79bd98ff05d4acedbb9d4add0a14fa78.ppt

- Количество слайдов: 18

TEMENOS ROMANIA Every time a step ahead March 18, 2003

TEMENOS ROMANIA Every time a step ahead March 18, 2003

Introduction Hilde Corbu CEO, Temenos Romania n TEMENOS ROMANIA S. A. Member of the International Temenos Group P Distribution, Implementation, Support and Training Center for Temenos banking products in Romania and Republic of Moldavia P

Introduction Hilde Corbu CEO, Temenos Romania n TEMENOS ROMANIA S. A. Member of the International Temenos Group P Distribution, Implementation, Support and Training Center for Temenos banking products in Romania and Republic of Moldavia P

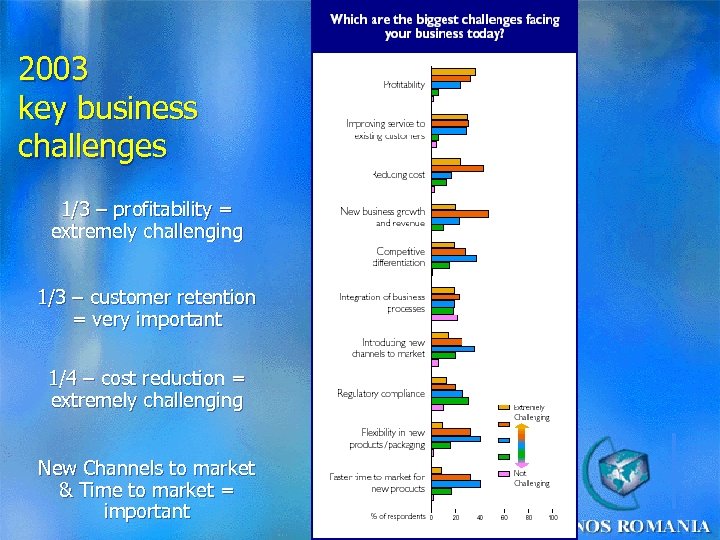

2003 key business challenges 1/3 – profitability = extremely challenging 1/3 – customer retention = very important 1/4 – cost reduction = extremely challenging New Channels to market & Time to market = important

2003 key business challenges 1/3 – profitability = extremely challenging 1/3 – customer retention = very important 1/4 – cost reduction = extremely challenging New Channels to market & Time to market = important

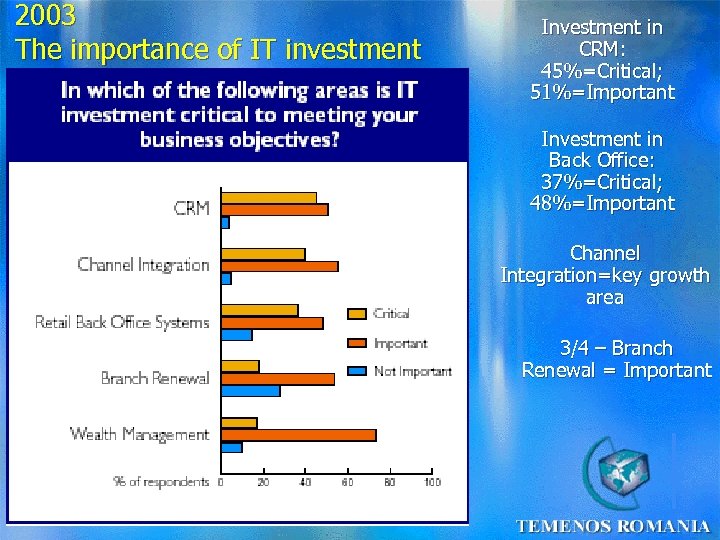

2003 The importance of IT investment Investment in CRM: 45%=Critical; 51%=Important Investment in Back Office: 37%=Critical; 48%=Important Channel Integration=key growth area 3/4 – Branch Renewal = Important

2003 The importance of IT investment Investment in CRM: 45%=Critical; 51%=Important Investment in Back Office: 37%=Critical; 48%=Important Channel Integration=key growth area 3/4 – Branch Renewal = Important

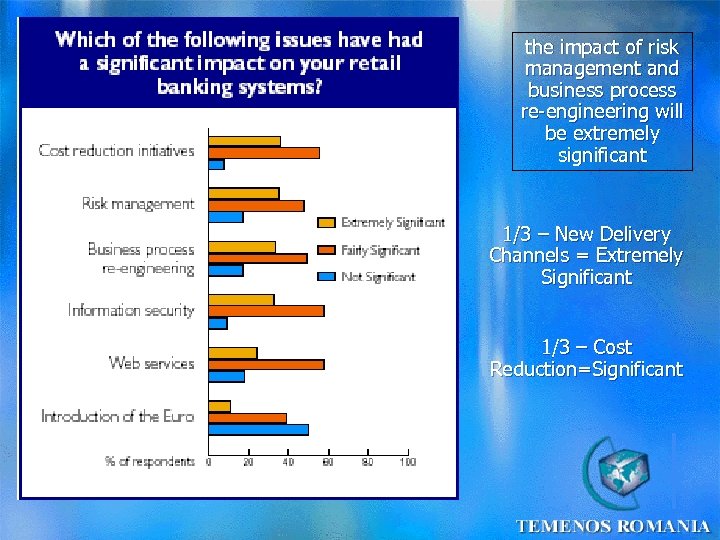

the impact of risk management and business process re-engineering will be extremely significant 1/3 – New Delivery Channels = Extremely Significant 1/3 – Cost Reduction=Significant

the impact of risk management and business process re-engineering will be extremely significant 1/3 – New Delivery Channels = Extremely Significant 1/3 – Cost Reduction=Significant

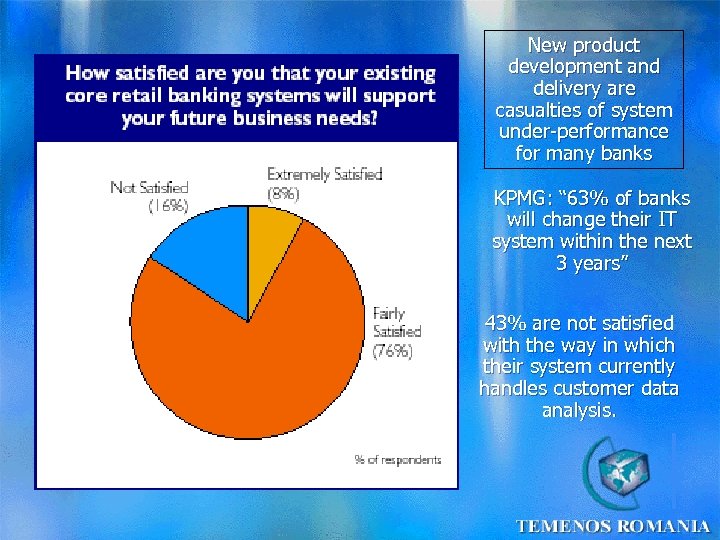

New product development and delivery are casualties of system under-performance for many banks KPMG: “ 63% of banks will change their IT system within the next 3 years” 43% are not satisfied with the way in which their system currently handles customer data analysis.

New product development and delivery are casualties of system under-performance for many banks KPMG: “ 63% of banks will change their IT system within the next 3 years” 43% are not satisfied with the way in which their system currently handles customer data analysis.

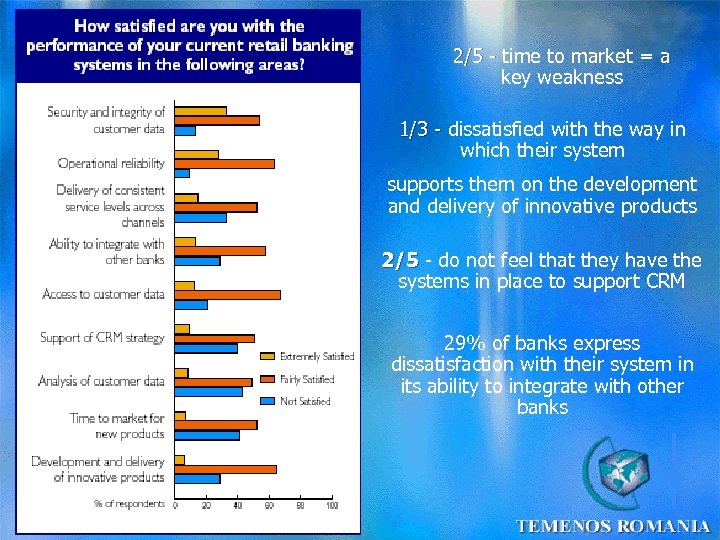

2/5 - time to market = a key weakness 1/3 - dissatisfied with the way in which their system supports them on the development and delivery of innovative products 2/5 - do not feel that they have the systems in place to support CRM 29% of banks express dissatisfaction with their system in its ability to integrate with other banks

2/5 - time to market = a key weakness 1/3 - dissatisfied with the way in which their system supports them on the development and delivery of innovative products 2/5 - do not feel that they have the systems in place to support CRM 29% of banks express dissatisfaction with their system in its ability to integrate with other banks

Characteristics of the Retail Business Market Banks in order to attract retail customers, and at the same time be successful in this business, need: Ø To be competitive in terms or interest rates and charges Ø To provide service quality Ø To be innovative in offering new products and services Ø To find alternative channels to promote and sell retail products in a controlled and secure way. Ø To manage the relations with their customers in a cost efficient and sales efficient way Ø To measure their exposure and manage their risks Ø Manage delinquencies Ø Control their costs due to the volumes of this business

Characteristics of the Retail Business Market Banks in order to attract retail customers, and at the same time be successful in this business, need: Ø To be competitive in terms or interest rates and charges Ø To provide service quality Ø To be innovative in offering new products and services Ø To find alternative channels to promote and sell retail products in a controlled and secure way. Ø To manage the relations with their customers in a cost efficient and sales efficient way Ø To measure their exposure and manage their risks Ø Manage delinquencies Ø Control their costs due to the volumes of this business

Modern IT solutions supports the Bank to gain competitive advantage 1) Processing (credit scoring) of the profile of the customer and all his “risk related” data, in order to define: Ø The “worthiness” of the customer, Ø The credit limit the Bank is willing to grant to this customer for all consumer lending related products (i. e. credit cards, consumer loans, mortgages, overdrafts e. t. c. ). Ø The brake down of the credit limit to the several retail lending products, Ø “Personalization” of the product depending on the creditability “ of the client.

Modern IT solutions supports the Bank to gain competitive advantage 1) Processing (credit scoring) of the profile of the customer and all his “risk related” data, in order to define: Ø The “worthiness” of the customer, Ø The credit limit the Bank is willing to grant to this customer for all consumer lending related products (i. e. credit cards, consumer loans, mortgages, overdrafts e. t. c. ). Ø The brake down of the credit limit to the several retail lending products, Ø “Personalization” of the product depending on the creditability “ of the client.

Modern IT solutions supports the Bank to gain competitive advantage 2) Credit Card products Ø should be supported and ideally allow the customer to be given the possibility to switch between credit card debt (revolving credit line which is normally more expensive) to term loans, which are normally less expensive, and vice versa 3) Flexibility to define Loan Product characteristics, the terms and conditions, which will be automatically applied on every loan product depending on the commodity. 4) Processing and evaluation of customer’s applications in order to grant a loan or a credit card and support the operational workflows in order to process the request

Modern IT solutions supports the Bank to gain competitive advantage 2) Credit Card products Ø should be supported and ideally allow the customer to be given the possibility to switch between credit card debt (revolving credit line which is normally more expensive) to term loans, which are normally less expensive, and vice versa 3) Flexibility to define Loan Product characteristics, the terms and conditions, which will be automatically applied on every loan product depending on the commodity. 4) Processing and evaluation of customer’s applications in order to grant a loan or a credit card and support the operational workflows in order to process the request

Modern IT solutions supports the Bank to gain competitive advantage 5) Checking for the presence of all required documents, which documents are a prerequisite for granting a consumer loan or any other facility 6) Production of all related documentation including all “agreements”, which need to be signed at the time of granting the loan 7) Functionality, that can be introduced, to improve the relationship with cooperating merchants and allow settlement of commissions to be paid to them. 8) Monitoring of payments due, and if a payment is not done on due time, then a past due payment record should be automatically created for which the Bank should apply its policy in terms of grace periods, penalty interest, hierarchy of payments, accruing of interest, transferring of the record to “Non Accrual basis” so that interest will not be booked in the P&L but in memo accounts etc.

Modern IT solutions supports the Bank to gain competitive advantage 5) Checking for the presence of all required documents, which documents are a prerequisite for granting a consumer loan or any other facility 6) Production of all related documentation including all “agreements”, which need to be signed at the time of granting the loan 7) Functionality, that can be introduced, to improve the relationship with cooperating merchants and allow settlement of commissions to be paid to them. 8) Monitoring of payments due, and if a payment is not done on due time, then a past due payment record should be automatically created for which the Bank should apply its policy in terms of grace periods, penalty interest, hierarchy of payments, accruing of interest, transferring of the record to “Non Accrual basis” so that interest will not be booked in the P&L but in memo accounts etc.

Modern IT solutions supports the Bank to gain competitive advantage Automation = Cost reduction Possibility to serve the retail customer through “direct banking channels” = Cost reduction

Modern IT solutions supports the Bank to gain competitive advantage Automation = Cost reduction Possibility to serve the retail customer through “direct banking channels” = Cost reduction

Modern IT solutions supports the Bank to gain competitive advantage By using such channels customers will not have to visit the branches, as often as they do today, and will be in a position to perform, by themselves, the majority of the banking transactions needed: Ø If there is the need for cash withdrawal the customer could use the ATM network Ø If there is a need to know an account balance, a credit card balance, a loan balance, or a need to receive a statement, the customer could use the ATM, or internet banking or phone banking Ø Similarly, if there is a need for a fund transfer, the ATM or the phone banking could be used (for simple transfers) and the Internet Banking or Mobile phone banking could be used (for more demanding fund transfers). International payments could also be served through these channels, as well as, buying or selling foreign currency. Ø Placing orders to buy or sell securities can also be served by the direct banking channels

Modern IT solutions supports the Bank to gain competitive advantage By using such channels customers will not have to visit the branches, as often as they do today, and will be in a position to perform, by themselves, the majority of the banking transactions needed: Ø If there is the need for cash withdrawal the customer could use the ATM network Ø If there is a need to know an account balance, a credit card balance, a loan balance, or a need to receive a statement, the customer could use the ATM, or internet banking or phone banking Ø Similarly, if there is a need for a fund transfer, the ATM or the phone banking could be used (for simple transfers) and the Internet Banking or Mobile phone banking could be used (for more demanding fund transfers). International payments could also be served through these channels, as well as, buying or selling foreign currency. Ø Placing orders to buy or sell securities can also be served by the direct banking channels

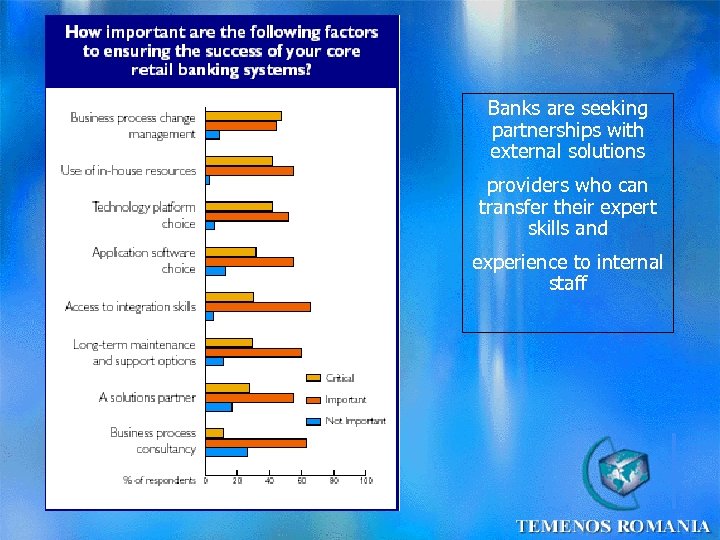

Banks are seeking partnerships with external solutions providers who can transfer their expert skills and experience to internal staff

Banks are seeking partnerships with external solutions providers who can transfer their expert skills and experience to internal staff

TEMENOS ROMANIA Every time a step ahead Software Applications to address the Banking Industry

TEMENOS ROMANIA Every time a step ahead Software Applications to address the Banking Industry

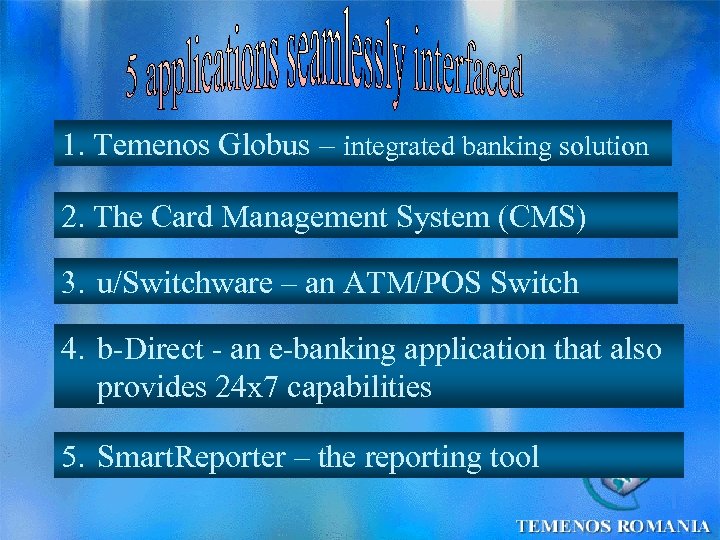

1. Temenos Globus – integrated banking solution 2. The Card Management System (CMS) 3. u/Switchware – an ATM/POS Switch 4. b-Direct - an e-banking application that also provides 24 x 7 capabilities 5. Smart. Reporter – the reporting tool

1. Temenos Globus – integrated banking solution 2. The Card Management System (CMS) 3. u/Switchware – an ATM/POS Switch 4. b-Direct - an e-banking application that also provides 24 x 7 capabilities 5. Smart. Reporter – the reporting tool

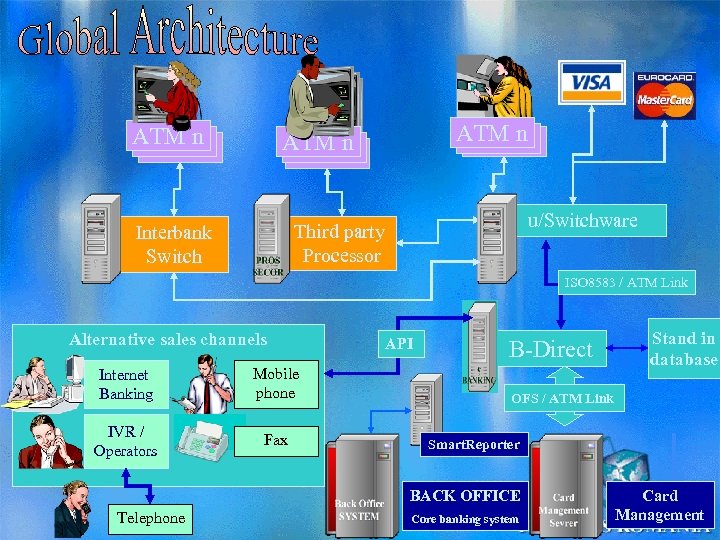

ATM n ATM 2 ATM 1 ATM n 1 ATM 2 ATM u/Switchware Third party Processor Interbank Switch ISO 8583 / ATM Link Alternative sales channels Internet Banking Mobile phone IVR / Operators Fax API B-Direct OFS / ATM Link Smart. Reporter BACK OFFICE Telephone Stand in database Core banking system Card Management

ATM n ATM 2 ATM 1 ATM n 1 ATM 2 ATM u/Switchware Third party Processor Interbank Switch ISO 8583 / ATM Link Alternative sales channels Internet Banking Mobile phone IVR / Operators Fax API B-Direct OFS / ATM Link Smart. Reporter BACK OFFICE Telephone Stand in database Core banking system Card Management

www. temenos. ro

www. temenos. ro