34756b86d7ac1ac9858c5817f6431bba.ppt

- Количество слайдов: 21

The 2011 Census in the West Midlands: housing trends and patterns Richard Turkington, Rachel Wright & John Connell richardturkington@housingvision. co. uk 22 nd April 2013 | The Futures Network West Midlands

The 2011 Census in the West Midlands: housing trends and patterns Richard Turkington, Rachel Wright & John Connell richardturkington@housingvision. co. uk 22 nd April 2013 | The Futures Network West Midlands

Structure Within the limitations of published Census data: • • Take stock of changes since 2001 Where are we now? Where do we go from here? The Big Questions Understanding the maps Red/pink = high: which does not always mean good! Dark/pale blue = low: which is not always bad!

Structure Within the limitations of published Census data: • • Take stock of changes since 2001 Where are we now? Where do we go from here? The Big Questions Understanding the maps Red/pink = high: which does not always mean good! Dark/pale blue = low: which is not always bad!

Taking Stock: growth 2. 3 million homes, growth of 144, 000 or 7% • • Lowest: North Warwickshire 2. 5% Highest: Rugby 15% What type of homes have been added? • • • Detached: Semi-detached: Terraced: Purpose-built flats: Converted flats: Other: 19% (24% in total) 24% (37% in total) 15% (23% in total) 35% (13% in total) 4% (2% in total) 3% (1% in total)

Taking Stock: growth 2. 3 million homes, growth of 144, 000 or 7% • • Lowest: North Warwickshire 2. 5% Highest: Rugby 15% What type of homes have been added? • • • Detached: Semi-detached: Terraced: Purpose-built flats: Converted flats: Other: 19% (24% in total) 24% (37% in total) 15% (23% in total) 35% (13% in total) 4% (2% in total) 3% (1% in total)

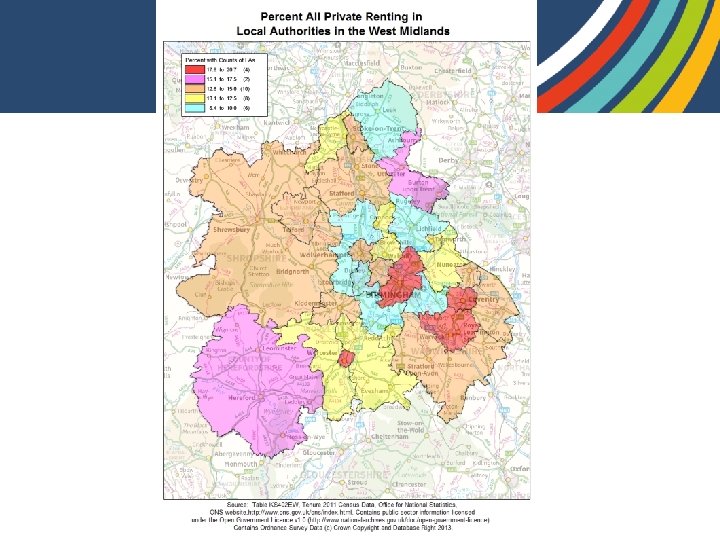

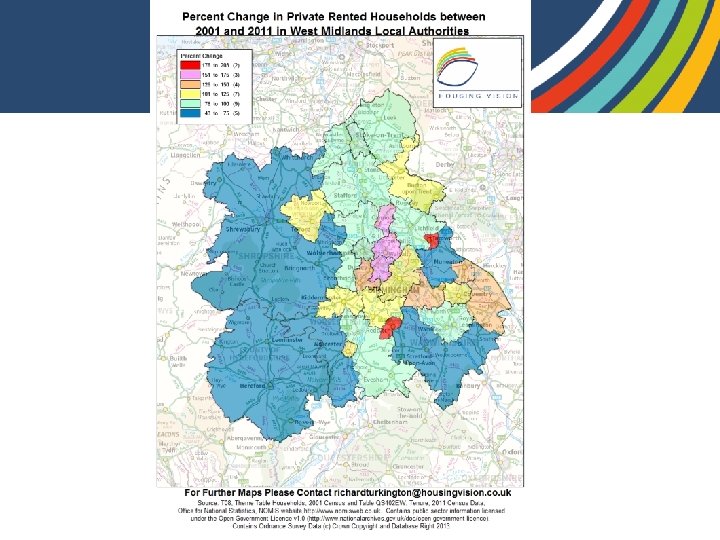

Tenure Change Private rented sector • As a proportion - has doubled to 14% • Sector has grown everywhere, from 55% in Stratford to almost 300% in Redditch Home ownership • As a proportion - declined from 69% to 65% • Numbers have grown by 6% in Shropshire but fallen by 7% in Coventry

Tenure Change Private rented sector • As a proportion - has doubled to 14% • Sector has grown everywhere, from 55% in Stratford to almost 300% in Redditch Home ownership • As a proportion - declined from 69% to 65% • Numbers have grown by 6% in Shropshire but fallen by 7% in Coventry

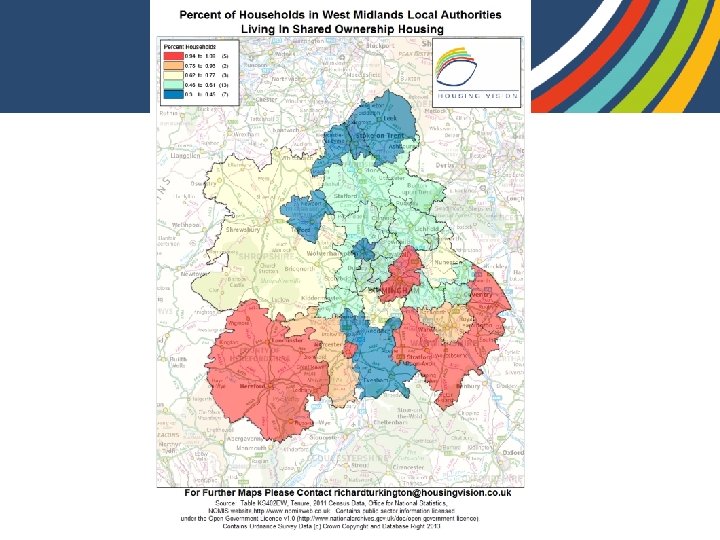

Tenure change Where has this left social renting? • As a proportion - declined from 21% to 19% The place of shared ownership? • Stabilised at 0. 7% - growth of 750 units • 0. 35% in Staffordshire Moorlands to 1. 1% in Stratford-upon-Avon • Strongest growth in Birmingham - 500 units • Stock has declined in some locations • By over 700 units in Stoke-on-Trent

Tenure change Where has this left social renting? • As a proportion - declined from 21% to 19% The place of shared ownership? • Stabilised at 0. 7% - growth of 750 units • 0. 35% in Staffordshire Moorlands to 1. 1% in Stratford-upon-Avon • Strongest growth in Birmingham - 500 units • Stock has declined in some locations • By over 700 units in Stoke-on-Trent

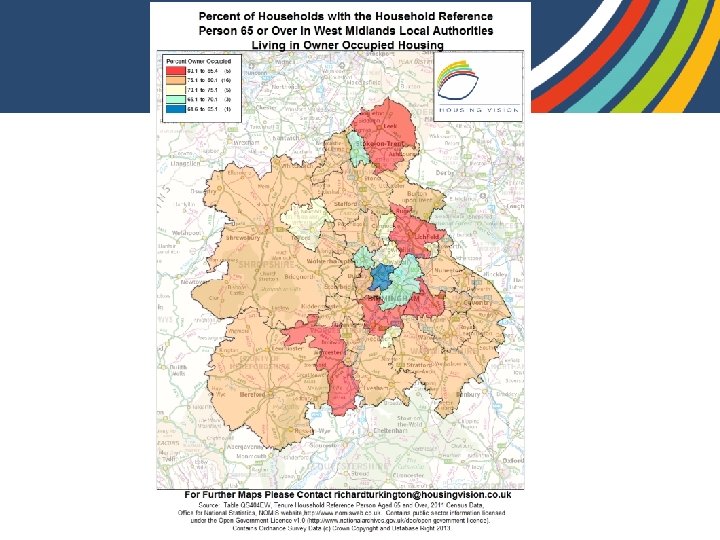

Tenure & older people Very different patterns for 65+ households: • 75% home ownership • 19% social rented • 4% private renting Implications? • Level of equity owned • Good quality of social rented housing • Poor quality of private rented housing • The likelihood of downsizing • What if this doesn’t happen?

Tenure & older people Very different patterns for 65+ households: • 75% home ownership • 19% social rented • 4% private renting Implications? • Level of equity owned • Good quality of social rented housing • Poor quality of private rented housing • The likelihood of downsizing • What if this doesn’t happen?

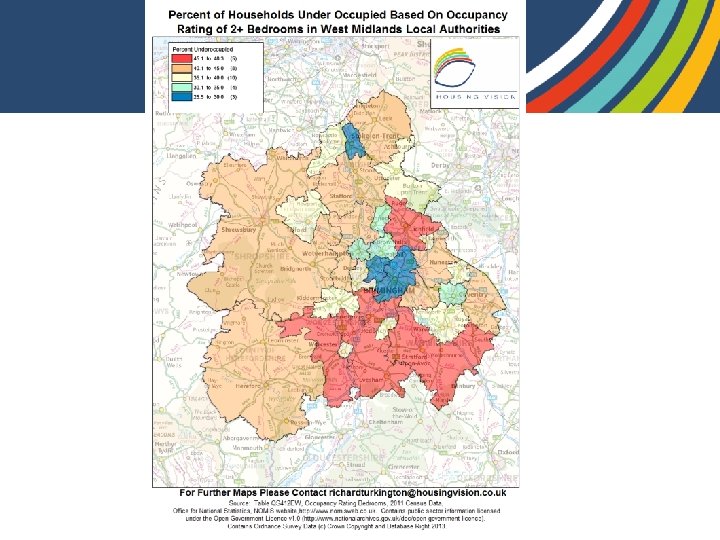

Where are we now? Under-occupation 2 or more bedrooms: • • 36% for all households Likely to be double for 65+ households From 26% in Stoke-on-Trent To 48% in Bromsgrove

Where are we now? Under-occupation 2 or more bedrooms: • • 36% for all households Likely to be double for 65+ households From 26% in Stoke-on-Trent To 48% in Bromsgrove

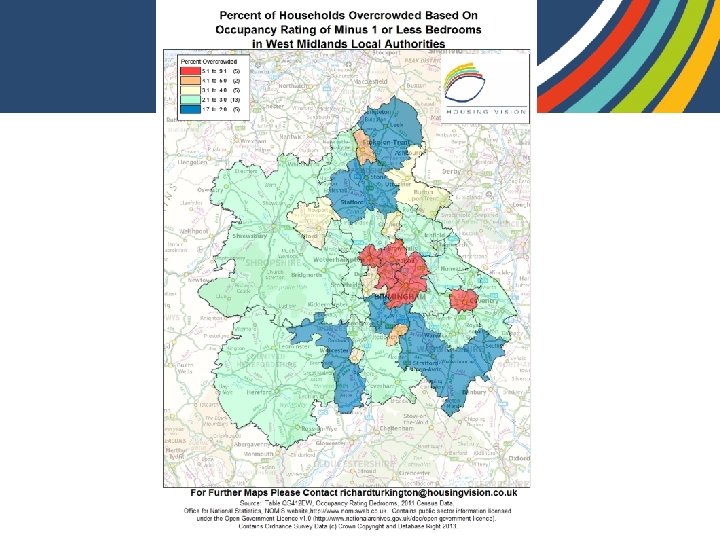

Where are we now? Overcrowding • 3. 9% of all households have 1 bedroom less than their requirements • 0. 7% have 2 bedrooms less • From 1. 8% in Bromsgrove, Malvern & Stratford • To 7% in Sandwell & 9% in Birmingham

Where are we now? Overcrowding • 3. 9% of all households have 1 bedroom less than their requirements • 0. 7% have 2 bedrooms less • From 1. 8% in Bromsgrove, Malvern & Stratford • To 7% in Sandwell & 9% in Birmingham

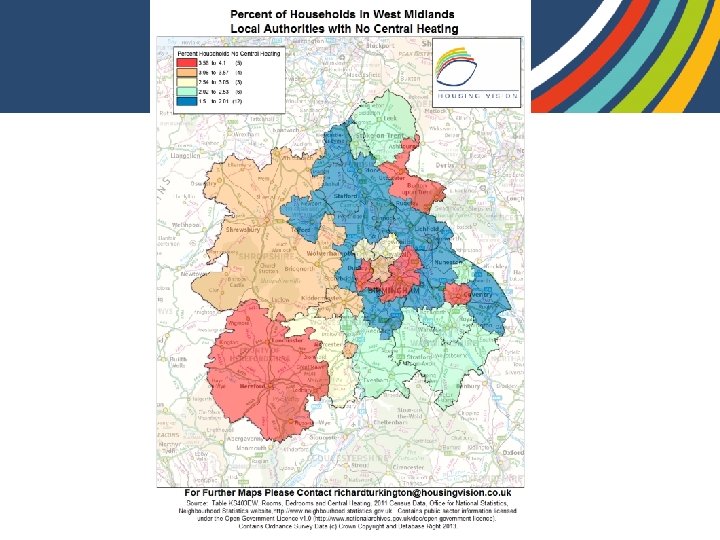

Where are we now? The quality of housing No central heating • 3% of all households • From 1. 5 -1. 6% in Redditch, Cannock and Lichfield • To 3. 9 -4. 1% in East Staffordshire & Birmingham Though can people afford to use it?

Where are we now? The quality of housing No central heating • 3% of all households • From 1. 5 -1. 6% in Redditch, Cannock and Lichfield • To 3. 9 -4. 1% in East Staffordshire & Birmingham Though can people afford to use it?

Where do we go from here? Gross requirements 2011 -21 Gross housing requirements by age and bedsize Age/ Bedsize 15 -24 25 -34 35 -44 45 -54 55 -59 60 -64 65 -74 75 -84 85 + Totals Shared 5, 775 5, 680 -2, 136 -3, 584 1, 123 -1, 331 5, 512 12, 039 6, 072 29, 150 1 bed -7, 454 1, 293 -5, 513 -4, 634 22, 322 -11, 548 10, 776 29, 681 28, 258 63, 181 2 bed -1, 070 8, 362 11, 055 16, 425 4, 947 1, 112 1, 090 823 726 43, 470 3 bed 1, 107 5, 571 -6, 924 -1, 788 13, 190 4, 643 11, 235 3, 951 269 31, 254 159 1, 702 1, 931 5, 029 398 430 562 244 138 10, 593 15 -24 25 -34 35 -44 45 -54 55 -59 60 -64 65 -74 75 -84 85 + -1, 483 22, 608 -1, 587 11, 448 41, 980 -6, 694 29, 175 46, 738 35, 463 4 bed + Totals 177, 648

Where do we go from here? Gross requirements 2011 -21 Gross housing requirements by age and bedsize Age/ Bedsize 15 -24 25 -34 35 -44 45 -54 55 -59 60 -64 65 -74 75 -84 85 + Totals Shared 5, 775 5, 680 -2, 136 -3, 584 1, 123 -1, 331 5, 512 12, 039 6, 072 29, 150 1 bed -7, 454 1, 293 -5, 513 -4, 634 22, 322 -11, 548 10, 776 29, 681 28, 258 63, 181 2 bed -1, 070 8, 362 11, 055 16, 425 4, 947 1, 112 1, 090 823 726 43, 470 3 bed 1, 107 5, 571 -6, 924 -1, 788 13, 190 4, 643 11, 235 3, 951 269 31, 254 159 1, 702 1, 931 5, 029 398 430 562 244 138 10, 593 15 -24 25 -34 35 -44 45 -54 55 -59 60 -64 65 -74 75 -84 85 + -1, 483 22, 608 -1, 587 11, 448 41, 980 -6, 694 29, 175 46, 738 35, 463 4 bed + Totals 177, 648

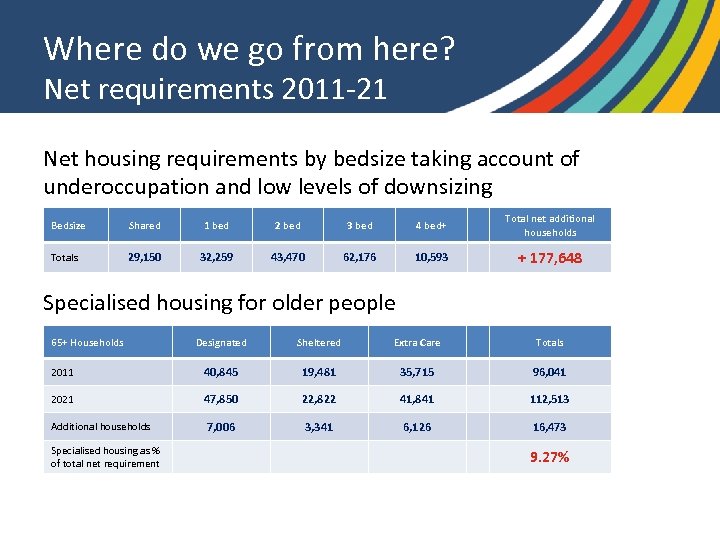

Where do we go from here? Net requirements 2011 -21 Net housing requirements by bedsize taking account of underoccupation and low levels of downsizing Bedsize Shared 1 bed 2 bed 3 bed 4 bed+ Total net additional households Totals 29, 150 32, 259 43, 470 62, 176 10, 593 + 177, 648 Specialised housing for older people 65+ Households Designated Sheltered Extra Care Totals 2011 40, 845 19, 481 35, 715 96, 041 2021 47, 850 22, 822 41, 841 112, 513 Additional households 7, 006 3, 341 6, 126 16, 473 Specialised housing as % of total net requirement 9. 27%

Where do we go from here? Net requirements 2011 -21 Net housing requirements by bedsize taking account of underoccupation and low levels of downsizing Bedsize Shared 1 bed 2 bed 3 bed 4 bed+ Total net additional households Totals 29, 150 32, 259 43, 470 62, 176 10, 593 + 177, 648 Specialised housing for older people 65+ Households Designated Sheltered Extra Care Totals 2011 40, 845 19, 481 35, 715 96, 041 2021 47, 850 22, 822 41, 841 112, 513 Additional households 7, 006 3, 341 6, 126 16, 473 Specialised housing as % of total net requirement 9. 27%

The Big Questions 1. Understanding housing market dynamics ‘musical chairs’, changing requirements & the ‘fit’ between housing and households? 2. The place of regeneration and renewal? 3. The emergence of new problems in old areas or new problems in new areas? 4. The stability and security of private renting? 5. Housing older people - stay or move? 6. Providing more homes - quantity & quality?

The Big Questions 1. Understanding housing market dynamics ‘musical chairs’, changing requirements & the ‘fit’ between housing and households? 2. The place of regeneration and renewal? 3. The emergence of new problems in old areas or new problems in new areas? 4. The stability and security of private renting? 5. Housing older people - stay or move? 6. Providing more homes - quantity & quality?