3a3b4083c690b05dd622ad68884edaae.ppt

- Количество слайдов: 61

TELUS National Evolution A perspective on 10 years of fundamental change November 2009

TELUS National Evolution A perspective on 10 years of fundamental change November 2009

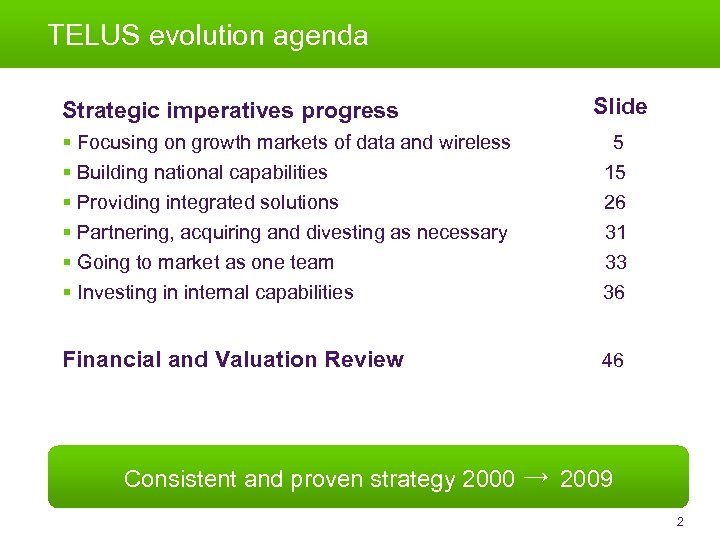

TELUS evolution agenda Slide Strategic imperatives progress § Focusing on growth markets of data and wireless 5 § Building national capabilities 15 § Providing integrated solutions 26 § Partnering, acquiring and divesting as necessary 31 § Going to market as one team 33 § Investing in internal capabilities 36 Financial and Valuation Review 46 Consistent and proven strategy 2000 → 2009 2

TELUS evolution agenda Slide Strategic imperatives progress § Focusing on growth markets of data and wireless 5 § Building national capabilities 15 § Providing integrated solutions 26 § Partnering, acquiring and divesting as necessary 31 § Going to market as one team 33 § Investing in internal capabilities 36 Financial and Valuation Review 46 Consistent and proven strategy 2000 → 2009 2

TELUS evolution 2000 → 2009 20001 20092 % change Revenue $6. 0 B $9. 6 B 60% EBITDA $2. 4 B $3. 6 B 50% $681 M $1. 1 B 62% Net income / employee 3 $29 K $42 K 45% Earnings per share $2. 86 $3. 56 24% Total connections 6. 0 M 11. 9 M 98% Wireless subscribers 1. 1 M 6. 4 M 482% Network Access Lines 4. 5 M 4. 1 M 26 K 1. 1 M 4131% Enterprise value $10. 5 B $17. 9 B 70% Cash returned to shareholders 4 $336 M $602 M 79% Net income High Speed Internet subscribers 9% 1 Revenue, EBITDA, net income and EPS are 12 -months trailing from June 30, 2000. Subscribers and enterprise value as at Jan. 1, 2000 2 Revenue, EBITDA, net income and EPS are 12 -months trailing from Sept. 30, 2009. Subscribers and enterprise value as at Sept. 30, 2009 3 Excluding TELUS International 4 Using dividends declared and normal course issuer bid share purchases 3

TELUS evolution 2000 → 2009 20001 20092 % change Revenue $6. 0 B $9. 6 B 60% EBITDA $2. 4 B $3. 6 B 50% $681 M $1. 1 B 62% Net income / employee 3 $29 K $42 K 45% Earnings per share $2. 86 $3. 56 24% Total connections 6. 0 M 11. 9 M 98% Wireless subscribers 1. 1 M 6. 4 M 482% Network Access Lines 4. 5 M 4. 1 M 26 K 1. 1 M 4131% Enterprise value $10. 5 B $17. 9 B 70% Cash returned to shareholders 4 $336 M $602 M 79% Net income High Speed Internet subscribers 9% 1 Revenue, EBITDA, net income and EPS are 12 -months trailing from June 30, 2000. Subscribers and enterprise value as at Jan. 1, 2000 2 Revenue, EBITDA, net income and EPS are 12 -months trailing from Sept. 30, 2009. Subscribers and enterprise value as at Sept. 30, 2009 3 Excluding TELUS International 4 Using dividends declared and normal course issuer bid share purchases 3

Focusing on growth markets of data and wireless

Focusing on growth markets of data and wireless

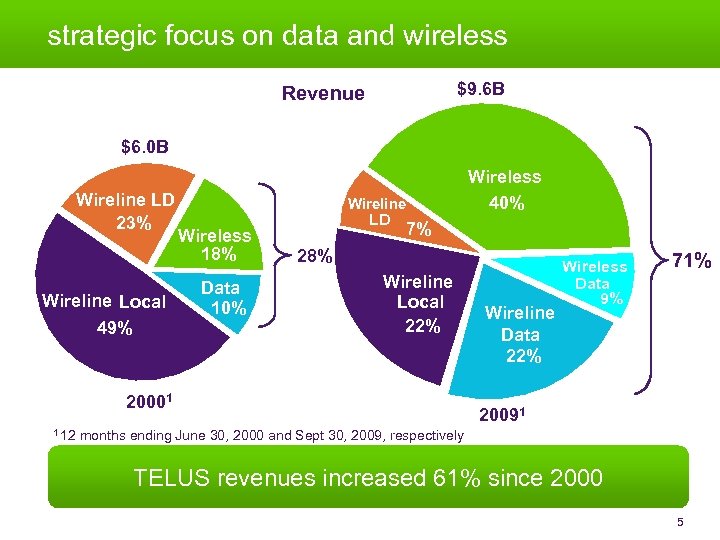

strategic focus on data and wireless $9. 6 B Revenue $6. 0 B Wireline LD 23% Wireline Local 49% Wireless 40% Wireline Wireless 18% Data 10% LD 7% 28% Wireline Local 22% 20001 Wireline Data 22% Wireless Data 9% 71% 20091 1 12 months ending June 30, 2000 and Sept 30, 2009, respectively TELUS revenues increased 61% since 2000 5

strategic focus on data and wireless $9. 6 B Revenue $6. 0 B Wireline LD 23% Wireline Local 49% Wireless 40% Wireline Wireless 18% Data 10% LD 7% 28% Wireline Local 22% 20001 Wireline Data 22% Wireless Data 9% 71% 20091 1 12 months ending June 30, 2000 and Sept 30, 2009, respectively TELUS revenues increased 61% since 2000 5

TELUS total customer connections 11. 9 (millions) Voice - Network Access Lines Data - Internet and TV Wireless 6. 0 65% Internet, TV and wireless 24% 2000 Q 3 2009 98% increase in client connections since 2000 6

TELUS total customer connections 11. 9 (millions) Voice - Network Access Lines Data - Internet and TV Wireless 6. 0 65% Internet, TV and wireless 24% 2000 Q 3 2009 98% increase in client connections since 2000 6

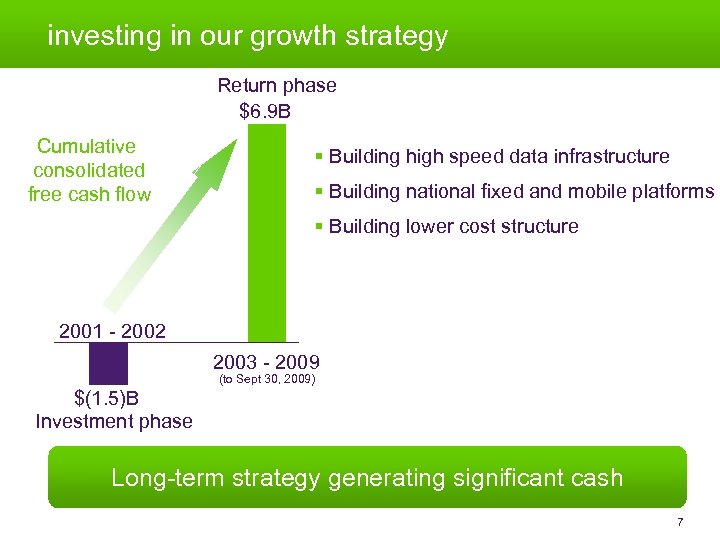

investing in our growth strategy Return phase $6. 9 B Cumulative consolidated free cash flow § Building high speed data infrastructure § Building national fixed and mobile platforms § Building lower cost structure 2001 - 2002 2003 - 2009 (to Sept 30, 2009) $(1. 5)B Investment phase Long-term strategy generating significant cash 7

investing in our growth strategy Return phase $6. 9 B Cumulative consolidated free cash flow § Building high speed data infrastructure § Building national fixed and mobile platforms § Building lower cost structure 2001 - 2002 2003 - 2009 (to Sept 30, 2009) $(1. 5)B Investment phase Long-term strategy generating significant cash 7

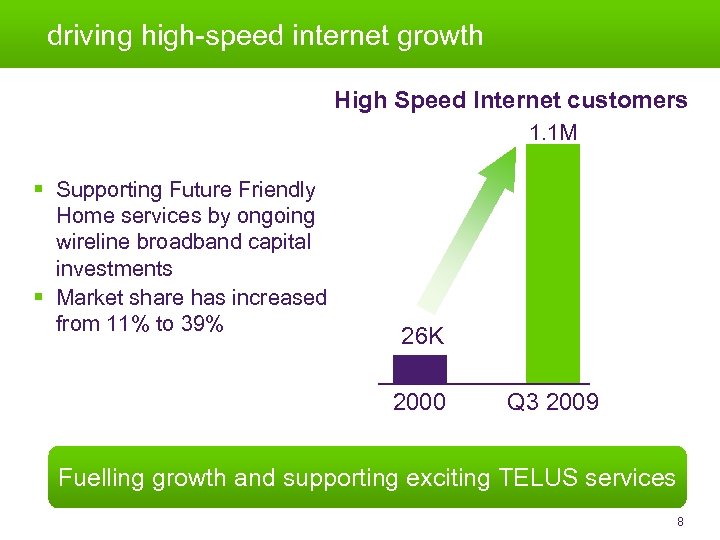

review of operations – wireless driving high-speed internet growth High Speed Internet customers 1. 1 M § Supporting Future Friendly Home services by ongoing wireline broadband capital investments § Market share has increased from 11% to 39% 26 K 2000 Q 3 2009 Fuelling growth and supporting exciting TELUS services 8

review of operations – wireless driving high-speed internet growth High Speed Internet customers 1. 1 M § Supporting Future Friendly Home services by ongoing wireline broadband capital investments § Market share has increased from 11% to 39% 26 K 2000 Q 3 2009 Fuelling growth and supporting exciting TELUS services 8

TELUS TV evolution TELUS TV subscribers 137 K 0 2000 Q 3 2009 Offering TELUS TV – IPTV and Satellite TV 9

TELUS TV evolution TELUS TV subscribers 137 K 0 2000 Q 3 2009 Offering TELUS TV – IPTV and Satellite TV 9

TELUS TV evolution Top 48 Communities Abbotsford Airdrie Beaumont Belcarra Burnaby Calgary Campbell River Chilliwack Cochrane Coquitlam Delta Devon Edmonton Fort Langley Fort Mc. Murray Ft Saskatchewan Grande Prairie Kamloops Kelowna Langley Leduc Lethbridge Maple Ridge Medicine Hat Mission Morinville Nanaimo New Westminster North Vancouver Okotoks Penticton Pitt Meadows Port Coquitlam Port Moody Prince George Red Deer Richmond Sherwood Park Spruce Grove St Albert Stony Plain Strathmore Surrey Vancouver Vernon Victoria West Vancouver Whistler § STV Coverage Tier 1 IPTV Markets Bedroom Communities Tier 2 IPTV Markets * Nov/Dec TTV Launches Moving to provide IPTV coverage in 48 top communities TV coverage footprint in BC and Alberta has increased from 0 in 2000 to > 90% today 10

TELUS TV evolution Top 48 Communities Abbotsford Airdrie Beaumont Belcarra Burnaby Calgary Campbell River Chilliwack Cochrane Coquitlam Delta Devon Edmonton Fort Langley Fort Mc. Murray Ft Saskatchewan Grande Prairie Kamloops Kelowna Langley Leduc Lethbridge Maple Ridge Medicine Hat Mission Morinville Nanaimo New Westminster North Vancouver Okotoks Penticton Pitt Meadows Port Coquitlam Port Moody Prince George Red Deer Richmond Sherwood Park Spruce Grove St Albert Stony Plain Strathmore Surrey Vancouver Vernon Victoria West Vancouver Whistler § STV Coverage Tier 1 IPTV Markets Bedroom Communities Tier 2 IPTV Markets * Nov/Dec TTV Launches Moving to provide IPTV coverage in 48 top communities TV coverage footprint in BC and Alberta has increased from 0 in 2000 to > 90% today 10

continuing wireless growth Wireless subscribers 6. 4 M 1. 1 M 2000 Q 3 2009 Apple i. Phone 3 GS Generating stellar growth through successful acquisition and execution 11

continuing wireless growth Wireless subscribers 6. 4 M 1. 1 M 2000 Q 3 2009 Apple i. Phone 3 GS Generating stellar growth through successful acquisition and execution 11

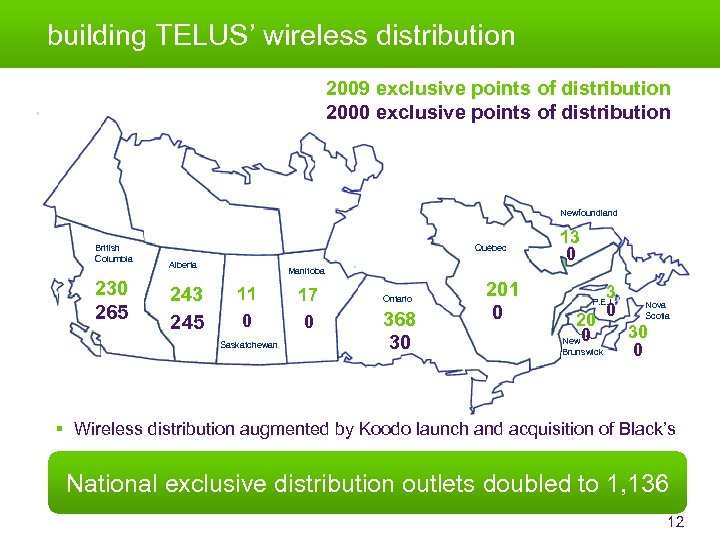

building TELUS’ wireless distribution 2009 exclusive points of distribution 2000 exclusive points of distribution Newfoundland British Columbia 230 265 Québec Alberta 243 245 13 0 Manitoba 11 0 Saskatchewan 17 0 Ontario 368 30 201 0 3 0 P. E. I. 20 New 0 Brunswick Nova Scotia 30 0 § Wireless distribution augmented by Koodo launch and acquisition of Black’s National exclusive distribution outlets doubled to 1, 136 12

building TELUS’ wireless distribution 2009 exclusive points of distribution 2000 exclusive points of distribution Newfoundland British Columbia 230 265 Québec Alberta 243 245 13 0 Manitoba 11 0 Saskatchewan 17 0 Ontario 368 30 201 0 3 0 P. E. I. 20 New 0 Brunswick Nova Scotia 30 0 § Wireless distribution augmented by Koodo launch and acquisition of Black’s National exclusive distribution outlets doubled to 1, 136 12

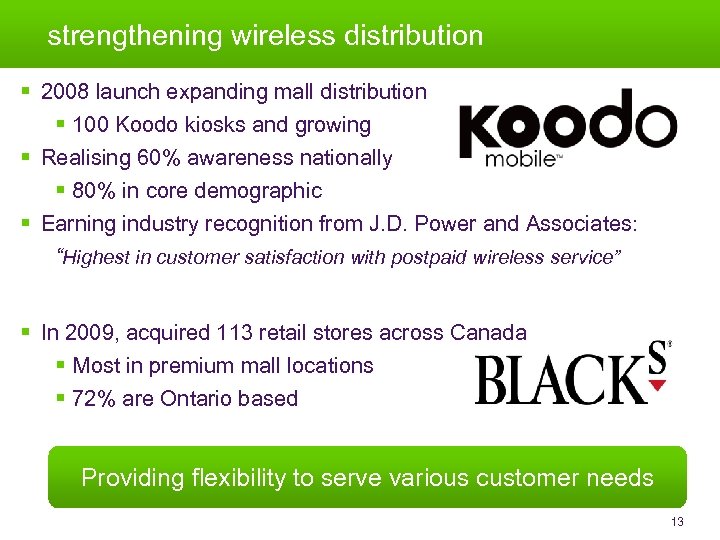

strengthening wireless distribution § 2008 launch expanding mall distribution § 100 Koodo kiosks and growing § Realising 60% awareness nationally § 80% in core demographic § Earning industry recognition from J. D. Power and Associates: “Highest in customer satisfaction with postpaid wireless service” § In 2009, acquired 113 retail stores across Canada § Most in premium mall locations § 72% are Ontario based Providing flexibility to serve various customer needs 13

strengthening wireless distribution § 2008 launch expanding mall distribution § 100 Koodo kiosks and growing § Realising 60% awareness nationally § 80% in core demographic § Earning industry recognition from J. D. Power and Associates: “Highest in customer satisfaction with postpaid wireless service” § In 2009, acquired 113 retail stores across Canada § Most in premium mall locations § 72% are Ontario based Providing flexibility to serve various customer needs 13

Building national capabilities

Building national capabilities

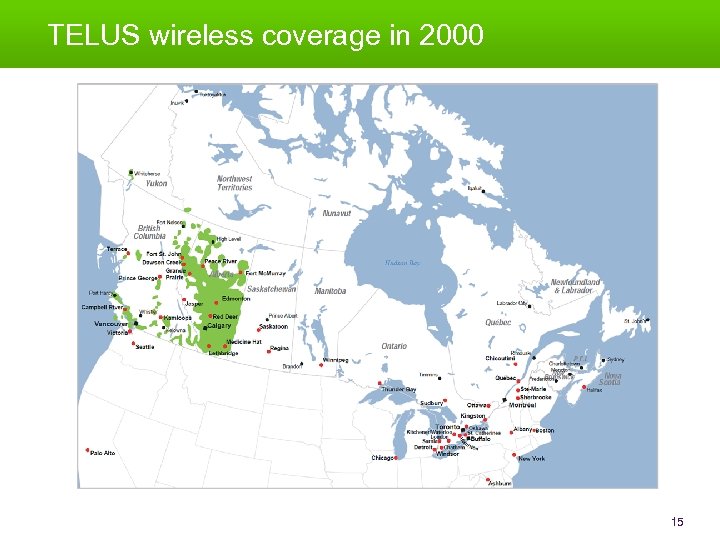

TELUS wireless coverage in 2000 15

TELUS wireless coverage in 2000 15

TELUS wireless coverage today 16

TELUS wireless coverage today 16

TELUS vs Rogers - HSPA east coverage TELUS HSPA+ coverage TELUS HSPA coverage *Completing rollout of HSPA+ in 2010 * Based on Rogers’ Sept. 14, 2009 public announcement of HSPA+ coverage within the cities indicated (using associated census metropolitan areas). ** Based on coverage maps made publicly available by Rogers on Oct. 23, 2009. Coverage areas are approximate as of October 2009. Actual coverage and network service can vary and are subject to change. 17

TELUS vs Rogers - HSPA east coverage TELUS HSPA+ coverage TELUS HSPA coverage *Completing rollout of HSPA+ in 2010 * Based on Rogers’ Sept. 14, 2009 public announcement of HSPA+ coverage within the cities indicated (using associated census metropolitan areas). ** Based on coverage maps made publicly available by Rogers on Oct. 23, 2009. Coverage areas are approximate as of October 2009. Actual coverage and network service can vary and are subject to change. 17

TELUS vs Rogers - HSPA west coverage TELUS HSPA+ coverage * Based on Rogers’ Sept. 14, 2009 public announcement of HSPA+ coverage within the cities indicated (using associated census metropolitan areas). ** Based on coverage maps made publicly available by Rogers on Oct. 23, 2009. Coverage areas are approximate as of October 2009. Actual coverage and network service can vary and are subject to change 18

TELUS vs Rogers - HSPA west coverage TELUS HSPA+ coverage * Based on Rogers’ Sept. 14, 2009 public announcement of HSPA+ coverage within the cities indicated (using associated census metropolitan areas). ** Based on coverage maps made publicly available by Rogers on Oct. 23, 2009. Coverage areas are approximate as of October 2009. Actual coverage and network service can vary and are subject to change 18

TELUS backbone optical and IP network in 2000 19

TELUS backbone optical and IP network in 2000 19

TELUS backbone optical and IP network today Doing business in 87 cities on IP networks outside Alberta and B. C. 20

TELUS backbone optical and IP network today Doing business in 87 cities on IP networks outside Alberta and B. C. 20

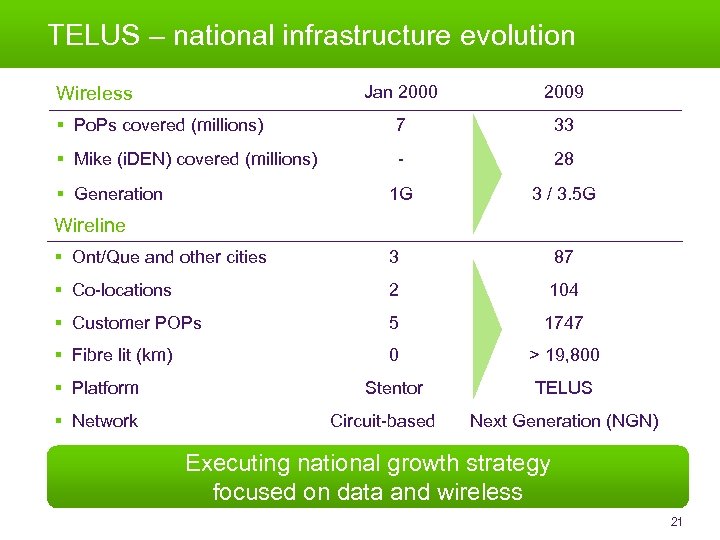

TELUS – national infrastructure evolution Jan 2000 2009 § Po. Ps covered (millions) 7 33 § Mike (i. DEN) covered (millions) - 28 1 G 3 / 3. 5 G Wireless § Generation Wireline § Ont/Que and other cities 3 87 § Co-locations 2 104 § Customer POPs 5 1747 § Fibre lit (km) 0 > 19, 800 Stentor TELUS § Platform § Network Circuit-based Next Generation (NGN) Executing national growth strategy focused on data and wireless 21

TELUS – national infrastructure evolution Jan 2000 2009 § Po. Ps covered (millions) 7 33 § Mike (i. DEN) covered (millions) - 28 1 G 3 / 3. 5 G Wireless § Generation Wireline § Ont/Que and other cities 3 87 § Co-locations 2 104 § Customer POPs 5 1747 § Fibre lit (km) 0 > 19, 800 Stentor TELUS § Platform § Network Circuit-based Next Generation (NGN) Executing national growth strategy focused on data and wireless 21

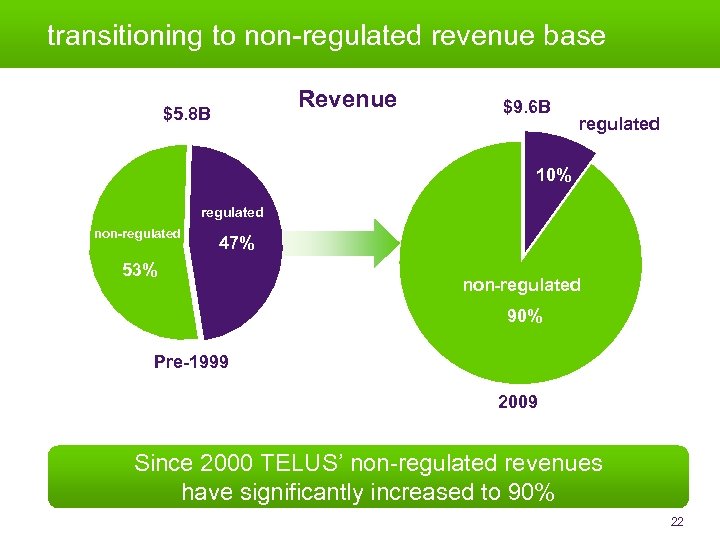

transitioning to non-regulated revenue base Revenue $5. 8 B $9. 6 B regulated 10% regulated non-regulated 47% 53% non-regulated 90% Pre-1999 2009 Since 2000 TELUS’ non-regulated revenues have significantly increased to 90% 22

transitioning to non-regulated revenue base Revenue $5. 8 B $9. 6 B regulated 10% regulated non-regulated 47% 53% non-regulated 90% Pre-1999 2009 Since 2000 TELUS’ non-regulated revenues have significantly increased to 90% 22

building economies of scale in Central Canada $1, 200 M Revenue Operating profit Cash flow $260 M $4 M $0 ($50 M) ($200 M) 20001 1 12 2008 months ending Jan 1, 2000 Focused on managed data network services 23

building economies of scale in Central Canada $1, 200 M Revenue Operating profit Cash flow $260 M $4 M $0 ($50 M) ($200 M) 20001 1 12 2008 months ending Jan 1, 2000 Focused on managed data network services 23

TELUS’ growth in Central Canada 2000 2008 Central Canada § Revenue § EBITDA § Cash flow Latest § $4 million § $0 § $(200) million Business market approach Fragmented § $1. 2 billion § $260 million § $(50) million Focused on data and managed applications in five industry verticals § Energy, public sector, health care, financial services, and telecom (doing business as Partner Solutions) Central Canada success Limited Track record of large wins and successful contract implementations Examples: § TD Bank Financial Group § Government of Ontario § Ville de Montréal § Government of Canada § Yellow Pages § Government of Québec 24

TELUS’ growth in Central Canada 2000 2008 Central Canada § Revenue § EBITDA § Cash flow Latest § $4 million § $0 § $(200) million Business market approach Fragmented § $1. 2 billion § $260 million § $(50) million Focused on data and managed applications in five industry verticals § Energy, public sector, health care, financial services, and telecom (doing business as Partner Solutions) Central Canada success Limited Track record of large wins and successful contract implementations Examples: § TD Bank Financial Group § Government of Ontario § Ville de Montréal § Government of Canada § Yellow Pages § Government of Québec 24

Providing integrated solutions

Providing integrated solutions

TELUS’ growth in enterprise segment 2000 Virtually unknown in large corporate market outside Western Canada Leverage investment in national Next Generation Network Opportunity n Customer dissatisfaction with incumbents n Potential IP platform to drive strategic solutions n Need to convert to IP platform n Support western base n Leverage IP technology Challenge n Customer n Few Excellent reputation for innovation, transition and operations of large client deals Outcome risk n Top fears n Cumulative aversion n Migration 2009 reference clients score for client satisfaction $2. 6 B in contract values won n Anchor clients in key industry verticals n Non-contract growth n Low churn and high renewal rates 26

TELUS’ growth in enterprise segment 2000 Virtually unknown in large corporate market outside Western Canada Leverage investment in national Next Generation Network Opportunity n Customer dissatisfaction with incumbents n Potential IP platform to drive strategic solutions n Need to convert to IP platform n Support western base n Leverage IP technology Challenge n Customer n Few Excellent reputation for innovation, transition and operations of large client deals Outcome risk n Top fears n Cumulative aversion n Migration 2009 reference clients score for client satisfaction $2. 6 B in contract values won n Anchor clients in key industry verticals n Non-contract growth n Low churn and high renewal rates 26

building on large enterprise deals Investing in and focusing on key industry verticals § Public sector § Financial services § Energy § Healthcare § Wholesale National Defence Implementation track record leading to contract wins 27

building on large enterprise deals Investing in and focusing on key industry verticals § Public sector § Financial services § Energy § Healthcare § Wholesale National Defence Implementation track record leading to contract wins 27

major contract wins across Canada § § § § Québec Government – $900 million over 10 years Department of National Defence – $200 million over 5 years TD Bank – $180 million contract over 5 years Government of Ontario – $140 million contract over 5 years Yellow Pages Group – $90 million over long term Ville de Montréal – $87 million over 10 years Government of B. C. - $245 million over 4 years Excellent progress in Central Canadian business market 28

major contract wins across Canada § § § § Québec Government – $900 million over 10 years Department of National Defence – $200 million over 5 years TD Bank – $180 million contract over 5 years Government of Ontario – $140 million contract over 5 years Yellow Pages Group – $90 million over long term Ville de Montréal – $87 million over 10 years Government of B. C. - $245 million over 4 years Excellent progress in Central Canadian business market 28

enhancing our leadership position in healthcare § § § § TELUS #1 Healthcare IT Company in Canada by Branham Group 2008 Canadian Health IT Company of the Year (ITAC Health) Emergis purchased January 2008 Electronic Health Records for 5 million Canadians 4. 1 M Emergis Assure drug cards covering 8. 5 million Canadians 3, 000+ pharmacies using our pharmacy management software Exclusive partner to host and operate Microsoft Health. Vault in Canada Leading the evolution of healthcare delivery in Canada 29

enhancing our leadership position in healthcare § § § § TELUS #1 Healthcare IT Company in Canada by Branham Group 2008 Canadian Health IT Company of the Year (ITAC Health) Emergis purchased January 2008 Electronic Health Records for 5 million Canadians 4. 1 M Emergis Assure drug cards covering 8. 5 million Canadians 3, 000+ pharmacies using our pharmacy management software Exclusive partner to host and operate Microsoft Health. Vault in Canada Leading the evolution of healthcare delivery in Canada 29

Partnering, acquiring and divesting as necessary

Partnering, acquiring and divesting as necessary

strategic journey 2000 → 2009 Acquired Clearnet ($6. 6 B) & Québec. Tel ($700 M) 2000 Divestiture of non-core real estate, directory and equipment leasing ($1. 2 B) 2001 Purchase of PSINet’s Canadian operations plus 6 other acquisitions 2002 Roaming / resale agreements with Bell Mobility Verizon divested 20. 5% ($2. 2 B) equity interest 2003 Acquisition of Ambergris Solutions (international call centers) 2004 Launched unsuccessful bid for Microcell 2005 Discussions to acquire BCE / not pursued 2006 Accenture partnership 2007 Acquisition of Emergis ($743 M) HSPA network build - partnership with Bell Canada 2008 Acquisition of Black’s ($28 M) 2009 Satellite TV launch - agreement with Bell Canada Agreement to carry Apple i. Phone Acquisitions and partnerships furthering TELUS’ strategy 31

strategic journey 2000 → 2009 Acquired Clearnet ($6. 6 B) & Québec. Tel ($700 M) 2000 Divestiture of non-core real estate, directory and equipment leasing ($1. 2 B) 2001 Purchase of PSINet’s Canadian operations plus 6 other acquisitions 2002 Roaming / resale agreements with Bell Mobility Verizon divested 20. 5% ($2. 2 B) equity interest 2003 Acquisition of Ambergris Solutions (international call centers) 2004 Launched unsuccessful bid for Microcell 2005 Discussions to acquire BCE / not pursued 2006 Accenture partnership 2007 Acquisition of Emergis ($743 M) HSPA network build - partnership with Bell Canada 2008 Acquisition of Black’s ($28 M) 2009 Satellite TV launch - agreement with Bell Canada Agreement to carry Apple i. Phone Acquisitions and partnerships furthering TELUS’ strategy 31

Going to market as one team

Going to market as one team

transformation to a single strong brand Nature based brand helps make technology simple 33

transformation to a single strong brand Nature based brand helps make technology simple 33

brand recognition § One of Canada’s top brands § Canadian Best Brands - 2009 § One of Canada’s Most Valuable Brands – 2009 § Valued at $1. 5 billion § 10 years of Brand Excellence § Gold Award for Sustained Success § #1 brand in advertising and brand awareness – 2003 “One of most recognizable and best loved brands in Canada” 34

brand recognition § One of Canada’s top brands § Canadian Best Brands - 2009 § One of Canada’s Most Valuable Brands – 2009 § Valued at $1. 5 billion § 10 years of Brand Excellence § Gold Award for Sustained Success § #1 brand in advertising and brand awareness – 2003 “One of most recognizable and best loved brands in Canada” 34

Investing in internal capabilities

Investing in internal capabilities

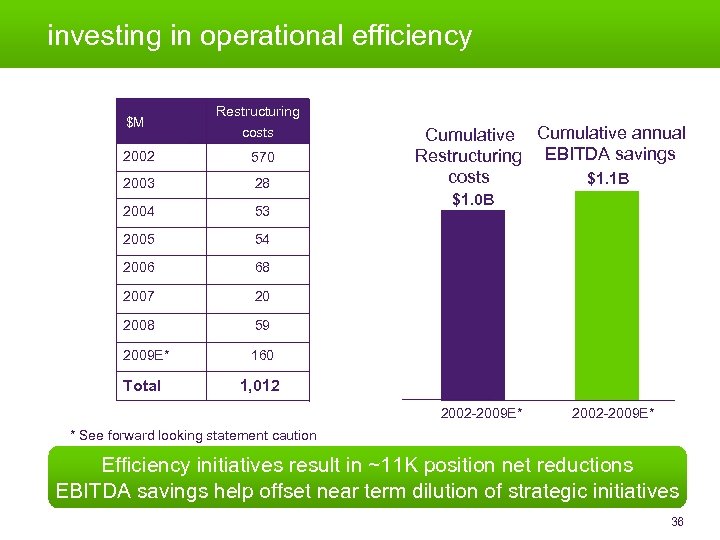

investing in operational efficiency $M Restructuring costs 2002 570 2003 28 2004 53 2005 54 2006 68 2007 20 2008 59 2009 E* 160 Total Cumulative annual Restructuring EBITDA savings costs $1. 1 B 1, 012 $1. 0 B 2002 -2009 E* * See forward looking statement caution Efficiency initiatives result in ~11 K position net reductions EBITDA savings help offset near term dilution of strategic initiatives 36

investing in operational efficiency $M Restructuring costs 2002 570 2003 28 2004 53 2005 54 2006 68 2007 20 2008 59 2009 E* 160 Total Cumulative annual Restructuring EBITDA savings costs $1. 1 B 1, 012 $1. 0 B 2002 -2009 E* * See forward looking statement caution Efficiency initiatives result in ~11 K position net reductions EBITDA savings help offset near term dilution of strategic initiatives 36

TELUS – transforming our culture 2000 Seniority-based wage leader limited pay for performance Multiple plans 2009 COMPENSATION BENEFITS Non-competitive HOURS OF WORK / PAID TIME OFF Most restrictive in North America CONTRACTING OUT Flexibility threatened Overtime voluntary, union scheduling & seniority job posting EASTERN OPERATIONS / MOBILITY OPERATIONAL ISSUES Administrative processes not ADMINISTRATION & aligned, contract terms foster adversarialism UNION-MGMT RELATIONS Performance-based, competitive with universal variable pay Harmonized plans Competitive/service driven Restrictions eliminated Flexibility preserved Management schedules work & overtime, best qualified job posting Harmonized procedures, practices & systems. Contract terms promote business-focused problem solving

TELUS – transforming our culture 2000 Seniority-based wage leader limited pay for performance Multiple plans 2009 COMPENSATION BENEFITS Non-competitive HOURS OF WORK / PAID TIME OFF Most restrictive in North America CONTRACTING OUT Flexibility threatened Overtime voluntary, union scheduling & seniority job posting EASTERN OPERATIONS / MOBILITY OPERATIONAL ISSUES Administrative processes not ADMINISTRATION & aligned, contract terms foster adversarialism UNION-MGMT RELATIONS Performance-based, competitive with universal variable pay Harmonized plans Competitive/service driven Restrictions eliminated Flexibility preserved Management schedules work & overtime, best qualified job posting Harmonized procedures, practices & systems. Contract terms promote business-focused problem solving

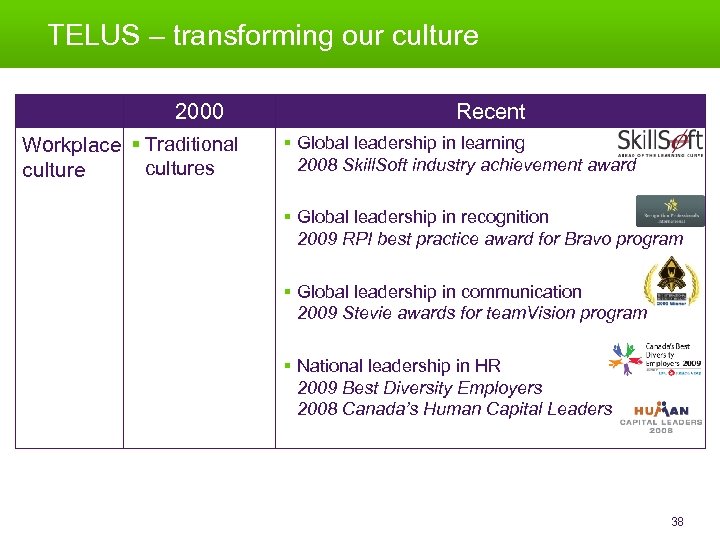

TELUS – transforming our culture 2000 Workplace § Traditional cultures culture Recent § Global leadership in learning 2008 Skill. Soft industry achievement award § Global leadership in recognition 2009 RPI best practice award for Bravo program § Global leadership in communication 2009 Stevie awards for team. Vision program § National leadership in HR 2009 Best Diversity Employers 2008 Canada’s Human Capital Leaders 38

TELUS – transforming our culture 2000 Workplace § Traditional cultures culture Recent § Global leadership in learning 2008 Skill. Soft industry achievement award § Global leadership in recognition 2009 RPI best practice award for Bravo program § Global leadership in communication 2009 Stevie awards for team. Vision program § National leadership in HR 2009 Best Diversity Employers 2008 Canada’s Human Capital Leaders 38

TELUS – transforming our culture 2000 Training and § Traditional development § No benchmarking Recent § Web enabled § 2009, 2007, 2005, 2004, 2003 ASTD BEST awards § Rankings #7, #6, #3 worldwide §Named one of Canada’s 10 Most Admired Corporate Cultures for 2009 Practises § Multiple systems, practices and cultures § More unified systems, practices and cultures § e. g. Amdocs billing systems consolidations (wireline and wireless) § Consistent 4 team values drive decisions and actions 39

TELUS – transforming our culture 2000 Training and § Traditional development § No benchmarking Recent § Web enabled § 2009, 2007, 2005, 2004, 2003 ASTD BEST awards § Rankings #7, #6, #3 worldwide §Named one of Canada’s 10 Most Admired Corporate Cultures for 2009 Practises § Multiple systems, practices and cultures § More unified systems, practices and cultures § e. g. Amdocs billing systems consolidations (wireline and wireless) § Consistent 4 team values drive decisions and actions 39

TELUS approach to Corporate Social Responsibility CSR § Economic § Social § Environmental Corporate Governance § Ethical conduct § Internal controls and financial reporting § Independent and effective Board § External and internal assurance § Accountability to shareholders § Reasonable executive compensation Strong corporate governance provides necessary foundation for CSR leadership 40

TELUS approach to Corporate Social Responsibility CSR § Economic § Social § Environmental Corporate Governance § Ethical conduct § Internal controls and financial reporting § Independent and effective Board § External and internal assurance § Accountability to shareholders § Reasonable executive compensation Strong corporate governance provides necessary foundation for CSR leadership 40

becoming a leading corporate citizen For our economy • • • Sustainable revenue generation and ROI Robust internal financial controls and disclosure mechanisms Investment in technology research and development Contribution to corporate tax base Contribution to sustainable National economic growth For our environment For our society Communities and customers • Investment through TELUS Community Boards • Strategic partnerships • Philanthropy & volunteerism • Social impacts of our products and services • Customer satisfaction Team members • Recruitment, retention, and development • Engagement and diversity • Labour relations • Health and safety • • • Impact of TELUS operations Product life-cycle responsibility Influence in supply chain Help customers minimize their impacts Complete climate change strategy TELUS must incorporate CSR into key business decisions 41

becoming a leading corporate citizen For our economy • • • Sustainable revenue generation and ROI Robust internal financial controls and disclosure mechanisms Investment in technology research and development Contribution to corporate tax base Contribution to sustainable National economic growth For our environment For our society Communities and customers • Investment through TELUS Community Boards • Strategic partnerships • Philanthropy & volunteerism • Social impacts of our products and services • Customer satisfaction Team members • Recruitment, retention, and development • Engagement and diversity • Labour relations • Health and safety • • • Impact of TELUS operations Product life-cycle responsibility Influence in supply chain Help customers minimize their impacts Complete climate change strategy TELUS must incorporate CSR into key business decisions 41

TELUS and Corporate Social Responsibility (CSR) 2000 § Basic reporting § Limited disclosure 2009 § TELUS an internationally recognized leader in CSR § Only North American telco on DJSI World Index for 9 consecutive years § Only 1 of 11 Canadian companies listed Transforming TELUS’ CSR strategy 42

TELUS and Corporate Social Responsibility (CSR) 2000 § Basic reporting § Limited disclosure 2009 § TELUS an internationally recognized leader in CSR § Only North American telco on DJSI World Index for 9 consecutive years § Only 1 of 11 Canadian companies listed Transforming TELUS’ CSR strategy 42

investment in our communities 2000 Community Investment & Engagement § Year-round team volunteerism and giving programs § $7. 8 M donated 2009 § Nine Community Boards across Canada - Local and TELUS Community Leaders - $4. 1 M to be donated in 2009 § Year-round team volunteerism and giving plus - 2009 TELUS Day of Service: over 9000 participants in over 150 activities - $7. 1 M being donated in 2009 through team donations and TELUS matches § Corporate philanthropic endeavours - $43 M committed to science centres - Upopolis social networking for children’s hospitals - TELUS Walk to Cure Diabetes Since 2000 TELUS and team members contributed $137 M to charitable organizations & 2. 6 million volunteer hours 43

investment in our communities 2000 Community Investment & Engagement § Year-round team volunteerism and giving programs § $7. 8 M donated 2009 § Nine Community Boards across Canada - Local and TELUS Community Leaders - $4. 1 M to be donated in 2009 § Year-round team volunteerism and giving plus - 2009 TELUS Day of Service: over 9000 participants in over 150 activities - $7. 1 M being donated in 2009 through team donations and TELUS matches § Corporate philanthropic endeavours - $43 M committed to science centres - Upopolis social networking for children’s hospitals - TELUS Walk to Cure Diabetes Since 2000 TELUS and team members contributed $137 M to charitable organizations & 2. 6 million volunteer hours 43

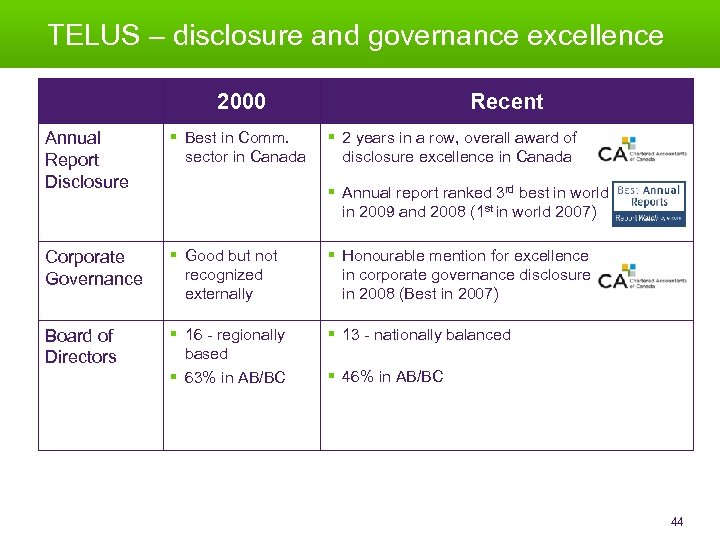

TELUS – disclosure and governance excellence 2000 Recent Annual Report Disclosure § Best in Comm. sector in Canada § 2 years in a row, overall award of disclosure excellence in Canada Corporate Governance § Good but not recognized externally § Honourable mention for excellence in corporate governance disclosure in 2008 (Best in 2007) Board of Directors § 16 - regionally based § 63% in AB/BC § 13 - nationally balanced § Annual report ranked 3 rd best in world in 2009 and 2008 (1 st in world 2007) § 46% in AB/BC 44

TELUS – disclosure and governance excellence 2000 Recent Annual Report Disclosure § Best in Comm. sector in Canada § 2 years in a row, overall award of disclosure excellence in Canada Corporate Governance § Good but not recognized externally § Honourable mention for excellence in corporate governance disclosure in 2008 (Best in 2007) Board of Directors § 16 - regionally based § 63% in AB/BC § 13 - nationally balanced § Annual report ranked 3 rd best in world in 2009 and 2008 (1 st in world 2007) § 46% in AB/BC 44

Financial and valuation review

Financial and valuation review

TELUS forward looking statements This slide deck and our answers to questions contain statements about expected future events and financial and operating results of TELUS that are forward-looking. By their nature, forward-looking statements require the Company to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that the forward-looking statements will not prove to be accurate. Readers are cautioned not to place undue reliance on forward-looking statements as a number of factors could cause actual future results and events to differ materially from that expressed in the forward -looking statements. Accordingly our comments are subject to the disclaimer and qualified by the assumptions (including assumptions for 2009 guidance and a preliminary assessment of expected 2010 capital expenditure levels), qualifications and risk factors (including those associated with the deployment and operation of the new national high-speed packet access network and associated introduction of new products, services and systems) referred to in the Management’s discussion and analysis in the 2008 annual report, and in the 2009 first, second and third quarter reports. Except as required by law, TELUS disclaims any intention or obligation to update or revise forwardlooking statements, and reserves the right to change, at any time at its sole discretion, its current practice of updating annual targets and guidance.

TELUS forward looking statements This slide deck and our answers to questions contain statements about expected future events and financial and operating results of TELUS that are forward-looking. By their nature, forward-looking statements require the Company to make assumptions and are subject to inherent risks and uncertainties. There is significant risk that the forward-looking statements will not prove to be accurate. Readers are cautioned not to place undue reliance on forward-looking statements as a number of factors could cause actual future results and events to differ materially from that expressed in the forward -looking statements. Accordingly our comments are subject to the disclaimer and qualified by the assumptions (including assumptions for 2009 guidance and a preliminary assessment of expected 2010 capital expenditure levels), qualifications and risk factors (including those associated with the deployment and operation of the new national high-speed packet access network and associated introduction of new products, services and systems) referred to in the Management’s discussion and analysis in the 2008 annual report, and in the 2009 first, second and third quarter reports. Except as required by law, TELUS disclaims any intention or obligation to update or revise forwardlooking statements, and reserves the right to change, at any time at its sole discretion, its current practice of updating annual targets and guidance.

EBITDA evolution $3. 6 B $2. 3 B Wireless 17% Wireline 83% 2000 12 mo. June Wireline 45% Wireless 55% 2009 12 mo. Sept Executing strategy drives wireless growth, now 55% of operating profit 47

EBITDA evolution $3. 6 B $2. 3 B Wireless 17% Wireline 83% 2000 12 mo. June Wireline 45% Wireless 55% 2009 12 mo. Sept Executing strategy drives wireless growth, now 55% of operating profit 47

strategic focus yields strong results Wireless earnings and cash flow growth EBITDA ($M) 1, 906 1, 445 1, 144 530 1, 925 1, 753 EBITDA less capex ($M) 817 2, 005 1, 326 1, 355 1, 457 1, 150 1, 040 790 457 357 70 2001 2002 (288) 2003 2004 2005 2006 2007 2008 2009 E* * See forward looking statement caution Continued focus on profitable customer growth 48

strategic focus yields strong results Wireless earnings and cash flow growth EBITDA ($M) 1, 906 1, 445 1, 144 530 1, 925 1, 753 EBITDA less capex ($M) 817 2, 005 1, 326 1, 355 1, 457 1, 150 1, 040 790 457 357 70 2001 2002 (288) 2003 2004 2005 2006 2007 2008 2009 E* * See forward looking statement caution Continued focus on profitable customer growth 48

managing through challenging times Macroeconomic factors 2000 → 2009 § 2000 -Tech bubble burst destroyed over $100 B in North American telecom value § 2001 - Corp governance crisis – increased cost of financing and regulatory e. g. Sarbanes-Oxley (SOX) § 2007 - Income Trust conversion decision destroyed over $3 B in Canadian telecom shareholder value § 2008/2009 – Credit crisis and global recession impacted ability and cost to finance operations Systemic industry trends 2000 → 2009 § Long Distance erosion § Reduced $480 M of high margin revenue since 2001 at TELUS § Local line erosion due to technology substitution and competition § Reduced $550 M of revenue since 2000 at TELUS Achieving financial success despite adversity 49

managing through challenging times Macroeconomic factors 2000 → 2009 § 2000 -Tech bubble burst destroyed over $100 B in North American telecom value § 2001 - Corp governance crisis – increased cost of financing and regulatory e. g. Sarbanes-Oxley (SOX) § 2007 - Income Trust conversion decision destroyed over $3 B in Canadian telecom shareholder value § 2008/2009 – Credit crisis and global recession impacted ability and cost to finance operations Systemic industry trends 2000 → 2009 § Long Distance erosion § Reduced $480 M of high margin revenue since 2001 at TELUS § Local line erosion due to technology substitution and competition § Reduced $550 M of revenue since 2000 at TELUS Achieving financial success despite adversity 49

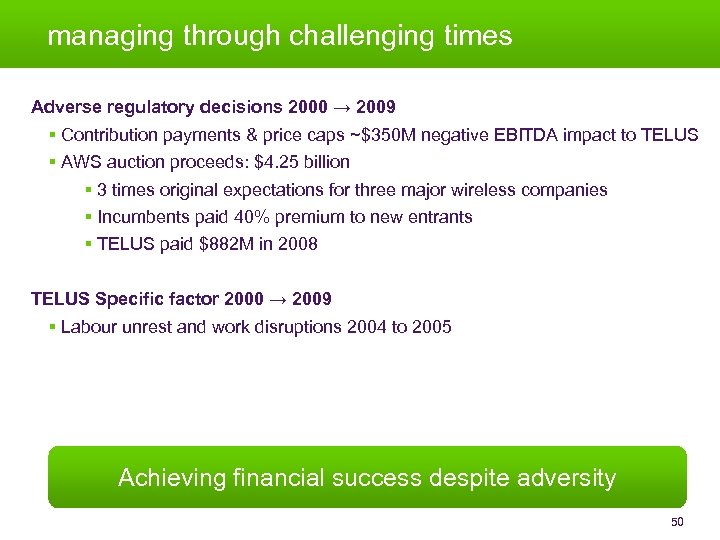

managing through challenging times Adverse regulatory decisions 2000 → 2009 § Contribution payments & price caps ~$350 M negative EBITDA impact to TELUS § AWS auction proceeds: $4. 25 billion § 3 times original expectations for three major wireless companies § Incumbents paid 40% premium to new entrants § TELUS paid $882 M in 2008 TELUS Specific factor 2000 → 2009 § Labour unrest and work disruptions 2004 to 2005 Achieving financial success despite adversity 50

managing through challenging times Adverse regulatory decisions 2000 → 2009 § Contribution payments & price caps ~$350 M negative EBITDA impact to TELUS § AWS auction proceeds: $4. 25 billion § 3 times original expectations for three major wireless companies § Incumbents paid 40% premium to new entrants § TELUS paid $882 M in 2008 TELUS Specific factor 2000 → 2009 § Labour unrest and work disruptions 2004 to 2005 Achieving financial success despite adversity 50

TELUS capital expenditures Wireline Wireless $2. 25 B Expected 2009 $1. 75 B $1. 77 B $1. 69 B $2. 1 B $1. 86 B $1. 62 B $1. 32 B $1. 25 B $1. 32 B 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 E* * See forward looking statement caution Over $16. 8 B invested into core businesses in Canada 51

TELUS capital expenditures Wireline Wireless $2. 25 B Expected 2009 $1. 75 B $1. 77 B $1. 69 B $2. 1 B $1. 86 B $1. 62 B $1. 32 B $1. 25 B $1. 32 B 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 E* * See forward looking statement caution Over $16. 8 B invested into core businesses in Canada 51

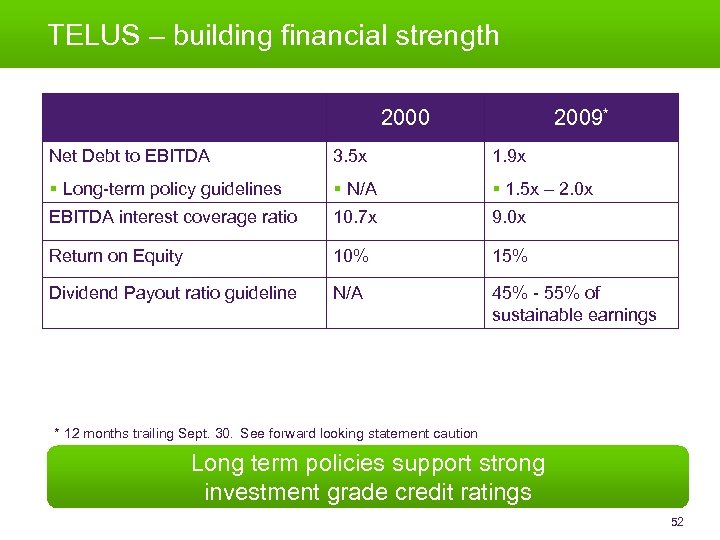

TELUS – building financial strength 2000 2009* Net Debt to EBITDA 3. 5 x 1. 9 x § Long-term policy guidelines § N/A § 1. 5 x – 2. 0 x EBITDA interest coverage ratio 10. 7 x 9. 0 x Return on Equity 10% 15% Dividend Payout ratio guideline N/A 45% - 55% of sustainable earnings * 12 months trailing Sept. 30. See forward looking statement caution Long term policies support strong investment grade credit ratings 52

TELUS – building financial strength 2000 2009* Net Debt to EBITDA 3. 5 x 1. 9 x § Long-term policy guidelines § N/A § 1. 5 x – 2. 0 x EBITDA interest coverage ratio 10. 7 x 9. 0 x Return on Equity 10% 15% Dividend Payout ratio guideline N/A 45% - 55% of sustainable earnings * 12 months trailing Sept. 30. See forward looking statement caution Long term policies support strong investment grade credit ratings 52

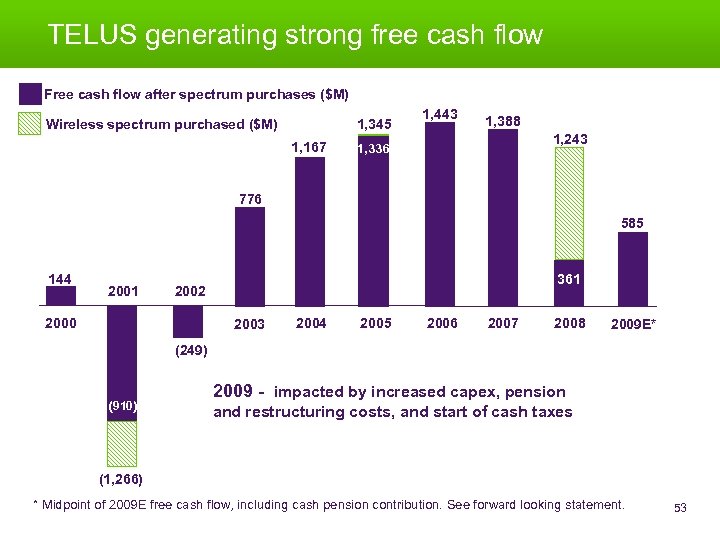

361 53 TELUS generating strong free cash flow Free cash flow after spectrum purchases ($M) Wireless spectrum purchased ($M) 1, 345 1, 167 1, 443 1, 388 1, 243 1, 336 776 585 144 2001 361 2002 2000 2003 2004 2005 2006 2007 2008 2009 E* (249) (910) 2009 - impacted by increased capex, pension and restructuring costs, and start of cash taxes (1, 266) * Midpoint of 2009 E free cash flow, including cash pension contribution. See forward looking statement. 53

361 53 TELUS generating strong free cash flow Free cash flow after spectrum purchases ($M) Wireless spectrum purchased ($M) 1, 345 1, 167 1, 443 1, 388 1, 243 1, 336 776 585 144 2001 361 2002 2000 2003 2004 2005 2006 2007 2008 2009 E* (249) (910) 2009 - impacted by increased capex, pension and restructuring costs, and start of cash taxes (1, 266) * Midpoint of 2009 E free cash flow, including cash pension contribution. See forward looking statement. 53

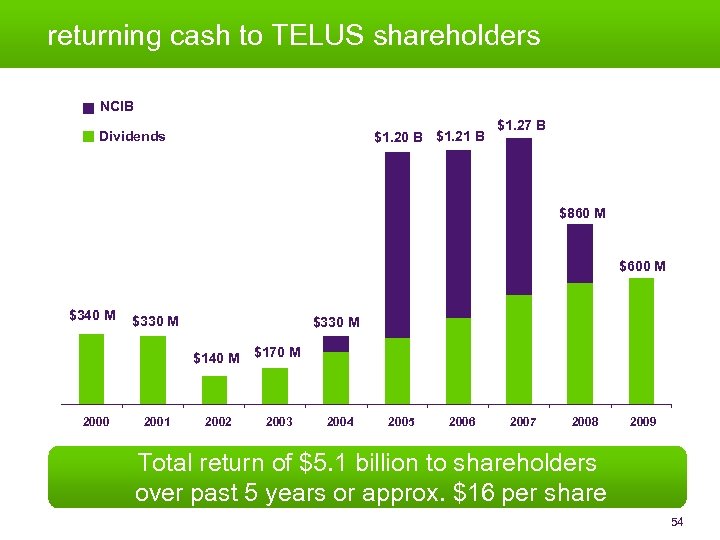

returning cash to TELUS shareholders 5. 5 B NCIB Dividends $1. 20 B $1. 21 B $1. 27 B $860 M $600 M $340 M $330 M $140 M $170 M 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Total return of $5. 1 billion to shareholders over past 5 years or approx. $16 per share 54

returning cash to TELUS shareholders 5. 5 B NCIB Dividends $1. 20 B $1. 21 B $1. 27 B $860 M $600 M $340 M $330 M $140 M $170 M 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Total return of $5. 1 billion to shareholders over past 5 years or approx. $16 per share 54

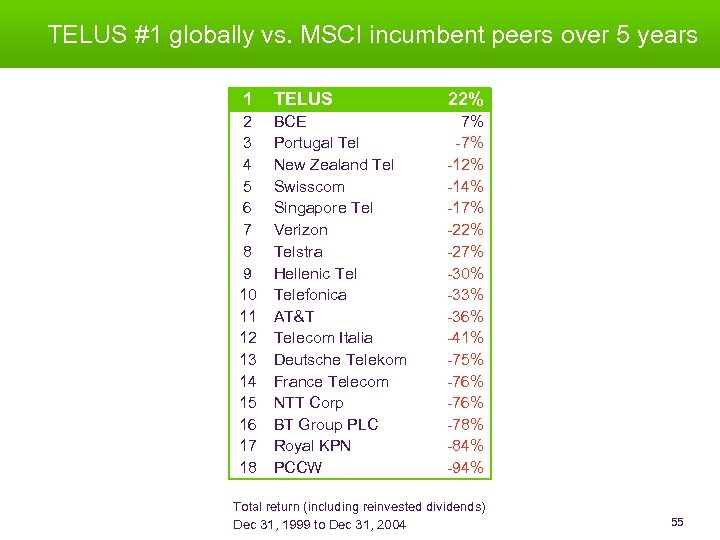

TELUS #1 globally vs. MSCI incumbent peers over 5 years 1 TELUS 22% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Portugal Tel New Zealand Tel Swisscom Singapore Tel Verizon Telstra Hellenic Telefonica AT&T Telecom Italia Deutsche Telekom France Telecom NTT Corp BT Group PLC Royal KPN PCCW 7% -12% -14% -17% -22% -27% -30% -33% -36% -41% -75% -76% -78% -84% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2004 55

TELUS #1 globally vs. MSCI incumbent peers over 5 years 1 TELUS 22% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Portugal Tel New Zealand Tel Swisscom Singapore Tel Verizon Telstra Hellenic Telefonica AT&T Telecom Italia Deutsche Telekom France Telecom NTT Corp BT Group PLC Royal KPN PCCW 7% -12% -14% -17% -22% -27% -30% -33% -36% -41% -75% -76% -78% -84% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2004 55

TELUS #1 globally vs. MSCI incumbent peers over 6 years 1 TELUS 64% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Singapore Tel Hellenic Tel New Zealand Tel Portugal Tel Swisscom Telefonica AT&T Telstra Verizon Telecom Italia BT Group PLC NTT Corp Deutsche Telekom France Telecom Royal KPN PCCW 8% -5% -6% -9% -18% -34% -36% -38% -39% -50% -74% -76% -78% -80% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2005 56

TELUS #1 globally vs. MSCI incumbent peers over 6 years 1 TELUS 64% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Singapore Tel Hellenic Tel New Zealand Tel Portugal Tel Swisscom Telefonica AT&T Telstra Verizon Telecom Italia BT Group PLC NTT Corp Deutsche Telekom France Telecom Royal KPN PCCW 8% -5% -6% -9% -18% -34% -36% -38% -39% -50% -74% -76% -78% -80% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2005 56

TELUS #1 globally vs. MSCI incumbent peers over 7 years 1 TELUS 88% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Singapore Tel Hellenic Tel Portugal Tel AT&T Swisscom Telefonica New Zealand Tel Verizon Telstra Telecom Italia BT Group PLC Royal KPN NTT Corp Deutsche Telekom France Telecom PCCW 28% 27% 20% 10% -2% -4% -13% -14% -18% -30% -50% -64% -73% -75% -77% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2006 57

TELUS #1 globally vs. MSCI incumbent peers over 7 years 1 TELUS 88% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Singapore Tel Hellenic Tel Portugal Tel AT&T Swisscom Telefonica New Zealand Tel Verizon Telstra Telecom Italia BT Group PLC Royal KPN NTT Corp Deutsche Telekom France Telecom PCCW 28% 27% 20% 10% -2% -4% -13% -14% -18% -30% -50% -64% -73% -75% -77% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2006 57

TELUS #1 globally vs. MSCI incumbent peers over 8 years 1 TELUS 79% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Singapore Tel Hellenic Tel Portugal Telefonica AT&T Verizon Swisscom New Zealand Telstra Telecom Italia BT Group PLC Royal KPN France Telecom Deutsche Telekom NTT Corp PCCW 69% 64% 36% 25% 23% 18% 0% -5% -14% -16% -51% -65% -67% -72% -74% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2007 58

TELUS #1 globally vs. MSCI incumbent peers over 8 years 1 TELUS 79% 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 BCE Singapore Tel Hellenic Tel Portugal Telefonica AT&T Verizon Swisscom New Zealand Telstra Telecom Italia BT Group PLC Royal KPN France Telecom Deutsche Telekom NTT Corp PCCW 69% 64% 36% 25% 23% 18% 0% -5% -14% -16% -51% -65% -67% -72% -74% -94% Total return (including reinvested dividends) Dec 31, 1999 to Dec 31, 2007 58

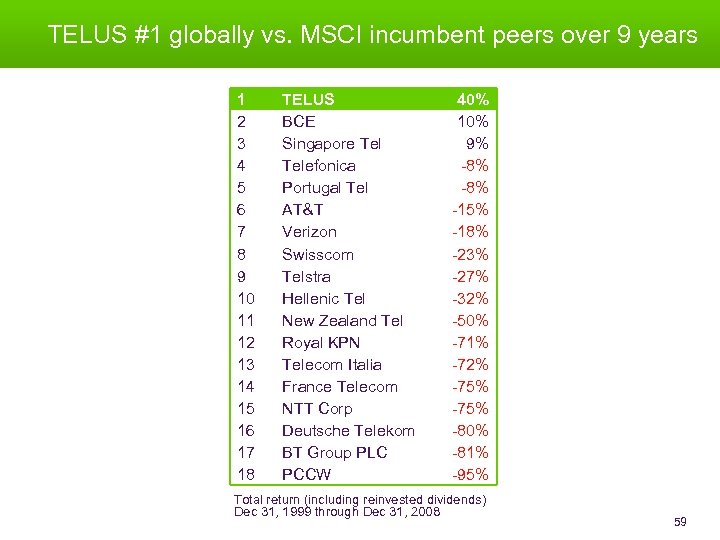

TELUS #1 globally vs. MSCI incumbent peers over 9 years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 TELUS BCE Singapore Telefonica Portugal Tel AT&T Verizon Swisscom Telstra Hellenic Tel New Zealand Tel Royal KPN Telecom Italia France Telecom NTT Corp Deutsche Telekom BT Group PLC PCCW 40% 10% 9% -8% -15% -18% -23% -27% -32% -50% -71% -72% -75% -80% -81% -95% Total return (including reinvested dividends) Dec 31, 1999 through Dec 31, 2008 59

TELUS #1 globally vs. MSCI incumbent peers over 9 years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 TELUS BCE Singapore Telefonica Portugal Tel AT&T Verizon Swisscom Telstra Hellenic Tel New Zealand Tel Royal KPN Telecom Italia France Telecom NTT Corp Deutsche Telekom BT Group PLC PCCW 40% 10% 9% -8% -15% -18% -23% -27% -32% -50% -71% -72% -75% -80% -81% -95% Total return (including reinvested dividends) Dec 31, 1999 through Dec 31, 2008 59

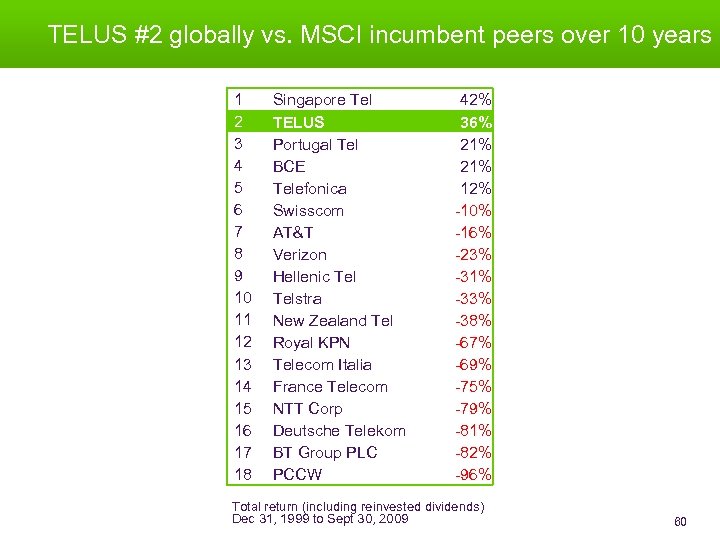

TELUS #2 globally vs. MSCI incumbent peers over 10 years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Singapore Tel TELUS Portugal Tel BCE Telefonica Swisscom AT&T Verizon Hellenic Telstra New Zealand Tel Royal KPN Telecom Italia France Telecom NTT Corp Deutsche Telekom BT Group PLC PCCW 42% 36% 21% 12% -10% -16% -23% -31% -33% -38% -67% -69% -75% -79% -81% -82% -96% Total return (including reinvested dividends) Dec 31, 1999 to Sept 30, 2009 60

TELUS #2 globally vs. MSCI incumbent peers over 10 years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Singapore Tel TELUS Portugal Tel BCE Telefonica Swisscom AT&T Verizon Hellenic Telstra New Zealand Tel Royal KPN Telecom Italia France Telecom NTT Corp Deutsche Telekom BT Group PLC PCCW 42% 36% 21% 12% -10% -16% -23% -31% -33% -38% -67% -69% -75% -79% -81% -82% -96% Total return (including reinvested dividends) Dec 31, 1999 to Sept 30, 2009 60

Investor relations 1 800 667 4871 telus. com ir@telus. com

Investor relations 1 800 667 4871 telus. com ir@telus. com