance of education is still limited. Source: European Commission

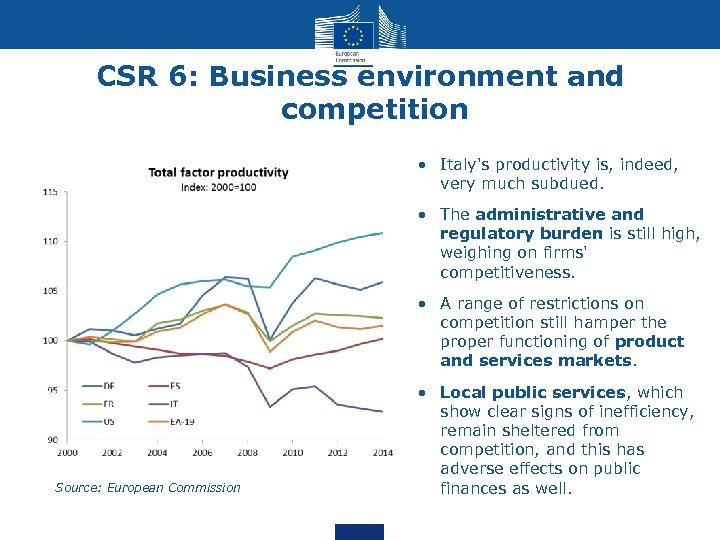

CSR 6: Business environment and competition • Italy's productivity is, indeed, very much subdued. • The administrative and regulatory burden is still high, weighing on firms' competitiveness. • A range of restrictions on competition still hamper the proper functioning of product and services markets. Source: European Commission • Local public services, which show clear signs of inefficiency, remain sheltered from competition, and this has adverse effects on public finances as well.

CSR 6: Business environment and competition • Italy's productivity is, indeed, very much subdued. • The administrative and regulatory burden is still high, weighing on firms' competitiveness. • A range of restrictions on competition still hamper the proper functioning of product and services markets. Source: European Commission • Local public services, which show clear signs of inefficiency, remain sheltered from competition, and this has adverse effects on public finances as well.

5. Next steps 21

5. Next steps 21

• June 2015: discussion of the country-specific recommendations in the committees of the Council and in the relevant Council formations • 25 -26 June 2015: endorsement of the country-specific recommendations by the European Council • July 2015: final approval of the recommendations by the Ecofin Council country-specific THEN • National semester! 22

• June 2015: discussion of the country-specific recommendations in the committees of the Council and in the relevant Council formations • 25 -26 June 2015: endorsement of the country-specific recommendations by the European Council • July 2015: final approval of the recommendations by the Ecofin Council country-specific THEN • National semester! 22

Useful information • http: //ec. europa. eu/europe 2020/making-it-happen/countryspecific-recommendations/index_en. htm 23

Useful information • http: //ec. europa. eu/europe 2020/making-it-happen/countryspecific-recommendations/index_en. htm 23

Background slides

Background slides

Recommendation 1: public finances & taxation Achieve a fiscal adjustment of at least 0. 25% of GDP towards the medium-term objective in 2015 and of 0. 1% of GDP in 2016 by taking the necessary structural measures in both 2015 and 2016, taking into account the allowed deviation for the implementation of major structural reforms. Swiftly and thoroughly implement the privatisation programme and use windfall gains to make further progress towards putting the general government debt ratio on an appropriate downward path. Implement the enabling law for tax reform by September 2015, in particular the revision of tax expenditures and cadastral values and the measures to enhance tax compliance.

Recommendation 1: public finances & taxation Achieve a fiscal adjustment of at least 0. 25% of GDP towards the medium-term objective in 2015 and of 0. 1% of GDP in 2016 by taking the necessary structural measures in both 2015 and 2016, taking into account the allowed deviation for the implementation of major structural reforms. Swiftly and thoroughly implement the privatisation programme and use windfall gains to make further progress towards putting the general government debt ratio on an appropriate downward path. Implement the enabling law for tax reform by September 2015, in particular the revision of tax expenditures and cadastral values and the measures to enhance tax compliance.

Recommendation 2: transports & management of EU funds Adopt the planned national strategic plan for ports and logistics, particularly to help promote intermodal transport through better connections. Ensure that the Agency for Territorial Cohesion is made fully operational so that the management of EU funds markedly improves.

Recommendation 2: transports & management of EU funds Adopt the planned national strategic plan for ports and logistics, particularly to help promote intermodal transport through better connections. Ensure that the Agency for Territorial Cohesion is made fully operational so that the management of EU funds markedly improves.

Recommendation 3: public administration & civil justice Adopt and implement the pending laws aimed at improving the institutional framework and modernising the public administration. Revise the statute of limitations by mid-2015. Ensure that the reforms adopted to improve the efficiency of civil justice help reduce the length of proceedings.

Recommendation 3: public administration & civil justice Adopt and implement the pending laws aimed at improving the institutional framework and modernising the public administration. Revise the statute of limitations by mid-2015. Ensure that the reforms adopted to improve the efficiency of civil justice help reduce the length of proceedings.

Recommendation 4: financial sector Introduce binding measures by end-2015 to tackle remaining weaknesses in the corporate governance of banks, particularly the role of foundations, and take measures to accelerate the broad-based reduction of non-performing loans.

Recommendation 4: financial sector Introduce binding measures by end-2015 to tackle remaining weaknesses in the corporate governance of banks, particularly the role of foundations, and take measures to accelerate the broad-based reduction of non-performing loans.

Recommendation 5: labour market & education Adopt the legislative decrees on the use of wage supplementation schemes, the revision of contractual arrangements, work-life balance and the strengthening of active labour market policies. Establish, in consultation with the social partners and in accordance with national practices, an effective framework for second-level contractual bargaining. As part of efforts to tackle youth unemployment, adopt and implement the planned school reform and expand vocationallyoriented tertiary education.

Recommendation 5: labour market & education Adopt the legislative decrees on the use of wage supplementation schemes, the revision of contractual arrangements, work-life balance and the strengthening of active labour market policies. Establish, in consultation with the social partners and in accordance with national practices, an effective framework for second-level contractual bargaining. As part of efforts to tackle youth unemployment, adopt and implement the planned school reform and expand vocationallyoriented tertiary education.

Recommendation 6: business environment & competition Implement the simplification agenda for 2015 -2017 to ease the administrative and regulatory burden. Adopt competition-enhancing measures in all the sectors covered by the competition law, and take decisive action to remove remaining barriers. Ensure that local public services contracts not complying with the requirements on in-house awards are rectified by no later than end-2015.

Recommendation 6: business environment & competition Implement the simplification agenda for 2015 -2017 to ease the administrative and regulatory burden. Adopt competition-enhancing measures in all the sectors covered by the competition law, and take decisive action to remove remaining barriers. Ensure that local public services contracts not complying with the requirements on in-house awards are rectified by no later than end-2015.

Stability and Growth Pact

Stability and Growth Pact

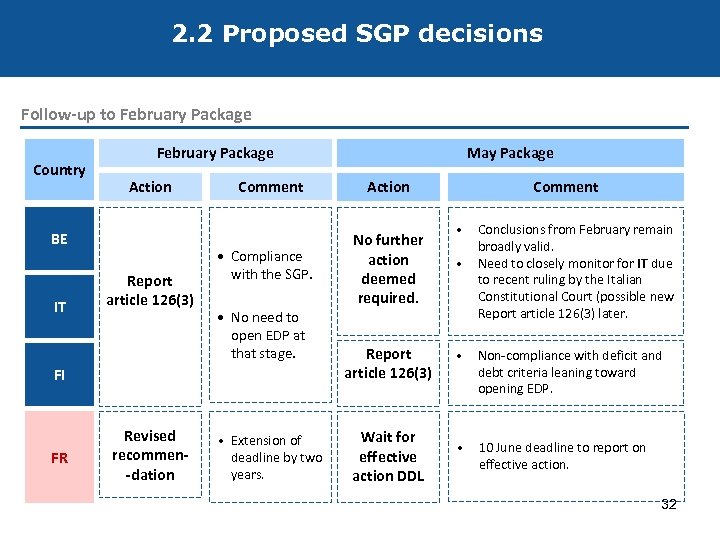

2. 2 Proposed SGP decisions Follow-up to February Package Country February Package Action BE IT Report article 126(3) Comment • Compliance with the SGP. • No need to open EDP at that stage. FI FR Revised recommen-dation • Extension of deadline by two years. May Package Comment Action No further action deemed required. Report article 126(3) Wait for effective action DDL • • Conclusions from February remain broadly valid. Need to closely monitor for IT due to recent ruling by the Italian Constitutional Court (possible new Report article 126(3) later. • Non-compliance with deficit and debt criteria leaning toward opening EDP. • 10 June deadline to report on effective action. 32

2. 2 Proposed SGP decisions Follow-up to February Package Country February Package Action BE IT Report article 126(3) Comment • Compliance with the SGP. • No need to open EDP at that stage. FI FR Revised recommen-dation • Extension of deadline by two years. May Package Comment Action No further action deemed required. Report article 126(3) Wait for effective action DDL • • Conclusions from February remain broadly valid. Need to closely monitor for IT due to recent ruling by the Italian Constitutional Court (possible new Report article 126(3) later. • Non-compliance with deficit and debt criteria leaning toward opening EDP. • 10 June deadline to report on effective action. 32

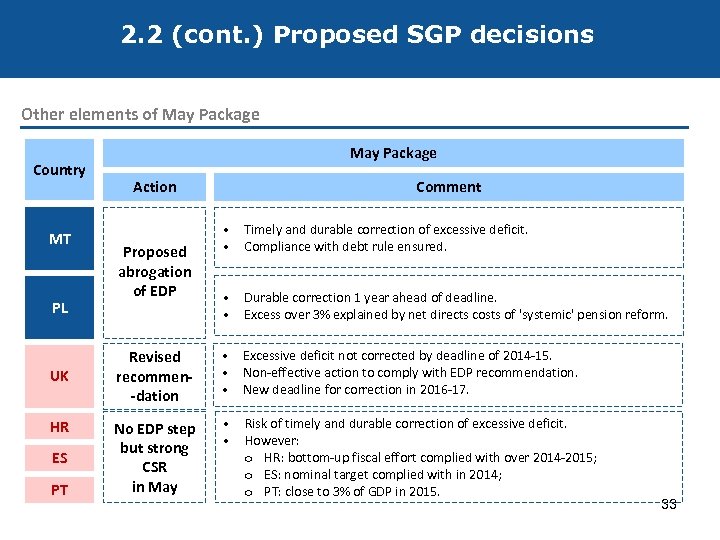

2. 2 (cont. ) Proposed SGP decisions Other elements of May Package Country MT PL UK HR ES PT May Package Comment Action • • Timely and durable correction of excessive deficit. Compliance with debt rule ensured. • • Durable correction 1 year ahead of deadline. Excess over 3% explained by net directs costs of 'systemic' pension reform. Revised recommen-dation • • • Excessive deficit not corrected by deadline of 2014 -15. Non-effective action to comply with EDP recommendation. New deadline for correction in 2016 -17. No EDP step but strong CSR in May • • Risk of timely and durable correction of excessive deficit. However: o HR: bottom-up fiscal effort complied with over 2014 -2015; o ES: nominal target complied with in 2014; o PT: close to 3% of GDP in 2015. Proposed abrogation of EDP 33

2. 2 (cont. ) Proposed SGP decisions Other elements of May Package Country MT PL UK HR ES PT May Package Comment Action • • Timely and durable correction of excessive deficit. Compliance with debt rule ensured. • • Durable correction 1 year ahead of deadline. Excess over 3% explained by net directs costs of 'systemic' pension reform. Revised recommen-dation • • • Excessive deficit not corrected by deadline of 2014 -15. Non-effective action to comply with EDP recommendation. New deadline for correction in 2016 -17. No EDP step but strong CSR in May • • Risk of timely and durable correction of excessive deficit. However: o HR: bottom-up fiscal effort complied with over 2014 -2015; o ES: nominal target complied with in 2014; o PT: close to 3% of GDP in 2015. Proposed abrogation of EDP 33