a9524d6e9c824826ed7642321db23707.ppt

- Количество слайдов: 89

Texas Margin Tax on Business Entities

Texas Margin Tax - Agenda • Background • Comparison to current law • Detailed analysis • Application and planning • Financial reporting 2

Texas Margin Tax – Background • Texas Supreme Court holds that Texas system of funding schools violates Texas constitutional prohibition of a state-wide property tax, Neeley v. West Orange-Cove I. S. D. (Nov. 22, 2005) and established a June 1, 2006 deadline for a legislative fix. • Governor Perry appoints John Sharp to chair a Tax Reform Commission to recommend reform of the state’s business tax structure to close loopholes, broaden the base of businesses that pay the tax, and provide significant property tax relief. • HB 3 (margin tax) enacted in special session and signed by Governor Perry May 18, 2006. Part of a package of bills that included property tax relief. 3

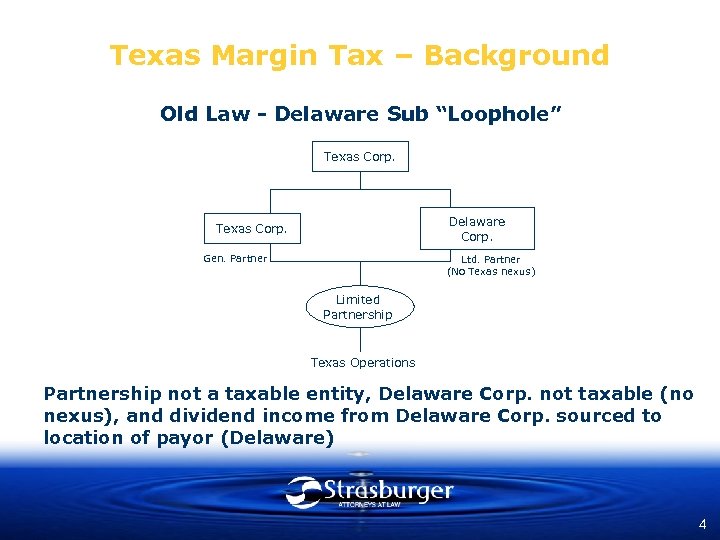

Texas Margin Tax – Background Old Law - Delaware Sub “Loophole” Texas Corp. Delaware Corp. Texas Corp. Gen. Partner Ltd. Partner (No Texas nexus) Limited Partnership Texas Operations Partnership not a taxable entity, Delaware Corp. not taxable (no nexus), and dividend income from Delaware Corp. sourced to location of payor (Delaware) 4

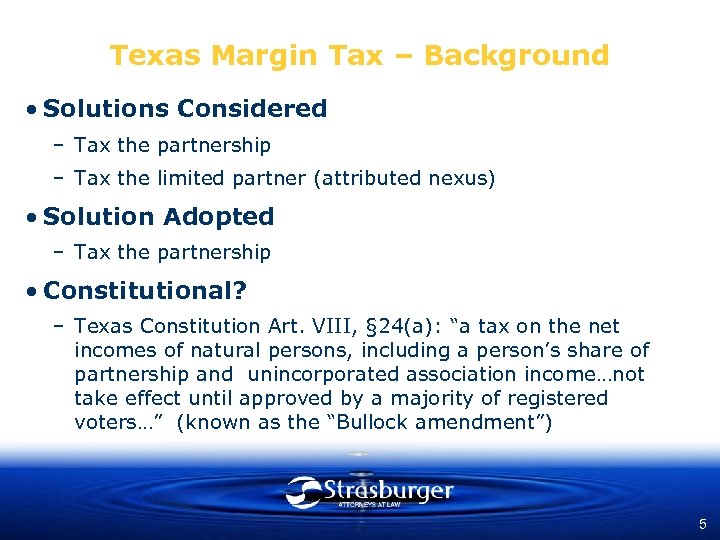

Texas Margin Tax – Background • Solutions Considered – Tax the partnership – Tax the limited partner (attributed nexus) • Solution Adopted – Tax the partnership • Constitutional? – Texas Constitution Art. VIII, § 24(a): “a tax on the net incomes of natural persons, including a person’s share of partnership and unincorporated association income…not take effect until approved by a majority of registered voters…” (known as the “Bullock amendment”) 5

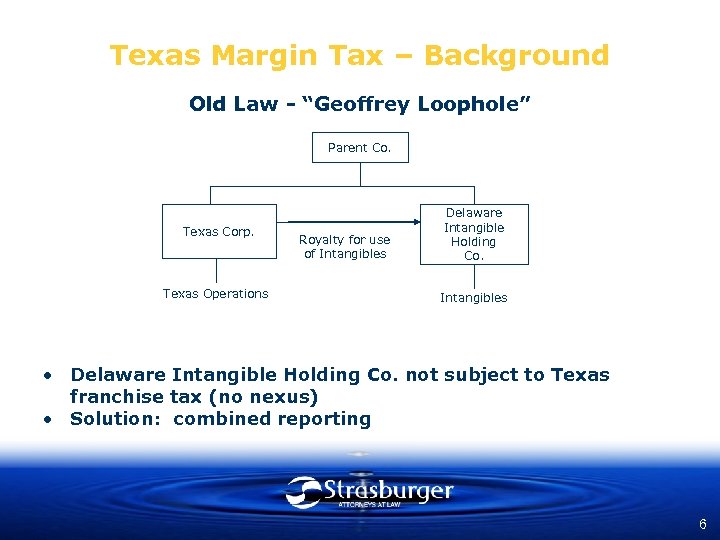

Texas Margin Tax – Background Old Law - “Geoffrey Loophole” Parent Co. Texas Corp. Texas Operations Royalty for use of Intangibles Delaware Intangible Holding Co. not subject to Texas franchise tax (no nexus) Solution: combined reporting 6

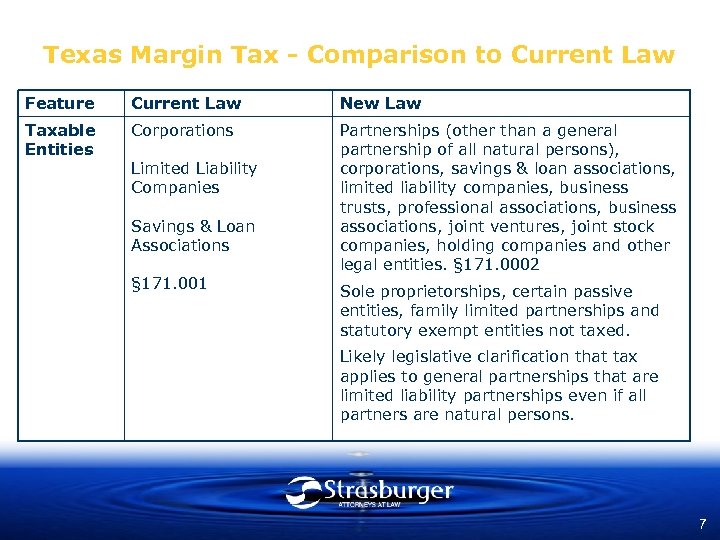

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Taxable Entities Corporations Partnerships (other than a general partnership of all natural persons), corporations, savings & loan associations, limited liability companies, business trusts, professional associations, business associations, joint ventures, joint stock companies, holding companies and other legal entities. § 171. 0002 Limited Liability Companies Savings & Loan Associations § 171. 001 Sole proprietorships, certain passive entities, family limited partnerships and statutory exempt entities not taxed. Likely legislative clarification that tax applies to general partnerships that are limited liability partnerships even if all partners are natural persons. 7

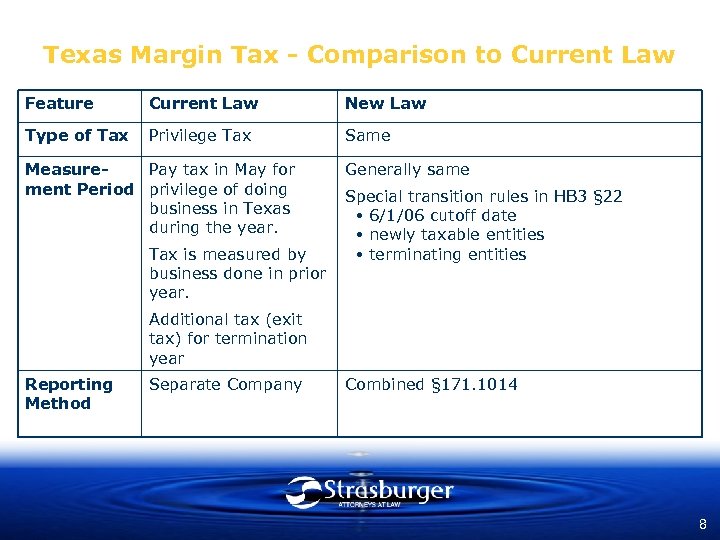

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Type of Tax Privilege Tax Same Measure. Pay tax in May for ment Period privilege of doing business in Texas during the year. Tax is measured by business done in prior year. Generally same Special transition rules in HB 3 § 22 6/1/06 cutoff date newly taxable entities terminating entities Additional tax (exit tax) for termination year Reporting Method Separate Company Combined § 171. 1014 8

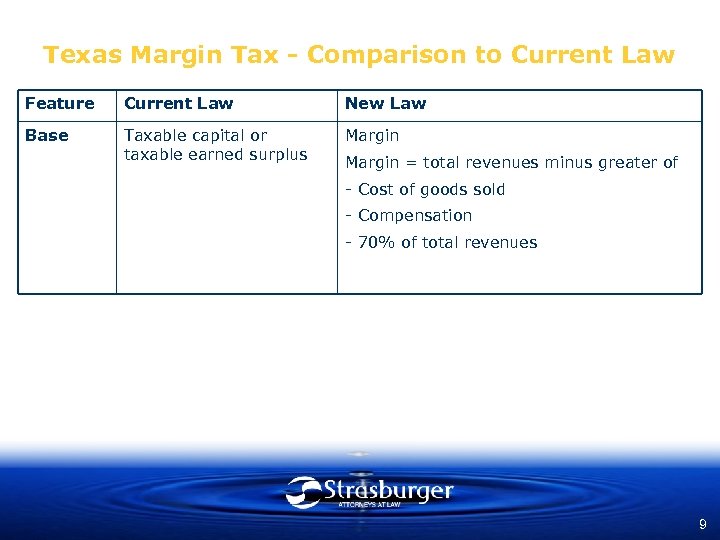

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Base Taxable capital or taxable earned surplus Margin = total revenues minus greater of - Cost of goods sold - Compensation - 70% of total revenues 9

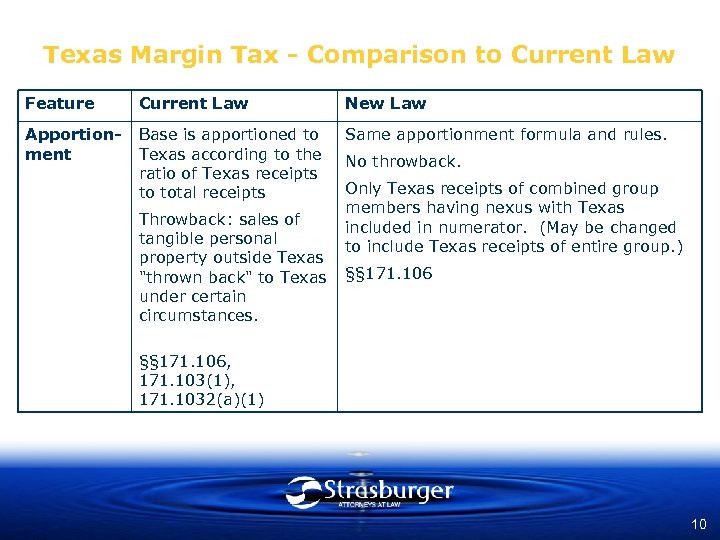

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Apportionment Base is apportioned to Texas according to the ratio of Texas receipts to total receipts Same apportionment formula and rules. Throwback: sales of tangible personal property outside Texas "thrown back" to Texas under certain circumstances. No throwback. Only Texas receipts of combined group members having nexus with Texas included in numerator. (May be changed to include Texas receipts of entire group. ) §§ 171. 106, 171. 103(1), 171. 1032(a)(1) 10

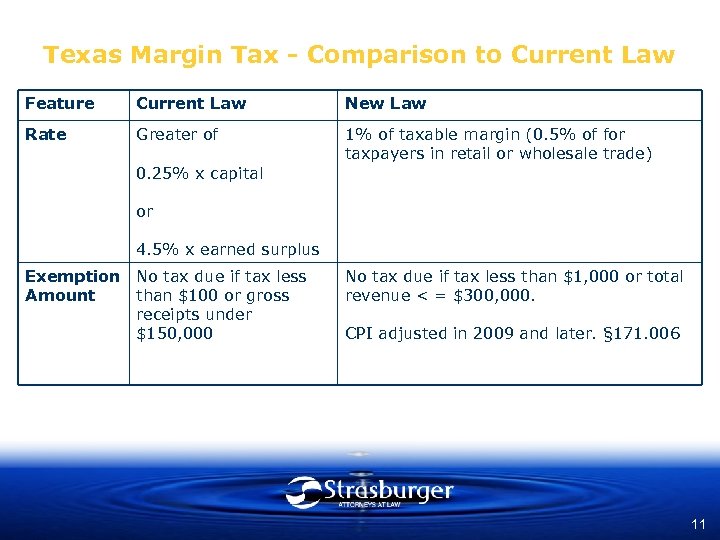

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Rate Greater of 1% of taxable margin (0. 5% of for taxpayers in retail or wholesale trade) 0. 25% x capital or 4. 5% x earned surplus Exemption No tax due if tax less Amount than $100 or gross receipts under $150, 000 No tax due if tax less than $1, 000 or total revenue < = $300, 000. CPI adjusted in 2009 and later. § 171. 006 11

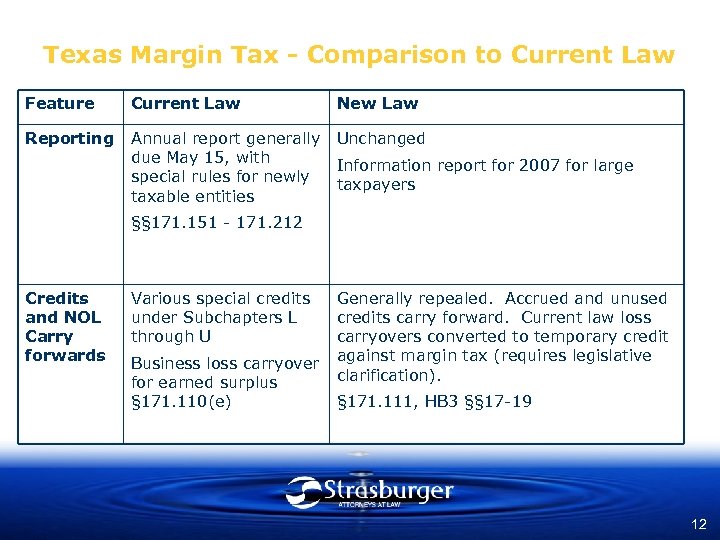

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Reporting Annual report generally due May 15, with special rules for newly taxable entities Unchanged Information report for 2007 for large taxpayers §§ 171. 151 - 171. 212 Credits and NOL Carry forwards Various special credits under Subchapters L through U Business loss carryover for earned surplus § 171. 110(e) Generally repealed. Accrued and unused credits carry forward. Current law loss carryovers converted to temporary credit against margin tax (requires legislative clarification). § 171. 111, HB 3 §§ 17 -19 12

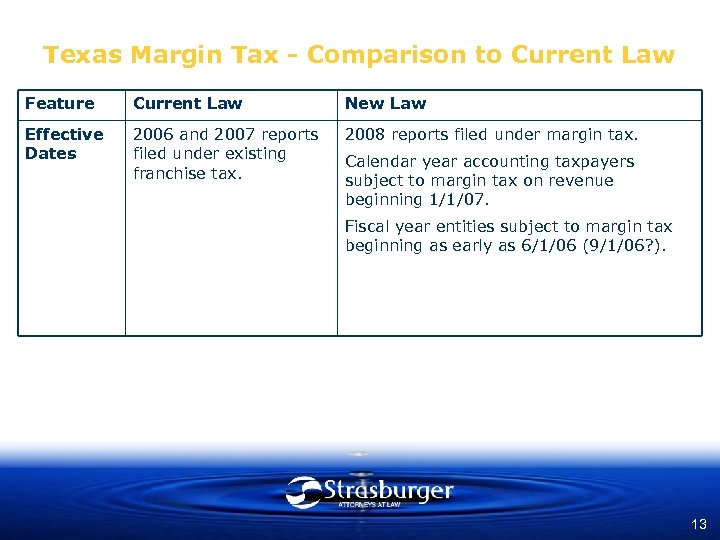

Texas Margin Tax - Comparison to Current Law Feature Current Law New Law Effective Dates 2006 and 2007 reports filed under existing franchise tax. 2008 reports filed under margin tax. Calendar year accounting taxpayers subject to margin tax on revenue beginning 1/1/07. Fiscal year entities subject to margin tax beginning as early as 6/1/06 (9/1/06? ). 13

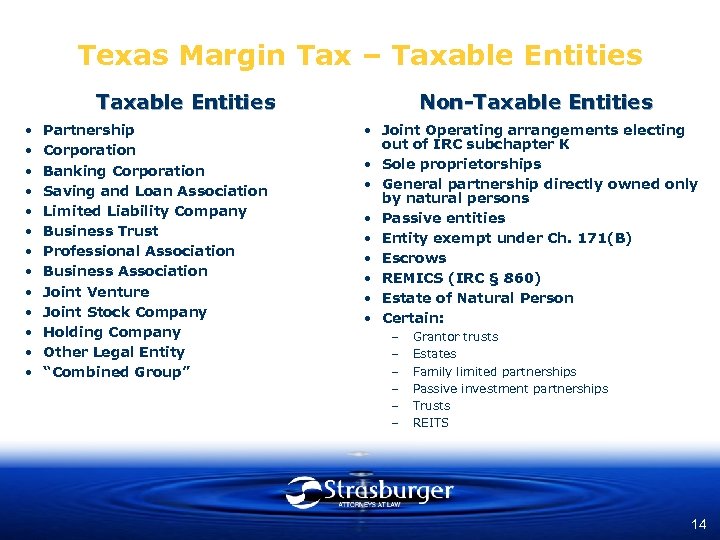

Texas Margin Tax – Taxable Entities • • • • Partnership Corporation Banking Corporation Saving and Loan Association Limited Liability Company Business Trust Professional Association Business Association Joint Venture Joint Stock Company Holding Company Other Legal Entity “Combined Group” Non-Taxable Entities • Joint Operating arrangements electing out of IRC subchapter K • Sole proprietorships • General partnership directly owned only by natural persons • Passive entities • Entity exempt under Ch. 171(B) • Escrows • REMICS (IRC § 860) • Estate of Natural Person • Certain: – – – Grantor trusts Estates Family limited partnerships Passive investment partnerships Trusts REITS 14

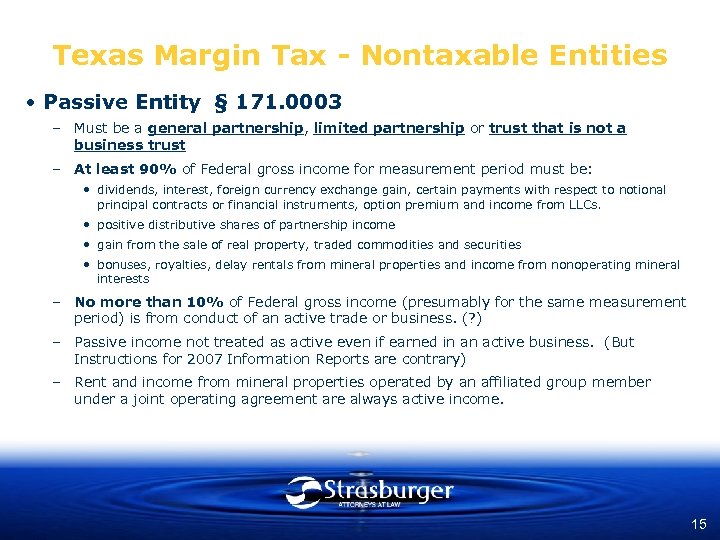

Texas Margin Tax - Nontaxable Entities • Passive Entity § 171. 0003 – Must be a general partnership, limited partnership or trust that is not a business trust – At least 90% of Federal gross income for measurement period must be: • dividends, interest, foreign currency exchange gain, certain payments with respect to notional principal contracts or financial instruments, option premium and income from LLCs. • positive distributive shares of partnership income • gain from the sale of real property, traded commodities and securities • bonuses, royalties, delay rentals from mineral properties and income from nonoperating mineral interests – No more than 10% of Federal gross income (presumably for the same measurement period) is from conduct of an active trade or business. (? ) – Passive income not treated as active even if earned in an active business. (But Instructions for 2007 Information Reports are contrary) – Rent and income from mineral properties operated by an affiliated group member under a joint operating agreement are always active income. 15

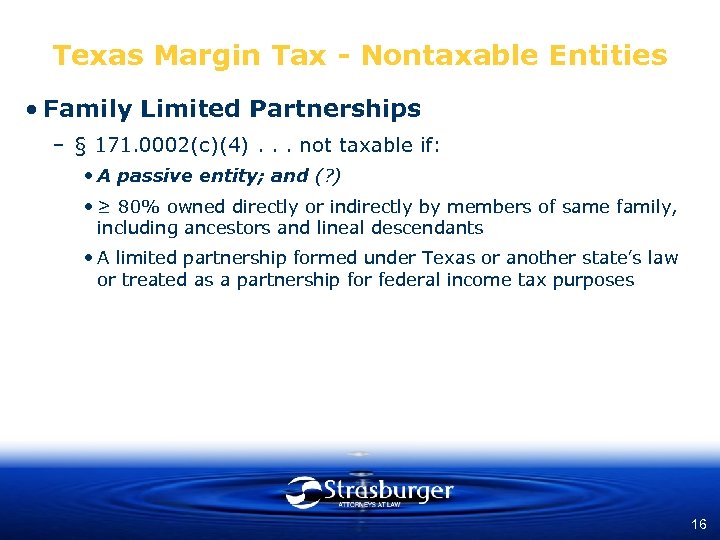

Texas Margin Tax - Nontaxable Entities • Family Limited Partnerships – § 171. 0002(c)(4). . . not taxable if: • A passive entity; and (? ) • ≥ 80% owned directly or indirectly by members of same family, including ancestors and lineal descendants • A limited partnership formed under Texas or another state’s law or treated as a partnership for federal income tax purposes 16

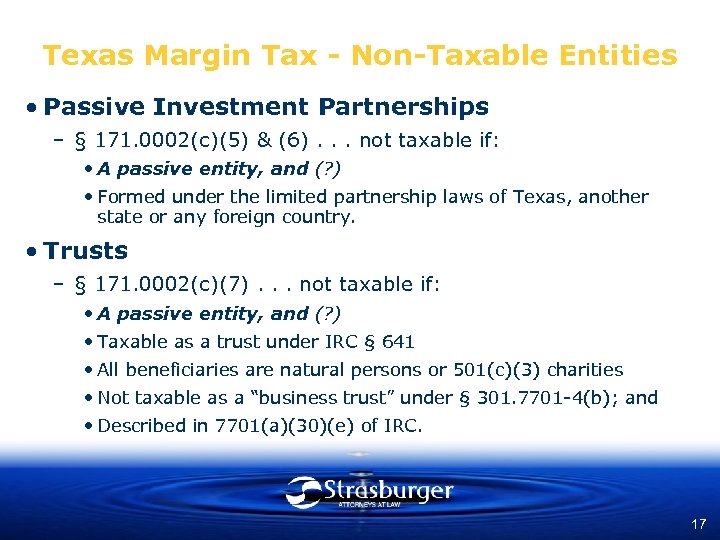

Texas Margin Tax - Non-Taxable Entities • Passive Investment Partnerships – § 171. 0002(c)(5) & (6). . . not taxable if: • A passive entity, and (? ) • Formed under the limited partnership laws of Texas, another state or any foreign country. • Trusts – § 171. 0002(c)(7). . . not taxable if: • A passive entity, and (? ) • Taxable as a trust under IRC § 641 • All beneficiaries are natural persons or 501(c)(3) charities • Not taxable as a “business trust” under § 301. 7701 -4(b); and • Described in 7701(a)(30)(e) of IRC. 17

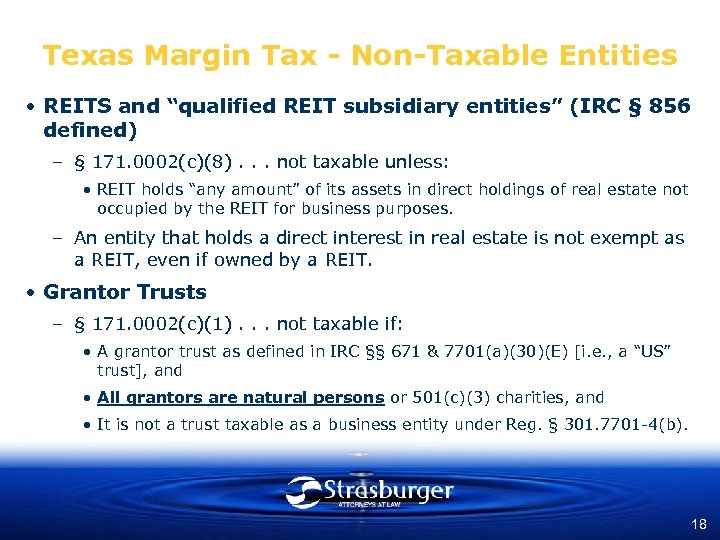

Texas Margin Tax - Non-Taxable Entities • REITS and “qualified REIT subsidiary entities” (IRC § 856 defined) – § 171. 0002(c)(8). . . not taxable unless: • REIT holds “any amount” of its assets in direct holdings of real estate not occupied by the REIT for business purposes. – An entity that holds a direct interest in real estate is not exempt as a REIT, even if owned by a REIT. • Grantor Trusts – § 171. 0002(c)(1). . . not taxable if: • A grantor trust as defined in IRC §§ 671 & 7701(a)(30)(E) [i. e. , a “US” trust], and • All grantors are natural persons or 501(c)(3) charities, and • It is not a trust taxable as a business entity under Reg. § 301. 7701 -4(b). 18

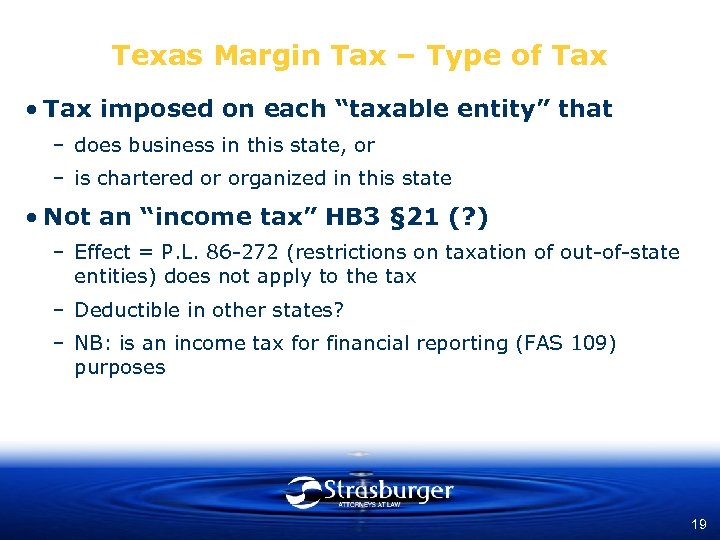

Texas Margin Tax – Type of Tax • Tax imposed on each “taxable entity” that – does business in this state, or – is chartered or organized in this state • Not an “income tax” HB 3 § 21 (? ) – Effect = P. L. 86 -272 (restrictions on taxation of out-of-state entities) does not apply to the tax – Deductible in other states? – NB: is an income tax for financial reporting (FAS 109) purposes 19

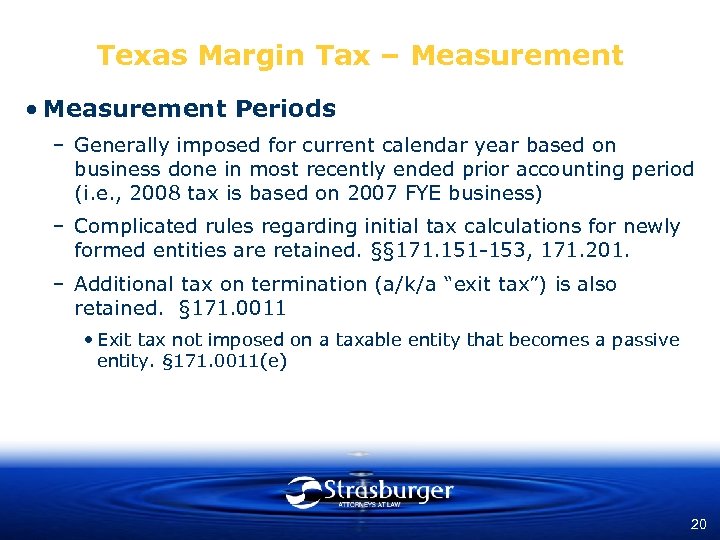

Texas Margin Tax – Measurement • Measurement Periods – Generally imposed for current calendar year based on business done in most recently ended prior accounting period (i. e. , 2008 tax is based on 2007 FYE business) – Complicated rules regarding initial tax calculations for newly formed entities are retained. §§ 171. 151 -153, 171. 201. – Additional tax on termination (a/k/a “exit tax”) is also retained. § 171. 0011 • Exit tax not imposed on a taxable entity that becomes a passive entity. § 171. 0011(e) 20

Texas Margin Tax – Reporting Method • Combined Reporting Requirement – Required of all taxable entities that are part of an affiliated group that is engaged in a unitary business. Treated as a single taxable entity for margin tax purposes. § 171. 1014 21

Texas Margin Tax – Reporting Method • Affiliated Group Test - § 171. 0001(1), (8) – Affiliated group = group of one or more entities in which a controlling interest is owned by a common owner or owners. – Controlling Interest = • Corporation: – ≥ 80% direct or indirect ownership of voting power; or – ≥ 80% direct or indirect ownership of beneficial ownership of voting stock (different than voting power? ) • Other entities: – ≥ 80% direct or indirect ownership of capital, profits or beneficial interest. 22

Texas Margin Tax –Reporting Method • Unitary Business Test § 171. 0001(17) – Divisions or entities that are “sufficiently interdependent, integrated, and interrelated through their activities so as to provide a synergy and mutual benefit that produces a sharing or exchange of value among them and a significant flow of value to the separate parts. ” – Factors • Whether activities of group members are in same general line of business or are steps in a vertically structured business • Whether members are functionally integrated through strong centralized management – Concept of unitary has been in franchise tax since § 171. 1061 was added in response to Allied Signal, 504 U. S. 768 (1992) 23

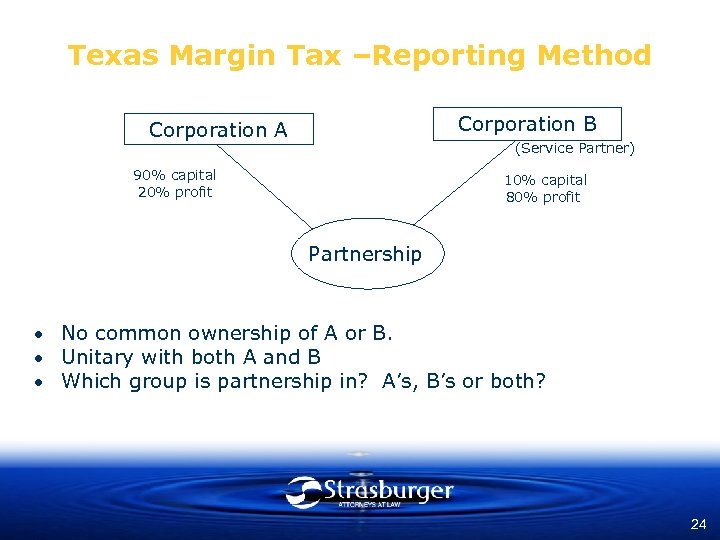

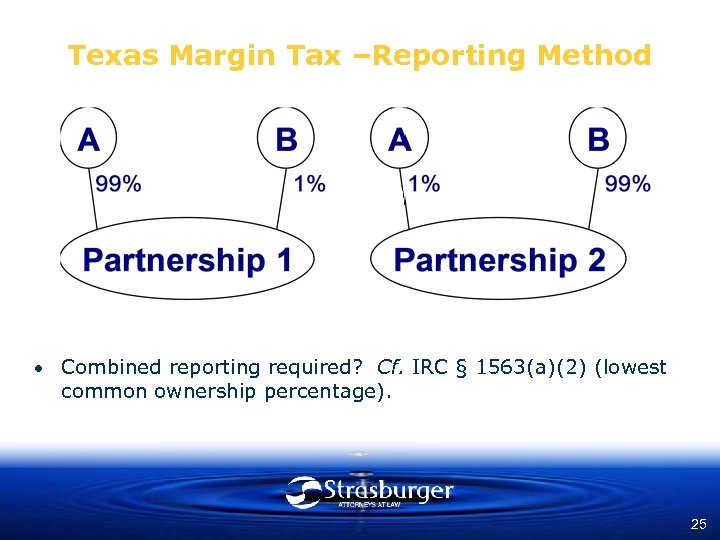

Texas Margin Tax –Reporting Method Corporation B Corporation A (Service Partner) 90% capital 20% profit 10% capital 80% profit Partnership No common ownership of A or B. Unitary with both A and B Which group is partnership in? A’s, B’s or both? 24

Texas Margin Tax –Reporting Method Combined reporting required? Cf. IRC § 1563(a)(2) (lowest common ownership percentage). 25

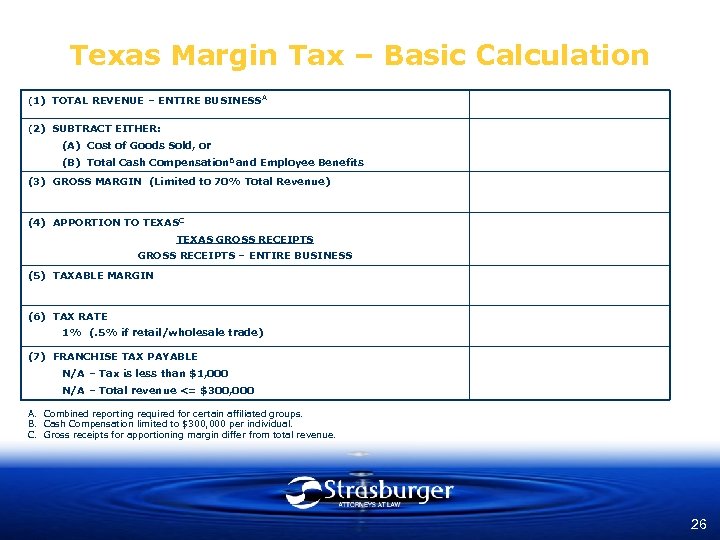

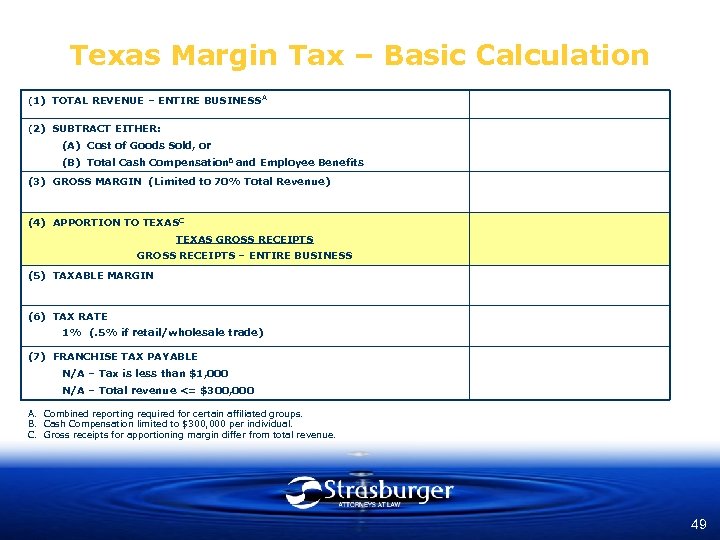

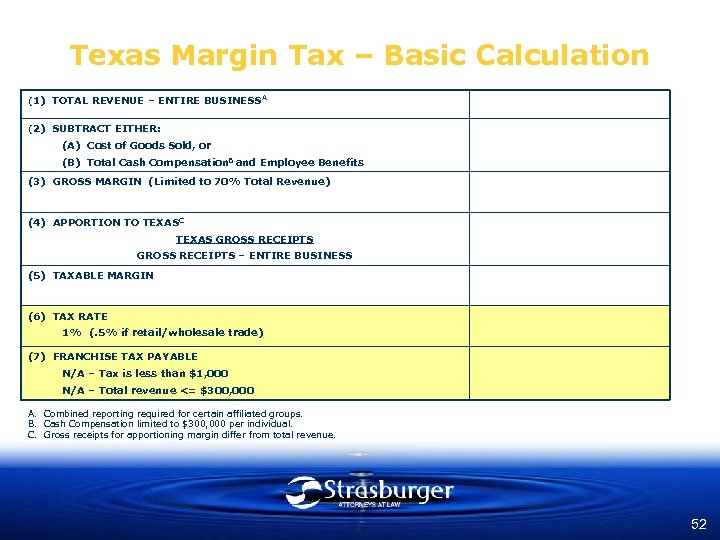

Texas Margin Tax – Basic Calculation (1) TOTAL REVENUE – ENTIRE BUSINESS A (2) SUBTRACT EITHER: (A) Cost of Goods Sold, or (B) Total Cash Compensation. B and Employee Benefits (3) GROSS MARGIN (Limited to 70% Total Revenue) (4) APPORTION TO TEXASC TEXAS GROSS RECEIPTS – ENTIRE BUSINESS (5) TAXABLE MARGIN (6) TAX RATE 1% (. 5% if retail/wholesale trade) (7) FRANCHISE TAX PAYABLE N/A – Tax is less than $1, 000 N/A – Total revenue <= $300, 000 A. Combined reporting required for certain affiliated groups. B. Cash Compensation limited to $300, 000 per individual. C. Gross receipts for apportioning margin differ from total revenue. 26

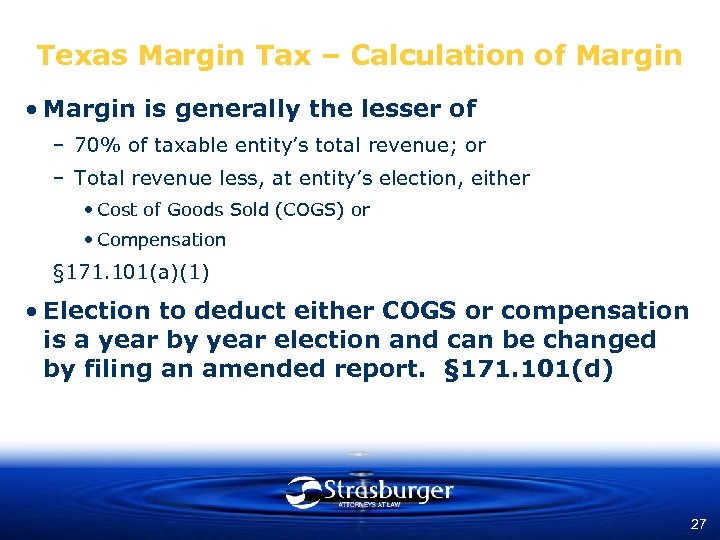

Texas Margin Tax – Calculation of Margin • Margin is generally the lesser of – 70% of taxable entity’s total revenue; or – Total revenue less, at entity’s election, either • Cost of Goods Sold (COGS) or • Compensation § 171. 101(a)(1) • Election to deduct either COGS or compensation is a year by year election and can be changed by filing an amended report. § 171. 101(d) 27

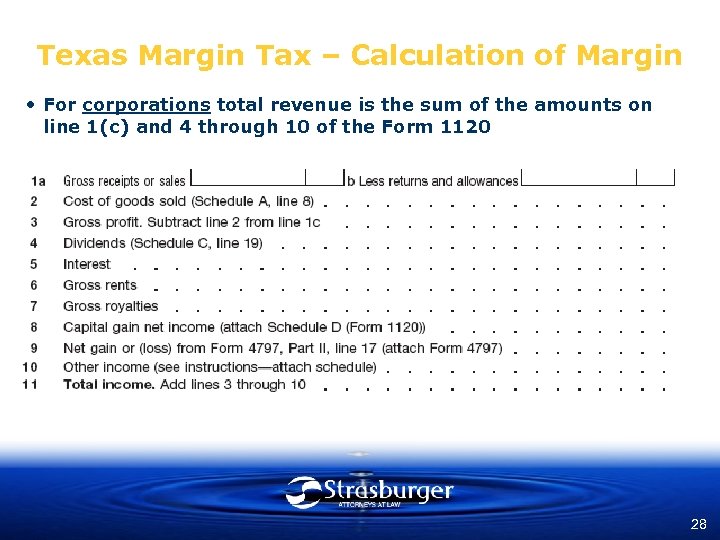

Texas Margin Tax – Calculation of Margin • For corporations total revenue is the sum of the amounts on line 1(c) and 4 through 10 of the Form 1120 28

Texas Margin Tax – Calculation of Margin • Corporate Subtractions: – bad debts – certain foreign income – income allocated to corporation from or by partnerships, S corporations, trusts, LLC’s and disregarded entities (avoids multiple taxation of same revenue) – Form 1120 Schedule C deductions (i. e. , dividend received deductions, to extend dividends included in income) § 171. 1011(c)(1)(B) 29

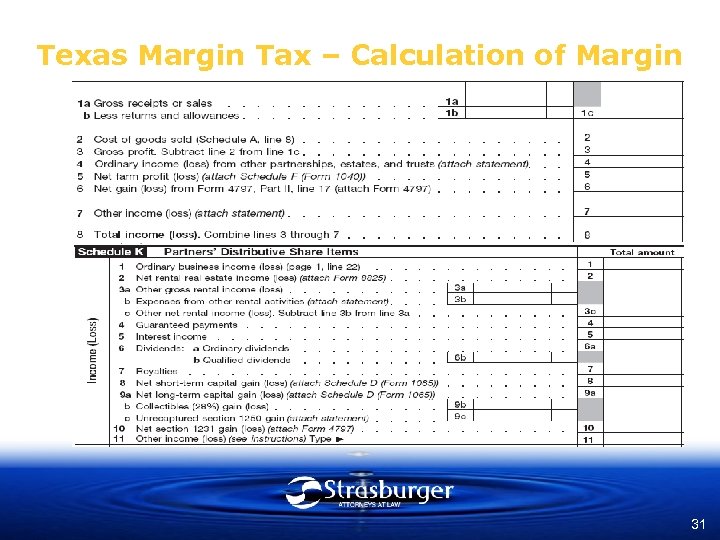

Texas Margin Tax – Calculation of Margin • Partnerships – Total revenue is the sum of the amounts on lines 1(c) and 4 through 7 of Form 1065 and on lines 2 through 11 of Form 1065 Schedule K (see next slide) – Subtractions are similar to corporate subtractions • bad debts • certain foreign income • income allocated to partnership from or by another partnership, trust, LLC, disregarded entity and S corporation 30

Texas Margin Tax – Calculation of Margin 31

Texas Margin Tax – Calculation of Margin • Other Entities – Margin is computed in a manner substantially similar to rules for corporations and partnerships as determined by Comptroller rules. § 171. 1011(c)(3) • Consolidated group members – Corporations that are part of consolidated Federal returns compute margin as if a separate federal return had been filed (which will then be combined with other members of the Texas combined report). § 171. 1011(d) 32

Texas Margin Tax – Calculation of Margin • Provisions to Avoid Double-Counting – Deduction for Income from Pass-Through Entities • Taxable entity can deduct net income from federal pass-through and disregarded entities. § 171. 101(c)(1)(B)(iii), (iv) • Can’t exclude income from a passive entity (PE) § 171. 1011(e) • Note: Owners can election to pay tax on behalf of the passthrough entity. § 171. 1015. – Exclusion of income from passive entity • Margin of taxable entity does not include income from a passive entity (PE) not in a combined report to the extent attributable to margin of a taxable entity. § 171. 1011(e) • Applies when taxable entity owns a PE, which in turn owns a lower-tier pass-through taxable entity (a PE “sandwich”) 33

Texas Margin Tax – Calculation of Margin • Provisions to Avoid Double-Counting (con’t) – Flow-through funds § 171. 1011(f) – (g-3) • Items mandated by law or fiduciary duty (e. g. , sales tax). • Items mandated by contract involving only the following: – Sales commissions to non-employees – Tax basis of securities underwritten – Subcontracting payments for services, labor, or material provided in connection with real property construction or surveying • Lending institution’s proceeds from loan principal repayments • Tax basis of securities and loans sold • Legal services entity’s flow through funds and reimbursements for out-ofpocket costs – Flow-through funds exclusion is not applicable if receipt is paid to an affiliated group member § 171. 1011(g) 34

Texas Margin Tax – Calculation of Margin • Provisions to Avoid Double-Counting (con’t) – Staff leasing company can exclude payments received from clients for wages etc. of assigned employees §§ 171. 1011(k), 171. 0001(11) – Management company can exclude reimbursements of costs incurred to conduct the business of the managed entity, including wages and cash compensation §§ 171. 1011(m-1), 171. 0001(11) • Other Revenue Exclusions – Dividends and interest on federal obligations § 171. 1011(m) 35

Texas Margin Tax – Calculation of Margin • Health Care Providers § 171. 1011(n) – Exclude from revenue payments received • under Medicaid program, Medicare program, Indigent Health Care and Treatment Act, and Children’s Health Insurance Program (CHIP); • for professional services provided in relation to a workers’ compensation claim; and • for professional services provided to a beneficiary rendered under the TRICARE military health system. – Exclude from revenue the cost for uncompensated care – Health care provider = taxable entity that participates as a provider in programs listed above 36

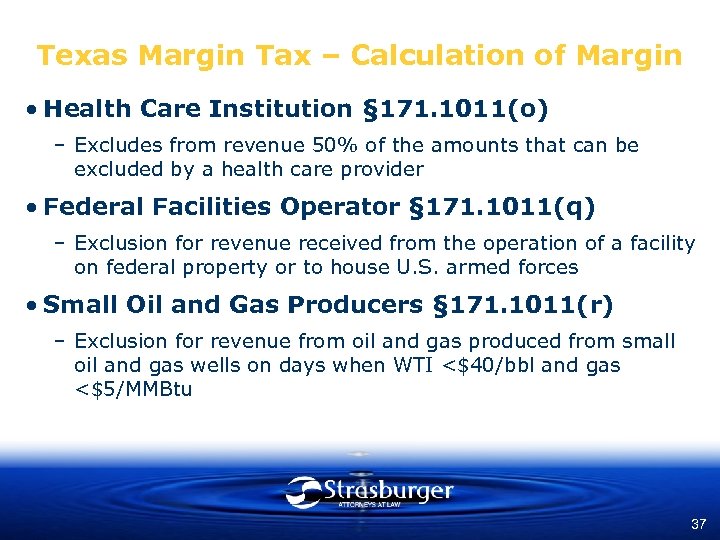

Texas Margin Tax – Calculation of Margin • Health Care Institution § 171. 1011(o) – Excludes from revenue 50% of the amounts that can be excluded by a health care provider • Federal Facilities Operator § 171. 1011(q) – Exclusion for revenue received from the operation of a facility on federal property or to house U. S. armed forces • Small Oil and Gas Producers § 171. 1011(r) – Exclusion for revenue from oil and gas produced from small oil and gas wells on days when WTI <$40/bbl and gas <$5/MMBtu 37

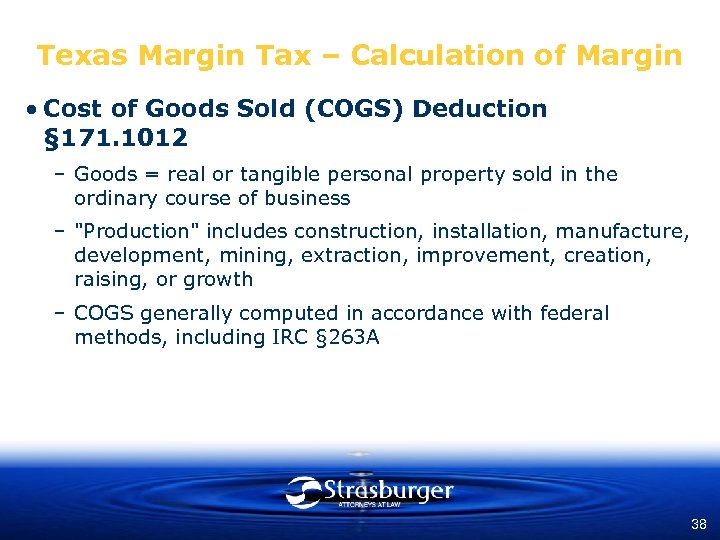

Texas Margin Tax – Calculation of Margin • Cost of Goods Sold (COGS) Deduction § 171. 1012 – Goods = real or tangible personal property sold in the ordinary course of business – "Production" includes construction, installation, manufacture, development, mining, extraction, improvement, creation, raising, or growth – COGS generally computed in accordance with federal methods, including IRC § 263 A 38

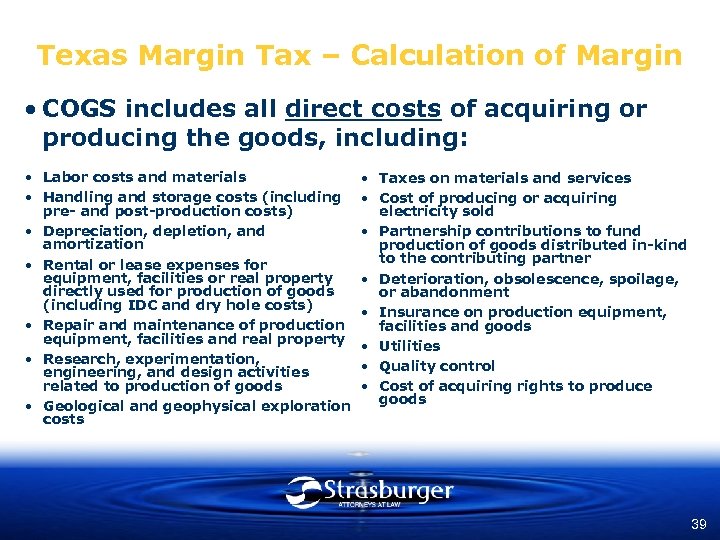

Texas Margin Tax – Calculation of Margin • COGS includes all direct costs of acquiring or producing the goods, including: • Labor costs and materials • Handling and storage costs (including pre- and post-production costs) • Depreciation, depletion, and amortization • Rental or lease expenses for equipment, facilities or real property directly used for production of goods (including IDC and dry hole costs) • Repair and maintenance of production equipment, facilities and real property • Research, experimentation, engineering, and design activities related to production of goods • Geological and geophysical exploration costs • Taxes on materials and services • Cost of producing or acquiring electricity sold • Partnership contributions to fund production of goods distributed in-kind to the contributing partner • Deterioration, obsolescence, spoilage, or abandonment • Insurance on production equipment, facilities and goods • Utilities • Quality control • Cost of acquiring rights to produce goods 39

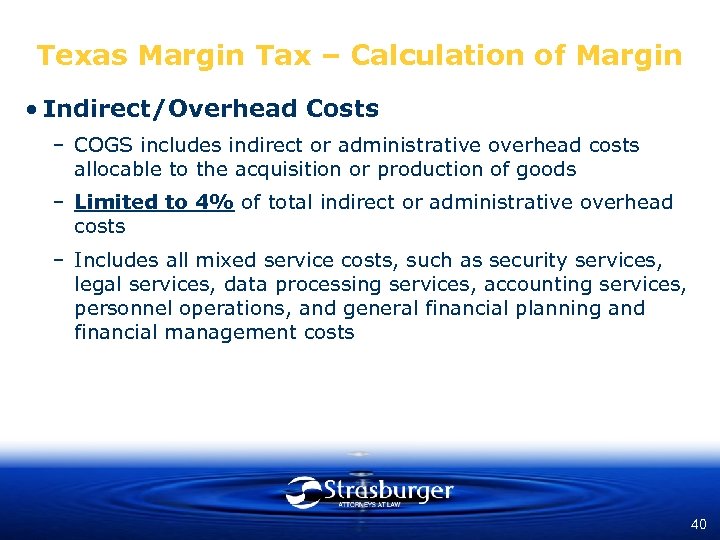

Texas Margin Tax – Calculation of Margin • Indirect/Overhead Costs – COGS includes indirect or administrative overhead costs allocable to the acquisition or production of goods – Limited to 4% of total indirect or administrative overhead costs – Includes all mixed service costs, such as security services, legal services, data processing services, accounting services, personnel operations, and general financial planning and financial management costs 40

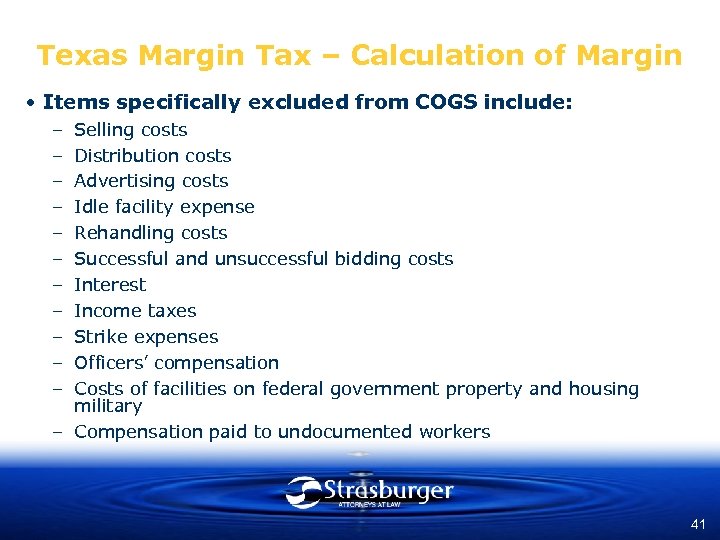

Texas Margin Tax – Calculation of Margin • Items specifically excluded from COGS include: – – – Selling costs Distribution costs Advertising costs Idle facility expense Rehandling costs Successful and unsuccessful bidding costs Interest Income taxes Strike expenses Officers’ compensation Costs of facilities on federal government property and housing military – Compensation paid to undocumented workers 41

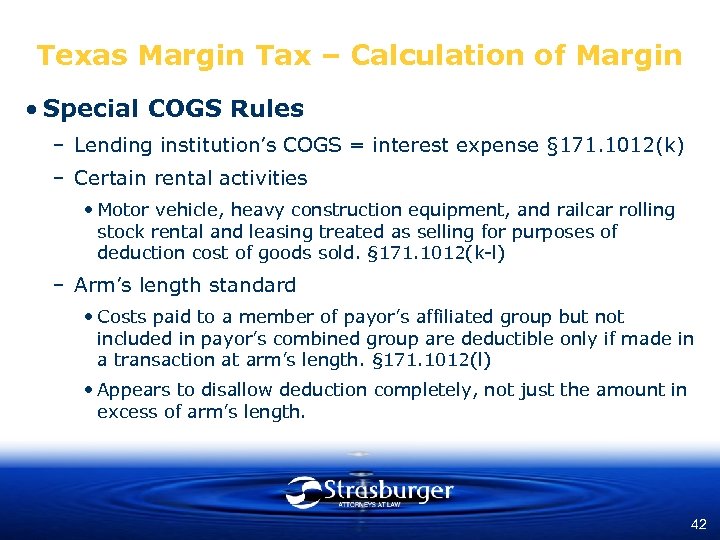

Texas Margin Tax – Calculation of Margin • Special COGS Rules – Lending institution’s COGS = interest expense § 171. 1012(k) – Certain rental activities • Motor vehicle, heavy construction equipment, and railcar rolling stock rental and leasing treated as selling for purposes of deduction cost of goods sold. § 171. 1012(k-l) – Arm’s length standard • Costs paid to a member of payor’s affiliated group but not included in payor’s combined group are deductible only if made in a transaction at arm’s length. § 171. 1012(l) • Appears to disallow deduction completely, not just the amount in excess of arm’s length. 42

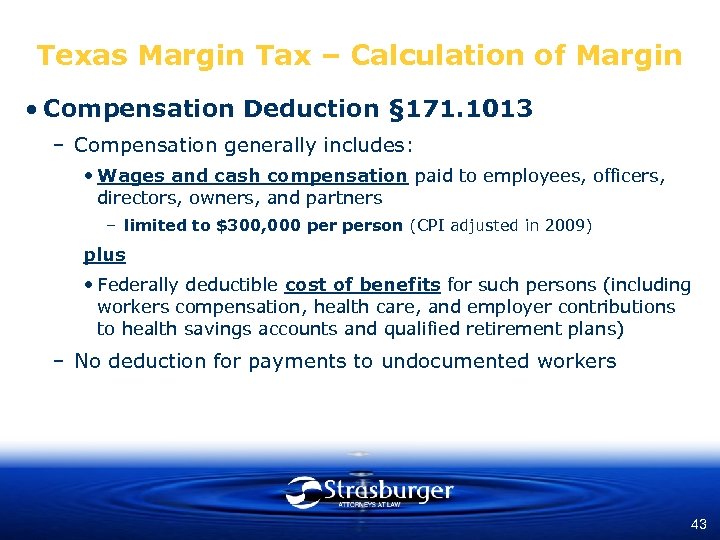

Texas Margin Tax – Calculation of Margin • Compensation Deduction § 171. 1013 – Compensation generally includes: • Wages and cash compensation paid to employees, officers, directors, owners, and partners – limited to $300, 000 person (CPI adjusted in 2009) plus • Federally deductible cost of benefits for such persons (including workers compensation, health care, and employer contributions to health savings accounts and qualified retirement plans) – No deduction for payments to undocumented workers 43

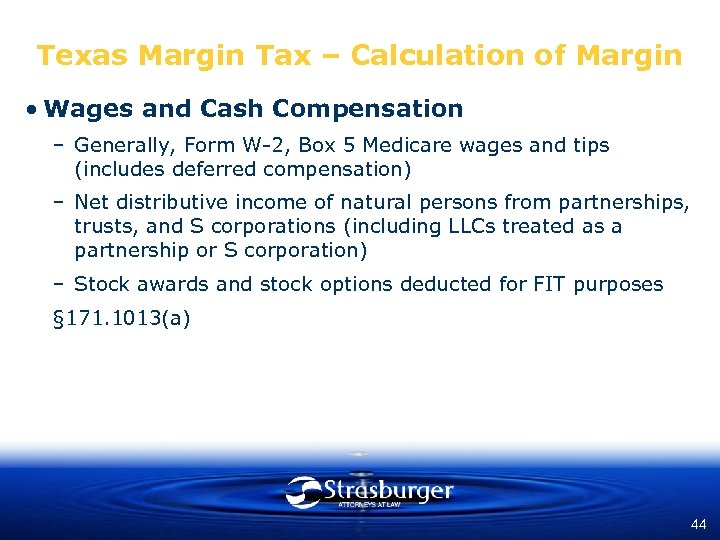

Texas Margin Tax – Calculation of Margin • Wages and Cash Compensation – Generally, Form W-2, Box 5 Medicare wages and tips (includes deferred compensation) – Net distributive income of natural persons from partnerships, trusts, and S corporations (including LLCs treated as a partnership or S corporation) – Stock awards and stock options deducted for FIT purposes § 171. 1013(a) 44

Texas Margin Tax – Calculation of Margin • Staff Leasing Companies § 171. 1013(d), (e) – Leasing company deducts compensation only for its own employees, and not for assigned employees – Client company deducts payments to leasing company for wages and benefits of assigned employees as if the assigned employees were actual employees of client • Cannot deduct any administrative fee • Cannot deduct any other amount, including payroll taxes – Leasing company revenue exclusion is in § 171. 1011(k) 45

Texas Margin Tax – Calculation of Margin • Management Companies § 171. 1013(f), (g) – Management company can’t deduct compensation costs that are reimbursed by a managed entity – Managed entity deducts reimbursements made to management company for compensation of leased employees as if the reimbursements were paid to employees of the managed entity • Cannot deduct any administrative fee • Cannot deduct any other amount, including payroll taxes – Management company revenue exclusion is in § 171. 1011(m-1) 46

Texas Margin Tax – Calculation of Margin • Federal Facilities Operators § 171. 1013(h) – Can’t include as wages or cash compensation amounts paid to an employee associated with the operation of a facility on federal property or for housing U. S. armed forces – Federal facilities operators’ revenue exclusion is in § 171. 1011(q) 47

Texas Margin Tax – Calculation of Margin • Combined Reporting § 171. 1014 – A combined group is a single taxable entity – Total revenue for the combined group is sum of each member’s separate revenues less intragroup revenues. – Single COGS v. compensation deduction election; applies to all members • Deduction is sum of each member’s separate COGS or compensation, less COGS or compensation paid to another group member – May elect to include in the combined group an “exempt entity” that would be in the group if it were not exempt 48

Texas Margin Tax – Basic Calculation (1) TOTAL REVENUE – ENTIRE BUSINESS A (2) SUBTRACT EITHER: (A) Cost of Goods Sold, or (B) Total Cash Compensation. B and Employee Benefits (3) GROSS MARGIN (Limited to 70% Total Revenue) (4) APPORTION TO TEXASC TEXAS GROSS RECEIPTS – ENTIRE BUSINESS (5) TAXABLE MARGIN (6) TAX RATE 1% (. 5% if retail/wholesale trade) (7) FRANCHISE TAX PAYABLE N/A – Tax is less than $1, 000 N/A – Total revenue <= $300, 000 A. Combined reporting required for certain affiliated groups. B. Cash Compensation limited to $300, 000 per individual. C. Gross receipts for apportioning margin differ from total revenue. 49

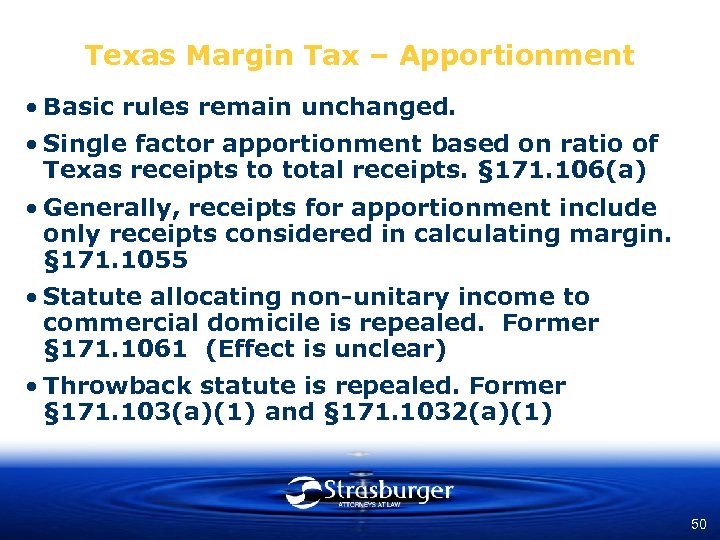

Texas Margin Tax – Apportionment • Basic rules remain unchanged. • Single factor apportionment based on ratio of Texas receipts to total receipts. § 171. 106(a) • Generally, receipts for apportionment include only receipts considered in calculating margin. § 171. 1055 • Statute allocating non-unitary income to commercial domicile is repealed. Former § 171. 1061 (Effect is unclear) • Throwback statute is repealed. Former § 171. 103(a)(1) and § 171. 1032(a)(1) 50

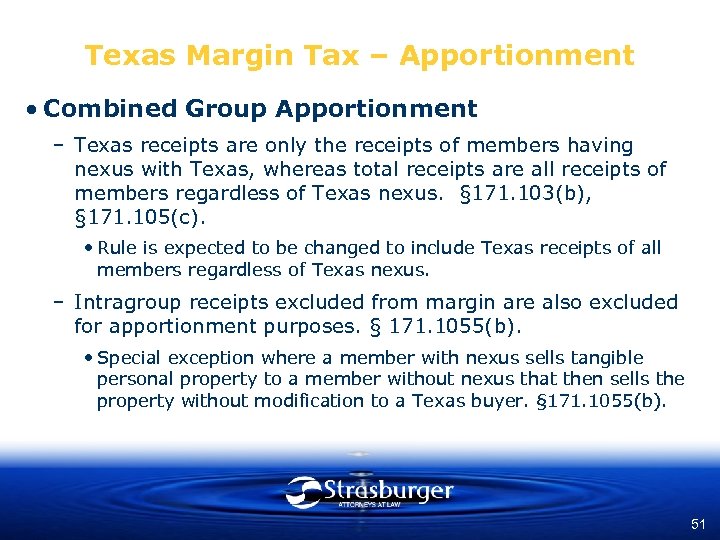

Texas Margin Tax – Apportionment • Combined Group Apportionment – Texas receipts are only the receipts of members having nexus with Texas, whereas total receipts are all receipts of members regardless of Texas nexus. § 171. 103(b), § 171. 105(c). • Rule is expected to be changed to include Texas receipts of all members regardless of Texas nexus. – Intragroup receipts excluded from margin are also excluded for apportionment purposes. § 171. 1055(b). • Special exception where a member with nexus sells tangible personal property to a member without nexus that then sells the property without modification to a Texas buyer. § 171. 1055(b). 51

Texas Margin Tax – Basic Calculation (1) TOTAL REVENUE – ENTIRE BUSINESS A (2) SUBTRACT EITHER: (A) Cost of Goods Sold, or (B) Total Cash Compensation. B and Employee Benefits (3) GROSS MARGIN (Limited to 70% Total Revenue) (4) APPORTION TO TEXASC TEXAS GROSS RECEIPTS – ENTIRE BUSINESS (5) TAXABLE MARGIN (6) TAX RATE 1% (. 5% if retail/wholesale trade) (7) FRANCHISE TAX PAYABLE N/A – Tax is less than $1, 000 N/A – Total revenue <= $300, 000 A. Combined reporting required for certain affiliated groups. B. Cash Compensation limited to $300, 000 per individual. C. Gross receipts for apportioning margin differ from total revenue. 52

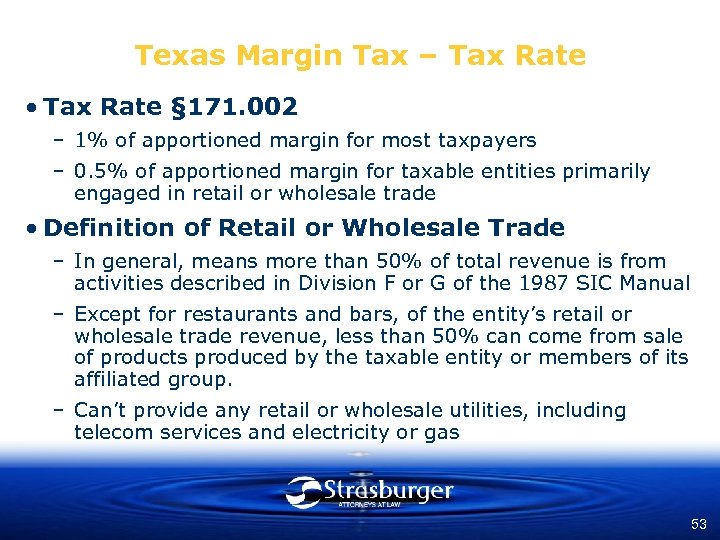

Texas Margin Tax – Tax Rate • Tax Rate § 171. 002 – 1% of apportioned margin for most taxpayers – 0. 5% of apportioned margin for taxable entities primarily engaged in retail or wholesale trade • Definition of Retail or Wholesale Trade – In general, means more than 50% of total revenue is from activities described in Division F or G of the 1987 SIC Manual – Except for restaurants and bars, of the entity’s retail or wholesale trade revenue, less than 50% can come from sale of products produced by the taxable entity or members of its affiliated group. – Can’t provide any retail or wholesale utilities, including telecom services and electricity or gas 53

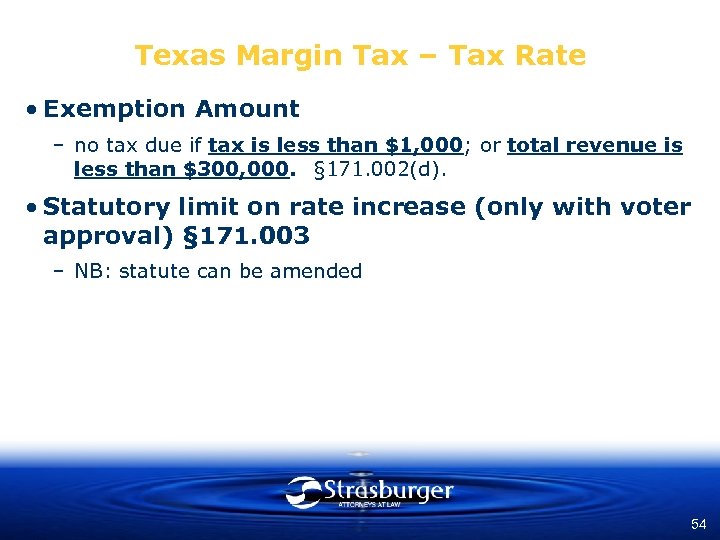

Texas Margin Tax – Tax Rate • Exemption Amount – no tax due if tax is less than $1, 000; or total revenue is less than $300, 000. § 171. 002(d). • Statutory limit on rate increase (only with voter approval) § 171. 003 – NB: statute can be amended 54

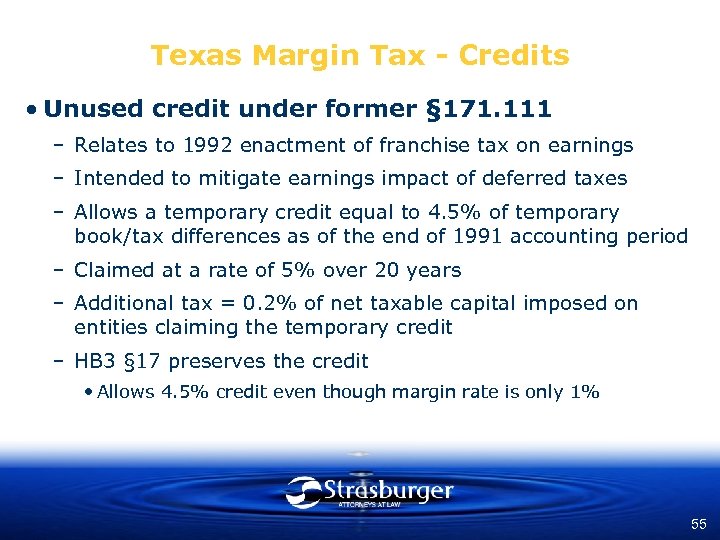

Texas Margin Tax - Credits • Unused credit under former § 171. 111 – Relates to 1992 enactment of franchise tax on earnings – Intended to mitigate earnings impact of deferred taxes – Allows a temporary credit equal to 4. 5% of temporary book/tax differences as of the end of 1991 accounting period – Claimed at a rate of 5% over 20 years – Additional tax = 0. 2% of net taxable capital imposed on entities claiming the temporary credit – HB 3 § 17 preserves the credit • Allows 4. 5% credit even though margin rate is only 1% 55

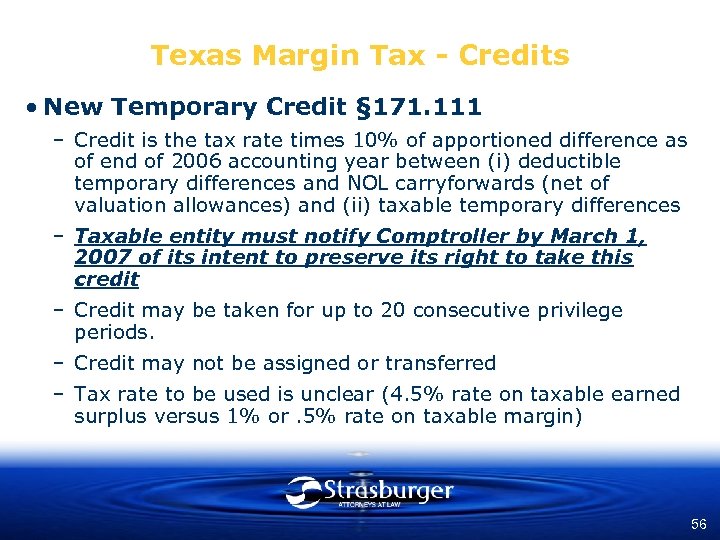

Texas Margin Tax - Credits • New Temporary Credit § 171. 111 – Credit is the tax rate times 10% of apportioned difference as of end of 2006 accounting year between (i) deductible temporary differences and NOL carryforwards (net of valuation allowances) and (ii) taxable temporary differences – Taxable entity must notify Comptroller by March 1, 2007 of its intent to preserve its right to take this credit – Credit may be taken for up to 20 consecutive privilege periods. – Credit may not be assigned or transferred – Tax rate to be used is unclear (4. 5% rate on taxable earned surplus versus 1% or. 5% rate on taxable margin) 56

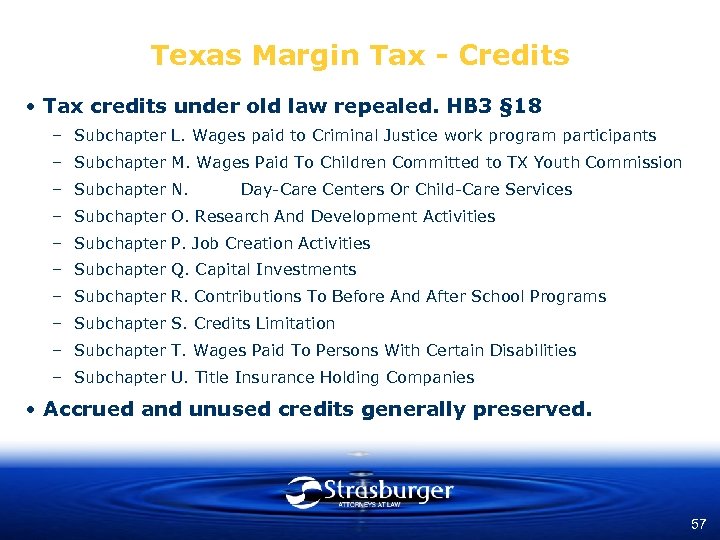

Texas Margin Tax - Credits • Tax credits under old law repealed. HB 3 § 18 – Subchapter L. Wages paid to Criminal Justice work program participants – Subchapter M. Wages Paid To Children Committed to TX Youth Commission – Subchapter N. Day-Care Centers Or Child-Care Services – Subchapter O. Research And Development Activities – Subchapter P. Job Creation Activities – Subchapter Q. Capital Investments – Subchapter R. Contributions To Before And After School Programs – Subchapter S. Credits Limitation – Subchapter T. Wages Paid To Persons With Certain Disabilities – Subchapter U. Title Insurance Holding Companies • Accrued and unused credits generally preserved. 57

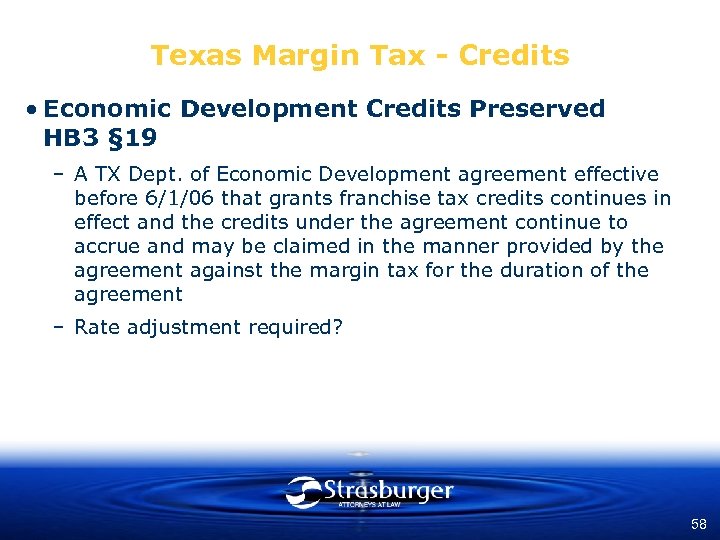

Texas Margin Tax - Credits • Economic Development Credits Preserved HB 3 § 19 – A TX Dept. of Economic Development agreement effective before 6/1/06 that grants franchise tax credits continues in effect and the credits under the agreement continue to accrue and may be claimed in the manner provided by the agreement against the margin tax for the duration of the agreement – Rate adjustment required? 58

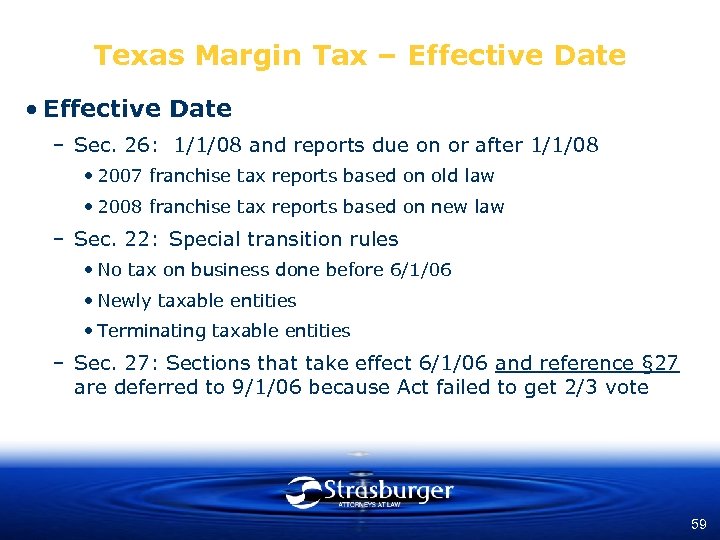

Texas Margin Tax – Effective Date • Effective Date – Sec. 26: 1/1/08 and reports due on or after 1/1/08 • 2007 franchise tax reports based on old law • 2008 franchise tax reports based on new law – Sec. 22: Special transition rules • No tax on business done before 6/1/06 • Newly taxable entities • Terminating taxable entities – Sec. 27: Sections that take effect 6/1/06 and reference § 27 are deferred to 9/1/06 because Act failed to get 2/3 vote 59

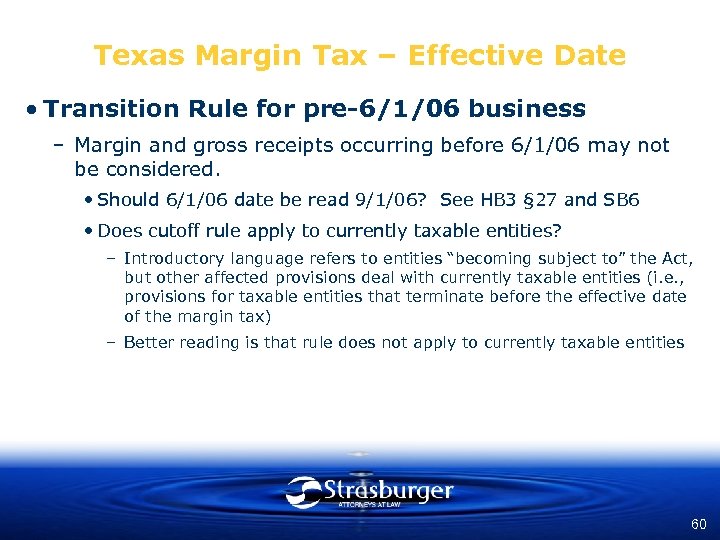

Texas Margin Tax – Effective Date • Transition Rule for pre-6/1/06 business – Margin and gross receipts occurring before 6/1/06 may not be considered. • Should 6/1/06 date be read 9/1/06? See HB 3 § 27 and SB 6 • Does cutoff rule apply to currently taxable entities? – Introductory language refers to entities “becoming subject to” the Act, but other affected provisions deal with currently taxable entities (i. e. , provisions for taxable entities that terminate before the effective date of the margin tax) – Better reading is that rule does not apply to currently taxable entities 60

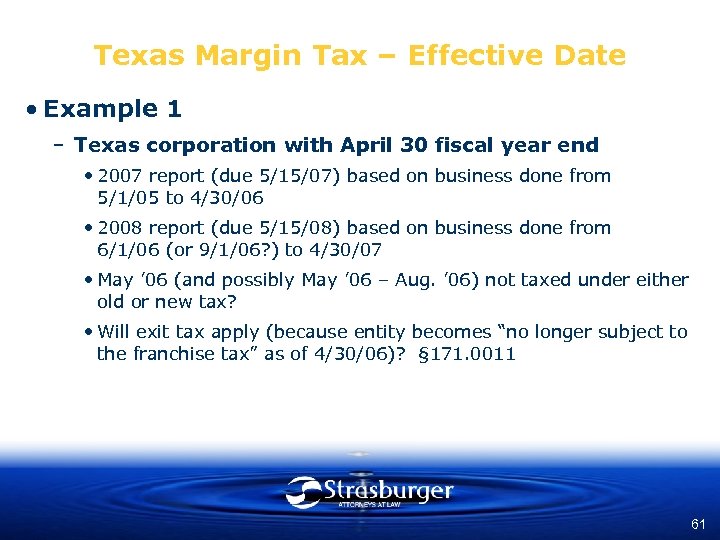

Texas Margin Tax – Effective Date • Example 1 – Texas corporation with April 30 fiscal year end • 2007 report (due 5/15/07) based on business done from 5/1/05 to 4/30/06 • 2008 report (due 5/15/08) based on business done from 6/1/06 (or 9/1/06? ) to 4/30/07 • May ’ 06 (and possibly May ’ 06 – Aug. ’ 06) not taxed under either old or new tax? • Will exit tax apply (because entity becomes “no longer subject to the franchise tax” as of 4/30/06)? § 171. 0011 61

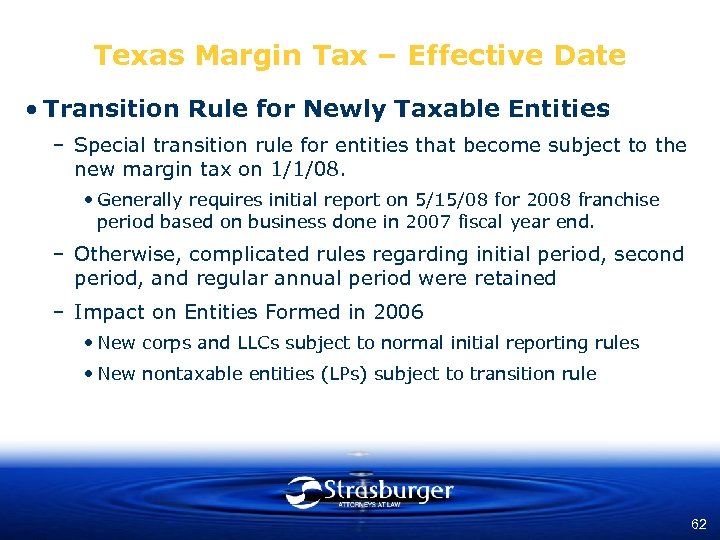

Texas Margin Tax – Effective Date • Transition Rule for Newly Taxable Entities – Special transition rule for entities that become subject to the new margin tax on 1/1/08. • Generally requires initial report on 5/15/08 for 2008 franchise period based on business done in 2007 fiscal year end. – Otherwise, complicated rules regarding initial period, second period, and regular annual period were retained – Impact on Entities Formed in 2006 • New corps and LLCs subject to normal initial reporting rules • New nontaxable entities (LPs) subject to transition rule 62

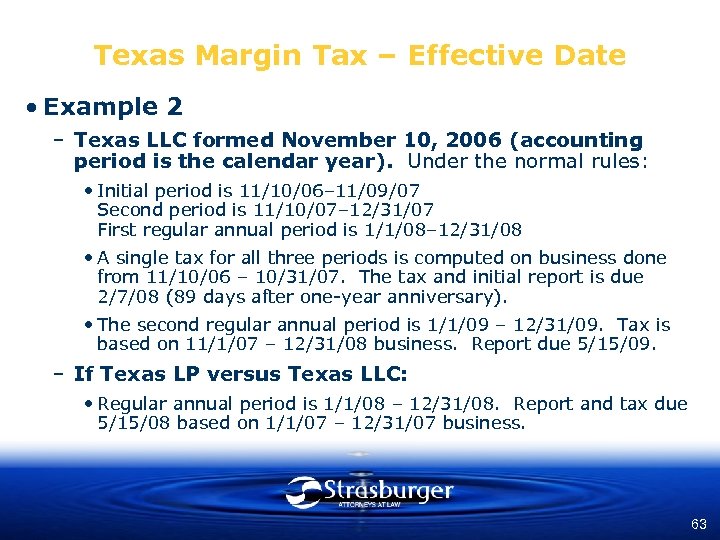

Texas Margin Tax – Effective Date • Example 2 – Texas LLC formed November 10, 2006 (accounting period is the calendar year). Under the normal rules: • Initial period is 11/10/06– 11/09/07 Second period is 11/10/07– 12/31/07 First regular annual period is 1/1/08– 12/31/08 • A single tax for all three periods is computed on business done from 11/10/06 – 10/31/07. The tax and initial report is due 2/7/08 (89 days after one-year anniversary). • The second regular annual period is 1/1/09 – 12/31/09. Tax is based on 11/1/07 – 12/31/08 business. Report due 5/15/09. – If Texas LP versus Texas LLC: • Regular annual period is 1/1/08 – 12/31/08. Report and tax due 5/15/08 based on 1/1/07 – 12/31/07 business. 63

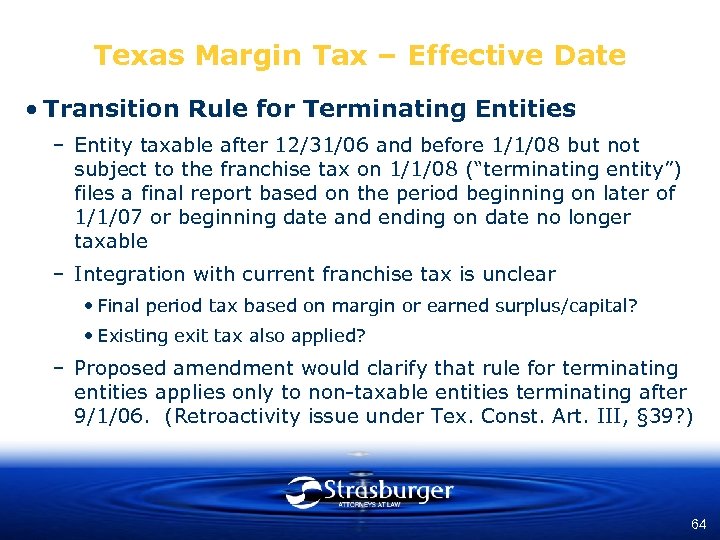

Texas Margin Tax – Effective Date • Transition Rule for Terminating Entities – Entity taxable after 12/31/06 and before 1/1/08 but not subject to the franchise tax on 1/1/08 (“terminating entity”) files a final report based on the period beginning on later of 1/1/07 or beginning date and ending on date no longer taxable – Integration with current franchise tax is unclear • Final period tax based on margin or earned surplus/capital? • Existing exit tax also applied? – Proposed amendment would clarify that rule for terminating entities applies only to non-taxable entities terminating after 9/1/06. (Retroactivity issue under Tex. Const. Art. III, § 39? ) 64

Texas Margin Tax – Effective Date • Example 3 – Texas corporation with calendar year end dissolves August 31, 2007 • Files final report for period 1/1/07 to 8/31/07 • HB 3 § 22(b)(3) doesn’t say anything about tax due. Is the tax for this privilege period based on margin, old law (i. e. , existing exit tax), or both? • Does business done for period 9/1/06 – 12/31/07 escape tax? 65

Texas Margin Tax – Effective Date • Continuing Partnerships – “A partnership is considered terminated only if no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership. ” HB 3 § 22(d) – Example: Partnership ABC dissolves during 2007. A and B then form a new limited partnership and continue their portion of the partnership business. It appears that AB Partnership will be taxed on ABC Partnership’s 2007 business (regardless of the percentage of ownership overlap or business continued). 66

Texas Margin Tax – Effective Date • Merged/Divided Partnerships – A merged or consolidated partnership is deemed continued if its owners hold >50% of the surviving partnership’s capital and profits. HB 3 § 22(e) – In a division of a partnership, the resulting partnerships are deemed to be a continuation of the former partnership unless the former owners own 50% or less of the resulting partnership’s capital and profits. HB 3 § 22(f) 67

Texas Margin Tax – Effective Date • Loophole for Terminating Partnerships – Nontaxable entities that terminate before 1/1/08 never become subject to the margin tax – Rules for continuing partnerships do not appear to cover a conversion to an LLC – Proposed amendment (SB 6) would have imposed margin tax on period from 9/1/06 to termination date • Note: Imposes tax on margin of calendar year entities earned in 2006 that would not otherwise be subject to tax • If enacted in 2007 legislative session, it would in some cases impose tax on privileges exercised prior to enactment, which is probably unconstitutional under TX Const. Art. III, Sec. 39. 68

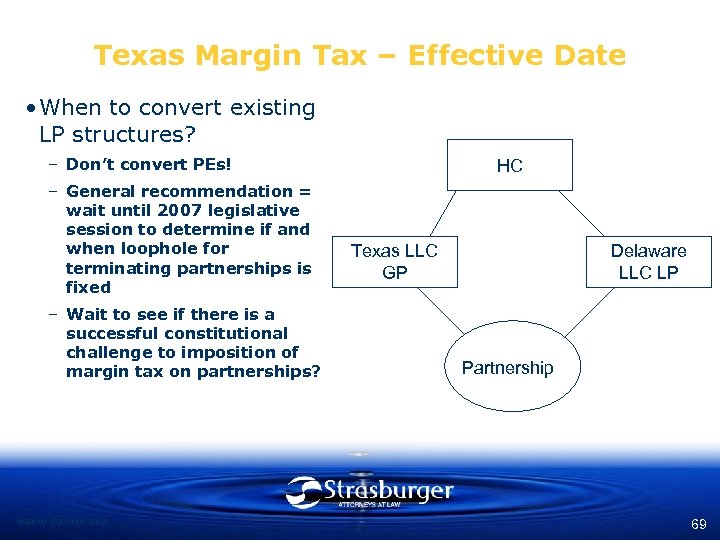

Texas Margin Tax – Effective Date • When to convert existing LP structures? – Don’t convert PEs! – General recommendation = wait until 2007 legislative session to determine if and when loophole for terminating partnerships is fixed – Wait to see if there is a successful constitutional challenge to imposition of margin tax on partnerships? 1888050. 1/SP/0005. 0002 HC Texas LLC GP Delaware LLC LP Partnership 69

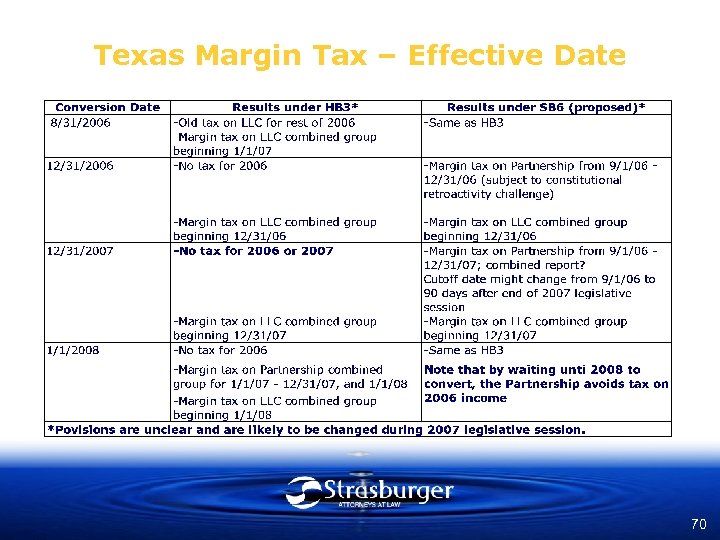

Texas Margin Tax – Effective Date 70

Texas Margin Tax – Effective Date • Special Information Reports HB 3 § 23 – Affected entities = 1000 entities • owing the most franchise tax for 2005 • with the greatest gross receipts in 2005 • with the most employees in 2005 • with the greatest school M&O property tax levy – Must compute tax due on 2005 FYE data – Draft forms and instructions issued 10/13 – Forms will be mailed 11/15/06 – 12/2/06. Due 2/15/07 (no extensions). Failure to file = charter forfeited. 71

Texas Margin Tax – Constitutionality • Texas Supreme Court has exclusive and original jurisdiction over challenges to the constitutionality of the tax and must rule on challenges within 120 days of filing. HB 3 § 24 • Comptroller Strayhorn has requested Attorney General to rule on whether Margin Tax violates “Bullock Amendment” to Texas Constitution as an unconstitutional tax on natural persons’ share of partnership income 72

Texas Margin Tax APPLICATION AND PLANNING 73

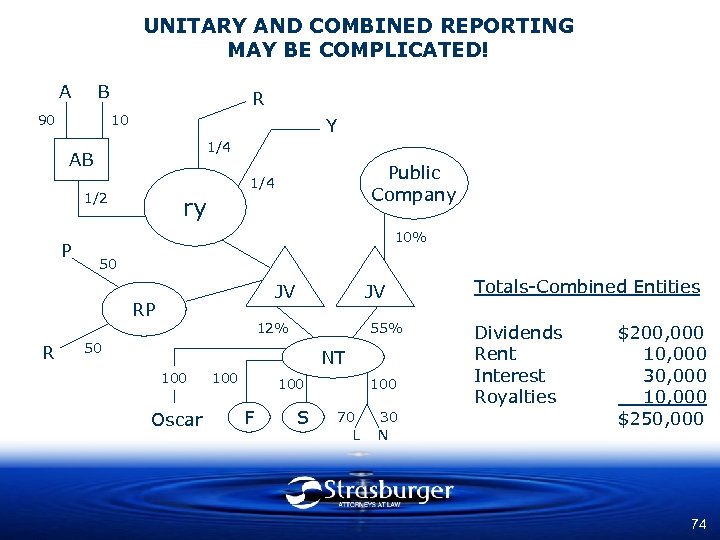

UNITARY AND COMBINED REPORTING MAY BE COMPLICATED! A B 90 R 10 Y 1/4 AB 1/2 P ry 10% 50 JV RP R Public Company 1/4 JV 12% 55% 50 NT 100 Oscar 100 F S 100 70 L 30 N Totals-Combined Entities Dividends Rent Interest Royalties $200, 000 10, 000 30, 000 10, 000 $250, 000 74

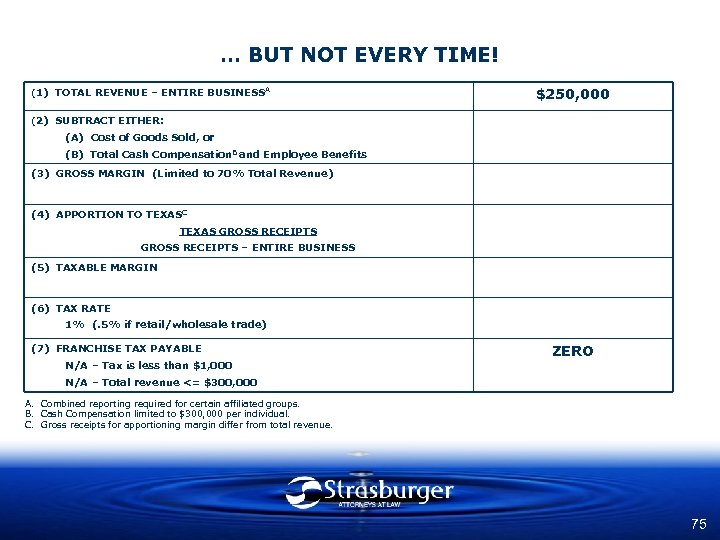

… BUT NOT EVERY TIME! (1) TOTAL REVENUE – ENTIRE BUSINESS A $250, 000 (2) SUBTRACT EITHER: (A) Cost of Goods Sold, or (B) Total Cash Compensation. B and Employee Benefits (3) GROSS MARGIN (Limited to 70% Total Revenue) (4) APPORTION TO TEXASC TEXAS GROSS RECEIPTS – ENTIRE BUSINESS (5) TAXABLE MARGIN (6) TAX RATE 1% (. 5% if retail/wholesale trade) (7) FRANCHISE TAX PAYABLE N/A – Tax is less than $1, 000 ZERO N/A – Total revenue <= $300, 000 A. Combined reporting required for certain affiliated groups. B. Cash Compensation limited to $300, 000 per individual. C. Gross receipts for apportioning margin differ from total revenue. 75

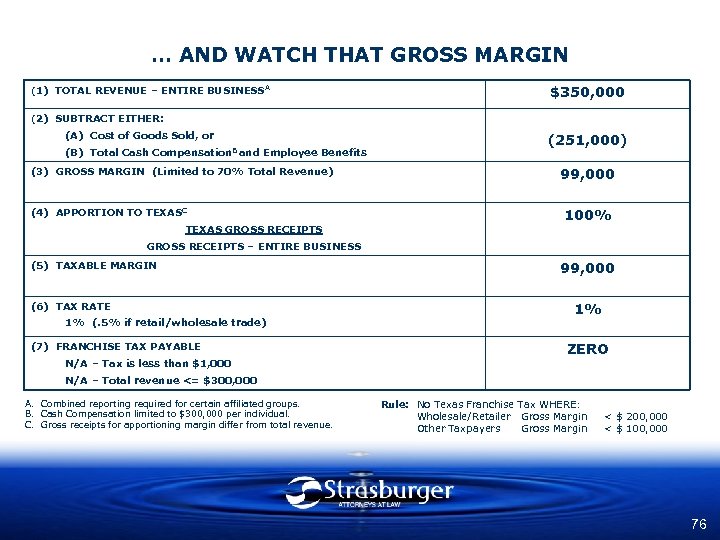

… AND WATCH THAT GROSS MARGIN (1) TOTAL REVENUE – ENTIRE BUSINESS A $350, 000 (2) SUBTRACT EITHER: (A) Cost of Goods Sold, or (B) Total Cash Compensation. B and Employee Benefits (3) GROSS MARGIN (Limited to 70% Total Revenue) (4) APPORTION TO TEXASC TEXAS GROSS RECEIPTS (251, 000) 99, 000 100% GROSS RECEIPTS – ENTIRE BUSINESS (5) TAXABLE MARGIN (6) TAX RATE 1% (. 5% if retail/wholesale trade) (7) FRANCHISE TAX PAYABLE N/A – Tax is less than $1, 000 99, 000 1% ZERO N/A – Total revenue <= $300, 000 A. Combined reporting required for certain affiliated groups. B. Cash Compensation limited to $300, 000 per individual. C. Gross receipts for apportioning margin differ from total revenue. Rule: No Texas Franchise Tax WHERE: Wholesale/Retailer Gross Margin Other Taxpayers Gross Margin < $ 200, 000 < $ 100, 000 76

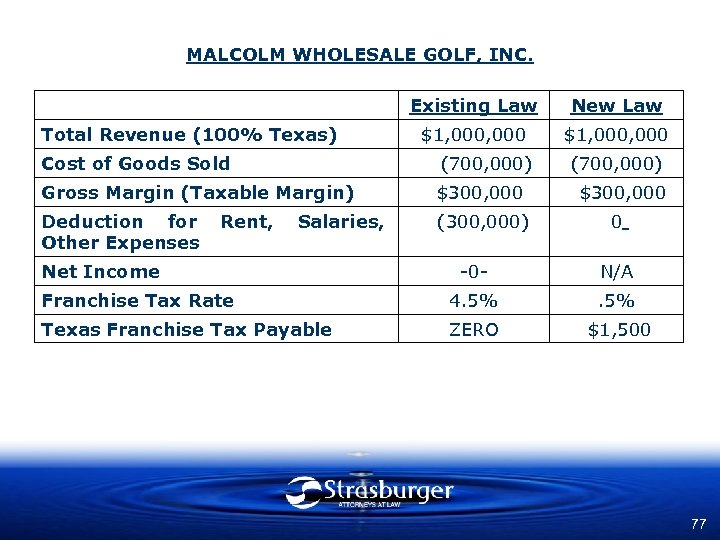

MALCOLM WHOLESALE GOLF, INC. Existing Law Total Revenue (100% Texas) New Law $1, 000, 000 Cost of Goods Sold (700, 000) Gross Margin (Taxable Margin) $300, 000 Deduction for Other Expenses (300, 000) Rent, Salaries, Net Income (700, 000) $300, 000 0 -0 - N/A Franchise Tax Rate 4. 5% Texas Franchise Tax Payable ZERO $1, 500 77

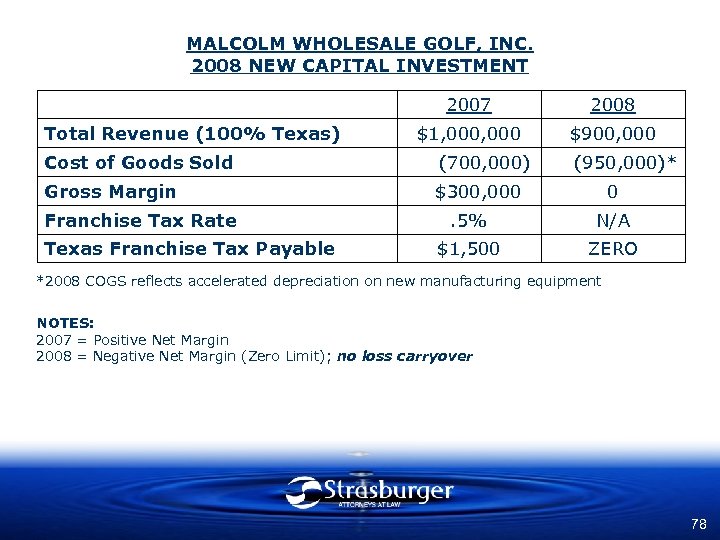

MALCOLM WHOLESALE GOLF, INC. 2008 NEW CAPITAL INVESTMENT 2007 Total Revenue (100% Texas) 2008 $1, 000 $900, 000 Cost of Goods Sold (700, 000) Gross Margin $300, 000 Franchise Tax Rate Texas Franchise Tax Payable (950, 000)* 0 . 5% N/A $1, 500 ZERO *2008 COGS reflects accelerated depreciation on new manufacturing equipment NOTES: 2007 = Positive Net Margin 2008 = Negative Net Margin (Zero Limit); no loss carryover 78

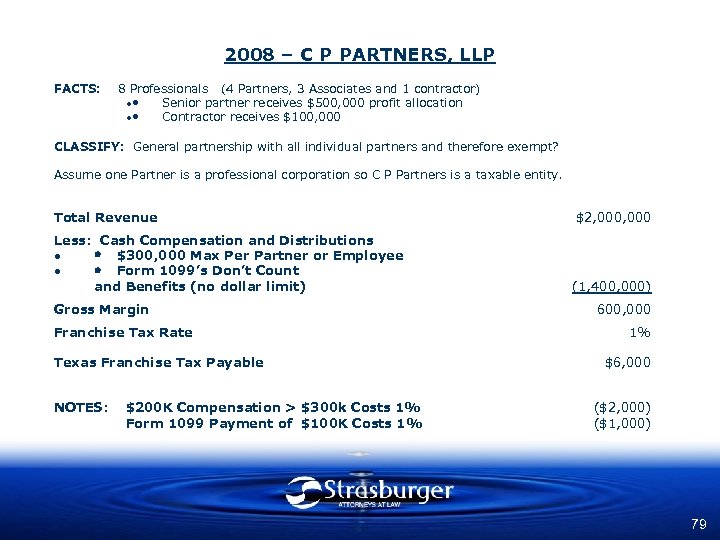

2008 – C P PARTNERS, LLP FACTS: 8 Professionals (4 Partners, 3 Associates and 1 contractor) Senior partner receives $500, 000 profit allocation Contractor receives $100, 000 CLASSIFY: General partnership with all individual partners and therefore exempt? Assume one Partner is a professional corporation so C P Partners is a taxable entity. Total Revenue $2, 000 Less: Cash Compensation and Distributions $300, 000 Max Per Partner or Employee Form 1099’s Don’t Count and Benefits (no dollar limit) (1, 400, 000) Gross Margin Franchise Tax Rate Texas Franchise Tax Payable NOTES: $200 K Compensation > $300 k Costs 1% Form 1099 Payment of $100 K Costs 1% 600, 000 1% $6, 000 ($2, 000) ($1, 000) 79

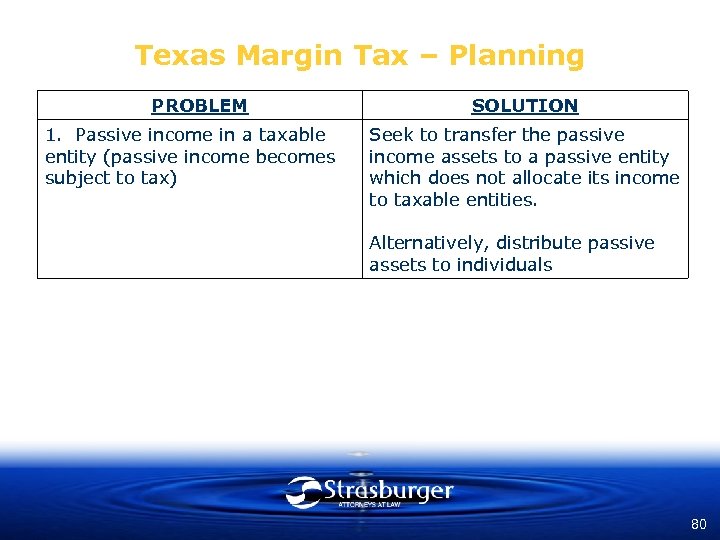

Texas Margin Tax – Planning PROBLEM 1. Passive income in a taxable entity (passive income becomes subject to tax) SOLUTION Seek to transfer the passive income assets to a passive entity which does not allocate its income to taxable entities. Alternatively, distribute passive assets to individuals 80

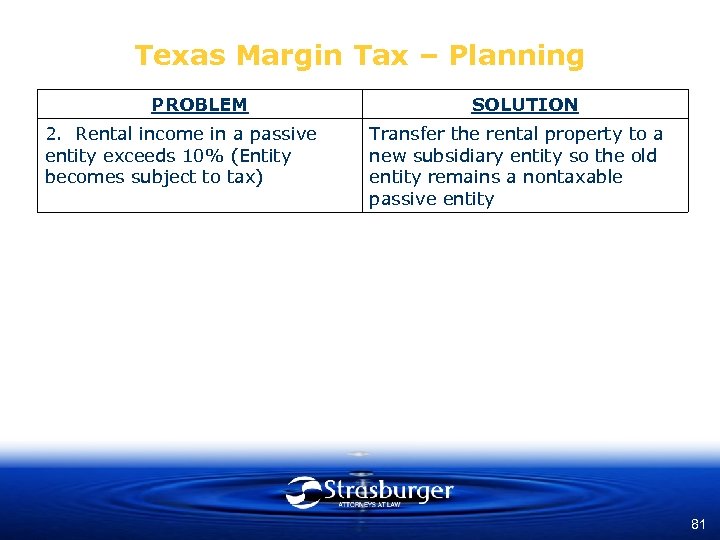

Texas Margin Tax – Planning PROBLEM 2. Rental income in a passive entity exceeds 10% (Entity becomes subject to tax) SOLUTION Transfer the rental property to a new subsidiary entity so the old entity remains a nontaxable passive entity 81

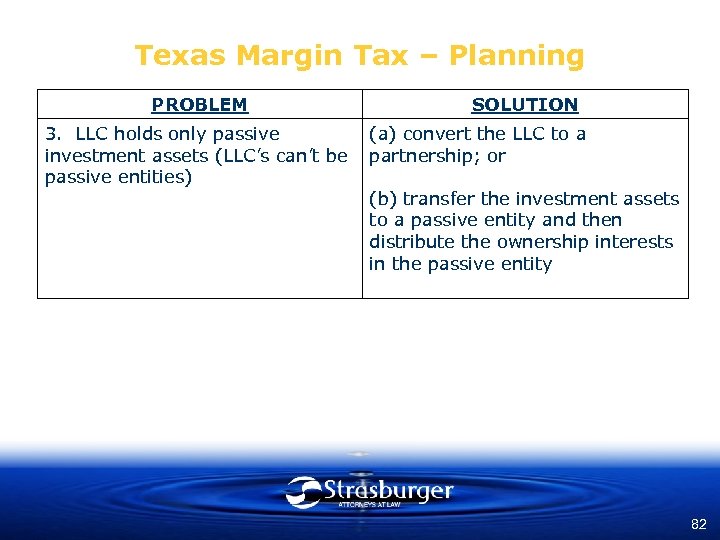

Texas Margin Tax – Planning PROBLEM 3. LLC holds only passive investment assets (LLC’s can’t be passive entities) SOLUTION (a) convert the LLC to a partnership; or (b) transfer the investment assets to a passive entity and then distribute the ownership interests in the passive entity 82

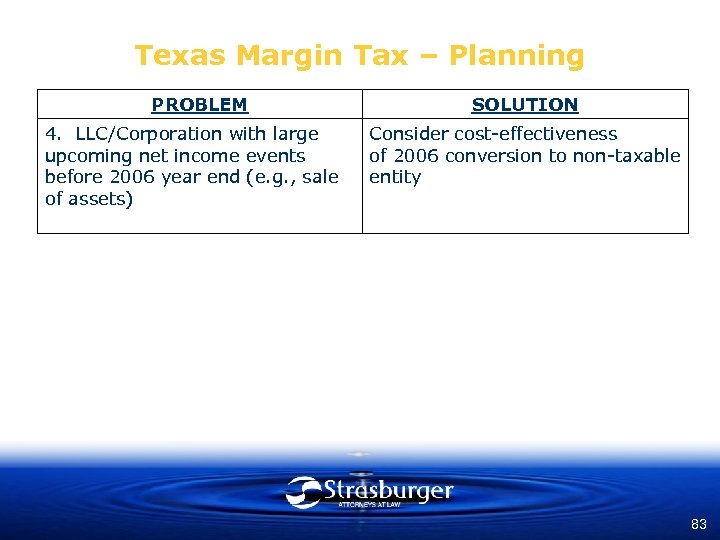

Texas Margin Tax – Planning PROBLEM 4. LLC/Corporation with large upcoming net income events before 2006 year end (e. g. , sale of assets) SOLUTION Consider cost-effectiveness of 2006 conversion to non-taxable entity 83

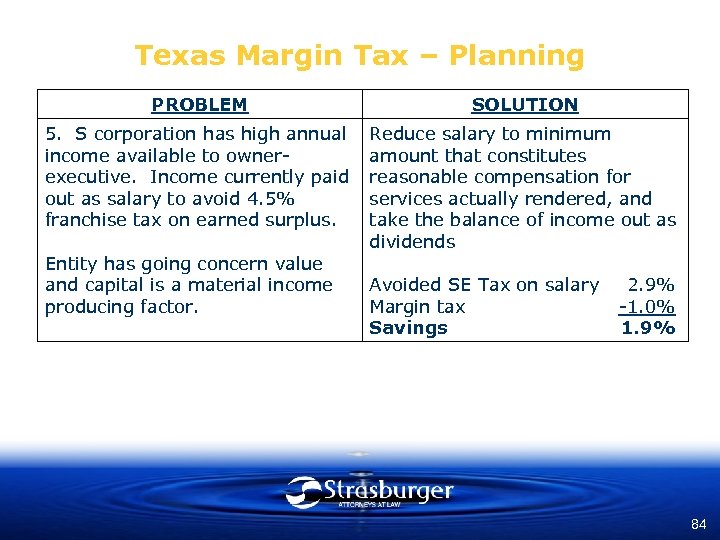

Texas Margin Tax – Planning PROBLEM SOLUTION 5. S corporation has high annual income available to ownerexecutive. Income currently paid out as salary to avoid 4. 5% franchise tax on earned surplus. Reduce salary to minimum amount that constitutes reasonable compensation for services actually rendered, and take the balance of income out as dividends Entity has going concern value and capital is a material income producing factor. Avoided SE Tax on salary Margin tax Savings 2. 9% -1. 0% 1. 9% 84

Texas Margin Tax – Planning • Entity classification – – Partnerships of “all” natural persons Avoid 10% limit on active income in a passive entity Qualifying for the 0. 5% tax rate based on business mix Losing retailer status by selling utilities • Combined reporting – Avoid mixing manufacture/retail with service business – Get passive entities out of combined group – Avoid mixing REIT/REMIC eligible income with other income 85

Texas Margin Tax – Planning • Revenue – Review revenue accounts and reclassify or restructure flowthrough items (e. g. , consider whether reimbursements should be recorded as contra expense, or restructure contract to provide direct payment) • Deductions – Employee vs. contractor: wages favored under the tax; consider using a staff leasing company for contractors – Benefits: not subject to the $300 k cap on wages – COGS: review inventory costing 86

Texas Margin Tax – Planning • Apportionment – Minimize or resource Texas receipts – Hyping non-Texas receipts generally not effective if it creates an equivalent amount of taxable margin • 2006 planning for partnerships – Revenue acceleration and basis step-up transactions – Defer deductible compensation or COGS (watch $300 k limit on wages) 87

Texas Margin Tax – Financial Reporting • Income tax for FAS 109 purposes – Exclude from multi-state blended-rate calculations? • Existing deferred tax assets and liabilities – Benefit/liability to be realized prior to FY 2007 – Benefit/liability to be realized after FY 2007 – Reassess credit carryforwards (HB 3 §§ 17 -19) • Temporary credit under § 171. 111 – Probably too uncertain to be booked as a deferred tax asset • Double tax reported for 2007 if taxed on capital 88

DISCLAIMER Any tax advice contained in this document was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties that may be imposed under applicable tax laws, or (ii) promoting, marketing, or recommending to another party any transaction or tax-related matter. 89

a9524d6e9c824826ed7642321db23707.ppt