cf93b5e3f9762f04126a9b13a4059f2e.ppt

- Количество слайдов: 26

Tertiary Education Financing Models Around the World: Conceptual basis, policy implications and recent international experience Bruce Chapman Crawford School of Economics and Government The Australian National University Canberra ACT 0200 (Bruce. Chapman@anu. edu. au) Public and Private Mechanisms for Financing Higher Education Santiago, November 24, 2009

Tertiary Education Financing Models Around the World: Conceptual basis, policy implications and recent international experience Bruce Chapman Crawford School of Economics and Government The Australian National University Canberra ACT 0200 (Bruce. Chapman@anu. edu. au) Public and Private Mechanisms for Financing Higher Education Santiago, November 24, 2009

OUTLINE 1. - The Shared International Challenge 2. - Costs and Benefits for Students 3. - Loans: The Need for Government Intervention 1. 4. - The Problems with Government Guaranteed Bank Loans 5. - The Costs and Benefits of Income Contingent Loans 6. - An ICL Case Study: Australia`s HECS 1989 -2005 7. - The Critical Role of Collection 8. - Changes Internationally Towards ICL 9. - Conclusions

OUTLINE 1. - The Shared International Challenge 2. - Costs and Benefits for Students 3. - Loans: The Need for Government Intervention 1. 4. - The Problems with Government Guaranteed Bank Loans 5. - The Costs and Benefits of Income Contingent Loans 6. - An ICL Case Study: Australia`s HECS 1989 -2005 7. - The Critical Role of Collection 8. - Changes Internationally Towards ICL 9. - Conclusions

1. - The Shared International Challenge • unmet demand for places • inequitable access • shortage of finances • an emerging concensus for student contributions

1. - The Shared International Challenge • unmet demand for places • inequitable access • shortage of finances • an emerging concensus for student contributions

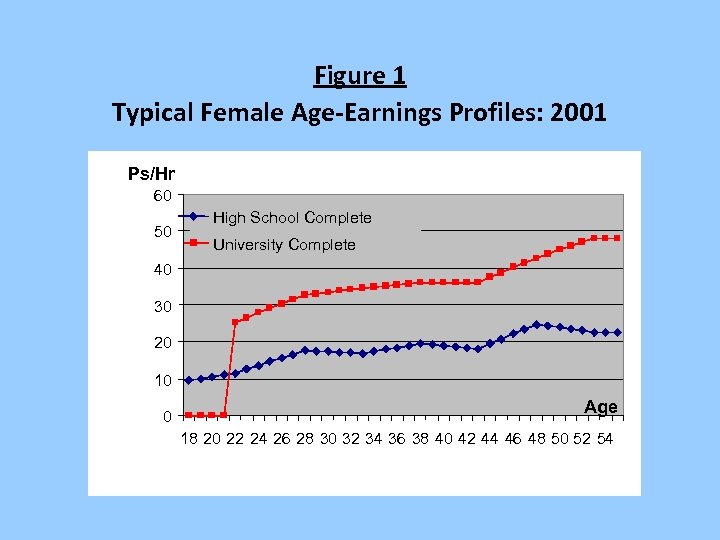

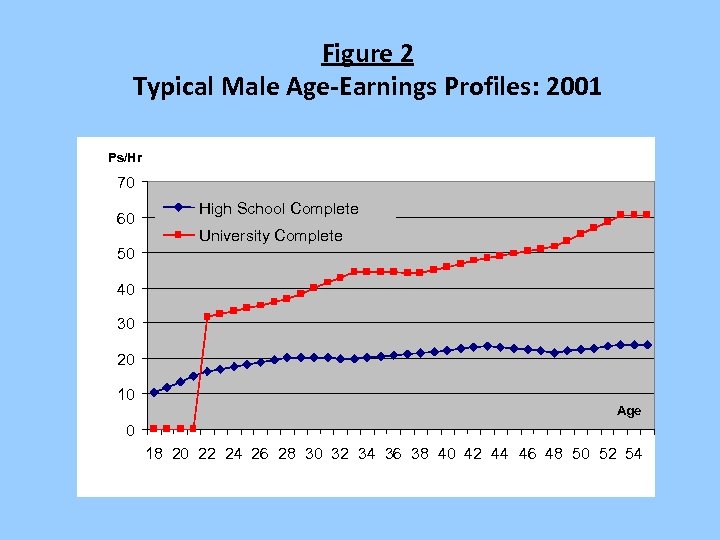

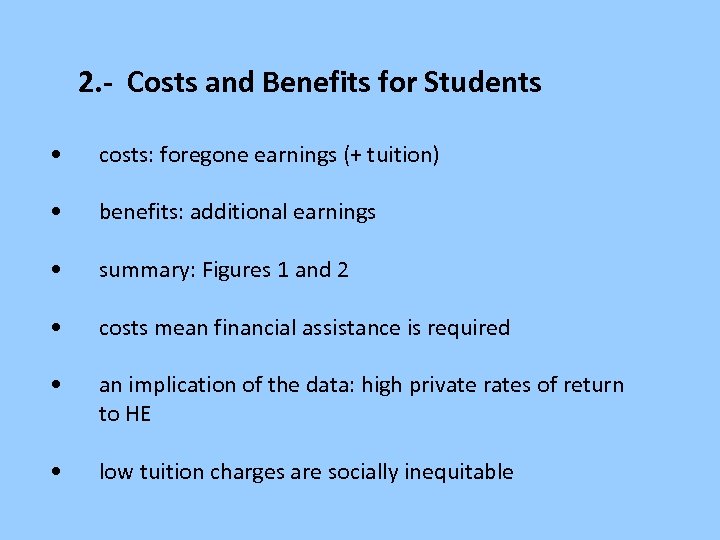

2. - Costs and Benefits for Students • costs: foregone earnings (+ tuition) • benefits: additional earnings • summary: Figures 1 and 2 • costs mean financial assistance is necessary • net benefits imply the case for a charge

2. - Costs and Benefits for Students • costs: foregone earnings (+ tuition) • benefits: additional earnings • summary: Figures 1 and 2 • costs mean financial assistance is necessary • net benefits imply the case for a charge

Figure 1 Typical Female Age-Earnings Profiles: 2001 Ps/Hr 60 50 High School Complete University Complete 40 30 20 10 0 Age 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54

Figure 1 Typical Female Age-Earnings Profiles: 2001 Ps/Hr 60 50 High School Complete University Complete 40 30 20 10 0 Age 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54

Figure 2 Typical Male Age-Earnings Profiles: 2001 Ps/Hr 70 60 50 High School Complete University Complete 40 30 20 10 Age 0 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54

Figure 2 Typical Male Age-Earnings Profiles: 2001 Ps/Hr 70 60 50 High School Complete University Complete 40 30 20 10 Age 0 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54

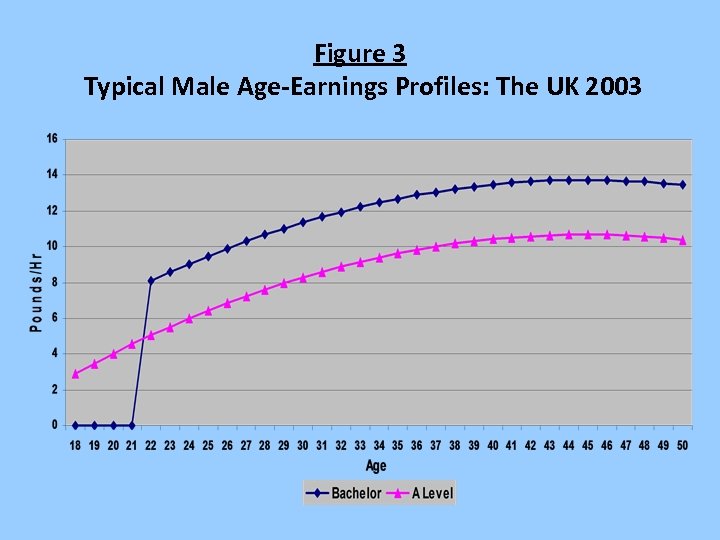

Figure 3 Typical Male Age-Earnings Profiles: The UK 2003

Figure 3 Typical Male Age-Earnings Profiles: The UK 2003

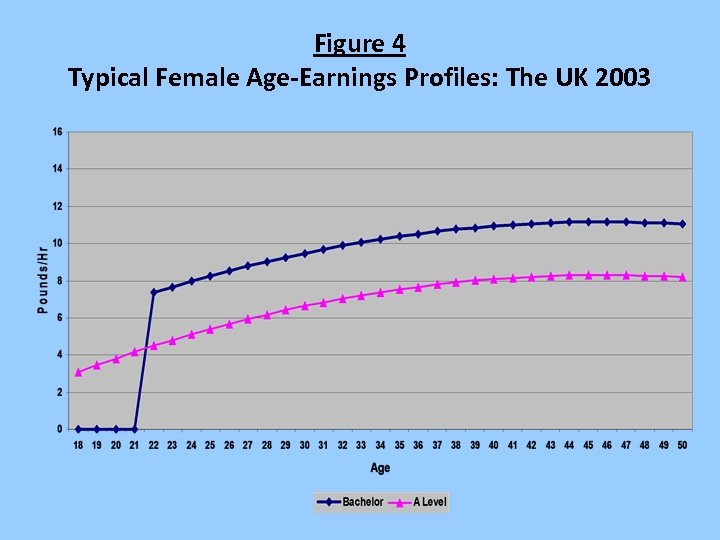

Figure 4 Typical Female Age-Earnings Profiles: The UK 2003

Figure 4 Typical Female Age-Earnings Profiles: The UK 2003

2. - Costs and Benefits for Students • costs: foregone earnings (+ tuition) • benefits: additional earnings • summary: Figures 1 and 2 • costs mean financial assistance is required • an implication of the data: high private rates of return to HE • low tuition charges are socially inequitable

2. - Costs and Benefits for Students • costs: foregone earnings (+ tuition) • benefits: additional earnings • summary: Figures 1 and 2 • costs mean financial assistance is required • an implication of the data: high private rates of return to HE • low tuition charges are socially inequitable

3. - Loans: The Need for Government Intervention • human capital investment is very uncertain for lenders and for borrowers – completion • human capital investment is very uncertain for lenders and for borrowers – ability • human capital investment is very uncertain for lenders and for borrowers – the future labor market • uncertainty leads to default • the problem for banks: no saleable collateral • the problem for students: no access to loans • government intervention is required

3. - Loans: The Need for Government Intervention • human capital investment is very uncertain for lenders and for borrowers – completion • human capital investment is very uncertain for lenders and for borrowers – ability • human capital investment is very uncertain for lenders and for borrowers – the future labor market • uncertainty leads to default • the problem for banks: no saleable collateral • the problem for students: no access to loans • government intervention is required

4. - The Problems with Government Guaranteed Bank Loans • the usual solution: government guaranteed commercial bank loans. • benefit 1: solves the lender default problem • benefit 2: provides commercial finance simply BUT cost 1 - defaults expensive for taxpayers cost 2 - some hardship when repaying (no consumption smoothing) cost 3 - some credit risk of default (no insurance) cost 4 - collection can be administratively expensive cost 5 - collection can be administratively expensive

4. - The Problems with Government Guaranteed Bank Loans • the usual solution: government guaranteed commercial bank loans. • benefit 1: solves the lender default problem • benefit 2: provides commercial finance simply BUT cost 1 - defaults expensive for taxpayers cost 2 - some hardship when repaying (no consumption smoothing) cost 3 - some credit risk of default (no insurance) cost 4 - collection can be administratively expensive cost 5 - collection can be administratively expensive

5. - The Costs and Benefits of Income Contingent Loans • • describing an unusual but growing solution: income related loans below) • benefit 2: fixes the student default problem (insurance) • benefit 3: if universal no family sharing issues • cost 1: some students avoid payment if don‘t participate • cost 2: collection requirements can be complex

5. - The Costs and Benefits of Income Contingent Loans • • describing an unusual but growing solution: income related loans below) • benefit 2: fixes the student default problem (insurance) • benefit 3: if universal no family sharing issues • cost 1: some students avoid payment if don‘t participate • cost 2: collection requirements can be complex

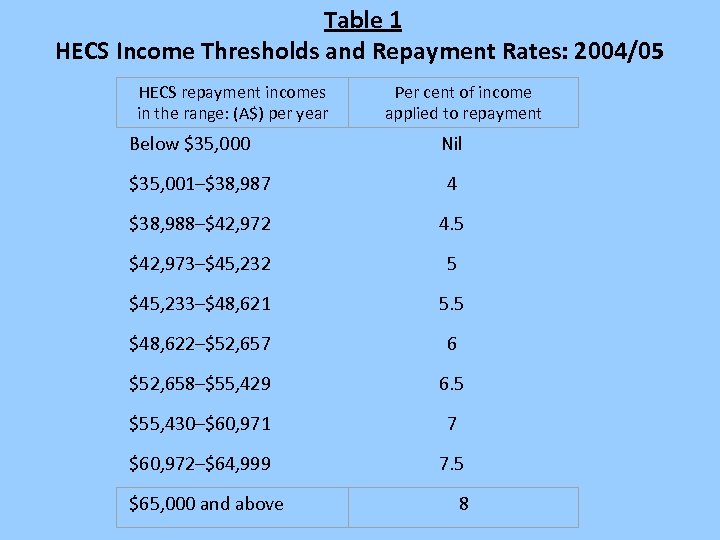

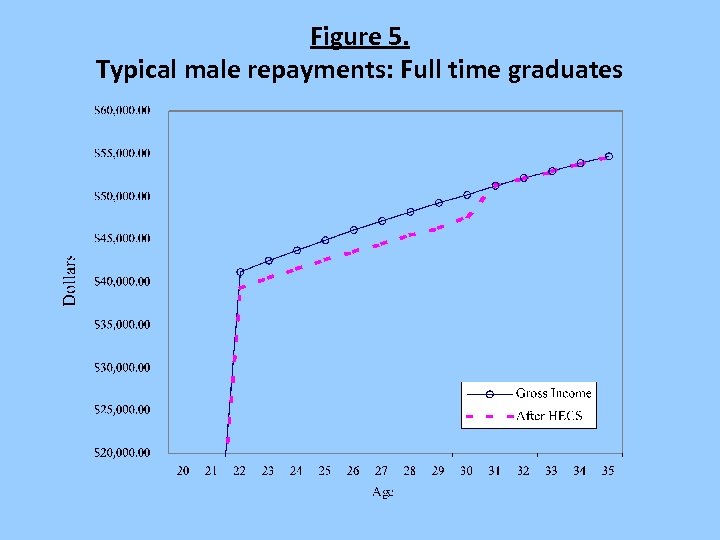

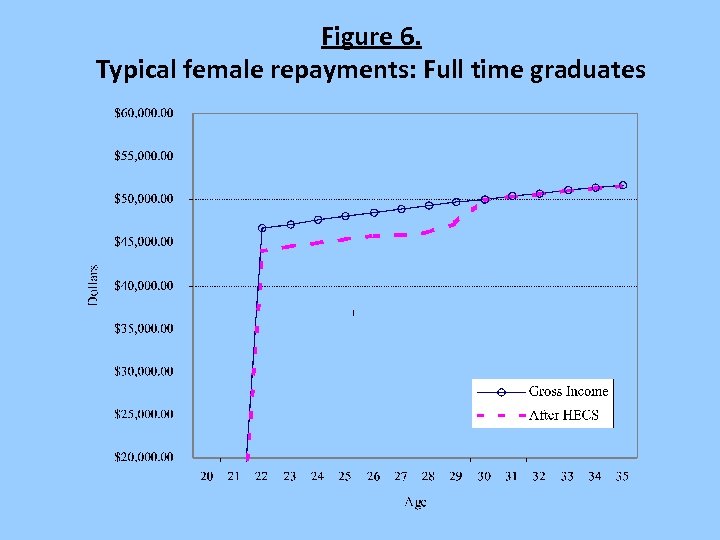

6. - An ICL Case Study: Australia`s HECS 19892005 • HECS charges described: $3, 000 -$6, 000 pa, different by course. A typical debt is $16, 000. • HECS n peration: ecording he uition ebt ith he ax i o r t t d w t T Office • HECS collection parameters: Table 1 • HECS typical repayments: Figures 5 and 6

6. - An ICL Case Study: Australia`s HECS 19892005 • HECS charges described: $3, 000 -$6, 000 pa, different by course. A typical debt is $16, 000. • HECS n peration: ecording he uition ebt ith he ax i o r t t d w t T Office • HECS collection parameters: Table 1 • HECS typical repayments: Figures 5 and 6

Table 1 HECS Income Thresholds and Repayment Rates: 2004/05 HECS repayment incomes in the range: (A$) per year Per cent of income applied to repayment Below $35, 000 Nil $35, 001–$38, 987 4 $38, 988–$42, 972 4. 5 $42, 973–$45, 232 5 $45, 233–$48, 621 5. 5 $48, 622–$52, 657 6 $52, 658–$55, 429 6. 5 $55, 430–$60, 971 7 $60, 972–$64, 999 7. 5 $65, 000 and above 8

Table 1 HECS Income Thresholds and Repayment Rates: 2004/05 HECS repayment incomes in the range: (A$) per year Per cent of income applied to repayment Below $35, 000 Nil $35, 001–$38, 987 4 $38, 988–$42, 972 4. 5 $42, 973–$45, 232 5 $45, 233–$48, 621 5. 5 $48, 622–$52, 657 6 $52, 658–$55, 429 6. 5 $55, 430–$60, 971 7 $60, 972–$64, 999 7. 5 $65, 000 and above 8

Figure 5. Typical male repayments: Full time graduates

Figure 5. Typical male repayments: Full time graduates

Figure 6. Typical female repayments: Full time graduates

Figure 6. Typical female repayments: Full time graduates

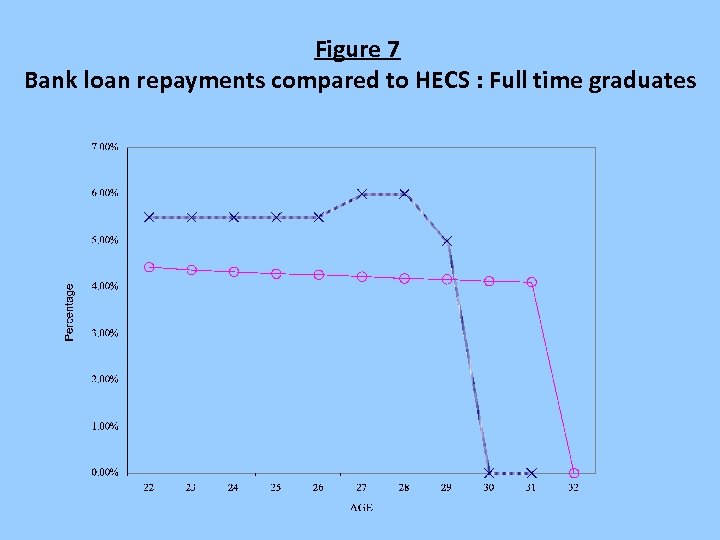

Figure 7 Bank loan repayments compared to HECS : Full time graduates

Figure 7 Bank loan repayments compared to HECS : Full time graduates

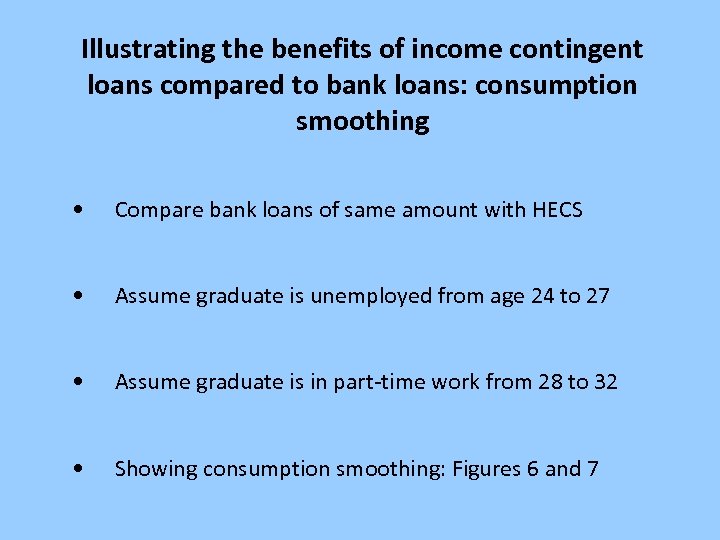

Illustrating the benefits of income contingent loans compared to bank loans: consumption smoothing • Compare bank loans of same amount with HECS • Assume graduate is unemployed from age 24 to 27 • Assume graduate is in part-time work from 28 to 32 • Showing consumption smoothing: Figures 6 and 7

Illustrating the benefits of income contingent loans compared to bank loans: consumption smoothing • Compare bank loans of same amount with HECS • Assume graduate is unemployed from age 24 to 27 • Assume graduate is in part-time work from 28 to 32 • Showing consumption smoothing: Figures 6 and 7

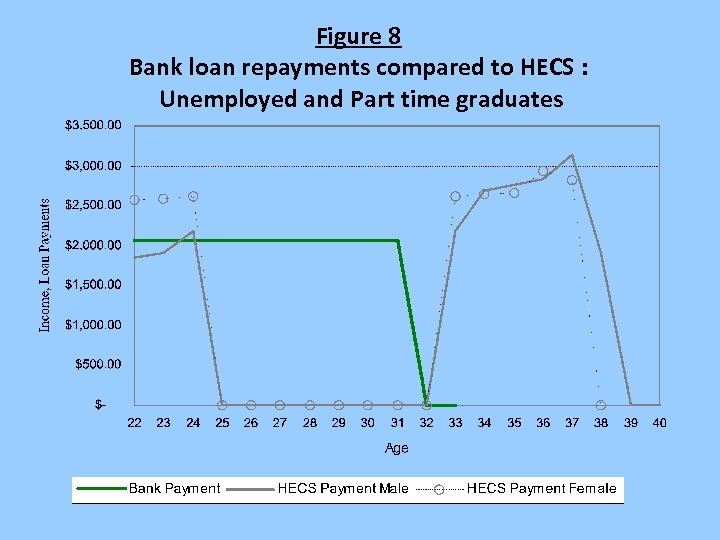

Figure 8 Bank loan repayments compared to HECS : Unemployed and Part time graduates

Figure 8 Bank loan repayments compared to HECS : Unemployed and Part time graduates

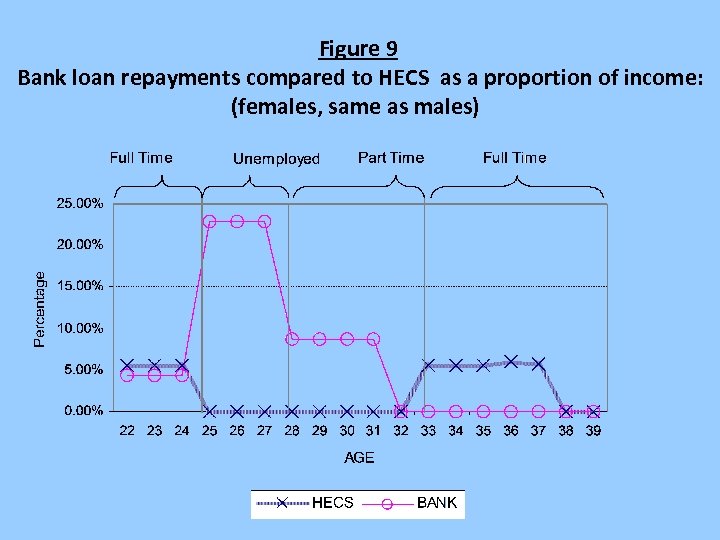

Figure 9 Bank loan repayments compared to HECS as a proportion of income: (females, same as males)

Figure 9 Bank loan repayments compared to HECS as a proportion of income: (females, same as males)

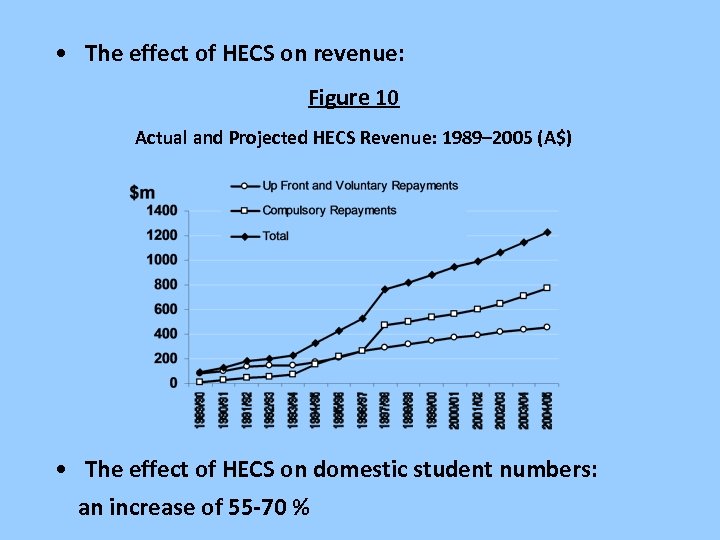

• The effect of HECS on revenue: Figure 10 Actual and Projected HECS Revenue: 1989– 2005 (A$) • The effect of HECS on domestic student numbers: an increase of 55 -70 %

• The effect of HECS on revenue: Figure 10 Actual and Projected HECS Revenue: 1989– 2005 (A$) • The effect of HECS on domestic student numbers: an increase of 55 -70 %

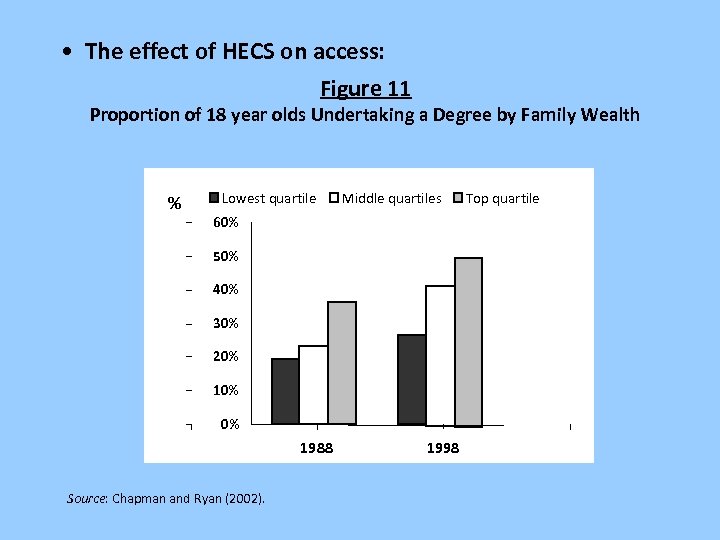

• The effect of HECS on access: Figure 11 Proportion of 18 year olds Undertaking a Degree by Family Wealth % Lowest quartile Middle quartiles 60% 50% 40% 30% 20% 10% 0% 1988 Source: Chapman and Ryan (2002). 1998 Top quartile

• The effect of HECS on access: Figure 11 Proportion of 18 year olds Undertaking a Degree by Family Wealth % Lowest quartile Middle quartiles 60% 50% 40% 30% 20% 10% 0% 1988 Source: Chapman and Ryan (2002). 1998 Top quartile

ccurate eping 7. - The Critical Role of Collection Minimum Requirements in Summary: • • • a reliable, preferably universal, system of unique identifiers; studying); computerised record-keeping system; and • an efficient of way determining accuracy, time, with over the actual incomes of former students.

ccurate eping 7. - The Critical Role of Collection Minimum Requirements in Summary: • • • a reliable, preferably universal, system of unique identifiers; studying); computerised record-keeping system; and • an efficient of way determining accuracy, time, with over the actual incomes of former students.

1. 8. - Changes Internationally Towards ICL. . . Yale (1970 s) (failed) Sweden (mid-1980 s) (blunt form) Australia (1989) (first to use tax office) New Zealand (1992) the US (1994, modified 2007) South Africa (1994) the UK (1997, expanded considerably in 2006) Thailand, 2007 (only) Hungary, 2003 Canada (? ), 2009 Malaysia, 2010 Ireland, 2010 Under consideration in many other countries: Germany, Colombia, EU, Israel, PNG

1. 8. - Changes Internationally Towards ICL. . . Yale (1970 s) (failed) Sweden (mid-1980 s) (blunt form) Australia (1989) (first to use tax office) New Zealand (1992) the US (1994, modified 2007) South Africa (1994) the UK (1997, expanded considerably in 2006) Thailand, 2007 (only) Hungary, 2003 Canada (? ), 2009 Malaysia, 2010 Ireland, 2010 Under consideration in many other countries: Germany, Colombia, EU, Israel, PNG

9. - Conclusions • the economically and socially advantaged derive large benefits from higher education • thus, charging low or no tuition is socially inequitable • tuition revenue can provide extra finances for higher education efficiency and growth (or assisting other areas of education) • Intervention is needed, but there are important problems with bank loans • ICL provide an equitable system: only pay when you are able • thus ICL provides default insurance and consumption smoothing • ICL can be used for income support as well as tuition • many countries currently have adopted or are adopting ICL, but not all BUT: the collection mechanism of ICL is critical to success and these approaches cannot be used in many countries

9. - Conclusions • the economically and socially advantaged derive large benefits from higher education • thus, charging low or no tuition is socially inequitable • tuition revenue can provide extra finances for higher education efficiency and growth (or assisting other areas of education) • Intervention is needed, but there are important problems with bank loans • ICL provide an equitable system: only pay when you are able • thus ICL provides default insurance and consumption smoothing • ICL can be used for income support as well as tuition • many countries currently have adopted or are adopting ICL, but not all BUT: the collection mechanism of ICL is critical to success and these approaches cannot be used in many countries

Thank you

Thank you