bcfff37c39318c84f4792cc231603590.ppt

- Количество слайдов: 22

The 10 -Year Review: Price Implications Presented to NPPC May 10, 2016

The 10 -Year Review: Price Implications Presented to NPPC May 10, 2016

10 -Year Review: Process and Timing • Starts – Late December 2016 • PRC will ask for comments on whether the system is working • If PRC finds it is not, will ask for comments on how to make it work • PRC will issue Decision, probably outlining method USPS must use to ask for additional money. Q 4? Q 1 2017? 2

10 -Year Review: Process and Timing • Starts – Late December 2016 • PRC will ask for comments on whether the system is working • If PRC finds it is not, will ask for comments on how to make it work • PRC will issue Decision, probably outlining method USPS must use to ask for additional money. Q 4? Q 1 2017? 2

10 -Year Review: Process and Timing • Mailers and/or USPS will have 30 days to appeal PRC Decision • USPS will file for price increase soon after PRC Decision • PRC likely to issue Decision in that filing before Court review finished 3

10 -Year Review: Process and Timing • Mailers and/or USPS will have 30 days to appeal PRC Decision • USPS will file for price increase soon after PRC Decision • PRC likely to issue Decision in that filing before Court review finished 3

The 10 Year Review Should Not Revisit the CPI Price Cap • Mailers will argue “PAEA doesn’t allow it. ” If the PRC decides to the contrary, the DC Circuit will likely have the final say. • But even if PAEA does allow a CPI cap revisit, the system has worked well to balance the objectives, considering the factors. – (2) predictabilty and stability in rates balances very well with … – (5) adequate revenue…to maintain financial stability 4

The 10 Year Review Should Not Revisit the CPI Price Cap • Mailers will argue “PAEA doesn’t allow it. ” If the PRC decides to the contrary, the DC Circuit will likely have the final say. • But even if PAEA does allow a CPI cap revisit, the system has worked well to balance the objectives, considering the factors. – (2) predictabilty and stability in rates balances very well with … – (5) adequate revenue…to maintain financial stability 4

But If the PRC Allows a Cap Review Resulting in a Price Increase, How Big Could that Price Increase Be? • USPS View – How high can you count? • Mailers View – Are there numbers less than zero? • PRC View - ? ? ? 5

But If the PRC Allows a Cap Review Resulting in a Price Increase, How Big Could that Price Increase Be? • USPS View – How high can you count? • Mailers View – Are there numbers less than zero? • PRC View - ? ? ? 5

? ? ? Further Expanded • Predicting PRC decisions always adds a level of uncertainty • Chairman Taub has said that the review allows a chance to “clean-up” the balance sheet and the offbalance sheet liabilities. And make sure operating income provides viability. • Cost of service rate cases and the exigent case provide a historic precedent to operationalize a “clean -up” 6

? ? ? Further Expanded • Predicting PRC decisions always adds a level of uncertainty • Chairman Taub has said that the review allows a chance to “clean-up” the balance sheet and the offbalance sheet liabilities. And make sure operating income provides viability. • Cost of service rate cases and the exigent case provide a historic precedent to operationalize a “clean -up” 6

“What Numbers to Use? ” The Next Uncertainty • Started with actuals for FY 2015 (Balance Sheet and Off-Balance Sheet) and Integrated Financial Plan (IFP) for Expenses and Revenues to calculate Operating Income • Adjusted IFP Expenses and Revenues for actuals through February to estimate year end Operating Income • Assumed default on 2016 RHBF prefunding per IFP 7

“What Numbers to Use? ” The Next Uncertainty • Started with actuals for FY 2015 (Balance Sheet and Off-Balance Sheet) and Integrated Financial Plan (IFP) for Expenses and Revenues to calculate Operating Income • Adjusted IFP Expenses and Revenues for actuals through February to estimate year end Operating Income • Assumed default on 2016 RHBF prefunding per IFP 7

From Balance Sheet and Income Statement to Revenue Requirement • • RPYL Applied to Balance Sheet – 1/9 CSRS Deficit – Amortized RHBF Deficit – Amortized Net loss or gain from Operations Sum these 4 to get change in breakeven revenue Then “gross up” for price elasticity volume loss 8

From Balance Sheet and Income Statement to Revenue Requirement • • RPYL Applied to Balance Sheet – 1/9 CSRS Deficit – Amortized RHBF Deficit – Amortized Net loss or gain from Operations Sum these 4 to get change in breakeven revenue Then “gross up” for price elasticity volume loss 8

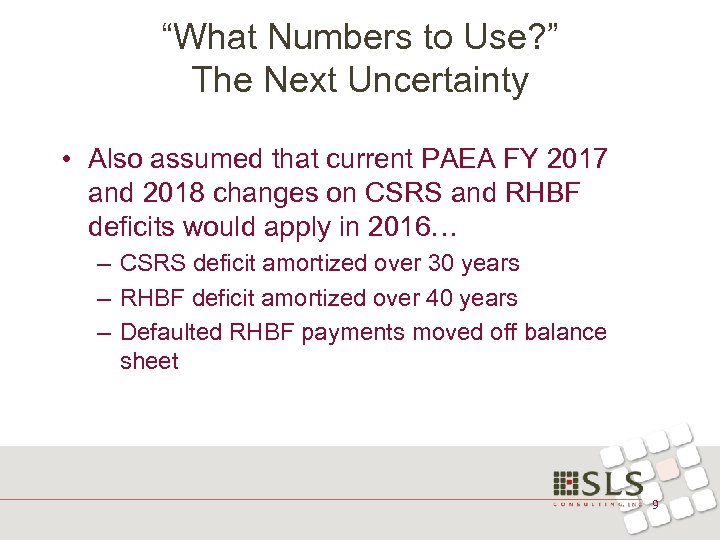

“What Numbers to Use? ” The Next Uncertainty • Also assumed that current PAEA FY 2017 and 2018 changes on CSRS and RHBF deficits would apply in 2016… – CSRS deficit amortized over 30 years – RHBF deficit amortized over 40 years – Defaulted RHBF payments moved off balance sheet 9

“What Numbers to Use? ” The Next Uncertainty • Also assumed that current PAEA FY 2017 and 2018 changes on CSRS and RHBF deficits would apply in 2016… – CSRS deficit amortized over 30 years – RHBF deficit amortized over 40 years – Defaulted RHBF payments moved off balance sheet 9

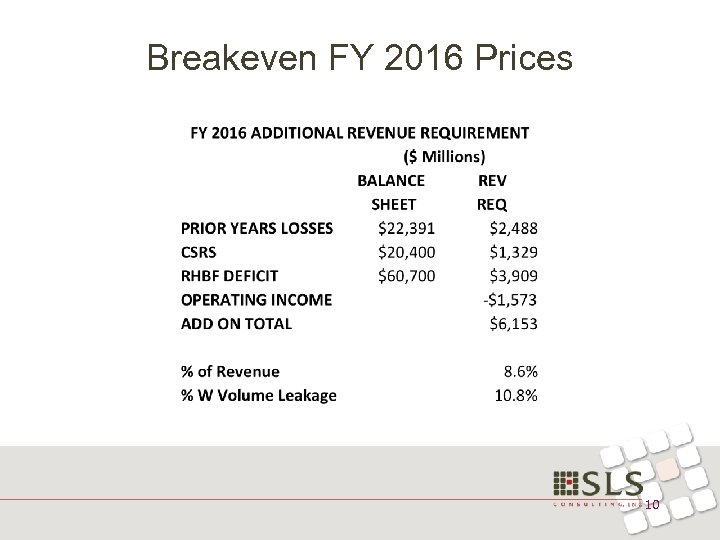

Breakeven FY 2016 Prices 10

Breakeven FY 2016 Prices 10

A Digression on Fund Deficits • Deficit = PV (Assets – Liabilities) • Fund Assets and Liabilities Change Each Year – Payins – Payouts – Assets earn interest – Changes in future premiums/annuity 11

A Digression on Fund Deficits • Deficit = PV (Assets – Liabilities) • Fund Assets and Liabilities Change Each Year – Payins – Payouts – Assets earn interest – Changes in future premiums/annuity 11

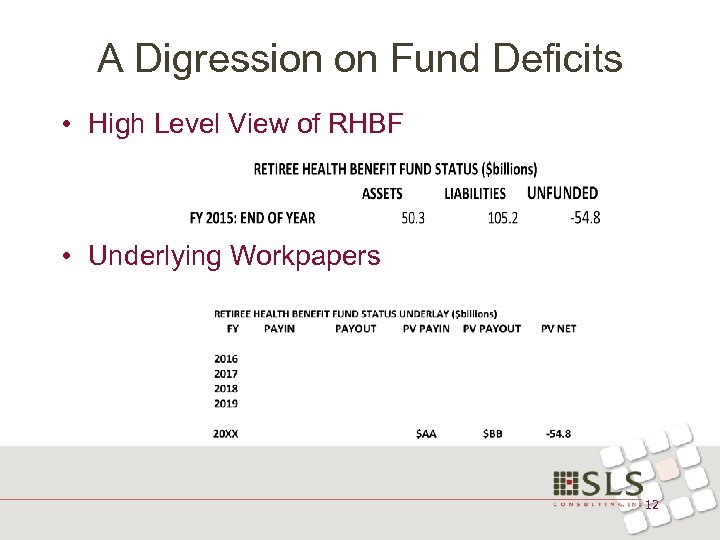

A Digression on Fund Deficits • High Level View of RHBF • Underlying Workpapers 12

A Digression on Fund Deficits • High Level View of RHBF • Underlying Workpapers 12

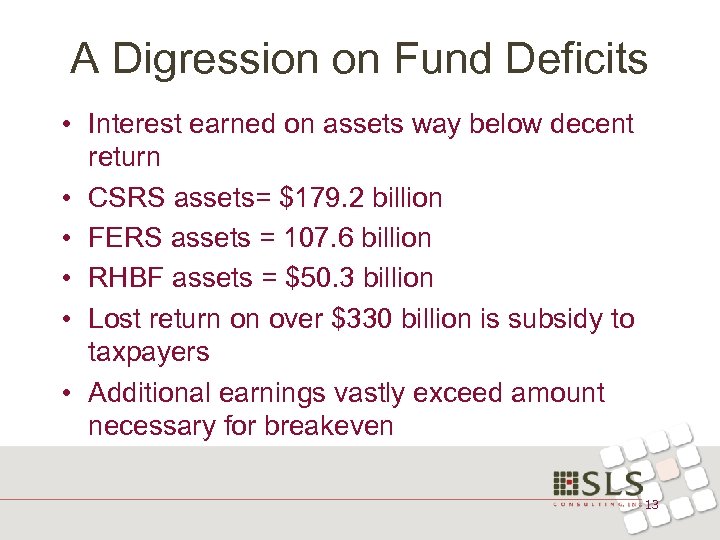

A Digression on Fund Deficits • Interest earned on assets way below decent return • CSRS assets= $179. 2 billion • FERS assets = 107. 6 billion • RHBF assets = $50. 3 billion • Lost return on over $330 billion is subsidy to taxpayers • Additional earnings vastly exceed amount necessary for breakeven 13

A Digression on Fund Deficits • Interest earned on assets way below decent return • CSRS assets= $179. 2 billion • FERS assets = 107. 6 billion • RHBF assets = $50. 3 billion • Lost return on over $330 billion is subsidy to taxpayers • Additional earnings vastly exceed amount necessary for breakeven 13

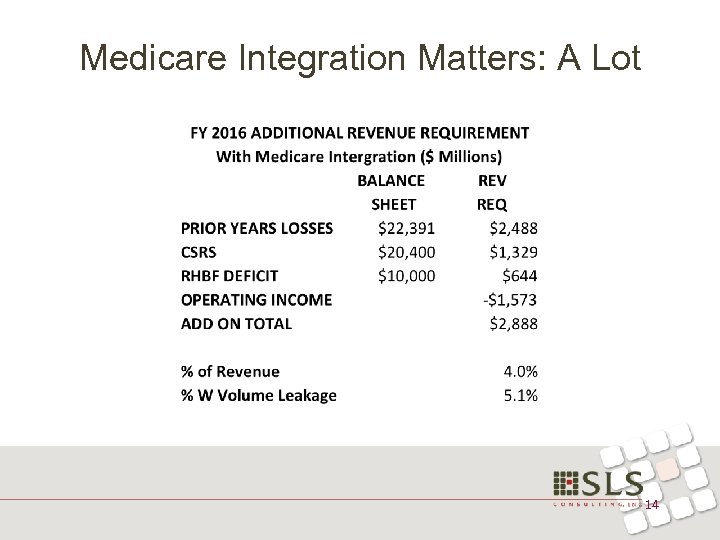

Medicare Integration Matters: A Lot 14

Medicare Integration Matters: A Lot 14

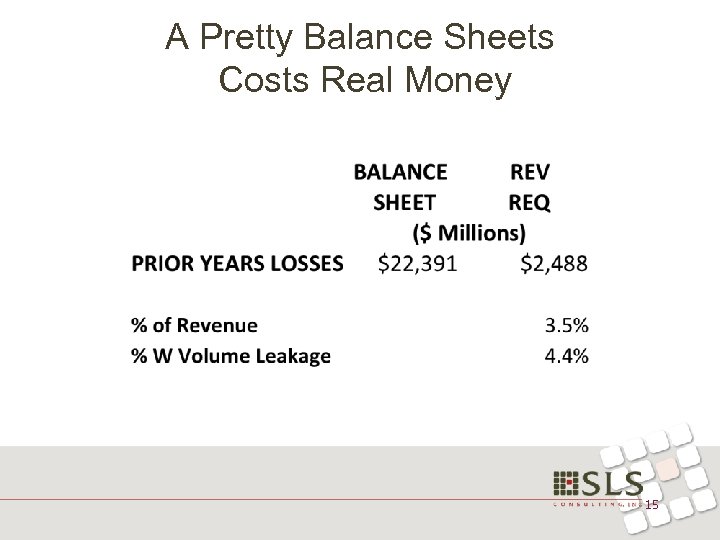

A Pretty Balance Sheets Costs Real Money 15

A Pretty Balance Sheets Costs Real Money 15

And is Totally Unnecessary • “We expect to end the year with approximately $6. 6 billion of unrestricted cash, essentially even with 2015…. ”(USPS from IFP) • USPS needs enough cash to operate and invest…. • But not enough so a hedge fund will buy them for the cash on the balance sheet. 16

And is Totally Unnecessary • “We expect to end the year with approximately $6. 6 billion of unrestricted cash, essentially even with 2015…. ”(USPS from IFP) • USPS needs enough cash to operate and invest…. • But not enough so a hedge fund will buy them for the cash on the balance sheet. 16

Breakeven is More as/if Operating Income Degrades 17

Breakeven is More as/if Operating Income Degrades 17

Any Cleanup of On and Off Balance Sheet Should be Inclusive • “The purchase price of Postal Service real estate is $27 billion, but the fair market value is far greater. The Postal Service owns real estate in premium locations. For example, the nearby National Postal Museum has a purchase price of $47 million, but a tax assessed value of $304 million. ” 18

Any Cleanup of On and Off Balance Sheet Should be Inclusive • “The purchase price of Postal Service real estate is $27 billion, but the fair market value is far greater. The Postal Service owns real estate in premium locations. For example, the nearby National Postal Museum has a purchase price of $47 million, but a tax assessed value of $304 million. ” 18

Any Cleanup of On and Off Balance Sheet Should be Inclusive • “The current net book value (of real estate) totals only $13. 2 billion. The fair market value has been estimated as high as $85 billion…. ” OIG FT-WP-15 -003 19

Any Cleanup of On and Off Balance Sheet Should be Inclusive • “The current net book value (of real estate) totals only $13. 2 billion. The fair market value has been estimated as high as $85 billion…. ” OIG FT-WP-15 -003 19

Any Cleanup of On and Off Balance Sheet Should be Inclusive • So if PRC decides a cleanup is necessary, it should net out property assets. That means there is no RPYL to amortize. 20

Any Cleanup of On and Off Balance Sheet Should be Inclusive • So if PRC decides a cleanup is necessary, it should net out property assets. That means there is no RPYL to amortize. 20

The 10 -Year Review has HUGE Price Implications 21

The 10 -Year Review has HUGE Price Implications 21

Questions? 22

Questions? 22